Beruflich Dokumente

Kultur Dokumente

Bir Train-Income Tax

Hochgeladen von

Patricia Blanca SDVROriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bir Train-Income Tax

Hochgeladen von

Patricia Blanca SDVRCopyright:

Verfügbare Formate

Briefing on RA 10963: Tax

Reform for Acceleration and

Inclusion (TRAIN) – Income Tax

NIRC Provision NIRC TRAIN

Section 24 Taxable income of individuals are subject to the Revised personal income tax

Income tax rates following graduated rates: brackets of 2018-2022:

on individual Tax Schedule Tax Schedule effective January 1,

citizen and 2018 to December 31, 2022

individual resident Not over P10,000 5%

alien of the Not over 0%

Over P10,000 but not P500 + 10% of the

Philippines P250,000

over P30,000 excess over P10,000

Over P30,000 but not P2,500 + 15% of the

over P70,000 excess over P30,000

Over P70,000 but not P8,500 + 20% of the

over P140,000 excess over P70,000

Over P140,000 but not P22,500 + 25% of the

over P250,000 excess over P140,000

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 24 Taxable income of individuals are subject Revised personal income tax brackets of

Income tax rates to the following graduated rates: 2018-2022:

on individual Tax Schedule Tax Schedule effective January 1, 2018 to

citizen and December 31, 2022

individual Over P250,000 but P50,000 + 30% of Over P250,000 but 20% of the excess over

resident alien of not over P500,000 the excess over not over P400000 P250,000

the Philippines P250,000 Over P400,000 but P30,000 + 20% of the

Over P500,000 P125,000 + 32% of not over P800,000 excess over P400,000

the excess over

Over P800,000 but P130,000 + 30% of the

P500,000

not over P2million excess over P800,000

Over P2Million but P490,000 + 32% of the

not over P8Million excess over P2Million

Over P8Million P2,410,000 + 35% of the

excess over P8Million

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

NIRC Provision NIRC TRAIN

Section 24 For 2023 onwards:

Income tax rates Tax Schedule effective January 1, 2018 to

on individual December 31, 2022

citizen and Not over P250,000 0%

individual resident

Over P250,000 but not 15% of the excess over

alien of the

over P400,000 P250,000

Philippines

Over P400,000 but not P22,500 +20% of the

over P800,000 excess over P400,000

Over P800,000 but not P102,500 + 25% of the

over P2,000,000 excess over P800,000

Over P2Million but not P402,500 + 30% of the

over P8Million excess over P2Million

Over P8Million P2,202,500 + 35% of the

excess over P2Million

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 24 Refer to Revenue Memorandum Circular (RMC)

Income tax rates on Nos. 105-2017 and 1-2018, Revised Withholding

individual citizen and Tax on Compensation Table

individual resident

alien of the

Philippines

Section 24 Taxable income is subject to the For purely self-employed and/or professionals

Income tax of self- same graduated rates whose gross sales/receipt and other non-

employed and/or operational income do not exceed the VAT

professionals threshold of P3Million, the tax shall be, at the

taxpayer’s option, either:

1. 8% income tax on gross sales or gross

receipts in excess of P250,000 in lieu of the

graduated income tax rates and the other

percentage tax; OR

2. Income tax based on the graduated income

tax rates for individuals

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

NIRC NIRC TRAIN

Provision

Section 24 Taxable income is subject to For mixed income earners (earning both compensation

Income tax of mixed the same graduated rates income and income from business or practice of

income earners profession, their income taxes shall be:

1. For income from compensation – Graduated

income tax rates fro individuals, AND

2. For income from business or practice of

profession:

a. Gross sales/receipts which do not exceed the

VAT threshold of P3Million – 8% income tax

on gross sales/receipts and other non-

operating income OR graduated income tax

rates on taxable income, at the taxpayer’s

option

b. Gross sales/receipts and other non-operating

income which exceeds the VAT threshold of

P3Million – graduated income tax rates for

individuals

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Illustration 1: Mr. CSO, works for G.O.D., Inc. He is not engaged in business

nor has any other source of income other than his employment. For 2018, Mr.

CSO earned a total taxable compensation income of ₱1,060,000.00.

Compute for the Income Tax Due of Mr. CSO.

His income tax liability will be computed as follows:

Taxable Compensation Income ₱ 1,060,000.00

Tax Due:

On P800,000.00 ₱ 130,000.00

On excess (P1,060,000.00 - P800,000.00) x 30%

78,000.00

Tax Due ₱ 208,000.00

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Illustration 2: Ms. EBQ operates a convenience store while she offers bookkeeping

services to her clients. In 2018, her gross sales amounted to P800,000.00, in addition

to her receipts from bookkeeping services of ₱300,000.00. She already signified her

intention to be taxed at 8% income tax rate in her 1st quarter return.

Her income tax liability for the year will be computed as follows:

Gross Sales – Convenience Store ₱ 800,000.00

Gross Receipts – Bookkeeping 300,000.00

Total Sales/Receipts ₱ 1,100,000.00

Less: Amount allowed as deduction under Sec. 24(A)(2)(b) 250,000.00

Taxable Income ₱ 850,000.00

Tax Due:

8% of P850,000.00 ₱ 68,000.00

* The total of gross sales and gross receipts is below the VAT threshold of ₱3,000,000.00.

* Income tax imposed herein is based on the total of gross sales and gross receipts.

* Income tax payment is in lieu of the graduated income tax rates under subsection (A) hereof and

percentage tax due, by express provision of law.

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Illustration 3: Ms. EBQ above, failed to signify her intention to be taxed at 8% income

tax rate on gross sales in her 1st Quarter Income Tax Return, and she incurred cost

of sales and operating expenses amounting to ₱600,000.00 and ₱200,000.00,

respectively, or a total of ₱800,000.00, the income tax shall be computed as follows:

Gross Sales/Receipts ₱ 1,100,000.00

Less: Cost of Sales 600,000.00

Gross Income ₱ 500,000.00

Less: Operating Expenses 200,000.00

Taxable Income ₱ 300,000.00

Tax Due:

On excess (P300,000 - P250,000) x 20% ₱ 10,000.00

* Aside from income tax, Ms. EBQ is likewise liable to pay business tax.

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Illustration 4: Mr. JMLH signified her intention to be taxed at 8% income tax rate on

gross sales in her 1st Quarter Income Tax Return. However, her gross sales during the

taxable year has exceeded the VAT threshold.

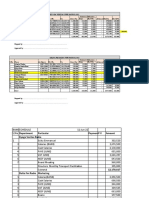

Q1 Q2 Q3 Q4

(8% Rate) (8% Rate) (8% Rate)

Total Sales ₱ 500,000.00 ₱ 500,000.00 ₱ 2,000,000.00 ₱ 3,000,000.00

Less: Cost of Sales 300,000.00 300,000.00 1,200,000.00 1,200,000.00

Gross Income ₱ 200,000.00 ₱ 200,000.00 ₱ 800,000.00 ₱ 1,800,000.00

Less: Operating

Expenses 120,000.00 120,000.00 480,000.00 720,000.00

Taxable Income ₱ 80,000.00 ₱ 80,000.00 ₱ 320,000.00 ₱ 1,080,000.00

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Tax due shall be computed as follows:

Total Sales ₱ 6,000,000.00

Less: Cost of Sales 3,000,000.00

Gross Income ₱ 3,000,000.00

Less: Operating Expenses 1,440,000.00

Taxable Income ₱ 1,560,000.00

Income Tax Due

Tax Due under the graduated rates ₱ 358,000.00

Less: 8% income tax previously paid (Q1 to Q3) 220,000.00

Annual Income Tax Payable ₱ 138,000.00

* The gross receipts exceeded the VAT threshold of P3,000,000.00. Taxpayer shall be liable to pay income

tax under graduated rates pursuant to Section 24(A)(2)(a) of the Tax Code, as amended.

* Taxpayer shall be allowed an income tax credit of quarterly payments initially made under the 8%

income tax option.

* Taxpayer is likewise liable for business tax(es), in addition to income tax. A percentage tax pursuant to

Section 116 of the Tax Code, as amended, shall be imposed on the first P3,000,000.00. The excess of the

threshold shall be

subject to VAT.

*Percentage tax due on the P3,000,000.00 shall be collected without penalty, if timely paid on the due

date immediately following the month the threshold was breached.

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Illustration 5: Ms. RPSV, a prominent independent contractor who offers architectural

and engineering services. Since her career flourished, her total gross receipts

amounted to ₱4,250,000.00 for taxable year 2018. Her recorded cost of service and

operating expenses were ₱2,150,000.00 and ₱1,000,000.00, respectively.

Her income tax liability will be computed as follows:

Gross Receipts – (Arch. and Eng’g Services) ₱ 4,250,000.00

Less: Cost of Service 2,150,000.00

Gross Income ₱ 2,100,000.00

Less: Operating Expenses 1,000,000.00

Taxable Income ₱ 1,100,000.00

Tax Due:

On ₱800,000.00 ₱ 130,000.00

On excess (P1,100,000.00 - P800,000.00) X 30% 90,000.00

Income Tax Due ₱ 220,000.00

* The gross receipts exceeded the VAT threshold of P3,000,000.00. She is

liable for

business tax/es, in addition to income tax.

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Illustration 6: In 2018, Mr. GCC owns a nightclub and videoke bar, with gross

sales/receipts of ₱2,500,000.00. His cost of sales and operating expenses are

₱1,000,000.00 and ₱600,000.00, respectively, and with non-operating income of ₱100,000.00.

His tax due for 2018 shall be computed as follows:

Taxable Income from Business:

Gross Sales ₱ 2,500,000.00

Less: Cost of Sales 1,000,000.00

Gross Income ₱ 1,500,000.00

Less: Operating Expenses 600,000.00

Net Income from Operation ₱ 900,000.00

Add: Non-operating Income 100,000.00

Taxable Income ₱ 1,000,000.00

Tax Due:

On ₱800,000.00 ₱ 130,000.00

On excess (₱1,000,000.00 - ₱800,000.00) x 30% 60,000.00

Total Income Tax ₱ 190,000.00

* The taxpayer has no option to avail of the 8% income tax rate on his income from business since his business income is subject to

Other Percentage Tax under Section 125 of the Tax Code, as amended.

* Aside from income tax, taxpayer is liable to pay the prescribed business tax.

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Illustration 7: In 2018, Mr. MAG, a Financial Comptroller of JAB Company, earned

annual compensation of ₱1,500,000.00, inclusive of 13th month and other benefits in

the amount of ₱120,000.00 but net of mandatory contributions to SSS and

Philhealth. Aside from employment income, he owns a convenience store, with gross

sales of ₱2,400,000. His cost of sales and operating expenses are ₱1,000,000.00 and

₱600,000.00, respectively, and with non-operating income of ₱100,000.00.

a. His tax due for 2018 shall be computed as follows if he opted to be taxed at eight percent (8%)

income tax rate of his gross sales for his income from business:

Total compensation income ₱ 1,500,000.00

Less: Non-taxable 13th month pay and other benefits ____ 90,000.00

Taxable Compensation Income ₱ 1,410,000.00

Tax due:

1. On Compensation:

On ₱800,000.00 ₱ 130,000.00

On excess (P1,410,000 – P800,000) x 30% 183,000.00

Tax due on Compensation Income ₱ 313,000.00

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

2. On Business Income:

Gross Sales ₱ 2,400,000.00

Add: non-operating income of 100,000.00

Taxable Business Income ₱ 2,500,000.00

Multiplied by income tax rate 8%

Tax Due on Business Income ₱ 200,000.00

Total Income Tax Due (Compensation and Business) ₱ 513,000.00

* The option of 8% income tax rate is applicable only to taxpayer’s income from

business and the same is in lieu of the income tax under the graduated income

tax rates and the percentage tax under Section 116 of the Tax Code, as

amended.

* The amount of ₱250,000.00 allowed as deduction under the law for taxpayers

earning solely from self-employment/practice of profession, is not applicable

for mixed income earner under the 8% income tax rate option.

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

b. His tax due for 2018 shall be computed as follows if he did not opt for the eight percent (8%) income

tax based on gross sales/receipts and other nonoperating income:

Total compensation income ₱ 1,500,000.00

Less: Non-taxable 13th month pay and other benefits 90,000.00

Taxable Compensation Income ₱ 1,410,000.00

Add: Taxable Income from Business –

Gross Sales ₱ 2,400,000.00

Less: Cost of Sales 1,000,000.00

Gross Income ₱ 1,400,000.00

Less: Operating Expenses 600,000.00

Net Income from Operation ₱ 800,000.00

Add: Non-operating Income 100,000.00

Total Taxable Income ₱ 2,310,000.00

Tax Due:

On ₱2,000,000.00 ₱ 490,000.00

On excess (₱2,310,000 - 2,000,000) x 32% 99,200.00

Total Income Tax ₱ 582,200.00

* The taxable income from both compensation and business shall be combined for purposes of computing the income tax due if the

taxpayer chose to be subject under the graduated income tax rates.

* In addition to the income tax, Mr. MAG is likewise liable to pay percentage tax of ₱72,000.00, which is 3% of ₱2,400,000.00

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Illustration 8: In 2018. Mr. WBV, an officer of AMBS International Corp. earned annual compensation of

₱1,200,000.00, inclusive of 13 th month and other benefits in the amount of ₱120,000.00. Aside from

employment income, he owns a farm, with gross sales of ₱3,500,000. His cost of sales and operating

expenses are ₱1,000,000.00 and ₱600,000.00, respectively, and with non-operating income of

₱100,000.00.

His tax due for 2018 shall be computed as follows:

Total compensation income ₱ 1,200,000.00

Less: Non-taxable 13th month pay and other benefits (max)

90,000.00

Taxable Compensation Income ₱ 1,110,000.00

Add: Taxable Income from Business –

Gross Sales ₱ 3,500,000.00

Less: Cost of Sales 1,000,000.00

Gross Income ₱ 2,500,000.00

Less: Operating Expenses 600,000.00

Net Income from Operation ₱ 1,900,000.00

Add: Non-operating Income 100,000.00 2,000,000.00

Total Taxable Income ₱ 3,110,000.00

Tax Due:

On ₱2,000,000.00 ₱ 490,000.00

On excess (₱3,110,000 - ₱2,000,000) x 32% 355,200.00

Total Briefing

TRAIN income– tax dueTax

Income ₱ 845,200.00

VER 1.0 – January 2018

Illustration 12: Ms. RPSV is a prominent independent contractor who offers architectural and

engineering services. Since her career flourished, her total gross receipts amounted to ₱4,250,000.00

for taxable year 2018. Her recorded cost of service and operating expenses were ₱2,150,000.00 and

₱1,000,000.00, respectively.

OSD will be computed as follows:

Gross Receipts – Architectural and Engineering Services ₱ 4,250,000.00

Multiply by Rate 40%

Optional Standard Deduction ₱ 1,700,000.00

Her Net Taxable Income will be computed as follows:

Gross Receipts – Architectural and Engineering Services ₱ 4,250,000.00

Less: OSD 1,700,000.00

Net Taxable Income ₱ 2,550,000.00

Her income tax liability will be computed as follows:

On ₱2,000,000.00 ₱ 490,000.00

On Excess (₱2,550,000.00 – ₱2,000,000.00) x 32%

176,000.00

Income Tax Due ₱ 666,000.00

* The individual taxpayer elected OSD in the computation of her income tax and the election is irrevocable for the

taxable year for which the return was made.

* Taxpayer is not required to submit his financial statements with his tax return.

* The gross receipts exceeded the VAT threshold of ₱3,000,000.00, thus, the taxpayer is subject under the graduated

income tax rates and liable for business tax, in addition to income tax.

TRAIN Briefing – Income Tax

VER 1.0 – January 2018

Das könnte Ihnen auch gefallen

- Bir Train Income TaxDokument34 SeitenBir Train Income TaxJC CASTILLONoch keine Bewertungen

- Bir - Train - It & WT PDFDokument73 SeitenBir - Train - It & WT PDFElizaFaithEcleoNoch keine Bewertungen

- Bir - Train - It - WT - Tmap 04262018Dokument74 SeitenBir - Train - It - WT - Tmap 04262018Mark Lord Morales Bumagat100% (1)

- RRM - Standard - Specifications - Volume 2 - FinalDokument265 SeitenRRM - Standard - Specifications - Volume 2 - FinalVumelani Vincent KhumaloNoch keine Bewertungen

- Significance of TRAIN LawDokument6 SeitenSignificance of TRAIN LawDo.koNoch keine Bewertungen

- Bir Train-Income TaxDokument34 SeitenBir Train-Income TaxJemma SaponNoch keine Bewertungen

- 07 TRAIN Income Tax 1Dokument20 Seiten07 TRAIN Income Tax 1Amorlina Flores MaganaNoch keine Bewertungen

- Briefing On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN) - Income TaxDokument24 SeitenBriefing On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN) - Income TaxMaketh.ManNoch keine Bewertungen

- BIR TRAIN TOT Briefing Income Tax 20180130Dokument24 SeitenBIR TRAIN TOT Briefing Income Tax 20180130Cyb Brio NrbnNoch keine Bewertungen

- Briefing On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)Dokument24 SeitenBriefing On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)Reina Regina S. CamusNoch keine Bewertungen

- 1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Dokument24 Seiten1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Jordan Tagao ColcolNoch keine Bewertungen

- Brie NG On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)Dokument74 SeitenBrie NG On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)FutureLawyerNoch keine Bewertungen

- Briefing On RA 10963 (TRAIN LAW)Dokument74 SeitenBriefing On RA 10963 (TRAIN LAW)robertoii_suarez50% (2)

- RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)Dokument74 SeitenRA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)randyblanza2014100% (5)

- Bir - Train - It - WT - Tmap 04262018Dokument74 SeitenBir - Train - It - WT - Tmap 04262018RonStephaneMaylonNoch keine Bewertungen

- Bir Train Law PresentationDokument74 SeitenBir Train Law PresentationPAULINE KRISTINE FULGENCIO100% (3)

- Bir - Train - It & WT - 20180418Dokument87 SeitenBir - Train - It & WT - 20180418Corrine AbucejoNoch keine Bewertungen

- Train Law 2018Dokument55 SeitenTrain Law 2018Mira Mendoza100% (1)

- 1 Day TRAIN PDFDokument248 Seiten1 Day TRAIN PDFChristine ElardoNoch keine Bewertungen

- Train Law Vs Nirc Income TaxDokument7 SeitenTrain Law Vs Nirc Income TaxShiela Marie Sta AnaNoch keine Bewertungen

- TRAIN LAW - Individual Income TaxationDokument25 SeitenTRAIN LAW - Individual Income TaxationJennilyn SantosNoch keine Bewertungen

- RA 10963: Tax Reform For Acceleration and Inclusion (Train) - BIR Training ofDokument176 SeitenRA 10963: Tax Reform For Acceleration and Inclusion (Train) - BIR Training ofTes Areglo DonosoNoch keine Bewertungen

- Ra10963: Tax Reform For Acceleration and Inclusion Law (Train)Dokument6 SeitenRa10963: Tax Reform For Acceleration and Inclusion Law (Train)fantasighNoch keine Bewertungen

- BIR TRAIN BriefingDokument223 SeitenBIR TRAIN BriefingRealliance PHNoch keine Bewertungen

- Amendments Introduced by TRAINDokument4 SeitenAmendments Introduced by TRAINMarc Lester Hernandez-Sta AnaNoch keine Bewertungen

- TRAIN Law On Income Tax For Individuals, Partnerships & Corporations - Part 1Dokument44 SeitenTRAIN Law On Income Tax For Individuals, Partnerships & Corporations - Part 1ranichi14Noch keine Bewertungen

- Taxation On Individuals: A. Resident CitizenDokument49 SeitenTaxation On Individuals: A. Resident CitizenVeron Gem DalumbarNoch keine Bewertungen

- Morales Taxation Topic 2 Tax On IndividualsDokument23 SeitenMorales Taxation Topic 2 Tax On IndividualsMary Joice Delos santosNoch keine Bewertungen

- Sec. 24 Tax On IndividualsDokument4 SeitenSec. 24 Tax On IndividualsJan P. ParagadosNoch keine Bewertungen

- Train Final Ver A 1.25.2018Dokument89 SeitenTrain Final Ver A 1.25.2018Careyssa MaeNoch keine Bewertungen

- Tax Updates Vs Tax Code OldDokument7 SeitenTax Updates Vs Tax Code OldGianna Chloe S Victoria100% (1)

- Old Tax Law Vs Train Law Tax PH Lessons - CompressDokument7 SeitenOld Tax Law Vs Train Law Tax PH Lessons - CompressRonron De ChavezNoch keine Bewertungen

- Primer On Train LawDokument8 SeitenPrimer On Train LawVeronica ChanNoch keine Bewertungen

- Train Law Focus Notes Ac518Dokument6 SeitenTrain Law Focus Notes Ac518Romeo Mcrom IralNoch keine Bewertungen

- 2018-Tax Reform For Acceleration and Inclusion2Dokument14 Seiten2018-Tax Reform For Acceleration and Inclusion2Sinetch EteyNoch keine Bewertungen

- PreFi TaxationDokument42 SeitenPreFi TaxationVincent TanNoch keine Bewertungen

- Tax Codal NewDokument11 SeitenTax Codal NewPrincess Hazel GriñoNoch keine Bewertungen

- Tabc - Train - Noel N. Cobangbang, CpaDokument117 SeitenTabc - Train - Noel N. Cobangbang, CpaIsaac CursoNoch keine Bewertungen

- Orca Share Media1613096356709 6765816501330676436Dokument9 SeitenOrca Share Media1613096356709 6765816501330676436Mara Gianina QuejadaNoch keine Bewertungen

- Income Tax For IndividualsDokument37 SeitenIncome Tax For IndividualsKristine Aubrey AlvarezNoch keine Bewertungen

- M7 - P1 Individual Income Taxation - Students'Dokument66 SeitenM7 - P1 Individual Income Taxation - Students'micaella pasionNoch keine Bewertungen

- Notes in Tax On IndividualsDokument4 SeitenNotes in Tax On IndividualsPaula BatulanNoch keine Bewertungen

- Amount of Net Taxable Income Rate Over But Not OverDokument1 SeiteAmount of Net Taxable Income Rate Over But Not OverDennah Faye SabellinaNoch keine Bewertungen

- 11-134191-1987-Tio v. Videogram Regulatory BoardDokument9 Seiten11-134191-1987-Tio v. Videogram Regulatory Boarderic akoNoch keine Bewertungen

- Resident Citizen NRC, Ra, Nra-Etb Nra-Netb Regular Income Passive Income (Within The PH) Capital Gains Subject To CGTDokument19 SeitenResident Citizen NRC, Ra, Nra-Etb Nra-Netb Regular Income Passive Income (Within The PH) Capital Gains Subject To CGTKrizza TerradoNoch keine Bewertungen

- Train I.ppt - Vers. 10.21.2018Dokument103 SeitenTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoNoch keine Bewertungen

- First Tax Reform Plan: Restructuring Personal Tax Rates: Taxwise or OtherwiseDokument3 SeitenFirst Tax Reform Plan: Restructuring Personal Tax Rates: Taxwise or Otherwisegrumpybear16Noch keine Bewertungen

- Tax AmendmentsDokument109 SeitenTax AmendmentsPrincess Hazel GriñoNoch keine Bewertungen

- Income TaxDokument70 SeitenIncome TaxMary Fatima LiganNoch keine Bewertungen

- DTTL Tax Philippineshighlights 2020Dokument8 SeitenDTTL Tax Philippineshighlights 2020Jayson CeriasNoch keine Bewertungen

- Train LawDokument41 SeitenTrain LawJoana Lyn GalisimNoch keine Bewertungen

- Regular IncomeDokument12 SeitenRegular IncomeRebecca TatadNoch keine Bewertungen

- Tax Intro - AmendmentsDokument8 SeitenTax Intro - AmendmentsNombs NomNoch keine Bewertungen

- Individual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )Dokument12 SeitenIndividual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )jimmatthamNoch keine Bewertungen

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Dokument4 SeitenLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNoch keine Bewertungen

- Train LawDokument25 SeitenTrain LawMariel Mangalino BautistaNoch keine Bewertungen

- Tax 605Dokument5 SeitenTax 605NhajNoch keine Bewertungen

- Withholding Tax Bureau of Internal RevenueDokument10 SeitenWithholding Tax Bureau of Internal RevenueFunnyPearl Adal GajuneraNoch keine Bewertungen

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesVon EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNoch keine Bewertungen

- Landlord Tax Planning StrategiesVon EverandLandlord Tax Planning StrategiesNoch keine Bewertungen

- Overview of Prosecution Witnesses TestimonyDokument7 SeitenOverview of Prosecution Witnesses TestimonyPatricia Blanca SDVRNoch keine Bewertungen

- Plea Bargaining RA 9165 May 18 2018.ppsxDokument13 SeitenPlea Bargaining RA 9165 May 18 2018.ppsxPatricia Blanca SDVRNoch keine Bewertungen

- PHILIP MORRIS Vs FORTUNE TOBACCODokument2 SeitenPHILIP MORRIS Vs FORTUNE TOBACCOPatricia Blanca SDVRNoch keine Bewertungen

- PMC FormDokument3 SeitenPMC FormPatricia Blanca SDVRNoch keine Bewertungen

- Faller NotesDokument197 SeitenFaller NotesPatricia Blanca SDVRNoch keine Bewertungen

- Doctrines in Legal Medicine - AssignmentDokument1 SeiteDoctrines in Legal Medicine - AssignmentPatricia Blanca SDVRNoch keine Bewertungen

- 3b - Reyma Vs Philippine Home AssuranceDokument2 Seiten3b - Reyma Vs Philippine Home AssurancePatricia Blanca SDVRNoch keine Bewertungen

- 4 Taxation PDFDokument19 Seiten4 Taxation PDFPatricia Blanca SDVRNoch keine Bewertungen

- Comment To FoE SampleDokument3 SeitenComment To FoE SamplePatricia Blanca SDVRNoch keine Bewertungen

- Complaint Affidavit PRACCOURTDokument7 SeitenComplaint Affidavit PRACCOURTPatricia Blanca SDVRNoch keine Bewertungen

- Tax1 (Notes For Midterm)Dokument30 SeitenTax1 (Notes For Midterm)AbbyNoch keine Bewertungen

- IAS-01 Audit Application Form V40 (5 May 23)Dokument7 SeitenIAS-01 Audit Application Form V40 (5 May 23)hrdhse. WanxindaNoch keine Bewertungen

- "Jurisprudence of Proviso": AUTHORED BY: - (09.08.2021)Dokument8 Seiten"Jurisprudence of Proviso": AUTHORED BY: - (09.08.2021)raj pandeyNoch keine Bewertungen

- VAT PayableSetupDokument15 SeitenVAT PayableSetupHyder Abbas100% (1)

- Withholding Tax From BIR WebsiteDokument37 SeitenWithholding Tax From BIR Websitepeanut47Noch keine Bewertungen

- Taxation Midterm Reviewer Ongteco, Erika Therese Gonzaga: Topic Case RulingDokument16 SeitenTaxation Midterm Reviewer Ongteco, Erika Therese Gonzaga: Topic Case RulingEKANGNoch keine Bewertungen

- Etsy Success POD Launch Your T-Shirt Business Coaching Book 927Dokument53 SeitenEtsy Success POD Launch Your T-Shirt Business Coaching Book 927A MNoch keine Bewertungen

- Improving Tax Administration in Developing Countries: Richard M. BirdDokument23 SeitenImproving Tax Administration in Developing Countries: Richard M. BirdPuput WaryantoNoch keine Bewertungen

- DT - Volume 1 - June 22& Dec 22 - CS Executive - CA Saumil ManglaniDokument281 SeitenDT - Volume 1 - June 22& Dec 22 - CS Executive - CA Saumil ManglaniIshani MukherjeeNoch keine Bewertungen

- Unit 1 IncotaxDokument98 SeitenUnit 1 IncotaxKimberly GallaronNoch keine Bewertungen

- Practical Accounting For Executive in BangladeshDokument17 SeitenPractical Accounting For Executive in BangladeshOrtu BDNoch keine Bewertungen

- VAT ON SALE OF GOODS OR PROPERTIESv2Dokument27 SeitenVAT ON SALE OF GOODS OR PROPERTIESv2Trisha Mae BoholNoch keine Bewertungen

- Vat ComputationDokument18 SeitenVat ComputationWillowNoch keine Bewertungen

- A Study On Jindal Aluminium LTDDokument20 SeitenA Study On Jindal Aluminium LTDNAVYA PNoch keine Bewertungen

- Second Division G.R. No. 213394, April 06, 2016Dokument32 SeitenSecond Division G.R. No. 213394, April 06, 2016Maria Nicole VaneeteeNoch keine Bewertungen

- Xxont So Ack PrintDokument3 SeitenXxont So Ack Printanon_357846910Noch keine Bewertungen

- 850 DDFDokument38 Seiten850 DDFvenkateswarlu mandalapuNoch keine Bewertungen

- Bank Schedle Sept 2022Dokument10 SeitenBank Schedle Sept 2022Mercy FaithNoch keine Bewertungen

- Value Added Tax: A. Business TaxesDokument3 SeitenValue Added Tax: A. Business TaxesNerish PlazaNoch keine Bewertungen

- Drugstores Association of The Philippines, Inc. v. National Council On Disability Affairs FactsDokument16 SeitenDrugstores Association of The Philippines, Inc. v. National Council On Disability Affairs FactsJayson Lloyd P. MaquilanNoch keine Bewertungen

- BH Vat and Frequently Asked QuestionsDokument6 SeitenBH Vat and Frequently Asked QuestionsJamesNoch keine Bewertungen

- Mathematics and Statistics and Fundamentals of ManagementDokument416 SeitenMathematics and Statistics and Fundamentals of Managementalchemist100% (2)

- Annex A C of RMC No. 57 2015Dokument5 SeitenAnnex A C of RMC No. 57 2015Sergy DictadoNoch keine Bewertungen

- Bcda 1 Boq - 20230318Dokument3.079 SeitenBcda 1 Boq - 20230318John Rheynor MayoNoch keine Bewertungen

- Authority: Roads & Buildings Department, NH Division, Rajkot, GujaratDokument16 SeitenAuthority: Roads & Buildings Department, NH Division, Rajkot, GujaratRajeev RanjanNoch keine Bewertungen

- Surendra Kumar MahatoDokument3 SeitenSurendra Kumar MahatoThe Cultural CommitteeNoch keine Bewertungen

- Power Sector Assets v. CIR GR 198146 8 Aug 2017Dokument19 SeitenPower Sector Assets v. CIR GR 198146 8 Aug 2017John Ludwig Bardoquillo PormentoNoch keine Bewertungen

- WS Retail Services Pvt. LTD.Dokument1 SeiteWS Retail Services Pvt. LTD.Joydev GangulyNoch keine Bewertungen