Beruflich Dokumente

Kultur Dokumente

PED 2014-68-EU Guidelines en v4

Hochgeladen von

Bharadwaj RangarajanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PED 2014-68-EU Guidelines en v4

Hochgeladen von

Bharadwaj RangarajanCopyright:

Verfügbare Formate

Feature Report

Short-Cut Piping Costs

This method saves TABLE 1. STRAIGHT RUN PROCESS PIPING —

BASE COSTS AND BARE MODULE INSTALLED PRICES

precious time in Pipe type Sched- CP·a

ule

FM·a Pipe Field Equipment,

Base cost pipe, Material Racks, installa- engineering,

CBM·a

Total bare

FBM·a

Instal-

preparing estimates for flanges, and

preparation,

$/m

Factor $/m tion, $/m contractor’s

expenses,

$/m

module cost,

$/m

lation

factor

pre-design and other Polyvinylchloride (PVC) 80

5-cm nominal diameter — pressures up to 10 barg

3.63 0.3 14.77 9.89 15.74 44.03 3.4

approximated analyses Chlorinated polyvinyl-

chloride (CPVC)

80 9.35 0.7 14.77 9.89 15.74 49.75 3.9

Carbon Steel 40 12.83 1.0 11.05 11.24 16.25 51.36 4.0

Stainless 304L 10 19.92 1.6 11.95 11.24 17.99 61.10 4.8

Gael D. Ulrich and Stainless 316L 10 25.67 2.0 11.95 11.24 18.74 67.60 5.3

Palligarnai T. Vasudevan Lined carbon steel 40

• Rubber 29.20 2.3 19.41 14.05 22.20 84.86 6.6

University of New Hampshire

• Conventional plastic 61.68 4.8 20.91 14.05 26.98 123.62 9.6

E

• Fluorocarbon 126.07 9.8 19.41 14.05 31.94 191.48 14.9

ngineers often need to predict • Glass 127.42 9.9 22.36 14.05 34.14 197.98 15.4

the cost of piping and pipefitting Fiberglass-reinforced 63.33 4.9 19.41 14.05 26.23 123.02 9.6

associated with a process unit. plastic (FRP)

Alloy 20 10 112.13 8.7 12.41 11.58 27.73 163.84 12.8

Even though detailed prices are

Monel 10 140.42 11.0 12.11 11.24 29.98 193.75 15.1

available, finding and organizing them Hastelloy C-276 10 195.07 15.2 13.17 12.14 37.47 257.84 20.1

takes time and costs money. For those Titanium 10 127.81 10.0 14.08 13.04 32.22 187.16 14.6

needing a quick method of approxima- Zirconium 10 388.29 30.3 14.08 13.04 58.45 473.86 37.0

tion (such as for a pre-design estimate), 10-cm nominal dia. — pressures up to 10 barg

a short-cut piping cost method is pre- Polyvinylchloride (PVC) 80 9.41 0.4 14.77 12.59 17.99 54.76 2.1

Chlorinated polyvinyl- 80 26.62 1.0 14.77 12.59 19.48 73.47 2.8

sented in this article. For convenience chloride (CPVC)

and compactness, the relevant equa- Carbon Steel 40 25.85 1.0 11.49 14.61 20.69 72.64 2.8

tions and data lists are superimposed Stainless 304L 10 39.69 1.5 12.40 14.61 23.23 89.94 3.5

on the same diagram as the base cost Stainless 316L 10 49.63 1.9 12.41 14.61 23.98 100.63 3.9

curves (p. 48). The method of the chart’s Lined carbon steel 40

• Rubber 49.97 1.9 24.30 16.86 28.89 120.02 4.6

compilation and other background de-

• Conventional plastic 132.23 5.1 26.98 16.86 38.22 214.30 8.3

tails are described below. • Fluorocarbon 239.81 9.3 24.30 16.86 48.37 329.34 12.7

Lindley and Floyd [1] reported de- • Glass 215.41 8.3 30.35 16.86 48.32 310.95 12.0

tailed data for more than 30 types of Fiberglass-reinforced 91.43 3.5 24.30 16.86 33.72 166.31 6.4

piping in three diameters (2, 4 and 6 plastic (FRP)

Alloy 20 10 232.83 9.0 12.85 15.06 43.47 304.21 11.8

in., essentially equivalent to 5, 10 and

Monel 10 324.09 12.5 12.55 14.61 51.71 402.97 15.6

15 cm. nominal dia.) and two types of Hastelloy C-276 10 557.37 21.6 13.62 15.96 77.94 664.89 25.7

installation: Titanium 10 282.15 10.9 14.52 17.31 51.71 365.70 14.1

1. Simple straight runs such as those Zirconium 10 1017.76 39.4 14.52 17.31 125.15 1174.75 45.4

used to convey raw materials from 15-cm nominal dia. — pressures up to 10 barg

storage to a process module Polyvinylchloride (PVC) 80 16.84 0.4 17.94 14.39 21.73 70.90 1.7

Chlorinated polyvinyl- 80 51.55 1.2 17.94 14.39 25.48 109.36 2.6

2. Complex systems such as the chloride (CPVC)

plumbing associated with a distilla- Carbon Steel 40 42.40 1.0 12.37 17.09 25.79 97.65 2.3

tion column or heat exchanger Stainless 304L 10 63.51 1.5 13.28 17.09 28.48 122.36 2.9

That database is, no doubt, valued by Stainless 316L 10 80.90 1.9 13.28 17.09 29.98 141.24 3.3

many who prepare detailed definitive Lined carbon steel 40 0.0

• Rubber 58.15 1.4 30.06 19.67 33.98 141.86 3.3

cost estimates. We likewise found it

• Conventional plastic 215.34 5.1 35.22 19.67 51.71 321.94 7.6

useful to construct our short-cut chart, • Fluorocarbon 359.90 8.5 30.06 19.67 64.45 474.08 11.2

which is applicable to the same set of • Glass 373.16 8.8 37.77 19.67 69.13 499.72 11.8

piping sizes and materials. Fiberglass-reinforced 152.43 3.6 30.06 19.67 43.84 246.00 5.8

plastic (FRP)

Alloy 20 10 364.58 8.6 13.73 17.76 59.20 455.27 10.7

Simple, straight pipe runs

Monel 10 912.96 21.5 13.43 17.09 113.91 1057.39 24.9

Consider a simple system made of Hastelloy C-276 10 750.98 17.7 14.49 18.89 100.42 884.78 20.9

standard piping suitable for pressures Titanium 10 415.52 9.8 15.40 20.68 68.95 520.55 12.3

up to 10 barg at ambient tempera- Zirconium 10 1168.91 27.6 15.40 20.68 144.64 1349.64 31.8

44 CHEMICAL ENGINEERING WWW.CHE.COM MARCH 2006

NOMENCLATURE

CBM·a Bare module price of piping material Dact Bare pipe actual outside diameter, cm Fp

Pressure factor, dimensionless

”a”, i.e., its total contribution to the FBM·a Bare module installation factor for L

Pipe length, m

capital cost of a process material “a“ (ratio of bare module p

Internal pipe pressure, barg (bars gage)

module, $/m installed cost to purchase price of car- S

Design stress of pipeline material,

CBM·Ins Bare module price of piping bon steel), dimensionless bara (bar absolute)

insulation, $/m of pipe length FM·a Material factor for material “a“ t Pipe wall thickness, cm

CP·a Base cost or purchase price of (quotient of base cost CP·a for piping topt Optimum insulation thickness, cm

piping material “a“ prepared for material divided by CP·cs the base cost ∆T Difference between pipe temperature

transport to an installation site, $/m of carbon steel pipe having the same and ambient, °C

D, Dnom Bare pipe nominal diameter, cm diameter), dimensionless

TABLE 2. COMPLEX PIPING SYSTEMS —

BASE COSTS AND BARE MODULE INSTALLED PRICES �������������

������������� �������

Pipe type Sched- CP·a FM·a Pipe Field Equipment, CBM·a FBM·a ��� �������

ule Base cost Material Racks, instal- engineering, Total bare Instal-

pipe, flanges, Factor $/m lation, contractor’s module lation

�

and prepara- $/m expenses, cost, $/m factor

tion, $/m $/m

5-cm nominal diameter — pressures up to 10 barg ������������

Polyvinylchloride (PVC) 80 18.42 0.4 7.62 23.27 29.11 78.42 1.7 ����������

Chlorinated polyvinyl- 80 26.09 0.6 7.62 23.27 30.43 87.40 1.9

chloride (CPVC) ��

Carbon Steel 40 46.67 1.0 19.56 23.44 50.79 140.45 3.0 � �� ���

Stainless 304L 10 71.96 1.5 19.88 23.44 53.13 168.41 3.6 ���������������������

Stainless 316L 10 83.62 1.8 19.88 23.44 52.83 179.77 3.9

Lined carbon steel 40 FIGURE 1. To obtain an installed price

• Rubber 80.31 1.7 25.88 25.85 40.48 172.53 3.7 for any either complex or straight-run pip-

• Conventional plastic 204.03 4.4 29.04 25.85 50.85 309.77 6.6 ing, simply multiply the appropriate value

• Fluorocarbon 329.87 7.1 25.88 25.85 60.38 441.99 9.5 from this figure by the installation factor,

• Glass 294.49 6.3 31.67 25.85 61.90 413.92 8.9 FBM·a, for that material

Fiberglass-reinforced 180.23 3.9 25.88 25.85 49.18 281.15 6.0

plastic (FRP)

ture.1 To prepare carbon steel pipe

Alloy 20 10 325.92 7.0 20.03 23.55 72.84 442.34 9.5

Monel 10 285.72 6.1 19.94 23.44 69.32 398.42 8.5

for straight runs, it is normally cut to

Hastelloy C-276 10 420.80 9.0 20.28 23.55 87.31 551.93 11.8 length (typically 6 or 12 m) in a shop

Titanium 10 356.52 7.6 20.62 23.66 86.78 487.58 10.4 where flanges are welded at each end.

Zirconium 10 763.40 16.4 20.62 23.66 120.88 928.56 19.9 These “thimbles” are sandblasted,

10-cm nominal dia. — pressures up to 10 barg painted and otherwise made ready for

Polyvinylchloride (PVC) 80 36.91 0.5 7.62 27.93 40.02 112.48 1.4

transport to the plant site.2 In 1993,

Chlorinated polyvinyl- 80 66.59 0.8 7.62 27.93 42.04 144.18 1.8

chloride (CPVC) Lindley and Floyd reported the price

Carbon Steel 40 80.62 1.0 30.48 28.19 75.16 214.45 2.7 for such preconditioned, Schedule 40,

Stainless 304L 10 139.64 1.7 30.79 28.19 79.89 278.50 3.5 5-cm (2 in.) nominal dia., carbon-steel

Stainless 316L 10 164.25 2.0 30.79 28.19 82.21 305.44 3.8 pipe to be $1,711 for a 500-ft long

Lined carbon steel 40

(152.4-m) section. This corresponds

• Rubber 111.29 1.4 45.12 32.60 61.34 250.35 3.1

• Conventional plastic 382.20 4.7 50.59 32.60 84.23 549.62 6.8

to a base price of $11.23/m in 1993

• Fluorocarbon 588.56 7.3 45.12 32.60 98.70 764.98 9.5 dollars. For this article, we escalated

• Glass 486.91 6.0 57.02 32.60 100.72 677.25 8.4 numbers to mid-2003 dollars by mul-

Fiberglass-reinforced 267.92 3.3 45.12 32.60 74.38 420.02 5.2 tiplying all 1993 data by 400 (the CE

plastic (FRP)

Plant Cost Index [CE PCI] for mid

Alloy 20 10 732.76 9.1 30.94 28.24 124.25 916.20 11.4

Monel 10 706.76 8.8 30.86 28.19 123.58 889.38 11.0

2003) and then dividing it by 350 (the

Hastelloy C-276 10 1072.30 13.3 31.19 28.36 165.55 1297.39 16.1 CE PCI for 1993). The resulting 5-cm

Titanium 10 765.74 9.5 31.53 28.52 145.87 971.67 12.1 carbon-steel base price in mid-2003

Zirconium 10 1852.97 23.0 31.53 28.52 238.46 2151.49 26.7 dollars is $12.83/m, the value shown

15-cm nominal dia. — pressures up to 10 barg in the third row of Table 1.

Polyvinylchloride (PVC) 80 65.26 0.5 10.46 32.17 49.01 156.90 1.3

To update data in this article to a

Chlorinated polyvinyl- 80 127.78 1.0 10.46 32.17 54.07 224.49 1.8

chloride (CPVC)

1. Ranges of suitable temperatures vary widely,

Carbon Steel 40 124.18 1.0 39.57 32.51 95.16 291.42 2.3 depending on type of pipe. Some conventional

Stainless 304L 10 262.43 2.1 39.47 32.51 104.02 438.42 3.5 plastic pipe is limited to 65°C (service tem-

Stainless 316L 10 313.44 2.5 39.47 32.51 108.67 494.08 4.0 peratures for specific polymers can be found in

Dennis [2] or in Perry [3], Tables 10-15, 10-16,

Lined carbon steel 40 10-17, and 28-22). Copper and aluminum tubing

• Rubber 137.44 1.1 58.20 39.34 73.46 308.45 2.5 are not normally recommended above 150°C.

• Conventional plastic 635.69 5.1 64.64 39.34 114.40 854.07 6.9 Carbon steel is suitable to 500°C if protected

from oxidation. Stainless steels and nickel al-

• Fluorocarbon 919.33 7.4 58.20 39.34 132.25 1149.12 9.3 loys serve up to 600°C under favorable circum-

• Glass 785.32 6.3 73.35 39.34 135.41 1033.42 8.3 stances. Limits for titanium and glass-lined

Fiberglass-reinforced 506.23 4.1 58.20 39.34 101.66 705.43 5.7 pipe are 315°C and 232°C respectively (Perry

plastic (FRP) [3], pages 10-96 and 10-99).

Alloy 20 10 1171.58 9.4 39.62 32.59 173.04 1416.83 11.4 2. Some of those preparation steps could be con-

sidered installation expenses rather than part

Monel 10 1610.63 13.0 39.53 32.51 216.73 1899.40 15.3 of base pipe cost. We included them in the base

Hastelloy C-276 10 1685.59 13.6 39.87 32.73 227.37 1985.57 16.0 cost to place all pipe on the same footing, because

Titanium 10 1368.80 11.0 40.21 32.96 209.80 1651.76 13.3 some types come from the factory as thimbles

already prepared for the field with no need for

Zirconium 10 2714.46 21.9 40.21 32.96 317.23 3104.85 25.0 cleaning, painting, or welding.

CHEMICAL ENGINEERING WWW.CHE.COM MARCH 2006 45

Feature Report

year after 2003, multiply your result

TABLE 3. MATERIAL FACTORS FOR SELECTED CONSTRUCTION

by the overall CE PCI for the more

MATERIALS AND COMPONENTSe

recent time period and then divide by

Material Pipec Metal Process vessels, Pumpsa Heat exchang-

400 (the value for mid 2003). For ex- plated etc. a,b ers a,b

ample, per the final Dec. 2005 index Carbon steel 1.0 1.0 1.0 1.0 1.0

(the most up to date CE PCI as of this Aluminum 1.5

issue, p. 84) the ratio is approximately Copper/Brass 1.8 1.4

476/400 or 1.19. Rubber-lined steel 1.6 1.3 1.4

Meanwhile, installation includes Stainless, 304 1.7 1.7 2.8 1.7

Stainless, 316 2.0 2.0 2.9 1.8

transport to the site, pipe rack con-

Alloy 20 8.6 5 6.1 5.2

struction, pipe assembly, equipment Titanium 9.8 13-35 10.7 8.7

rental, labor and contractor fees. The Monel 12 20 9.0 3.3 7.3

sum of updated costs for these activities Hastelloy C-276 15 15 12.5 10.1

reported by Lindley and Floyd yields Zirconium 26 11 8.7

an installed bare-module value equal a. Holland and Wilkinson (Perry [3], page 9-74)

to $51.40/m for 5-cm dia., Schedule 40, b. Yau and Bird [6]

c. This study, average of all data in Tables 1 and 2

carbon steel pipe. Installed cost divided

d. McMaster-Carr [7] catalogue

by the base price ($51.40/m ÷ $12.80/ e. Because of labor, installation factors are not the same as material factors. The material factor for

m) yields a bare module (installation) titanium, for example, is about 10 times that of carbon steel. The ratio of installed costs, on the other

hand, is usually between 3 and 5 because much of the expense involves labor, which is basically the

factor FBM·cs of 4.0.3 Installation fac- same for both materials. Because of ambiguity in some data sources, some numbers in this list may

tors for 14 other types of piping were be ratios of installed costs rather than ratios of purchase prices (the definition of FM in this article)

computed via the same procedure and

are listed in Table 1. (Values quoted costs four times as much as the average ter (Figure 1).6 There are two lines: one

above for carbon steel can be found in fitting. Results are contained in Table for straight runs, the other for complex

the carbon steel row of the 5-cm-pipe 2. By way of explanation, consider each piping networks. This requires only six

sub-table.) Material factors, FBM·a column of that table briefly: data points from Tables 1 and 2; for

(where subscript “a” denotes material • Base costs, valves included, are straight-run and complex carbon-steel

of construction), are equal to the base listed in column three4 piping in three diameters.

cost, CP·a (again, where subscript “a” • FM·a material factors (ratios of CP·a

denotes material of construction), for to CP·cs), are listed in column four Different materials of

each type of piping divided by CP·cs, the • Pipe rack costs (unaffected by the construction and installation

base cost of carbon steel pipe having presence of valves) were drawn di- Two simple curves for carbon steel

the same diameter. rectly from Lindley and Floyd5 pipe in Figure 1 serve as the launch-

• Columns six and seven, Field installa- ing point from which installed costs

Complex piping systems tion, and Equipment engineering and of many types and sizes of pipes will

Complex piping systems were ana- contractor fees, were revised by as- be estimated. To obtain an installed

lyzed by an approach similar to that suming that reported differences be- price for any type of pipe, one simply

used for straight pipe runs. Lindley tween complex and straight-run pipe multiplies the appropriate value from

and Floyd assumed a layout averag- were due to fittings. These differences Figure 1 by the installation factor for

ing one fitting (elbow or tee) every 3 were increased by 40% to account for that material. For example, the in-

m and one valve every 7.5 m. They did valves and added back to original stallation factor from Table 2 aver-

not include purchase and installation straight-run prices for each pipe size ages about 3.5 for Type 304 stainless-

of valves in their tally, however, be- and type steel pipe in complex networks. This

cause they felt that valve prices vary • After these adjustments, total bare yields a mid-2003 cost for 8-cm dia.

too widely to be included in data in- module price CBM·a is simply the 304-stainless-steel piping associated

tended for definitive estimates. sum of the costs. Installation factors with process equipment of $240/m

Valves can be included in a pre- FBM·a were derived as the quotient (CP·cs of $68/m from Figure 1 for 8-cm

liminary estimate like the one in this of CBM·a and the base cost of carbon pipe in a complex network, multiplied

article, where limits of precision are steel CP·cs by 3.5). For a straight run, where the

broader. Bare module costs for complex In the preparation of a cost chart, CP·cs installation factor (Table 1) is 4.0,

pipe systems, valves included, were de- is plotted versus nominal pipe diame- the mid-2003 price in 304 stainless

termined by using Lindley and Floyd’s is $84/m (CP·cs of $21/m from Fig-

assumption of 2.5 fittings for every 4. Costs of pipe, flanges, and routine fittings were ure 1 for 8-cm dia., straight-run pipe

listed by Lindley and Floyd. To estimate the added

valve and our estimate that a valve effect of valves, prices for fittings were multiplied times 4.0). To predict costs for the

by 1.6 (0.4 valves per fitting at four times the same piping in a project planned for

price). Sandblasting and painting charges were

3. Based on Guthrie’s capital-cost estimation tech- not changed. Shop fabrication expenses were in- the future, one would multiply these

nique [4, 5], where installed cost of equipment in creased by 40% to allow for valves. These were

a bare process module is equal to purchase cost summed to give Base Cost, valves included.

multiplied by bare module factor. Subscript “cs” 6. The chart employs log-log coordinates, since

denotes material of construction (carbon steel in 5. Adjusted to mid 2003 prices and normalized capital costs usually follow the six-tenths rule,

this case). per meter of pipe length. producing a straight line when plotted.

46 CHEMICAL ENGINEERING WWW.CHE.COM MARCH 2006

EXAMPLE– PIPELINE COST ESTIMATE

O

wners of a steam boiler are considering a plant expansion. pipe is calculated to be 4.9 from Equation (3). Thus, the mid-

No change is planned for the boiler module itself, but its 2003 bare-module cost of uninsulated pipe is 4.9 $11.50/m

fuel-oil storage tanks are to be relocated. This will require a = $56/m.

new fuel-feed pipeline, 65 m in length. Construction is expected to The pipe must be traced to maintain its temperature at 95°C.

occur in 2006. Estimate the cost of running the new line. From Equation (5), the optimum insulation thickness is found to

An operator pumps fuel from storage to the feed drum once every be 2.6 cm. With this value for topt and 4.8 cm for Dact, we find

shift for a period of 15 minutes, requiring a flow of 3.9 liter/s. an additional cost of $22/m for insulation. Thus, the total bare

Perry [3], page 6-14, suggests an optimum flow velocity in the module cost in 2003 dollars is $78/m or $5,100 for a 65-m

range of 1.8–2.4 m/s for this situation. Nominal-3.8-cm standard run. Based on a projected CE Plant Cost Index of 485, the 2006

pipe will suffice (1-1/2 in., Schedule 40, 4.1-cm actual inside di- predicted price is $5,100 485/400 = $6,200.

ameter, 4.8 cm OD).a, b Past experience with the old line suggests that we might save

A corrosion checkc confirms common experience that almost any in maintenance dollars and aggravation if we make the line of

of the metals covered by the short-cut chart (p. 48) will contain Schedule 10, Type 304 stainless steel. In this case, FM is 1.5,

the fuel without corroding. Carbon steel, the current metal, has leading to a value of 5.5 for FBM. Uninsulated pipe cost is 5.5

served for many years, and maintenance people tell us that sur- $11.50/m = $63/m. With insulation at $22/m, the bare module

face conditions inside the pipe are like new. Otherwise, weather cost is $85/m or $5,525 in 2003 dollars; $6,700 in 2006. The

exposure on the outside has required periodic repainting and difference is slight enough to seriously consider stainless steel.

other maintenance. A more experienced engineer notes that even though Sched-

According to the short-cut chart (p. 48), the base cost CP·cs for ule-10 or light-wall pipe is adequate for the pressure and expo-

nominal 3.8 cm pipe (straight run) is $11.50/m. For carbon steel sure, it may not tolerate abused. A heavier wall stock would be

with material and pressure factors of unity, FBM•cs for straight-run safer. She suggests using 304 stainless steel, Schedule-40 pipe.

Since this is the wall thickness in alloy piping denoted for high

a. At 2.4 m/s, the calculated diameter is 4.5 cm. Optimum pipe diame- pressure service, we can estimate its price by using a pressure

ters/flow velocities from Perry [3] assume continuous pumping of fluid. A

rigorous analysis of batch transfers like this one will push the optimum factor of 1.6 in the equation for FBM. Doing so, we find FBM

to a slightly smaller diameter and a higher velocity for Schedule 40, 304-stainless-steel pipe is 6.5. Its 2006 bare

b. We must, of course, choose a diameter that is commercially available. module price is $7,600 for the 65 m line. ❒

Standard U.S. nominal pipe sizes are denoted by ticks on the horizontal

axis of the short-cut chart, p. 48.

d. A large fraction of industrial safety/pollution incidents is caused by

c. See, for example, Table 4-1a, Ulrich and Vasudevan [8] vehicles puncturing outdoor pipelines and storage tanks

results by the ratio of the future CE Table 3 lists material factors for vari- where FM values are those listed in

PCI to 400. In mid 2007, for instance, ous piping materials alongside values Columns 4 of Tables 1 and 2, and

current trends suggest a CE PCI of that have been published throughout Fp = 1.0 for pressures less than 10 barg

500. Thus, mid-2007 prices would be literature for other types of equip- Fp = 1.6 for 10 to 40 barg pressure

25% greater than those cited in this ment. Values for alloy plate, pumps,

example. heat exchangers, process vessels, and Insulation costs

To make things easier for spread- so on, are included. With the information assembled thus

sheet formulation, we gain generality far, one can quickly estimate installed

and consistency with a minor loss of High pressure service prices for simple and complex net-

precision by using equations to calcu- By an analysis similar to that just works from Figure 1 for fifteen differ-

late installation factors. For straight- described, pressure factors can be de- ent types of pipe between 5 and 15-cm

runs, Equation (1) yields factors for all rived to predict bare module prices of nominal dia. at pressures up to 40

three diameters that, on average, fall heavier pipe. Lindley and Floyd in- barg. The approach is even more use-

within ±5% of those listed in Table 17 cluded data for seven piping materials ful if it is extended to include the cost

FBM⋅a = 11.6 D −0.84 + 1.13 FM ⋅a rated for up to 40 barg pressure. These of insulation, which is necessary in

(1) higher pressure piping costs can be most chemical process applications.

The following equation does almost as predicted via Figure 1 if equations for Finding the optimum thickness of

well for complex networks in Table 2 FBM are revised by replacing FM in pipe insulation is discussed in Chap-

each case with the product FM·Fp. ter 7 of Ulrich and Vasudevan [8].

FBM⋅a = 2.0 − 0.024 D − 0.001D2 + 1.22 FM⋅a

Straight-run piping systems: Based on that analysis using 2003

−0.011D ⋅ FM⋅a − 0.015 D ⋅ ( FM⋅a )

−2

(2) energy prices, one finds the optimum

FBM⋅a = 11.6 D –0.84 + 1.13 FM ⋅a ⋅ Fp

With these equations, a list of mate- (3) insulation thickness to be10

rial factors, and two cost curves, one Complex piping networks: 0.20

topt = 0.85 Dnom ⋅ ∆T 0.65

can estimate bare module prices for 2

(5)

FBM⋅a = 2.0 – 0.024 D − 0.001D + 1.22 FM⋅a ⋅ Fp

straight-run and complex piping sys- where

( )

−2

tems in 15 materials and all diameters −0.011D ⋅ FM⋅a ⋅ Fp − 0.015 D FM⋅a ⋅ Fp topt = optimum insulation thickness,

between 5 and 15 cm.8, 9 For context, (4) cm

Dnom = bare pipe nominal diameter,

7. Two thirds of the calculations fall within plus eter. The act of smoothing data with a general cm

or minus 5%. None differs by more than 20% correlation like the one we are building might ∆T = the difference between pipe tem-

from original data. actually improve their reliability.

8. For a few materials in Tables 1 and 2, FM·a

perature and ambient, °C

9. Pipe made from premium metals, because of

varies erratically from one pipe size to another. greater strength and smaller corrosion allow- With thickness known, the 2003 cost

This stems from the data source where Hastel- ance, can be lighter than carbon steel. Thin-wall

loy C-276, for example, is reported to cost 70% (schedule 10) stainless steel and alloy piping 10. Steam-traced pipe based on energy costs of

more than Monel in 10-cm pipe but 15% less in serves at pressures up to 10 barg, for example, $3.80/GJ. For other energy prices, electrical trac-

15-cm pipe. Except for a few discrepancies like in service where schedule 40 would be required ing, and different circumstances, see Ulrich and

this, relative prices in Lindley and Floyd’s tables if made from carbon steel. Schedule 40 alloy pipe Vasudevan [8], Chapter 7 or Perry [3], Tables 11-

change only slightly and consistently with diam- can often be used at pressures up to 40 barg. 21 and 11-22.

CHEMICAL ENGINEERING WWW.CHE.COM MARCH 2006 47

Feature Report

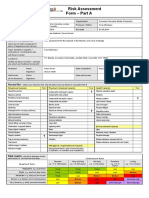

THE SHORT-CUT METHOD FOR PIPING COSTS

Using data from this chart (right) and the

�����������������������������

table (below), these equations can be used to ��������������������������������

quickly estimate costs for 15 different piping �����������������������������������

materials of 5–15-cm dia. at pressures up to ���

40 barg.

�������������

�������������� �������

�������

CBM = FBM ⋅ CP⋅cs + CBM⋅Ins

(

CBM⋅Ins = 1.13 ⋅ topt Dact + topt )

For straight-run piping systems:

������������

FBM⋅a = 11.6 D –0.84 + 1.13 FM ⋅a Fp ����������

���������

��������

For complex piping networks: �����

������

���� ���� �� ������ �� �� �� �� �� �� ��� ���

FBM⋅a = 2.0 – 0.024 D − 0.001D2 + 1.22 FM ⋅a ⋅ Fp ��

������ ������ ��� ���

( )

−2 � �� ���

−0.011D ⋅ FM ⋅a ⋅ Fp − 0.015 D FM ⋅a ⋅ Fp �����������������������������

MATERIAL FACTORS [FM]

Piping type Straight-run Complex Piping type Straight-run Complex

Polyvinyl chloride (PVC) 0.4 0.5 Fiberglass-reinforced plastic (FRP) 4.0 3.8

Chlorinated polyvinyl chloride (CPVC) 0.9 0.8 Alloy 20 8.8 8.5

Carbon steel 1.0 1.0 Titanium 10.2 9.4

Type 304 stainless steel 1.5 1.8 Monel 15.0 9.3

Type 316 stainless steel 1.9 2.1 Hastelloy C-276 18.2 12.0

Carbon-steel pipe lined with: Zirconium 32.4 20.4

-rubber 1.9 1.4

PRESSURE FACTORS Fp

-conventional plastic (cp) 5.0 4.7

-fluorocarbon plastic (fp) 9.2 7.3 Less than 10 barg 1.0

-glass 9.0 6.2 10 to 40 barg 1.6

of purchasing and installing insula- trapolated with confidence outside the p⋅ D (8)

t=

tion can be calculated from 5–15 cm range.) 2(0.9 S − 0.6 p)

First, one would expect the cost of With typical design-stress values S

(

CBM⋅Ins = 1.13 ⋅ topt Dact + topt ) pipe to be proportional to mass — a falling in the range of 1,000 bara and

(6) variation on π·D·t·L. Accordingly, for at pipe internal pressures of 40 barg

where Dact is actual bare-pipe outside pipes of different diameter made from or less, the second term in the denom-

diameter, cm the same material, their base cost inator’s parenthetical expression can

ratio would be be disregarded. Thus, wall thickness

The cost chart CP 1⋅a D1 ⋅ t1 is directly proportional to pressure

Finally, we have the information to = and diameter. For pipes of the same

CP 2⋅a D2 ⋅ t2

prepare a refined, comprehensive cost (7) material designed to handle the same

chart. In composing it, let us consider The relevant design expression that pressure, thickness ratio is, therefore,

basic capital cost concepts and revisit relates wall thickness to material equal to diameter ratio.

the lines in Figure 1. (With creative strength, pressure, and diameter is11: t1 D1 (9)

=

insight, these curves might be ex- 11. See Ulrich and Vasudevan [8], p. 95. t2 D2

References 2. Dennis, G., Picking the Best Thermoplastic

Lining, Chem. Eng., pp. 122-124, October,

Beach, California, 1974.

6. Yau, T. and K.W. Bird, Know which Reactive

1. Lindley, N.L. and J.C. Floyd, Piping Systems: 1998. and Refractory Metals Work for You, Chem.

How Installation Costs Stack Up, Chem. 3. Perry, J. H., D.W. Green, and J.O. Maloney, Eng. Prog., 88, pp. 65-69, February, 1992.

Eng., pp. 94-100, January, 1993. (This com- “Perry’s Chemical Engineers’ Handbook,”

prehensive study is more than 10 years old, 7. McMaster-Carr Catalogue 106, McMaster-

7th Ed., McGraw-Hill, New York, 1997. Carr Supply Company, New Brunswick, N.J.,

near the limit recommended for scaling with

inflation factors. No major technological or 4. Guthrie, K.M., Data and Techniques for Pre- 2000, www.mcmaster.com.

productivity changes have occurred with pip- liminary Capital Cost Estimation, Chem. 8. Ulrich, G.D. and P.T. Vasudevan, “Chemical

efitting in the interim, however, so escalated Eng., pp. 114-142, Mar. 24, 1969. Engineering Process Design and Economics,

numbers reported here are considered valid 5. Guthrie, K.M., “Process Plant Estimating, A Practical Guide,” 2nd Ed., Process Publish-

for today’s use.) Evaluation and Control,” Craftsman, Solano ing, 2004, ulrichvasudesign.com.

48 CHEMICAL ENGINEERING WWW.CHE.COM MARCH 2006

Authors

Gael D. Ulrich (34R Pren-

tiss St., Cambridge, MA

Substituting Equation (9) into Equa- at small diameter and two at large 02140-2241; Email: gael.

tion (7) suggests that piping cost should diameter. ulrich@comcast.net) is pro-

fessor emeritus of chemical

be proportional to diameter squared: A closer look at Figure 1 revels that engineering at the University

2

the data points are actually represented of New Hampshire, where he

joined the faculty in 1970. He

CP 1⋅a D1 ⋅ t1 D1 much more accurately by a curved line worked at Atomics Interna-

= =

CP 2⋅a D2 ⋅ t2 D2 (10) than a straight one. In the final short- tional Div. of North American

aviation and Cabot Corp. prior

cut cost chart (p. 48), curves for both to entering teaching. He holds

a B.S.Ch.E. and an M.S.Ch.E. from the University

According to Equation (10), cost plot- simple and complex piping systems of Utah and an Sc.D. from the Massachusetts In-

ted against diameter on a log-log chart are drawn to pass through the center stitute of Technology. For the past thirty years, he

has consulted for a number of corporations and

should have a slope of two. of each data point and asymptotically presided over a small contract research firm for

A quick check of Figure 1, however, approach the limiting slopes zero and ten. Material in this article was extracted from

Reference [8] published with coauthor P. T. Va-

reveals a slope much closer to one. two. This graph, along with relevant sudevan in 2004.

This deviation from theoretical is data and equations summarized next Palligarnai T. Vasudevan

is professor of chemical en-

caused by other factors included in to it, are all that is needed to prepare a gineering at the University

base cost. Some of these (shop labor, quick estimate of piping costs12. of New Hampshire (Chemi-

cal Engineering Department,

etc.), vary less with diameter than For an illustrative example of how to Kingsbury Hall, Rm W301, 33

do materials alone. As diameter in- use the chart and equations to estimate College Road, Durham, NH

03824; Phone: 603-862-2298;

creases, however, the labor compo- piping costs, see the box, p. 47. ■ Email: vasu@unh.edu) where

nent should diminish, causing the Edited by Rebekkah Marshall he joined the faculty in 1988.

He worked for a large petro-

slope to drift toward two. As diameter chemical company for seven

years prior to entering teaching. For the past 15

decreases, on the other hand, labor 12. Cost data derived from the short-cut chart are years, he has worked in the areas of catalysis and

will become dominant and the slope compared with the data used to create it on pp. biocatalysis. He is currently collaborating with

355 and 356 of Reference [8]. Standard deviations researchers in Spain in the areas of hydrode-

will approach zero. This suggests that average less than ±15% in most cases. The largest sulfurization and enzyme catalysis. Vasudevan

the two lines in Figure 1 should be variances match anomalies in data mentioned ear- holds a B.S.Ch.E. from Madras, India, a M.S.Ch.

lier. Most errors are overestimates by the correla- E. from SUNY at Buffalo and a Ph.D. in chemical

curved, with slopes approaching zero tion, especially for the smallest diameter pipe. engineering from Clarkson University.

PRESSURE RELIEF FOR

ALMOST ANY APPLICATION

O

ver pressure conditions threaten productivity at the most

inopportune time. Late at night, the weekend, a holiday.

Your process needs safety protection and emergency service.

At Continental Disc Corporation, our professionals

are trained and on-call for situations like

these. They’ll ask the right questions and

proceed into emergency production and

shipping. You’ll get the protection you

need in your time of need. Call it

24/7/365 Emergency Service.

Let us be your pressure-relief partner.

• Rupture Discs • Pressure/Vacuum Relief Valves

• Flame/Detonation Arresters • Pilot Operated Valves

3160 West Heartland Drive

• Blanket Gas Regulators

Liberty, MO 64068-3385

(816) 792-1500 Come see us at ACHEMA, Booth N48-N50

www.contdisc.com

email: pressure@contdisc.com CERTIFICATIONS:

Emergency Service • Design/Sizing Services • Inventory Management • Training Seminars

Circle 25 on p. 72 or go to adlinks.che.com/5827-25

CHEMICAL ENGINEERING WWW.CHE.COM MARCH 2006 49

Das könnte Ihnen auch gefallen

- Demag - Terex Roadmaster5300Dokument5 SeitenDemag - Terex Roadmaster5300Bharadwaj RangarajanNoch keine Bewertungen

- 5 PDFDokument1 Seite5 PDFBharadwaj RangarajanNoch keine Bewertungen

- Stoichiometry - Elemental AnalysisDokument4 SeitenStoichiometry - Elemental AnalysisBharadwaj RangarajanNoch keine Bewertungen

- Rapport - PDF: Rapport To PDF: DescriptionDokument2 SeitenRapport - PDF: Rapport To PDF: DescriptionBharadwaj RangarajanNoch keine Bewertungen

- High Voltage Cable Selection Guide: Discipline: Engineering (Electrical) Category: StandardDokument7 SeitenHigh Voltage Cable Selection Guide: Discipline: Engineering (Electrical) Category: StandardBharadwaj RangarajanNoch keine Bewertungen

- NS130 - Standard Trench Dimensions PDFDokument116 SeitenNS130 - Standard Trench Dimensions PDFBharadwaj RangarajanNoch keine Bewertungen

- Class-4 - Equipment ListDokument5 SeitenClass-4 - Equipment ListBharadwaj RangarajanNoch keine Bewertungen

- Pressure Vessel Design RulesDokument3 SeitenPressure Vessel Design RulesBharadwaj RangarajanNoch keine Bewertungen

- CE Evap Selection PDFDokument8 SeitenCE Evap Selection PDFBharadwaj RangarajanNoch keine Bewertungen

- Chemical Engineering August 2009Dokument64 SeitenChemical Engineering August 2009Bharadwaj RangarajanNoch keine Bewertungen

- Cost of Equipment 93851 - 20Dokument7 SeitenCost of Equipment 93851 - 20genergiaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Engineering Piping Design Guide Fiberglass Reinforced Piping SystemsDokument36 SeitenEngineering Piping Design Guide Fiberglass Reinforced Piping Systemsoscarhdef100% (1)

- Heat and Mass Transfer Study in The Spray Drying of Tomato JuiceDokument6 SeitenHeat and Mass Transfer Study in The Spray Drying of Tomato Juicefatemeh afariNoch keine Bewertungen

- Geography Sheet Work About HydrographsDokument1 SeiteGeography Sheet Work About HydrographsIsaac CharlesonNoch keine Bewertungen

- (Anderson Poul) Satan's World (B-Ok - Xyz) PDFDokument128 Seiten(Anderson Poul) Satan's World (B-Ok - Xyz) PDFFüleki Eszter100% (1)

- Crystal Structure Refinement and Hydration Behaviour of Doped Tricalcium AluminateDokument10 SeitenCrystal Structure Refinement and Hydration Behaviour of Doped Tricalcium AluminateJuliano. PQMNoch keine Bewertungen

- A Premium Institute For CBSE, NEET & JEEDokument33 SeitenA Premium Institute For CBSE, NEET & JEEZUHAIB KAMALNoch keine Bewertungen

- Bc20122lnh-1 Assay Sheet (For Bc-30 Vet Research Use Only)Dokument1 SeiteBc20122lnh-1 Assay Sheet (For Bc-30 Vet Research Use Only)Subodh SahuNoch keine Bewertungen

- Removal of Gaseous Chlorine From Cylinders and Ton ContainersDokument4 SeitenRemoval of Gaseous Chlorine From Cylinders and Ton Containersmailmaverick8167Noch keine Bewertungen

- OuchterlonyDokument4 SeitenOuchterlonyd_caasi100% (1)

- Introduction To Skin Effect Heat Tracing SystemDokument22 SeitenIntroduction To Skin Effect Heat Tracing Systemvivek bevaraNoch keine Bewertungen

- XXI Paper 044Dokument9 SeitenXXI Paper 044RICARDO3454Noch keine Bewertungen

- Weo Water Treatment and ReuseDokument4 SeitenWeo Water Treatment and ReuseWendyNoch keine Bewertungen

- Osmotic Fragility of Red Blood CellsDokument3 SeitenOsmotic Fragility of Red Blood Cellschaudhry umar farooqNoch keine Bewertungen

- 12 - Effect of Blanching On TextureDokument9 Seiten12 - Effect of Blanching On TexturevishalNoch keine Bewertungen

- JHJDokument1 SeiteJHJtrivina ira riszkiNoch keine Bewertungen

- Section A: Multiple Choice Questions (Compulsory)Dokument19 SeitenSection A: Multiple Choice Questions (Compulsory)ivyNoch keine Bewertungen

- Solar and Stellar Magnetic Activity - ISBN0521582865 PDFDokument402 SeitenSolar and Stellar Magnetic Activity - ISBN0521582865 PDFOmar Musalem100% (1)

- Vacuum Super Insulated Heat Storage Up To 400 °C: January 2015Dokument11 SeitenVacuum Super Insulated Heat Storage Up To 400 °C: January 2015Arvin SlayerNoch keine Bewertungen

- CHAPTER 2design Against Static LoadDokument33 SeitenCHAPTER 2design Against Static LoadmanishtopsecretsNoch keine Bewertungen

- 1 s2.0 S0001868613001140 Main PDFDokument11 Seiten1 s2.0 S0001868613001140 Main PDFBEN DUNCAN MALAGA ESPICHANNoch keine Bewertungen

- Techno-Economic Evaluation of Microalgae For Protein - Sari Et Al 2016Dokument9 SeitenTechno-Economic Evaluation of Microalgae For Protein - Sari Et Al 2016Laura Soto SierraNoch keine Bewertungen

- Standard Book Material - Thermodynamics - Arjuna JEE AIR 2024 (Physical Chemistry)Dokument5 SeitenStandard Book Material - Thermodynamics - Arjuna JEE AIR 2024 (Physical Chemistry)PULKIT ARORANoch keine Bewertungen

- Risk AssessmentDokument2 SeitenRisk AssessmentFaraiMbudaya0% (1)

- HPTLCDokument46 SeitenHPTLCVedha K Chalam100% (1)

- Influence of Acerola Pulp Concentration On Mead Production by Saccharomyces Cerevisiae AWRI 796Dokument8 SeitenInfluence of Acerola Pulp Concentration On Mead Production by Saccharomyces Cerevisiae AWRI 796mashelyNoch keine Bewertungen

- Herb-Modle Peptide in Anaerobic Titration and Reduce-05032013Dokument4 SeitenHerb-Modle Peptide in Anaerobic Titration and Reduce-05032013陳育孝Noch keine Bewertungen

- Octahedral Molecular GeometryDokument24 SeitenOctahedral Molecular GeometryAnonymous gUjimJKNoch keine Bewertungen

- 19 Heat of Combustion MGDokument5 Seiten19 Heat of Combustion MGmanuelscribdgonzalesNoch keine Bewertungen

- Examples 1Dokument17 SeitenExamples 1Nahom GebremariamNoch keine Bewertungen

- Flexural Design Procedure For Singly Reinforced Rectangular BeamsDokument3 SeitenFlexural Design Procedure For Singly Reinforced Rectangular BeamstvelasquezNoch keine Bewertungen