Beruflich Dokumente

Kultur Dokumente

23122018.pdf (Dragged)

Hochgeladen von

Anonymous J2Bf6PlOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

23122018.pdf (Dragged)

Hochgeladen von

Anonymous J2Bf6PlCopyright:

Verfügbare Formate

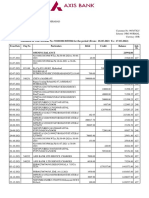

SBI Gold & More Card Monthly Statement

GSTIN of SBI Card : 06AAECS5981K1ZV Stmt/Debit Note/Credit Note/Tax Invoice (ORIGINAL FOR RECIPIENT)

SUHEL CHAUHAN Credit Card Number

XXXX XXXX XXXX XX39

Dear SBI Cardholder,

*Total Amount Due ( ` )

To get regular updates and

4,414.00 incl. EMI information on our latest offers,

PLACE OF SUPPLY : UP/9/UTTAR PRADESH

**Minimum Amount Due ( ` ) please ensure your mobile number

STMT No. : D18122747889 and email id is always updated in

4,414.00

Pay Now our records.

Credit Limit ( ` ) (including cash) Cash Limit ( ` )(as part of credit limit) Statement Date

92,000.00 27,600.00 23 Dec 2018

Available Credit Limit ( ` ) Available Cash Limit ( ` ) Payment Due Date

21,477.73 21,477.73 12 Jan 2019

ACCOUNT SUMMARY

Additions

Payments,

Previous Balance Reversals & other Fee, Taxes & Total Outstanding

Purchases & Other

(`) Credits ( ` ) Debits ( ` ) Interest Charges ( ` ) (`)

71,046.14 1,414.00 0.00 890.13 70,522.00

SHOP & SMILE SUMMARY

Cash Back

Earned Previous Redeemed Closing

Balance Earned /Expired Balance Points Expiry Details

0 90 points will get expired by

2443 0 0 2443 31 Jan 2019 if not redeemed

Date Transaction Details Amount ( ` )

for Statement dated 23 Dec 2018

11 Dec 18 NEFT 0000000000000000000N345180701002659 1,414.00 C

23 Dec 18 FP EMI 07/24(EXCL TAX 135.78) 4,278.76 M

23 Dec 18 INTEREST ON EMI 754.35 D

IGST DB @ 18.00% 135.78 D

Transactions highlighted in grey color, if any, do not form part of Purchases & Other Debits; #Transactions fully/partially converted to Flexipay/Encash/Merchant EMI .

C=Credit; D=Debit; EN=Encash; FP=Flexipay; EMD=Easy Money Draft; BT=Balance Transfer; M=Monthly Installments; TAD=Total Amount Due; T=Temporary Credit.

Important Messages

>W.E.F. 1 Sept '18, you need to have retail spends of Rs. 1,00,000 or more in the anniversary year (12 months from card fee date or renewal date) to get renewal fee reversal.

>Please note, cumulative 10X Reward Points accrued on Dining, Movies, Departmental Store & Grocery spends for your SimplySAVE SBI Card will have a maximum cap of 5,000 Reward Points per month.

Post the cap, standard Reward Points, as per the card policy, will continue to accrue on the aforementioned categories w.e.f 01 Aug'18.T&C.

>Please note 90 points will expire on 31 Jan 2019. Call our helpline to redeem your points.

>Dear SBI Cardholder, a fee of Rs. 100 will be charged for payments made by cheque for an amount less than or equal to Rs. 10,000. No additional fee will be charged for cheque payments more than

Rs. 10,000. Visit sbicard.com to make payments digitally. T&C

> W.E.F. 16 August'18 , the Late Payment Charges will be revised to : NIL for Total Amount Due between Rs.0- Rs.200; Rs.100 for Total Amount Due between Rs.200- Rs.500; Rs.400 for Total Amount Due between

Rs.500- Rs.1000; Rs.600 for Total Amount Due between Rs.1000- Rs.10,000; Rs.800 for Total Amount Due between Rs.10,000- Rs.25,000 & Rs.950 for Total Amount Due greater than Rs. 25,000

>You can now combine your credit card transactions of Rs.500 & above and pay back in Flexipay EMIs. Min. Booking Amt.Rs.- 2500.

*Total Amount Due (TAD) needs to be paid by payment due date to avoid levy of finance charges on new transactions done after the statement date. The difference, if any, between the Total Amount Due and the Total

Outstanding is the balance on the Flexipay/Encash/Installments as applicable.

** To keep your credit card in good standing, you have the option of paying atleast the minimum amount due on or before the due date. The Minimum Amount Due includes the EMI on Flexipay/Encash/Installment

amounts & 100% of all applicable taxes. Content of this statement will be considered correct if no error is reported within 20 days.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Please Read & Follow The Instructions Carefully Instructions Note Carefully The Units in Which The Choices Are Given and AskedDokument5 SeitenPlease Read & Follow The Instructions Carefully Instructions Note Carefully The Units in Which The Choices Are Given and AskedRohit Kumar PandeyNoch keine Bewertungen

- Services Quality Analysis in SBI BankDokument110 SeitenServices Quality Analysis in SBI Bankvinodksrini007100% (4)

- Lazy Portfolios: Core and SatelliteDokument2 SeitenLazy Portfolios: Core and Satellitesan291076Noch keine Bewertungen

- SWGI Growth Fund - 2009 Annual ReportDokument51 SeitenSWGI Growth Fund - 2009 Annual ReportThe Russia MonitorNoch keine Bewertungen

- Affordability Form 20224Dokument2 SeitenAffordability Form 20224devilinpajamaNoch keine Bewertungen

- Indian Financial SystemDokument38 SeitenIndian Financial SystemNikita DakiNoch keine Bewertungen

- Assignment QuestionDokument3 SeitenAssignment QuestionMohd Tajudin DiniNoch keine Bewertungen

- Bofa Approval LetterDokument3 SeitenBofa Approval LetterSteve Mun GroupNoch keine Bewertungen

- No Dues Certificate - 19 - 47 - 18Dokument2 SeitenNo Dues Certificate - 19 - 47 - 18chenchu kuppaswamyNoch keine Bewertungen

- BesavillaDokument1 SeiteBesavillaJohn Michael Parco50% (2)

- Himilo University: Direct QuestionsDokument2 SeitenHimilo University: Direct QuestionsSabina MaxamedNoch keine Bewertungen

- Your Ultimate Guide To Trading Binary Options Like A Pro!Dokument50 SeitenYour Ultimate Guide To Trading Binary Options Like A Pro!thamu100% (1)

- Statement Current yEAR KotakDokument19 SeitenStatement Current yEAR KotakRikshawala 420100% (1)

- Relief International® Admin/Finance Payment Voucher: Voucher No. Date Country/LocationDokument1 SeiteRelief International® Admin/Finance Payment Voucher: Voucher No. Date Country/LocationVassay KhaliliNoch keine Bewertungen

- Eco Book For May 2023Dokument185 SeitenEco Book For May 2023Kshitij PatilNoch keine Bewertungen

- Paper Specimen ASDokument14 SeitenPaper Specimen ASG.m. ShahNoch keine Bewertungen

- Engineering EconomicsDokument31 SeitenEngineering EconomicsWall_CNoch keine Bewertungen

- Home Office and Branch Accounting Special ProceduresDokument17 SeitenHome Office and Branch Accounting Special ProceduresOrnica BalesNoch keine Bewertungen

- Account STMTDokument4 SeitenAccount STMTsreehas sreehasNoch keine Bewertungen

- Real Estate InvestingDokument6 SeitenReal Estate Investingkrossi9183Noch keine Bewertungen

- LoansDokument17 SeitenLoansPia Samantha DasecoNoch keine Bewertungen

- ch#5 of CFDokument2 Seitench#5 of CFAzeem KhalidNoch keine Bewertungen

- Indian Foreign Exchange ReserveDokument10 SeitenIndian Foreign Exchange Reserveece_shreyasNoch keine Bewertungen

- British Council Online Refund Form.Dokument1 SeiteBritish Council Online Refund Form.Irene PinedaNoch keine Bewertungen

- Usefulness of Accounting Information To Investors and CreditorsDokument19 SeitenUsefulness of Accounting Information To Investors and Creditorsmuudey sheikhNoch keine Bewertungen

- Value A Guide To Managers and Investors, Who Is Regarded As Father of Share Holder Value, The FollowingDokument2 SeitenValue A Guide To Managers and Investors, Who Is Regarded As Father of Share Holder Value, The FollowingJubit Johnson100% (1)

- Electrosteel Castings Result UpdatedDokument8 SeitenElectrosteel Castings Result UpdatedAngel BrokingNoch keine Bewertungen

- Refund and Excess Payments (Credit Balances) Policy and Procedure PDFDokument8 SeitenRefund and Excess Payments (Credit Balances) Policy and Procedure PDFMinh DuongNoch keine Bewertungen

- Definition of Elements of Financial StatementsDokument1 SeiteDefinition of Elements of Financial StatementsKc B.Noch keine Bewertungen

- Indian BankDokument9 SeitenIndian BankPraneelaNoch keine Bewertungen