Beruflich Dokumente

Kultur Dokumente

Bajaj Octagonal Poles

Hochgeladen von

Goutam MandalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bajaj Octagonal Poles

Hochgeladen von

Goutam MandalCopyright:

Verfügbare Formate

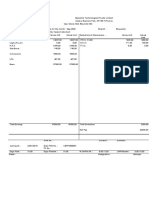

"THE WEST BENGAL VALUE ADDED TAX RULES, 2005

Form15e

Acknowledgement for electronic filing of return in Form 15

[see sub-rule (3) of rule 34AA]

Acknowledgement Date of

No

: 20150900784331 Submission

: 04-FEB-2016

Trade Name : M/S NORTH BENGAL ENTERPRISE

Return

TIN No : 19834324097 : 201509

Period

Charge Name : JALPAIGURI Group Code : 04

Abstract of return as per data transmitted electronically

Particulars Turnover / Amount Tax

Turnover of purchase not from registered dealers and

tax payable u/s 12

0.00 0.00

Aggregate of sale price (excluding VAT) 0.00

Turnover of sales 0.00

Tax payable on sale:–

i) u/s 16(3A) @ 4% 0.00 0.00

ii)u/s 16(3B) @ 2% 0.00 0.00

iii)u/s 16(6) @ 4% 0.00 0.00

iv)Tax payable at any other rate, if applicable 0.00 0.00

Contractual transfer price and tax payable u/s 18(4) 0.00 0.00

Particulars 1st Month 2nd Month 3rd Month

Output Tax Payable 0.00 0.00 0.00

Interest Payable 0.00 0.00 0.00

Late fee payable 600.00

Tax deducted at source u/s 40, if any 0.00 0.00 0.00

Tax paid in excess earlier now adjusted 0.00 0.00 0.00

Total amount of tax, interest or late fee paid by

challans:-

0.00 0.00 600.00

Short payment made, if any :-

Tax 0.00 0.00 0.00

Interest 0.00 0.00 0.00

Late fee 0.00

Signature of dealer :

Status :

Print Logout

You may generate and print the Return Filing Certificate from

Dealer's Profile(Download Return Filing Certificate)

Das könnte Ihnen auch gefallen

- Payslip 147988 202311-10Dokument1 SeitePayslip 147988 202311-10SUNKARA ISNoch keine Bewertungen

- Payslip 59904 202401Dokument1 SeitePayslip 59904 202401Sk Imran IslamNoch keine Bewertungen

- Letters p1 Individual and Company Nil Estimate 3Dokument3 SeitenLetters p1 Individual and Company Nil Estimate 3Mark SilbermanNoch keine Bewertungen

- Payslip 147988 202312-27Dokument1 SeitePayslip 147988 202312-27SUNKARA ISNoch keine Bewertungen

- 4 MergedDokument12 Seiten4 MergedPonugoti Pavan kumarNoch keine Bewertungen

- Feb PayslipDokument1 SeiteFeb Payslipnegishilpa051Noch keine Bewertungen

- Tax Return (2019-20) MR - AsadDokument3 SeitenTax Return (2019-20) MR - AsadIkramNoch keine Bewertungen

- POWIBA NOTICE CORPORATE TAX AssessmentDokument2 SeitenPOWIBA NOTICE CORPORATE TAX AssessmentHassan OmaryNoch keine Bewertungen

- Manthan Aug NewDokument1 SeiteManthan Aug NewManthan ShahNoch keine Bewertungen

- Jul 2023Dokument1 SeiteJul 2023Praveen SainiNoch keine Bewertungen

- BLT FINAL Assignment (Feb - June 2020) FINALDokument16 SeitenBLT FINAL Assignment (Feb - June 2020) FINALSalman SajidNoch keine Bewertungen

- Ajaib Sultana ITR 2019Dokument4 SeitenAjaib Sultana ITR 2019Chaudhury Ahmed HabibNoch keine Bewertungen

- Salary Slip NovDokument1 SeiteSalary Slip NovRahul RajawatNoch keine Bewertungen

- Luminous Power Technologies Private Limited: Earnings DeductionsDokument1 SeiteLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNoch keine Bewertungen

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Dokument3 SeitenComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNoch keine Bewertungen

- Coi 23-24 Lalu YadavDokument2 SeitenCoi 23-24 Lalu Yadavtejpalsinghyadav786Noch keine Bewertungen

- Salary Slip OctDokument1 SeiteSalary Slip OctRahul RajawatNoch keine Bewertungen

- Payslip - May - 2020 PDFDokument1 SeitePayslip - May - 2020 PDFchanduNoch keine Bewertungen

- Form - I (A) : Department of Commercial Taxes, Government of Uttar PradeshDokument4 SeitenForm - I (A) : Department of Commercial Taxes, Government of Uttar PradeshPrakhar JainNoch keine Bewertungen

- Detailed - Computation AOKPV2391B 2004634 New Regime 20240411191153Dokument8 SeitenDetailed - Computation AOKPV2391B 2004634 New Regime 20240411191153vermaparas576Noch keine Bewertungen

- Preliminary Assessment NoticeDokument3 SeitenPreliminary Assessment NoticeHanabishi RekkaNoch keine Bewertungen

- C001 SP RMC3720 202106Dokument1 SeiteC001 SP RMC3720 202106suprakash samantaNoch keine Bewertungen

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDokument2 SeitenDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNoch keine Bewertungen

- Jan SlipDokument1 SeiteJan Slipherlyn8762Noch keine Bewertungen

- 1033553563Dokument1 Seite1033553563Virendra Nalawde100% (1)

- Up Vat Challan FormatDokument8 SeitenUp Vat Challan FormatVirender SainiNoch keine Bewertungen

- April Payment SleepDokument1 SeiteApril Payment Sleepizajahamed1Noch keine Bewertungen

- Kashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirDokument4 SeitenKashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirKhalil ShakirNoch keine Bewertungen

- Shahzad Haider: Declaration Acknowledgement SlipDokument2 SeitenShahzad Haider: Declaration Acknowledgement SlipShehzad HaiderNoch keine Bewertungen

- DfsDokument98 SeitenDfsŞtefan AlinNoch keine Bewertungen

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDokument3 SeitenCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNoch keine Bewertungen

- Salary PDFDokument2 SeitenSalary PDFAjay KharwarNoch keine Bewertungen

- Earning Rate Amount (RS.) Deductions Amount (RS.)Dokument2 SeitenEarning Rate Amount (RS.) Deductions Amount (RS.)Ajay KharwarNoch keine Bewertungen

- Earnings Deductions: Eicher Motors LimitedDokument1 SeiteEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNoch keine Bewertungen

- Employee DataDokument1 SeiteEmployee DataSubhankar DasNoch keine Bewertungen

- Rajesh Bora Itr PLBS 2022Dokument5 SeitenRajesh Bora Itr PLBS 2022ABDUL KHALIKNoch keine Bewertungen

- OE0036Dokument1 SeiteOE0036kumud kalaNoch keine Bewertungen

- Payslip Aug2021Dokument1 SeitePayslip Aug2021Umesh BabuNoch keine Bewertungen

- Submitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxDokument4 SeitenSubmitted Status:: Sales Tax Credit Gross Value Taxable Value Sales TaxaizazbarkiNoch keine Bewertungen

- Kirandeep August SalaryDokument1 SeiteKirandeep August Salaryprince.gill07Noch keine Bewertungen

- Cir V ST Lukes GR 203514Dokument10 SeitenCir V ST Lukes GR 203514Jane CuizonNoch keine Bewertungen

- Invoice: Please DO NOT PAY. You Will Be Charged The Amount Due Through Your Selected Method of PaymentDokument2 SeitenInvoice: Please DO NOT PAY. You Will Be Charged The Amount Due Through Your Selected Method of PaymentHareesh Pallathoor BalakrishnanNoch keine Bewertungen

- EFPS Home - EFiling and Payment SystemDokument1 SeiteEFPS Home - EFiling and Payment SystemIra MejiaNoch keine Bewertungen

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Dokument1 SeiteSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONoch keine Bewertungen

- Dobbala Raghu Nandan: Account StatementDokument10 SeitenDobbala Raghu Nandan: Account Statementraghu INoch keine Bewertungen

- 2010 Draft Budget BP Rev 10-09Dokument1 Seite2010 Draft Budget BP Rev 10-09J.MeansNoch keine Bewertungen

- ReceiptDokument1 SeiteReceiptNdavi KiangiNoch keine Bewertungen

- Tasleem MayDokument2 SeitenTasleem MayManthan ShahNoch keine Bewertungen

- Jan PayslipDokument1 SeiteJan Payslipnegishilpa051Noch keine Bewertungen

- IRPF 2022 2021 Origi Imagem Declaracao07Dokument1 SeiteIRPF 2022 2021 Origi Imagem Declaracao07BVC RoleplayNoch keine Bewertungen

- Cir V SMLCDokument18 SeitenCir V SMLCTracey FraganteNoch keine Bewertungen

- Vahan - Parivahan.gov - in Vahanservice Vahan Ui Eapplication formOldVehReceiptReport - XHTMLDokument1 SeiteVahan - Parivahan.gov - in Vahanservice Vahan Ui Eapplication formOldVehReceiptReport - XHTMLMR PERFECTNoch keine Bewertungen

- EMP23 Tax Sheet Report202311152219Dokument2 SeitenEMP23 Tax Sheet Report202311152219SoumyaranjanNoch keine Bewertungen

- Receipt PDFDokument1 SeiteReceipt PDFromeo mugoyaNoch keine Bewertungen

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDokument15 SeitenPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNoch keine Bewertungen

- Declaration 3630294043517Dokument3 SeitenDeclaration 3630294043517MuhammadWaqarNoch keine Bewertungen

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDokument1 SeiteE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsIan OmwambaNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Tendernotice 1Dokument122 SeitenTendernotice 1Goutam MandalNoch keine Bewertungen

- 2019 MIDAS Civil Price ListDokument1 Seite2019 MIDAS Civil Price ListGoutam MandalNoch keine Bewertungen

- The Commr. & Director of Industries, U.P. Store Purchase Section - 7 (E), KanpurDokument19 SeitenThe Commr. & Director of Industries, U.P. Store Purchase Section - 7 (E), KanpurGoutam MandalNoch keine Bewertungen

- Professional LED Lighting Products Price List 2015 PDFDokument25 SeitenProfessional LED Lighting Products Price List 2015 PDFGoutam Mandal100% (1)

- Sintex Watertanks Tecnical Details3 PDFDokument2 SeitenSintex Watertanks Tecnical Details3 PDFGoutam Mandal0% (1)

- 498 Plate Girder CombinedDokument1 Seite498 Plate Girder CombinedapooladiNoch keine Bewertungen

- PWD Schedule-Schedule of Rates of PWD (W.B) 2015 For Road Bridge Work (Vol-III) Wef 01 .12 .2015Dokument351 SeitenPWD Schedule-Schedule of Rates of PWD (W.B) 2015 For Road Bridge Work (Vol-III) Wef 01 .12 .2015Goutam Mandal84% (25)

- Air ConditioningDokument87 SeitenAir ConditioningAshraf Adel Nashed ZakiNoch keine Bewertungen

- Irc Gov in SP 102 2014 PDFDokument80 SeitenIrc Gov in SP 102 2014 PDFPari Athouba100% (4)

- SIEMENS Price List2009Dokument60 SeitenSIEMENS Price List2009Goutam MandalNoch keine Bewertungen

- BSC Quiz On Chapters 1&2-2Dokument4 SeitenBSC Quiz On Chapters 1&2-2Sachin KripalaniNoch keine Bewertungen

- CIR V SC JohnsonDokument3 SeitenCIR V SC JohnsonRonn Robby RosalesNoch keine Bewertungen

- WS Retail Services Pvt. LTD.,: Grand TotalDokument1 SeiteWS Retail Services Pvt. LTD.,: Grand TotalAbhinav MehraNoch keine Bewertungen

- Peligrino (Temp)Dokument6 SeitenPeligrino (Temp)JanJan Claros100% (1)

- No PE & 10F Format BHEL TENDERDokument4 SeitenNo PE & 10F Format BHEL TENDERvikalp123123Noch keine Bewertungen

- Group Activities Income StatmentDokument3 SeitenGroup Activities Income StatmentMarwin NavarreteNoch keine Bewertungen

- M1 Foundation in Financial Planning and Tax Planning Syllabus FinalDokument10 SeitenM1 Foundation in Financial Planning and Tax Planning Syllabus FinalCalvin YeohNoch keine Bewertungen

- 1 - Tuason vs. PosadasDokument5 Seiten1 - Tuason vs. PosadasJeanne CalalinNoch keine Bewertungen

- Govind Raghvan Vs Pioneer Urban Land and Infrastructure LTDDokument7 SeitenGovind Raghvan Vs Pioneer Urban Land and Infrastructure LTDmanojNoch keine Bewertungen

- BIR Form Deadline Quarterly Tax ReturnsDokument6 SeitenBIR Form Deadline Quarterly Tax Returnsdianne caballeroNoch keine Bewertungen

- 20244231544240339sro 614 (I) 2024Dokument1 Seite20244231544240339sro 614 (I) 2024BILWANI CONoch keine Bewertungen

- Tax Ordinance Sub Section 114 and 115Dokument4 SeitenTax Ordinance Sub Section 114 and 115faiz kamranNoch keine Bewertungen

- IFRS 2 - Share Based Payment1Dokument7 SeitenIFRS 2 - Share Based Payment1EmmaNoch keine Bewertungen

- Everytown Gun Safety Action Fund - 990 Tax FormDokument118 SeitenEverytown Gun Safety Action Fund - 990 Tax FormCNBC.comNoch keine Bewertungen

- Essentials of Federal Taxation 2016 Edition 7th Edition Spilker Test BankDokument173 SeitenEssentials of Federal Taxation 2016 Edition 7th Edition Spilker Test Bankchompdumetoseei5100% (25)

- 2003 Revised NGAS Chart of AccountsDokument56 Seiten2003 Revised NGAS Chart of AccountsJaniña Natividad100% (1)

- Dimple Is Not A Dealer in SecuritiesDokument2 SeitenDimple Is Not A Dealer in SecuritiesQueen ValleNoch keine Bewertungen

- Case DigestDokument16 SeitenCase DigestSheena Rima100% (1)

- Project On ITLDokument24 SeitenProject On ITLPayalRajputNoch keine Bewertungen

- Assam Professions Trades Callings and Employments Taxation Act19471Dokument68 SeitenAssam Professions Trades Callings and Employments Taxation Act19471Latest Laws TeamNoch keine Bewertungen

- Train Law RecommendationDokument10 SeitenTrain Law RecommendationMaria Angelica PanongNoch keine Bewertungen

- The Relationship Between Inflation and Economic GrowthDokument21 SeitenThe Relationship Between Inflation and Economic Growthasmar farajovaNoch keine Bewertungen

- State Bank of India34 PDFDokument2 SeitenState Bank of India34 PDFKhushboo PatidarNoch keine Bewertungen

- Modern India 1857-1964 - OptDokument546 SeitenModern India 1857-1964 - Optyadnyesh1981100% (8)

- Group Members: Guided By: Hiral ShahDokument13 SeitenGroup Members: Guided By: Hiral Shahtchandaria5458Noch keine Bewertungen

- 18-Oña v. CIR G.R. No. L-19342 May 25, 1972Dokument8 Seiten18-Oña v. CIR G.R. No. L-19342 May 25, 1972Jopan SJNoch keine Bewertungen

- Taxation Principles and Remedies Finals ReviewerDokument39 SeitenTaxation Principles and Remedies Finals ReviewerRamilNoch keine Bewertungen

- PTCL Accounts 2009 (Parent)Dokument48 SeitenPTCL Accounts 2009 (Parent)Najam U SaharNoch keine Bewertungen

- Principles of Interpretation of ConstitutionDokument22 SeitenPrinciples of Interpretation of ConstitutionpriyankaNoch keine Bewertungen