Beruflich Dokumente

Kultur Dokumente

Gruh Finance AR FY15 Review PDF

Hochgeladen von

Arman Khan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

14 Ansichten28 SeitenOriginaltitel

Gruh-Finance-AR-FY15-Review.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

14 Ansichten28 SeitenGruh Finance AR FY15 Review PDF

Hochgeladen von

Arman KhanCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 28

CAVEAT — Outside Cycle of Competence,

so it may get Funny ak

Places. Jane tis

veview senou ak

. |

your Own vis. We help you build homes

(A subsidiary of HOFC Lita)

DisclosuRE- No holdings

Tribute to the GRU ini

A dviving force for

Gutare momentum and growth

Reviewed By _

Vishal Khandeuwel

14-2015 [safalnives hak. cow]

Date-2lst Aug, 2015

Grun

ALL yound over the yeans cue

(lo-yr k S- yy CAGR) toe

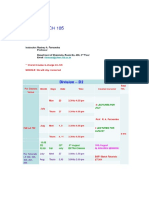

HIGHUGHTS

Tin crares) SV

ighlights 2014-15 2013-14 2012-13 2011-12 2010-11_2009-10 2008-09 2007-08 2006-07 2005-06 GAR

‘an Disbursements aia S77 ive 1487 atk 70S a6) Ba,

Net Interest Income “ Mow i me lll el ey:

Fees & Other Charges eee

Operating Cost o © @ & © 5s 2 2 H

Zor, | oeati rote ee ee loo

Provisions & Wate Of (Net) Ce

S47. | Prot Betore Tox 317s DR

27. | Pome ater Tax we 7st ww

ZEip, | Stocknoiders Equity 711 67451385860

Borrowed Funds 8216 6447 4.915 3833 2.966 23232245 1,73 1,305 1,089

277. [Lom asses 915 7,009 5438 4,067__3,172__2,449 2,086 17701377 1,068] BIZ

Key Financial Ratios

Ceptal Adequacy Ratio (%) «15.38. 16.35.—«14SH «ROSH «16551621 18.15 16.31 14.24

Debt Equity Ratio (es) cee et eee ete,

eons to Total ASets (4) a ee |

Gross NPAs to Loan Assets (%) 028027 O32 OS2 ORR Lose 138

Net NPAs to Loan Aes (35) ee ae

Net Interest Margin to

Average Assets (36) 418 42143846447) 382 337

Non Iterest Expenses to

average Ase (4) os 0 0s isso eta

Cost to Income Ratio (%) ot b mp we p> 2 we sy

PAT to Average Assets (36) 240-276 29432302265 aad 239 27203

ye eee ee ae ees)

CASR, tessuting shareholcers’ Weath CASK

ZEST. | karrings Per share (2) * 537 493 411 Bal 262 199145 1a? oO EL

Dividend Rate (36) woe oss aww

Did Payout Ratio (%) Cd

Book Value Per Share as at

227: | arcn3s (2) * 1 2 om om 510 27a ae a8] 2 ge

Market Pie Per Share as at

torch) 244 4765 10515 63.70 36022178937 1S44 1374933

Prieto Vue Rai (times) a 873 7HL_ 5833982854? 2812802

rice to Eamings Rat (times) eee

jrtetContatsaton(incrores) 8867 531937532249 1266756 sss are

Prof Aer Tax aves alr poweing Oeered Tax Lbity e193 @wes on Spel Reserve wich was wequres to be cated fom FY ores

Indes nine pc! et ie Ye Oued oR ousuaes

1 Daring FY 1213, met Sy 26, 2012, foe vie of equy sare of be Company was sb-ded to € 2 per equty sare from ® 10 per eaty share ad hence

‘sas for Spl and Bonus shares.

(@ The company ated bonus shares nthe ras of 1:1 dung June 014. Ondo he ul yer on enhanced cape post sue of bonus shares.

Market cop har m at? 2- vale f growth

1s er kt By ee bow pe gin eyestes

pay ewer Aine (when beugut at good pr

Dicleersements —> Loans

Up 24 Aud

pirectors‘rePoRn va Sze-

‘TO THE MEMBERS,

e

4

‘Your dtectors are please to present the TMbgty Ninth Annual Report

of your Company with the audited accountSMr the year ended

March 31, 2018.

FINANCIAL RESULTS,

(p erres)

For the

‘year ended

March 31, March 31,

2015, 2018

Profit Before Tax 300.84 244.46

Provision for Tax mr 6750

Deferred Tax on Special Reserve 19.33, 0.00

Profit After Tax 203.80 176.96

Add:

Balance brought forward

from last year

‘Amount available

for appropriation

‘Appropriations:

Special Reserve 5687 45.00

General Reserve 40.00 20,00

Addtional Reserve uls

28C of NHB Act, 1987 0.00 15.00

‘Amount utlised towards Corporate

Social Responsibility Activites 193 0.00

Proposed Dividend ns 54.04

‘Additional Tax on Proposed Dividend 14.80 9.18

Dividend pertaining to previous

year paid during the year 0.00 0.27

Balance caried to Balance Sheet 161.11 143.59

34738 287.08

Dividend

Your directors recommend payment of dvidend of € 2.00 per equity

share of face value of ® 2 each forthe year ended March 31, 2015

‘on the enhanced paid-up capital ofthe Company post the Issue of

bonus shares in the ratio of 1:1. Considering that the Company

decared a 1:1 bonus during the year, the effective dvdend for the

year is © 4.00 per equity share (ore-bonus) as compared to ® 3.00,

per share in the previous year. Although the bonus shares were

allotted on une 11, 2014, dividend on these shares wil be payable

for the entire nancial year. The dividend payout ratio for the year

Inclusive ofadctional taxon dividend wil be 43% as against 36% In

the previous year.

ven, Cun

Pye

Rn 8.2 Lae /.

(Changes in Share Capital

gtr yea.

f

Pi

Iie hep Yeu Bld homes

aie yes

During the year under review, the paid up share capital increased as

a result of the 1:1 Bonus Issue, whereby your Company alloted

38,01,31,150 Bonus shares. The paid up shire capital also increased

2 a resutof allotment of 31,22, 280 equity shares ofthe face value

of & 2/- each upon exercise of stock options under ESOS-2011

(renche-1) and ESOS-2011 (Tranche-t1). Consequently the equity

share capital has increased from € 36,02,62,300 divided into

18,01 31,150 equity shares of & 2/- each to 8 72,67,69,160 divided

into 36,35,64,580 equity shares of € 2/- each,

Golden Jubilee Rural Housing Finance Scheme

‘GRU disbursed € 1,296.14 crores in respect of 18,719 dueling

Units during the year Under the Golden Jubilee Rural Housing nance

‘Scheme of te Government of India, Cumulative disbursements under

the Scheme were & 5,379.87 crores in respect of 1,24,113 dwveling

units.

ural Housing Fund

‘The National Housing Bank (NHB) has formulated a scheme called

{the Rural Housing Fund ~ 2008 (RHF). The scheme is aimed towords

‘ual housing undertaken by families falling under the weaker Section

Category 25 defined in the Reserve Bank of India guidelines on

lending tothe priority sector,

During the year, GRUH disbursed € 301.06 crores in respect of

4,679 loans in rural areas wherein the loans meet the citeria lad

down under the scheme,

‘Urban Low Income Housing Scheme

‘The Ministy of Housing and Urban Poverty Alavation (MHUPA)

launched a special scheme called the Urban Low Income Housing

Scheme (LI) in January 2012 to finance femmes in the EWS / LIC

‘segment in urban areas. NHB fs the nodal agency for monitoring this

scheme,

Prog ter Tx

oa

288S8!

WOT ROOT BOUT Boy BASF DOTS

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- SICK Sensor Operating ManualDokument136 SeitenSICK Sensor Operating ManualArman KhanNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Valuation of Bonds and Stocks: Profsnrao 1Dokument51 SeitenValuation of Bonds and Stocks: Profsnrao 1Arman KhanNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Department Faculty CoordinatorDokument4 SeitenDepartment Faculty CoordinatorArman KhanNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Interesting!: That'sDokument36 SeitenInteresting!: That'sArman KhanNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Flexural Test ManualDokument3 SeitenFlexural Test ManualArman KhanNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Tutorial Problems and QuestionsDokument1 SeiteTutorial Problems and QuestionsArman KhanNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Sahil Modi CVDokument2 SeitenSahil Modi CVArman KhanNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- An Introduction To Programming Through C++: Abhiram G. Ranade CH 21: Representing Variable Length EntitiesDokument33 SeitenAn Introduction To Programming Through C++: Abhiram G. Ranade CH 21: Representing Variable Length EntitiesArman Khan0% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Indian Institute of Technology BombayDokument2 SeitenIndian Institute of Technology BombayArman KhanNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Indian Institute of Technology BombayDokument2 SeitenIndian Institute of Technology BombayArman KhanNoch keine Bewertungen

- English Class X Maths Chapter01Dokument58 SeitenEnglish Class X Maths Chapter01Arman KhanNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Catalog of Chess MistakesDokument216 SeitenCatalog of Chess MistakesArman Khan100% (2)

- The Art of The CheckmateDokument108 SeitenThe Art of The CheckmateArman Khan100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Lecture 1 Notes 2016 PDFDokument17 SeitenLecture 1 Notes 2016 PDFArman KhanNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- 12th Class Biology Ncert Chap-4Dokument10 Seiten12th Class Biology Ncert Chap-4Prathyusha MannemNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)