Beruflich Dokumente

Kultur Dokumente

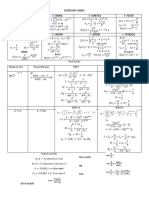

STAM Formula Sheet

Hochgeladen von

kosaundergroundCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

STAM Formula Sheet

Hochgeladen von

kosaundergroundCopyright:

Verfügbare Formate

Exam STAM

Adapt to Your Exam

SEVERITY, FREQUENCY &

SEVERITY, FREQUENCY & AGGREGATE Zero-Truncated Distributions Payment per Payment

AGGREGATE MODELS MODELS 1 𝑌𝑌 © : payment per payment

𝑝𝑝gá = 𝑝𝑝 , for 𝑛𝑛 = 1, 2, ⋯

1 − 𝑝𝑝B g E[𝑌𝑌 ö ]

Basic 1 E[𝑌𝑌 © ] = ; E[𝑌𝑌 ö ] = E[𝑌𝑌 © ] ⋅ 𝑆𝑆(𝑑𝑑)

E[(𝑁𝑁 á )G ] = E[𝑁𝑁 G ] 𝑆𝑆(𝑑𝑑)

CDFs, Survival Functions, and Hazard Functions 1 − 𝑝𝑝B With ordinary deductible 𝑑𝑑,

-

E[(𝑋𝑋 − 𝑑𝑑) • ]

𝐹𝐹(𝑥𝑥) = Pr(𝑋𝑋 ≤ 𝑥𝑥) = * 𝑓𝑓(𝑡𝑡) d𝑡𝑡 Zero-Modified Distributions 𝐸𝐸[𝑌𝑌 © ] = 𝑒𝑒(𝑑𝑑) = E[ 𝑋𝑋 − 𝑑𝑑 ∣ 𝑋𝑋 > 𝑑𝑑 ] =

./

1 − 𝑝𝑝Bä 𝑆𝑆(𝑑𝑑)

/

𝑆𝑆(𝑥𝑥) = Pr(𝑋𝑋 > 𝑥𝑥) = * 𝑓𝑓(𝑡𝑡) d𝑡𝑡 𝑝𝑝gä = 𝑝𝑝 , for 𝑛𝑛 = 1, 2, ⋯

1 − 𝑝𝑝B g Special Shortcuts for 𝑒𝑒(𝑑𝑑)

-

1 − 𝑝𝑝Bä

𝑓𝑓(𝑥𝑥) E[(𝑁𝑁 ä )G ] = E[𝑁𝑁 G ] 𝑒𝑒(𝑑𝑑)

ℎ(𝑥𝑥) = 1 − 𝑝𝑝B

𝑆𝑆(𝑥𝑥)

Exponential (𝜃𝜃) 𝜃𝜃

-

(𝑎𝑎, 𝑏𝑏, 0) Class Property 𝑏𝑏 − 𝑑𝑑

𝐻𝐻(𝑥𝑥) = * ℎ(𝑡𝑡) d𝑡𝑡 = − ln 𝑆𝑆(𝑥𝑥) ; 𝑆𝑆(𝑥𝑥) = 𝑒𝑒 .;(-) Uniform (𝑎𝑎, 𝑏𝑏)

./

𝑝𝑝g 𝑏𝑏 2

= 𝑎𝑎 + , for 𝑛𝑛 = 1, 2, ⋯ 𝜃𝜃 + 𝑑𝑑

𝑝𝑝g.I 𝑛𝑛 Pareto (𝛼𝛼, 𝜃𝜃)

Moments

/

Mixtures and Splices 𝛼𝛼 − 1

E[𝑔𝑔(𝑋𝑋)] = * 𝑔𝑔(𝑥𝑥) ⋅ 𝑓𝑓(𝑥𝑥) d𝑥𝑥 𝑑𝑑

./

Bernoulli Shortcut S-P Pareto (𝛼𝛼, 𝜃𝜃)

/ 𝑎𝑎, Probability = 𝑞𝑞 𝛼𝛼 − 1

= * 𝑔𝑔′(𝑥𝑥) ⋅ 𝑆𝑆(𝑥𝑥) d𝑥𝑥 If 𝑋𝑋 = ã , then:

𝑏𝑏, Probability = 1 − 𝑞𝑞 The Ultimate Formula for Insurance

B

Var[𝑋𝑋] = (𝑎𝑎 − 𝑏𝑏)M𝑞𝑞(1 − 𝑞𝑞) 𝑚𝑚 𝑑𝑑

𝑘𝑘 DE raw moment: 𝜇𝜇GH = E[𝑋𝑋 G ] ; 𝜇𝜇IH = 𝜇𝜇 E[𝑌𝑌 ö ] = 𝛼𝛼(1 + 𝑟𝑟) ™E ´𝑋𝑋 ∧ ≠ − E Æ𝑋𝑋 ∧ Ø∞

𝑘𝑘 DE central moment: 𝜇𝜇G = E[(𝑋𝑋 − 𝜇𝜇)G ] Poisson-Gamma Mixture 1 + 𝑟𝑟 1 + 𝑟𝑟

where

Var[𝑋𝑋] = 𝜎𝜎 M = 𝜇𝜇M If 𝑋𝑋 ∣ 𝜆𝜆 ∼ Poisson (𝜆𝜆) where 𝜆𝜆 ∼ Gamma (𝛼𝛼, 𝜃𝜃),

𝑑𝑑: deductible (set to 0 if not applicable)

Var[𝑔𝑔(𝑋𝑋)] = E[𝑔𝑔(𝑋𝑋)M] − E[𝑔𝑔(𝑋𝑋)]M then 𝑋𝑋 ∼ Neg. Binomial (𝑟𝑟 = 𝛼𝛼, 𝛽𝛽 = 𝜃𝜃).

𝑢𝑢: policy limit (set to ∞ if not applicable)

Covariance: Cov(𝑋𝑋, 𝑌𝑌) = E[𝑋𝑋𝑋𝑋] − E[𝑋𝑋]E[𝑌𝑌]

𝜎𝜎 Frailty Models 𝛼𝛼: coinsurance (set to 1 if not applicable)

Coefficient of variation: 𝐶𝐶𝐶𝐶 = ℎ( 𝑥𝑥 ∣ 𝛬𝛬 ) = 𝛬𝛬 ⋅ 𝑎𝑎(𝑥𝑥) 𝑟𝑟: inflation rate (set to 0 if not applicable)

𝜇𝜇 - 𝑢𝑢

𝜇𝜇_ 𝜇𝜇b 𝑚𝑚: maximum covered loss, which equals + 𝑑𝑑

Skewness = _ ; Kurtosis = b 𝑆𝑆(𝑥𝑥) = 𝑀𝑀ô [−𝐴𝐴(𝑥𝑥)], where 𝐴𝐴(𝑥𝑥) = * 𝑎𝑎(𝑡𝑡) d𝑡𝑡

𝜎𝜎 𝜎𝜎 ./

𝛼𝛼

Moment and Probability Generating Functions Aggregate Loss Models

Insurance Applications Collective Risk Model

𝑀𝑀d (𝑧𝑧) = E[𝑒𝑒 fd ]

(g) (g) 𝑌𝑌 ö : payment per loss If 𝑆𝑆 = ∑µ

¥∂I 𝑋𝑋¥ for independent 𝑁𝑁 and 𝑋𝑋, then:

𝑀𝑀d (0) = E[𝑋𝑋 g ] where 𝑀𝑀d is the 𝑛𝑛 DE derivative

(𝑧𝑧) d ] Policy Limits, 𝑢𝑢 • E[𝑆𝑆] = E[𝑁𝑁]E[𝑋𝑋]

𝑃𝑃d = E[𝑧𝑧

(g) 𝑋𝑋, 𝑋𝑋 < 𝑢𝑢 • Var[𝑆𝑆] = E[𝑁𝑁]Var[𝑋𝑋] + Var[𝑁𝑁]E[𝑋𝑋]M

𝑃𝑃d (1) = E[𝑋𝑋(𝑋𝑋 − 1) ⋯ (𝑋𝑋 − 𝑛𝑛 + 1)] 𝑌𝑌 ö = 𝑋𝑋 ∧ 𝑢𝑢 = ù

(g) 𝑢𝑢, 𝑋𝑋 ≥ 𝑢𝑢 Impact of Deductibles on Claim Frequency

where 𝑃𝑃d is the 𝑛𝑛 DE derivative E[(𝑌𝑌 ö )G ]

= E[(𝑋𝑋 ∧ 𝑢𝑢) G ]

ü For 𝑣𝑣 = Pr(𝑋𝑋 > 𝑑𝑑),

Conditional Distributions = * 𝑥𝑥 G 𝑓𝑓(𝑥𝑥) d𝑥𝑥 + 𝑢𝑢 G ⋅ 𝑆𝑆(𝑢𝑢) 𝑵𝑵 𝑵𝑵′

Pr(𝐴𝐴 ∩ 𝐵𝐵) Pr(𝐵𝐵 ∣ 𝐴𝐴) Pr(𝐴𝐴) B

Pr(𝐴𝐴 ∣ 𝐵𝐵) = = ü

Poisson 𝜆𝜆 𝑣𝑣𝑣𝑣

Pr(𝐵𝐵) Pr(𝐵𝐵) = * 𝑘𝑘𝑥𝑥 G.I𝑆𝑆(𝑥𝑥) d𝑥𝑥

𝑓𝑓d (𝑥𝑥) B

𝑓𝑓d∣rsdsG (𝑥𝑥) = , where 𝑗𝑗 < 𝑥𝑥 < 𝑘𝑘 E[𝑋𝑋 ∧ 𝑢𝑢]

Pr(𝑗𝑗 < 𝑋𝑋 < 𝑘𝑘) Binomial 𝑚𝑚, 𝑞𝑞 𝑚𝑚, 𝑣𝑣𝑣𝑣

Increased Limit Factor: 𝐼𝐼𝐼𝐼𝐼𝐼 =

E[𝑋𝑋 ∧ 𝑏𝑏]

Law of Total Probability Neg.

• 𝑏𝑏: original limit 𝑟𝑟, 𝛽𝛽 𝑟𝑟, 𝑣𝑣𝑣𝑣

Pr(𝑋𝑋 = 𝑥𝑥) = Ew [Pr(𝑋𝑋 = 𝑥𝑥 ∣ 𝑌𝑌)] Binomial

• 𝑢𝑢: increased limit

Law of Total Expectation

Negative Binomial/Exponential Compound Models

Deductibles, 𝑑𝑑

Ed [𝑋𝑋] = Ew xEd [𝑋𝑋 ∣ 𝑌𝑌]y 𝑁𝑁 ∼ Neg. Binomial (𝑟𝑟, 𝛽𝛽)

Ordinary deductible: ã π

Law of Total Variance 0, 𝑋𝑋 < 𝑑𝑑 𝑋𝑋 ∼ Exponential (𝜃𝜃)

𝑌𝑌 ö = (𝑋𝑋 − 𝑑𝑑)• = ã

Vard [𝑋𝑋] = Ew xVard [ 𝑋𝑋 ∣ 𝑌𝑌 ]y + Varw xEd [𝑋𝑋 ∣ 𝑌𝑌]y 𝑋𝑋 − 𝑑𝑑, 𝑋𝑋 ≥ 𝑑𝑑 ⇕

E[𝑌𝑌 ö ] = E[(𝑋𝑋 − 𝑑𝑑)• ] = E[𝑋𝑋] − E[𝑋𝑋 ∧ 𝑑𝑑] 𝛽𝛽

Independence E[(𝑌𝑌 ö )G ] = E[(𝑋𝑋 − 𝑑𝑑)G• ] 𝑁𝑁 ∼ Binomial ™𝑟𝑟, ∞

ª 1 + 𝛽𝛽 º

/

For independent 𝑋𝑋 and 𝑌𝑌, 𝑋𝑋 ∼ Exponential (𝜃𝜃[1 + 𝛽𝛽])

• Pr(𝑋𝑋 = 𝑥𝑥, 𝑌𝑌 = 𝑦𝑦) = Pr(𝑋𝑋 = 𝑥𝑥) ⋅ Pr(𝑌𝑌 = 𝑦𝑦) = * (𝑥𝑥 − 𝑑𝑑)G 𝑓𝑓(𝑥𝑥) d𝑥𝑥

¶

• E[𝑔𝑔(𝑋𝑋) ⋅ ℎ(𝑌𝑌)] = E[𝑔𝑔(𝑋𝑋)] ⋅ E[ℎ(𝑌𝑌)] / Compound Poisson Models

= * 𝑘𝑘(𝑥𝑥 − 𝑑𝑑)G.I𝑆𝑆(𝑥𝑥) d𝑥𝑥 A collective risk model where the frequency

Parametric Distributions ¶ follows a Poisson distribution.

Special Distribution Shortcuts E[𝑋𝑋 ∧ 𝑑𝑑]

Loss eliminiation ratio: 𝐿𝐿𝐿𝐿𝐿𝐿 =

E[𝑋𝑋]

𝑿𝑿 𝑿𝑿 − 𝒅𝒅 ∣ 𝑿𝑿 > 𝒅𝒅

Pareto (𝛼𝛼, 𝜃𝜃) Pareto (𝛼𝛼, 𝜃𝜃 + 𝑑𝑑) Franchise deductible:

0, 𝑋𝑋 < 𝑑𝑑

Exponential (𝜃𝜃) Exponential (𝜃𝜃) 𝑌𝑌 ö = ã

𝑋𝑋, 𝑋𝑋 ≥ 𝑑𝑑

Uniform (𝑎𝑎, 𝑏𝑏) Uniform (0, 𝑏𝑏 − 𝑑𝑑) E[𝑌𝑌 ö ] = E[(𝑋𝑋 − 𝑑𝑑)• ] + 𝑑𝑑 ⋅ 𝑆𝑆(𝑑𝑑)

www.coachingactuaries.com Copyright © 2018 Coaching Actuaries. All Rights Reserved. 1

Risk Measures Choosing from (𝑎𝑎, 𝑏𝑏, 0) Class 𝐷𝐷(𝑥𝑥) Plot

Value-at-Risk (VaR) Two methods to fit data to an (𝑎𝑎, 𝑏𝑏, 0) class Graph the difference between empirical CDF and

VaRæ (𝑋𝑋) = 𝐹𝐹d.I(𝑝𝑝) distributions: fitted CDF

• Method 1: Compare 𝑥𝑥̅ and 𝑠𝑠 M

Tail-Value-at-Risk (TVaR) Gg

TVaRæ (𝑋𝑋) = Ex𝑋𝑋 ∣ 𝑋𝑋 > VaRæ (𝑋𝑋)y • Method 2: Observe the slope of ‹

g‹›À

= VaRæ (𝑋𝑋) + 𝑒𝑒xVaRæ (𝑋𝑋)y

Distribution Method 1 Method 2

TVaRæ (𝑋𝑋) Poisson 𝑥𝑥̅ = 𝑠𝑠 M 0

𝜙𝜙¬𝑧𝑧æ √ Binomial M

𝑥𝑥̅ > 𝑠𝑠 Negative

Normal 𝜇𝜇 + 𝜎𝜎 ¿ ƒ

1 − 𝑝𝑝 Neg. Binomial 𝑥𝑥̅ < 𝑠𝑠 M Positive

Φ¬𝜎𝜎 − 𝑧𝑧æ √

Lognormal E[𝑋𝑋] ⋅ ¿ ƒ Variance of MLE

1 − 𝑝𝑝 Fisher’s Information

One Parameter:

Coherence

𝐼𝐼(𝜃𝜃) = −Ed [𝑙𝑙′′(𝜃𝜃)] Peak: 𝐷𝐷(𝑥𝑥) = 𝐹𝐹g ¬𝑥𝑥r √ − 𝐹𝐹∗ ¬𝑥𝑥r √

𝜌𝜌(𝑋𝑋) is coherent if it satisfies the properties below:

Varx𝜃𝜃”y = [𝐼𝐼(𝜃𝜃)].I

• Translation invariance: 𝜌𝜌(𝑋𝑋 + 𝑐𝑐) = 𝜌𝜌(𝑋𝑋) + 𝑐𝑐

Valley: 𝐷𝐷(𝑥𝑥) = 𝐹𝐹g ¬𝑥𝑥r.I √ − 𝐹𝐹 ∗¬𝑥𝑥r √

• Positive homogeneity: 𝜌𝜌(𝑐𝑐𝑐𝑐) = 𝑐𝑐 ⋅ 𝜌𝜌(𝑋𝑋) Two Parameters:

H (𝛼𝛼, 𝑝𝑝-𝑝𝑝 Plot

• Subadditivity: 𝜌𝜌(𝑋𝑋 + 𝑌𝑌) ≤ 𝜌𝜌(𝑋𝑋) + 𝜌𝜌(𝑌𝑌) 𝑙𝑙fiHH (𝛼𝛼, 𝜃𝜃) 𝑙𝑙fi,— 𝜃𝜃) 𝑗𝑗

• Monotonicity: 𝜌𝜌(𝑋𝑋) ≤ 𝜌𝜌(𝑌𝑌), if Pr(𝑋𝑋 ≤ 𝑌𝑌) = 1 𝐼𝐼(𝛼𝛼, 𝜃𝜃) = −Ed ¿ H ƒ Coordinate: Ó𝐹𝐹g ¬𝑥𝑥r √, 𝐹𝐹 ∗¬𝑥𝑥r √Ô where 𝐹𝐹g ¬𝑥𝑥r √ =

𝑙𝑙fi,— (𝛼𝛼, 𝜃𝜃) 𝑙𝑙—HH (𝛼𝛼, 𝜃𝜃) 𝑛𝑛 + 1

VaR is not coherent because it fails subaddivity. Var[𝛼𝛼÷] Covx𝛼𝛼÷, 𝜃𝜃”y

TVaR is coherent. [𝐼𝐼(𝛼𝛼, 𝜃𝜃)].I = fl ‡ Hypothesis Tests: Chi-Square Goodness-of-Fit

Covx𝛼𝛼÷, 𝜃𝜃”y Varx𝜃𝜃”y Chi-Square Goodness-of-Fit Test

Tail Weight

G M

1. Fewer positive raw moments ⟹ heavier tail Delta Approximation ¬𝐸𝐸r − 𝑂𝑂r √

(-) Õ (-) One-Variable: Test statistic: 𝜒𝜒M = Ò where

2. If lim À(-) = ∞ or lim À(-) = ∞, then numerator 𝐸𝐸r

M r∂I

-→/ Ã -→/ ÕÃ 𝑑𝑑

has a heavier tail. Varx𝑔𝑔¬𝜃𝜃”√y ≈ Æ 𝑔𝑔(𝜃𝜃)Ø Varx𝜃𝜃”y • 𝑘𝑘: # of groups

𝑑𝑑𝑑𝑑

3. ℎ(𝑥𝑥) decreases with 𝑥𝑥 ⟹ heavy tail • 𝐸𝐸r : expected # of observations in group 𝑗𝑗

4. 𝑒𝑒(𝑑𝑑) increases with 𝑑𝑑 ⟹ heavy tail Two-Variable: • 𝑂𝑂r : actual # of observations in group 𝑗𝑗

Varx𝑔𝑔¬𝛼𝛼÷, 𝜃𝜃”√y ≈ (𝑔𝑔fiH )M Var[𝛼𝛼÷] + 2𝑔𝑔fiH 𝑔𝑔—H Covx𝛼𝛼÷, 𝜃𝜃”y Degrees of freedom = 𝑘𝑘 − 1 − 𝑟𝑟 where

+(𝑔𝑔—H )MVarx𝜃𝜃”y • 𝑟𝑟: # of estimated parameters

CONSTRUCTION AND SELECTION OF

CONSTRUCTION AND SELECTION OF

PARAMETRIC MODELS Confidence Interval Chi-Square Goodness-of-Fit Test Properties

PARAMETRIC MODELS

• Individual and grouped data

x𝜃𝜃”y

𝜃𝜃” ± 𝑧𝑧(I•æ)/M‰Var

Maximum Likelihood Estimators • Continuous and discrete fit

Steps to Calculating MLE Hypothesis Tests • No adjustments to critical value for censored

1. 𝐿𝐿(𝜃𝜃) = ∏ 𝑓𝑓(𝑥𝑥) –

3. 𝑙𝑙H (𝜃𝜃) = 𝑙𝑙(𝜃𝜃) 𝐻𝐻B : null hypothesis data

2. 𝑙𝑙(𝜃𝜃) = ln 𝐿𝐿(𝜃𝜃) –—

H (𝜃𝜃) 𝐻𝐻I : alternative hypothesis • If parameters are estimated, critical value is

4. Set 𝑙𝑙 = 0 automatically adjusted via degrees of freedom

Reject 𝐻𝐻B when test statistic > critical value

Incomplete Data • No change for critical value if sample size is

𝑯𝑯𝟎𝟎 is true 𝑯𝑯𝟎𝟎 is false large

Left-truncated at 𝑑𝑑 𝑓𝑓(𝑥𝑥)⁄𝑆𝑆(𝑑𝑑) • Data needs to be grouped according to 𝐸𝐸r

Type I Correct

Right-censored at 𝑢𝑢 𝑆𝑆(𝑢𝑢) Reject 𝑯𝑯𝟎𝟎

Error Decision • More weights on intervals with poor fit

Grouped data on interval

Pr(𝑎𝑎 < 𝑋𝑋 ≤ 𝑏𝑏) Fail to reject Correct Type II Hypothesis Tests: Likelihood Ratio

(𝑎𝑎, 𝑏𝑏]

𝑯𝑯𝟎𝟎 Decision Error Test statistic: 𝑇𝑇 = 2[𝑙𝑙(𝜃𝜃I ) − 𝑙𝑙(𝜃𝜃B )]

Special Cases

Degrees of freedom = # of free parameters in 𝐻𝐻I

Hypothesis Tests: Kolmogorov-Smirnov

Distribution Shortcuts Empirical Distribution − # of free parameters in 𝐻𝐻B

Gamma, 𝑥𝑥̅ Equal probability for each observation Score-Based Approaches

𝜃𝜃” = # of observations ≤ 𝑥𝑥 Two types of criteria:

fixed 𝛼𝛼 𝛼𝛼 𝐹𝐹g (𝑥𝑥) =

𝜇𝜇̂ = 𝑥𝑥̅

𝑛𝑛 • Schwarz Bayesian Criterion (SBC), a.k.a.

Kolmogorov-Smirnov Test Bayesian Information Criterion (BIC)

Normal ∑ g

¥∂I 𝑥𝑥¥

M

𝜎𝜎÷ M = − 𝜇𝜇̂ M Test statistic: 𝐷𝐷 = max x𝐷𝐷r y where • Akaike Information Criterion (AIC)

𝑛𝑛 ÍÎÎ r

∑g¥∂I ln 𝑥𝑥¥ 𝐷𝐷r = max¬Ï𝐹𝐹g ¬𝑥𝑥r √ − 𝐹𝐹 ∗¬𝑥𝑥r √Ï, Ï𝐹𝐹g ¬𝑥𝑥r.I√ − 𝐹𝐹∗ ¬𝑥𝑥r √Ï√ 𝑟𝑟

SBC/BIC 𝑙𝑙 − ln 𝑛𝑛

𝜇𝜇̂ = If data is truncated at 𝑑𝑑, then 2

𝑛𝑛

Lognormal

𝐹𝐹(𝑥𝑥) − 𝐹𝐹(𝑑𝑑)

g

∑¥∂I(ln 𝑥𝑥¥ ) M AIC 𝑙𝑙 − 𝑟𝑟

𝜎𝜎÷ M = − 𝜇𝜇̂ M 𝐹𝐹 ∗(𝑥𝑥) = , for 𝑥𝑥 ≥ 𝑑𝑑

𝑛𝑛 1 − 𝐹𝐹(𝑑𝑑)

where

Poisson 𝜆𝜆◊ = 𝑥𝑥̅ Kolmogorov-Smirnov Test Properties 𝑙𝑙: log-likelihood

𝑥𝑥̅ • Individual data only 𝑟𝑟: # of estimated parameters

Binomial,

𝑞𝑞÷ = • Continuous fit only 𝑛𝑛: sample size

fixed 𝑚𝑚 𝑚𝑚

• Lower critical value for censored data Select model with the highest SBC or AIC value.

Neg. Binomial, 𝑥𝑥̅ • If parameters are estimated, critical value

𝛽𝛽◊ =

fixed 𝑟𝑟 𝑟𝑟 should be adjusted

Zero-Truncated Distribution: • Lower critical value if sample size is large

• Match E[𝑋𝑋 á ] to 𝑥𝑥̅ • No discretion

Zero-Modified Distribution: • Uniform weight on all parts of distribution

• Match 𝑝𝑝Bä to the proportion of zero observations

• Match E[𝑋𝑋 ä ] to 𝑥𝑥̅

Uniform Distribution on (0, 𝜃𝜃):

• 𝜃𝜃” = max(𝑥𝑥I, 𝑥𝑥M, … , 𝑥𝑥g )

www.coachingactuaries.com Copyright © 2018 Coaching Actuaries. All Rights Reserved. 2

CREDIBILITY CREDIBILITY Bühlmann As Least Squares Estimate of Exact Credibility

Bayesian Bayesian estimate = Bühlmann estimate

Classical Credibility M

Minimize ∑ÍÎÎ - ´𝑝𝑝- ¬𝑌𝑌- − 𝑌𝑌”- √ ≠ where • Poisson/Gamma

a.k.a. Limited Fluctuation Credibility

• Binomial/Beta

𝑌𝑌- : Bayesian estimate given 𝑋𝑋I = 𝑥𝑥

Full Credibility • Exponential/Inv. Gamma

# of exposures needed for full credibility, 𝑛𝑛ı : 𝑌𝑌”- : Bühlmann estimate given 𝑋𝑋I = 𝑥𝑥

• Normal/Normal

Full credibility of aggregate claims: Properties of a Bayesian/Bühlmann graph

𝑧𝑧(I•æ)⁄M M • Bühlmann estimates are on a straight line Empirical Bayes Non-Parametric Methods

𝑛𝑛ı = ´ ≠ (𝐶𝐶𝑉𝑉 M) • Bayesian estimates are within the range of Uniform Exposures

𝑘𝑘

hypothetical means ∑!¥∂I ∑gr∂I 𝑥𝑥¥r

# of claims needed for full credibility, 𝑛𝑛ˆ : 𝜇𝜇̂ =

Full credibility of aggregate claims: • There are Bayesian estimates above and below

𝑟𝑟 ⋅ 𝑛𝑛

M

𝑧𝑧(I•æ)⁄M M 𝜎𝜎µM the Bühlmann line ! g

∑¥∂I ∑r∂I¬𝑥𝑥¥r − 𝑥𝑥̅ ¥ √

𝑛𝑛ˆ = ´ ≠ fl + 𝐶𝐶𝑉𝑉dM‡ • Bühlmann estimates are between the sample 𝑣𝑣÷ =

𝑘𝑘 𝜇𝜇µ 𝑟𝑟(𝑛𝑛 − 1)

mean and theoretical mean

• Full credibility of claim frequency: set 𝐶𝐶𝑉𝑉dM = 0

!

∑¥∂I(𝑥𝑥̅ ¥ − 𝑥𝑥̅ ) M

𝑣𝑣÷

˜ Ã̄ Conjugate Priors 𝑎𝑎÷ = −

• Full credibility of claim severity: set = 0 𝑟𝑟 − 1 𝑛𝑛

˘¯ Poisson/Gamma

𝑛𝑛ˆ Non-uniform Exposures

𝑛𝑛ˆ = 𝑛𝑛ı ⋅ 𝜇𝜇µ ; 𝑛𝑛ı = • Model: Poisson (𝜆𝜆)

𝜇𝜇µ • Prior: Gamma (𝛼𝛼, 𝜃𝜃) ∑!¥∂I ∑gr∂I

"

𝑚𝑚¥r 𝑥𝑥¥r

𝜇𝜇̂ =

Partial Credibility 𝑚𝑚

( 𝜆𝜆 ∣ data ) ∼ Gamma (𝛼𝛼 ∗, 𝜃𝜃 ∗)

M

Credibility premium: 𝑃𝑃˙ = 𝑍𝑍𝑥𝑥̅ + (1 − 𝑍𝑍)𝑀𝑀

g

∑!¥∂I ∑r∂I"

𝑚𝑚¥r ¬𝑥𝑥¥r − 𝑥𝑥̅ ¥ √

= 𝑀𝑀 + 𝑍𝑍(𝑥𝑥̅ − 𝑀𝑀) Posterior • 𝛼𝛼 ∗ = 𝛼𝛼 + ∑g¥∂I 𝑥𝑥¥ 𝑣𝑣÷ =

∑!¥∂I(𝑛𝑛¥ − 1)

where I .I

• 𝜃𝜃 ∗ = Ó + 𝑛𝑛Ô

𝑀𝑀: manual premium — ∑!¥∂I 𝑚𝑚¥ (𝑥𝑥̅ ¥ − 𝑥𝑥̅ )M − 𝑣𝑣÷(𝑟𝑟 − 1)

𝑎𝑎÷ =

𝑍𝑍: credibility factor/credibility Predictive Neg. Binomial (𝑟𝑟 = 𝛼𝛼 ∗, 𝛽𝛽 = 𝜃𝜃 ∗) 𝑚𝑚 − 𝑚𝑚 .I ∑!¥∂I 𝑚𝑚¥M

𝑛𝑛 𝑛𝑛′

Balancing the Estimators

Square Root Rule: 𝑍𝑍 = ¸ =¸ Binomial/Beta ∑!¥∂I 𝑍𝑍¥ 𝑥𝑥̅ ¥

𝑛𝑛ı 𝑛𝑛ˆ

• Model: ( 𝑋𝑋 ∣ 𝑞𝑞 ) ∼ Binomial (𝑚𝑚, 𝑞𝑞) Estimate EHM as: 𝜇𝜇̂ = !

where ∑¥∂I 𝑍𝑍¥

• Prior: 𝑞𝑞 ∼ Beta (𝑎𝑎, 𝑏𝑏, 1)

𝑛𝑛: actual # of exposures

Empirical Bayes Semi-Parametric Methods

𝑛𝑛′: actual # of claims ( 𝑞𝑞 ∣ data ) ∼ Beta (𝑎𝑎∗ , 𝑏𝑏 ∗, 1)

To estimate 𝑣𝑣÷:

Posterior • 𝑎𝑎∗ = 𝑎𝑎 + ∑g¥∂I 𝑥𝑥¥

Bayesian Credibility Model 𝒗𝒗

%

Model Distribution • 𝑏𝑏 ∗ = 𝑏𝑏 + [𝑛𝑛(𝑚𝑚) − ∑g¥∂I 𝑥𝑥¥ ]

Poisson (𝜆𝜆) 𝑥𝑥̅

Distribution of model conditioned on a parameter Predictive - Neg. Binomial (𝑟𝑟, 𝛽𝛽) 𝑥𝑥̅ (1 + 𝛽𝛽)

Model density function: 𝑓𝑓( 𝑥𝑥 ∣ 𝜃𝜃 )

Gamma (𝛼𝛼, 𝜃𝜃) 𝑥𝑥̅ 𝜃𝜃

Exponential/Inv. Gamma

Prior Distribution

• Model: ( 𝑋𝑋 ∣ 𝜃𝜃 ) ∼ Exponential (𝜃𝜃) To estimate 𝜇𝜇̂ and 𝑎𝑎÷, use the non-parametric

Initial distribution of the parameter

Prior density function: 𝜋𝜋(𝜃𝜃) • Prior: 𝜃𝜃 ∼ Inv. Gamma (𝛼𝛼, 𝛽𝛽) method formulas shown above.

Posterior Distribution ( 𝜃𝜃 ∣ data ) ∼ Inv. Gamma (𝛼𝛼 ∗, 𝛽𝛽 ∗ )

Revised distribution of the parameter Posterior • 𝛼𝛼 ∗ = 𝛼𝛼 + 𝑛𝑛

Posterior density function: 𝜋𝜋(𝜃𝜃 ∣ data) • 𝛽𝛽 ∗ = 𝛽𝛽 + ∑g¥∂I 𝑥𝑥¥

𝑓𝑓( data ∣ 𝜃𝜃 ) ⋅ 𝜋𝜋(𝜃𝜃)

𝜋𝜋(𝜃𝜃 ∣ data) = / Predictive Pareto (𝛼𝛼 = 𝛼𝛼 ∗, 𝜃𝜃 = 𝛽𝛽 ∗ )

∫./ 𝑓𝑓( data ∣ 𝜃𝜃 ) ⋅ 𝜋𝜋(𝜃𝜃) d𝜃𝜃

Normal/Normal

Predictive Distribution

Revised unconditional distribution (w.r.t. model) • Model: ( 𝑋𝑋 ∣ 𝜃𝜃 ) ∼ Normal (𝜃𝜃, 𝑣𝑣)

of the model • Prior: 𝜃𝜃 ∼ Normal (𝜇𝜇, 𝑎𝑎)

Predictive density function: 𝑓𝑓(𝑥𝑥 ∣ data) ( 𝜃𝜃 ∣ data ) ∼ Normal (𝜇𝜇∗ , 𝑎𝑎∗ )

Predictive Mean = Bayesian Premium

Posterior • 𝜇𝜇∗ = 𝑍𝑍𝑥𝑥̅ + (1 − 𝑍𝑍)𝜇𝜇

Bühlmann Credibility • 𝑎𝑎∗ = (1 − 𝑍𝑍)𝑎𝑎

Expected Hypothetical Mean (EHM):

𝜇𝜇 = ExE[𝑋𝑋 ∣ 𝜃𝜃]y Predictive Normal (𝜇𝜇 = 𝜇𝜇 ∗, 𝜎𝜎 M = 𝑣𝑣 + 𝑎𝑎∗ )

Expected Process Variance (EPV):

Uniform/S-P Pareto

𝑣𝑣 = ExVar[𝑋𝑋 ∣ 𝜃𝜃]y

• Model: ( 𝑋𝑋 ∣ 𝜃𝜃 ) ∼ Uniform (0, 𝜃𝜃)

Variance of Hypothetical Mean (VHM): • Prior: 𝜃𝜃 ∼ S-P Pareto (𝛼𝛼, 𝛽𝛽)

𝑎𝑎 = VarxE[𝑋𝑋 ∣ 𝜃𝜃]y

𝑣𝑣 ( 𝜃𝜃 ∣ data ) ∼ S-P Pareto (𝛼𝛼 ∗, 𝛽𝛽 ∗ )

Bühlmann 𝑘𝑘: 𝑘𝑘 =

𝑎𝑎 Posterior

𝑛𝑛 • 𝛼𝛼 ∗ = 𝛼𝛼 + 𝑛𝑛

Bühlmann Credibility Factor: 𝑍𝑍 = • 𝛽𝛽 ∗ = max(𝛽𝛽, 𝑥𝑥I, … , 𝑥𝑥g )

𝑛𝑛 + 𝑘𝑘

Bühlmann Credibility Premium: Predictive -

𝑃𝑃˙ = 𝑍𝑍𝑥𝑥̅ + (1 − 𝑍𝑍)𝜇𝜇

= 𝜇𝜇 + 𝑍𝑍(𝑥𝑥̅ − 𝜇𝜇)

www.coachingactuaries.com Copyright © 2018 Coaching Actuaries. All Rights Reserved. 3

SHORT-TERM INSURANCES Expenses and Profit

SHORT-TERM INSURANCES SHORT-TERM INSURANCES Expenses and Profit 𝐸𝐸ä

Variable Expense Ratio: 𝑉𝑉𝐸𝐸= ä

Insurance Coverages Variable Expense Ratio: 𝑉𝑉 = 𝑃𝑃

Insurance Coverages 𝑃𝑃ç

𝐸𝐸

Homeowners Coinsurance

Homeowners Coinsurance 𝐼𝐼 Fixed Expense Ratio: 𝐹𝐹𝐸𝐸= ç

𝐼𝐼 Fixed Expense Ratio: 𝐹𝐹 = 𝑃𝑃

min 0𝐼𝐼, ⋅ 𝐿𝐿7 , 𝐼𝐼 < 𝑐𝑐𝑐𝑐 𝑃𝑃

Permissible Loss Ratio: PLR = 1 − 𝑉𝑉 − 𝑄𝑄 ,

Compensation: 𝑃𝑃 = min / 0𝐼𝐼, 𝐿𝐿7 , 𝐼𝐼 < 𝑐𝑐𝑐𝑐

⋅𝑐𝑐𝑐𝑐 Permissible Loss Ratio: PLR = 1 − 𝑉𝑉 − 𝑄𝑄ë , ë

Compensation: 𝑃𝑃 = / 𝑐𝑐𝑐𝑐 where 𝑄𝑄ë is the target profit and contingencies ratio

min(𝐼𝐼, 𝐿𝐿) , 𝐼𝐼 ≥ 𝑐𝑐𝑐𝑐 where 𝑄𝑄 is the target profit and contingencies ratio

min(𝐼𝐼, 𝐿𝐿) , 𝐼𝐼 ≥ 𝑐𝑐𝑐𝑐

ë

Disappearing Deductible Premium

Disappearing Deductible Premium

Deductible decreases linearly over a specific range:

Deductible decreases linearly over a specific range:

𝑑𝑑, 𝑋𝑋 ≤ 𝑎𝑎

𝑑𝑑, 𝑋𝑋 ≤ 𝑎𝑎 Premium

𝑏𝑏 − 𝑋𝑋

𝐷𝐷 = =𝑏𝑏𝑑𝑑 − 0 𝑋𝑋 7 , 𝑎𝑎 < 𝑋𝑋 ≤ 𝑏𝑏

𝐷𝐷 = =𝑑𝑑 0 𝑏𝑏 − 7 ,𝑎𝑎 𝑎𝑎 < 𝑋𝑋 ≤ 𝑏𝑏

𝑏𝑏 − 𝑎𝑎0, 𝑋𝑋 > 𝑏𝑏

Claim Payment: 0, 𝑋𝑋 > 𝑏𝑏 Aggregation Current Rate Level

Claim Payment: 0, 𝑋𝑋 ≤ 𝑑𝑑

⎧ 0, 𝑋𝑋 ≤ 𝑑𝑑 • Calendar Year (CY) • Extension of Exposures

⎪ 𝑋𝑋 𝑋𝑋

⎧ − 𝑑𝑑, 𝑑𝑑 < 𝑋𝑋 ≤ 𝑎𝑎

− 𝑑𝑑, 𝑑𝑑 < 𝑋𝑋 ≤ 𝑎𝑎 • Policy Year (PY) Method

𝑌𝑌⎪= 𝑏𝑏 − 𝑋𝑋 • Parallelogram Method

𝑌𝑌 = ⎨ 𝑋𝑋 − 𝑏𝑏𝑑𝑑 − 0 𝑋𝑋 7 , 𝑎𝑎 < 𝑋𝑋 ≤ 𝑏𝑏

⎨ 𝑋𝑋⎪− 𝑑𝑑 0 𝑏𝑏 −7 ,𝑎𝑎 𝑎𝑎 < 𝑋𝑋 ≤ 𝑏𝑏

⎪ ⎩ 𝑏𝑏 − 𝑋𝑋,𝑎𝑎 𝑋𝑋 > 𝑏𝑏

⎩ 𝑋𝑋, 𝑋𝑋 > 𝑏𝑏

Loss Reserving Premium at Current Rates

Loss Reserving

Expected Loss Ratio Method

Expected Loss Ratio Method

1. 𝐿𝐿KLMN. = 𝑃𝑃P ⋅ 𝐸𝐸𝐸𝐸𝐸𝐸

Unearned premium for CY 𝑖𝑖:

1. 𝐿𝐿KLMN. = 𝑃𝑃KPLMN. ⋅ 𝐸𝐸𝐸𝐸𝐸𝐸 Unearned premium for CY 𝑖𝑖:

2. 𝑅𝑅 K= 𝐿𝐿 − 𝐿𝐿S 𝑃𝑃í = 𝑃𝑃ì − 𝑃𝑃P + í

í 𝑃𝑃Us\

2. 𝑅𝑅 = 𝐿𝐿LMN. − 𝐿𝐿S 𝑃𝑃Uí =U 𝑃𝑃Uì −U 𝑃𝑃UP +U 𝑃𝑃Us\

Chain-Ladder Method

Extension of Exposures Method

Chain-Ladder Method Extension of Exposures Method

a.k.a. Loss Development Triangle Method Recalculates the premiums of historical policies under the current rate level

a.k.a. Loss Development Triangle Method Recalculates the premiums of historical policies under the current rate level

1.LMN.𝑓𝑓ULMN. =X∏X WYZ[\ 𝑓𝑓W

1. 𝑓𝑓U = ∏WYZ[\ 𝑓𝑓W Parallelogram Method

Parallelogram Method

2. K

𝐿𝐿 LMN.

= 𝐿𝐿 ⋅ 𝑓𝑓ULMN. Calculates average factors to be applied to the aggregate historical premiums

2. 𝐿𝐿KLMN.

U =U

𝐿𝐿 U,Z ⋅ U,ZLMN.

𝑓𝑓 U Calculates average factors to be applied to the aggregate historical premiums

3. 𝑅𝑅 K= KLMN. − S to make them on-level

LMN.𝐿𝐿 S 𝐿𝐿

3. 𝑅𝑅 = 𝐿𝐿 − 𝐿𝐿 to make them on-level

Bornhuetter-Ferguson Method

Ratemaking

Bornhuetter-Ferguson Method Ratemaking

1 Loss Ratio Method

𝑅𝑅 = 𝐿𝐿KLMN. 01 − 1 7 where Loss Ratio Method 𝐿𝐿𝐿𝐿 + 𝐹𝐹

𝑅𝑅 = 𝐿𝐿KLMN. 01 − LMN.𝑓𝑓7LMN. where Indicated Avg. Rate Change =𝐿𝐿𝐿𝐿 + 𝐹𝐹 − 1

K LMN. 𝑓𝑓 Indicated Avg. Rate Change = 1 − 𝑉𝑉 − 𝑄𝑄− 1

• 𝐿𝐿 is calculated based on the expected loss ratio method 1 − 𝑉𝑉 − 𝑄𝑄ë ë

• 𝐿𝐿KLMN. is calculated based on the expected loss ratio method

• 𝑓𝑓 LMN. is calculated based on the chain-ladder method

𝐿𝐿𝑅𝑅U

• 𝑓𝑓 LMN. is calculated based on the chain-ladder method Indicated Relativity = Current Relativity 𝐿𝐿𝑅𝑅 ⋅ U

Alternatively, Indicated RelativityU = UCurrent RelativityU ⋅ U 𝐿𝐿𝑅𝑅òôöõ

Alternatively, 1

𝐿𝐿𝑅𝑅òôöõ

1 + Indicated Avg. Rate Change

𝑅𝑅 = 𝑤𝑤 ⋅ 𝑅𝑅 + (1 − 𝑤𝑤) ⋅ 𝑅𝑅gi where 𝑤𝑤 =1 LMN.

Indicated Base Rate = Current Base Rate 1+ ⋅ Indicated Avg. Rate Change

𝑅𝑅 = 𝑤𝑤 ⋅ 𝑅𝑅fg +fg(1 − 𝑤𝑤) ⋅ 𝑅𝑅gi where 𝑤𝑤 = LMN.𝑓𝑓 Indicated Base Rate = Current Base Rate ⋅ Off-Balance Factor

𝑓𝑓

Indicated Avg. RelativityOff-Balance Factor

Frequency-Severity Method

Frequency-Severity Method Off-Balance FactorIndicated Avg.

= Relativity

Alternate Method: Off-Balance Factor = Current Avg. Relativity

Alternate Method: Current Avg. Relativity

1. Apply the chain-ladder method to frequency and severity separately

Pure Premium Method

1. Apply the chain-ladder method to frequency and severity separately

2. 𝐿𝐿KLMN. k=LMN.𝑁𝑁 k LMN. LMN.

K ⋅ 𝑋𝑋

K LMN. Pure Premium Method

𝐿𝐿† + 𝐸𝐸†ç

2. 𝐿𝐿KLMN. = 𝑁𝑁 LMN. ⋅ 𝑋𝑋 S

3. 𝑅𝑅 K= K

𝐿𝐿 − 𝐿𝐿 Indicated Avg. Rate =𝐿𝐿† + 𝐸𝐸†ç

3. 𝑅𝑅 = 𝐿𝐿LMN. − 𝐿𝐿S Indicated Avg. Rate = 1 − 𝑉𝑉 − 𝑄𝑄

Closure Method:

1 − 𝑉𝑉 − 𝑄𝑄ë ë

Closure Method:

Avg. RateU

Frequency Avg. Relativity Avg. = RateU

Frequency Avg. RelativityU = U Base Rate

1. 𝑐𝑐U,W = lkm,n

lm,n

Base RateU U

1. 𝑐𝑐U,W = ompqr. som,ntu 𝐿𝐿

𝐿𝐿U U

o kmpqr. so

kULMN. − 𝑁𝑁U,Ws\z Adj. 𝐿𝐿† =

Adj. 𝐿𝐿†U = U Avg. RelativityU ⋅ Exposure

m,ntu

2. 𝑛𝑛wU,W = 𝑐𝑐̂kWLMN. y𝑁𝑁

2. 𝑛𝑛wU,W = 𝑐𝑐̂W y𝑁𝑁U − 𝑁𝑁U,Ws\z

Avg. RelativityU ⋅ ExposureU U

Aggregate

Adj. 𝐿𝐿†U

Aggregate Indicated Relativity =Adj. 𝐿𝐿†U

|1. 𝑙𝑙|U,W = 𝑛𝑛wU,W ⋅ 𝑥𝑥wU,W Indicated RelativityU = U Adj. 𝐿𝐿†òôöõ

1. 𝑙𝑙U,W = 𝑛𝑛wU,W ⋅ 𝑥𝑥wU,W

2. 𝑅𝑅 = ∑U[WÄ 𝑙𝑙|U,W , where 𝑦𝑦 is the valuation CY

Adj. 𝐿𝐿†òôöõ

2. 𝑅𝑅 = ∑U[WÄ 𝑙𝑙|U,W , where 𝑦𝑦 is the valuation CY

Indicated Avg. Rate

Indicated Base Rate =Indicated Avg. Rate

Data Preparation Indicated Base Rate = Indicated Avg. Relativity

Data Preparation Indicated Avg. Relativity

Losses

Losses

Credibility-Weighted Relativities

Credibility-Weighted Relativities

Losses New Relativity = 𝑍𝑍(Indicated Relativity) + (1 − 𝑍𝑍)(Current Relativity)

New Relativity

= 𝑍𝑍(Indicated Relativity) + (1 − 𝑍𝑍)(Current Relativity)

Other Topics

Other Topics

Increased Limit Factor

Increased Limit Factor

𝐿𝐿𝐿𝐿𝐿𝐿(𝑢𝑢) + 𝑅𝑅𝐿𝐿ß

Aggregation Develop to Trending

𝐼𝐼𝐼𝐼𝐼𝐼𝐿𝐿𝐿𝐿𝐿𝐿(𝑢𝑢)

= + 𝑅𝑅𝐿𝐿ß

• Calendar Year (CY) Ultimate • Trend Period 𝐼𝐼𝐼𝐼𝐼𝐼 =

𝐿𝐿𝐿𝐿𝐿𝐿(𝑏𝑏) + 𝑅𝑅𝐿𝐿

𝐿𝐿𝐿𝐿𝐿𝐿(𝑏𝑏) + 𝑅𝑅𝐿𝐿® ®

• Accident Year (AY) • Loss Development • Trend Factor • 𝑏𝑏: original limit

• 𝑏𝑏: original limit

• Policy Year (PY) Factors • 𝑢𝑢: increased limit

• 𝑢𝑢: increased limit

Rate of policy variation with limit 𝑢𝑢 = 𝐼𝐼𝐼𝐼𝐹𝐹ß ⋅ Indicated Base Rate

Rate of policy variation with limit 𝑢𝑢

= 𝐼𝐼𝐼𝐼𝐹𝐹ß ⋅ Indicated Base Rate

Loss Elimination Ratio

Loss Elimination Ratio

𝐿𝐿𝐿𝐿𝐿𝐿(𝑑𝑑) − 𝐿𝐿𝐿𝐿𝐿𝐿(𝑏𝑏)

Projected Losses

𝐿𝐿𝐿𝐿𝑅𝑅 𝐿𝐿𝐿𝐿𝐿𝐿(𝑑𝑑)

= − 𝐿𝐿𝐿𝐿𝐿𝐿(𝑏𝑏)

𝐿𝐿𝐿𝐿𝑅𝑅© =© 𝑥𝑥̅ − 𝐿𝐿𝐿𝐿𝐿𝐿(𝑏𝑏)

𝑥𝑥̅ − 𝐿𝐿𝐿𝐿𝐿𝐿(𝑏𝑏)

Incurred losses for CY 𝑖𝑖: 𝐿𝐿É = 𝐿𝐿S + 𝑅𝑅 − 𝑅𝑅 • 𝑏𝑏: original deductible

Incurred losses for CY 𝑖𝑖: 𝐿𝐿ÉU = U𝐿𝐿SU +U 𝑅𝑅U − U𝑅𝑅Us\ Us\ • 𝑏𝑏: original deductible

where 𝑅𝑅U is the reserves at the end of CY 𝑖𝑖 • 𝑢𝑢: increased deductible

where 𝑅𝑅U is the reserves at the end of CY 𝑖𝑖 • 𝑢𝑢: increased deductible

Rate of policy variation with deductible 𝑑𝑑 = (1 − 𝐿𝐿𝐿𝐿𝑅𝑅 ) ⋅ Indicated Base Rate

Incurred losses for AY or PY 𝑖𝑖: 𝐿𝐿É = 𝐿𝐿S + 𝑅𝑅 Rate of policy variation with deductible 𝑑𝑑 = (1 − 𝐿𝐿𝐿𝐿𝑅𝑅© ) ⋅©Indicated Base Rate

Incurred losses for AY or PY 𝑖𝑖: 𝐿𝐿ÉU = U𝐿𝐿SU +U 𝑅𝑅U U

where 𝑅𝑅U is the reserves as of the valuation date

where 𝑅𝑅U is the reserves as of the valuation date

Copyright © 2018 Coaching Actuaries. All Rights Reserved. 4

www.coachingactuaries.com

www.coachingactuaries.com Personal copies

Copyright permitted.

© 2018 Resale

Coaching or distribution

Actuaries. is prohibited.

All Rights Reserved. 4

Das könnte Ihnen auch gefallen

- GUO P ManualDokument432 SeitenGUO P ManualYiran CaoNoch keine Bewertungen

- Ltam Formula Sheet PDFDokument7 SeitenLtam Formula Sheet PDFbemiphucro50% (2)

- Ifm Formula Sheet ADokument12 SeitenIfm Formula Sheet AFPNoch keine Bewertungen

- Guo Spring 08 PDokument434 SeitenGuo Spring 08 PYutaro TanakaNoch keine Bewertungen

- Exam C Manual PDFDokument2 SeitenExam C Manual PDFJohnathan0% (1)

- FM GuoDokument664 SeitenFM GuoLoh Hui Yin86% (7)

- SOA Exam FM CASDokument1.368 SeitenSOA Exam FM CASSolomonJOBSNoch keine Bewertungen

- H. Mahler Study Aids For SOA Exam C and CAS Exam 4 2013 NodrmDokument4.960 SeitenH. Mahler Study Aids For SOA Exam C and CAS Exam 4 2013 NodrmBob Liu100% (3)

- Deeper Understanding, Faster Calculation - Exam P Insights and ShortcutsDokument432 SeitenDeeper Understanding, Faster Calculation - Exam P Insights and ShortcutsSteven Lai88% (8)

- Exam FM: You Have What It Takes To PassDokument5 SeitenExam FM: You Have What It Takes To Passenquiry no100% (2)

- A&J Study Manual For SOA Exam FM/ CAS Exam 2Dokument19 SeitenA&J Study Manual For SOA Exam FM/ CAS Exam 2anjstudymanual70% (10)

- A&J Flashcards For SOA Exam P/CAS Exam 1Dokument28 SeitenA&J Flashcards For SOA Exam P/CAS Exam 1anjstudymanualNoch keine Bewertungen

- Arch MLCDokument471 SeitenArch MLCStéphanie Gagnon100% (3)

- FM Formula Sheet 2022Dokument3 SeitenFM Formula Sheet 2022Laura StephanieNoch keine Bewertungen

- Lecture 24Dokument8 SeitenLecture 24gewaray536Noch keine Bewertungen

- SOA Exam MFE Flash CardsDokument21 SeitenSOA Exam MFE Flash CardsSong Liu100% (2)

- Coaching Actuaries P Complete Formula PDFDokument3 SeitenCoaching Actuaries P Complete Formula PDFbernabarillo100% (1)

- Formulas For The MFE ExamDokument17 SeitenFormulas For The MFE ExamrortianNoch keine Bewertungen

- Finance 2017Dokument4 SeitenFinance 2017Aamir0% (1)

- A&J Questions Bank For SOA Exam MFE/ CAS Exam 3FDokument24 SeitenA&J Questions Bank For SOA Exam MFE/ CAS Exam 3Fanjstudymanual100% (1)

- Exam P FormulasDokument2 SeitenExam P Formulasasdfg888100% (1)

- Examp Formula SheetsDokument6 SeitenExamp Formula SheetsSanjay GhimireNoch keine Bewertungen

- MFEDokument531 SeitenMFEJi Li100% (3)

- Formulas For SOA/CAS Exam FM/2Dokument15 SeitenFormulas For SOA/CAS Exam FM/2jeff_cunningham_11100% (3)

- DUMLC Guo ManualDokument68 SeitenDUMLC Guo ManualJose Martinez-Gracida50% (2)

- Exam LTAM: You Have What It Takes To PassDokument12 SeitenExam LTAM: You Have What It Takes To Passderianfg100% (1)

- Actuarial Mathematics (Lecture Notes) PDFDokument168 SeitenActuarial Mathematics (Lecture Notes) PDFVladimir Montero100% (1)

- YGM Manual MLCDokument285 SeitenYGM Manual MLCNyikoEvensNoch keine Bewertungen

- Guo-Deeper Understanding Faster Calc SOA MFE PDFDokument538 SeitenGuo-Deeper Understanding Faster Calc SOA MFE PDFPierre-Louis TruchetNoch keine Bewertungen

- A&J Flashcards For Exam SOA Exam FM/ CAS Exam 2Dokument39 SeitenA&J Flashcards For Exam SOA Exam FM/ CAS Exam 2anjstudymanualNoch keine Bewertungen

- ADAPT Formula Sheet PDFDokument2 SeitenADAPT Formula Sheet PDFMariahDeniseCarumbaNoch keine Bewertungen

- MLC Preparation NotesDokument87 SeitenMLC Preparation NotesSasha WoodroffeNoch keine Bewertungen

- Exam FM Practice Exam With Answer KeyDokument71 SeitenExam FM Practice Exam With Answer KeyAki TsukiyomiNoch keine Bewertungen

- Guo S Manuals SOA Exam C PDFDokument284 SeitenGuo S Manuals SOA Exam C PDFAustin FritzkeNoch keine Bewertungen

- Sample Chapter From Yufeng Guo's Study GuideDokument22 SeitenSample Chapter From Yufeng Guo's Study Guide赤铁炎Noch keine Bewertungen

- Actuarial Mathematics Ii: AboutDokument107 SeitenActuarial Mathematics Ii: AboutClerry SamuelNoch keine Bewertungen

- MLC FormulasDokument17 SeitenMLC Formulasvermanerds100% (1)

- Stam Formula SheetDokument8 SeitenStam Formula SheetAlfredo Leonardo Mijares ColmenaresNoch keine Bewertungen

- Distributions Formulas (Formula Sheet)Dokument2 SeitenDistributions Formulas (Formula Sheet)mariammaged981Noch keine Bewertungen

- Form p1 Me414Dokument1 SeiteForm p1 Me414Fabrício EugênioNoch keine Bewertungen

- Assignment 10 AnsDokument10 SeitenAssignment 10 AnsAnuska DeyNoch keine Bewertungen

- ( ) : ( ) ( - ) ( - ) Máxima SimilitudDokument1 Seite( ) : ( ) ( - ) ( - ) Máxima SimilitudErick XavierNoch keine Bewertungen

- Formulario Mate IV - M. PatlánDokument2 SeitenFormulario Mate IV - M. PatlánKaren CardonaNoch keine Bewertungen

- EEE 147 ReviewerDokument4 SeitenEEE 147 Reviewerfrancojieo27Noch keine Bewertungen

- Formulario Examen Segudo HemiDokument5 SeitenFormulario Examen Segudo HemiAndres CalderonNoch keine Bewertungen

- Beta Gamma Function Unit IDokument16 SeitenBeta Gamma Function Unit IDhiren PanditNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledTsubasa EndoNoch keine Bewertungen

- 2 FourierDokument17 Seiten2 FourierTingyang YUNoch keine Bewertungen

- Statistics ProofsDokument1 SeiteStatistics ProofsRaghad Al-ShaikhNoch keine Bewertungen

- MT1 EquationSheet PDFDokument1 SeiteMT1 EquationSheet PDFzndr27Noch keine Bewertungen

- Derivadas: Teoremas Básicos para Derivadas 1. ( ), ( ) 0Dokument2 SeitenDerivadas: Teoremas Básicos para Derivadas 1. ( ), ( ) 0Daniela OrtizNoch keine Bewertungen

- Lec 07-08 - FinalDokument32 SeitenLec 07-08 - FinalNadeem ArainNoch keine Bewertungen

- EDA - FormulaDokument2 SeitenEDA - FormulaLyka Mae MancolNoch keine Bewertungen

- Chapter 5 &6 Differentiation &its Applications: Quotient RuleDokument2 SeitenChapter 5 &6 Differentiation &its Applications: Quotient RuleRahul SinghNoch keine Bewertungen

- Absorption InfoflowDokument3 SeitenAbsorption InfoflowZed Brier OdilaoNoch keine Bewertungen

- Negative Order Integer Calculus Using Iterative IntegrationDokument5 SeitenNegative Order Integer Calculus Using Iterative IntegrationInije EjiroNoch keine Bewertungen

- Lecture 3Dokument5 SeitenLecture 3Debayan BiswasNoch keine Bewertungen

- 234-Lectures 1 2Dokument7 Seiten234-Lectures 1 2yazan aNoch keine Bewertungen

- Final Formula Sheet MArk3120Dokument2 SeitenFinal Formula Sheet MArk3120Sophia RosieeNoch keine Bewertungen

- Inverse Trigonometric Functions (Trigonometry) Mathematics Question BankVon EverandInverse Trigonometric Functions (Trigonometry) Mathematics Question BankNoch keine Bewertungen

- A-level Maths Revision: Cheeky Revision ShortcutsVon EverandA-level Maths Revision: Cheeky Revision ShortcutsBewertung: 3.5 von 5 Sternen3.5/5 (8)

- PygmyManual v2 - 31Dokument67 SeitenPygmyManual v2 - 31myplaxisNoch keine Bewertungen

- Chemistry 460 Problems: SET 1, Statistics and Experimental DesignDokument69 SeitenChemistry 460 Problems: SET 1, Statistics and Experimental DesignDwie Sekar Tyas PrawestryNoch keine Bewertungen

- Bsi Bs en 1366-8 Smoke Extraction DuctsDokument40 SeitenBsi Bs en 1366-8 Smoke Extraction DuctsMUSTAFA OKSUZNoch keine Bewertungen

- Irc 89 PDFDokument49 SeitenIrc 89 PDFShashank SrivastavaNoch keine Bewertungen

- Grade Beam Design CalculationDokument3 SeitenGrade Beam Design CalculationArnold VercelesNoch keine Bewertungen

- Thermal Analysis of Concrete DamDokument9 SeitenThermal Analysis of Concrete DamchayoubhaasNoch keine Bewertungen

- Principles of Communication Systems LAB: Lab Manual (EE-230-F) Iv Sem Electrical and Electronics EngineeringDokument87 SeitenPrinciples of Communication Systems LAB: Lab Manual (EE-230-F) Iv Sem Electrical and Electronics Engineeringsachin malikNoch keine Bewertungen

- Certificate: Internal Examiner External ExaminerDokument51 SeitenCertificate: Internal Examiner External ExamineraryanNoch keine Bewertungen

- NTPC Nabinagar BiharDokument3 SeitenNTPC Nabinagar BiharTECH FoReVerNoch keine Bewertungen

- Chapter 13Dokument5 SeitenChapter 13Shrey MangalNoch keine Bewertungen

- Diagnostic Trouble Code Index AllisonDokument16 SeitenDiagnostic Trouble Code Index AllisonLuis Gongora100% (6)

- Reversi (Othello) - Game StrategyDokument11 SeitenReversi (Othello) - Game StrategysuperyoopyNoch keine Bewertungen

- Part Number 27-60 Revision B: Installation, Operation, and Maintenance With Illustrated Parts BreakdownDokument66 SeitenPart Number 27-60 Revision B: Installation, Operation, and Maintenance With Illustrated Parts BreakdownLuis Eduardo Albarracin RugelesNoch keine Bewertungen

- SortDokument174 SeitenSortPeter CampellNoch keine Bewertungen

- Exambank HigherDokument62 SeitenExambank HigherJust WadeNoch keine Bewertungen

- Piping Presentation - PpsDokument61 SeitenPiping Presentation - PpsVijayabaraniNoch keine Bewertungen

- Detailed Lesson Plan (DLP) Format: Nowledge ObjectivesDokument2 SeitenDetailed Lesson Plan (DLP) Format: Nowledge ObjectivesErwin B. NavarroNoch keine Bewertungen

- ORM-II Theory+exercise+ Answer PDFDokument58 SeitenORM-II Theory+exercise+ Answer PDFGOURISH AGRAWALNoch keine Bewertungen

- IBM PVM Getting Started GuideDokument104 SeitenIBM PVM Getting Started GuideNoureddine OussouNoch keine Bewertungen

- Yagi Antenna Desig 00 Un SeDokument232 SeitenYagi Antenna Desig 00 Un Sefrankmhowell100% (1)

- Predictive Data Mining and Discovering Hidden Values of Data WarehouseDokument5 SeitenPredictive Data Mining and Discovering Hidden Values of Data WarehouseLangit Merah Di SelatanNoch keine Bewertungen

- Basics of Robotics 24.06.2020Dokument25 SeitenBasics of Robotics 24.06.2020prabhaNoch keine Bewertungen

- Mobile Working Hydraulic System DynamicsDokument107 SeitenMobile Working Hydraulic System Dynamicsbr1404100% (1)

- Research On The Formation of M1-Type Alite Doped With MgO and SO3-a Route To Improve The Quality of Cement Clinker With A High Content of MgODokument11 SeitenResearch On The Formation of M1-Type Alite Doped With MgO and SO3-a Route To Improve The Quality of Cement Clinker With A High Content of MgODerekNoch keine Bewertungen

- KeyViewFilterSDK 12.10 DotNetProgrammingDokument270 SeitenKeyViewFilterSDK 12.10 DotNetProgrammingOswaldo JuradoNoch keine Bewertungen

- 7805 Regulator DescriptionDokument4 Seiten7805 Regulator DescriptionyeateshwarriorNoch keine Bewertungen

- Airstage J-IIDokument6 SeitenAirstage J-IIBulclimaNoch keine Bewertungen

- Moventas PH2900.2 - FinésDokument13 SeitenMoventas PH2900.2 - FinésDaniel Fuhr100% (1)

- Man Act GB Vec211r4Dokument218 SeitenMan Act GB Vec211r4Román AndrésNoch keine Bewertungen