Beruflich Dokumente

Kultur Dokumente

Circular On Payment of VAT Simplex Concrete Piles India Limited Gurgaon 07.04.2006

Hochgeladen von

rayudu vvs0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten2 Seiten1. The document is an order of clarification from the Financial Commissioner & Principal Secretary of Haryana regarding the tax liability of a sub-contractor, Simplex Concrete Piles India Limited, for works performed on a highway construction project.

2. It determines that unlike the previous Haryana tax act, the sub-contractor is liable to pay tax under the Haryana Value Added Tax Act since the goods involved in the sub-contract will pass directly from the sub-contractor to the project owners.

3. Both the main contractor and sub-contractor are jointly and severally liable for the taxes, but the main contractor can claim rebates for taxes paid by the sub-contract

Originalbeschreibung:

Circular on Payment of VAT Simplex Concrete Piles India Limited Gurgaon 07.04.2006 by NHAI

Originaltitel

Circular on Payment of VAT Simplex Concrete Piles India Limited Gurgaon 07.04.2006

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden1. The document is an order of clarification from the Financial Commissioner & Principal Secretary of Haryana regarding the tax liability of a sub-contractor, Simplex Concrete Piles India Limited, for works performed on a highway construction project.

2. It determines that unlike the previous Haryana tax act, the sub-contractor is liable to pay tax under the Haryana Value Added Tax Act since the goods involved in the sub-contract will pass directly from the sub-contractor to the project owners.

3. Both the main contractor and sub-contractor are jointly and severally liable for the taxes, but the main contractor can claim rebates for taxes paid by the sub-contract

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten2 SeitenCircular On Payment of VAT Simplex Concrete Piles India Limited Gurgaon 07.04.2006

Hochgeladen von

rayudu vvs1. The document is an order of clarification from the Financial Commissioner & Principal Secretary of Haryana regarding the tax liability of a sub-contractor, Simplex Concrete Piles India Limited, for works performed on a highway construction project.

2. It determines that unlike the previous Haryana tax act, the sub-contractor is liable to pay tax under the Haryana Value Added Tax Act since the goods involved in the sub-contract will pass directly from the sub-contractor to the project owners.

3. Both the main contractor and sub-contractor are jointly and severally liable for the taxes, but the main contractor can claim rebates for taxes paid by the sub-contract

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

(Issued vide no. 631/ST-1, dated 7.4.

2006)

ORDER OF CLARIFICATION MADE BY SHRI L.S.M. SALINS,

FINANCIAL COMMISSIONER & PRINCIPAL SECRETARY,

GOVERNMENT OF HARYANA, EXCISE AND TAXATION

DEPARTMENT UNDER SECTION 56(3) OF THE

HARYANA VALUE ADDED TAX ACT, 2003

Querist: Simplex Concrete Piles India Limited, Gurgaon

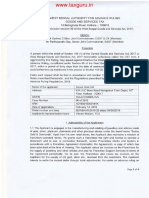

Bare minimum facts to appreciate the query are that the National

Highway Authority of India (NHAI) is converting Delhi-Gurgaon section

of NH-8 from single highway to dual highway. NHAI appointed Jay Pee

DSC Ventures Limited as Concessionaires for doing the same. The

Concessionaires awarded contract of constructing the dual highway to

DS Construction Limited, who awarded contract of piling-work of the

Haryana section of the aforesaid highway from Km.23.96 to Km.42.00

to the querist. The question put is whether the querist is a sub-

contractor and if so is he liable to pay tax under the Haryana Value

Added Tax Act, 2003 (‘the HVAT Act’) in respect of the works contract

awarded to it or not. The querist has referred to the decision of the

Punjab and Haryana High Court in DLF Industries Ltd. Vs. State of

Haryana where the court after examination of the provisions of the

Haryana General Sales Tax Act, 1973 (‘HGST Act’) relating to the

definition of the contractor, contractee and the charging section 6,

which absolves a sub-contractor of liability to pay tax as it devolves

the same on the contractor alone, and noting the facts of the case

before it that there was no privity of contract between the contractee

and the sub-contractor and as the contractor alone was liable to the

contractee, held that the contractor was liable to pay tax in respect of

the works contract.

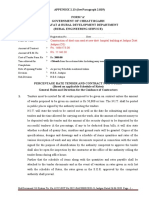

2. Under the HVAT Act things are materially different from the HGST

Act because there is no provision in the HVAT Act which absolves a

sub-contractor of his liability to pay tax as was the case in the

charging section in the HGST Act though there is no change in the

definitions of contractor and contractee in the two Acts. It has been

stated by the querist that the property involved in the execution of the

works contract of piling awarded to him in respect of Haryana section

of NH-8 will pass directly from him to NHAI / Concessionaires. This

means also that NHAI / Concessionaires will be privy to this

arrangement. Thus there will be a sale of these goods from him to

NHAI / Concessionaires and he will be liable to pay tax on such sale

of goods under the provisions of the Act. (See Gannon Dunkerley v

State of Rajasthan 88 STC 204 (SC) Page 232 para 2 reading “Since

the taxable event is the transfer of property in goods involved in the

execution of a works contract and the said transfer of property in such

goods takes place when the goods are incorporated in the works, …”)

-2-

3. It may be added that under section 42 of the HVAT Act, the

contractor and the sub-contractor both are jointly and severally liable

to pay tax in respect of transfer of property in goods whether as goods

or in some other form involved in the execution of the works contract

by the sub-contractor and further if the contractor proves to the

satisfaction of the assessing authority that the tax has been paid by

the sub-contractor in respect of the sub-contract and the assessment

of such tax has become final, the liability of the contractor to that

extent shall abate. Thus, a contractor, who includes the turnover of

the sub-contractor in his taxable turnover, can claim the rebate of the

tax paid by the sub-contractor from his tax liability in his returns and

assessment subject to the provisions of section 42 of the Act.

(L.S.M.SALINS)

Chandigarh Financial Commissioner & Principal Secretary

Dated: 30.3.2006 to Govt. Haryana, Excise & Taxation Department

Das könnte Ihnen auch gefallen

- Activity 1Dokument4 SeitenActivity 1LFGS Finals50% (2)

- 5b8d6 Liability W.R.T. Jda Entered Prior To GST ArticleDokument3 Seiten5b8d6 Liability W.R.T. Jda Entered Prior To GST ArticleKunalKumarNoch keine Bewertungen

- Before The Hon'ble Real Estate Regulatory Authority at Cambala at Satya PradeshDokument12 SeitenBefore The Hon'ble Real Estate Regulatory Authority at Cambala at Satya Pradeshsanchit singlaNoch keine Bewertungen

- Works Contract and Principle of AccretionDokument5 SeitenWorks Contract and Principle of AccretionNeeladri CNoch keine Bewertungen

- Taxation Case Analysis - Niyati Div A 21010224036 2Dokument8 SeitenTaxation Case Analysis - Niyati Div A 21010224036 2Niyati SrivastavaNoch keine Bewertungen

- Affidavit/ Undertaking: Condition Road - 2021 - 1Dokument18 SeitenAffidavit/ Undertaking: Condition Road - 2021 - 1Executive Engineer HSVP Division No.II,HisarNoch keine Bewertungen

- Impact of Retrospective Application of RERA: 1. MaharashtraDokument3 SeitenImpact of Retrospective Application of RERA: 1. MaharashtraDisha LohiyaNoch keine Bewertungen

- Various Issues Relating To Works ContractDokument5 SeitenVarious Issues Relating To Works ContractApoorvnujsNoch keine Bewertungen

- J 1959 SCR 379 AIR 1958 SC 560 1958 9 STC 353 Kavyagupta Nlujodhpuracin 20211010 130928 1 23Dokument23 SeitenJ 1959 SCR 379 AIR 1958 SC 560 1958 9 STC 353 Kavyagupta Nlujodhpuracin 20211010 130928 1 23Divyansh MoroliaNoch keine Bewertungen

- High Court of Delhi - Engineer To Correct Ambiguities or ErrorsDokument17 SeitenHigh Court of Delhi - Engineer To Correct Ambiguities or ErrorsSanjayNoch keine Bewertungen

- Case Comment Gannon Dunkerley v. State of MadrasDokument12 SeitenCase Comment Gannon Dunkerley v. State of MadrasNitish Joshi100% (1)

- RERA - Analysis of The Maha RERA Amendment Rules 2019Dokument3 SeitenRERA - Analysis of The Maha RERA Amendment Rules 2019parasshah.kljNoch keine Bewertungen

- VAT Applicability To Construction ServicesDokument17 SeitenVAT Applicability To Construction ServicesAayush ModiNoch keine Bewertungen

- In Re Senco Gold LTD GST AAR West BangalDokument4 SeitenIn Re Senco Gold LTD GST AAR West Bangalkinnar2013Noch keine Bewertungen

- Case Studies in TDS: 294, The 1961 Act Is An Integrated CodeDokument10 SeitenCase Studies in TDS: 294, The 1961 Act Is An Integrated CodeGitanjali ShindeNoch keine Bewertungen

- Vol-III - 10 - Attachment-27-Certification by The Bidder Per DoE OrderDokument1 SeiteVol-III - 10 - Attachment-27-Certification by The Bidder Per DoE Ordersarat mishraNoch keine Bewertungen

- Interstate Trade and Commerce Under Indian Constitution: K. AnushaDokument6 SeitenInterstate Trade and Commerce Under Indian Constitution: K. AnushaTushar GuptaNoch keine Bewertungen

- What Is Works Contract?Dokument10 SeitenWhat Is Works Contract?Naga BhushanNoch keine Bewertungen

- 20Th Century Finance Corpn. Ltd. & ... Vs State of Maharashtra On 9 May, 2000Dokument20 Seiten20Th Century Finance Corpn. Ltd. & ... Vs State of Maharashtra On 9 May, 2000Randhir KumarNoch keine Bewertungen

- LOA Gooty JNDokument27 SeitenLOA Gooty JNrohit rajNoch keine Bewertungen

- WORK CONTRACTS AND IMPLICATIONS FOR ROADS OR HIGHWAYS. - Kanoon For AllDokument10 SeitenWORK CONTRACTS AND IMPLICATIONS FOR ROADS OR HIGHWAYS. - Kanoon For AllRaviNoch keine Bewertungen

- DOJ OPINION 72 s.2003Dokument10 SeitenDOJ OPINION 72 s.2003Katleya Kate BelderolNoch keine Bewertungen

- 2022 141 Taxmann Com 223 New Delhi CESTAT 18 02 2022Dokument30 Seiten2022 141 Taxmann Com 223 New Delhi CESTAT 18 02 2022pradeepkumarsnairNoch keine Bewertungen

- MHBE Deloitte Contract 040414 - RedactedDokument40 SeitenMHBE Deloitte Contract 040414 - RedactedCraig O'DonnellNoch keine Bewertungen

- ADR Award OGDokument3 SeitenADR Award OGmohak vilechaNoch keine Bewertungen

- CAMELLA HOMES - Residential RenovationDokument3 SeitenCAMELLA HOMES - Residential RenovationRikka Marie CatotoNoch keine Bewertungen

- Subcontractor AgreementDokument1 SeiteSubcontractor AgreementSeph InfanteNoch keine Bewertungen

- Vendor-Agreement NDokument16 SeitenVendor-Agreement NSekar KrishNoch keine Bewertungen

- Sample Standard Subcontract AgreementDokument12 SeitenSample Standard Subcontract Agreementtvera404Noch keine Bewertungen

- SKA - Sectionwise GST Analysis - Finance Bill 2021Dokument24 SeitenSKA - Sectionwise GST Analysis - Finance Bill 2021Sandip GoyalNoch keine Bewertungen

- Adwitya Spaces P LTD inDokument4 SeitenAdwitya Spaces P LTD ingauravNoch keine Bewertungen

- Electrical Agreement - JJ Electrical (1) (1) RelianceDokument3 SeitenElectrical Agreement - JJ Electrical (1) (1) RelianceAman GargNoch keine Bewertungen

- Logic Serve - AGI - AmendAg ExecutedDokument8 SeitenLogic Serve - AGI - AmendAg ExecutedmanojkumarcscietNoch keine Bewertungen

- Model Buyer's Agreement by CCIDokument104 SeitenModel Buyer's Agreement by CCIAmit JainNoch keine Bewertungen

- CGST 16 (2) (C)Dokument31 SeitenCGST 16 (2) (C)noorensaba01Noch keine Bewertungen

- National Highways Authority of India Vs Punjab NatDE20211101211527433COM896528Dokument29 SeitenNational Highways Authority of India Vs Punjab NatDE20211101211527433COM896528aridaman raghuvanshiNoch keine Bewertungen

- Versus: Efore Apadnis Ember AND Djudicating FficerDokument3 SeitenVersus: Efore Apadnis Ember AND Djudicating Fficerrohit jadhavNoch keine Bewertungen

- Bangalore Turf Club Validity of GST Rules, GST On Commission OnlyDokument27 SeitenBangalore Turf Club Validity of GST Rules, GST On Commission OnlyMonish RaghuwanshiNoch keine Bewertungen

- GST WeeklyDokument5 SeitenGST WeeklySona GuptaNoch keine Bewertungen

- Arbitration and Advanced Professional PracticeDokument10 SeitenArbitration and Advanced Professional PracticevishalakshiNoch keine Bewertungen

- 12march, 2004 Supreme Court of India: Case 1. Consumer Protection ActDokument5 Seiten12march, 2004 Supreme Court of India: Case 1. Consumer Protection ActShubham SinghNoch keine Bewertungen

- Dri - 4.1Dokument11 SeitenDri - 4.1Nihar BhalotiaNoch keine Bewertungen

- Works Contract Under GST Regime: ProjectDokument24 SeitenWorks Contract Under GST Regime: ProjectShachi SinghNoch keine Bewertungen

- WWW Livelaw in News Updates Section 3 Rera Occupancy Certificate Jurisdiction HaDokument21 SeitenWWW Livelaw in News Updates Section 3 Rera Occupancy Certificate Jurisdiction HaAmaya SrivastavaNoch keine Bewertungen

- TDS On Inter-State Works Contract: Prashant RaizadaDokument3 SeitenTDS On Inter-State Works Contract: Prashant RaizadalovelyshreeNoch keine Bewertungen

- DetailedTenderDocument 2 13 PDFDokument32 SeitenDetailedTenderDocument 2 13 PDFSUDHIR PANDEYNoch keine Bewertungen

- In Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalDokument20 SeitenIn Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalAshish AgarwalNoch keine Bewertungen

- 35225370a NitDokument6 Seiten35225370a NitAMM GSD JODHPURNoch keine Bewertungen

- Hire PlantDokument5 SeitenHire PlantSANDEEP DARGODENoch keine Bewertungen

- Artha Real Estate Corporation LTD Vs Ashok KrishnaRT2023210723172325280COM62689Dokument8 SeitenArtha Real Estate Corporation LTD Vs Ashok KrishnaRT2023210723172325280COM62689KRISHNA AGHAVNoch keine Bewertungen

- P-630 (11-20) Equipment Maintenance Agreement - 2Dokument24 SeitenP-630 (11-20) Equipment Maintenance Agreement - 2Yoseph TsegayeNoch keine Bewertungen

- Board of Trustees, P 27Dokument15 SeitenBoard of Trustees, P 27Kritin BahugunaNoch keine Bewertungen

- Master Services Agreement ExampleDokument41 SeitenMaster Services Agreement ExampleChristian BethlenNoch keine Bewertungen

- CC 11 Attach 1Dokument73 SeitenCC 11 Attach 1Obi A AgusioboNoch keine Bewertungen

- PrebidReply VRKPkg13Dokument11 SeitenPrebidReply VRKPkg13Rajnish ShuklaNoch keine Bewertungen

- Template Service AgreementDokument19 SeitenTemplate Service Agreementshivangi.bharadwajNoch keine Bewertungen

- Contract Data Sheet: Mechanical Maintenance & Emergency RepairsDokument20 SeitenContract Data Sheet: Mechanical Maintenance & Emergency Repairs9998228948Noch keine Bewertungen

- 064 AttachE ProFormaDokument11 Seiten064 AttachE ProFormaRinjin ShizukuNoch keine Bewertungen

- Act on Contracts to Which a Local Government Is a PartyVon EverandAct on Contracts to Which a Local Government Is a PartyNoch keine Bewertungen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Annexture A Specification For Road WorkDokument1 SeiteAnnexture A Specification For Road Workrayudu vvsNoch keine Bewertungen

- Safety Report 27.04.2019Dokument13 SeitenSafety Report 27.04.2019rayudu vvsNoch keine Bewertungen

- MCR, 1960Dokument148 SeitenMCR, 1960Nano GowthamNoch keine Bewertungen

- Assam Minor Mineral Rules AMMCR2013Dokument178 SeitenAssam Minor Mineral Rules AMMCR2013rayudu vvsNoch keine Bewertungen

- Annexture A Specification For Road WorkDokument27 SeitenAnnexture A Specification For Road WorkCgpscAspirantNoch keine Bewertungen

- Readers Digest Best JokesDokument16 SeitenReaders Digest Best JokesEskay95% (58)

- Safety ReportDokument22 SeitenSafety Reportrayudu vvs50% (4)

- Box Culvert 2 Cell x8mx5mDokument168 SeitenBox Culvert 2 Cell x8mx5mrayudu vvs67% (3)

- Formwork & Reinforcing of Highway Bridge DecksDokument1 SeiteFormwork & Reinforcing of Highway Bridge Decksrayudu vvsNoch keine Bewertungen

- Intake Drawings BSEBDokument3 SeitenIntake Drawings BSEBrayudu vvsNoch keine Bewertungen

- Modified Standard Operating Procedure For Conciliation 18.07.2018Dokument2 SeitenModified Standard Operating Procedure For Conciliation 18.07.2018rayudu vvsNoch keine Bewertungen

- Clarification On Bank Rate For EPC Contracts Issued Vide Circular Dated 29.08.2017Dokument2 SeitenClarification On Bank Rate For EPC Contracts Issued Vide Circular Dated 29.08.2017rayudu vvsNoch keine Bewertungen

- Article On Review of Compensation CL For Land Compensation of Highway Projects in IRCDokument2 SeitenArticle On Review of Compensation CL For Land Compensation of Highway Projects in IRCVvs RayuduNoch keine Bewertungen

- Article On Review of Compensation CL For Land Compensation of Highway Projects in IRCDokument3 SeitenArticle On Review of Compensation CL For Land Compensation of Highway Projects in IRCrayudu vvsNoch keine Bewertungen

- Formwork & Reinforcing of Highway Bridge DecksDokument10 SeitenFormwork & Reinforcing of Highway Bridge DecksRavi KumarNoch keine Bewertungen

- Article On Review of Compensation CL For Land Compensation of Highway Projects in IRCDokument2 SeitenArticle On Review of Compensation CL For Land Compensation of Highway Projects in IRCVvs RayuduNoch keine Bewertungen

- Contract Manager ResponsibilitiesDokument3 SeitenContract Manager Responsibilitieskoledc5Noch keine Bewertungen

- Arbitration Rules of SARODDokument30 SeitenArbitration Rules of SARODrayudu vvsNoch keine Bewertungen

- Abxxxxxxxd q4 2022-23Dokument4 SeitenAbxxxxxxxd q4 2022-23pchak.sbiNoch keine Bewertungen

- Add01 New-1Dokument52 SeitenAdd01 New-1Do Tuan Anh (K16HL)Noch keine Bewertungen

- Clean Water Act and Renewable Energy ActDokument48 SeitenClean Water Act and Renewable Energy ActDaphne Cosi LealNoch keine Bewertungen

- TPPLDokument12 SeitenTPPLvinaypandeychandNoch keine Bewertungen

- Bill of RightsDokument64 SeitenBill of RightsShasharu Fei-fei LimNoch keine Bewertungen

- Tax Administration: 1. IndividualDokument9 SeitenTax Administration: 1. Individualkelly yuNoch keine Bewertungen

- TA2812TUU5FQPDokument3 SeitenTA2812TUU5FQPvragavhNoch keine Bewertungen

- Chapter 1 To 3Dokument56 SeitenChapter 1 To 3Michelle Ann Dela Cruz100% (1)

- Fundamentals Cheat SheetDokument2 SeitenFundamentals Cheat SheetUDeconNoch keine Bewertungen

- M&S 2023 Annual ReportDokument236 SeitenM&S 2023 Annual ReportMANoch keine Bewertungen

- A Study On Financial Ratios On Selected FMCG CompaniesDokument42 SeitenA Study On Financial Ratios On Selected FMCG CompaniesShoaib AhmedNoch keine Bewertungen

- Case Digest TAXDokument12 SeitenCase Digest TAXCayle Andre E. NepomucenoNoch keine Bewertungen

- (TAX 1) Scope and Limitations - 05 JRRBDokument3 Seiten(TAX 1) Scope and Limitations - 05 JRRBJay-ar Rivera BadulisNoch keine Bewertungen

- Ingersoll Rand Onboard Power Vhp40rmh Operation Maintenance Manual 2012Dokument23 SeitenIngersoll Rand Onboard Power Vhp40rmh Operation Maintenance Manual 2012mistythompson020399sdz100% (28)

- Goods and Services Tax - Form GSTR-2B (Quarterly)Dokument71 SeitenGoods and Services Tax - Form GSTR-2B (Quarterly)Param JainNoch keine Bewertungen

- Request For Proposals: Jalkhad (SNJ) Road (KM 12+000 To 49+000) Length: 37 KM"Dokument1 SeiteRequest For Proposals: Jalkhad (SNJ) Road (KM 12+000 To 49+000) Length: 37 KM"Munir HussainNoch keine Bewertungen

- MEXICO - Benjamin Lessing Paper - Endogenous State Weakness in Violent DemocraciesDokument44 SeitenMEXICO - Benjamin Lessing Paper - Endogenous State Weakness in Violent Democraciescelsochini7106Noch keine Bewertungen

- Senado Federal Aprueba Histórico Proyecto de Estímulo EconómicoDokument880 SeitenSenado Federal Aprueba Histórico Proyecto de Estímulo EconómicoEl Nuevo DíaNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoicevenkataraja bandhaNoch keine Bewertungen

- Ra 7686Dokument25 SeitenRa 7686Marvz Espanillo LitanNoch keine Bewertungen

- Guideline For The Employers On Deducting Withholding Tax Paye From 01-01-2020 To 31-03-2020Dokument4 SeitenGuideline For The Employers On Deducting Withholding Tax Paye From 01-01-2020 To 31-03-2020kNoch keine Bewertungen

- W-8BEN: Do NOT Use This Form IfDokument1 SeiteW-8BEN: Do NOT Use This Form IfdoyokaNoch keine Bewertungen

- Herarc Realty Corporation vs. The Provincial Treasurer of Batangas DigestDokument2 SeitenHerarc Realty Corporation vs. The Provincial Treasurer of Batangas DigestEmir MendozaNoch keine Bewertungen

- Gap Between Irrigation Service Price PDFDokument370 SeitenGap Between Irrigation Service Price PDFNguyen Van KienNoch keine Bewertungen

- PaysheetDokument1 SeitePaysheetPierre KotzeNoch keine Bewertungen

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDokument12 SeitenForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuNoch keine Bewertungen

- CT 1 - QP - Icse - X - GSTDokument2 SeitenCT 1 - QP - Icse - X - GSTAnanya IyerNoch keine Bewertungen

- Examples Transfer PricingDokument15 SeitenExamples Transfer PricingRajat RathNoch keine Bewertungen

- Abridged Version of ProspectusDokument12 SeitenAbridged Version of ProspectusAbbasi Hira100% (1)