Beruflich Dokumente

Kultur Dokumente

Toa 333-1

Hochgeladen von

CPAOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Toa 333-1

Hochgeladen von

CPACopyright:

Verfügbare Formate

*,fllt

<"r,!'71,* K.*;-,, *,/-"0 4 A.-nr"'t^.-rf.' ?L"-r,l-"/ fr*-r**"

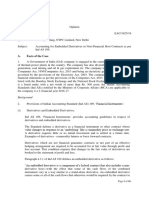

TA.333: INVESTMENTS - PNNI L Or 2

Sources: PAS 28IPAS 32/?AS 39/PFRS glApplicable AICPA/Various test banks

\ 1. Under PAS 39, it is pny contract that gives rise to a financial asset of one entity and a financial liability

A

I or equity instrument of another enl.ity.

O Financial instrument c. Hedging instrument

5. Neqotiable instrument d. Debt instrument

It 2. Under PAS 32, it is any contract that evidences

deducting all of its liabilities,

a resrdual interest in the assets of an entity after

'a. Debt instrument C, Hybrid instrument

p Equity instrument d. Compound instrurnent

{\ 3. Under PAS 39, available-for-sale investments are securities

\t' - . a. Considered as a derivative instrument

1 9 - @ Purchased with the intent of selling.in the near future or very soon to generate a profit

from short-term fluctuation in price or dealer's margin

c. Purchased and held indefinitely and will be available to be sold when the need for liquid

funds arises

r / r.- 1! ^ d. With fixed or determinable

ir,: payments and fixed maturity that an enterprise has the

positive intent and ability to hold to maturity

4. Under PFRS 9, which of tfie following ts ffOf a category of financia( assecsT

trf (

-Tt-

- a. Financial assets at fair value through other comprehensive income '

- b. Financial assets at fair value through profit or loss

1r'r 1i] - a. Financial assets at amortized cost

iA Financial assets held for sale

L_".,

t 5. The term 'financial assets at fair value through profit or loss'under PFRS 9 closely corresponds to PAS

.r-'

t 39',.s

19 Trading securities (TS) c.

Held-to-maturity securities (HTM)

b. Available-for sale securities (AFS) d.

Investment in subsidiaries and associates

.: -iomprehensive

6. The term 'financial assets at fair value through other income' under PFRS 9 closely

\, corresponds to PAS 39's

a. Trading securities (TS) c. Held-to-matu rity secu rities (HTM)

Available-for sale securities (AFS) d. Investment in subsidiaries and associates

.'1

O

7. Under PAS 39, equity securities may be classified as

a. TS only c. TS or AFS

b. AFS only @ TS, AFS or HTM

B Un.lfr PAS 39, debt securities may be classified as

\/ @ HTM only c. AFS or HTM

b. TS or HTM d. TS, AFS OT HTM

n 9. Under PAS 39, trading securities are classified as

+i 6l Current assets c. Current or noncurrent assets

V. Noncurrent assets d. Current or noncurrent liabilities

ii 10. Under PAS 39, which may be classif ied as NON-CURRENT at initial recognition?

\r,,

a. TS and AFS d nrS and HTM

b. TS and HTM d. TS, AFS and HTM

11. Und_er PAS 39, transaction costs incurred are expensed in acquiring this type of investment securities.

P @ TS only c. HTM only

b. AFS only d. TS and AFS

ii 12. Transaction costs directly attributable to the acqujeition of a financial asset DO NOT include

\: a. .Fees and commissions to agents LQ Financingtaxesand administrative costs

.b. Levies by regulatory agencies d. Transfer and duties

i.. 13. Subsequent to acquisition, these securities are generally reported at FAIR VALUE under PAS 39.

I b.i rs and AFS c. TS and HTM

b. AFS and HTM d. TS, AFS and HTM

|, 14. Investment in equity securitigs that DO NOT have a quoted market price in an active market and whose

I fair value CANNOJ be reliably estimated is measu;ed at

' a. Cost G, Lower of cost or net realizable value

b. Net realizable value d. Discounted value

Page 1 of3 pages

Das könnte Ihnen auch gefallen

- 13 Methods To Increase Your Conditioning - Strength by SkylerDokument5 Seiten13 Methods To Increase Your Conditioning - Strength by SkylerMarko Štambuk100% (1)

- The Mystique of The Dominant WomanDokument8 SeitenThe Mystique of The Dominant WomanDorothy HaydenNoch keine Bewertungen

- Afarq 2 Corporate LiquidationDokument4 SeitenAfarq 2 Corporate LiquidationCPANoch keine Bewertungen

- NASA Corrosion of SS TubingDokument14 SeitenNASA Corrosion of SS TubingClaudia Mms100% (1)

- Ben Graham Net Current Asset ValueDokument6 SeitenBen Graham Net Current Asset ValueOld School Value100% (3)

- FAR.2926 Financial Assets Summary DIY PDFDokument11 SeitenFAR.2926 Financial Assets Summary DIY PDFNah HamzaNoch keine Bewertungen

- How To Trade Derivatives And CFDs To Make MillionsVon EverandHow To Trade Derivatives And CFDs To Make MillionsNoch keine Bewertungen

- ACLS Post Test (Copy) 낱말 카드 - QuizletDokument18 SeitenACLS Post Test (Copy) 낱말 카드 - Quizlet김민길Noch keine Bewertungen

- Far2921investments in Debt Instruments PDF FreeDokument6 SeitenFar2921investments in Debt Instruments PDF FreeMarcus MonocayNoch keine Bewertungen

- Learning Advancement Cpa Review Center: Revenue From Contracts With CustomersDokument4 SeitenLearning Advancement Cpa Review Center: Revenue From Contracts With CustomersCPANoch keine Bewertungen

- 13 Impairment of Assets PDFDokument20 Seiten13 Impairment of Assets PDFsharielles /100% (1)

- Bonding and Adhesives in DentistryDokument39 SeitenBonding and Adhesives in DentistryZahn ÄrztinNoch keine Bewertungen

- தமிழ் உணவு வகைகள் (Tamil Cuisine) (Archive) - SkyscraperCityDokument37 Seitenதமிழ் உணவு வகைகள் (Tamil Cuisine) (Archive) - SkyscraperCityAsantony Raj0% (1)

- Financial Asset at Fair Value - 1S - SY1819 PDFDokument3 SeitenFinancial Asset at Fair Value - 1S - SY1819 PDFPea Del Monte AñanaNoch keine Bewertungen

- #16 Investment PropertyDokument4 Seiten#16 Investment PropertyClaudine DuhapaNoch keine Bewertungen

- FAFVPL-FAFVOCI IARev RLPDokument2 SeitenFAFVPL-FAFVOCI IARev RLPBrian Daniel BayotNoch keine Bewertungen

- JOHARI Window WorksheetDokument2 SeitenJOHARI Window WorksheetAnonymous j9lsM2RBaINoch keine Bewertungen

- ch12 Test Bank For Intermediate Accounting Ifrs Edition 3eDokument42 Seitench12 Test Bank For Intermediate Accounting Ifrs Edition 3eQuỳnh Châu100% (1)

- 1.3. Sales: Regulatory Framework For Business Transactions MadbolivarDokument9 Seiten1.3. Sales: Regulatory Framework For Business Transactions MadbolivarJims Leñar CezarNoch keine Bewertungen

- Intangible Assets Problems and Solutions2Dokument22 SeitenIntangible Assets Problems and Solutions2Destiny LazarteNoch keine Bewertungen

- FAR.2921 Investments in Debt InstrumentsDokument6 SeitenFAR.2921 Investments in Debt Instrumentsbrmo.amatorio.uiNoch keine Bewertungen

- FAR 4.3MC Investments in Debt Equity InstrumentsDokument4 SeitenFAR 4.3MC Investments in Debt Equity InstrumentsEunice FulgencioNoch keine Bewertungen

- Toaz Intermediate Accounting CompressDokument6 SeitenToaz Intermediate Accounting Compressjohnlloydcarrillo1Noch keine Bewertungen

- PAS 32 - Financial Instruments, PAS 39 - Financial Instruments, PFRS 7Dokument8 SeitenPAS 32 - Financial Instruments, PAS 39 - Financial Instruments, PFRS 7d.pagkatoytoyNoch keine Bewertungen

- Toa 334-1 PDFDokument1 SeiteToa 334-1 PDFCPANoch keine Bewertungen

- 中級会計 PERFECTDokument7 Seiten中級会計 PERFECTRodolfo ManalacNoch keine Bewertungen

- Discussion Problems: FAR.2925-Derivatives and Hedge Accounting OCTOBER 2020Dokument12 SeitenDiscussion Problems: FAR.2925-Derivatives and Hedge Accounting OCTOBER 2020Edmark LuspeNoch keine Bewertungen

- Impairment of Nonfinancial AssDokument6 SeitenImpairment of Nonfinancial AssMarjorie Joyce BarituaNoch keine Bewertungen

- Dysas Center For Cpa Review (Dccpar) : Financial AccountingDokument9 SeitenDysas Center For Cpa Review (Dccpar) : Financial AccountingFernando III PerezNoch keine Bewertungen

- Financial Accounting 3 ConceptsDokument8 SeitenFinancial Accounting 3 ConceptsWafah HadjisalicNoch keine Bewertungen

- Investment PropertyDokument4 SeitenInvestment PropertyLoi GachoNoch keine Bewertungen

- Pas 40Dokument5 SeitenPas 40Carmel Therese100% (1)

- AAFR by Sir Nasir Abbas - RemovedDokument559 SeitenAAFR by Sir Nasir Abbas - RemovedAbdul BalochNoch keine Bewertungen

- 7.30.22 Am Investments-In-Debt-InstrumentsDokument6 Seiten7.30.22 Am Investments-In-Debt-InstrumentsAether SkywardNoch keine Bewertungen

- AE 17 Lesson 02Dokument52 SeitenAE 17 Lesson 02JAJANoch keine Bewertungen

- Chapter 4: Investments 1. A Financial Instrument Is Any Contract That Gives Rise ToDokument2 SeitenChapter 4: Investments 1. A Financial Instrument Is Any Contract That Gives Rise ToRafael CaparasNoch keine Bewertungen

- Iact-1 Rev FinalsDokument50 SeitenIact-1 Rev FinalsmickaNoch keine Bewertungen

- Benjamin Graham S Net Current Asset Value Approach PDFDokument6 SeitenBenjamin Graham S Net Current Asset Value Approach PDFBimal MaheshNoch keine Bewertungen

- Seatwork - INTANGIBLE ASSETSDokument32 SeitenSeatwork - INTANGIBLE ASSETSGianJoshuaDayritNoch keine Bewertungen

- H 45Dokument1 SeiteH 45Spade XNoch keine Bewertungen

- Review 105 - Day 20 TOADokument7 SeitenReview 105 - Day 20 TOABriccioNoch keine Bewertungen

- MANSCI Final Exam QuestionnaireDokument10 SeitenMANSCI Final Exam QuestionnaireChristine NionesNoch keine Bewertungen

- TOA - InvestmentsDokument8 SeitenTOA - InvestmentsPrincessDiana Doloricon EscrupoloNoch keine Bewertungen

- Discussion Problems: FAR.2831-Leases MAY 2020Dokument13 SeitenDiscussion Problems: FAR.2831-Leases MAY 2020Eira ShaneNoch keine Bewertungen

- A. B. C. D.: Do Not Write Anything On The QuestionnaireDokument2 SeitenA. B. C. D.: Do Not Write Anything On The QuestionnairedaryllNoch keine Bewertungen

- Lecture07 - Accounting For Tangible Non-Current AssetsDokument47 SeitenLecture07 - Accounting For Tangible Non-Current AssetsAnnaNoch keine Bewertungen

- Review 105 - Day 9 Theory of AccountsDokument12 SeitenReview 105 - Day 9 Theory of AccountsKathleen PardoNoch keine Bewertungen

- CFAS Review QuestionsDokument3 SeitenCFAS Review QuestionsJay-B AngeloNoch keine Bewertungen

- Quiz No. 06: Financial InstrumentsDokument2 SeitenQuiz No. 06: Financial InstrumentsPHI NGUYEN HOANGNoch keine Bewertungen

- AcctgDokument14 SeitenAcctgLara Lewis AchillesNoch keine Bewertungen

- editedQUIZ CHAPTER-9 INVESTMENT-PROPERTYDokument3 SeiteneditedQUIZ CHAPTER-9 INVESTMENT-PROPERTYanna mariaNoch keine Bewertungen

- Far.2912 - Nca Hfs.Dokument4 SeitenFar.2912 - Nca Hfs.Edmark LuspeNoch keine Bewertungen

- Ifric 16 20Dokument2 SeitenIfric 16 20Edaño, Camille T.Noch keine Bewertungen

- Financial Accounting One - PART IIDokument43 SeitenFinancial Accounting One - PART IIDennis VelasquezNoch keine Bewertungen

- Bsa 12Dokument3 SeitenBsa 12Gray JavierNoch keine Bewertungen

- Ac1101 Final Exam QuestionnaireDokument11 SeitenAc1101 Final Exam QuestionnaireAngel ObligacionNoch keine Bewertungen

- Mfrs112 - Income TaxesDokument13 SeitenMfrs112 - Income TaxesMUHAMMAD ALIF AMMAR BIN ZAFRINoch keine Bewertungen

- Eac SMDokument16 SeitenEac SMAnupam KumarNoch keine Bewertungen

- ch12 - Problems and SolutionsDokument44 Seitench12 - Problems and SolutionsErica Borres0% (1)

- Intermediate Accounting 1 - 044932Dokument6 SeitenIntermediate Accounting 1 - 044932AMIEL TACULAONoch keine Bewertungen

- 13 Impairment of AssetsDokument21 Seiten13 Impairment of AssetsKylie Luigi Leynes BagonNoch keine Bewertungen

- Toa 334-2Dokument1 SeiteToa 334-2CPANoch keine Bewertungen

- Financial Instruments Ifrs 9Dokument29 SeitenFinancial Instruments Ifrs 9chalojunior16Noch keine Bewertungen

- I. Financial Assets - FVPLDokument2 SeitenI. Financial Assets - FVPLShane Aberie Villaroza AmidaNoch keine Bewertungen

- MydisclosureassDokument3 SeitenMydisclosureassAlthea AguadillaNoch keine Bewertungen

- t01 Partnerships ReviewerDokument6 Seitent01 Partnerships ReviewerPrincess Alyssa BarawidNoch keine Bewertungen

- Accounting Theories (Summary in Intermediate Accounting)Dokument9 SeitenAccounting Theories (Summary in Intermediate Accounting)Leira Ramos DepanteNoch keine Bewertungen

- Gen 009 P1 ReviewerDokument2 SeitenGen 009 P1 ReviewerShane QuintoNoch keine Bewertungen

- D9Dokument11 SeitenD9Saida MolinaNoch keine Bewertungen

- Cpar AuditingDokument10 SeitenCpar AuditingCPANoch keine Bewertungen

- MS 3412-8Dokument1 SeiteMS 3412-8CPANoch keine Bewertungen

- LeadDokument46 SeitenLeadCPANoch keine Bewertungen

- J "0 A. N,", o ,: UnitDokument1 SeiteJ "0 A. N,", o ,: UnitCPANoch keine Bewertungen

- Rurnover: '.::::"" ':'U ' O, .-Ffhsffihr"ODokument1 SeiteRurnover: '.::::"" ':'U ' O, .-Ffhsffihr"OCPANoch keine Bewertungen

- Financial: " " 1" 2. 3. 4. 5. RetiosDokument1 SeiteFinancial: " " 1" 2. 3. 4. 5. RetiosCPANoch keine Bewertungen

- MS 3412-2Dokument1 SeiteMS 3412-2CPANoch keine Bewertungen

- MS 3412-3Dokument1 SeiteMS 3412-3CPANoch keine Bewertungen

- Fif, T n'1t : Q, o D.".-,". R, , 5-Il, L"!,' 2qC! 2) I Ti 2) JTDokument1 SeiteFif, T n'1t : Q, o D.".-,". R, , 5-Il, L"!,' 2qC! 2) I Ti 2) JTCPANoch keine Bewertungen

- Toa 334-1 PDFDokument1 SeiteToa 334-1 PDFCPANoch keine Bewertungen

- Iht#I T:,Ffi, I:Trri ,:FFJLLLJ H:!:Iiiff: at ofDokument1 SeiteIht#I T:,Ffi, I:Trri ,:FFJLLLJ H:!:Iiiff: at ofCPANoch keine Bewertungen

- Toa 334-3Dokument1 SeiteToa 334-3CPANoch keine Bewertungen

- Toa 334-2Dokument1 SeiteToa 334-2CPANoch keine Bewertungen

- RFBT 34new-1Dokument1 SeiteRFBT 34new-1CPANoch keine Bewertungen

- Toa 333-2 PDFDokument1 SeiteToa 333-2 PDFCPANoch keine Bewertungen

- RFBT 34new-3Dokument1 SeiteRFBT 34new-3CPANoch keine Bewertungen

- Toa 333-3 PDFDokument1 SeiteToa 333-3 PDFCPANoch keine Bewertungen

- Regulatory Framework For Business Transactions Madbolivar: Quiz 2-ContractsDokument2 SeitenRegulatory Framework For Business Transactions Madbolivar: Quiz 2-ContractsCPANoch keine Bewertungen

- RFBT 34new-2Dokument1 SeiteRFBT 34new-2CPANoch keine Bewertungen

- C. D. A. B. C. It D.: Il', I:TjrDokument1 SeiteC. D. A. B. C. It D.: Il', I:TjrCPANoch keine Bewertungen

- Financial Accounting and Reporting MsvegaDokument2 SeitenFinancial Accounting and Reporting MsvegaCPANoch keine Bewertungen

- RFBT Handout 4Dokument5 SeitenRFBT Handout 4CPANoch keine Bewertungen

- RFBT Handout 4Dokument5 SeitenRFBT Handout 4CPANoch keine Bewertungen

- Toa 34B-1Dokument1 SeiteToa 34B-1CPANoch keine Bewertungen

- Toa 34B-2Dokument1 SeiteToa 34B-2CPANoch keine Bewertungen

- Handouts ConsolidationIntercompany Sale of Plant AssetsDokument3 SeitenHandouts ConsolidationIntercompany Sale of Plant AssetsCPANoch keine Bewertungen

- Park Agreement LetterDokument2 SeitenPark Agreement LetterKrishna LalNoch keine Bewertungen

- Keandalan Bangunan Rumah SusunDokument9 SeitenKeandalan Bangunan Rumah SusunDewi ARimbiNoch keine Bewertungen

- 3M Window Film PR SeriesDokument3 Seiten3M Window Film PR SeriesPhan CrisNoch keine Bewertungen

- 4 - Mixing Equipments Used in Flocculation and CoagulationDokument27 Seiten4 - Mixing Equipments Used in Flocculation and Coagulationhadeer osmanNoch keine Bewertungen

- Dysfunctional Uterine Bleeding (DUB)Dokument1 SeiteDysfunctional Uterine Bleeding (DUB)Bheru LalNoch keine Bewertungen

- Texas Steering and Insurance DirectionDokument2 SeitenTexas Steering and Insurance DirectionDonnie WeltyNoch keine Bewertungen

- Gambaran Professional Quality of Life Proqol GuruDokument7 SeitenGambaran Professional Quality of Life Proqol Gurufebrian rahmatNoch keine Bewertungen

- Seachem Laboratories, Inc. Safety Data SheetDokument10 SeitenSeachem Laboratories, Inc. Safety Data SheetJorge Restrepo HernandezNoch keine Bewertungen

- Learnership AgreementDokument10 SeitenLearnership Agreementkarl0% (1)

- Unsaturated HydrocarbonsDokument84 SeitenUnsaturated HydrocarbonsHey itsJamNoch keine Bewertungen

- MLT IMLT Content Guideline 6-14Dokument4 SeitenMLT IMLT Content Guideline 6-14Arif ShaikhNoch keine Bewertungen

- Labor EstimateDokument26 SeitenLabor EstimateAngelica CabreraNoch keine Bewertungen

- Hotel ClassificationDokument10 SeitenHotel ClassificationRonelyn Boholst100% (1)

- Legg Calve Perthes DiseaseDokument97 SeitenLegg Calve Perthes Diseasesivaram siddaNoch keine Bewertungen

- Expressions of QuantityDokument5 SeitenExpressions of Quantitybenilde bastidaNoch keine Bewertungen

- Bsbfia401 3Dokument2 SeitenBsbfia401 3nattyNoch keine Bewertungen

- Unit 18: Calculating Food Costs, Selling Prices and Making A ProfitDokument4 SeitenUnit 18: Calculating Food Costs, Selling Prices and Making A Profitkarupukamal100% (2)

- Unit 5.4 - Incapacity As A Ground For DismissalDokument15 SeitenUnit 5.4 - Incapacity As A Ground For DismissalDylan BanksNoch keine Bewertungen

- Assignment2 Ero, ZyraDokument3 SeitenAssignment2 Ero, Zyrams.cloudyNoch keine Bewertungen

- Contoh Reflection PaperDokument2 SeitenContoh Reflection PaperClaudia KandowangkoNoch keine Bewertungen

- Ceilcote 222HT Flakeline+ds+engDokument4 SeitenCeilcote 222HT Flakeline+ds+englivefreakNoch keine Bewertungen

- Sewage and Effluent Water Treatment Plant Services in PuneDokument11 SeitenSewage and Effluent Water Treatment Plant Services in PunedipakNoch keine Bewertungen

- This Study Resource WasDokument3 SeitenThis Study Resource WasNayre JunmarNoch keine Bewertungen