Beruflich Dokumente

Kultur Dokumente

Bar Questions 2017 TAX

Hochgeladen von

Elaine HonradeCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bar Questions 2017 TAX

Hochgeladen von

Elaine HonradeCopyright:

Verfügbare Formate

Allowable Deductions

1. Calvin Dela Pisa was a Permits and Licensing Officer (rank-and-file) of Sta. Portia Realty Corporation (SPRC). He

invited the Regional Director of the Housing and Land Use Regulatory Board (HLURB) to lunch at the Sulo Hotel in

Quezon City to discuss the approval of SPRC's application for a development permit in connection with its subdivision

development project in Pasig City. At breakfast the following day, Calvin met a prospective client interested to enter

into a joint venture with SPRC for the construction of a residential condominium unit in Cainta, Rizal.

Calvin incurred expenses for the lunch and breakfast meetings he had with the Regional Director of HLURB and the

prospective client, respectively. The expenses were duly supported by official receipts issued in his name. At month's

end, he requested the reimbursement of his expenses, and SPRC granted his request.

(a) Can SPRC claim an allowable deduction for the expenses incurred by Calvin? Explain your answer. (2.5%)

(b) Is the reimbursement received by Calvin from SPRC subject to tax? Explain your answer. (2.5%)

Answers:

a. Under the Tax Code, business expenses are allowed as a deduction provided that they are ordinary and

necessary expenditures, directly connected with or pertaining to the taxpayer’s trade or business and that

such expenses are substantiated by adequate proof like official receipts. Applying the requisites in the case

at bar, Calvin’s incurred expenses with respect to the HLURB Director cannot be considered as ordinary and

necessary because the application and approval of a subdivision development permit need not be discussed

outside the place of work of the HLURB Regional Director. Although these are directly connected with the

taxpayer’s business and substantiated with official receipts, it fell short of the first requirement. With respect

to the expenses incurred in meeting a prospective client, those expenses are considered ordinary and

necessary because those are helpful in the development of the taxpayer’s business. Therefore, only the

expenses incurred with respect to the prospective client can be claimed as a deduction by SPRC.

b. No. As a general rule, allowances received by a public officer or employee of a private entity in addition to

his regular compensation is a compensation subject to withholding tax. However, any amount paid, either as

advances or reimbursements, are not considered as compensation subject to withholding tax if they were

incurred as ordinary and necessary or they are reasonably incurred by the employee in the performance of his

duties.

Double Taxation; Interest Income; Withholding Tax

2. Upon his retirement, Alfredo transferred his savings derived from his salary as a marketing assistant to a time deposit

with AAB Bank. The bank regularly deducted 20% final withholding tax on the interest income from the time deposit.

Alfredo contends that the 20% final tax on the interest income constituted double taxation because his salary had been

already subjected to withholding tax.

Is Alfredo's contention correct? Explain your answer. (3%)

Answer: No. Based on jurisprudence, there is double taxation when the same property has been taxed twice

when it should have been taxed once. Both taxes must be imposed on the same property or subject matter for

the same purpose. It must be imposed by the same taxing authority. It must be taxed within the same

jurisdiction during the same taxing period and lastly it must be of the same kind and character. In this case,

while taxes were imposed twice on the same subject matter by the same taxing authority, the character and

purpose for which they were taxed are entirely distinct from one another and that the taxes were not imposed

during the same tax period.

Exclusions Gross Income

3.. The Board of Directors of Sumo Corporation, a company primarily engaged in the business of marketing and

distributing pest control products, approved the partial cessation of its commercial operations, resulting in the

separation of 32 regular employees. Only half of the affected employees were notified of the board resolution.

Rule on the taxability of the separation pay and indemnity that will be received by the affected employees as the result

of their separation from service. Explain your answer. (3%)

Answer: Under the Tax Code, any amount received by an official or employee or by his heirs from the employer

as consequence from the service of the employer because of death, sickness or other physical disability or

for any cause beyond the control of the said official or employee shall be exempt from taxation on gross

income. In this case, the separation of the affected employees was due to cessation of commercial operations

by the employer, a cause beyond the control of the employees. That being the case, whatever amount that

may be received by the employee shall be exempt from tax on gross income.

Real Property Tax; Income Tax

4.San Juan University is a non-stock, non-profit educational institution. It owns a piece of land in Caloocan City on

which its three 2-storey school buildings stood. Two of the buildings are devoted to classrooms, laboratories, a canteen,

a bookstore and administrative offices. The third building is reserved as dormitory for student athletes who are granted

scholarships for a given academic year.

In 2017, San Juan University earned income from tuition fees and from leasing a portion of its premises to various

concessionaires of food, books, and school supplies.

(a) Can the City Treasurer of Caloocan City collect real property taxes on the land and building of San Juan University?

Explain your answer. (5%)

Generally no. Under the Constitution, lands, buildings, and improvements actually, directly and exclusively

used for educational purposes are exempt from property tax whether the educational institution is

proprietary or non-profit.

(b) Is the income earned by San Juan University for the year 2017 subject to income tax? Explain your answer. (5%)

Yes. Revenue or income from trade, business or other activity, the conduct of which is not related to the

exercise or performance of religious, educational and charitable purposes or functions shall be subject to

internal revenue taxes when the same is not actually, directly or exclusively used for the intended purposes.

Das könnte Ihnen auch gefallen

- Wills 2nd ReviewerDokument5 SeitenWills 2nd ReviewerronaldNoch keine Bewertungen

- Compiled Cases For Succession Project Full Time StudentsDokument94 SeitenCompiled Cases For Succession Project Full Time StudentsYanz RamsNoch keine Bewertungen

- Commercial Law FaqsDokument30 SeitenCommercial Law FaqsDiane UyNoch keine Bewertungen

- EUFRACIO D. ROJAS, Plaintiff-Appellant, vs. CONSTANCIO B. MAGLANA, Defendant-Appellee. G.R. No. 30616 - December 10, 1990 - PARAS, J.: FactsDokument9 SeitenEUFRACIO D. ROJAS, Plaintiff-Appellant, vs. CONSTANCIO B. MAGLANA, Defendant-Appellee. G.R. No. 30616 - December 10, 1990 - PARAS, J.: FactsRyanNewEraNoch keine Bewertungen

- 21 Labor Relations BarQADokument5 Seiten21 Labor Relations BarQALuz Celine CabadingNoch keine Bewertungen

- Conducting Cash Exams Step-by-StepDokument22 SeitenConducting Cash Exams Step-by-StepBon Carlo Medina MelocotonNoch keine Bewertungen

- Lim VS. HMR Phils. Inc. DigestDokument3 SeitenLim VS. HMR Phils. Inc. DigestKriziaItao100% (1)

- Genil vs. RiveraDokument2 SeitenGenil vs. RiveraElaine HonradeNoch keine Bewertungen

- Retail Invoice for MedicinesDokument1 SeiteRetail Invoice for MedicinesSapat DasNoch keine Bewertungen

- CORPO Finals Case DigestsDokument71 SeitenCORPO Finals Case DigestsKeith Wally Balamban88% (17)

- PUBCORP Reviewer PM PDFDokument8 SeitenPUBCORP Reviewer PM PDFThe ChogsNoch keine Bewertungen

- Merope de Catalan vs. Loula Catalan-Lee (Doctrine of Presumed-Identity Approach or Processual Presumption)Dokument2 SeitenMerope de Catalan vs. Loula Catalan-Lee (Doctrine of Presumed-Identity Approach or Processual Presumption)Andrei Jose V. LayeseNoch keine Bewertungen

- RAMOS - Diaz Vs PeopleDokument5 SeitenRAMOS - Diaz Vs PeopleRovi Kennth RamosNoch keine Bewertungen

- 3M TSN 2015 - Provisional Remedies CompleteDokument63 Seiten3M TSN 2015 - Provisional Remedies CompleteCid Benedict PabalanNoch keine Bewertungen

- Tax Bar QA 2013-2017Dokument62 SeitenTax Bar QA 2013-2017Victor LimNoch keine Bewertungen

- For Digest (Handwritten)Dokument11 SeitenFor Digest (Handwritten)Feliz Xhanea CanoyNoch keine Bewertungen

- Santos Vs Bishop of Nueva CaceresDokument1 SeiteSantos Vs Bishop of Nueva CaceresCJNoch keine Bewertungen

- Fule Vs CA (286 Scra 698) FulltextDokument10 SeitenFule Vs CA (286 Scra 698) FulltextTiu Bi ZhuNoch keine Bewertungen

- Saludo Vs American ExpressDokument3 SeitenSaludo Vs American Expressmelaniem_1Noch keine Bewertungen

- Pagal v. PeopleDokument5 SeitenPagal v. PeopleJulie BeeNoch keine Bewertungen

- Tax TSN Compilation Complete Team DonalvoDokument46 SeitenTax TSN Compilation Complete Team DonalvoEliza Den Devilleres100% (1)

- Mortgagee in Good Faith Doctrine InapplicableDokument3 SeitenMortgagee in Good Faith Doctrine Inapplicablerhodz 88Noch keine Bewertungen

- Labor Law Bar Q & A ARTS. 37-73: Submitted To: Atty. Voltaire DuanoDokument8 SeitenLabor Law Bar Q & A ARTS. 37-73: Submitted To: Atty. Voltaire DuanoJohn Lester TanNoch keine Bewertungen

- Labor2 Finals Reviewer JCTDokument110 SeitenLabor2 Finals Reviewer JCTAngelo TiglaoNoch keine Bewertungen

- Arts. 1 - 36Dokument23 SeitenArts. 1 - 36John Lester TanNoch keine Bewertungen

- Security Bank and Trust Company vs. GanDokument2 SeitenSecurity Bank and Trust Company vs. GanElaine HonradeNoch keine Bewertungen

- Double Taxation Prohibition in Manila Revenue CodeDokument8 SeitenDouble Taxation Prohibition in Manila Revenue CodeAna leah Orbeta-mamburamNoch keine Bewertungen

- 3 DfgasfgDokument5 Seiten3 DfgasfgFLOYD MORPHEUSNoch keine Bewertungen

- Labor Law Bar Q 2003Dokument4 SeitenLabor Law Bar Q 2003Mackoy WillchurchNoch keine Bewertungen

- Castillo v. de Leon-CastilloDokument2 SeitenCastillo v. de Leon-CastilloElaine HonradeNoch keine Bewertungen

- FINAL EXAM - Public Officers, Admin and Election Law (BarQs)Dokument17 SeitenFINAL EXAM - Public Officers, Admin and Election Law (BarQs)Venice Jamaila DagcutanNoch keine Bewertungen

- PIL CasesDokument297 SeitenPIL CasesAleah-Hidaya Ali Hadji RakhimNoch keine Bewertungen

- Dissenting Opinion LeonenDokument64 SeitenDissenting Opinion LeonenRapplerNoch keine Bewertungen

- Dissenting Opinion LeonenDokument64 SeitenDissenting Opinion LeonenRapplerNoch keine Bewertungen

- PMA Cadet Appeals Dismissal for Alleged Honor Code ViolationDokument7 SeitenPMA Cadet Appeals Dismissal for Alleged Honor Code ViolationElaine HonradeNoch keine Bewertungen

- Rivera Vs CADokument8 SeitenRivera Vs CAMae Anne PioquintoNoch keine Bewertungen

- Lorzano Vs Tabayag 665 SCRA 38, GR 189647 (Feb. 6, 2012)Dokument7 SeitenLorzano Vs Tabayag 665 SCRA 38, GR 189647 (Feb. 6, 2012)Lu Cas100% (1)

- Saura vs. AgdeppaDokument1 SeiteSaura vs. AgdeppaElaine HonradeNoch keine Bewertungen

- JCV Guia Incoterms 2020 - 7oct2019Dokument26 SeitenJCV Guia Incoterms 2020 - 7oct2019MAHER CASTRO CHÁVEZNoch keine Bewertungen

- Tenebro v. CADokument2 SeitenTenebro v. CAElaine HonradeNoch keine Bewertungen

- Donation Inter Vivos or Mortis Causa: Bonsato v. CA and Puig v. PenafloridaDokument7 SeitenDonation Inter Vivos or Mortis Causa: Bonsato v. CA and Puig v. PenafloridaNikko SterlingNoch keine Bewertungen

- Rosete vs. LimDokument2 SeitenRosete vs. LimElaine Honrade100% (1)

- National Housing Authority ordered to allocate Tatalon Estate lotsDokument4 SeitenNational Housing Authority ordered to allocate Tatalon Estate lotsElaine HonradeNoch keine Bewertungen

- People v. Lagman: Treachery Qualifies Stabbing to MurderDokument42 SeitenPeople v. Lagman: Treachery Qualifies Stabbing to MurderFrancis FlorentinNoch keine Bewertungen

- Magdayao vs. PeopleDokument2 SeitenMagdayao vs. PeopleElaine HonradeNoch keine Bewertungen

- Mercado vs. VitrioloDokument2 SeitenMercado vs. VitrioloElaine HonradeNoch keine Bewertungen

- Ga Vanessa May Quiz 3-Final TermDokument2 SeitenGa Vanessa May Quiz 3-Final TermVanessa May Caseres GaNoch keine Bewertungen

- People's Industrial and Commercial Employees Vs People's IndustrialDokument5 SeitenPeople's Industrial and Commercial Employees Vs People's IndustrialMarefel AnoraNoch keine Bewertungen

- Invalid Mortgage Due to Forgery and Lack of Due DiligenceDokument12 SeitenInvalid Mortgage Due to Forgery and Lack of Due DiligenceJanlo FevidalNoch keine Bewertungen

- Persons Bar Exam QDokument5 SeitenPersons Bar Exam QKate HizonNoch keine Bewertungen

- Alonso Vs Cebu Country ClubDokument6 SeitenAlonso Vs Cebu Country ClubJairus SociasNoch keine Bewertungen

- Maralit Case DigestDokument1 SeiteMaralit Case DigestKim Andaya-YapNoch keine Bewertungen

- II. Po Yeng Cho Vs Lim Ka YumDokument11 SeitenII. Po Yeng Cho Vs Lim Ka YumTalomo PulisNoch keine Bewertungen

- Legal Counseling First Exam Reviewer PDFDokument20 SeitenLegal Counseling First Exam Reviewer PDFMadeleine DinoNoch keine Bewertungen

- SUCCESSION TITLEDokument11 SeitenSUCCESSION TITLEAyen Rodriguez MagnayeNoch keine Bewertungen

- 2019 Bar Review: Taxation Law Chair'S CasesDokument19 Seiten2019 Bar Review: Taxation Law Chair'S CasesClarisse-joan Bumanglag GarmaNoch keine Bewertungen

- Preponderance of Evidence Standard Applied in Brokers Commission CaseDokument2 SeitenPreponderance of Evidence Standard Applied in Brokers Commission CaseJoshua AbadNoch keine Bewertungen

- Remedial Law March 03, 2022Dokument2 SeitenRemedial Law March 03, 2022MarcJunardJoverNoch keine Bewertungen

- Atty JBJ-Organizational JusticeDokument68 SeitenAtty JBJ-Organizational JusticeModiNoch keine Bewertungen

- Digest 2Dokument27 SeitenDigest 2Vianice BaroroNoch keine Bewertungen

- Montinola Vs VillanuevaDokument6 SeitenMontinola Vs VillanuevaJay TabuzoNoch keine Bewertungen

- Stockholders failed to exhaust remedies in derivative suitDokument1 SeiteStockholders failed to exhaust remedies in derivative suitjoyiveeongNoch keine Bewertungen

- 2 Sameer Overseas Placement Agency, Inc., Petitioner, vs. JOY C. CABILES, Respondent. G.R. No. 170139 August 5, 2014Dokument1 Seite2 Sameer Overseas Placement Agency, Inc., Petitioner, vs. JOY C. CABILES, Respondent. G.R. No. 170139 August 5, 2014James WilliamNoch keine Bewertungen

- Cipriano Verastigue, Et Al. V CADokument2 SeitenCipriano Verastigue, Et Al. V CAJohn YeungNoch keine Bewertungen

- Cagayan Fishing Dev. Co., Inc. v. Teodoro Sandiko, 65 Phil. 223 (1937)Dokument32 SeitenCagayan Fishing Dev. Co., Inc. v. Teodoro Sandiko, 65 Phil. 223 (1937)bentley CobyNoch keine Bewertungen

- MCIAA V Heirs of Marcelino SetoDokument3 SeitenMCIAA V Heirs of Marcelino SetoNLainie OmarNoch keine Bewertungen

- Civil Actions vs. Special Proceedings 5. Personal Actions and Real ActionsDokument4 SeitenCivil Actions vs. Special Proceedings 5. Personal Actions and Real ActionsHazel LunaNoch keine Bewertungen

- 5th BatchDokument48 Seiten5th BatchEmmanuel Enrico de VeraNoch keine Bewertungen

- Abanag v Mabute: No Admin Sanction for Breach of Promise to MarryDokument1 SeiteAbanag v Mabute: No Admin Sanction for Breach of Promise to MarryMonicaCelineCaroNoch keine Bewertungen

- Heirs Not Guilty of Fraud in Estate Tax ReturnDokument3 SeitenHeirs Not Guilty of Fraud in Estate Tax ReturnYsabelleNoch keine Bewertungen

- Tax Cases Page 6Dokument5 SeitenTax Cases Page 6MikhailFAbzNoch keine Bewertungen

- LaborDokument15 SeitenLaborAivan Dale B.CampillaNoch keine Bewertungen

- Purisima, Jr. V PurisimaDokument2 SeitenPurisima, Jr. V PurisimaAriel Christen EbradaNoch keine Bewertungen

- Angeles, Paul Mikee O. 1-qDokument5 SeitenAngeles, Paul Mikee O. 1-qMikee AngelesNoch keine Bewertungen

- Ching V. Goyanko GR NO. 165879 NOV. 10, 2006 Carpio-Morales, J.: FactsDokument3 SeitenChing V. Goyanko GR NO. 165879 NOV. 10, 2006 Carpio-Morales, J.: FactsKatherence D DavidNoch keine Bewertungen

- Negado Vs MakabentaDokument1 SeiteNegado Vs MakabentaMark Delos SantosNoch keine Bewertungen

- Chavez Vs PEADokument3 SeitenChavez Vs PEAElaine HonradeNoch keine Bewertungen

- Wiegel v. Sempio-DyDokument1 SeiteWiegel v. Sempio-DyElaine HonradeNoch keine Bewertungen

- BPI Vs SMPDokument1 SeiteBPI Vs SMPElaine HonradeNoch keine Bewertungen

- Small ClaimsDokument66 SeitenSmall ClaimsarloNoch keine Bewertungen

- Regala VS SBDokument5 SeitenRegala VS SBElaine HonradeNoch keine Bewertungen

- Art. 41, Family Code, Judicial Declaration of Presumptive Death Manuel v. People 476 SCRA 461 2005 FactsDokument2 SeitenArt. 41, Family Code, Judicial Declaration of Presumptive Death Manuel v. People 476 SCRA 461 2005 FactsElaine HonradeNoch keine Bewertungen

- Paz vs. Pavon G.R. No. 166579 18 February 2010Dokument2 SeitenPaz vs. Pavon G.R. No. 166579 18 February 2010vestiahNoch keine Bewertungen

- Roth vs. USDokument2 SeitenRoth vs. USElaine HonradeNoch keine Bewertungen

- PPL Vs SandiganbayanDokument1 SeitePPL Vs SandiganbayanElaine HonradeNoch keine Bewertungen

- Ocampo vs. Abando SC ruling on murder case against CPP-NPA membersDokument7 SeitenOcampo vs. Abando SC ruling on murder case against CPP-NPA membersElaine Honrade100% (1)

- Lim vs. Court of AppealsDokument2 SeitenLim vs. Court of AppealsElaine HonradeNoch keine Bewertungen

- Republic vs. Marcos-ManotocDokument4 SeitenRepublic vs. Marcos-ManotocElaine HonradeNoch keine Bewertungen

- Sex TraffickingDokument14 SeitenSex TraffickingElaine Honrade100% (1)

- Ra 10641Dokument6 SeitenRa 10641Sarah Jean CaneteNoch keine Bewertungen

- Environmental AnnotationDokument63 SeitenEnvironmental AnnotationIvan Angelo ApostolNoch keine Bewertungen

- Other Special LawsDokument9 SeitenOther Special LawsElaine HonradeNoch keine Bewertungen

- CaguioaDokument64 SeitenCaguioaRappler100% (1)

- Separate Opinion BernabeDokument35 SeitenSeparate Opinion BernabeRapplerNoch keine Bewertungen

- DE7Dokument2 SeitenDE7Ronnie Lee MickleNoch keine Bewertungen

- Account Statement From 1 Feb 2022 To 31 Jan 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument15 SeitenAccount Statement From 1 Feb 2022 To 31 Jan 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAarti ThdfcNoch keine Bewertungen

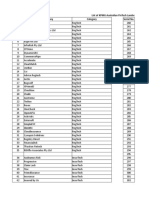

- List of KPMG Australian Fintech LandscapeDokument12 SeitenList of KPMG Australian Fintech LandscapeFaysal Bank Strategy TeamNoch keine Bewertungen

- Bank Statement Books: Deposits and Credits Checks and Debits Cash Receipts Cash DisbursementsDokument1 SeiteBank Statement Books: Deposits and Credits Checks and Debits Cash Receipts Cash DisbursementsSteven SandersonNoch keine Bewertungen

- Obc Sbi Gold N More Brochure PDFDokument11 SeitenObc Sbi Gold N More Brochure PDFRahul KainNoch keine Bewertungen

- 3879 0 0 0 0 3879 SGST (0006)Dokument2 Seiten3879 0 0 0 0 3879 SGST (0006)Nishi GuptaNoch keine Bewertungen

- Airtel Bill PDFDokument13 SeitenAirtel Bill PDFsourabhNoch keine Bewertungen

- Laundry InvoiceDokument1 SeiteLaundry InvoiceprashantkgargNoch keine Bewertungen

- 2307 New PDFDokument2 Seiten2307 New PDFallan paolo neveidaNoch keine Bewertungen

- Life Station Medical Alert BrochureDokument7 SeitenLife Station Medical Alert Brochuremhs2822Noch keine Bewertungen

- Carrier Selection and ContractingDokument52 SeitenCarrier Selection and ContractingSaman NaqviNoch keine Bewertungen

- IPCC Account Current ChapterDokument6 SeitenIPCC Account Current ChapterHarish KumarNoch keine Bewertungen

- DD Form 2657 BlankDokument3 SeitenDD Form 2657 BlankdavejschroederNoch keine Bewertungen

- Iesha Indi June Statement 2021Dokument1 SeiteIesha Indi June Statement 2021Sharon JonesNoch keine Bewertungen

- ViewSoa PDFDokument6 SeitenViewSoa PDFIan DelesNoch keine Bewertungen

- E Passbook 2024 02 19 17 04 55 PMDokument25 SeitenE Passbook 2024 02 19 17 04 55 PMRajju RajjuNoch keine Bewertungen

- Fees Can Be Deposited in Any Punjab National Bank Branch Across IndiaDokument1 SeiteFees Can Be Deposited in Any Punjab National Bank Branch Across IndiaIshan BakshiNoch keine Bewertungen

- Edge360 FAQDokument6 SeitenEdge360 FAQAadeesh JainNoch keine Bewertungen

- QTBD SimulationDokument133 SeitenQTBD SimulationSaptarshi BhowmikNoch keine Bewertungen

- Uzor, Blessing Amarachukwu: Trans. Date Reference Value Date Debit Credit Balance RemarksDokument5 SeitenUzor, Blessing Amarachukwu: Trans. Date Reference Value Date Debit Credit Balance RemarksThank GodNoch keine Bewertungen

- Coa Untuk MyobDokument24 SeitenCoa Untuk MyobM AlfiansyahNoch keine Bewertungen

- BAPA FormDokument6 SeitenBAPA FormkatrinaNoch keine Bewertungen

- Branches in Sarawak: Kuching Laksamana MiriDokument1 SeiteBranches in Sarawak: Kuching Laksamana MiridomromeoNoch keine Bewertungen

- Business Report On TCSDokument25 SeitenBusiness Report On TCSMutahhir KhanNoch keine Bewertungen

- Bio-Cam2017-017 Umma Sankar GunasegaranDokument1 SeiteBio-Cam2017-017 Umma Sankar Gunasegaranmeenaloshini SatgunamNoch keine Bewertungen