Beruflich Dokumente

Kultur Dokumente

BA 99.2 Current Liabilities Additional Exercises

Hochgeladen von

Alison BlackCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BA 99.2 Current Liabilities Additional Exercises

Hochgeladen von

Alison BlackCopyright:

Verfügbare Formate

BA 99.

2 Current Liabilities Additional Exercises

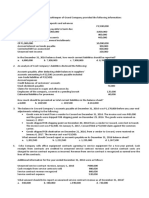

1. On 31 December 2014, the bookkeeper of North Company provided the following information:

Accounts payable, including deposits and advances from customers of Php500,000 Php2,500,000

Notes payable, including note payable to bank due on 31 December 2016 for Php1,000,000 3,000,000

Share dividends payable 800,000

Serial bonds, payable in semi-annual installments of Php1,000,000 10,000,000

Accrued interest on bonds payable 300,000

Contested BIR tax assessment 600,000

Unearned rent revenue 100,000

In the 31 December 2014 statement of financial position, how much current liabilities should be reported?

2. In November and December 2014, South Company received Php792,000 for 1,000, 3-year subscriptions at Php254

per issue per year, starting with the January 2015 issue. South Company elected to include the entire Php792,000 in

its 2014 income statement for tax purposes. What amount should South report in its 2014 statement of financial

position as unearned subscription revenue?

3. West Company sells calculators that carry a one-year warranty against manufacturer’s defects. Based on company’s

experience, warranty costs are estimated at Php300 per calculator. During 2014, West sold 24,000 calculators and

paid warranty costs of Php170,000. In its income statement for the year ending 31, December 2014, how much

should West report as warranty expense?

4. The selling price of East Company’s units is Php80,000 each. The buyers are provided with a 2-year warranty that is

expected to cost the company Php2,000 per unit in the year of sale and Php6,000 per unit in the year following the

sale. The company sold 80 units in 2014 and 100 units in 2015. Actual payments for warranty claims were Php80,000

and Php520,000 in 2014 and 2015, respectively. How much would be the warranty expense for 2014 and 2015,

respectively?

5. A new product introduced by NE Company carried a two-year warranty against defects. The estimated warranty

costs related to sales are as follows:

Year of sale 3%

Year after sale 5%

Sales and actual warranty expenditures for the years ended 31 December 2014 and 2015 are as follows:

Year Sale Actual Warranty Expenditures

2014 Php800,000 Php20,000

2015 1,000,000 70,000

What amount should Beauty report as its estimated liability as of 31 December 2014 and 2015, respectively?

Das könnte Ihnen auch gefallen

- Qualifying Examination: Financial Accounting 2Dokument11 SeitenQualifying Examination: Financial Accounting 2Patricia ByunNoch keine Bewertungen

- BondsDokument12 SeitenBondsGelyn Cruz100% (1)

- P1 HSHSJSKDJHSHDokument8 SeitenP1 HSHSJSKDJHSHabcdefg0% (1)

- FINAL For Students Premium and Warranry Liability and LiabilitiesDokument8 SeitenFINAL For Students Premium and Warranry Liability and LiabilitiesHardly Dare GonzalesNoch keine Bewertungen

- IA2Dokument12 SeitenIA2John FloresNoch keine Bewertungen

- Cpa Review School - Prac 1Dokument12 SeitenCpa Review School - Prac 1jikee1150% (2)

- 2018 ACCO 4103 2nd Summer ExamDokument5 Seiten2018 ACCO 4103 2nd Summer ExamSherri BonquinNoch keine Bewertungen

- Drill 3 FSUU AccountingDokument10 SeitenDrill 3 FSUU AccountingRobert CastilloNoch keine Bewertungen

- Prelim Lecture 1 Assignment: Multiple ChoiceDokument4 SeitenPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNoch keine Bewertungen

- Drill 3 AK FSUU AccountingDokument15 SeitenDrill 3 AK FSUU AccountingRobert CastilloNoch keine Bewertungen

- This Study Resource Was: Audit of Liabilities Case 1Dokument9 SeitenThis Study Resource Was: Audit of Liabilities Case 1Alexandra Nicole IsaacNoch keine Bewertungen

- Problems - Docx 1Dokument25 SeitenProblems - Docx 1You Knock On My DoorNoch keine Bewertungen

- Quiz On LiabilitiesDokument5 SeitenQuiz On LiabilitiesDewdrop Mae RafananNoch keine Bewertungen

- Auditing FinalMockBoard ADokument11 SeitenAuditing FinalMockBoard ACattleyaNoch keine Bewertungen

- Remedial 01 FAR With AnswersDokument7 SeitenRemedial 01 FAR With AnswersJennifer AdvientoNoch keine Bewertungen

- Audit of Liabilities QuizDokument2 SeitenAudit of Liabilities QuizCattleyaNoch keine Bewertungen

- P1 Day1 RMDokument4 SeitenP1 Day1 RMabcdefg100% (2)

- PRACTICAL ACCOUNTING I Quiz No. 2Dokument6 SeitenPRACTICAL ACCOUNTING I Quiz No. 2ROB1015120% (2)

- Liabilities: Problem 1Dokument8 SeitenLiabilities: Problem 1Frederick AbellaNoch keine Bewertungen

- Liabilities: Problem 1Dokument3 SeitenLiabilities: Problem 1Frederick Abella0% (1)

- Guided Exercises Current Liabilities PDFDokument4 SeitenGuided Exercises Current Liabilities PDFlexfred55Noch keine Bewertungen

- Drill 4 FSUU AccountingDokument6 SeitenDrill 4 FSUU AccountingRobert CastilloNoch keine Bewertungen

- DySAS General Review Acctg6 - AnsDokument11 SeitenDySAS General Review Acctg6 - Ansyasira0% (1)

- Liabilities Part 2Dokument4 SeitenLiabilities Part 2Jay LloydNoch keine Bewertungen

- Ac3b Qe Oct2014 (TQ)Dokument12 SeitenAc3b Qe Oct2014 (TQ)Julrick Cubio EgbusNoch keine Bewertungen

- 7160 - FAR Preweek ProblemDokument14 Seiten7160 - FAR Preweek ProblemMAS CPAR 93Noch keine Bewertungen

- Audit of LiabilitiesDokument6 SeitenAudit of LiabilitiesandreamrieNoch keine Bewertungen

- LiabilitiesDokument34 SeitenLiabilitiesErin LumogdangNoch keine Bewertungen

- UCU Audit ProblemsDokument9 SeitenUCU Audit ProblemsTCC FreezeNoch keine Bewertungen

- Shane Josa Marie M. Tabunggao AC22Dokument15 SeitenShane Josa Marie M. Tabunggao AC22Shane TabunggaoNoch keine Bewertungen

- LLL 14 PDF FreeDokument34 SeitenLLL 14 PDF FreeLayNoch keine Bewertungen

- Acctg 5Dokument6 SeitenAcctg 5Charmane MatiasNoch keine Bewertungen

- Prelim ExaminationDokument9 SeitenPrelim ExaminationShannel Angelica Claire RiveraNoch keine Bewertungen

- Adjusting Entries A. Short ProblemsDokument3 SeitenAdjusting Entries A. Short ProblemsFeiya LiuNoch keine Bewertungen

- Semi-Finals Financial Accounting and ReportingDokument23 SeitenSemi-Finals Financial Accounting and Reportingjoyce KimNoch keine Bewertungen

- 8th PICPA National Accounting Quiz ShowdownDokument28 Seiten8th PICPA National Accounting Quiz Showdownrcaa04Noch keine Bewertungen

- Quiz Activity#2 INTACCDokument7 SeitenQuiz Activity#2 INTACCGellie Buenaventura100% (1)

- Assets Maam MaconDokument6 SeitenAssets Maam Maconchristinemariet.ramirezNoch keine Bewertungen

- Afar QuestionsDokument16 SeitenAfar Questionspopsie tulalianNoch keine Bewertungen

- FAR Practical Exercises Liabilities PDFDokument8 SeitenFAR Practical Exercises Liabilities PDFRemy Caperocho80% (5)

- Auditing Exam Part IDokument2 SeitenAuditing Exam Part Ianna19 lopezNoch keine Bewertungen

- Audit of Inventories and Trade Payables BA 123 Exercise Set BDokument6 SeitenAudit of Inventories and Trade Payables BA 123 Exercise Set BBecky GonzagaNoch keine Bewertungen

- 1stpreboard Oct 2013-2014Dokument19 Seiten1stpreboard Oct 2013-2014Michael BongalontaNoch keine Bewertungen

- Quiz in AE 09 (Current Liabilities)Dokument2 SeitenQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- FAR-01 Trade & Other PayableDokument3 SeitenFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Inbound 874801235495269853Dokument5 SeitenInbound 874801235495269853MarielleNoch keine Bewertungen

- Pamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Dokument5 SeitenPamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Trixie HicaldeNoch keine Bewertungen

- RP Accrual MethodDokument3 SeitenRP Accrual MethodViky Rose EballeNoch keine Bewertungen

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetDokument14 SeitenMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer Sheetmimi supasNoch keine Bewertungen

- QuizDokument2 SeitenQuizAlyssa CamposNoch keine Bewertungen

- Biyaya 3Dokument8 SeitenBiyaya 3palakol bagsakNoch keine Bewertungen

- Prelim Exam - Intermediate AccountingDokument4 SeitenPrelim Exam - Intermediate AccountingLea Gabrielle Fariola0% (1)

- Quiz - Current LiabDokument2 SeitenQuiz - Current LiabAna Mae HernandezNoch keine Bewertungen

- Answer-F UNIT 2 - Practice and Exercises Answer-F UNIT 2 - Practice and ExercisesDokument3 SeitenAnswer-F UNIT 2 - Practice and Exercises Answer-F UNIT 2 - Practice and ExercisesDaniella Mae ElipNoch keine Bewertungen

- RT and Co. Basic Accounting Wizard EasyDokument12 SeitenRT and Co. Basic Accounting Wizard EasyJoseph SalidoNoch keine Bewertungen

- Memory Enhancement ProgramDokument8 SeitenMemory Enhancement ProgramLhowellaAquinoNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- Industries-Heritage Hotel Manila Supervisors Chapter (Nuwhrain-HHMSC) G.R. No. 178296, January 12, 2011Dokument2 SeitenIndustries-Heritage Hotel Manila Supervisors Chapter (Nuwhrain-HHMSC) G.R. No. 178296, January 12, 2011Pilyang SweetNoch keine Bewertungen

- Ioana Ramona JurcaDokument1 SeiteIoana Ramona JurcaDaia SorinNoch keine Bewertungen

- Aguirre Vs Judge BelmonteDokument2 SeitenAguirre Vs Judge BelmonteGulf StreamNoch keine Bewertungen

- Preserving The Gains of Ramadan10 Deeds To Be Continued After RamadanDokument2 SeitenPreserving The Gains of Ramadan10 Deeds To Be Continued After RamadantakwaniaNoch keine Bewertungen

- Audi A6 (4B) Headlight Aim Control (Dynamic Light)Dokument2 SeitenAudi A6 (4B) Headlight Aim Control (Dynamic Light)Krasimir PetkovNoch keine Bewertungen

- How To Instantly Connect With AnyoneDokument337 SeitenHow To Instantly Connect With AnyoneF C100% (2)

- ANNEX A-Final For Ustad InputDokument15 SeitenANNEX A-Final For Ustad Inputwafiullah sayedNoch keine Bewertungen

- EF4C HDT3 Indicators GDP IIP CSP20 PDFDokument41 SeitenEF4C HDT3 Indicators GDP IIP CSP20 PDFNikhil AgrawalNoch keine Bewertungen

- Terms and ConditionsDokument3 SeitenTerms and ConditionsAkash Aryans ShrivastavaNoch keine Bewertungen

- Reference and RevisionDokument6 SeitenReference and RevisionRohit kumar SharmaNoch keine Bewertungen

- People Vs ParanaDokument2 SeitenPeople Vs ParanaAnonymous fL9dwyfekNoch keine Bewertungen

- Education in Colonial EraDokument17 SeitenEducation in Colonial EraAnanda PadhanNoch keine Bewertungen

- Business Law and Regulations 1Dokument4 SeitenBusiness Law and Regulations 1Xyrah Yvette PelayoNoch keine Bewertungen

- Clado-Reyes V LimpeDokument2 SeitenClado-Reyes V LimpeJL A H-DimaculanganNoch keine Bewertungen

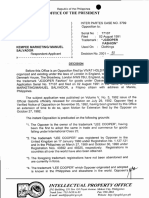

- Office of The Presiden T: Vivat Holdings PLC) Inter Partes Case No - 3799 OpposerDokument5 SeitenOffice of The Presiden T: Vivat Holdings PLC) Inter Partes Case No - 3799 OpposermarjNoch keine Bewertungen

- TAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFDokument25 SeitenTAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFSilver LilyNoch keine Bewertungen

- Advantage: A Health Cover For at The Cost of Your Monthly Internet BillDokument4 SeitenAdvantage: A Health Cover For at The Cost of Your Monthly Internet BillAmitabh WaghmareNoch keine Bewertungen

- Level 2 Repair: 7-1. Components On The Rear CaseDokument9 SeitenLevel 2 Repair: 7-1. Components On The Rear CaseVietmobile PageNoch keine Bewertungen

- Business ProcessesDokument2 SeitenBusiness ProcessesjeffNoch keine Bewertungen

- PIL PresentationDokument7 SeitenPIL PresentationPrashant GuptaNoch keine Bewertungen

- Arnold Emergency Motion 22cv41008 Joseph Et AlDokument13 SeitenArnold Emergency Motion 22cv41008 Joseph Et AlKaitlin AthertonNoch keine Bewertungen

- Metode Al-Qur'An Dalam Memaparkan Ayat-Ayat HukumDokument24 SeitenMetode Al-Qur'An Dalam Memaparkan Ayat-Ayat HukumAfrian F NovalNoch keine Bewertungen

- Aguinaldo DoctrineDokument7 SeitenAguinaldo Doctrineapril75Noch keine Bewertungen

- Final Managerial AccountingDokument8 SeitenFinal Managerial Accountingdangthaibinh0312Noch keine Bewertungen

- Internship Report For Accounting Major - English VerDokument45 SeitenInternship Report For Accounting Major - English VerDieu AnhNoch keine Bewertungen

- Form PDF 344472690310722Dokument11 SeitenForm PDF 344472690310722NandhakumarNoch keine Bewertungen

- DRAFT FY2014-FY2018 Transportation Capital Investment PlanDokument117 SeitenDRAFT FY2014-FY2018 Transportation Capital Investment PlanMassLiveNoch keine Bewertungen

- Cpi Sells Computer Peripherals at December 31 2011 Cpi S InventoryDokument1 SeiteCpi Sells Computer Peripherals at December 31 2011 Cpi S Inventorytrilocksp SinghNoch keine Bewertungen

- H.1.a. Definition of A Motion: H.1. Motions in GeneralDokument24 SeitenH.1.a. Definition of A Motion: H.1. Motions in GeneralMyco MemoNoch keine Bewertungen

- Metrobank V Chuy Lu TanDokument1 SeiteMetrobank V Chuy Lu TanRobert RosalesNoch keine Bewertungen