Beruflich Dokumente

Kultur Dokumente

Code of Ethics Summary

Hochgeladen von

Yixing Xing0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten4 SeitenCode of Ethics

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCode of Ethics

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten4 SeitenCode of Ethics Summary

Hochgeladen von

Yixing XingCode of Ethics

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

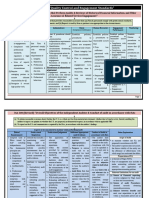

PART A: GENERAL APPLICATION b.

Acting as an advocate on behalf of the client in litigation or in resolving disputes

with third parties

Fundamental Principles- PCOPI

4. Familiarity Threat

Professional Competence and Due Care a. Member of engagement team has an immediate or close family member that is the

o Competence i. Director or officer of the client

Attainment- education, exam, experience ii. Employee with significant influence

Maintenance b. Former partner of firm is a director or officer or employee with significant influence

Confidentiality over the subject matter of engagement

o When an auditor can disclose c. Engagement team’s Senior member’s long association of the client

Permitted by client 5. Intimidation Threats

Permitted by law a. Threats to litigation or dismissal or replacement

Professional duty/ as defense

Objectivity

Professional Behavior Safeguards

Integrity

-actions or other measures that eliminates threats or reduces them to an acceptable level

1. Safeguards created by the profession, legislation or regulation

Conceptual Framework Approach a. Education, Exam, Experience

b. Continuing professional education

1. Identify threats to compliance with fundamental principles c. Corporate Governance

2. Evaluate the significance of identified threats- both quantitative and qualitative d. Professional Standards

3. Apply safeguards when necessary e. External review of firm’s quality control system

2. Safeguards in the work environment

a. Firm-wide safeguards

Threats to Compliance- SSAFI i. More on policies and procedures and making sure all employees are aware

and following them

1. Self-Interest b. Engagement-specific safeguards

a. Direct or material indirect financial interest i. Rotation of senior assurance team personnel

b. Undue dependence on fees ii. Involving a third party to review the work done

c. Potential employment iii. Discuss ethical issues with those charges with governance

2. Self-Review 3. Additional Safeguards for CPAs in public practice of which they may rely, but NOT solely rely

a. Member of engagement team is on the safeguards of the client

i. Former director or officer of client a. Safeguards within the client’s systems and procedures

ii. Employee with significant influence i. Competent employees

iii. Involved in preparation of data to generate FS ii. Implemented internal procedures that ensure objectivity

iv. Involved in design or implementation iii. Has a corporate governance structure

b. Discovery of significant error during re-evaluation of the work of the professional

accountant in public practice When there are no safeguards available, the last resort is to eliminate the activity creating the threat

3. Advocacy or refuse to accept or continue the engagement.

a. Promoter of securities in a client

PART B: PROFESSIONAL ACCOUNTANTS IN PUBLIC PRACTICE Safeguard: contact existing accountants

Professional Appointment

1. Client Acceptance Fees and Other Types of Remuneration

a. Threats to integrity and professional behavior

b. Safeguards 1. Professional Fees should be a reflection of

i. Obtain knowledge and understanding of the client Skill and knowledge

2. Engagement Acceptance Level of training and experience

a. Threats to competence and due care Time to perform services

b. Safeguards Degree of responsibility

i. Obtain understanding on business and industry

Low fees are not unethical but if fees are quotes so low then there is a threat to competence

ii. Agree on a realistic time frame

and due care

3. Changes in Professional Appointment (existing is replaced by new accountant)

a. Threats to competence and due care i. Safeguards

b. Safeguards 1. Make client aware the terms of the engagement and the basis for the remuneration

i. Discuss with existing accountants (have to obtain permission from client 2. Assign qualified and competent staff

first) 2. Contingent Fees

ii. If cannot obtain permission, inquire third parties

c. Successor accountants has the burden of initiating communication with Fees received for a specific finding or achievement

predecessor accountants after obtaining expressed permission with the client Self-Interest Threat: the significance of which is based on factors

Conflict of Interest i. Nature of engagement

ii. Range of possible fee amounts

Threat to objectivity iii. Basis for determining the fee

o When you own a business that competes directly with the client iv. Whether result is to be reviewed by a third party

Threat to objectivity and confidentiality Safeguards

o When you have 2 engagements that are in conflict with one another i. advance agreement

Safeguards ii. disclosure

1. Disclosure- notify client iii. review by an objective third party

2. Control- create an ethical wall In your mind; use confidentiality agreements 3. Referral Fees and Commission

signed by employees and partners; separate engagement teams Self-interest threat to objectivity and competence and due care

3. Avoidance Receipt and payments have the same threats

Referral Fee- referring a continuing client to another professional accountant

Second Opinions

Commission- professional account act as INTERMEDIARY between client and

-an accountant in public practice is asked to give a second opinion on the accounting, auditing or vendor

reporting application to specific circumstances

A professional accountant should not pay or receive referral fees or commissions UNLESS it

Threats to professional competence and due care has established appropriate SAFEGUARDS OF disclosures or advanced agreements.

o Why?

Second opinion may not be based on the same set of FS

Inadequate evidence

A professional accountant may purchase all or a part of a firm on the basis that Objectivity- All Services

payments are made to original owners and not to heirs or estates. This is NOT

Safeguards

considered as referral fees or commissions.

Withdraw from the engagement

Supervisory procedures (compensating control)

Marketing Professional Services Terminate financial or business relationship that causes the threat

Discuss issue with higher levels of management

Self-interest threat to professional behavior

Discuss issue with those charged with governance

Should not

o Make exaggerated claims

o Make unsubstantiated comparisons to the work of another

Info should include INDEPENDENCE

o Name 1. Independence of Mind- auditor’s perception

o Contact number 2. Independence in Appearance- public perception

o Services offered

o Address Both are required.

General Rule: Any form of advertisement is ALLOWED. 1. Engagement Period

a. Starts when assurance team begins to perform assurance services

b. Ends when

Gifts and Hospitality i. When engagement is recurring by nature: issue of assurance report

ii. When engagement is expected to recur: notification by either party

Self-Interest Threat to objectivity

that professional relationship has terminated OR issuance of final

ALLOWED as long as immaterial

assurance report WHICHEVER COMES LATER

c. For financial statement audits

i. Starts: period covered by the financial statements reported on by

Custody of Client Assets

the firm or accountant begins audit review or attestation procedures

A public accountant should not take custody of the client’s assets unless it is permitted by such as signing of engagement letter WHICHEVER COME EARLIER

law or in compliance with legal duties 2. Independence Requirement

a. Only for ASSURANCE services

Self-interest threat to objectivity

Safeguards Is independence required?

o Keep assets separately from personal or firm assets 3 types of Assurance Assurance Team Firm Network Firm

o Use only for the purpose intended Audit yes yes yes

o Keep an account on income and expenses of such assets Non-Audit (unrestricted) yes yes no

o Make inquiries of the source of such assets Non-Audit (restricted) yes no no

Additional requirement for Non-Audit(restricted): No material DIRECT AND i. Provision of taxation services to assurance clients

INDIRECT financial interest in an assurance client. i. Will not impair as long as you are assisting such as tax compliance

Network firm is a group of accounting for the purpose of cooperation provision of taxation opinions and assistance in the resolution of tax

disputes

j. Provision of legal services to assurance clients

3. Independence Interpretations and Rulings i. Advocacy- impairs

a. Financial Interest ii. Advisory-does not impair

i. Control = direct iii. Independence is impaired when a CPA provides corporate finance

i. Material and immaterial impairs services such as underwriting securities

ii. no control = indirect k. Recruiting senior management

i. only material impairs i. IMPAIRS

b. Loans and Guarantees ii. Managerial decision will always impair independence

i. Loan to Financial institution does not impair if l. Fees-overdue

i. Loan is immaterial to both firm and client i. IMPAIRED when previous year’s fees are unpaid if at the time the

ii. Usual business assurance report is issued

ii. Loan to Nonfinancial institutions does not impair if m. Contingent Fees

i. Immaterial i. IMPAIRS

c. Close Business Relationship ii. NOT considered contingent fees

i. INDIRECT FINANCIAL INTEREST i. Fixed by court or other public authority

ii. Only impairs if material ii. Based on judicial or government agency proceedings

d. Family and Personal Relationships n. Gifts and Hospitality

i. Impairs if it is an IMMEDIATE FAMILY MEMBER o. Actual or threatened litigation

e. Past Employment with an assurance client

i. Only within the engagement period

f. Serving as an officer or director on the Board of Assurance Clients

i. Director/ Officer = independence is impaired

ii. Honorary Member = No impairments

g. Long Association with assurance clients Close Family = parents, siblings, children

i. Senior personnel/ lead engagement is rotated every 5 years

Immediate Family = spouse

h. Provision of accounting and bookkeeping services to assurance clients

i. Listed entities: FIRMS CANNOT PROVIDE SUCH SERVICES

ii. Non-listed entities: FIRMS CAN

iii. Exceptions

i. Client accepts responsibility for results

ii. Firm does not assume management decisions

iii. Personnel providing services are not members of the

assurance team

Das könnte Ihnen auch gefallen

- Nine Practices of the Successful Security Leader: Research ReportVon EverandNine Practices of the Successful Security Leader: Research ReportNoch keine Bewertungen

- Fundamental Principles-PCOPI: Part A: General ApplicationDokument4 SeitenFundamental Principles-PCOPI: Part A: General ApplicationYixing XingNoch keine Bewertungen

- Guide Questions in The Study of Part B of Code of Ethics For Professional AccountantsDokument4 SeitenGuide Questions in The Study of Part B of Code of Ethics For Professional AccountantsAnifahchannie PacalnaNoch keine Bewertungen

- AudTheo NoteDokument2 SeitenAudTheo NoteJorelyn Rose BaronNoch keine Bewertungen

- The Overview of Assurance EngagementsDokument6 SeitenThe Overview of Assurance EngagementsJelyn RuazolNoch keine Bewertungen

- Preliminary Discussion Assurance Engagements 5 Elements of Assurance EngagementDokument3 SeitenPreliminary Discussion Assurance Engagements 5 Elements of Assurance EngagementChristine NionesNoch keine Bewertungen

- Chapter 3 QuizDokument2 SeitenChapter 3 QuizRia VuNoch keine Bewertungen

- ATDokument5 SeitenATA. MagnoNoch keine Bewertungen

- Compliance Assessment Results: A.5 Information Security PoliciesDokument22 SeitenCompliance Assessment Results: A.5 Information Security PoliciesKaram AlMashhadiNoch keine Bewertungen

- Module 2.2 Code of EthicsDokument29 SeitenModule 2.2 Code of EthicsMary Grace Dela CruzNoch keine Bewertungen

- Auditing Theory: Professional and Legal Responsibility Quiz 2Dokument9 SeitenAuditing Theory: Professional and Legal Responsibility Quiz 2Mikasa MikasaNoch keine Bewertungen

- Audit ReviewerDokument2 SeitenAudit ReviewerAngelly EsguerraNoch keine Bewertungen

- Chapter 7 Code of Ethics For Professional Accountants in The PhilippinesDokument29 SeitenChapter 7 Code of Ethics For Professional Accountants in The PhilippinesJames Diaz100% (3)

- 02 Code of EthicsDokument3 Seiten02 Code of EthicscarloNoch keine Bewertungen

- ISO 27001 - 27002 Audit Check List A5 Operational 2Dokument10 SeitenISO 27001 - 27002 Audit Check List A5 Operational 2nasser abdelrahmanNoch keine Bewertungen

- Code of Ethics of Professional Accountants in The PhilippinesDokument9 SeitenCode of Ethics of Professional Accountants in The PhilippinesYamateNoch keine Bewertungen

- ISO 27001 Controls - Audit ChecklistDokument9 SeitenISO 27001 Controls - Audit ChecklistpauloNoch keine Bewertungen

- F8 Audit and Assurance: Ethics and EngagementDokument12 SeitenF8 Audit and Assurance: Ethics and EngagementMan HughNoch keine Bewertungen

- Fundamentals of Auditing and Assurance ServicesDokument6 SeitenFundamentals of Auditing and Assurance ServicesEdgie Trinidad TusiNoch keine Bewertungen

- Industrial Security Acitivity 1 P2Dokument2 SeitenIndustrial Security Acitivity 1 P2Lawrence Kent Mercado100% (1)

- Solutions Manual Audit and Assurance: 1st EditionDokument29 SeitenSolutions Manual Audit and Assurance: 1st EditionJunior WaqairasariNoch keine Bewertungen

- Acctg 401 - SET A DDokument9 SeitenAcctg 401 - SET A DRaprapNoch keine Bewertungen

- ISO 27001 2022 Audit Checklist Part 3 1697651244Dokument10 SeitenISO 27001 2022 Audit Checklist Part 3 1697651244NaveenchdrNoch keine Bewertungen

- Define Business Analysis ApproachDokument2 SeitenDefine Business Analysis ApproachSaurabh MehtaNoch keine Bewertungen

- Management Consultancy Practice NotesDokument4 SeitenManagement Consultancy Practice NotesEricka AudijeNoch keine Bewertungen

- At.3221 Ethical Standards and Responsibilities of Professional Accountants (Updated)Dokument10 SeitenAt.3221 Ethical Standards and Responsibilities of Professional Accountants (Updated)Denny June CraususNoch keine Bewertungen

- Internal Auditing 02 IA OverviewDokument3 SeitenInternal Auditing 02 IA OverviewSummer FitzNoch keine Bewertungen

- MIDTERM NOTES in Auditing 1Dokument4 SeitenMIDTERM NOTES in Auditing 1Ella Mae Botnande VillariasNoch keine Bewertungen

- ISO 27001-2022 Audit Checklist - Part 3Dokument10 SeitenISO 27001-2022 Audit Checklist - Part 3nasser abdelrahmanNoch keine Bewertungen

- AuditingDokument3 SeitenAuditingSittie Asiyah Dimaporo AbubacarNoch keine Bewertungen

- ISO27k ISMS 9.2 Audit Exercise 2021 - Crib Sheet - EnglishDokument5 SeitenISO27k ISMS 9.2 Audit Exercise 2021 - Crib Sheet - Englishsungray0% (1)

- PG AuditDokument4 SeitenPG AuditSalma Shinta AnggrainiNoch keine Bewertungen

- Hr-4th EditionDokument24 SeitenHr-4th EditionSahana PoovappaNoch keine Bewertungen

- SA 'S ChartsDokument46 SeitenSA 'S ChartsBharath Kumar100% (1)

- Pankaj Sir Revision Charts-1-26 PDFDokument26 SeitenPankaj Sir Revision Charts-1-26 PDFVaibhav GuptaNoch keine Bewertungen

- Referencer For Quick Revision: Final Course Paper-3: Advanced Auditing and Professional EthicsDokument30 SeitenReferencer For Quick Revision: Final Course Paper-3: Advanced Auditing and Professional Ethicsruhi MalviyaNoch keine Bewertungen

- AT.1304 - Code of EthicsDokument28 SeitenAT.1304 - Code of EthicsUzumaki NarutoNoch keine Bewertungen

- Multiple Choice: Auditing & Assurance Principles AT.113-Code of Ethics - Part II Nu Sports AcademyDokument7 SeitenMultiple Choice: Auditing & Assurance Principles AT.113-Code of Ethics - Part II Nu Sports AcademyPatrickMendozaNoch keine Bewertungen

- Employment Discrimination Law Outline 2018Dokument8 SeitenEmployment Discrimination Law Outline 2018Catlin PegelowNoch keine Bewertungen

- CODE OF ETHICS For Professional Accountants in TheDokument61 SeitenCODE OF ETHICS For Professional Accountants in TheDiana Rose BassigNoch keine Bewertungen

- Chapter 4 - Lesson Outline - StudentDokument28 SeitenChapter 4 - Lesson Outline - StudentKim Heok ChuaNoch keine Bewertungen

- REVIEW OF AUDITING THEORYDokument12 SeitenREVIEW OF AUDITING THEORYLlyod Francis LaylayNoch keine Bewertungen

- Aud 2019Dokument9 SeitenAud 2019Marjorie AmpongNoch keine Bewertungen

- AT.1201 - Fundamentals of Assurance and Non Assurance Engagements - StudentsDokument8 SeitenAT.1201 - Fundamentals of Assurance and Non Assurance Engagements - Studentsdave excelleNoch keine Bewertungen

- RESA at 1505 Final PreboardDokument12 SeitenRESA at 1505 Final PreboardLlyod Francis LaylayNoch keine Bewertungen

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDokument5 SeitenLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoFídely PierréNoch keine Bewertungen

- CA Final audit summarizeDokument69 SeitenCA Final audit summarizeTaha SiddiquiNoch keine Bewertungen

- COE UnfinishedDokument10 SeitenCOE Unfinishedamanda masolutionNoch keine Bewertungen

- Assignment 1 SOLUTION PDFDokument1 SeiteAssignment 1 SOLUTION PDFJulian ChanNoch keine Bewertungen

- Standards 402Dokument6 SeitenStandards 402Blessed OrtegaNoch keine Bewertungen

- Threats and SafeguardsDokument4 SeitenThreats and SafeguardsMR.diwash PokhrelNoch keine Bewertungen

- Audit Quick ReferenceDokument45 SeitenAudit Quick ReferencecadkmarwahNoch keine Bewertungen

- Exploring The Iesba Code: Installment 2: The Conceptual Framework-Step 1, Identifying ThreatsDokument2 SeitenExploring The Iesba Code: Installment 2: The Conceptual Framework-Step 1, Identifying ThreatsElena PanainteNoch keine Bewertungen

- Promote Employee Welfare & ProductivityDokument4 SeitenPromote Employee Welfare & ProductivityAdriane AriolaNoch keine Bewertungen

- AT.2822 - Code of Ethics For Professional Accountants PDFDokument11 SeitenAT.2822 - Code of Ethics For Professional Accountants PDFMaeNoch keine Bewertungen

- MGT209 Review of Corporate GovernanceDokument3 SeitenMGT209 Review of Corporate GovernanceRendyl Angel BonquinNoch keine Bewertungen

- BA401 - External Environment AnalysisDokument7 SeitenBA401 - External Environment AnalysisNapat InseeyongNoch keine Bewertungen

- GGSR ReviewerDokument5 SeitenGGSR ReviewerTrisha mae CruzNoch keine Bewertungen

- Risk-Based Audit Process and TechniquesDokument4 SeitenRisk-Based Audit Process and TechniquesmhadzmpNoch keine Bewertungen

- Mas 6Dokument8 SeitenMas 6CGNoch keine Bewertungen

- Document WPS OfficeDokument1 SeiteDocument WPS OfficeYixing XingNoch keine Bewertungen

- Product CostingDokument2 SeitenProduct CostingYixing XingNoch keine Bewertungen

- Actual Costs Static Incurre D Budge TDokument1 SeiteActual Costs Static Incurre D Budge TShiba InuNoch keine Bewertungen

- Evaluate Financial MisstatementsDokument11 SeitenEvaluate Financial MisstatementsSebastian GarciaNoch keine Bewertungen

- Thesis StatementDokument1 SeiteThesis StatementYixing XingNoch keine Bewertungen

- Take The StairsDokument7 SeitenTake The StairsYixing XingNoch keine Bewertungen

- T1049191Dokument1 SeiteT1049191Yixing XingNoch keine Bewertungen

- Fpure ch2Dokument22 SeitenFpure ch2Kunal JainNoch keine Bewertungen

- Chhhapter 9Dokument10 SeitenChhhapter 9Yixing XingNoch keine Bewertungen

- From Foreign Currency To Presentation Currency Into Functional CurrencyDokument1 SeiteFrom Foreign Currency To Presentation Currency Into Functional CurrencyYixing XingNoch keine Bewertungen

- ANSWER KEY Sampling ... Other Assurance EngagementsDokument2 SeitenANSWER KEY Sampling ... Other Assurance EngagementsYixing XingNoch keine Bewertungen

- Daffodils by William WordsworthDokument6 SeitenDaffodils by William WordsworthYixing Xing100% (1)

- Pride and Prejudice VocabularyDokument6 SeitenPride and Prejudice VocabularyYixing XingNoch keine Bewertungen

- Oveseas Voc and Higher Ed Quals - Second Edition 2009 PDFDokument164 SeitenOveseas Voc and Higher Ed Quals - Second Edition 2009 PDFYixing XingNoch keine Bewertungen

- ACL Exer - ExpenditureDokument2 SeitenACL Exer - ExpenditureYixing XingNoch keine Bewertungen

- Ncy - NG 1-: 950 Official Gazette VDokument35 SeitenNcy - NG 1-: 950 Official Gazette VYixing XingNoch keine Bewertungen

- ACL Exer - FraudDokument2 SeitenACL Exer - FraudYixing XingNoch keine Bewertungen

- TOS FAR RevisedDokument7 SeitenTOS FAR RevisedAdmin ElenaNoch keine Bewertungen

- (Problems) - Audit of InventoriesDokument22 Seiten(Problems) - Audit of Inventoriesapatos40% (5)

- Official Gazette 950 V - 113, N - 1: General Appropriations Act, Fy 2018Dokument35 SeitenOfficial Gazette 950 V - 113, N - 1: General Appropriations Act, Fy 2018Yixing XingNoch keine Bewertungen

- Illustrative Entries For Regular Agency FundDokument24 SeitenIllustrative Entries For Regular Agency FundYixing XingNoch keine Bewertungen

- IFRS 39 Financial InstrumentsDokument48 SeitenIFRS 39 Financial Instrumentssulman TariqNoch keine Bewertungen

- Advanced Financial Accounting TopicsDokument9 SeitenAdvanced Financial Accounting TopicsAdmin ElenaNoch keine Bewertungen

- PhiloDokument2 SeitenPhiloYixing XingNoch keine Bewertungen

- After Virtue: Chapter SummaryDokument20 SeitenAfter Virtue: Chapter SummaryChristos MoissidisNoch keine Bewertungen

- Investment QuestionsDokument6 SeitenInvestment QuestionsYixing XingNoch keine Bewertungen

- 1Dokument1 Seite1Yixing XingNoch keine Bewertungen

- Structural - Analysis - Skid A4401 PDFDokument94 SeitenStructural - Analysis - Skid A4401 PDFMohammed Saleem Syed Khader100% (1)

- Twitch V CruzzControl CreatineOverdoseDokument19 SeitenTwitch V CruzzControl CreatineOverdoseAndy ChalkNoch keine Bewertungen

- An Improved Ant Colony Algorithm and Its ApplicatiDokument10 SeitenAn Improved Ant Colony Algorithm and Its ApplicatiI n T e R e Y eNoch keine Bewertungen

- Gujarat Technological University: Aeronautical EngineeringDokument16 SeitenGujarat Technological University: Aeronautical EngineeringumodiNoch keine Bewertungen

- Solidwork Flow Simulation TutorialDokument298 SeitenSolidwork Flow Simulation TutorialMilad Ah100% (8)

- Special Proceedings Case DigestDokument14 SeitenSpecial Proceedings Case DigestDyan Corpuz-Suresca100% (1)

- 8086 Microprocessor: J Srinivasa Rao Govt Polytechnic Kothagudem KhammamDokument129 Seiten8086 Microprocessor: J Srinivasa Rao Govt Polytechnic Kothagudem KhammamAnonymous J32rzNf6ONoch keine Bewertungen

- Efficient Power Supply for Inductive LoadsDokument7 SeitenEfficient Power Supply for Inductive LoadsMary AndersonNoch keine Bewertungen

- Assessment of Benefits and Risk of Genetically ModDokument29 SeitenAssessment of Benefits and Risk of Genetically ModSkittlessmannNoch keine Bewertungen

- A Development of The Test For Mathematical Creative Problem Solving AbilityDokument27 SeitenA Development of The Test For Mathematical Creative Problem Solving AbilityanwarNoch keine Bewertungen

- Module-1 STSDokument35 SeitenModule-1 STSMARYLIZA SAEZNoch keine Bewertungen

- Lignan & NeolignanDokument12 SeitenLignan & NeolignanUle UleNoch keine Bewertungen

- Project Final Report: Crop BreedingDokument16 SeitenProject Final Report: Crop BreedingAniket PatilNoch keine Bewertungen

- Illegal FishingDokument1 SeiteIllegal FishingDita DwynNoch keine Bewertungen

- Classification of Methods of MeasurementsDokument60 SeitenClassification of Methods of MeasurementsVenkat Krishna100% (2)

- Wargames Illustrated #115Dokument64 SeitenWargames Illustrated #115Анатолий Золотухин100% (1)

- Indra: Detail Pre-Commissioning Procedure For Service Test of Service Water For Unit 040/041/042/043Dokument28 SeitenIndra: Detail Pre-Commissioning Procedure For Service Test of Service Water For Unit 040/041/042/043AnhTuấnPhanNoch keine Bewertungen

- Heads of Departments - 13102021Dokument2 SeitenHeads of Departments - 13102021Indian LawyerNoch keine Bewertungen

- 114 ArDokument254 Seiten114 ArJothishNoch keine Bewertungen

- Abend CodesDokument8 SeitenAbend Codesapi-27095622100% (1)

- Ejemplo FFT Con ArduinoDokument2 SeitenEjemplo FFT Con ArduinoAns Shel Cardenas YllanesNoch keine Bewertungen

- VISCOSITY CLASSIFICATION GUIDE FOR INDUSTRIAL LUBRICANTSDokument8 SeitenVISCOSITY CLASSIFICATION GUIDE FOR INDUSTRIAL LUBRICANTSFrancisco TipanNoch keine Bewertungen

- Effects of War On EconomyDokument7 SeitenEffects of War On Economyapi-3721555100% (1)

- Manuais - 727312 - manuais-Raios-X AXR - 77000001249Dokument72 SeitenManuais - 727312 - manuais-Raios-X AXR - 77000001249Hosam Ahmed HashimNoch keine Bewertungen

- 2020 - Audcap1 - 2.3 RCCM - BunagDokument1 Seite2020 - Audcap1 - 2.3 RCCM - BunagSherilyn BunagNoch keine Bewertungen

- LDokument32 SeitenLDenNoch keine Bewertungen

- Networks Lab Assignment 1Dokument2 SeitenNetworks Lab Assignment 1006honey006Noch keine Bewertungen

- After EffectsDokument56 SeitenAfter EffectsRodrigo ArgentoNoch keine Bewertungen

- Löwenstein Medical: Intensive Care VentilationDokument16 SeitenLöwenstein Medical: Intensive Care VentilationAlina Pedraza100% (1)

- Imp RssDokument8 SeitenImp RssPriya SharmaNoch keine Bewertungen