Beruflich Dokumente

Kultur Dokumente

Anti Manipulation

Hochgeladen von

Kasem AhmedOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Anti Manipulation

Hochgeladen von

Kasem AhmedCopyright:

Verfügbare Formate

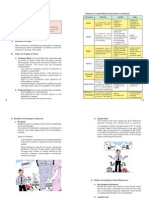

Definition. KEY ELEMENT: Intent to Manipulate.

MANIPULATION

Transactions that create or maintain an -Manipulative intent sufficient to bring cause of action

artificial price for security w/ conduct even if the attempted manipulation was not successful.

Give a little more attention to designed to deceive or defraud investors by Converse: Investment intent will VOID a charge of

hot issues. controlling AN ARTIFICIAL price of manipulation if it is proven sufficiently; regardless of

securities. transaction's impact on price.

Purchases/Bids by People Involved in Distribution

9(a)(2) & 10b-5 CAN Prohibit involved transactions

Excessive Trading

Rule 10b-18

Reg M 101 & 102. No Purchase by Saf. Harb. from

Excessive Trading Manipulative Devices

-Distribution participant, issuer, or 9a2/10b5

Manip. (Note: No manip device is necessary forr Sec. 9

affiliates thereof. Unless excepted. for non-IPO

actions; -> see Muarkowski. Even REAL TRADES

(if on test, just check listed exceptions) transactions.

9(a)(2) - Illegal to (1) w/ intent to stabilize/increase/decrease price are

engage in transactions manipulative) -Prohibition ends when distribution is

complete. Issuer Must:

creating (2) actual or

(1) use only one

apparent active -Wash Sales: Selling and repurcahsing the same or

B/D for all affiliates

trading or raising or substantially same security for purpose of

Reg M 103 -> Market Makers exempt on same day; (2)

depressing the price (3) 9(f) generating activity to increase the price

from Regs 101 & 102. Make purchases

for purpose of private

-Allowed to buy shares to honor the during midday ,

inducing the right of -Matched Sales: Trader places both buy and sell

shares it is going to sell ON NASDAQ. reg hours; (3)

purchase/sale of the action orders at same price; increase in activity intended

-Due to role of MMs on NASDAQ: must Price may not

security by others. to attract additional investors.

effect transactions given to it. exceed highest

[Interstatne commerce

independent bid;

or Nat'l sec exchange] -Painting the Tape: Group of traders create activity

AND (4) stock

or rumors with purpose of generating activiyt and

Reg M 105 -> Manipulative Short must be

10b-5 - Sinilar increasing price.

Sales. PRE-DISTRIBUTION!!! repurchased on an

requirements; scienter

exchange

etc. Manipulative Withholding: Parially fulfilling customer orders

device. (Interstate (withholding shares from market) to prevent prcie -Unlawful to purchase securities in a firm

commerce rom dropping. commitment equity offering from UW or

(Work out market) BD participaiting in the offering if that

person sold short the security that is the

"For purpose of" -> Absnet Rule 415 Compliance, shelf registration subject of the offering

Purpose must soley to practices may be manipulative as

raise price. work-outmarket/withoolding securities. [Unless exceptions apply; but i dont' think

we put much time into them]

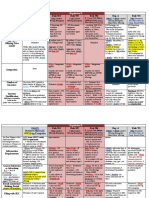

Hot Issue Manipulation

Hot issue occurs when an IPO security is popular and goes above the IPO price on first day Stablization. @ IPO.

of trading. Not manipulative per se, but highly susceptible to manipulative activities. NEVER ALLOWED unless Regulation M Compliant.

Free Riding SEC/FINRA Response Reg M 104 -> NO STABILIZATION.

Problematic. -> New Rules 104(a) unlawful to stabilize a bid in connection with an offering

Purchasing price -> Require prompt unless rule permits.

at IPO with delivery and confirmation 104(b) -> Permitted ONLY to prevent a decline in the MKT price.

of securities to customers; (1) to prevent decline; (2) at or below offering pirce; (3) initated a

intention to

immediatley re-sell -> Prospectus period price no higher than then-current price; (4) prior notice must be

w/o long-term extended to 90 days for given to the MKT; and (5) purchasers must recieve disclosure in

investment. first-time issuers. registratoin statment OR propsecuts of possibility of stabilizing

-> Prohibit witholding of bids.

securities by UW, delaers,

& associates for

subsequent sales at

higher prices; AND Manipulation Liability -> Four Main

-> Prohibit excessive

compensation to 9: Must prove Wilfulness and that price was actually

udnerwriters in form of affected by manipulation.

warrants of cheap stock. 10b: 10b-5 applies to ALL securities, not just exchange

traded.

15(c): Not limited to exchange-traded securities. (limited to

Underwriters Should AVOID (per SEC Release) actions by Broker-Dealers

17(a): Dealer cannot charge prices not reasonably related

-> Inducements to purchase or other aftermarket soclicitations prior to to prevailing mrket price w/o disclosure.

completition of distribution

-> Communicating to customers that interest in buying shares in immediate SEC typically brings charges under all four if possible

aftermarket would help them get some shares;

-> Solicit customers prior to completion of distribution regarding post-distribution

quanttities;

-> Proposing aftermarket prices to customers;

-> Accepting or seeking expressions of interest from customers that they intend to

purchase an amount of shars in aftermarket equal to size of IPO;

->Allocating additional IPO shares to customers who pledge to buy in aftermarket;

Das könnte Ihnen auch gefallen

- Acclaw4 ReviewerDokument5 SeitenAcclaw4 ReviewerNICOLE GAGULANoch keine Bewertungen

- Institutions Who Come Together To Search And: Upper Bound DiagramDokument2 SeitenInstitutions Who Come Together To Search And: Upper Bound DiagramVinodhKumarNoch keine Bewertungen

- CFA Level 3 Book 5Dokument11 SeitenCFA Level 3 Book 5sasasNoch keine Bewertungen

- Short Swing ProfitsDokument1 SeiteShort Swing ProfitsmattNoch keine Bewertungen

- Summary of Capital Market Instruments in IndonesiaDokument6 SeitenSummary of Capital Market Instruments in IndonesiaAyesha MaroofNoch keine Bewertungen

- Flash CardDokument13 SeitenFlash Cardkren24Noch keine Bewertungen

- Topic 3 - IAS 36Dokument15 SeitenTopic 3 - IAS 36antran.31201025723Noch keine Bewertungen

- Far 02 - Discontinued Operations and Non-Current Assets Held For SaleDokument2 SeitenFar 02 - Discontinued Operations and Non-Current Assets Held For SaleMarie GonzalesNoch keine Bewertungen

- 1Dokument5 Seiten1Abdul RaufNoch keine Bewertungen

- Takeovers 6Th Set of Transparencies For TocfDokument20 SeitenTakeovers 6Th Set of Transparencies For TocfKalwant SinghNoch keine Bewertungen

- MarginDokument1 SeiteMarginRaj GaikarNoch keine Bewertungen

- 4569b26b-b609-47a5-894e-887996cef8c4Dokument25 Seiten4569b26b-b609-47a5-894e-887996cef8c4Mohamed ElsirNoch keine Bewertungen

- Chapter 1Dokument4 SeitenChapter 1Mary MacbethNoch keine Bewertungen

- CHAP001 2eDokument47 SeitenCHAP001 2eeren rasteNoch keine Bewertungen

- Chap1 - Market Structure&OrganizationDokument3 SeitenChap1 - Market Structure&Organizationeya KhamassiNoch keine Bewertungen

- Differentiating A Legitimate Hedge From A Target For ManipulationDokument37 SeitenDifferentiating A Legitimate Hedge From A Target For ManipulationVladislavNoch keine Bewertungen

- ECOMANDokument2 SeitenECOMANLoise MorenoNoch keine Bewertungen

- LP Delta NeutralDokument11 SeitenLP Delta NeutralMatthias SyllaNoch keine Bewertungen

- SS - 5-6 - Mindmaps - Financial ReportingDokument48 SeitenSS - 5-6 - Mindmaps - Financial Reportinghaoyuting426Noch keine Bewertungen

- Fundamentals of AccountingDokument6 SeitenFundamentals of AccountingMJ Dela PenaNoch keine Bewertungen

- Dividend Policy MindmapDokument4 SeitenDividend Policy Mindmapnurul hamizah yang hamzahNoch keine Bewertungen

- 4 QuizDokument3 Seiten4 QuizAnandapadmanaban Muralidharan Muralidharan100% (1)

- Firm Org-Vertical Boundaries G3-G4Dokument32 SeitenFirm Org-Vertical Boundaries G3-G4Aquib RahmanNoch keine Bewertungen

- Economics Mrunalsir Notes2 AnnotatedDokument10 SeitenEconomics Mrunalsir Notes2 AnnotatedakankshaNoch keine Bewertungen

- PDF Warren SM ch07 Final - CompressDokument20 SeitenPDF Warren SM ch07 Final - CompressBerliana MustikasariNoch keine Bewertungen

- Far 02 - Discontinued Operations and Non-Current Assets Held For SaleDokument3 SeitenFar 02 - Discontinued Operations and Non-Current Assets Held For SaleMarie GonzalesNoch keine Bewertungen

- @csupdates Competition Act 2002Dokument18 Seiten@csupdates Competition Act 2002Syed BukhariNoch keine Bewertungen

- Target Redemption Forward (TARF) : Tailor-Made Solution To Enhance Your Currency RateDokument2 SeitenTarget Redemption Forward (TARF) : Tailor-Made Solution To Enhance Your Currency RateVishalMehrotraNoch keine Bewertungen

- PWC 10minutes DivestituresDokument8 SeitenPWC 10minutes DivestituresfuckmegayNoch keine Bewertungen

- Checklist On "Foreign Exchange Risk Management"Dokument2 SeitenChecklist On "Foreign Exchange Risk Management"Mazharul Islam RafiNoch keine Bewertungen

- Reviewer SalesDokument13 SeitenReviewer SalesJana marieNoch keine Bewertungen

- Oct 29 - Reliance InfrastructureDokument1 SeiteOct 29 - Reliance InfrastructureMadhukar DasNoch keine Bewertungen

- Cyclos: A Concentrated Liquidity Market Maker On Serum Order BooksDokument3 SeitenCyclos: A Concentrated Liquidity Market Maker On Serum Order BooksJublangan NerakaNoch keine Bewertungen

- Instructions For Schedule D (Form 1120S) : Pager/SgmlDokument4 SeitenInstructions For Schedule D (Form 1120S) : Pager/SgmlIRSNoch keine Bewertungen

- Impairment of Non Current Assets - Ias 36: - Impairment Is A Reduction To The Recoverable Amount of An Asset or ADokument89 SeitenImpairment of Non Current Assets - Ias 36: - Impairment Is A Reduction To The Recoverable Amount of An Asset or ATram NguyenNoch keine Bewertungen

- Dealings in PropertiesDokument8 SeitenDealings in Propertiesricamae saladagaNoch keine Bewertungen

- 2020 - L1 - Derivatives and Alternative InvestmentDokument81 Seiten2020 - L1 - Derivatives and Alternative InvestmentMlungisi MalazaNoch keine Bewertungen

- Cheat Sheet For Valuation (2) - 1Dokument2 SeitenCheat Sheet For Valuation (2) - 1RISHAV BAIDNoch keine Bewertungen

- Ifrs 3 - Business Combination: According To The Nature of BusinessDokument5 SeitenIfrs 3 - Business Combination: According To The Nature of BusinessBrian GoNoch keine Bewertungen

- Ind AS 105 PDFDokument32 SeitenInd AS 105 PDFSATYANARAYANA MOTAMARRINoch keine Bewertungen

- Week 9 Impairment of Non-Current Assets (MFRS 136) For StudentsDokument32 SeitenWeek 9 Impairment of Non-Current Assets (MFRS 136) For StudentsAnselmNoch keine Bewertungen

- Finman ReviewerDokument24 SeitenFinman ReviewerXeleen Elizabeth ArcaNoch keine Bewertungen

- Chapter 3Dokument2 SeitenChapter 3Azi LheyNoch keine Bewertungen

- Instructions For Schedule D (Form 1120S) : Capital Gains and Losses and Built-In GainsDokument3 SeitenInstructions For Schedule D (Form 1120S) : Capital Gains and Losses and Built-In GainsIRSNoch keine Bewertungen

- WilliamBlair CES Navigating Stock RestrictionsDokument2 SeitenWilliamBlair CES Navigating Stock RestrictionsTheodoros MaragakisNoch keine Bewertungen

- Accounting STDS and ProceduresDokument9 SeitenAccounting STDS and ProceduresVaishnavi ChaturvediNoch keine Bewertungen

- Zero Counterparty Risk Custodial Exchange For Algorithms: ConceptDokument1 SeiteZero Counterparty Risk Custodial Exchange For Algorithms: ConceptAnton KravchenkoNoch keine Bewertungen

- Knowledge - Skills - ConductDokument9 SeitenKnowledge - Skills - ConductShilpi JainNoch keine Bewertungen

- Level I - Derivatives and Alternative Investments: Last Revised: 05/05/2021Dokument77 SeitenLevel I - Derivatives and Alternative Investments: Last Revised: 05/05/2021Harsh JainNoch keine Bewertungen

- Dex AttackDokument18 SeitenDex Attackif05041736Noch keine Bewertungen

- The Capital Market The Capital MarketDokument43 SeitenThe Capital Market The Capital MarketTarun BaldiaNoch keine Bewertungen

- Financial Risk IdentificationDokument3 SeitenFinancial Risk IdentificationMaria Hannah GallanoNoch keine Bewertungen

- Foreign Exchange Risk ManagementDokument4 SeitenForeign Exchange Risk ManagementMiran shah chowdhuryNoch keine Bewertungen

- Pfrs 5 - Noncurrent Asset Held For Sale and Discontinuted Operations Noncurrent Asset Held For SaleDokument2 SeitenPfrs 5 - Noncurrent Asset Held For Sale and Discontinuted Operations Noncurrent Asset Held For SaleKent Raysil PamaongNoch keine Bewertungen

- Getting Smarter Series Arbitrage FundsDokument7 SeitenGetting Smarter Series Arbitrage Fundskishore13Noch keine Bewertungen

- Infographic FIN346 Chapter 5Dokument2 SeitenInfographic FIN346 Chapter 5AmaninaYusri100% (2)

- Bodie8ce FormulaSheet PDFDokument24 SeitenBodie8ce FormulaSheet PDFSandini Dharmasena PereraNoch keine Bewertungen

- Ateneo Central Bar Operations 2007 Civil Law Summer ReviewerDokument24 SeitenAteneo Central Bar Operations 2007 Civil Law Summer ReviewerMiGay Tan-Pelaez89% (9)

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionVon EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionBewertung: 4.5 von 5 Sternen4.5/5 (15)

- Best Criminal Law OutlineDokument46 SeitenBest Criminal Law OutlineKasem Ahmed75% (4)

- Stambovsky V AckleyDokument4 SeitenStambovsky V AckleyKasem AhmedNoch keine Bewertungen

- USFR Outline CondensedDokument40 SeitenUSFR Outline CondensedKasem AhmedNoch keine Bewertungen

- Great Old Property Outline DetailedDokument203 SeitenGreat Old Property Outline DetailedKasem AhmedNoch keine Bewertungen

- Constitutional Law OutlineDokument32 SeitenConstitutional Law OutlineKasem AhmedNoch keine Bewertungen

- Chart OutlineDokument29 SeitenChart OutlineKasem AhmedNoch keine Bewertungen

- Corporations DBR Fall 2018-OutlinedepotDokument185 SeitenCorporations DBR Fall 2018-OutlinedepotKasem AhmedNoch keine Bewertungen

- Roin Torts1Dokument72 SeitenRoin Torts1Kasem AhmedNoch keine Bewertungen

- Corporate Finance Outline, Spring 2013Dokument60 SeitenCorporate Finance Outline, Spring 2013Kasem Ahmed100% (1)

- Mergers and Acquisition OutlineDokument53 SeitenMergers and Acquisition OutlineKasem AhmedNoch keine Bewertungen

- Torts Wyman Spring 2008Dokument62 SeitenTorts Wyman Spring 2008hmckinney86Noch keine Bewertungen

- Law B262F Business Law I: Lecturers: Lana Tang (OUHK)Dokument20 SeitenLaw B262F Business Law I: Lecturers: Lana Tang (OUHK)Kasem AhmedNoch keine Bewertungen

- Roin Torts1Dokument72 SeitenRoin Torts1Kasem AhmedNoch keine Bewertungen

- Foreign Relations Law Cheat SheetDokument5 SeitenForeign Relations Law Cheat SheetKasem AhmedNoch keine Bewertungen

- Constitutional Law West Falcon 2015Dokument39 SeitenConstitutional Law West Falcon 2015Kasem AhmedNoch keine Bewertungen

- '33 Act Exemptions BroadlyDokument1 Seite'33 Act Exemptions BroadlyKasem AhmedNoch keine Bewertungen

- Pfaff Criminallaw Spring 2018 OutlineDokument39 SeitenPfaff Criminallaw Spring 2018 OutlineKasem AhmedNoch keine Bewertungen

- Schwarzenegger AobDokument59 SeitenSchwarzenegger AobKasem AhmedNoch keine Bewertungen

- Torts Outline1Dokument32 SeitenTorts Outline1Kasem AhmedNoch keine Bewertungen

- 201-f Retail Sale of Halal Food or Food ProductsDokument2 Seiten201-f Retail Sale of Halal Food or Food ProductsKasem AhmedNoch keine Bewertungen

- Burger King Corp. v. RudzewiczDokument1 SeiteBurger King Corp. v. RudzewiczKasem AhmedNoch keine Bewertungen

- Personal. Jurisdiction Attack OutlineDokument11 SeitenPersonal. Jurisdiction Attack OutlineKasem AhmedNoch keine Bewertungen

- Torts Outline1Dokument32 SeitenTorts Outline1Kasem AhmedNoch keine Bewertungen

- Amadei V Duke ComplaintDokument21 SeitenAmadei V Duke ComplaintKasem AhmedNoch keine Bewertungen

- DeWeerth v. Baldinger 1994Dokument24 SeitenDeWeerth v. Baldinger 1994Kasem AhmedNoch keine Bewertungen

- 11.15 Psych 101 LectureDokument2 Seiten11.15 Psych 101 LectureKasem AhmedNoch keine Bewertungen

- The Man Who Could Have Stopped The Islamic StateDokument8 SeitenThe Man Who Could Have Stopped The Islamic StateKasem AhmedNoch keine Bewertungen

- AP Physics ReviewDokument96 SeitenAP Physics Reviewderekcal100% (6)

- KM - Strengthen and WeakenDokument41 SeitenKM - Strengthen and WeakenKasem AhmedNoch keine Bewertungen

- Class Test PartnershipDokument2 SeitenClass Test PartnershippalashndcNoch keine Bewertungen

- Director VP Marketing in Boston MA Resume Jeffrey LawsonDokument2 SeitenDirector VP Marketing in Boston MA Resume Jeffrey LawsonJeffreyLawsonNoch keine Bewertungen

- 2307 WestmeridianDokument2 Seiten2307 WestmeridianRheddy RaymundoNoch keine Bewertungen

- Case Study On LakmeDokument3 SeitenCase Study On LakmeSudhir KakarNoch keine Bewertungen

- Enron ScandalDokument9 SeitenEnron ScandalRohith MohanNoch keine Bewertungen

- MS 900T01 Microsoft 365 Fundamentals MCT PDFDokument158 SeitenMS 900T01 Microsoft 365 Fundamentals MCT PDFhernan100% (1)

- Applying Value Stream Mapping Technique in Apparel IndustryDokument9 SeitenApplying Value Stream Mapping Technique in Apparel IndustryAbhinav Ashish100% (1)

- UEH Booklet Articulation Programme 2022 - 2023Dokument19 SeitenUEH Booklet Articulation Programme 2022 - 2023THANH NGUYEN MINHNoch keine Bewertungen

- Solution Maf503 - Jun 2018Dokument8 SeitenSolution Maf503 - Jun 2018anis izzati100% (1)

- Nptel: TopicDokument104 SeitenNptel: TopicRAJAT . 20GSOB1010459Noch keine Bewertungen

- Business Analytics: From IIM KozhikodeDokument8 SeitenBusiness Analytics: From IIM KozhikodeNirmalya SenNoch keine Bewertungen

- Professional Ethics-Unit 1Dokument21 SeitenProfessional Ethics-Unit 1Infanta mary100% (1)

- Ship Labour Act 2013Dokument21 SeitenShip Labour Act 2013alexNoch keine Bewertungen

- What Are 10 Reasons Why You Need ISO 9001 Certification?Dokument4 SeitenWhat Are 10 Reasons Why You Need ISO 9001 Certification?Rajesh SharmaNoch keine Bewertungen

- Abc Analysis of Ca Final FR For May 2022 ExamsDokument4 SeitenAbc Analysis of Ca Final FR For May 2022 ExamsYuva LakshmiNoch keine Bewertungen

- Yvette Cyprian ElewaDokument5 SeitenYvette Cyprian Elewaapi-535701983Noch keine Bewertungen

- Creating A Functional Process Control Configuration in HFMDokument3 SeitenCreating A Functional Process Control Configuration in HFMDeva Raj0% (1)

- 2nd Phase TestDokument6 Seiten2nd Phase TestFaiza OmarNoch keine Bewertungen

- Country Risk Analysis 2Dokument34 SeitenCountry Risk Analysis 2donmogamboNoch keine Bewertungen

- Inventory Management: Iscussion UestionsDokument17 SeitenInventory Management: Iscussion UestionssebastianNoch keine Bewertungen

- Jurnal KM 7 PDFDokument14 SeitenJurnal KM 7 PDFFatirah AzzahraNoch keine Bewertungen

- Jill Barad's CaseDokument3 SeitenJill Barad's Case{OK}Noch keine Bewertungen

- Quiz 1 ConsulDokument4 SeitenQuiz 1 ConsulJenelyn Pontiveros40% (5)

- SWOT Analysis of Amazon - Brand Amazon SWOT AnalysisDokument12 SeitenSWOT Analysis of Amazon - Brand Amazon SWOT AnalysisFUNTV5Noch keine Bewertungen

- War22e Ch13Dokument77 SeitenWar22e Ch13tamparddNoch keine Bewertungen

- Joint Venture Agreement - DRAFT CriptocurrencyDokument10 SeitenJoint Venture Agreement - DRAFT CriptocurrencyTomás González CuervoNoch keine Bewertungen

- MBA Finance (Production Functions: CH 3) MBS (Production and Cost Analysis: CH 3) MBM (Theory of Production and Cost: Ch3)Dokument48 SeitenMBA Finance (Production Functions: CH 3) MBS (Production and Cost Analysis: CH 3) MBM (Theory of Production and Cost: Ch3)Saru Regmi100% (1)

- Deloitte CN Cip Omni Channel Retail White Paper en 171107Dokument27 SeitenDeloitte CN Cip Omni Channel Retail White Paper en 171107Shyam KiranNoch keine Bewertungen

- The Rise and Rise of The B2B Brand: Rick Wise and Jana ZednickovaDokument10 SeitenThe Rise and Rise of The B2B Brand: Rick Wise and Jana Zednickovasobti_mailmeNoch keine Bewertungen

- The Importance of Independence.: Q:-Who Is Subject To Independence Restrictions?Dokument5 SeitenThe Importance of Independence.: Q:-Who Is Subject To Independence Restrictions?anon-583391Noch keine Bewertungen