Beruflich Dokumente

Kultur Dokumente

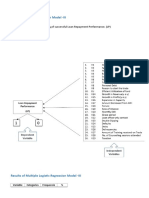

Multivariate Regression Model-LE

Hochgeladen von

manjushreeCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Multivariate Regression Model-LE

Hochgeladen von

manjushreeCopyright:

Verfügbare Formate

Multivariate Regression Model – II

To identify Significant Influencers of Loan repayment efficiency (LE)

Results of Multivariate Regression Model – II

Goodness of Fit of the Regression Model

Observations 148.000

Sum of weights 148.000

DF 120.000

R² 0.945

Adjusted R² 0.933

MSE 16.025

RMSE 4.003

MAPE 2.999

DW

Cp 28.000

AIC 435.538

SBC 519.460

PC 0.080

Interpretation

Given the R²= 93% of the variability of the dependent variable Loan Repayment Efficiency is explained

by the 25 explanatory variables.

The Strength of Correlation between the Dependent Variable LE and the 25 Explanatory Variables is

Very Strong.

R²= 93% deems an Excellent fit of the Regression Model means Very strong Correlation

between the Data observed and the Regression Model

ANOVA of Regression Model

Source DF Sum of squares Mean squares F p-Value

Model 27 33256.392 1231.718 76.861 < 0.0001

Error 120 1923.034 16.025

Corrected Total 147 35179.426

Interpretation

Given the p-value of the F statistic computed in the ANOVA table, and given the significance level of 5%, the

information brought by the explanatory variables is significantly better than what a basic mean would bring.

Type III Sum of Squares Analysis

Source D Sum of Mean F p-Value

F squares squares

Monthly Income 1 0.049 0.049 0.003 <0.0001

Sources of Income 1 39.630 39.630 2.473 <0.0001

Personal Capital 1 0.117 0.117 0.007 0.932

Total Business Debt 1 74.450 74.450 4.646 0.033

Personal Debt 1 0.092 0.092 0.006 <0.0001

Reason to start the trade 1 1.362 1.362 0.085 0.771

Efficent Utilization of Funds 1 25.357 25.357 1.582 0.0021

Growth in Revenue(y o y) 1 5.012 5.012 0.313 0.0058

Growth in Profits(y o y) 1 0.236 0.236 0.015 0.0090

Expansion in Capacity 1 8.227 8.227 0.513 0.0475

Amount Borrowed from MFI 1 36.999 36.999 2.309 0.0131

Tenure 1 0.090 0.090 0.006 0.0940

Rate of Interest 1 6.004 6.004 0.375 <0.0001

EMI 1 13.831 13.831 0.863 0.0035

Grace period 1 22.736 22.736 1.419 0.0236

Loan officer yrly contact 1 23.954 23.954 1.495 0.0224

Double Dipping 1 32.910 32.910 2.054 0.0154

Defaults 1 0.470 0.470 0.029 0.864

Delay 1 0.324 0.324 0.020 0.887

Delinquencies 1 7.904 7.904 0.493 0.0484

Amount of Training received on Trade 1 1.778 1.778 0.111 0.0074

No. of Counselling sessions attended 1 27.169 27.169 1.695 0.0020

Taxation 1 38.001 38.001 2.371 0.0126

Gender 1 39.274 39.274 2.451 0.120

Age 3 23.663 7.888 0.492 0.688

Interpretation

Based on Type III – Sum of Squares Analysis the following variables bring significant value of

information in explaining the variability in the Dependent Variable –LE

Significant Variables

1. Monthly Income 1. Double Dipping

2. Sources of Income 2. Delinquencies

3. Total Business Debt 3. Amount of Training

4. Personal Debt 4. Counselling session

5. EU 5. Taxation

6. Expansion in Capacity

7. Amount Borrowed

8. Growth in Revenue

9. Growth in Profits

Based on Type III –

10. Loan officer Contact

Sum of Squares

Analysis the following variables Do NOT bring significant value of information in explaining the

variability in the Dependent Variable –LE

Variable Total Business Debt is the most influential that affects Loan Repayment Efficiency LE

In-Significant Variables

1. Personal Capital

2. Reason to Start the trade

3. Defaults

4. Delays

5. Gender

6. Age

Model Parameters

Source Value Standar t p-value

d error

Intercept 113.084 46.240 2.446 0.016

Monthly Income 9.332 0.000 0.055 <0.0001

Sources of Income 5.326 3.387 1.573 <0.0001

Personal Capital 0.000 0.000 -0.085 0.932

Total Business Debt -0.910 0.000 -2.155 0.033

Personal Debt -0.068 0.000 -0.076 <0.0001

Reason to start the trade 0.321 1.102 0.292 0.771

Efficient Utilization of Funds 0.192 0.153 1.258 0.0021

Growth in Revenue(y o y) 0.493 0.881 -0.559 0.0058

Growth in Profits(y o y) 1.117 0.964 0.121 0.0090

Expansion in Capacity 0.419 0.585 -0.717 0.0475

Amount Borrowed from MFI -3.000 0.000 -1.519 0.0131

Tenure 0.041 0.550 -0.075 0.0940

Rate of Interest -0.381 0.622 0.612 <0.0001

EMI -0.020 0.002 0.929 0.0035

Grace period 3.027 2.541 -1.191 0.0236

Loan officer yrly contact 0.531 0.434 -1.223 0.0224

Double Dipping -2.261 1.578 1.433 0.0154

Defaults -0.428 2.497 -0.171 0.864

Delay -0.182 1.282 -0.142 0.887

Delinquencies -1.411 2.010 0.702 0.0484

Amount of Training received on Trade 0.043 0.130 0.333 0.0074

No. of Counselling sessions attended 0.591 0.454 1.302 0.0020

Taxation -1.117 0.725 -1.540 0.0126

Gender-0 -1.154 0.737 -1.565 0.120

Gender-1 0.000 0.000 0.688

Age-1 -0.759 3.228 -0.235 0.814

Age-2 2.144 3.013 0.711 0.478

Age-3 1.760 2.321 0.758 0.450

Age-4 0.000 0.000

Regression Equation for LE

LE = 113.084

+9.332* Monthly Income

+5.326*Sources of Income

+0.000*Personal Capital

-0.910* Total Business Debt

-0.068* Personal Debt

-0.321* Reason to start the trade

+0.192*Efficient Utilization of Funds

+0.493* Growth in Revenue(y o y)

+1.117*Growth in Profits(y o y)

+0.419* Expansion in Capacity

-3*Amount Borrowed from MFI

+0.041*Tenure

-0.381*Rate of Interest

-0.020*EMI

+3.027* Grace period

+0.531*Loan officer yrly contact

-2.261*Double Dipping

-0.428*Defaults

-0.182*Delay

-1.411*Delinquencies

+0.043*Amount of Training received on Trade

0.591*No. of Counselling sessions attended

-1.117*Taxation

+Factor*Gender + Factor*Age

Variables with +Ve influence on LE Variables with –Ve influence on LE

Intercept Total Business Debt

Monthly Income Personal Debt

Sources of Income Amount Borrowed from MFI

Personal Capital Rate of Interest

Reason to start the trade EMI

Efficient Utilization of Funds Double Dipping

Growth in Revenue(y o y) Defaults

Growth in Profits(y o y) Delay

Expansion in Capacity Delinquencies

Tenure Taxation

Grace period

Loan officer yrly contact

Amount of Training received on Trade

No. of Counselling sessions attended

Das könnte Ihnen auch gefallen

- Financial Management Accounting InsightsDokument11 SeitenFinancial Management Accounting InsightsHannahPojaFeria50% (2)

- Cement Industry RatiosDokument6 SeitenCement Industry RatiosSiddharth ShahNoch keine Bewertungen

- Schaum's Outline of Basic Business Mathematics, 2edVon EverandSchaum's Outline of Basic Business Mathematics, 2edBewertung: 5 von 5 Sternen5/5 (1)

- What Is The Zeitgeist - PART IDokument13 SeitenWhat Is The Zeitgeist - PART IMalcolm Armstrong100% (1)

- Alignment To Content Standards Texas Ela Oct 2019Dokument83 SeitenAlignment To Content Standards Texas Ela Oct 2019mvm100% (1)

- Seminar Report On Satellite CommunicationDokument17 SeitenSeminar Report On Satellite CommunicationHapi ER67% (6)

- Multiple Logistic Regression Model-LPDokument7 SeitenMultiple Logistic Regression Model-LPmanjushreeNoch keine Bewertungen

- 2003 DecemberDokument7 Seiten2003 DecemberSherif AwadNoch keine Bewertungen

- Tutorial 13 14 Answer MFRS9Dokument4 SeitenTutorial 13 14 Answer MFRS9NavaneetaNoch keine Bewertungen

- Grant Thornton Business COmbination PDFDokument51 SeitenGrant Thornton Business COmbination PDFPuneet SharmaNoch keine Bewertungen

- Accounting for Cash and Short-Term InvestmentsDokument13 SeitenAccounting for Cash and Short-Term InvestmentsZeshan ChNoch keine Bewertungen

- FA Assingement wk3Dokument13 SeitenFA Assingement wk3pranjal92pandeyNoch keine Bewertungen

- Financial Statements Analysis: Author: Tănase Alin-Eliodor, EVERET România DistributionDokument12 SeitenFinancial Statements Analysis: Author: Tănase Alin-Eliodor, EVERET România Distributionعبد المؤمنNoch keine Bewertungen

- 4.EF232.FIM (IL-II) Solution CMA 2023 January ExamDokument6 Seiten4.EF232.FIM (IL-II) Solution CMA 2023 January ExamnobiNoch keine Bewertungen

- KISANGHAR1000000Dokument15 SeitenKISANGHAR1000000Suresh VarmaNoch keine Bewertungen

- Welcome To Our PresentationDokument38 SeitenWelcome To Our PresentationTamanna ShaonNoch keine Bewertungen

- Second Practice - Operaciones Bancarias Internacionales - Mayo 25 - 2022-1Dokument18 SeitenSecond Practice - Operaciones Bancarias Internacionales - Mayo 25 - 2022-1David Maguiña riosNoch keine Bewertungen

- Seminar 12 Earnings Quality Analysis 2016Dokument31 SeitenSeminar 12 Earnings Quality Analysis 2016mattNoch keine Bewertungen

- Excercise 1 AnswersDokument3 SeitenExcercise 1 AnswersfaisalNoch keine Bewertungen

- Analyze financial statements and reduce costsDokument3 SeitenAnalyze financial statements and reduce costsMayur NikumbhNoch keine Bewertungen

- Financial Plan AnalysisDokument11 SeitenFinancial Plan AnalysisNadrahNoch keine Bewertungen

- LIC Housing Finance LTD: Key Data ' ' ' 'Dokument4 SeitenLIC Housing Finance LTD: Key Data ' ' ' 'Venkata KiranNoch keine Bewertungen

- Descriptive FindingsDokument8 SeitenDescriptive FindingsValdi NadhifNoch keine Bewertungen

- Amr Assignment 2: Logistic Regression On Credit RiskDokument6 SeitenAmr Assignment 2: Logistic Regression On Credit RiskKarthic C MNoch keine Bewertungen

- Accounts Must Do Questions by Vinit Mishra SirDokument137 SeitenAccounts Must Do Questions by Vinit Mishra SirCan I Get 1000 SubscribersNoch keine Bewertungen

- Determinants of Bank Selection in Delhi: A Factor Analysis by Sajeevan Rao R.K. SharmaDokument22 SeitenDeterminants of Bank Selection in Delhi: A Factor Analysis by Sajeevan Rao R.K. SharmaPooja SinghNoch keine Bewertungen

- Group AssignmentDokument6 SeitenGroup AssignmentIshiyaku Adamu NjiddaNoch keine Bewertungen

- Reliance CommunicationsDokument10 SeitenReliance CommunicationsSubharaj ChakrabortyNoch keine Bewertungen

- Chapter TwoDokument16 SeitenChapter TwoHananNoch keine Bewertungen

- Marriott Corporation WACC CalculationDokument3 SeitenMarriott Corporation WACC CalculationSaraNoch keine Bewertungen

- Final Exam 2017Dokument10 SeitenFinal Exam 2017Ahtisham KhawajaNoch keine Bewertungen

- BF405 May 2016 PDFDokument4 SeitenBF405 May 2016 PDFhuku memeNoch keine Bewertungen

- Part One: True /false Items: Write "True" If The Statement Is Correct & Write "False" If TheDokument3 SeitenPart One: True /false Items: Write "True" If The Statement Is Correct & Write "False" If TheAbatneh MengistNoch keine Bewertungen

- Ceci TEAMWORK HW - Case - New and Repaired FurnaceDokument14 SeitenCeci TEAMWORK HW - Case - New and Repaired FurnaceMarcela GzaNoch keine Bewertungen

- Latihan Soal Audit Internal Bab 9 PDFDokument2 SeitenLatihan Soal Audit Internal Bab 9 PDFdijono2Noch keine Bewertungen

- Financial Accounting Cat 1 JonathanDokument14 SeitenFinancial Accounting Cat 1 JonathanjonathanNoch keine Bewertungen

- Financial Analysis of Nestle India and ACC LtdDokument20 SeitenFinancial Analysis of Nestle India and ACC Ltdrahil0786Noch keine Bewertungen

- BDM AssignmentDokument11 SeitenBDM AssignmenttatualynaNoch keine Bewertungen

- Bora Assignment FinalDokument12 SeitenBora Assignment FinalBora AslanNoch keine Bewertungen

- Attribute Coeffs S.E. Wald Z P-ValueDokument8 SeitenAttribute Coeffs S.E. Wald Z P-Valuesarthak mendirattaNoch keine Bewertungen

- Ratio AnalysisDokument66 SeitenRatio AnalysisRenny WidyastutiNoch keine Bewertungen

- Amortization Schedule: PMT I PV I 0.06 PV 2500 N 6 PMT 2500Dokument4 SeitenAmortization Schedule: PMT I PV I 0.06 PV 2500 N 6 PMT 2500Ensbert HarnoisNoch keine Bewertungen

- SMChap 006Dokument22 SeitenSMChap 006Anonymous mKjaxpMaLNoch keine Bewertungen

- Financial SustainabilityDokument33 SeitenFinancial SustainabilitySam DhuriNoch keine Bewertungen

- Konsep Bisnis KSP IndonusaDokument5 SeitenKonsep Bisnis KSP Indonusahanda2Noch keine Bewertungen

- Konsep Bisnis KSP IndonusaDokument5 SeitenKonsep Bisnis KSP Indonusahanda2Noch keine Bewertungen

- Mu BashirDokument6 SeitenMu BashirShahzaib ShaikhNoch keine Bewertungen

- FM Notes by Dipan SirDokument178 SeitenFM Notes by Dipan SirchimbanguraNoch keine Bewertungen

- Submitted To: Ms Sukhwinder Kaur Submitted By: Megha Tah (T1901B46)Dokument34 SeitenSubmitted To: Ms Sukhwinder Kaur Submitted By: Megha Tah (T1901B46)vijaybaliyanNoch keine Bewertungen

- Marriot Corporation - Cost of CapitalDokument3 SeitenMarriot Corporation - Cost of CapitalInderpreet Singh Saini100% (17)

- Analyzing Investment Projects with NPV, IRR, MIRRDokument15 SeitenAnalyzing Investment Projects with NPV, IRR, MIRRRussiell DanoNoch keine Bewertungen

- Sunway Berhad (F) Part 2 (Page 97-189)Dokument93 SeitenSunway Berhad (F) Part 2 (Page 97-189)qeylazatiey93_598514100% (1)

- Fimd Training Unit 1 - Financial AnalysisDokument31 SeitenFimd Training Unit 1 - Financial AnalysisErrol ThompsonNoch keine Bewertungen

- Exam Revision - Chapter 3 4Dokument6 SeitenExam Revision - Chapter 3 4Vũ Thị NgoanNoch keine Bewertungen

- Ing NV 2010 PDFDokument296 SeitenIng NV 2010 PDFSergiu ToaderNoch keine Bewertungen

- Risk Event Impact Proby. of Risk Occurence (Pe) Proby. of Impact (Pi)Dokument5 SeitenRisk Event Impact Proby. of Risk Occurence (Pe) Proby. of Impact (Pi)Ankur KhareNoch keine Bewertungen

- FOH Audit 2022 1Dokument14 SeitenFOH Audit 2022 1palyc.ali2024Noch keine Bewertungen

- Entrep Lesson 6 ActivityDokument2 SeitenEntrep Lesson 6 ActivityKarina AcalNoch keine Bewertungen

- Finance For ManagersDokument17 SeitenFinance For ManagersIkramNoch keine Bewertungen

- Discounted Cash Flow: A Theory of the Valuation of FirmsVon EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsNoch keine Bewertungen

- Final Project SociologyDokument14 SeitenFinal Project Sociologyvikas rajNoch keine Bewertungen

- Sony Kdl-42w654a rb1g PDFDokument100 SeitenSony Kdl-42w654a rb1g PDFMihaela CaciumarciucNoch keine Bewertungen

- Test October ADokument2 SeitenTest October AAna Paula CarlãoNoch keine Bewertungen

- Friction Stir Welding: Principle of OperationDokument12 SeitenFriction Stir Welding: Principle of OperationvarmaprasadNoch keine Bewertungen

- PI IK525、IK545Dokument32 SeitenPI IK525、IK545beh XulNoch keine Bewertungen

- Geo HK Guide To Retaining WallDokument259 SeitenGeo HK Guide To Retaining WallZaireen AzmeeNoch keine Bewertungen

- Biologicalisation - Biological Transformation in ManufacturingDokument32 SeitenBiologicalisation - Biological Transformation in ManufacturingGuillermo AvilesNoch keine Bewertungen

- Newsletter April.Dokument4 SeitenNewsletter April.J_Hevicon4246Noch keine Bewertungen

- SK08A Addressable Loop-Powered Siren Installation Sheet (Multilingual) R2.0Dokument12 SeitenSK08A Addressable Loop-Powered Siren Installation Sheet (Multilingual) R2.0123vb123Noch keine Bewertungen

- Textual Equivalence-CohesionDokument39 SeitenTextual Equivalence-CohesionTaufikNoch keine Bewertungen

- Leader 2Dokument13 SeitenLeader 2Abid100% (1)

- Critical Review By:: Shema Sheravie Ivory F. QuebecDokument3 SeitenCritical Review By:: Shema Sheravie Ivory F. QuebecShema Sheravie IvoryNoch keine Bewertungen

- Win10 Backup Checklist v3 PDFDokument1 SeiteWin10 Backup Checklist v3 PDFsubwoofer123Noch keine Bewertungen

- Guia de Manejo Sdra 2019Dokument27 SeitenGuia de Manejo Sdra 2019Jorge VidalNoch keine Bewertungen

- Soft Start - Altistart 48 - VX4G481Dokument2 SeitenSoft Start - Altistart 48 - VX4G481the hawakNoch keine Bewertungen

- 5E Lesson Plan ScienceDokument8 Seiten5E Lesson Plan ScienceHanema MENORNoch keine Bewertungen

- SQ3R Is A Reading Strategy Formed From Its LettersDokument9 SeitenSQ3R Is A Reading Strategy Formed From Its Letterschatura1989Noch keine Bewertungen

- ASTM C186 - 15a Standard Test Method For Heat of Hydration of Hydraulic CementDokument3 SeitenASTM C186 - 15a Standard Test Method For Heat of Hydration of Hydraulic CementKalindaMadusankaDasanayakaNoch keine Bewertungen

- 55fbb8b0dd37d Productive SkillDokument6 Seiten55fbb8b0dd37d Productive SkilldewiNoch keine Bewertungen

- Citizen Journalism Practice in Nigeria: Trends, Concerns, and BelievabilityDokument30 SeitenCitizen Journalism Practice in Nigeria: Trends, Concerns, and BelievabilityJonathan Bishop100% (3)

- SPM Literature in English Tips + AdviseDokument2 SeitenSPM Literature in English Tips + AdviseJessica NgNoch keine Bewertungen

- Vibration TransducerDokument2 SeitenVibration TransducerSurendra Reddy0% (1)

- LLRP PROTOCOLDokument19 SeitenLLRP PROTOCOLRafo ValverdeNoch keine Bewertungen

- PESTEL Team Project (Group)Dokument9 SeitenPESTEL Team Project (Group)Yadira Alvarado saavedraNoch keine Bewertungen

- Motenergy Me1507 Technical DrawingDokument1 SeiteMotenergy Me1507 Technical DrawingHilioNoch keine Bewertungen

- Bus210 Week5 Reading1Dokument33 SeitenBus210 Week5 Reading1eadyden330% (1)

- Nikbakht H. EFL Pronunciation Teaching - A Theoretical Review.Dokument30 SeitenNikbakht H. EFL Pronunciation Teaching - A Theoretical Review.researchdomain100% (1)