Beruflich Dokumente

Kultur Dokumente

CDS JPM1

Hochgeladen von

Sree KuchibhatlaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CDS JPM1

Hochgeladen von

Sree KuchibhatlaCopyright:

Verfügbare Formate

New York JPMorgan Securities Inc.

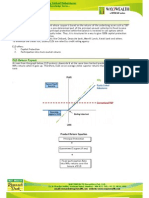

October 24, 2001 Credit Derivatives

Par Credit Default Swap Spread Approximation from Default Probabilities

Purpose: There have been considerable client inquiries on how The valuation of the contingent leg is approximated by:

default probabilities are calculated from credit default swap spreads PV of Contingent = ContingentN =

using our pricing analytic 1. This is a quantitative process that is not N

easy to explain intuitively. As such, rather than explain the (1 − R ) ∑ DFi ⋅ (PND i −1 − PND i )

calculation of default probabilities from credit default swap spreads, i =1

this paper focuses on the reverse – approximating par credit default where, R is the Recovery Rate of the reference obligation

swap spreads from default probabilities.

Therefore, for a par credit default swap,

Definition: A credit default swap is an agreement in which one party Valuation of Fee Leg =Valuation of Contingent Leg

buys protection for losses occurring due to a credit event of a

or

reference entity up to the maturity date of the swap. The buyer of N N

∆i

protection on a bond, a loan, or a class of bonds or loans, will S N ∑ DFi ⋅ PND i ⋅ ∆ i + S N ∑ DF i ⋅ ( PND i −1 − PND i ) ⋅ =

typically buy protection on the notional of the asset and, upon the i =1 i =1 2

occurrence of a credit event, would deliver an obligation of the N

reference credit in exchange for the protection payout. The (1 − R ) ∑ DFi ⋅ (PNDi −1 − PNDi )

protection buyer pays a periodic fee for this protection up to the i =1

maturity date, unless a credit event triggers the contingent payment. or

N

(1 − R)∑ DFi ⋅ ( PNDi−1 − PNDi )

If such trigger happens, the buyer of protection only needs to pay

the accrued fee up to the day of the credit event (standard credit

i =1

default swap). SN = N

∆i

∑ DF i ⋅ PNDi ⋅ ∆ i + DFi ⋅ (PNDi −1 − PNDi ) ⋅

Determining the Par Spread: A credit default swap has two i =1 2

valuation legs: fee and contingent. For a par spread, the net present

value of both legs must equal to zero. Example:

Recovery 30%

The valuation of the fee leg is approximated by:

PV of No Default Fee Pmts = S N ⋅ Annuity N = Period (i) Yldi DF i PNDi AnnuityN

Default

AccrualN ContingentN

Approx SN

(A/360)

N

S N ∑ DFi ⋅ PNDi ⋅ ∆ i

0.25 2.35% 99.41% 96.43% 0.240 0.004 0.025 1008

0.5 2.33% 98.84% 93.05% 0.470 0.008 0.048 988

i =1 0.75 2.39% 98.25% 89.76% 0.690 0.012 0.071 995

1 2.52% 97.63% 86.56% 0.901 0.016 0.093 998

where, SN is the Par Spread for maturity N

1.25 2.70% 96.98% 83.91% 1.104 0.019 0.111 972

DFi is the Riskless Discount Factor from To to Ti 1.5 2.87% 96.28% 81.51% 1.300 0.022 0.127 945

PNDi is the No Default Probability from To to Ti 1.75 3.05% 95.55% 79.41% 1.490 0.025 0.141 915

∆i is the Accrual Period from Ti-1 to Ti 2 3.22% 94.78% 77.30% 1.673 0.028 0.155 896

2.25 3.37% 93.99% 75.79% 1.851 0.030 0.165 863

2.5 3.52% 93.17% 74.32% 2.024 0.032 0.175 837

If accrual fee is paid upon default, then the valuation of the fee leg is 2.75 3.67% 92.31% 72.87% 2.192 0.034 0.184 813

approximated by: 3 3.82% 91.44% 71.45% 2.355 0.036 0.193 794

PV of No Default Fee Pmts + PV of Default Accruals = 3.25

3.5

3.92% 90.55% 70.66%

4.02% 89.64% 69.90%

2.515

2.672

0.037

0.038

0.198

0.203

763

737

S N ⋅ Annuity N + S N ⋅ Default AccrualN = 3.75 4.12% 88.72% 69.14% 2.825 0.039 0.208 714

4 4.22% 87.79% 68.37% 2.975 0.040 0.213 695

N N

∆i

S N ∑ DF i ⋅ PND i ⋅ ∆ i + S N ∑ DFi ⋅ (PND i −1 − PND i ) ⋅

4.25 4.30% 86.85% 68.22% 3.123 0.040 0.214 665

4.5 4.37% 85.91% 68.06% 3.269 0.040 0.215 639

i =1 i =1 2 4.75 4.45% 84.96% 67.91% 3.413 0.040 0.216 615

where, (PNDi-1 – PNDi) is the Probability of a Credit Event 5 4.52% 84.00% 67.76% 3.555 0.040 0.217 594

occurring during period Ti-1 to Ti

∆i

is the Average Accrual from Ti-1 to Ti

2

1

Our pricing analytic is available on Orbit ( www.morgancredit.com) or on Bloomberg ([ticker] [coupon] [maturity]<Corp>CDSW<Go> ).

Additional information is available upon request. Information herein is believed to be reliable but JPMorgan does not warrant its completeness or accuracy. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. The investments and strategies discussed

here may not be suitable for all investors; if you have any doubts you should consult your investment advisor. The investments discussed may fluctuate in price or value. Changes in rates of exchange may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any

financial instrument. JPMorgan and/or its affiliates and employees may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as underwriter, placement agent, advisor or lender to such issuer. Copyright 2001 J.P. Morgan Chase & Co. All rights reserved. JPMorgan is the marketing name for

J.P. Morgan Chase & Co., and its subsidiaries and affiliates worldwide. J.P. Morgan Securities Inc. (JPMSI), member of NYSE and SIPC. JPMorgan Chase Bank is a member of FDIC. J.P. Morgan Securities (Asia Pacific) Limited, is regulated by the Hong Kong Securities & Futures Commission. JPMorgan Securities Asia Pte. Ltd (JPMSA) is

regulated by the Monetary Authority of Singapore and the Financial Services Agency in Japan.

J.P. Morgan Futures Inc., is a member of the NFA. Issued and approved for distribution in the U.K. and the European Economic Area by J.P. Morgan Securities Ltd., Chase Manhattan International Limited and J.P. Morgan plc, members of the London Stock Exchange and regulated by the FSA. Issued and distributed in Australia by Chase

Securities Australia Limited and J.P. Morgan Australia Securities Limited which accept responsibility for its contents and are regulated by the Australian Securities and Investments Commission. J.P. Morgan Markets Australia Pty Ltd. is a licensed investment adviser and futures broker member of the Sydney Futures Exchange. Clients should

contact analysts at and execute transactions through a JPMorgan entity in their home jurisdiction unless governing law permits otherwise.

European Economic Area: Issued for distribution in the European Economic Area (the “EEA”) by J.P. Morgan Securities Ltd. and Chase Manhattan International Limited (“CMIL”), a firm regulated in the conduct of investment business in the United Kingdom by the Securities and Futures Authority Limited. This report has been issued, in

the UK, only to persons of a kind described in Article 11(3) of the Financial Services Act 1986 (Investment Advertisements) (Exemptions) Order 1997 (as amended) and, in other EEA countries, to persons regarded as professional investors (or equivalent) in their home jurisdiction. It is intended for use by the recipient only and may not

be published, copied or distributed to any other person. Any EEA persons wanting further information on, or services in relation to, anything contained in this report should contact CMIL (telephone 44 171 777 4945). This report has been prepared by an entity which may have its own specific interest in relation to the issuer, the financial

instruments or the transactions which are the subject matter of the report. We do not make investments mentioned herein available to any EEA persons other than professional or institutional investors.

This report should not be distributed to others or replicated in any form without prior consent of JPMorgan

Das könnte Ihnen auch gefallen

- EEA Fact Sheet April 2010Dokument2 SeitenEEA Fact Sheet April 2010maxamsterNoch keine Bewertungen

- Equity Tips and Market Analysis For 11 JulyDokument7 SeitenEquity Tips and Market Analysis For 11 JulySurbhi JoshiNoch keine Bewertungen

- Essar Enegry ProspectusDokument672 SeitenEssar Enegry ProspectusAnkur JainNoch keine Bewertungen

- CH - 2 InvestmentDokument7 SeitenCH - 2 Investmentnatnaelsleshi3Noch keine Bewertungen

- Chapter 11Dokument42 SeitenChapter 11Sajid NazirNoch keine Bewertungen

- Derivatives Report 04 Sep 2012Dokument3 SeitenDerivatives Report 04 Sep 2012Angel BrokingNoch keine Bewertungen

- Knowledge Series : Typical Payoff Scenario Typical Payoff ScenarioDokument2 SeitenKnowledge Series : Typical Payoff Scenario Typical Payoff ScenarioAvinash NairNoch keine Bewertungen

- CHAPTER 1 Risk Analysis and ManagementDokument95 SeitenCHAPTER 1 Risk Analysis and Managementyebegashet0% (1)

- Lecture 5Dokument21 SeitenLecture 5Mahina NozirovaNoch keine Bewertungen

- Derivatives Report 07 Dec 2012Dokument3 SeitenDerivatives Report 07 Dec 2012Angel BrokingNoch keine Bewertungen

- Mini Bull Certificates - Arques Industries AGDokument6 SeitenMini Bull Certificates - Arques Industries AGsh2k2kNoch keine Bewertungen

- Basic Financial Concepts - FinalDokument34 SeitenBasic Financial Concepts - FinalDu Baladad Andrew MichaelNoch keine Bewertungen

- Derivatives Report 23 Oct 2012Dokument3 SeitenDerivatives Report 23 Oct 2012Angel BrokingNoch keine Bewertungen

- Key Information Document SyntheticIndex ZumamarketsDokument4 SeitenKey Information Document SyntheticIndex ZumamarketsCarlos Campuzano CalvoNoch keine Bewertungen

- 23 Risk Management and Hedging Strategies PDFDokument24 Seiten23 Risk Management and Hedging Strategies PDFemmadavisons100% (1)

- Bond3 - PGBF Prospectus PDFDokument53 SeitenBond3 - PGBF Prospectus PDFChes CitadelNoch keine Bewertungen

- March I.F. Solution 9833088336: (2 Hours) (Total Marks: 60)Dokument8 SeitenMarch I.F. Solution 9833088336: (2 Hours) (Total Marks: 60)Omkar ShingareNoch keine Bewertungen

- Interest Rate Derivatives Credit Default Swaps Currency DerivativesDokument30 SeitenInterest Rate Derivatives Credit Default Swaps Currency DerivativesAtul JainNoch keine Bewertungen

- Derivatives & Risk MGMTDokument24 SeitenDerivatives & Risk MGMTRox31Noch keine Bewertungen

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Von EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Noch keine Bewertungen

- Cappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsDokument3 SeitenCappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsLameuneNoch keine Bewertungen

- Currency SwapDokument5 SeitenCurrency SwapSachin RanadeNoch keine Bewertungen

- Derivatives Report 2nd JanDokument3 SeitenDerivatives Report 2nd JanAngel BrokingNoch keine Bewertungen

- Interest Rate Swap ThesisDokument5 SeitenInterest Rate Swap Thesisdwham6h1100% (2)

- DCF Budgeting: A Step-By-Step Guide to Financial SuccessVon EverandDCF Budgeting: A Step-By-Step Guide to Financial SuccessNoch keine Bewertungen

- Fresh Highs To Come: Newedge ResearchDokument3 SeitenFresh Highs To Come: Newedge Researchapi-26289577Noch keine Bewertungen

- Kid Deriv CFD Synthetic IndicesDokument5 SeitenKid Deriv CFD Synthetic IndicesSamir Ciro Acosta100% (1)

- MaximDokument31 SeitenMaximForexProNoch keine Bewertungen

- Derivatives Report, 04 Apr 2013Dokument3 SeitenDerivatives Report, 04 Apr 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report, 14 March 2013Dokument3 SeitenDerivatives Report, 14 March 2013Angel BrokingNoch keine Bewertungen

- Unit 6Dokument16 SeitenUnit 6Nigussie BerhanuNoch keine Bewertungen

- Unit 6Dokument16 SeitenUnit 6Abrham TamiruNoch keine Bewertungen

- 3.1.2. If Gasoline Trades in A Competitive Market, Would A Transportation Company That Has A UseDokument16 Seiten3.1.2. If Gasoline Trades in A Competitive Market, Would A Transportation Company That Has A UseJair Azevedo JúniorNoch keine Bewertungen

- Non Deliverable Forward TransactDokument17 SeitenNon Deliverable Forward TransactBadal Shah100% (1)

- Confident Guidance CG 09-2013Dokument4 SeitenConfident Guidance CG 09-2013api-249217077Noch keine Bewertungen

- Derivatives Report, 06 Jun 2013Dokument3 SeitenDerivatives Report, 06 Jun 2013Angel BrokingNoch keine Bewertungen

- Eagle Investor Presentation FinalDokument20 SeitenEagle Investor Presentation Finalandrew1181987Noch keine Bewertungen

- Chapter-03 - Structure of Interest RatesDokument26 SeitenChapter-03 - Structure of Interest RatesZareen TasfiahNoch keine Bewertungen

- Derivaties CNDokument34 SeitenDerivaties CNMarshNoch keine Bewertungen

- Derivatives Report 28 Aug 2012Dokument3 SeitenDerivatives Report 28 Aug 2012Angel BrokingNoch keine Bewertungen

- Citi - Convertible Bond Calcs CheatsheetDokument1 SeiteCiti - Convertible Bond Calcs Cheatsheetchuff6675Noch keine Bewertungen

- 435x Lecture 2 Futures and Swaps VFinalDokument41 Seiten435x Lecture 2 Futures and Swaps VFinalMari Tafur BobadillaNoch keine Bewertungen

- Managing Transaction ExposureDokument30 SeitenManaging Transaction ExposureImtiaz MasroorNoch keine Bewertungen

- 1 P.G Apte International Financial ManagementDokument42 Seiten1 P.G Apte International Financial ManagementrameshmbaNoch keine Bewertungen

- Interest Rates, Bond Valuation, and Stock ValuationDokument57 SeitenInterest Rates, Bond Valuation, and Stock Valuationnandita3693Noch keine Bewertungen

- CH 11Dokument34 SeitenCH 11PetersonNoch keine Bewertungen

- Deirvatives Report 27th DecDokument3 SeitenDeirvatives Report 27th DecAngel BrokingNoch keine Bewertungen

- Session 4: Bond Yield Internal Rate of Return (IRR)Dokument4 SeitenSession 4: Bond Yield Internal Rate of Return (IRR)gigiNoch keine Bewertungen

- Session 4: Bond Yield Internal Rate of Return (IRR)Dokument4 SeitenSession 4: Bond Yield Internal Rate of Return (IRR)adiNoch keine Bewertungen

- Derivatives Report 09 Aug 2012Dokument3 SeitenDerivatives Report 09 Aug 2012Angel BrokingNoch keine Bewertungen

- Risk 1211 Brigo NewDokument5 SeitenRisk 1211 Brigo NewevanderstraetenbisNoch keine Bewertungen

- Bonds ValuationsDokument57 SeitenBonds ValuationsarmailgmNoch keine Bewertungen

- Derivatives Report 06 Dec 2012Dokument3 SeitenDerivatives Report 06 Dec 2012Angel BrokingNoch keine Bewertungen

- Derivatives - Zell Education 2024Dokument67 SeitenDerivatives - Zell Education 2024harshNoch keine Bewertungen

- Econ 122 Lecture 8 Debt Securities 4Dokument27 SeitenEcon 122 Lecture 8 Debt Securities 4cihtanbioNoch keine Bewertungen

- Final FX Risk & Exposure ManagementDokument33 SeitenFinal FX Risk & Exposure ManagementkarunaksNoch keine Bewertungen

- Chapter 4 - MinicaseDokument4 SeitenChapter 4 - MinicaseMuhammad Aditya TMNoch keine Bewertungen

- Homework 6Dokument4 SeitenHomework 6Chang Chun-MinNoch keine Bewertungen

- CW ReportDokument6 SeitenCW ReportZainab SarfrazNoch keine Bewertungen

- How To Benefit From Flexible Analytics Teams & ToolsDokument20 SeitenHow To Benefit From Flexible Analytics Teams & ToolsDwayne BranchNoch keine Bewertungen

- Canadian Crude SpecsDokument24 SeitenCanadian Crude SpecsDwayne BranchNoch keine Bewertungen

- Solving LP Problems Using The Graphical Solution MethodDokument9 SeitenSolving LP Problems Using The Graphical Solution MethodDwayne BranchNoch keine Bewertungen

- LevbetaDokument2 SeitenLevbetaapi-3763138Noch keine Bewertungen

- Argus - ASCI IndexDokument9 SeitenArgus - ASCI IndexDwayne BranchNoch keine Bewertungen

- Linear Programming Excel Solver ExampleDokument7 SeitenLinear Programming Excel Solver ExampleDwayne Branch100% (1)

- Risk in The BoardroomDokument2 SeitenRisk in The BoardroomDwayne BranchNoch keine Bewertungen

- Atlas of The MoonDokument117 SeitenAtlas of The MoonDwayne Branch100% (3)

- 052176727X AstronomDokument504 Seiten052176727X AstronomCcneneNoch keine Bewertungen

- Explore The Universe 3Dokument12 SeitenExplore The Universe 3Dwayne BranchNoch keine Bewertungen

- 166 Twenty Principles For Good Spreadsheet PracticeDokument20 Seiten166 Twenty Principles For Good Spreadsheet PracticesatstarNoch keine Bewertungen

- American Replication in The Presence of User Defined Smile DynamicsDokument29 SeitenAmerican Replication in The Presence of User Defined Smile DynamicsDwayne BranchNoch keine Bewertungen

- Construction of Free Cash Flows A Pedagogical Note. Part IDokument23 SeitenConstruction of Free Cash Flows A Pedagogical Note. Part IDwayne BranchNoch keine Bewertungen

- Valuing Asian & Portfolio OptionsDokument7 SeitenValuing Asian & Portfolio OptionsDwayne BranchNoch keine Bewertungen

- Paradise Lost: John MiltonDokument367 SeitenParadise Lost: John MiltonDwayne BranchNoch keine Bewertungen

- Hedging Under SABRModelDokument3 SeitenHedging Under SABRModelgammaslideNoch keine Bewertungen

- CevDokument17 SeitenCevDwayne BranchNoch keine Bewertungen

- InflationDokument24 SeitenInflationpietro2kNoch keine Bewertungen

- BS As On 23-09-2023Dokument28 SeitenBS As On 23-09-2023Farooq MaqboolNoch keine Bewertungen

- The April Fair in Seville: Word FormationDokument2 SeitenThe April Fair in Seville: Word FormationДархан МакыжанNoch keine Bewertungen

- Software Hackathon Problem StatementsDokument2 SeitenSoftware Hackathon Problem StatementsLinusNelson100% (2)

- Bs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Dokument52 SeitenBs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Tan Gui SongNoch keine Bewertungen

- Prepositions Below by in On To of Above at Between From/toDokument2 SeitenPrepositions Below by in On To of Above at Between From/toVille VianNoch keine Bewertungen

- Faida WTP - Control PhilosophyDokument19 SeitenFaida WTP - Control PhilosophyDelshad DuhokiNoch keine Bewertungen

- Optimization of Crude Oil DistillationDokument8 SeitenOptimization of Crude Oil DistillationJar RSNoch keine Bewertungen

- 14 CE Chapter 14 - Developing Pricing StrategiesDokument34 Seiten14 CE Chapter 14 - Developing Pricing StrategiesAsha JaylalNoch keine Bewertungen

- Chapter 123 RevisedDokument23 SeitenChapter 123 RevisedCristy Ann BallanNoch keine Bewertungen

- bz4x EbrochureDokument21 Seitenbz4x EbrochureoswaldcameronNoch keine Bewertungen

- NCR Minimum WageDokument2 SeitenNCR Minimum WageJohnBataraNoch keine Bewertungen

- Coca-Cola Summer Intern ReportDokument70 SeitenCoca-Cola Summer Intern ReportSourabh NagpalNoch keine Bewertungen

- Theories of Economic Growth ReportDokument5 SeitenTheories of Economic Growth ReportAubry BautistaNoch keine Bewertungen

- Math 1 6Dokument45 SeitenMath 1 6Dhamar Hanania Ashari100% (1)

- 8524Dokument8 Seiten8524Ghulam MurtazaNoch keine Bewertungen

- Is 778 - Copper Alloy ValvesDokument27 SeitenIs 778 - Copper Alloy ValvesMuthu KumaranNoch keine Bewertungen

- SyllabusDokument9 SeitenSyllabusrr_rroyal550Noch keine Bewertungen

- Press Release - INTRODUCING THE NEW LAND ROVER DEFENDER PDFDokument6 SeitenPress Release - INTRODUCING THE NEW LAND ROVER DEFENDER PDFJay ShahNoch keine Bewertungen

- Tajima TME, TMEF User ManualDokument5 SeitenTajima TME, TMEF User Manualgeorge000023Noch keine Bewertungen

- Vylto Seed DeckDokument17 SeitenVylto Seed DeckBear MatthewsNoch keine Bewertungen

- EMI-EMC - SHORT Q and ADokument5 SeitenEMI-EMC - SHORT Q and AVENKAT PATILNoch keine Bewertungen

- Tle 9 Module 1 Final (Genyo)Dokument7 SeitenTle 9 Module 1 Final (Genyo)MrRightNoch keine Bewertungen

- A Study On Effective Training Programmes in Auto Mobile IndustryDokument7 SeitenA Study On Effective Training Programmes in Auto Mobile IndustrySAURABH SINGHNoch keine Bewertungen

- Cara Membuat Motivation LetterDokument5 SeitenCara Membuat Motivation LetterBayu Ade Krisna0% (1)

- CW February 2013Dokument60 SeitenCW February 2013Clint FosterNoch keine Bewertungen

- Introduction To Radar Warning ReceiverDokument23 SeitenIntroduction To Radar Warning ReceiverPobitra Chele100% (1)

- Dbms UPDATED MANUAL EWITDokument75 SeitenDbms UPDATED MANUAL EWITMadhukesh .kNoch keine Bewertungen

- LISTA Nascar 2014Dokument42 SeitenLISTA Nascar 2014osmarxsNoch keine Bewertungen

- Certification DSWD Educational AssistanceDokument3 SeitenCertification DSWD Educational AssistancePatoc Stand Alone Senior High School (Region VIII - Leyte)Noch keine Bewertungen

- LR Format 1.2Dokument1 SeiteLR Format 1.2Ch.Suresh SuryaNoch keine Bewertungen