Beruflich Dokumente

Kultur Dokumente

George Rusu SA Tax Return 1

George Rusu SA Tax Return 1

Hochgeladen von

Flutur Gavril0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten2 SeitenThe requested information to the landlord of 23 Nunnery Lane has is

Originaltitel

George Rusu SA Tax Return 1(2)

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe requested information to the landlord of 23 Nunnery Lane has is

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten2 SeitenGeorge Rusu SA Tax Return 1

George Rusu SA Tax Return 1

Hochgeladen von

Flutur GavrilThe requested information to the landlord of 23 Nunnery Lane has is

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

GOV.

UK

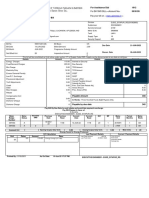

Mr George Rusu's tax return 2017-18 Sign out

Unique Taxpayer Reference (UTR): 6579999698

Your tax return is 100% complete

View your calculation

This section provides you with a breakdown of your full calculation. If it says your tax return is 100% complete

then you have submitted your return and this is a copy of the information held on your official online Self

Assessment tax account with HM Revenue and Customs.

Profit from self-employment £20,812.00

Total income received £20,812.00

minus Personal Allowance £11,500.00

Total income on which tax is due £9,312.00

How we have worked out your income tax

The Scottish rates and thresholds apply to non-savings non-dividend income of Scottish residents

The UK rates and thresholds apply to savings and dividends income

Amount Percentage Total

Pay, pensions, profit etc. (Scottish income tax rate).

Basic rate £9,312.00 x 20% £1,862.40

Starting rate £0.00 x 0% £0.00

Nil rate £0.00 x 0% £0.00

Basic rate £0.00 x 20% £0.00

Total income on which tax has been charged £9,312.00

Income Tax due £1,862.40

plus Class 4 National Insurance contributions £12,648.00 x 9% £1,138.32

plus Class 2 National Insurance contributions £148.20

Total Class 2 and Class 4 National Insurance contributions due £1,286.52

Income Tax, Class 2 and Class 4 National Insurance contributions £3,148.92

due

minus Tax deducted

CIS and trading income £6,172.00

Total tax deducted £6,172.00

Income Tax overpaid £3,023.08

Estimated overpayment at 31 January 2019

(Note: 2nd payment of £0.00 due 31 July 2019)

This calculation does not take into account any 2017-18 payments on account you may have already made or

tax due for earlier years

2017-18 balancing credit £3,023.08

Total overpaid at 31 January 2019 £3,023.08

Print your full calculation

Das könnte Ihnen auch gefallen

- Basic Pay Income Tax National Insurance: 8344788 Carlos Ariza 16-FEB-2020 ZR 57 69 94 UDokument3 SeitenBasic Pay Income Tax National Insurance: 8344788 Carlos Ariza 16-FEB-2020 ZR 57 69 94 UCamilo NietoNoch keine Bewertungen

- PaystubDokument1 SeitePaystubscalesjacob1997Noch keine Bewertungen

- Get NoticeDokument3 SeitenGet NoticeJo anne Jo anneNoch keine Bewertungen

- Sa302 2021-22Dokument2 SeitenSa302 2021-22Viktoria VasevaNoch keine Bewertungen

- Tax Invoice For: Your Telstra BillDokument3 SeitenTax Invoice For: Your Telstra BillPeter SmythNoch keine Bewertungen

- UtilityBillingStatement AGO2022Dokument2 SeitenUtilityBillingStatement AGO2022MexLex Tramites LegalesNoch keine Bewertungen

- Template 37 Construction Company Profit and Loss StatementDokument1 SeiteTemplate 37 Construction Company Profit and Loss StatementIhin SolihinNoch keine Bewertungen

- Fi Co Business Blue PrintDokument87 SeitenFi Co Business Blue PrintVenu Gattamaneni0% (2)

- Pay SlipDokument1 SeitePay Slipraj Kumar Thapa chhetriNoch keine Bewertungen

- Statement2023 PDFDokument2 SeitenStatement2023 PDFkayrincoddington2424Noch keine Bewertungen

- 2022 T1 Form - CompletedDokument8 Seiten2022 T1 Form - CompletedARSH GROVERNoch keine Bewertungen

- E0800J3WXBDokument2 SeitenE0800J3WXBAhmed Al AdawiNoch keine Bewertungen

- Ita34 1058123249Dokument3 SeitenIta34 1058123249Bahlakoana NtsasaNoch keine Bewertungen

- Strategic Audit On Mercedes BenzDokument21 SeitenStrategic Audit On Mercedes Benztinah100% (3)

- Sa302 2021Dokument1 SeiteSa302 2021Umt KayaNoch keine Bewertungen

- CvsDokument23 SeitenCvsDebanjan Mukhopadhyay100% (1)

- Payslip Month Ending 30 November 2022Dokument1 SeitePayslip Month Ending 30 November 2022zeppo1234Noch keine Bewertungen

- Fit NoteDokument1 SeiteFit NoteSammy RobertsNoch keine Bewertungen

- Preview 29Dokument16 SeitenPreview 29kakabadzebaiaNoch keine Bewertungen

- Stanley Application For Tenancy 3 PDFDokument3 SeitenStanley Application For Tenancy 3 PDFAnnie LamNoch keine Bewertungen

- Virgin Media BillDokument2 SeitenVirgin Media BillmktxouNoch keine Bewertungen

- Factory April BillDokument3 SeitenFactory April BillSumit AgarwalNoch keine Bewertungen

- SCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - RedactedDokument1 SeiteSCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - Redactedlarry-612445Noch keine Bewertungen

- FitNote - 3Dokument1 SeiteFitNote - 3Arindella AllenNoch keine Bewertungen

- Adonis Brooks 3379 Fernview DR Lawrenceville Ga, 30044: Checking SummaryDokument1 SeiteAdonis Brooks 3379 Fernview DR Lawrenceville Ga, 30044: Checking Summaryjkelle24Noch keine Bewertungen

- Statement 25-NOV-22 AC 43388212 27104301Dokument4 SeitenStatement 25-NOV-22 AC 43388212 27104301cecilia mwangiNoch keine Bewertungen

- Sample Arlington Eversource Bill - Direct Energy RDokument2 SeitenSample Arlington Eversource Bill - Direct Energy RtaiffourmohamedNoch keine Bewertungen

- NFJPIA Mockboard 2011 Auditing TheoryDokument6 SeitenNFJPIA Mockboard 2011 Auditing TheoryKathleen Ang100% (1)

- R43 2019 PDFDokument4 SeitenR43 2019 PDFDavid Mark AldridgeNoch keine Bewertungen

- International-Petroleum-Fiscal Daniel Johnston PDFDokument337 SeitenInternational-Petroleum-Fiscal Daniel Johnston PDFPrakarn Korkiat100% (1)

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Dokument2 SeitenNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977Noch keine Bewertungen

- PSEG Bill Residential Sample Community Solar FINAL 1Dokument6 SeitenPSEG Bill Residential Sample Community Solar FINAL 1Oluwafemi PeterNoch keine Bewertungen

- Inspired Sisters LTD Online) AUDokument3 SeitenInspired Sisters LTD Online) AUthankksNoch keine Bewertungen

- Nov 2018 Pathfinder SkillsDokument162 SeitenNov 2018 Pathfinder SkillsWaidi AdebayoNoch keine Bewertungen

- Anz Pensioner Advantage Statement: Welcome To Your Anz Account at A GlanceDokument12 SeitenAnz Pensioner Advantage Statement: Welcome To Your Anz Account at A GlancevtmnewsltdNoch keine Bewertungen

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDokument7 SeitenA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNoch keine Bewertungen

- Fit NoteDokument1 SeiteFit Noteamandawood1967Noch keine Bewertungen

- Annexure 1B PDFDokument1 SeiteAnnexure 1B PDFFolaNoch keine Bewertungen

- Document 3119946238763383936Dokument2 SeitenDocument 3119946238763383936abel zhangNoch keine Bewertungen

- CCTV Handbook 2016Dokument116 SeitenCCTV Handbook 2016thanhhieu2802100% (5)

- Proof of DeliveryDokument1 SeiteProof of DeliveryAbdulmalik Muhammad ElNoch keine Bewertungen

- 03KBH19z-51JH053EH6999 B43a99a8 PDFDokument4 Seiten03KBH19z-51JH053EH6999 B43a99a8 PDFPeter ChanNoch keine Bewertungen

- Kevin O DonnellDokument4 SeitenKevin O DonnellITNoch keine Bewertungen

- Australia Bank StatementDokument1 SeiteAustralia Bank Statementmdabir44567Noch keine Bewertungen

- Statement of Accounts: Today's StatementsDokument5 SeitenStatement of Accounts: Today's StatementsbronwynnpembertonNoch keine Bewertungen

- Residential Bill ExampleDokument3 SeitenResidential Bill ExampleDiwakar reddyNoch keine Bewertungen

- Agent Appointment FormDokument2 SeitenAgent Appointment FormSatyen ChikhliaNoch keine Bewertungen

- Batch Control PDFDokument9 SeitenBatch Control PDFAmet koko TaroNoch keine Bewertungen

- Proof of Balance Report: Jasmine Petrovski 5/71 Pine Street Reservoir Vic 3073 Australia Account BalancesDokument1 SeiteProof of Balance Report: Jasmine Petrovski 5/71 Pine Street Reservoir Vic 3073 Australia Account BalancesgeorgiaNoch keine Bewertungen

- Goods Documents Required Customs Prescriptions Remarks: IrelandDokument4 SeitenGoods Documents Required Customs Prescriptions Remarks: IrelandKelz YouknowmynameNoch keine Bewertungen

- DD Form - Watford Council TaxDokument1 SeiteDD Form - Watford Council TaxAfzal ShaikhNoch keine Bewertungen

- Your Account Summary BalanceDokument1 SeiteYour Account Summary BalanceВиктория ГринькоNoch keine Bewertungen

- Ambulance: VictoriaDokument2 SeitenAmbulance: VictoriaJames WearneNoch keine Bewertungen

- Statement 2020 03 10Dokument3 SeitenStatement 2020 03 10BrendaNoch keine Bewertungen

- Bas (SBR) 2020Dokument4 SeitenBas (SBR) 2020mahm82Noch keine Bewertungen

- Space Coast C.UDokument11 SeitenSpace Coast C.UВлад АнгелNoch keine Bewertungen

- Justine Roth Utility BillDokument2 SeitenJustine Roth Utility BilluzairNoch keine Bewertungen

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDokument6 SeitenICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNoch keine Bewertungen

- Nat 2938Dokument22 SeitenNat 2938fred fluchterNoch keine Bewertungen

- Form 16a - TDS - Blank 16aDokument1 SeiteForm 16a - TDS - Blank 16aJayNoch keine Bewertungen

- 6.110907 29424343Dokument10 Seiten6.110907 29424343Christy JosephNoch keine Bewertungen

- Statement of Benefits 30 04 2020Dokument10 SeitenStatement of Benefits 30 04 2020Chris MillsNoch keine Bewertungen

- For Assistance Dial 1912 5616195: For Bill SMS BILL Pay Your Bill OnDokument1 SeiteFor Assistance Dial 1912 5616195: For Bill SMS BILL Pay Your Bill OnShòbhì TNoch keine Bewertungen

- VzplanbillDokument15 SeitenVzplanbillcrimesilkNoch keine Bewertungen

- CNP BillDokument1 SeiteCNP BillebonyniiNoch keine Bewertungen

- Invoice Template Sales 1tax BasicDokument1 SeiteInvoice Template Sales 1tax BasicSodhi BazpuriyaNoch keine Bewertungen

- Say No To Corruption: PTCL STN: PTCL NTNDokument3 SeitenSay No To Corruption: PTCL STN: PTCL NTNTauqeer AbbasNoch keine Bewertungen

- CESC GSTN No: 29AACCC6636P1Z1 Cesc Pan No: Aaccc6636P: Meter Readings For Meter ID 8281845211Dokument2 SeitenCESC GSTN No: 29AACCC6636P1Z1 Cesc Pan No: Aaccc6636P: Meter Readings For Meter ID 8281845211Santhosh GnanasekaranNoch keine Bewertungen

- Case StudyDokument3 SeitenCase StudyFarhanAwaisiNoch keine Bewertungen

- Irish Standard: I.S. EN 12890:2000Dokument7 SeitenIrish Standard: I.S. EN 12890:2000Remi Joel Boris EssecofyNoch keine Bewertungen

- PVR Strips Limited: Values Stronger Than SteelDokument10 SeitenPVR Strips Limited: Values Stronger Than SteelPrateek DhimanNoch keine Bewertungen

- File 233Dokument6 SeitenFile 233Stark NessonNoch keine Bewertungen

- Marketing MaterialDokument25 SeitenMarketing MaterialKrishnaNoch keine Bewertungen

- 0022-Acme-Magnetic FilterDokument3 Seiten0022-Acme-Magnetic FilterMARKETING SIGMANoch keine Bewertungen

- Drilling CostsDokument6 SeitenDrilling CostsYash GandhiNoch keine Bewertungen

- First United Constructions Corporation v. Bayanihan Automotive CorporationDokument13 SeitenFirst United Constructions Corporation v. Bayanihan Automotive CorporationRainNoch keine Bewertungen

- Held by Promoter/promoter Group Held by Public: Page 1 of 5Dokument5 SeitenHeld by Promoter/promoter Group Held by Public: Page 1 of 5ratnadalNoch keine Bewertungen

- Attempt Any Five Questions. All Questions Carry Equal MarksDokument2 SeitenAttempt Any Five Questions. All Questions Carry Equal MarksIndian Lizard King100% (1)

- Plug (Parent) Spark (Subsidary) Lemon (Non Affiliate)Dokument25 SeitenPlug (Parent) Spark (Subsidary) Lemon (Non Affiliate)Pasha HarahapNoch keine Bewertungen

- Journal - ProblemsDokument1 SeiteJournal - ProblemsSheebaNoch keine Bewertungen

- Transactions 2025 An Economic Times Report On The Future of Payments in IndiaDokument16 SeitenTransactions 2025 An Economic Times Report On The Future of Payments in IndiaSaurabh JainNoch keine Bewertungen

- Vinamilk's Manufacturing System: Bach Khoa University School Industry ManagementDokument14 SeitenVinamilk's Manufacturing System: Bach Khoa University School Industry ManagementLẹ LâmNoch keine Bewertungen

- FSA Sears Vs WalmartDokument8 SeitenFSA Sears Vs WalmartAbhishek Maheshwari100% (2)

- Chapter 22: Ethics and Organizational ArchitectureDokument11 SeitenChapter 22: Ethics and Organizational ArchitecturejbyuriNoch keine Bewertungen

- SHSS Placement Brochure 09 - 11Dokument31 SeitenSHSS Placement Brochure 09 - 11healthsutraNoch keine Bewertungen

- Value Based Questions in Economics Class XIIDokument8 SeitenValue Based Questions in Economics Class XIIkkumar009Noch keine Bewertungen

- Naveed's ResumeDokument3 SeitenNaveed's ResumefarhanbaryarNoch keine Bewertungen

- Mgt211 Short Notes For VU PapersDokument35 SeitenMgt211 Short Notes For VU PapersUsman Bhatti83% (18)

- Flow of TCWDokument2 SeitenFlow of TCWChloe Felice Aguila PaelNoch keine Bewertungen

- Partner Quotes: LicensingDokument2 SeitenPartner Quotes: LicensingAndreja MilovicNoch keine Bewertungen