Beruflich Dokumente

Kultur Dokumente

Page Industries: CMP: ' TP: ' Accumulate

Hochgeladen von

Akshit SandoojaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Page Industries: CMP: ' TP: ' Accumulate

Hochgeladen von

Akshit SandoojaCopyright:

Verfügbare Formate

Consumer / Result Update

Page Industries DOLAT CAPITAL

CMP: ` 11,760 TP: ` 12,992 Accumulate High Points

Q3FY15 - Volume growth of 15% • Volume up 15%. Men and

Leisure segment drives

Volume growth of 15.2% was backed by a strong growth in the Mens and volumes.

Leisure wear segment at 15.6% and 19.7% respectively. Management

indicated that it will be able to sustain a 15% volume growth over the • Gross margins expanded

as RM cost declines.

next 3-4 years.

• Price hike of 3% taken in

Expansion in gross margin is likely to continue as cotton price have

Jan 2015.

corrected to `210/kg from `240/kg. Further, the company has taken a

price increase of 3% in Jan 2015. • View: Accumulate. Our

DCF based TP is ` 12,992

For FY15, the total capex stand at Rs500mn which in increase the capacity

to 190m pieces (an increase of 30mn pieces). The company has a capex

Scrip Details

plan of `750mn which would expand the capacity to 225mn pieces.

Equity ` 112mn

The company continues to introduce new products in each of the segment ............................................................................................................

which ensures sustained growth in volumes. However, in kids wear and Face Value ` 10/-

............................................................................................................

speedo there has been witnessing some challenges. Market Cap ` 131bn

............................................................................................................

USD 2.1bn

............................................................................................................

We believe Page Industries strong distribution reach and Jockey brand 52 week High / Low ` 12800 / 5456

India Research

............................................................................................................

provides company a strong platform to introduce new products. Its strong Avg. Volume (no) 10426

franchise ensures a sustained growth of 25%. Given the sustained growth ............................................................................................................

BSE Sensex 28,990

momentum in revenue and earnings, we value the company on DCF. On P/ ............................................................................................................

E basis the valuation would continue to look expensive. We estimate a 27% NSE Nifty 8,766

............................................................................................................

CAGR in revenue and 30% PAT CAGR for the company during FY15-17E. At Bloomberg Code PAG IN

............................................................................................................

CMP, the stock trades at 39x FY17E EPS of `299.5. Our DCF based price target Reuters Code PAGE.BO

is `12,992

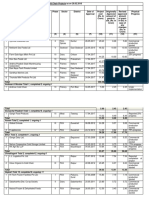

Q3FY15 Result (` mn)

Particulars Q3FY15 Q3FY14 YoY (%) Q2FY15 QoQ (%) 9MFY15 9MFY14 YoY (%)

Net Sales 3,774 3,025 24.8 3,896 -3.1 11,453 8,942 28.1

......................................................................................................................................................................................................................................................................................................

Expenditure 3,051 2,475 23.3 3,220 -5.2 9,224 7,134 29.3

......................................................................................................................................................................................................................................................................................................

Raw Materials 1,760 1,491 18.1 1,871 -5.9 5,475 4,328 26.5

......................................................................................................................................................................................................................................................................................................

Staff Cost 652 490 33.2 677 -3.7 1,926 1,396 38.0

......................................................................................................................................................................................................................................................................................................

Other Expenditure 639 494 29.3 671 -4.7 1,822 1,410 29.2

......................................................................................................................................................................................................................................................................................................

Operating Profit 723 550 31.3 677 6.8 2,230 1,808 23.3

......................................................................................................................................................................................................................................................................................................

Other Income 57 40 44.9 136 -57.7 261 147 76.9

......................................................................................................................................................................................................................................................................................................

Interest 39 28 42.9 33 17.3 110 67 63.9

......................................................................................................................................................................................................................................................................................................

Depreciation 45 36 24.6 34 33.1 130 99 31.5

......................................................................................................................................................................................................................................................................................................

PBT 696 526 32.2 745 -6.6 2,250 1,789 25.8

......................................................................................................................................................................................................................................................................................................

Tax 249 180 38.1 246 1.1 761 603 26.3

......................................................................................................................................................................................................................................................................................................

Net Profit 447 346 29.1 499 -10.4 1,489 1,187 25.5

Gross Margin (%) 53.4 50.7 264.4 52.0 138.7 52.2 51.6 59.6

......................................................................................................................................................................................................................................................................................................

OPM (%) 19.1 18.2 95.3 17.4 177.9 19.5 20.2 -74.9

......................................................................................................................................................................................................................................................................................................

EMPL (%) 17.3 16.2 109.2 17.4 -10.5 16.8 15.6 121.0

......................................................................................................................................................................................................................................................................................................

Other (%) 16.9 16.3 59.8 17.2 -28.6 15.9 15.8 13.5

......................................................................................................................................................................................................................................................................................................

NPM (%) 11.8 11.4 39.9 12.8 -96.1 13.0 13.3 -26.9

......................................................................................................................................................................................................................................................................................................

OPM (%) including OI 20.4 19.3 110.7 20.1 21.1 21.3 21.5 -25.1

Financials

Year Net Sales % Growth EBIDTA OPM % PAT Growth % EPS (`) % Growth PER (x) ROANW(%) ROACE (%)

FY14 11,731 35.9 2,367 20.2 1,538 36.7 137.9 36.7 85.3 61.2 41.1

......................................................................................................................................................................................................................................................................................................

FY15E 14,954 27.5 2,966 19.8 1,960 27.5 175.7 27.5 66.9 59.5 39.6

......................................................................................................................................................................................................................................................................................................

FY16E 19,036 27.3 3,897 20.5 2,553 30.2 228.9 30.2 51.4 60.3 41.7

......................................................................................................................................................................................................................................................................................................

FY17E 24,306 27.7 5,049 20.8 3,340 2.6 299.5 30.9 39.3 61.2 43.7

Figures in ` mn

Sr. Analyst: Amit Purohit Associate: Devanshi Dhruva

Tel : +9122 4096 9724 Tel: +9122 4096 9756 February 13, 2015

E-mail: amitp@dolatcapital.com E-mail: devanshid@dolatcapital.com

DOLAT CAPITAL

India Research

Net Sales at ` 3.77bn up 25% YoY (Dolat est. ` 3.95bn). EBITDA at ` 723mn (est

of `770mn) was up 31.3% YoY as EBITDA margins expanded by 95bps YoY to

19.1% (est. of 19.5%).

Gross margin expanded by 264bps YoY to 53.4%. However higher other exp

(mainly on account of ad spend) and employee cost restricted EBITDA margin

expansion. PBT at ` 696mn was up 32% YoY. Net profit grew by 29% YoY to `

447mn (Dolat est of ` 478mn).

Q3FY15 Result (` mn)

Particulars Q3FY15 Q3FY14 YoY (%) Q2FY15 QoQ (%) 9MFY15 9MFY14 YoY (%)

Volume Breakup

......................................................................................................................................................................................................................................................................................................

Men 17.7 15.4 15.6% 19.6 -9.6% 55.6 49.7 11.9%

......................................................................................................................................................................................................................................................................................................

mix 59.9% 59.7% 62.7% 60.9% 62.5%

......................................................................................................................................................................................................................................................................................................

Women 5.5 5.0 9.9% 5.9 -5.4% 17.8 15.2 17.3%

......................................................................................................................................................................................................................................................................................................

mix 18.7% 19.6% 18.7% 19.5% 19.1%

......................................................................................................................................................................................................................................................................................................

Leisure wear 6.3 5.3 19.7% 5.8 9.3% 17.7 14.4 22.8%

......................................................................................................................................................................................................................................................................................................

mix 21.3% 20.5% 18.4% 19.4% 18.1%

......................................................................................................................................................................................................................................................................................................

Speedo 0.03 0.05 -33.5% 0.1 0.3 0.2

......................................................................................................................................................................................................................................................................................................

mix 0.1% 0.2% 0.2% 0.3% 0.3%

Total 29.6 25.7 15.2% 31.3 -5.4% 91.4 79.5 14.9%

Realisation

......................................................................................................................................................................................................................................................................................................

Men 105.3 95.2 10.6% 104.4 0.9% 104.8 92.9 12.9%

......................................................................................................................................................................................................................................................................................................

Women 119.4 105.3 13.4% 116.4 2.7% 114.0 102.7 11.1%

......................................................................................................................................................................................................................................................................................................

Leisure wear 193 191 1.0% 193 -0.2% 193 184 4.8%

......................................................................................................................................................................................................................................................................................................

Speedo 571 525 564 1.3% 558 0

Avg Realisation 127.1 117.6 8.0% 123.8 2.7% 124.9 111.0 12.5%

Value

......................................................................................................................................................................................................................................................................................................

Men 1,869.2 1,462.0 27.9% 2,047.7 -8.7% 5,831.1 4,617.6 26.3%

......................................................................................................................................................................................................................................................................................................

mix 49.6% 48.3% 52.8% 51.1% 52.3%

......................................................................................................................................................................................................................................................................................................

Women 662.6 531.7 24.6% 682.5 -2.9% 2,031.7 1,559.5 30.3%

......................................................................................................................................................................................................................................................................................................

mix 17.6% 17.6% 17.6% 17.8% 17.7%

......................................................................................................................................................................................................................................................................................................

Leisure wear 1,215.0 1,005.1 20.9% 1,114.0 9.1% 3,417.2 2,653.4 28.8%

......................................................................................................................................................................................................................................................................................................

mix 32.3% 33.2% 28.8% 29.9% 30.0%

......................................................................................................................................................................................................................................................................................................

Speedo 19.4 26.8 -27.7% 30.5 -36.5% 140.0 - #DIV/0!

......................................................................................................................................................................................................................................................................................................

mix 0.5% 0.9% 0.8% 1.2% 0.0%

Total 3,766.2 3,025.6 24.5% 3,874.7 -2.8% 11,419.9 8,830.4 29.3%

Quarterly trend in operating performance

Source: Company, Dolat Research

Page Industries February 13, 2015 2

DOLAT CAPITAL

India Research

Quarterly trend in men volume growth Quarterly trend in Leisure volume growth

Source: Company, Dolat Research

Quarterly trend in Women volume growth Quarterly trend in total volume growth

Source: Company, Dolat Research

Quarterly trend in net sales Quarterly trend in realisation

Source: Company, Dolat Research

Page Industries February 13, 2015 3

DOLAT CAPITAL

India Research

INCOME STATEMENT ` mn CASH FLOW

Particulars Mar14 Mar15E Mar16E Mar17E Particulars Mar14 Mar15E Mar16E Mar17E

Net Sales 11,731 14,954 19,036 24,306 Profit before tax 2,335 2,970 3,868 5,061

...................................................................................................................................................

...................................................................................................................................................

Other income 211 320 350 450 Depreciation & w.o. 139 176 215 248

...................................................................................................................................................

...................................................................................................................................................

Total Income 11,942 15,274 19,386 24,756 Net Interest Exp 104 140 165 190

...................................................................................................................................................

................................................................................................................................................... Direct taxes paid (797) (1,010) (1,315) (1,721)

Total Expenditure 9,364 11,989 15,138 19,257 ...................................................................................................................................................

Chg. in Working Capital (1,097) (633) (1,048) (1,545)

...................................................................................................................................................

Operational / Direct expenses 5,902 7,094 9,010 11,524

................................................................................................................................................... (A) CF from Opet. Activities 684 1,643 1,884 2,233

...................................................................................................................................................

Employee Expenses 1,881 2,497 3,179 4,035

................................................................................................................................................... Capex (481) (664) (450) (500)

...................................................................................................................................................

Selling & Administrative Expenses1,581 2,397 2,949 3,698

................................................................................................................................................... Free Cash Flow 203 978 1,434 1,733

...................................................................................................................................................

EBIDTA (Excl. Other Income) 2,367 2,966 3,897 5,049

................................................................................................................................................... Inc./ (Dec.) in Investments 10 0 0 0

...................................................................................................................................................

EBIDTA (Incl. Other Income) 2,578 3,286 4,247 5,499

................................................................................................................................................... (B) CF from Invet. Activities (471) (664) (450) (500)

...................................................................................................................................................

Interest 104 140 165 190

...................................................................................................................................................

Issue of Equity/ Preference 146 (30) 0 0

...................................................................................................................................................

Gross Profit 2,474 3,146 4,082 5,309 Inc./(Dec.) in Debt 625 336 235 411

...................................................................................................................................................

...................................................................................................................................................

Depreciation 139 176 215 248 Interest exp net (104) (140) (165) (190)

...................................................................................................................................................

...................................................................................................................................................

Profit Before Tax & EO Items 2,335 2,970 3,868 5,061 Dividend Paid (Incl. Tax) (892) (1,147) (1,493) (1,954)

...................................................................................................................................................

................................................................................................................................................... (C) CF from Financing (224) (981) (1,423) (1,733)

Profit Before Tax 2,335 2,970 3,868 5,061 ...................................................................................................................................................

................................................................................................................................................... Net Change in Cash (11) (2) 11 (0)

...................................................................................................................................................

Tax 797 1,010 1,315 1,721

................................................................................................................................................... Opening Cash balances 46 35 32 43

...................................................................................................................................................

Net Profit 1,538 1,960 2,553 3,340 Closing Cash balances 35 32 43 43

E-estimates

BALANCE SHEET

Particulars Mar14 Mar15E Mar16E Mar17E IMPORTANT RATIOS

Sources of Funds

................................................................................................................................................... Particulars Mar14 Mar15E Mar16E Mar17E

Equity Capital 112 112 112 112

................................................................................................................................................... (A) Measures of Performance (%)

...................................................................................................................................................

Other Reserves 2,778 3,592 4,651 6,038

................................................................................................................................................... Contribution Margin

...................................................................................................................................................

Net Worth 2,890 3,703 4,763 6,149

................................................................................................................................................... EBIDTA Margin (excl. O.I.) 20.2 19.8 20.5 20.8

...................................................................................................................................................

Secured Loans 1,532 1,838 2,073 2,484

................................................................................................................................................... EBIDTA Margin (incl. O.I.) 21.6 21.5 21.9 22.2

...................................................................................................................................................

Unsecured Loans 100 130 130 130

................................................................................................................................................... Interest / Sales 0.9 0.9 0.9 0.8

...................................................................................................................................................

Loan Funds 1,632 1,968 2,203 2,614 Gross Profit Margin 49.7 52.6 52.7 52.6

...................................................................................................................................................

...................................................................................................................................................

Deferred Tax Liability 95 65 65 65 Tax/PBT 34.1 34.0 34.0 34.0

...................................................................................................................................................

Net Profit Margin 12.9 12.8 13.2 13.5

Total Capital Employed 4,617 5,736 7,031 8,828

(B) As Percentage of Net Sales

...................................................................................................................................................

Applications of Funds

................................................................................................................................................... Raw Material 50.3 47.4 47.3 47.4

...................................................................................................................................................

Gross Block 2,404 3,004 3,504 4,004

................................................................................................................................................... Employee Expenses 16.0 16.7 16.7 16.6

...................................................................................................................................................

Less: Accumulated Depreciation 676 852 1,066 1,314

................................................................................................................................................... Selling & Administrative Expenses 13.5 16.0 15.5 15.2

Net Block 1,728 2,153 2,438 2,690

...................................................................................................................................................

Capital Work in Progress 36 100 50 50 (C) Measures of Financial Status

...................................................................................................................................................

...................................................................................................................................................

Current Assets, Loans & Advances Debt / Equity (x) 0.6 0.5 0.5 0.4

...................................................................................................................................................

...................................................................................................................................................

Interest Coverage (x) 24.9 23.5 25.7 28.9

...................................................................................................................................................

Inventories 3,626 4,507 5,737 7,325

................................................................................................................................................... Average Cost Of Debt (%) 7.8 7.8 7.9 7.9

...................................................................................................................................................

Sundry Debtors 727 942 1,200 1,532

................................................................................................................................................... Debtors Period (days) 22.6 23.0 23.0 23.0

...................................................................................................................................................

Cash and Bank Balance 35 32 43 43

................................................................................................................................................... Closing stock (days) 112.8 110.0 110.0 110.0

...................................................................................................................................................

Loans and Advances 545 389 495 633

................................................................................................................................................... Inventory Turnover Ratio (x) 3.2 3.3 3.3 3.3

...................................................................................................................................................

sub total 4,932 5,870 7,475 9,532

................................................................................................................................................... Fixed Assets Turnover (x) 4.9 5.0 5.4 6.1

...................................................................................................................................................

Less : Current Liabilities & Provisions

................................................................................................................................................... Working Capital Turnover (x) 4.1 4.3 4.2 4.0

...................................................................................................................................................

Current Liabilities 1,838 2,017 2,442 2,925

................................................................................................................................................... Non Cash Working Capital (` Mn) 2,818 3,451 4,500 6,045

Provisions 241 370 490 520

...................................................................................................................................................

sub total 2,079 2,387 2,932 3,445 (D) Measures of Investment

...................................................................................................................................................

...................................................................................................................................................

Net Current Assets 2,853 3,483 4,543 6,088 EPS (`) 137.9 175.7 228.9 299.5

...................................................................................................................................................

CEPS (`) 150.4 191.5 248.1 321.7

...................................................................................................................................................

Total Assets 4,617 5,736 7,030 8,828 DPS (`) 68.3 87.9 114.4 149.7

...................................................................................................................................................

E-estimates Dividend Payout (%) 49.6 50.0 50.0 50.0

...................................................................................................................................................

Profit Ploughback (%) 50.4 50.0 50.0 50.0

...................................................................................................................................................

Shareholding Pattern as on Dec'14 (%) Book Value (`) 259.1 332.0 427.0 551.3

...................................................................................................................................................

RoANW (%) 61.2 59.5 60.3 61.2

...................................................................................................................................................

RoACE (%) 41.1 39.6 41.7 43.7

...................................................................................................................................................

RoAIC (%) (Excl Cash & Invest.) 63.0 60.5 63.5 66.6

6.3%9.9%

31.9% 51.8% (E) Valuation Ratios

...................................................................................................................................................

CMP (`) 11,760 11,760 11,760 11,760

...................................................................................................................................................

P/E (x) 85.3 66.9 51.4 39.3

...................................................................................................................................................

Market Cap. (` Mn.) 131,170 131,170 131,170 131,170

...................................................................................................................................................

MCap/ Sales (x) 11.2 8.8 6.9 5.4

...................................................................................................................................................

EV (` Mn.) 132,767 133,106 133,330 133,741

...................................................................................................................................................

Promoter FIIs DII Others EV/Sales (x) 11.3 8.9 7.0 5.5

...................................................................................................................................................

EV/EBDITA (x) 56.1 44.9 34.2 26.5

...................................................................................................................................................

P/BV (x) 45.4 35.4 27.5 21.3

...................................................................................................................................................

Dividend Yield (%) 0.6 0.7 1.0 1.3

E-estimates

Page Industries February 13, 2015 4

DOLAT CAPITAL

BUY Upside above 20%

ACCUMULATE Upside above 5% and up to 20%

REDUCE Upside of upto 5% or downside of upto 15%

SELL Downside of more than 15%

Analyst Sector/Industry/Coverage E-mail Tel.+91-22-4096 9700

Amit Khurana, CFA Co-Head Equities and Head of Research amit@dolatcapital.com +91-22-40969745

..........................................................................................................................................................................................................................................................................................................

Amit Purohit Consumer & Midcaps amitp@dolatcapital.com +91-22-40969724

..........................................................................................................................................................................................................................................................................................................

Deepali Gautam Utilities deepalig@dolatcapital.com +91-22-40969795

..........................................................................................................................................................................................................................................................................................................

Kunal Dalal Auto & Auto Ancillaries kunald@dolatcapital.com +91-22-40969749

..........................................................................................................................................................................................................................................................................................................

Priyank Chandra Oil & Gas priyank@dolatcapital.com +91-22-40969737

..........................................................................................................................................................................................................................................................................................................

Rahul Jain IT Services & Real Estate rahul@dolatcapital.com +91-22-40969754

..........................................................................................................................................................................................................................................................................................................

Rajiv Pathak Financials rajiv@dolatcapital.com +91-22-40969750

..........................................................................................................................................................................................................................................................................................................

Prachi Save Derivatives prachi@dolatcapital.com +91-22-40969733

Associates Sector/Industry/Coverage E-mail Tel.+91-22-4096 9700

Afshan Sayyad Agrochemicals afshans@dolatcapital.com +91-22-40969726

..........................................................................................................................................................................................................................................................................................................

Abhishek Lodhiya Real Estate abhishekl@dolatcapital.com +91-22-40969753

..........................................................................................................................................................................................................................................................................................................

Avinash Kumar Capital Goods avinashk@dolatcapital.com +91-22-40969764

..........................................................................................................................................................................................................................................................................................................

Devanshi Dhruva Consumer & Midcaps devanshid@dolatcapital.com +91-22-40969756

..........................................................................................................................................................................................................................................................................................................

Manish Raj Cement manishr@dolatcapital.com +91-22-40969725

..........................................................................................................................................................................................................................................................................................................

Pranav Joshi Financials pranavj@dolatcapital.com +91-22-40969706

Equity Sales/Trading Designation E-mail Tel.+91-22-4096 9797

Purvag Shah Principal purvag@dolatcapital.com +91-22-40969747

..........................................................................................................................................................................................................................................................................................................

Vikram Babulkar Co-Head Equities and Head of Sales vikram@dolatcapital.com +91-22-40969746

..........................................................................................................................................................................................................................................................................................................

Kapil Yadav AVP - Institutional Sales kapil@dolatcapital.com +91-22-40969735

..........................................................................................................................................................................................................................................................................................................

P. Sridhar Head Sales Trading sridhar@dolatcapital.com +91-22-40969728

..........................................................................................................................................................................................................................................................................................................

Chandrakant Ware AVP - Equity Sales Trading chandrakant@dolatcapital.com +91-22-40969707

..........................................................................................................................................................................................................................................................................................................

Jatin Padharia Head of Sales Trading - Derivatives jatin@dolatcapital.com +91-22-40969703

..........................................................................................................................................................................................................................................................................................................

Shirish Thakkar Sales Trader - Derivatives shirisht@dolatcapital.com +91-22-40969702

Dolat Capital Market Pvt. Ltd.

20, Rajabahadur Mansion, 1st Floor, Ambalal Doshi Marg, Fort, Mumbai - 400 001

DOLAT CAPITAL

Dolat Capital Market Pvt. Ltd.

Corporate Identity Number: U65990MH1993PTC075189

Member: BSE Limited and National Stock Exchange of India Limited.

SEBI Registration No: BSE - INB010710052 & INF010710052, NSE - INB230710031& INF230710031

Registered office: “DOLAT” Plot 60B, East West Road No. 2, JVPD Scheme, Vile Parle (West), Mumbai-400 049.

Board: +9122 40969700 | Fax: +9122 22651278 | Email: research@dolatcapital.com | www.dolatresearch.com

Analyst(s) Certification

The research analyst(s), with respect to each issuer and its securities covered by them in this research report, certify that: All of

the views expressed in this research report accurately reflect his or her or their personal views about all of the issuers and their

securities; and No part of his or her or their compensation was, is, or will be directly or indirectly related to the specific

recommendations or views expressed in this research report.

I. Analyst(s) holding in the Stock(s): (Nil)

II. Disclosures:

This research report has been prepared by Dolat Capital Market Pvt. Limited to provide information about the company(ies) and

sector(s), if any, covered in the report and may be distributed by it and/or its affiliated company(ies) solely for the purpose of

information of the select recipient of this report. This report and/or any part thereof, may not be duplicated in any form and/or

reproduced or redistributed without the prior written consent of Dolat Capital Market Pvt. Limited. This report has been

prepared independent of the companies covered herein. Dolat Capital Market Pvt. Limited and its affiliated companies are part

of a multi-service, integrated investment banking, brokerage and financing group. Dolat Capital Market Pvt. Limited and/or its

affiliated company(ies) might have provided or may provide services in respect of managing offerings of securities, corporate

finance, investment banking, mergers & acquisitions, financing or any other advisory services to the company(ies) covered

herein. Dolat Capital Market Pvt. Limited and/or its affiliated company(ies) might have received or may receive compensation

from the company(ies) mentioned in this report for rendering any of the above services. Research analysts and sales persons

of Dolat Capital Market Pvt. Limited may provide important inputs to its affiliated company(ies) associated with it. While

reasonable care has been taken in the preparation of this report, it does not purport to be a complete description of the

securities, markets or developments referred to herein, and Dolat Capital Market Pvt. Limited does not warrant its accuracy or

completeness. Dolat Capital Market Pvt. Limited may not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. This report is provided for information only and

is not an investment advice and must not alone be taken as the basis for an investment decision. The investment discussed or

views expressed herein may not be suitable for all investors. The user assumes the entire risk of any use made of this

information. The information contained herein may be changed without notice and Dolat Capital Market Pvt. Limited reserves

the right to make modifications and alterations to this statement as they may deem fit from time to time. Dolat Capital Market

Pvt. Limited and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short

position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential

conflict of interests with respect to any recommendation and other related information and opinions. This report is neither an

offer nor solicitation of an offer to buy and/or sell any securities mentioned herein and/or not an official confirmation of any

transaction. This report is not directed or intended for distribution to, or use by any person or entity who is a citizen or resident

of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would

be contrary to law, regulation or which would subject Dolat Capital Market Pvt. Limited and/or its affiliated company(ies) to any

registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for

sale in all jurisdictions or to a certain category of investors. Persons in whose possession this report may come, are required

to inform themselves of and to observe such restrictions.

Our Research reports are also available on Reuters, Thomson Publishers, DowJones and Bloomberg (DCML <GO>)

Das könnte Ihnen auch gefallen

- Airasia Group Berhad: Analyst Presentation First Quarter Results For The Financial Year 2020 30 June 2020Dokument22 SeitenAirasia Group Berhad: Analyst Presentation First Quarter Results For The Financial Year 2020 30 June 2020hayo ipwueNoch keine Bewertungen

- Retailing in The Middle East How To Recapture Profitable GrowthDokument8 SeitenRetailing in The Middle East How To Recapture Profitable GrowthMehdiNoch keine Bewertungen

- Strategic Plan 2015-2019Dokument5 SeitenStrategic Plan 2015-2019Frederyck TeixeiraNoch keine Bewertungen

- Mahindra & Mahindra LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDokument8 SeitenMahindra & Mahindra LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNoch keine Bewertungen

- IDirect PrimaPlastics CoUpdate Jun19Dokument4 SeitenIDirect PrimaPlastics CoUpdate Jun19Alokesh PhukanNoch keine Bewertungen

- Bản Sao Của ERM FinalDokument6 SeitenBản Sao Của ERM FinalTrường HồngNoch keine Bewertungen

- SKF India - 31 July 2018Dokument6 SeitenSKF India - 31 July 2018chaitanya.jNoch keine Bewertungen

- Infosys Ltd. Rs. 3,550: Key Result HighlightsDokument6 SeitenInfosys Ltd. Rs. 3,550: Key Result HighlightsSachin MokashiNoch keine Bewertungen

- Gulf Oil - Update - Jul19 - HDFC Sec-201907111135493400922Dokument18 SeitenGulf Oil - Update - Jul19 - HDFC Sec-201907111135493400922nareshjsharma1654Noch keine Bewertungen

- Stock Update: Greaves CottonDokument3 SeitenStock Update: Greaves CottonanjugaduNoch keine Bewertungen

- Dangote Cement PLC - 2Dokument16 SeitenDangote Cement PLC - 2gregNoch keine Bewertungen

- Nestle Upbeat On Growth Opportunities: Innovation, Renovation and Product Improvement To Boost ToplineDokument1 SeiteNestle Upbeat On Growth Opportunities: Innovation, Renovation and Product Improvement To Boost ToplineAzrin TalmiziNoch keine Bewertungen

- 2015 Macquarie UnitedTractors-PamaStillPoweringOn20150303Dokument28 Seiten2015 Macquarie UnitedTractors-PamaStillPoweringOn20150303Rahul SetiyaNoch keine Bewertungen

- 32 Daggu Srinivasa Chakravarthi D'Souza Abner Aldrich Damarla Geetha Susmitha Greenlam Industries LTD Stylam Industries LTDDokument16 Seiten32 Daggu Srinivasa Chakravarthi D'Souza Abner Aldrich Damarla Geetha Susmitha Greenlam Industries LTD Stylam Industries LTDDAGGU SRINIVASA CHAKRAVARTHINoch keine Bewertungen

- Music BroadcastDokument12 SeitenMusic BroadcastSBNoch keine Bewertungen

- Financial Management: ABV-Indian Institute of Information Technology and Management Gwalior (IIITM), GwaliorDokument8 SeitenFinancial Management: ABV-Indian Institute of Information Technology and Management Gwalior (IIITM), GwaliorAbhishek ChaurasiaNoch keine Bewertungen

- Letter To Shareowners: Annual Report 2015-16 Reliance Industries LimitedDokument4 SeitenLetter To Shareowners: Annual Report 2015-16 Reliance Industries Limitedramakanta mishraNoch keine Bewertungen

- Interim: For The Six Months Ended 30 June 2019Dokument24 SeitenInterim: For The Six Months Ended 30 June 2019Nasya YenitaNoch keine Bewertungen

- Grasim 3R Feb14 - 2023Dokument7 SeitenGrasim 3R Feb14 - 2023Rajavel GanesanNoch keine Bewertungen

- J.K Cement & Its Peers: A Financial Analysis: Financial Accounting Project ReportDokument12 SeitenJ.K Cement & Its Peers: A Financial Analysis: Financial Accounting Project ReportKOTHAPALLI SAI SARADA MYTHILINoch keine Bewertungen

- Piramal Enterprises Limited Investor Presentation: March 2020Dokument70 SeitenPiramal Enterprises Limited Investor Presentation: March 2020CHANDAN CHANDUNoch keine Bewertungen

- 67th AGM PDFDokument308 Seiten67th AGM PDFJubanasamad k aNoch keine Bewertungen

- 67th AGMDokument308 Seiten67th AGMPranshu RajNoch keine Bewertungen

- 2020-09, Ambit Insights - Motherson SumiDokument34 Seiten2020-09, Ambit Insights - Motherson SumiKarthikNoch keine Bewertungen

- Escorts: Expectation of Significant Recovery Due To A Better Monsoon BuyDokument7 SeitenEscorts: Expectation of Significant Recovery Due To A Better Monsoon BuynnsriniNoch keine Bewertungen

- Annual Review 2014-2015: Investing For SuccessDokument56 SeitenAnnual Review 2014-2015: Investing For Successabhigupta08Noch keine Bewertungen

- Amber Enterprises (India) Ltd. (Aeil) : Aeil'S Rac Sales Volumes Rose by A Robust 127% Yoy To 0.4 MN UnitsDokument4 SeitenAmber Enterprises (India) Ltd. (Aeil) : Aeil'S Rac Sales Volumes Rose by A Robust 127% Yoy To 0.4 MN UnitsdarshanmadeNoch keine Bewertungen

- India Infoline Limited (INDINF) : Next Delta Missing For Steep GrowthDokument24 SeitenIndia Infoline Limited (INDINF) : Next Delta Missing For Steep Growthanu nitiNoch keine Bewertungen

- Stylam IDBI Capital 200516Dokument20 SeitenStylam IDBI Capital 200516Vikas AggarwalNoch keine Bewertungen

- Antony WasteDokument7 SeitenAntony WastemiddlecricketwarriorsNoch keine Bewertungen

- Ki Adro 20190305Dokument6 SeitenKi Adro 20190305krisyanto krisyantoNoch keine Bewertungen

- AR2020Dokument186 SeitenAR2020Eugene TanNoch keine Bewertungen

- Corporate Governance & Forensic Accounting Tool PDFDokument17 SeitenCorporate Governance & Forensic Accounting Tool PDFnitin_pNoch keine Bewertungen

- Investor Update - CS Conference, 12 Jan 2018Dokument39 SeitenInvestor Update - CS Conference, 12 Jan 2018Andrea ManzoniNoch keine Bewertungen

- Dabur IndiaDokument10 SeitenDabur IndiaChinmayJoshiNoch keine Bewertungen

- Directors' ReportDokument9 SeitenDirectors' Reportabdul ohabNoch keine Bewertungen

- Rynair Financial Analysis - Sample Ratio Analysis Report PDFDokument22 SeitenRynair Financial Analysis - Sample Ratio Analysis Report PDFsalil naikNoch keine Bewertungen

- Working Capital QuizDokument3 SeitenWorking Capital QuizHarshit GoyalNoch keine Bewertungen

- Solid Housing ProspectsDokument1 SeiteSolid Housing Prospectsshaan1001gbNoch keine Bewertungen

- Gateway Distriparks LTD: Long Road To RecoveryDokument6 SeitenGateway Distriparks LTD: Long Road To RecoveryPratik ChandakNoch keine Bewertungen

- 2017-18 Third Quarter Report Fiscal UpdateDokument18 Seiten2017-18 Third Quarter Report Fiscal UpdateCTV CalgaryNoch keine Bewertungen

- Etm 2011 3 1 1Dokument1 SeiteEtm 2011 3 1 1rocker12_12Noch keine Bewertungen

- SupremeInd 3R Apr29 2022Dokument7 SeitenSupremeInd 3R Apr29 2022bdacNoch keine Bewertungen

- Arçelik Yatırımcı SunumuDokument32 SeitenArçelik Yatırımcı SunumuOnur YamukNoch keine Bewertungen

- Traf Presentation India WebcastDokument48 SeitenTraf Presentation India WebcastSwastik GroverNoch keine Bewertungen

- Airasia Plan During Covid 19 CrisisDokument43 SeitenAirasia Plan During Covid 19 Crisismalikldu100% (1)

- Auto - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDokument6 SeitenAuto - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNoch keine Bewertungen

- Chapter 2 FormulaDokument1 SeiteChapter 2 FormulaSean LooNoch keine Bewertungen

- AngelBrokingResearch CochinShipyard IC 310717Dokument12 SeitenAngelBrokingResearch CochinShipyard IC 310717durgasainathNoch keine Bewertungen

- MSFL PG 01 Cover PageDokument1 SeiteMSFL PG 01 Cover PageHimanshu KuriyalNoch keine Bewertungen

- Ceo Exec BriefDokument22 SeitenCeo Exec BriefJulia El SamraNoch keine Bewertungen

- Investoreye (6) - 6Dokument61 SeitenInvestoreye (6) - 6Harry AndersonNoch keine Bewertungen

- Continuing On Its Strong Growth Trajectory, The Electronics Industry Posted A Growth of 7.8pcDokument12 SeitenContinuing On Its Strong Growth Trajectory, The Electronics Industry Posted A Growth of 7.8pcFaria AlamNoch keine Bewertungen

- Prima Plastics Initiating Coverage IDBI CapitalDokument12 SeitenPrima Plastics Initiating Coverage IDBI CapitalAkhil ParekhNoch keine Bewertungen

- Glenmark Pharmaceuticals PDFDokument23 SeitenGlenmark Pharmaceuticals PDFsandyNoch keine Bewertungen

- IEA Report 3rd AprilDokument39 SeitenIEA Report 3rd AprilnarnoliaNoch keine Bewertungen

- Sula Vineyards-Q2-FY24 - Keynote CapitalsDokument8 SeitenSula Vineyards-Q2-FY24 - Keynote CapitalsravirameshkumarNoch keine Bewertungen

- CuminsIndia 3R Aug11 2022Dokument7 SeitenCuminsIndia 3R Aug11 2022Arka MitraNoch keine Bewertungen

- RHB Equity 360° - (IJM Land, Consumer, Construction, Dialog, Top Glove Technical: WCT)Dokument3 SeitenRHB Equity 360° - (IJM Land, Consumer, Construction, Dialog, Top Glove Technical: WCT)Rhb InvestNoch keine Bewertungen

- COld CHain ProjectsDokument17 SeitenCOld CHain ProjectsAkshit SandoojaNoch keine Bewertungen

- Dlecta Foods Private Limited: (400100) Disclosure of General Information About CompanyDokument73 SeitenDlecta Foods Private Limited: (400100) Disclosure of General Information About CompanyAkshit SandoojaNoch keine Bewertungen

- Top 500 APAC Tech ProvidersDokument13 SeitenTop 500 APAC Tech ProvidersAkshit SandoojaNoch keine Bewertungen

- Navitas Green Solutions Private Limited: Standalone Financial Statements For Period 01/04/2016 To 31/03/2017Dokument123 SeitenNavitas Green Solutions Private Limited: Standalone Financial Statements For Period 01/04/2016 To 31/03/2017Akshit SandoojaNoch keine Bewertungen

- Who Moved My Interest Rate - Lea - Duvvuri Subbarao PDFDokument1.102 SeitenWho Moved My Interest Rate - Lea - Duvvuri Subbarao PDFAkshit SandoojaNoch keine Bewertungen

- Drums Food International Private Limited: Standalone Financial Statements For Period 01/04/2015 To 31/03/2016Dokument82 SeitenDrums Food International Private Limited: Standalone Financial Statements For Period 01/04/2015 To 31/03/2016Akshit SandoojaNoch keine Bewertungen

- CB Insights Amazon Strategy HealthcareDokument40 SeitenCB Insights Amazon Strategy HealthcareAkshit SandoojaNoch keine Bewertungen

- Executive Committee - Indian Chemical Council (ICC)Dokument4 SeitenExecutive Committee - Indian Chemical Council (ICC)Akshit SandoojaNoch keine Bewertungen

- Cholamandalam Investment & Finance CompanyDokument2 SeitenCholamandalam Investment & Finance CompanyAkshit SandoojaNoch keine Bewertungen

- International Trademark License Agreement TemplateDokument15 SeitenInternational Trademark License Agreement TemplateAkshit SandoojaNoch keine Bewertungen

- FY 17A LVMH CFR Estee Lauder Luxotica Kering Swatch L'Oreal Ralph Lauren CTFJG PVH Fossil Hermes Michael KorsDokument2 SeitenFY 17A LVMH CFR Estee Lauder Luxotica Kering Swatch L'Oreal Ralph Lauren CTFJG PVH Fossil Hermes Michael KorsAkshit SandoojaNoch keine Bewertungen

- All India Plastic ManufacturersDokument102 SeitenAll India Plastic ManufacturersAkshit Sandooja50% (2)

- Ey The Retailer October December 2016Dokument28 SeitenEy The Retailer October December 2016Akshit SandoojaNoch keine Bewertungen

- Conceptual Framework of Cash FlowDokument19 SeitenConceptual Framework of Cash FlowAkshit Sandooja0% (1)

- Aircraft Landing Control Problem - Case Study 2Dokument9 SeitenAircraft Landing Control Problem - Case Study 2Akshit SandoojaNoch keine Bewertungen

- 2019 Ulverstone Show ResultsDokument10 Seiten2019 Ulverstone Show ResultsMegan PowellNoch keine Bewertungen

- Tan vs. Macapagal, 43 SCRADokument6 SeitenTan vs. Macapagal, 43 SCRANikkaDoriaNoch keine Bewertungen

- Evidentiary Value of NarcoDokument2 SeitenEvidentiary Value of NarcoAdv. Govind S. TehareNoch keine Bewertungen

- AMCAT All in ONEDokument138 SeitenAMCAT All in ONEKuldip DeshmukhNoch keine Bewertungen

- Chapter 3 - the-WPS OfficeDokument15 SeitenChapter 3 - the-WPS Officekyoshiro RyotaNoch keine Bewertungen

- Hibbeler, Mechanics of Materials-BendingDokument63 SeitenHibbeler, Mechanics of Materials-Bendingpoom2007Noch keine Bewertungen

- The Final Bible of Christian SatanismDokument309 SeitenThe Final Bible of Christian SatanismLucifer White100% (1)

- Sayyid Jamal Al-Din Muhammad B. Safdar Al-Afghani (1838-1897)Dokument8 SeitenSayyid Jamal Al-Din Muhammad B. Safdar Al-Afghani (1838-1897)Itslee NxNoch keine Bewertungen

- Ad1 MCQDokument11 SeitenAd1 MCQYashwanth Srinivasa100% (1)

- Delaware Met CSAC Initial Meeting ReportDokument20 SeitenDelaware Met CSAC Initial Meeting ReportKevinOhlandtNoch keine Bewertungen

- Configuration Steps - Settlement Management in S - 4 HANA - SAP BlogsDokument30 SeitenConfiguration Steps - Settlement Management in S - 4 HANA - SAP Blogsenza100% (4)

- Workshop 02.1: Restart Controls: ANSYS Mechanical Basic Structural NonlinearitiesDokument16 SeitenWorkshop 02.1: Restart Controls: ANSYS Mechanical Basic Structural NonlinearitiesSahil Jawa100% (1)

- Spring94 Exam - Civ ProDokument4 SeitenSpring94 Exam - Civ ProGenUp SportsNoch keine Bewertungen

- The Music of OhanaDokument31 SeitenThe Music of OhanaSquaw100% (3)

- Master Books ListDokument32 SeitenMaster Books ListfhaskellNoch keine Bewertungen

- Faith-Based Organisational Development (OD) With Churches in MalawiDokument10 SeitenFaith-Based Organisational Development (OD) With Churches in MalawiTransbugoyNoch keine Bewertungen

- Effect of Intensive Health Education On Adherence To Treatment in Sputum Positive Pulmonary Tuberculosis PatientsDokument6 SeitenEffect of Intensive Health Education On Adherence To Treatment in Sputum Positive Pulmonary Tuberculosis PatientspocutindahNoch keine Bewertungen

- University of Dar Es Salaam MT 261 Tutorial 1Dokument4 SeitenUniversity of Dar Es Salaam MT 261 Tutorial 1Gilbert FuriaNoch keine Bewertungen

- Directions: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankDokument2 SeitenDirections: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankRanulfo MayolNoch keine Bewertungen

- Shkodër An Albanian CityDokument16 SeitenShkodër An Albanian CityXINKIANGNoch keine Bewertungen

- PSYC1111 Ogden Psychology of Health and IllnessDokument108 SeitenPSYC1111 Ogden Psychology of Health and IllnessAleNoch keine Bewertungen

- Rosenberg Et Al - Through Interpreters' Eyes, Comparing Roles of Professional and Family InterpretersDokument7 SeitenRosenberg Et Al - Through Interpreters' Eyes, Comparing Roles of Professional and Family InterpretersMaria AguilarNoch keine Bewertungen

- NetStumbler Guide2Dokument3 SeitenNetStumbler Guide2Maung Bay0% (1)

- Jurnal Politik Dan Cinta Tanah Air Dalam Perspektif IslamDokument9 SeitenJurnal Politik Dan Cinta Tanah Air Dalam Perspektif Islamalpiantoutina12Noch keine Bewertungen

- Michel Agier - Between War and CityDokument25 SeitenMichel Agier - Between War and CityGonjack Imam100% (1)

- Framework For Marketing Management Global 6Th Edition Kotler Solutions Manual Full Chapter PDFDokument33 SeitenFramework For Marketing Management Global 6Th Edition Kotler Solutions Manual Full Chapter PDFWilliamThomasbpsg100% (9)

- Assignment 1 Front Sheet: Qualification BTEC Level 5 HND Diploma in Computing Unit Number and Title Submission DateDokument18 SeitenAssignment 1 Front Sheet: Qualification BTEC Level 5 HND Diploma in Computing Unit Number and Title Submission DatecuongNoch keine Bewertungen

- Final Box Design Prog.Dokument61 SeitenFinal Box Design Prog.afifa kausarNoch keine Bewertungen

- Dr. A. Aziz Bazoune: King Fahd University of Petroleum & MineralsDokument37 SeitenDr. A. Aziz Bazoune: King Fahd University of Petroleum & MineralsJoe Jeba RajanNoch keine Bewertungen

- Capgras SyndromeDokument4 SeitenCapgras Syndromeapi-459379591Noch keine Bewertungen