Beruflich Dokumente

Kultur Dokumente

Ap PW77 2 PDF

Hochgeladen von

Darrel0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

177 Ansichten8 SeitenOriginaltitel

AP-PW77-2.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

177 Ansichten8 SeitenAp PW77 2 PDF

Hochgeladen von

DarrelCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 8

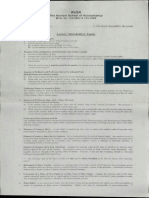

AP-PW77-2

CPA REVIEW SCHOOL OF THE PHILIPPINES

Manila

AUDITING PROBLEMS

PROBLEM 1

‘You have been asked by a client to review the records of BEBEL COMPANY, a small manufacturer

of precision tools and machines. Your client is interested in buying the business, and

arrangements have been made for you to review the accounting records.

CPA Review

Your examination reveals the following:

1, BEBEL commenced business on April 1, 2012, and has been reporting on a fiscal year ending

March 31. The company has never been audited, but the annual statements prepared by the

bookkeeper reflect the following income before closing and before deducting Income taxes:

Year Ended Income

2013 P 143,200

2014 222,800

2015 207,160

2. A relatively small number of machines have been shipped on consignment. These

transactions have been recorded as ordinary sales and billed as such. On March 31 of each

year, machines billed and in the hands of consignees amounted to:

2013 P 13,000

2014 None

2015 11,180

Sales price was determined by adding 30% to cost. Assume the consigned machines are sold

the following year.

3. On March 30, 2014, two machines were shipped to a customer on a C.O.D. basis, The sale

was not entered until April 5, 2014, when cash was received for P12,200. The machines were

not included in the inventory at March 31, 2014. (Title passed on March 30, 2014.)

4. All machines are sold subject to a five-year warranty. It is estimated that the expense

ultimately to be incurred In connection with the warranty will amount to ¥% of 1% of sales.

‘The company has charged an expense account for warranty costs incurred.

Sales per books and warranty costs were:

Warranty Expense

Year Ended For Sales Made In

March 31 Sales. 2013 2014 2015. _Total_

2013 P 1,880,000 ° P 1,520, P 1,520

2014 2,020,000 720 P 2,620 3,340

2015 3,590,000 > 640 3,240 P3820 7,700

5. Badidebts have been recorded on a direct writeoff basis. Experience of similar enterprises

insets that losses will approximate Ys of 1% of sales. Bad debts written off were:

Bad Debts Incurred on Sales Made In

2013 2014 2015 —Total_

2013 P 1,500 1,500

2014 1600 P 1,040 2/640

2015 700 3,600 3,400 7,700

6. Commissions on sales have been entered when paid. Commissions payable on March 31 of

each year were: "

2013 P 2,800

2014 1,600

| 2015 2;240

CPA REVIEW SCHOOL OF THE PHILIPPINES (CPAR) AP PWWTT-R

7. Arreview of the corporate minutes reveais the manager is entitled to a bonus of ¥2 of 1% of

the income:before deducting income taxes and the bonus. The bonuses have never been

recorded or paid.

‘pased! on the preceding Information, determine the foliowingt

1. Correct sales for the year ended March 32, 2013.

A. P1,867,000 B. P1,880,000 C. P1,870,000 D. Pi,873,000

2. Correct sales for the year ended March 32, 2014,

A. P2,035,200 B. P2,032,200 C. P2,042,200 .D. 2,045,200

3. Correct sales for the year ended March 31, 2015.

A. P3,569,200 'B. P3,566,620 C. 73,578,820 D. 3,590,000

4, Additional warranty expense for the year ended March 31, 2015.

A. P10,133 8. P24,834 C. 76,886 D. P17,833

5. Additional bad debt expense for the year ended March 31, 2014.

AL P2,473 B. P1,217 C. PB,917 D. P6858

6. Additional commission expense for the year ended March 31, 2015.

A, P4,600 8, P2,240 C. P4640 D. PeA0

| 7. Manager's bonus expense for the year ended March 31, 2015.

A. P92 B, P1781 C. P2,683 D. Piaa9

8 Correct income before income tax for the year ended March 31, 2013.

AL P229,841 B. P228,692 Cc. P125,785 D. P126,417

9. Correct income before income tax for the year ended March 31, 2014.

LAs P228,692 B. P179,488 C. P125,785 D. P126,417

10. Correct income before income tax for the year ended March 31, 2015.

JA. P179,488 B. P229,841 C. P180,390 D. P126,417

PROBLEM 2

MINA MINING CO. has acquired a track of mineral land for 27,000,000. Mina Mining estimates

that the acquired property will yield 120,000 tons of ore with sufficient mineral content to make

mining and processing profitable. It further estimates that 6,000 tons of ore will be mined the

first and last year and 12,000 tons every year in bebween. (Assume 11 years of mining

operations.) The iand will have @ residual value of P900,000.

Mina Mining builds necessary structures and sheds on the site at a total cost of P1,080,000. The

‘company estimates that these structures can be used for 15 years but, because they must be

dismantied if they are to be moved, they have no residual value. Mina Mining does not intend to

se the buicings elsewhere.

Mining machinery installed at the mine was purchased secondhand at a total cost of P1,800,000.

‘The machinery cost the former owner P4,500,000 and was 50% depreciated when purchased.

Mina Mining estimates that about half of this machinery will still be useful when the present

mineral resources have been exhausted but that dismantling and removal costs will just about

offset its value at that time. The company does not intend to use the machinery elsewhere. The

remaining machinery will last until about one-half the present estimated mineral ore has been

removed and will then be worthless. Cost is to be allocated equally between these two classes

of machinery.

1. What are the estimated depletion and depreciation charges for the first year?

Depletion Depreciation

A. 2,610,000 189,000

B. 1,305,000 378,000

c 2,610,000 234,000

D. 1,305,000 189,000

(CPA REVIEW SCHOOL OF THEPHILIPPINES (CPA) APTA:

2. What are the estimated depletion and depreciation charges for the St year?

Depletion Depreciation

A 1,305,000 378,000

B. 2,610,000 234,000

c 2,610,000 378,000

D. 1,305,000 234,000

3. What are the estimated depletion and depreciation charges for the 6" year?

Depletion Depreciation

A 2,610,000 378,000

B. 1,305,000 288,000

c 1,305,000 189,000

D> 2,620,000 288,000

4. What are the estimated depletion and depreciation charges for the 11" year?

Depreciation

x 305,000 99,000

8 1,305,000 189,000

© 2,610,000 99,000

D. 2,610,000 234,000

5. Whatare the depletion and depreciation charges for the first year assuming actual production

‘of 5,000 tons of mineral ore? (Nothing occurred during the year to cause the company

engineers to change their estimates of either the mineral resources or the life of the structures

and equipment.)

Depletion

A 1,087,500 P157,500

B P1,305,000 99,000

ie 1,305,000 P189,000

D. P 1,087,500 P82,500

PROBLEM 3

GATAS, INC. produces milk on its farms. Tt produces 30% of the country’s milk that is consumed.

Gatas owns 450 farms and has a stock of 21,000 cows and 10,500 heifers. The farms produce &

million kilograms of milk a year, and the average inventory held is 150,000 kilograms of milk.

However, the company is currently holding stocks of 500,000 kifograms of milk in powder form.

At October 31, 2015, the herds are:

* 21,000 cows (3 years old), all purchased on or before November 1, 2014

+ 7,500 heifers, average age 1.5 years, purchased on April 1, 2015

3,000 heifers, average age 2 years, purchased on November 1, 2014

No animals were bom or sold in the year.

‘The unit fair vaiues less estimated point-of-sale costs were:

L-year-old animal at October 31, 2015 3,200

2-year-old animal at October 31, 2015 4,500

LS-year-old animal at October 31, 2015 3,600

3-year-old animal at October 31, 2015 5,000

t-year-old animal at November 1, 2014 and

April 1, 2015 3,000

2-year-old animal at November 1, 2014 4,000

‘The company has had problems during the year: Contaminated milk was sold to customers. As

a result, milk consumption has gone down, The goverment has decided to compensate farmers

for potential loss in revenue from the sale of milk. This fact was published in the national press.

on September 1, 2015. Gatas received an offical letter on Gaober 10, 2015, stating that PS

million would be paid to'it on January 2, 2016.

The company’s business is spread over different parts of the country. The only region affected

by the contamination was Central Visayas, where the government curtailed milk production in the

region. The cattle were unaffected by the contamination and were healthy. The company

Das könnte Ihnen auch gefallen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- TU-91 2009 Accounting BasicsDokument38 SeitenTU-91 2009 Accounting BasicsGururaj NasaliNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Samples of Games WallpaperDokument2 SeitenSamples of Games WallpaperDarrelNoch keine Bewertungen

- 301 ExamsDokument67 Seiten301 ExamsDarrelNoch keine Bewertungen

- At 11Dokument4 SeitenAt 11DarrelNoch keine Bewertungen

- DOCUMENTATIONDokument2 SeitenDOCUMENTATIONDarrelNoch keine Bewertungen

- P1 Liabilities - LectureDokument4 SeitenP1 Liabilities - LectureDarrelNoch keine Bewertungen

- Accounting For Stock Issues PDFDokument26 SeitenAccounting For Stock Issues PDFJasonSpringNoch keine Bewertungen

- P1 - S.H.E PDFDokument16 SeitenP1 - S.H.E PDFDarrelNoch keine Bewertungen

- Welcome To The Ifrs For Smes UpdateDokument4 SeitenWelcome To The Ifrs For Smes UpdateDarrelNoch keine Bewertungen

- NCPAR HQ02 Contracts DominggoDokument17 SeitenNCPAR HQ02 Contracts DominggoDarrel100% (1)

- Welcome To The Ifrs For Smes UpdateDokument3 SeitenWelcome To The Ifrs For Smes UpdateDarrelNoch keine Bewertungen

- Welcome To The Ifrs For Smes UpdateDokument3 SeitenWelcome To The Ifrs For Smes UpdateDarrelNoch keine Bewertungen

- Welcome To The Ifrs For Smes UpdateDokument7 SeitenWelcome To The Ifrs For Smes UpdateDarrelNoch keine Bewertungen

- Welcome To The Ifrs For Smes UpdateDokument5 SeitenWelcome To The Ifrs For Smes UpdateDarrelNoch keine Bewertungen

- IFRS For SMEs Update May 2014Dokument3 SeitenIFRS For SMEs Update May 2014DarrelNoch keine Bewertungen

- Liabilities Arising From Participating in A Specific Market-Waste Electrical and Electronic EquipmentDokument6 SeitenLiabilities Arising From Participating in A Specific Market-Waste Electrical and Electronic EquipmentDarrelNoch keine Bewertungen

- International Financial Reporting Standards (IFRS) : An AICPA BackgrounderDokument16 SeitenInternational Financial Reporting Standards (IFRS) : An AICPA Backgroundernabaig14Noch keine Bewertungen

- IFRS For SMEs Update December 2016Dokument3 SeitenIFRS For SMEs Update December 2016DarrelNoch keine Bewertungen

- IFRS For SMEs Update October 2016Dokument3 SeitenIFRS For SMEs Update October 2016DarrelNoch keine Bewertungen

- IFRS For SMEs Update September 2016Dokument3 SeitenIFRS For SMEs Update September 2016DarrelNoch keine Bewertungen

- IFRS For SMEs Update AprilDokument2 SeitenIFRS For SMEs Update AprilDarrelNoch keine Bewertungen

- Welcome To The Ifrs For Smes UpdateDokument3 SeitenWelcome To The Ifrs For Smes UpdateDarrelNoch keine Bewertungen

- IFRS For SMEs Update JuneDokument3 SeitenIFRS For SMEs Update JuneDarrelNoch keine Bewertungen

- Ifric16 PDFDokument14 SeitenIfric16 PDFJorreyGarciaOplasNoch keine Bewertungen

- IFRS For SMEs Update October 2014 PDFDokument4 SeitenIFRS For SMEs Update October 2014 PDFDarrelNoch keine Bewertungen

- IFRS For SMEs Update September 2015Dokument3 SeitenIFRS For SMEs Update September 2015DarrelNoch keine Bewertungen

- Ifrs For Smes: UpdateDokument4 SeitenIfrs For Smes: UpdateDarrelNoch keine Bewertungen

- Preface To The Accounting Standards PDFDokument4 SeitenPreface To The Accounting Standards PDFJohn NashNoch keine Bewertungen

- IFRS For SMEs Update June 2015Dokument3 SeitenIFRS For SMEs Update June 2015DarrelNoch keine Bewertungen

- IFRS Learning Resources November 2015Dokument16 SeitenIFRS Learning Resources November 2015Anonymous NUn6MESxNoch keine Bewertungen