Beruflich Dokumente

Kultur Dokumente

Bajaj Group

Hochgeladen von

reshumanoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bajaj Group

Hochgeladen von

reshumanoCopyright:

Verfügbare Formate

A project report on financial

analysis of BAJAJ AUTO LTD.

Submitted By: Group No: 1

Girish Nair

Madhu Singh

Mala Thakker

Nirmal Gajjar

Reshma Manohar

Stevens Business School Page 1

Acknowledgement

As any other report the success of this report is the result of active involvement of many people:

From time of inception of an idea till the end. Many brains has worked together to make this

exclusive and informative Analysis of Balance sheet of Bajaj Auto Ltd.

With a great pleasure and privilege we are presenting this report with our deepest gratitude to our

institute for providing us this immense.

We would like to acknowledge our sincere thanks, to Dr. Himani Joshi (Academic Coordinator)

for her guidance throughout the project, her interest, enthusiasm and Involvement had been

greatest motivational factor during the study.

It is a privilege to have weighty appreciation to Mrs. Neha Saxena for giving us complete

support and cooperation, and for helping us with the knowledge regarding the planning of the

business and execution of the same.

Stevens Business School Page 2

Table of content

s. no Particulars Page no.

1. Introduction 4

2. Time series Analysis 7

3. Profit & Loss Analysis 20

4. Cash Flow Analysis 23

5. Cash Flow Ratio Analysis 26

6. Comparative Analysis 31

7. Facts About the Company 31

8. Annexure 37

9. References 40

Stevens Business School Page 3

INTRODUCTION

Stevens Business School Page 4

The Bajaj Group is amongst the top 10 business houses in India. Its footprint stretches over a

wide range of industries, spanning automobiles (two-wheelers and three-wheelers), home

appliances, lighting, iron and steel, insurance, travel and finance. The group's flagship company,

Bajaj Auto, is ranked as the world's fourth largest two- and three- wheeler manufacturer and the

Bajaj brand is well-known across several countries in Latin America, Africa, Middle East, South

and South East Asia

Bajaj Auto is a major Indian automobile manufacturer. It is India's second largest two wheeler

manufacturer and the world's 4th largest two- and three-wheeler maker. It is based in Pune,

Maharashtra, with plants in Akurdi and Chakan (Pune), Waluj (near Aurangabad) and Pantnagar

in Uttaranchal. Bajaj Auto makes and exports motorscooters, motorcycles and the auto rickshaw.

Over the last decade, the company has successfully changed its image from a scooter

manufacturer to a two wheeler manufacturer. Its product range encompasses scooterettes,

scooters and motorcycles. Its real growth in numbers has come in the last four years after

successful introduction of a few models in the motorcycle segment

The strength of the company is its quality products, excellence in engineering and design, and its

ability to delight the customers. The Pulsar, introduced in November 2004, is continually

dominating the premium segment of the motorcycle market, helping to maintain the market

superiority. Discover DTSi, one more successful bike on Indian roads, is in the 'value' segment

of the motorcycle market. It incorporates a high degree of power with fuel efficiency of a 100 cc

motorcycle

Stevens Business School Page 5

Images of Bajaj Bikes:

Stevens Business School Page 6

TIME SERIES ANALYSIS

Stevens Business School Page 7

PROFITABILITY RATIOS

1.) Why Gross Profit Margin is measured?

Ans: Gross profit margin gives a good indication of financial health. Without an adequate gross

margin, a company will be unable to pay its operating and other expenses and build for the

future.

Gross Profit Margin = Gross Profit*100/Net Sales

Gross Profit Margin (%) 14.37 13.2 12.87 11.11

Gross Profit Margin(%)

Gross Profit Margin(%)

14.37 13.2 12.87

11.11

Mar '06 Mar '07 Mar '08 Mar '09

2.) Why Gross profit margin is declining?

Ans: Fall in sales in domestic market.

a.) The Indian automotive sector has been hit by the fall in demand growth. The third

quarter of 2008-09 was particularly fierce. Average monthly sales of motorcycles in India

Stevens Business School Page 8

fell by over 17% in Q3 2008-09 versus Q2 — from an average of 524,939 units per

month to 435,114. The company has been affected by this downturn.

b.) Then came the hit in the third quarter, coinciding with the global financial meltdown and

very sharp cutbacks in the availability of consumer and retail credit.

3.) Why net profit margin is measured?

Ans: Net profit ratio = net profit*100/net sales

The ratio shows the earnings left for share holders as a percentage of net sales. It measures the

overall efficiency of production, administration, selling, financing. Pricing & tax management of

the firm.

Net Profit Margin (%) 13.86 12.66 8.32 7.4

Net Profit Margin(%)

Net Profit Margin(%)

13.86

12.66

7.95

7.075

Mar '06 Mar '07 Mar '08 Mar '09

Stevens Business School Page 9

4.) Why there is decline in net profit margin?

Ans: Net profit ratio decreases 7.95 to 7.07

Reason: Operating profit before tax (PBT) fell by 16.4% to Rs.8.46 billion. This was largely due

to a voluntary retirement scheme (VRS) of Rs.1.83 billion and mark-to-market losses of Rs.218

million. Even so, the operating profit margin was 9.6% of net sales and other operating income.

But decline in domestic sales have been offset by increase in international sales. The company

continues to be the country’s largest exporter of two- and three-wheelers. During 2008-09, Bajaj

Auto’ international sales achieved an all-time high of 772,519 units of two- and three-wheelers

— representing a growth 25% over the previous year. The growth was driven by the export of

two wheelers, which increased by 31% over 2007-08 to achieve sales of 633,463 units in 2008-

09. The total value of exports was Rs.26.4 billion, representing a growth of 29%.

5.) What is return on net worth means?

Ans: Return on net worth = PAT/ net worth.

A measure of a corporation's profitability; ROE reveals how much profit a company generates

with the money shareholders have invested.

Return On Net Worth (%) 23.09 22.36 47.61 37.86

Return On Net Worth(%)

Return On Net Worth(%)

47.61

37.86

23.09 22.36

Mar '06 Mar '07 Mar '08 Mar '09

Stevens Business School Page 10

6.) Why the return on net worth declining?

Ans: the net profit of the Bajaj auto ltd has decline.

7.) What is return on capital employed?

Ans: Return on capital employed = PBIT/capital employed

A ratio that indicates the efficiency and profitability of a company's capital investments.

Return On Capital Employed (%) 23.32 20.9 39.71 31.66

Return On Capital Employed(%)

Return On Capital Employed(%)

39.71

31.66

23.32 20.9

Mar '06 Mar '07 Mar '08 Mar '09

8.) Why it is declining?

Ans: profit before interest is declining & capital employed has increased (debt has increased in

2008-09).

Stevens Business School Page 11

9.) Why ROA is calculated?

Ans: Return on asset = PAT/total asset

An indicator of how profitable a company is relative to its total assets. ROA gives an idea as to

how efficient management is at using its assets to generate earnings. This is an important ratio

for companies deciding whether or not to initiate a new project

Return on Assets 11.05 10.6 15.3 11.91

Return on Assets

Return on Assets

15.3

11.05 11.91

10.6

Mar '06 Mar '07 Mar '08 Mar '09

10.) Why ROA is declining?

Ans: it is declining due to the decrease in net profit in 2008-09.

Stevens Business School Page 12

LIQUIDITY AND SOLVENCY RATIOS

11.) Why current ratio is measured?

Ans: Current ratio = Current asset/Current liabilities

The ratio is mainly used to give an idea of the company's ability to pay back its short-term

liabilities (debt and payables) with its short-term assets (cash, inventory, receivables). The higher

the current ratio, the more capable the company is of paying its obligations

Current ratio 0.799148 0.9026664

Current ratio (incl. mktbl. securites) 1.4976919 1.340349

The current ratio has increased from .79 in 2007-08 to .90 in 2008-09.

12.) Is the new current ratio good for the company?

Ans: Reason: Many companies have been forced to delay payments to vendors; Bajaj Auto has

gone the other way — helped its suppliers and dealers by offering improved payment terms by

significantly reducing payment cycle. This has reduced the current liabilities for the company &

the rise in export debtors, shows up in an increase in operating working capital as at 31, March

2009. In this way company is able to maintain healthy current ratio.

13.) Why quick ratio is taken into consideration?

Ans: Quick Ratio = Quick Asset/Current Liabilities

An indicator of a company's short-term liquidity. The quick ratio measures a company's ability to

meet its short-term obligations with its most liquid assets. The higher the quick ratio, the better

the position of the company

Stevens Business School Page 13

Quick Ratio 0.69 0.76 0.3635725 0.4339967

Quick Ratio

Quick Ratio

0.76

0.69

0.4339967

0.3635725

1 2 3 4

Quick Ratio is increasing from .36 to .433

14.) Why quick ratio is declining?

Reason: Quick ratio is lesser than current ratio because the major share in current asset

comprise of inventory & prepaid expenses which have been deducted while calculating

quick ratio. That’s why it is less than current ratio.

15,) Why debt equity ratio is measured?

Ans: Debt Equity Ratio = Debt / Equity

A measure of a company's financial leverage.

Investing in a company with a higher debt/equity ratio may be riskier, especially in

times of rising interest rates, due to the additional interest that has to be paid out for

the debt

Stevens Business School Page 14

Debt Equity Ratio 0.31 0.29 0.84 0.93

Debt Equity Ratio

Debt Equity Ratio

0.93

0.84

0.31 0.29

1 2 3 4

1.) Why is the debt equity ratio increasing?

Ans: Reason: the unsecured loan & bank borrowings has lead to an increase in total

borrowing which led to increase in debt equity ratio from 2007-08 to 2008-09.

Total borrowings 1346.33 1603.03

2.) Why company is increasing its debt?

Ans: The Company is increasing the proportion of debt for its huge R&D expenditure.

In 2008-09, the R&D department has prepared for major upgrades across the company’s

product range. It has also enhanced its infrastructure for design, prototyping and testing.

Two of the important products launched during 2008-09 are:

Platina 125 cc DTS-si

XCD 135 cc DTS-si

Stevens Business School Page 15

3.) Why interest coverage ratio is measured?

Ans: Interest Coverage Ratio = PBDITA /Interest.

Interest coverage ratio is a measure of a company's ability to honor its debt payments.

Interest Cover 4,280.03 280.28 209.03 45.51

Interest Coverage

Interest Coverage

4,280.03

280.28 209.03 45.51

1 2 3 4

Interest Coverage ratio is being reduced from 209.03 to 45.51.

16.) Why the interest coverage ratio is decling?

Ans: Reason:

1.) As PBDITA is decreasing.

PBDITA 1269.81 1035.85

2.) Interest payments has been increased from 5.16 to 21.89.

Stevens Business School Page 16

TURNOVER RATIOS

17.) What is stock turnover ratio? What is the implication of this ratio?

Stock Turnover Ratio: Stock turnover ratio is a ratio between cost of goods sold and average

stock. This ratio is also known as stock velocity or inventory turnover ratio.

Stock Turnover Ratio = Cost of Goods Sold/Average Stock

Inventory Turnover Ratio 34.14 36.88 29.33 28.64

Inventory Turnover Ratio

Inventory Turnover Ratio

36.88

34.14

29.33 28.64

Mar '06 Mar '07 Mar '08 Mar '09

This ratio provides guidelines to the management while framing stock policy. It measures how

fast the stock is moving through the firm and generating sales. It helps to maintain a proper

amount of stock to fulfill the requirements of the concern. A proper inventory turnover makes the

business to earn a reasonable margin of profit.

Stevens Business School Page 17

18.) What is debtor turnover ratio? What is the implication of this ratio?

a. Debtor’s turnover Ratio: Debtors turnover ratio indicates the relation between net credit

sales and average accounts receivables of the year.

Debtors Turnover Ratio = Net Credit Sales/Average Accounts Receivables

Debtors Turnover Ratio 22.66 21.93 29.86

Debtors Turnover Ratio -- 22.66

Debtors Turnover Ratio -- 22.66

29.86

22.66 21.93

Mar '07 Mar '08 Mar '09

Objective and Significance: This ratio indicates the efficiency of the concern to collect the

amount due from debtors. It determines the efficiency with which the trade debtors are managed.

Higher the ratio, better it is as it proves that the debts are being collected very quickly.

b. Debt Collection Period: Debt collection period is the period over which the debtors are

collected on an average basis. It indicates the rapidity or slowness with which the money

is collected from debtors.

Stevens Business School Page 18

c. Debt Collection Period = 12 Months or 360 Days/Debtors Turnover Ratio

This ratio indicates how quickly and efficiently the debts are collected. The shorter the period the

better it is and longer the period more the chances of bad debts.

19.) What is fixed asset turnover? What is the implication if this ratio?

Fixed Assets Turnover Ratio = Net Sales/Net Fixed Assets

Fixed Assets Turnover Ratio 2.62 2.96 2.95 2.6

Fixed Assets Turnover Ratio

Fixed Assets Turnover Ratio

2.96 2.95

2.62 2.6

Mar '06 Mar '07 Mar '08 Mar '09

Objective and Significance: This ratio expresses the number to times the fixed assets are being

turned over in a stated period. It measures the efficiency with which fixed assets are employed. A

high ratio means a high rate of efficiency of utilization of fixed asset and low ratio means

improper use of the assets.

Stevens Business School Page 19

PROFIT & LOSS ANALYSIS

Stevens Business School Page 20

1.) What does profit and loss statement exactly indicate?

The profit and loss statement reports the results of operations and indicates the reasons for

company’s profitability. It summarizes the revenues and expenses of an accounting period.

2.) What was the reason of the decline in the sales figure of Bajaj automotives in 2008-09 as

compared to the previous year?

The Indian automotive sector has been hit by the combined effect of a severe credit crunch and a

fall in demand growth. The third quarter of 2008-09 was particularly fierce. Average monthly

sales of motorcycles in India fell by

Over 17% in Q3 2008-09 versus Q2 — from an average of 524,939 units per month to 435,114.

3.) Why is there an increase in the interest payments?

The interest paid increased from 5.16 to 21.8from 2008 to 2009. The reason is due to the increase

in debt.

4.) What are the sales expectations for the next year??

Company will be introducing upgraded Pulsar models in May 2009 and brand new models for

the executive segment in the second quarter of 2009-10. With these, and the positive response to

the XCD 135 cc which was introduced in

February 2009, I expect sales to recover in 2009-10 — not to the levels seen in 2006-07, but

better than most of 2008-09.

Stevens Business School Page 21

5.) How could company maintain healthy operating profit margins, despite contracting

sales?

Despite the severe contraction in company’s sales in 2008-09, it has been able to maintain

healthy operating margins. Indeed, the fourth quarter saw a rise in the margin to 15.2% of net

sales and other operating income. This has much to do with a better product mix, higher

productivity and lower input costs. The other reason is the management focus on lower costs and

greater profitability.

6.) What was the reason for decline in operating profit before tax?

Operating profit before tax (PBT) fell by 16.4% to Rs.8.46 billion. This was largely due to a

voluntary retirement scheme (VRS) of Rs.1.83 billion and mark-to-market losses of Rs.218

million. Even so, the operating profit margin was 9.6% of net sales and other operating income.

Stevens Business School Page 22

CASH FLOW ANALYSIS

Stevens Business School Page 23

1.) What are the Major factors affecting changes in operating cash flow?

The changes in cash flow from operating activities are largely due to depreciation & VRS

compensation by the firm.

Depreciation 127.22

VRS compensation charged off 183.3

Working capital requirement- 215.65.

2.) Why there is huge requirement for working capital?

Ans: Working capital requirement 215.65

This has been made possible by the management’s conscious action to support its vendors, by

significantly reducing payment cycle. This, and the rise in export debtors, has resulted in an

increase in operating working capital requirement as at 31 March 2009.

3.) Major components of changes in working capital?

Ans: Huge cash inflow due to increase in trade and trade receivables amounting to 203.92. This

has happened due to the rise in export debtors

4.) How the requirements for working capital meet by the company?

Ans: Short term loans & other borrowings

Short term loans 261.82. The borrowings (as a part of financing activities) have helped to meet

the requirements of large working capital.

Stevens Business School Page 24

5.) What is the major component affecting the cash flow from investing activity?

Ans: the major component would be capital expenditure decision that is 399.61.

6.) Why Bajaj auto is incurring huge Capital Expenditure?

Ans: Capital Expenditure 399.61

This large amount of capital expenditure is meant to purchase the fixed assets for the day to day

operating activities. Also there is a need to finance the expansion purposes mainly R&D and new

launch by the firm which calls for lump sum amount of capital expenditure.

7.) What are the major component affecting changes in cash flow from financing activities?

Ans: Dividend paid 288.5, short term borrowings and foreign exchange transactions are affecting

the cash flow from financing activities.

8.) From where the Dividend Paid by the company?

Ans: according to our analysis the company is paying dividend from its net worth. The dividend

declared by Bajaj auto ltd is 220%..

9.) What are these Foreign Exchange Transactions?

Foreign currency translation reserve 43.65.

The foreign exchange reserve also forms a significant part of cash outflow from the financing

activities.

This reserve arises at the time of consolidating the foreign entities (subsidiaries, Associates and

Joint ventures) with Holding company..The resultant exchange gains or loss from translating

from foreign currency to domestic country is an unrealized loss, called" Foreign currency

translation reserve".

Stevens Business School Page 25

CASH FLOW RATIOS ANALYSIS

Stevens Business School Page 26

1.) What is cash flow to net ratio?

Cash Flow to net income ratio

The cash-flow-to-net-income ratio reflects the relationship between accrual-basis results of

operations and cash-basis results of operations. So it is an important indication of the extent to

which accrual-basis assumptions have affected net income.

Cash-flow-to-net-income ratio = cash from operations/net income

= 276.46/ 597.5

=0.4626

2.) How would it help Bajaj auto ltd to reach on certain conclusion?

If the cash-flow-to-net-income ratio is greater than 1, it is most likely because of noncash

expenses like depreciation and amortization, as well as revenues that are received before they are

earned. Noncash expenses reduce net income but have no effect on cash flow. The bigger the

ratio, the more accounting assumptions are impacting net income.

In the BAJAJ AUTO LTD case the ratio is less than 1.

The reason of this drastic decrease is the huge working capital requirement and VRS payout such

that even the non cash expenditure is insufficient to raise it up.

3.) What is cash flow adequacy ratio?

Cash Flow Adequacy Ratio (investing)

Cash flow adequacy refers to whether there is enough cash generated by a company’s operations

to pay for its investments in long-term assets such as its plant assets or equipment, and still have

cash to pay off debt or distribute dividends.

If ratio >1: firm’s operations generate enough cash to grow the business.

If ratio< 1: Unable to pay for business growth, and other sources of financing are needed to

support the cash cost of operations

Stevens Business School Page 27

Cash flow adequacy ratio = Cash from operations/ Expenditures for fixed asset additions & new

business acquisitions

=276.46/ 399.61

= 0.69

As the ratio is less than 1, the firm needs other financing sources for its investing activities.

Cash flow adequacy ratio (investing & financing)

Cash flow adequacy ratio= cash from operations/ Long-term asset purchases + Long-term Debt

repayments+ Dividend payments

=276.46/399.61+5.87+288.5

=276.46/693.98

=0.39

4.) What do you infer about Bajaj auto ltd after calculating this ratio?

In BAJAJ AUTO LTD case, as the ratio is less than 1,so it can be inferred that the cash

generated from operating activities in not sufficient to support investing and financing operations

of the firm

5.) What is operating cash flow ratio? Why it is calculated?

Operating cash flow

The operating cash flow ratio is similar to the current ratio. As such, it shows the company’s

ability to generate cash from its operations, to cover its current liabilities.

Operating cash flow = Cash flow from operations/ current liabilities

= 276.46/2450.43

= 0.11

Stevens Business School Page 28

6.) What is the significance of cash interest ratio?

Cash interest coverage

The cash interest coverage ratio conveys the company’s ability to pay the

Interest on its debt. The numerator therefore measures the cash before

Interest and tax payments are made.

Cash interest coverage=Cash flow from operations +Interest paid +Taxes paid/Interest paid

=276.46+21.89+288.8

=26.82

With the cash interest coverage ratio of 26.82, we can say that BAJAJ AUTO LTD is sufficiently

able to pay back the interest on its debt through the cash generated on its operating activities.

7.) What is the implication of cash to capital expenditure? How does it help the firm?

Cash to capital expenditure

Cash to capital expenditures focuses on company health and growth. This ratio indicates whether

a company can take advantage of opportunities for growth and still pay off debt.

Cash to capital expenditure=Cash flow from operations/Capital expenditures

=276.46/399.61

=0.69

This ratio stands at an average value comparing the industry standards. The firm is considered to

have an average health with a ratio of 0.69

Stevens Business School Page 29

8.) What is the implication of cash to total debt?

Cash to total debt

This ratio measures the ability of firm to pay back its liabilities from the cash generated through

its operating activities. The higher the ratio, the better it is for the firm.

Cash to total debt = Cash flow from operations/Total debt

= 276.46/1603.03

= 0.17

The ratio, being less than one, signifies that the firm is not in apposition to fully pay back all its

liabilities at one go.

Stevens Business School Page 30

COMPARATIVE ANALYSIS

Stevens Business School Page 31

1.) Why sales turnover less than hero Honda??

Herohonda offers efficient vehicles for huge population segment. While the major products of

the Bajaj are for the specific segments like pulsar for youth, rickshaw for commercial use. But

Bajaj is also coming up with variety of models for the mass which provides the growth

opportunity.

2.) What about the turnover ratios of hero Honda, they are healthier than Bajaj?

Yes as we can see the raw material cycle, debtor cycle, creditors cycle, all are healthy and better

than Bajaj in hero Honda

The finished turnover ratios are good because of the continues demand or the product offered

by the hero Honda so might be their finished goods inventory moves faster as compared to Bajaj.

But if we see the raw material working cycle its better in Bajaj than hero Honda which is a good

sign for Bajaj.

3.) Earning per share of Bajaj was less than hero Honda?

The current market price of Bajaj is 1700 and that of Hero Honda is 1734.55 and the EPS of

Bajaj in March was 45.37 and that of hero Honda was 64.18. So it’s clear that the Bajaj lags

behind. But just from the past data it can not be blindly said that the Bajaj will earn lesser. The

company is coming up with 2 new models this year and may be two more next year. It has

invested a lot in Research and development in the recent years which is expected to fetch good

results. Thus we can say that hero Honda is good but Bajaj can also be included in your portfolio

looking at the future growth opportunities.

Stevens Business School Page 32

4) Should an investor invest in Bajaj Auto?

The things we can conclude from the analysis is that the current year’s EPS , P/E ratio, sales, net

profit margin are all healthier in Hero Honda and hence it gives a good opportunity to an

investor. Simultaneously Bajaj can also be a good option with respect to future growth. A slight

risk in Bajaj may lead to higher +ve return in future.

4.) What about the turnover ratios of the company?

The inventory ratios are further divided into raw material turnover and finished good turnover

ratios.

Raw material turnover ratio

Raw material turnover ratio is 53.88

Working cycle 365/53.88=6.77

We can deduce that raw material is replaced every 6.77 days, on an average. This also shows that

the raw material inventory is not kept for the long time, maintaining the required inventory level

Finished goods turnover

Finished goods turnover ratio 26.60

The working cycle 9.21

This shows that on an average finished goods are kept as an inventory for 9.21days.this is little

bit high but then also can be accepted in an auto industry.

DEBTORS AND CREDITORS TURNOVER RATIO

The debtor turnover ratio is 29.89

Working cycle (days) is 12.20

This means that the average credit given by the company is 12.20 days

Stevens Business School Page 33

Creditor’s turnover ratio 8.484

Working cycle is 53.06 days

This means the company on an average gets credit of 53.06 days which is quiet good for the

liquidity of the company. The credit is given due to brand value of the company.

As the debtor working cycle is 12.2 very less than creditors working cycle 53.06 .Thus it is good

for the company as the company is recovering money faster and paying money after long time.

Stevens Business School Page 34

FACTS ABOUT THE COMPANY

Stevens Business School Page 35

In a difficult year, there has been some positive news. The first is Bajaj Auto’s exports. During

2008-09, your company’s exports achieved an all-time high of 772,519 units of two- and three-

wheelers — representing a growth of 25% over the previous year.

Total two-wheelers 482,026 633,463 31 %

Three –wheelers 136,315 139,056 2 %

Total vehicles 618,341 772,519 25 %

Passenger vehicle sales

Industry sales 375,180 415,411 10.7%

Bajaj Auto sales 263,598 264,332 0.3%

Bajaj Auto market share 70.3% 63.6% (6.7%)

Goods carriers

Industry sales 130,826 82,382 (37.0%)

Bajaj Auto sales 26,714 10,197 (61.8%)

Bajaj Auto market share 20.4% 12.4% (8.0%)

Total 3-wheelers

Industry sales 506,006 497,793 (1.6%)

Bajaj Auto sales 290,312 274,529 (5.4%)

Bajaj Auto market share 57.4% 55.1% (2.3%)

(21st Dec 2009)

Stevens Business School Page 36

Annexure:

Stevens Business School Page 37

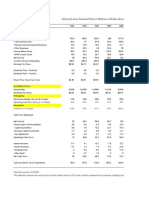

Profit & Loss

(Rs. in Crores)

Particulars Mar-09 Mar-08

INCOME :

Sales Turnover 9,049.66 9,689.95

Excise Duty 610.07 1,029.51

Net Sales 8,439.59 8,660.44

Other Income 495.60 507.19

Stock Adjustments -24.49 67.85

Total Income 8,910.70 9,235.48

EXPENDITURE :

Raw Materials 6,441.63 6,685.37

Power & Fuel Cost 60.89 69.20

Employee Cost 534.93 442.17

Other Manufacturing Expenses 131.34 147.16

Selling and Administration Expenses 458.73 450.69

Miscellaneous Expenses 193.59 151.00

Less: Pre-operative Expenses Capitalised 14.42 23.04

Total Expenditure 7,806.69 7,922.55

Operating Profit 1,104.01 1,312.93

Interest 21.01 5.16

Gross Profit 1,083.00 1,307.77

Depreciation 129.79 173.96

Profit Before Tax 953.21 1,133.81

Tax 298.00 392.00

Fringe Benefit tax 7.50 3.35

Deferred Tax -6.79 -17.32

Reported Net Profit 654.50 755.78

Extraordinary Items -114.78 -52.79

Adjusted Net Profit 769.28 808.57

Adjst. below Net Profit 0.00 0.00

P & L Balance brought forward 0.00 0.00

Statutory Appropriations 0.00 0.00

Appropriations 654.50 755.78

P & L Balance carried down 0.00 0.00

Dividend 318.30 289.37

Preference Dividend 0.00 0.00

Equity Dividend % 220.00 200.00

Earnings Per Share-Unit Curr 41.50 48.84

Earnings Per Share(Adj)-Unit Curr 41.50 NA

Book Value-Unit Curr 129.23 109.73

Stevens Business School Page 38

Balance Sheet

(Rs. in Crores)

Particulars Mar-09 Mar-08

SOURCES OF FUNDS :

Share Capital 144.68 144.68

Reserves Total 1,725.01 1,442.91

Total Shareholders Funds 1,869.69 1,587.59

Secured Loans 0.00 6.95

Unsecured Loans 1,570.00 1,327.39

Total Debt 1,570.00 1,334.34

Total Liabilities 3,439.69 2,921.93

APPLICATION OF FUNDS :

Gross Block 3,333.94 2,984.15

Less : Accumulated Depreciation 1,807.91 1,726.07

Less:Impairment of Assets 0.00 0.00

Net Block 1,526.03 1,258.08

Lease Adjustment 0.00 0.00

Capital Work in Progress 22.06 34.74

Investments 1,808.52 1,857.14

Current Assets, Loans & Advances

Inventories 338.84 349.61

Sundry Debtors 358.65 275.31

Cash and Bank 136.87 56.07

Loans and Advances 1,490.91 968.72

Total Current Assets 2,325.27 1,649.71

Less : Current Liabilities and Provisions

Current Liabilities 1,213.41 1,043.25

Provisions 1,224.15 834.04

Total Current Liabilities 2,437.56 1,877.29

Net Current Assets -112.29 -227.58

Miscellaneous Expenses not written off 199.56 10.53

Deferred Tax Assets 160.60 130.96

Deferred Tax Liability 164.79 141.94

Net Deferred Tax -4.19 -10.98

Total Assets 3,439.69 2,921.93

Contingent Liabilities 1,092.22 935.05

Stevens Business School Page 39

REFERENCES:

www.bajajauto.com

Stevens Business School Page 40

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Financial Market & InstrumentDokument73 SeitenFinancial Market & InstrumentSoumya ShettyNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- AB Bank Final ReportDokument72 SeitenAB Bank Final ReportShahjalal Sumon100% (1)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- A Year To Be Content WithDokument40 SeitenA Year To Be Content WithAnonymous Feglbx5Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Final Practical NAVTTCDokument8 SeitenFinal Practical NAVTTCParwaiz Ali JiskaniNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 05 Partnership DissolutionDokument15 Seiten05 Partnership DissolutionDarwyn MendozaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Market Technician No 44Dokument16 SeitenMarket Technician No 44ppfahdNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Value of Project ManagementDokument6 SeitenThe Value of Project ManagementRolly SocorroNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Linear Tech Dividend PolicyDokument25 SeitenLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- PRUlink One EngDokument11 SeitenPRUlink One Engsabrewilde29Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Annual Report Merk-2018Dokument59 SeitenAnnual Report Merk-2018Lisya Kimmiko100% (2)

- Accounting For LIPSADokument20 SeitenAccounting For LIPSAAjay Sahoo100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- An Investor's Due DiligenceDokument3 SeitenAn Investor's Due DiligenceNamtien UsNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Company Law: Important QuestionsDokument11 SeitenCompany Law: Important QuestionsGyanesh DoshiNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Jean-Louis Tourne PresentationDokument20 SeitenJean-Louis Tourne PresentationeatnutesNoch keine Bewertungen

- Complaint Against GreenlightDokument17 SeitenComplaint Against GreenlightRochester For AllNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- DerivativesDokument1 SeiteDerivativesRandy ManzanoNoch keine Bewertungen

- Videocon Industries LTD: Key Financial IndicatorsDokument4 SeitenVideocon Industries LTD: Key Financial IndicatorsryreddyNoch keine Bewertungen

- Wallstreetjournal 20171120 TheWallStreetJournalDokument46 SeitenWallstreetjournal 20171120 TheWallStreetJournalsadaq84Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Unit 4 Admission of New PartnerDokument5 SeitenUnit 4 Admission of New PartnerNeelabh KumarNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Capital Asset Pricing Model (Chapter 8)Dokument47 SeitenThe Capital Asset Pricing Model (Chapter 8)kegnataNoch keine Bewertungen

- Ratio Analysis of HR TextilesDokument26 SeitenRatio Analysis of HR TextilesOptimistic Eye100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- CostsDokument8 SeitenCostsTanjil Hasan TajNoch keine Bewertungen

- Accounting For Decision MakingDokument6 SeitenAccounting For Decision Makingswati_rathour0% (1)

- Analysis of Financial Statements of Harvest Investments CompanyDokument86 SeitenAnalysis of Financial Statements of Harvest Investments CompanyHarish AdithanNoch keine Bewertungen

- The Magic of CompoundingDokument4 SeitenThe Magic of Compoundingmaria gomezNoch keine Bewertungen

- Management Project - Vipra PatangiaDokument61 SeitenManagement Project - Vipra PatangiadilipNoch keine Bewertungen

- Investment Analysis and Portfolio ManagementDokument40 SeitenInvestment Analysis and Portfolio ManagementJohnNoch keine Bewertungen

- Exam 1 PDFDokument4 SeitenExam 1 PDFFiraa'ool YusufNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Foundation Model ConstitutionDokument18 SeitenFoundation Model ConstitutionMahmoodHassan100% (1)

- Class Exercise Session 1,2Dokument7 SeitenClass Exercise Session 1,2sheheryar50% (4)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)