Beruflich Dokumente

Kultur Dokumente

My Lab: Figure 9-7

Hochgeladen von

JoanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

My Lab: Figure 9-7

Hochgeladen von

JoanCopyright:

Verfügbare Formate

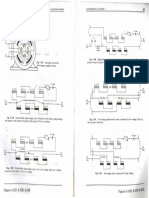

Figure 9-7

Short and Medium Run IS

Effects of an Increase in

Real interest rate, r

the Price of Oil

MyEconLab Animation rn

A

LM

rn LM

AA

Yn Yn

Output, Y

PC

PC

A

Change in inflation rate

p – p(–1)

A A

0

Yn Yn

Output, Y

inflation. For given wages, the price of oil leads firms to increase their prices, so inflation

is higher. The short-run equilibrium is given by point A= in the top and bottom panels. In

the short run, output does not change, but inflation is higher.

Turn to the dynamics. If the central bank were to leave the policy rate unchanged,

output would continue to exceed the now lower level of potential output, and infla-

tion would keep increasing. Thus, at some point, the central bank will increase the

policy rate to stabilize inflation. As it does so, the economy moves up from A= to A==

along the IS curve in the top panel, and down from A= to A== along the PC curve in the

bottom panel. As output decreases to its lower level, inflation continues to increase,

although more and more slowly until eventually it becomes stable again. Once the

economy is at point A==, the economy is in its medium-run equilibrium. Because po-

This is especially true if the oil tential output is lower, the increase in the price of oil is reflected in a permanently

producers are located in other lower level of output. Note that along the way, lower output is associated with higher

countries than the oil buyers inflation, a combination that economists call stagflation (stag for stagnation, and

(which is the case when the

United States buys oil from the

flation for inflation).

Middle East for example). As As in the previous sections, this description raises a number of issues. The first

the price increases and their in- is our assumption that the IS curve does not shift. In fact, there are many channels

come increases, the oil produc- through which the increase in the price of oil may affect demand and shift the IS curve.

ers are likely to spend most of it The higher price of oil may lead firms to change their investment plans, canceling some

on their own goods, not on the

goods produced by the oil buy-

investment projects, shifting to less energy-intensive equipment. The increase in the

ers. Thus, demand for domes- price of oil also redistributes income from oil buyers to oil producers. Oil producers may

tic goods is likely to go down. c spend less than oil buyers, leading to a decrease in demand. So it may well be that the IS

210 The Medium Run The Core

Das könnte Ihnen auch gefallen

- Aggregate Demand and Aggregate Supply: U N ItDokument19 SeitenAggregate Demand and Aggregate Supply: U N Itcharan chamarthiNoch keine Bewertungen

- S10. Aggregate Demand and Supply Analysis FDokument47 SeitenS10. Aggregate Demand and Supply Analysis FShrija Majumder BJ22152Noch keine Bewertungen

- Low Frequency Characteristic Analysis of Voltage Mode Boost ConverterDokument4 SeitenLow Frequency Characteristic Analysis of Voltage Mode Boost Converterkakkunuru kashyapNoch keine Bewertungen

- Macroeconomics Discussion4Dokument2 SeitenMacroeconomics Discussion4Chia Chia KoayNoch keine Bewertungen

- CB801Dokument18 SeitenCB801motrenko123Noch keine Bewertungen

- 04A InflationDokument21 Seiten04A InflationShrey JoshiNoch keine Bewertungen

- 120V Ac Positive Iq Remote Control Circuitry - Modulating (24Vdc)Dokument1 Seite120V Ac Positive Iq Remote Control Circuitry - Modulating (24Vdc)Amol BhaleraoNoch keine Bewertungen

- Scan0025 Fig 1-127 To 132 PDFDokument1 SeiteScan0025 Fig 1-127 To 132 PDFJayson Jonson AraojoNoch keine Bewertungen

- 2xa3 SuportDokument1 Seite2xa3 SuportCristian DobrescuNoch keine Bewertungen

- LabelingDokument2 SeitenLabelingSalwa Salsabila Az-zahraNoch keine Bewertungen

- L3 SchemaDokument1 SeiteL3 SchemaSelvakumar Murugesan100% (1)

- Static Pressure Acts:: Participant: Licence: Examination: Date 3 Munene, Munene Cpla 081 Principles of Flight 2/11/2013Dokument100 SeitenStatic Pressure Acts:: Participant: Licence: Examination: Date 3 Munene, Munene Cpla 081 Principles of Flight 2/11/2013trevor t.kNoch keine Bewertungen

- Syronous Genset DiagramDokument2 SeitenSyronous Genset Diagramromilanon61100% (4)

- IS-LM Mankiw TutorialDokument28 SeitenIS-LM Mankiw TutorialDillaNoch keine Bewertungen

- Application Note AN-6026: Design of Power Factor Correction Circuit Using FAN7529Dokument23 SeitenApplication Note AN-6026: Design of Power Factor Correction Circuit Using FAN7529miloud1911Noch keine Bewertungen

- Monetary Policy 2020 Pakistan PDFDokument20 SeitenMonetary Policy 2020 Pakistan PDFiftikharhassanNoch keine Bewertungen

- The Percentage of The Work Force That Is Unemployed at Any Given DateDokument4 SeitenThe Percentage of The Work Force That Is Unemployed at Any Given DateayushNoch keine Bewertungen

- Victoria Park + Colee Hammock - Market Activity Report - 2018Dokument17 SeitenVictoria Park + Colee Hammock - Market Activity Report - 2018Chip FalkangerNoch keine Bewertungen

- sugdan-ARCH1 1Dokument1 Seitesugdan-ARCH1 1Alfred BermudezNoch keine Bewertungen

- Understanding Linear Regulators and Their Key Performance ParametersDokument6 SeitenUnderstanding Linear Regulators and Their Key Performance ParametersUdai ValluruNoch keine Bewertungen

- 03 - SW10083 OBD2 D-METER Standard Version - EN - 2Dokument1 Seite03 - SW10083 OBD2 D-METER Standard Version - EN - 2KALILNoch keine Bewertungen

- Hitachi Ex33mu Ex58mu Excavator Service ManualDokument789 SeitenHitachi Ex33mu Ex58mu Excavator Service Manualюрий100% (1)

- Understanding Ldos PDFDokument6 SeitenUnderstanding Ldos PDFGiuseppe ZuffelatoNoch keine Bewertungen

- Transformer Testing Panel (Macro Plast)Dokument8 SeitenTransformer Testing Panel (Macro Plast)Harsh ThakurNoch keine Bewertungen

- Problem Set 4Dokument9 SeitenProblem Set 4ehab_ghazallaNoch keine Bewertungen

- Session 15, 16, 17 - AD-AsDokument59 SeitenSession 15, 16, 17 - AD-AsAyusha MakenNoch keine Bewertungen

- Staf, Staf-Sg, Staf-R, Stag 5-5-15 Bih: Balancing Valves Mengenabgleichventile 1996.08Dokument12 SeitenStaf, Staf-Sg, Staf-R, Stag 5-5-15 Bih: Balancing Valves Mengenabgleichventile 1996.08SiktonNoch keine Bewertungen

- Mapa Del AtlanticoDokument1 SeiteMapa Del AtlanticoJuan M. AlvarezNoch keine Bewertungen

- PDF DPWH Cost Estimation Manual For Low Rise Buildings CompressDokument107 SeitenPDF DPWH Cost Estimation Manual For Low Rise Buildings CompressMark Kenneth SolbitaNoch keine Bewertungen

- Classification of Reservoirs-Tarek - Ahmed - Equation - of - State - PVT - AnalysisDokument14 SeitenClassification of Reservoirs-Tarek - Ahmed - Equation - of - State - PVT - AnalysisDEISA YANIANY DUSSAN RAMIREZNoch keine Bewertungen

- Solution Manual Mankiw Macroeconomics PDDokument11 SeitenSolution Manual Mankiw Macroeconomics PDClerisha DsouzaNoch keine Bewertungen

- Sequential Turbocharging Part1Dokument4 SeitenSequential Turbocharging Part1Krzysztof DanileckiNoch keine Bewertungen

- S.4 Chapter 6.1 Elasticity of Demand SDokument30 SeitenS.4 Chapter 6.1 Elasticity of Demand SLee Yuet Tung 李悅彤 - (5E13)Noch keine Bewertungen

- End Sem Y17Dokument7 SeitenEnd Sem Y17harsh gargNoch keine Bewertungen

- Power Factor Correction Maintenance: Call Us On: 01799 530728 Fax Us On: 01799 530235Dokument2 SeitenPower Factor Correction Maintenance: Call Us On: 01799 530728 Fax Us On: 01799 530235Slick72Noch keine Bewertungen

- BTI Elite 1 / Elite 1 XP Sales LiteratureDokument2 SeitenBTI Elite 1 / Elite 1 XP Sales LiteraturebtiscribdNoch keine Bewertungen

- Standards of Internal ControlsDokument71 SeitenStandards of Internal Controlsnga8vu-2Noch keine Bewertungen

- Elman UkDokument1.601 SeitenElman UkKrocodileNoch keine Bewertungen

- Aggregate Supply CurveDokument17 SeitenAggregate Supply CurveHimaNoch keine Bewertungen

- Fuzzy Logic Controller For Vsi For Power Factor CorrectionDokument29 SeitenFuzzy Logic Controller For Vsi For Power Factor CorrectionJampana ShivaramakrishnaNoch keine Bewertungen

- TW-88 Storm Conduit Plan and ProfileDokument5 SeitenTW-88 Storm Conduit Plan and Profileinam khanNoch keine Bewertungen

- 2220 - Miller Effect PDFDokument4 Seiten2220 - Miller Effect PDFEdmundBlackadderIVNoch keine Bewertungen

- Engine Control 2 Toyota Corolla 2006 PDFDokument10 SeitenEngine Control 2 Toyota Corolla 2006 PDFjorgeNoch keine Bewertungen

- Oxford Notes PDFDokument239 SeitenOxford Notes PDFN S ChakNoch keine Bewertungen

- Parallel To HP Inclined To HP One Small Side Inclined To VP: Surface SurfaceDokument4 SeitenParallel To HP Inclined To HP One Small Side Inclined To VP: Surface Surfaceajeng.saraswatiNoch keine Bewertungen

- Projection of PlanesDokument14 SeitenProjection of PlanesIsSidNoch keine Bewertungen

- Energy Accounting - A Key Tool in Managing Energy Costs PDFDokument36 SeitenEnergy Accounting - A Key Tool in Managing Energy Costs PDFPrayoga AjaNoch keine Bewertungen

- 5.3. Block Diagram and Schematics: MS MSDokument9 Seiten5.3. Block Diagram and Schematics: MS MSMilly ContrerasNoch keine Bewertungen

- Panos Lianos - Final ExamDokument16 SeitenPanos Lianos - Final ExamPanagiotis LianosNoch keine Bewertungen

- Elman UkDokument1.700 SeitenElman UkMartin CavallariNoch keine Bewertungen

- Pre CalDokument13 SeitenPre CalCandia, Shyn Necole R.Noch keine Bewertungen

- Assignment 7Dokument5 SeitenAssignment 7singhaanya2003Noch keine Bewertungen

- Projection of PlaneDokument21 SeitenProjection of Plane20bt04047Noch keine Bewertungen

- ToMan UkDokument179 SeitenToMan UkОлег ДавыдовNoch keine Bewertungen

- Mind MapDokument1 SeiteMind Mapkedar majethiyaNoch keine Bewertungen

- P1 On InflationDokument6 SeitenP1 On Inflationeleni.nikolaouNoch keine Bewertungen

- GỬI NGUYỆNDokument1 SeiteGỬI NGUYỆNPhúcMậpNoch keine Bewertungen

- 04 InflationDokument20 Seiten04 InflationSaanika UneNoch keine Bewertungen

- The Case For Compensated Free Trade - New Europe PDFDokument4 SeitenThe Case For Compensated Free Trade - New Europe PDFJoanNoch keine Bewertungen

- Gravity DummiesDokument31 SeitenGravity DummiesRicardo CaffeNoch keine Bewertungen

- Minford-2019-The World Economy PDFDokument11 SeitenMinford-2019-The World Economy PDFJoanNoch keine Bewertungen

- Chapter 4Dokument32 SeitenChapter 4JoanNoch keine Bewertungen

- 12 Pentagramas en A4Dokument1 Seite12 Pentagramas en A4JoanNoch keine Bewertungen

- Business Environment Presentation On Wto, Gats and GattDokument18 SeitenBusiness Environment Presentation On Wto, Gats and GattYogi JiNoch keine Bewertungen

- Urban Renewal DelhiDokument18 SeitenUrban Renewal DelhiaanchalNoch keine Bewertungen

- Behind Maori NationalismDokument8 SeitenBehind Maori NationalismTricksy Mix100% (1)

- IB Economics HL Practice Test - Topics 2.1-2.3Dokument11 SeitenIB Economics HL Practice Test - Topics 2.1-2.3Daniil SHULGANoch keine Bewertungen

- Before The Notary Public at Bidhan Nagar, Kolkata Affidavit / No Objection CertificateDokument4 SeitenBefore The Notary Public at Bidhan Nagar, Kolkata Affidavit / No Objection CertificateSWAPAN DASGUPTANoch keine Bewertungen

- OperatingReview2014 EngDokument37 SeitenOperatingReview2014 EngBinduPrakashBhattNoch keine Bewertungen

- Globalization Is Changing: Jude Brian Mordeno BSTM 401ADokument4 SeitenGlobalization Is Changing: Jude Brian Mordeno BSTM 401AAnon MousNoch keine Bewertungen

- Characteristics of The Hungarian Economy in The Rákosi EraDokument3 SeitenCharacteristics of The Hungarian Economy in The Rákosi EraDorka LigetiNoch keine Bewertungen

- VAT Guide Saudi Arabia R3Dokument43 SeitenVAT Guide Saudi Arabia R3Adeel ArsalanNoch keine Bewertungen

- RTI Data Item Guide 20-21 v1-1Dokument57 SeitenRTI Data Item Guide 20-21 v1-1chethanNoch keine Bewertungen

- Iocl Trichy 1st Po-27076875Dokument14 SeitenIocl Trichy 1st Po-27076875SachinNoch keine Bewertungen

- BillDokument1 SeiteBillAskari NaqviNoch keine Bewertungen

- Golangco SyllabusDokument3 SeitenGolangco SyllabusMaria Cresielda EcalneaNoch keine Bewertungen

- (개정) 2021년 - 영어 - NE능률 (김성곤) - 2과 - 적중예상문제 1회 실전 - OKDokument11 Seiten(개정) 2021년 - 영어 - NE능률 (김성곤) - 2과 - 적중예상문제 1회 실전 - OK김태석Noch keine Bewertungen

- Uh Econ 607 NotesDokument255 SeitenUh Econ 607 NotesDamla HacıNoch keine Bewertungen

- Procurement Statement of WorkDokument4 SeitenProcurement Statement of WorkAryaan RevsNoch keine Bewertungen

- Security Seal 4-MALAYSIADokument124 SeitenSecurity Seal 4-MALAYSIAEkin Elias100% (1)

- Limited: Prime BankDokument1 SeiteLimited: Prime BankHabib MiaNoch keine Bewertungen

- Ngos in PakistanDokument13 SeitenNgos in Pakistanapi-339753830100% (1)

- 1.1 Introduction To Financial CrisisDokument13 Seiten1.1 Introduction To Financial CrisisvarshikaNoch keine Bewertungen

- Microeconomics Test 1Dokument14 SeitenMicroeconomics Test 1Hunter Brown100% (1)

- AFM@Research Assignment - Mba 1stDokument3 SeitenAFM@Research Assignment - Mba 1stUpneet SethiNoch keine Bewertungen

- P3 - Basic Revision Q & A Selected TopicsDokument96 SeitenP3 - Basic Revision Q & A Selected TopicsZin Tha100% (1)

- Daily Renewables WatchDokument2 SeitenDaily Renewables WatchunitedmanticoreNoch keine Bewertungen

- Studi Kelayakan Bisnis Bengkel Bubut Cipta Teknik Mandiri (Studi Kasus Di Perumnas Tangerang Banten)Dokument8 SeitenStudi Kelayakan Bisnis Bengkel Bubut Cipta Teknik Mandiri (Studi Kasus Di Perumnas Tangerang Banten)Billy AdityaNoch keine Bewertungen

- Five Year Plans of IndiaDokument18 SeitenFive Year Plans of IndiaYasser ArfatNoch keine Bewertungen

- Chapter 4 PDFDokument41 SeitenChapter 4 PDFAsad AsmatNoch keine Bewertungen

- Policy On Intellectual Property in KenyaDokument50 SeitenPolicy On Intellectual Property in KenyaE Kay Mutemi100% (1)

- Travel Green Guide 2009Dokument185 SeitenTravel Green Guide 2009Yunran100% (1)