Beruflich Dokumente

Kultur Dokumente

Prosecution Sanction Qua ANSSAS 2017

Hochgeladen von

PGurus0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

33K Ansichten9 SeitenProsecution Sanction Qua ANSSAS 2017 - Copy

Originaltitel

Prosecution Sanction Qua ANSSAS 2017 - Copy

Copyright

© © All Rights Reserved

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenProsecution Sanction Qua ANSSAS 2017 - Copy

Copyright:

© All Rights Reserved

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

33K Ansichten9 SeitenProsecution Sanction Qua ANSSAS 2017

Hochgeladen von

PGurusProsecution Sanction Qua ANSSAS 2017 - Copy

Copyright:

© All Rights Reserved

Sie sind auf Seite 1von 9

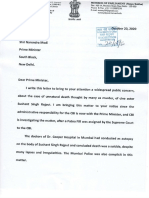

OFFICE OF THE

PR.COMMISSIONER OF INCOME TAX-22, DELHI

ROOM NO.315, 3°° FLOOR, B BLOCK,

PRATYAKSH KAR BHAWAN, DR. S.P.M. MUKHERJEE CIVIC CENTRE,

MINTO ROAD, NEW DELHI-110002.

F.No. Pr.CIT/Delhi-22/Sanetion for Pros./28(6)/2016-17/_ Dated:- 30" March, 2017.

SANCTION FOR PROSECUTION

U/S 279(1) OF INCOME TAX ACT , 1961

Whereas Ms. Shumana Sen, PAN AMPQS5036G, D/o Shri A.K. Sen, R/o B-602,

Plot No.F-2, the Crescent, Sector-50, Noida, U.P. ~ 201301 being a serving IRS officer of

11999 Batch and presently holding the rank of the Addl. Commissioner of Income Tax and

posted as AddI.CIT (TDS Range, Dehradun (henceforth the assessee) has filed the

Returns of Income for A.Ys. 2005-06, 2006-07, 2007-08 & 2008-09 as mandatory u/s

139(1) of 1.T. Act, 19061 wherein & whereunder the said assessee was duty bound by &

under the law to disclose her full, true & correct income and pay the tax due on her such

full, true and correct income for those A.Ys. and willful failure of which amounts to

‘commission of punishable offence liable to be punished with the Imprisonment as well

as with the fine or both as may be case under the provisions of |.T. Act, 1961 and other

applicable and enabling provisions of law including under the IPC, 1860.

Whereas the undersigned being the Principle Commissioner of Income Tax,

Delhi-22,New Delhi having his office at 3" floor, B Wing, Pratyaksh Kar Bhawan, Dr.

S.P.M. Civic Centre, New Delhi - 110002 by and under the enabling authorities in law

and issued by the Central Board of Direct Taxes and other authorities competent in law

is vested with the jurisdiction u/s I.T. Act,1961 over the cases of the said assessee and is

competent to exercise jurisdiction under the law under the provisions of 1.7. Act, 1961

and u/s 279 (1) of 1.7. Act,1961 and is competent under the law to consider the

application moved by the Ld. Assessing Officer for according the sanction for the

prosecution u/s 279(1) of |.T. Act, 1961 for various offences committed by assesses.

Whereas the Returns of Income of the said assessee for the A.Ys. 2005-06 to

2008-09 were picked up by Ld. Assessing Officer for scrutiny u/s 143(2) and after

conducting due inquiries and after following the due process of law, Ld. A.O., ACIT,

Circle 64(1), Delhi, New Delhi having office at 2° Floor, B Wing, Pratyaksh Kar Bhawan,

Or. S.P.M. Civic Centre, New Delhi ~ 110002 passed assessment orders u/s 143(3) of I.T.

Act, 1961 for A.Ys. 2005-06, 2006-07, 2007-08 & 2008-09 determining that the said

—s 78>

assessee had not disclosed his full, true and correct income for the A.Ys. 2005-06, 2006-

07, 2007-08 & 2008-09 in her Returns of Income and had furnished inaccurate

particulars of income and had concealed the particulars of her full, true and correct

come and did not pay the taxes due on her income. This case has been assigned to

AO. vide order No. CIT-XVI/2013-14/dated 27.08.2013 with the approval of CCIT-XIll,

New Delhi vide F.No. CCIT-XiII/Centralization /2013-14/640 dated 26.08.2013.

Whereas the income disclosed by the said assessee and the income assessed by

the Ld. A.0. for A.Ys. 2005-06, 2006-07, 2007-08 & 2008-09 in the cases of the said

assessee is tabulated hereinunder:-

SINo. [AY. | IncomeReturned | Income assessed _| Income concealed

(Rs.) (Rs.) (Rs.)

Ms. Shumana Sen.

PAN AMQPS5S036G,

presently Addl.CIT (TDS), Dehradun

D/o Shri A.K. Sen,

R/o Flat No.B-602,

The Crescent Apartment,

Sector 50, NOIDA, U.P.

1.__| 2005-06 _| 1,86,785/- 2,85,490/- 2,83,98,705/-

2. | 2006-07 | 1,95,928/- 1,37,7,341/- 1,35,81,413/-

3.__ | 2007-08 | 2,30,369/- 1,38,11,782/- 1,35,80,413/-

4. | 2008-09 _| 2,46,200/- 1,38,27,613/- 1,35,82,413/-

Gross income of Ms. Shumana Sen in India and abroad concealed by her from tax and

‘on which she has evaded tax being Rs.6,91,41,944/- and which is offences u/s 276C of

IT, Act, 1961 and which has been aided and abetted by accomplices which is also

offences under I.T. Act, 1961.

Whereas the willful attempt in any manner whatsoever to evade any tax, penalty

or interest chargeable or imposable under the IT. Act, 1961 is punishable with

imprisonment as well as fine or the both under the provisions of Section 267C of I.T. Act,

1961 and making false statement or delivering an account or statement which is false in

any verification under the I.T. Act, 1961 and/or the 1.7. Rules, 1962 as may be the case is

punishable with imprisonment as well as fine or the both under the provisions of

Section 277A of |.T. Act, 1961 and the abetment of false Return of Income is punishable

with imprisonment as well as fine or the both under the provisions of Section 278 of I.T.

Act, 1961. For the sake of brevity those provisions of law already in the public domain

and readily available to public is not being repeated hereinunder. Further, the assessee

being an IRS officer having worked both as the Assessing Officer as well as the Range-in-

Charge in the Income Tax Department is conversant with the law capable of

understanding its import.

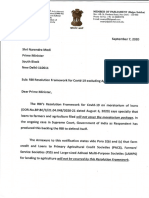

SIO

Whereas Ld. A.O. having passed assessments for A.Ys. 2005-06, 2006-07, 2007-

08 & 2008-09 moved application before undersigned for grant of sanction u/s 279(1) of

IT. Act, 1961 to report offences committed by the assessee and her accomplices in the

said offences to the Court of competent jurisdiction for prosecution of those offenders.

Whereas the undersigned has perused the application of the Ld. Assessing

Officer and has also perused the assessment records available with the office of Ld, A.O.

including the impugned Assessment Orders and replies, statements, objections, etc., of

the assessee brought on the record by assessee as well as by Ld. A.O. and has perused

the evidence collected by the Ld. A.0. and which was confronted to the said assessee.

The defense conducted by Ms. Shumana Sen and Ms. Ashima Neb on behalf of the

assessee and also by their accomplices has been produced.

Whereas the undersigned having perused the evidence collected by the Ld. A.O.

and available on record and having perused the response of the said assessee and

reading the material on record “as it is” is satisfied that prima facie a case for reporting

the alleged offences u/s 276C, 277, 277A & 278 of I.T. Act, 1961 rw. the applicable

provisions of the IPC, 1860 to the Court of the competent jurisdiction against the said

assessee Ms. Shumana Sen.

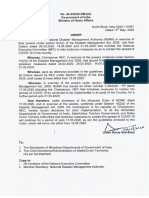

Therefore, the undersigned being the Pr.CIT-22, Delhi accords the sanction u/s

279 of |.T. Act, 1961 for prosecution of Ms. Shumana Sen and accomplices as reported

by Ld. A.O. in impugned assessment orders for the A.Ys. 2005-06, 2006-07, 2007-08 &

2008-09 u/s 276C, 277, 277A & 278 of |.T. Act, 1961 r. w. the applicable provisions of the

IPC, 1860 before the Court of competent jurisdiction and in accordance with law.

And the Ld. A.O. is directed to diligently place before the Ld. Trial Court all the

material evidence and to examine the witnesses who were examine by the Ld. A.O. in

Support of the case of the Revenue before the Ld. Trial Court in support of the case of

the Revenue as well and is further directed to undertake all the necessary steps to

ensure the safety and security and preservation of the material record and the

evidence.

The Office is directed to forward this Sanction Order alongwith case records to

the Ld. A.O. for further necessary action in law as may be provided in law.

— »7

(Ashol

IRS.

Pr. CIT, Delhi-22, New Delhi.

—

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

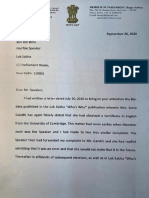

- Letter To Prime Minister On AIIMS Investigation of SSRDokument3 SeitenLetter To Prime Minister On AIIMS Investigation of SSRPGurusNoch keine Bewertungen

- Swamy Legal Notice To Indian ExpressDokument12 SeitenSwamy Legal Notice To Indian ExpressPGurusNoch keine Bewertungen

- Subramanian Swamy's Letter To Speaker On Sonia Faking Qualifications Sept 28, 2020Dokument3 SeitenSubramanian Swamy's Letter To Speaker On Sonia Faking Qualifications Sept 28, 2020PGurusNoch keine Bewertungen

- Madurai HC Palani Temple JudgmentDokument22 SeitenMadurai HC Palani Temple JudgmentPGurus100% (2)

- Letter To Prime MinisterDokument2 SeitenLetter To Prime MinisterPGurus100% (1)

- Section 144 DetailsDokument2 SeitenSection 144 DetailsPGurusNoch keine Bewertungen

- Dr. K Kathirvel vs. CBI (Status Report)Dokument20 SeitenDr. K Kathirvel vs. CBI (Status Report)PGurus100% (1)

- CFD factFindingCommittee ReportDokument49 SeitenCFD factFindingCommittee ReportPGurus100% (1)

- APPWW Opposition To St. Paul ResolutionDokument3 SeitenAPPWW Opposition To St. Paul ResolutionPGurusNoch keine Bewertungen

- Subramanian Swamy's Letter To Foreign Sec On Defmation Action Against UN Under Sec May 20, 2013Dokument3 SeitenSubramanian Swamy's Letter To Foreign Sec On Defmation Action Against UN Under Sec May 20, 2013PGurus100% (2)

- Subramanian Swamy's Letter To PM On Uttarakhand Temple Board May 27, 2020Dokument2 SeitenSubramanian Swamy's Letter To PM On Uttarakhand Temple Board May 27, 2020PGurusNoch keine Bewertungen

- MHA Order Dt. 30.5.2020 With Guidelines On Extension of LD in Containment Zones and Phased ReopeningDokument8 SeitenMHA Order Dt. 30.5.2020 With Guidelines On Extension of LD in Containment Zones and Phased ReopeningPGurusNoch keine Bewertungen

- Delhi Govt SuggestionsDokument7 SeitenDelhi Govt SuggestionsPGurusNoch keine Bewertungen

- MHA Order Dt. 17.5.2020 On Extension of Lockdown Till 31.5.2020 With Guidelines On Lockdown MeasuresDokument9 SeitenMHA Order Dt. 17.5.2020 On Extension of Lockdown Till 31.5.2020 With Guidelines On Lockdown MeasuresThe Indian Express75% (16)

- Press Note 1Dokument6 SeitenPress Note 1PGurusNoch keine Bewertungen

- CM Letter PalgharDokument4 SeitenCM Letter PalgharPGurusNoch keine Bewertungen

- Lockdown Extension & Guidelines - Press Release - 1st MayDokument7 SeitenLockdown Extension & Guidelines - Press Release - 1st MayPGurusNoch keine Bewertungen

- Telegraph 1Dokument1 SeiteTelegraph 1PGurusNoch keine Bewertungen

- The Hindu Group Salary Cuts LetterDokument2 SeitenThe Hindu Group Salary Cuts LetterPGurus100% (1)

- Press Note 2Dokument7 SeitenPress Note 2PGurusNoch keine Bewertungen

- Tax Department Notice To NDTVDokument32 SeitenTax Department Notice To NDTVThe WireNoch keine Bewertungen

- Journalist UnionsDokument6 SeitenJournalist UnionsPGurusNoch keine Bewertungen

- CommerceMin DirectiveDokument4 SeitenCommerceMin DirectivePGurusNoch keine Bewertungen

- Dr. Shiva Ayyadurai's Letter To President Donald TrumpDokument4 SeitenDr. Shiva Ayyadurai's Letter To President Donald TrumpPGurus96% (24)

- HMO Directives On The 21-Day Lock DownDokument1 SeiteHMO Directives On The 21-Day Lock DownPGurusNoch keine Bewertungen

- Indian Express CEO LetterDokument3 SeitenIndian Express CEO LetterPGurusNoch keine Bewertungen

- GuidelinesDokument6 SeitenGuidelinesThe Indian ExpressNoch keine Bewertungen

- PM Speech On March 24, 2020Dokument6 SeitenPM Speech On March 24, 2020PGurusNoch keine Bewertungen

- DR Swamy S Letter To PM 2020 03 20Dokument6 SeitenDR Swamy S Letter To PM 2020 03 20PGurus100% (3)

- 04 - Press Release On FM's Comments On SBI ChairmanDokument2 Seiten04 - Press Release On FM's Comments On SBI ChairmanPGurus0% (2)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)