Beruflich Dokumente

Kultur Dokumente

Estrategia Forex

Hochgeladen von

meirelesunivixOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Estrategia Forex

Hochgeladen von

meirelesunivixCopyright:

Verfügbare Formate

Presents

Forex 3T

Trading Strategy

eBook

By James Chen, CTA, CMT

FXpath.com | Copyright 2010 James Chen, CTA, CMT

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

IMPORTANT NOTE: Please direct all inquiries regarding this document and all requests for this

document to the website: FXpath.com, or to the email address: ebooks@fxpath.com.

Copyright

No part of this publication may be reproduced, transmitted, or distributed in any form or by any

means, mechanical or electronic, including photocopying and recording, or by any information

storage and retrieval system, without permission in writing from the Author (except by a

reviewer, who may quote brief passages in a review.)

Risk Warning

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all

investors. The high degree of leverage can work against you as well as for you. Before deciding

to trade foreign exchange you should carefully consider your investment objectives, level of

experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of

your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice

from an independent financial advisor if you have any doubts.

Market Comments/Opinions and Distribution

Any opinions, comments, or other information contained on this document is provided as general

market commentary, and does not constitute investment advice. The author and distributor of this

document will not accept liability for any loss or damage, including, but without limitation to, any

loss of profit, which may arise directly or indirectly from use of or reliance on such information.

These comments are for information purposes only. The information contained on this document

does not constitute a solicitation to buy or sell, and is not to be available to individuals in a

jurisdiction where such availability would be contrary to local regulation or law. It is the

responsibility of readers of this document to ascertain the terms of and comply with any local law

or regulation to which they are subject. Opinions, market data, and recommendations are subject

to change at any time.

Hypothetical Results

Hypothetical performance results have many inherent limitations, some of which are described

below. No representation is being made that any account will or is likely to achieve profits or

losses similar to those discussed in this document. In fact, there are frequently sharp differences

between hypothetical performance results and the actual results achieved by any particular trading

program. One of the limitations of hypothetical performance results is that they are generally

prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial

risk, and no hypothetical trading record can completely account for the impact of financial risk in

actual trading. For example, the ability to withstand losses or to adhere to a particular trading

program in spite of trading losses are material points which can also adversely affect actual

trading results. There are numerous other factors related to the markets in general or to the

implementation of any specific trading program which cannot be fully accounted for in the

preparation of hypothetical performance results and all of which can adversely affect actual

trading results.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 2

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

ABOUT THE AUTHOR

James Chen, CTA, CMT is Chief Technical Strategist at FX

Solutions, a global leader in foreign exchange trading. He is

also a registered Commodity Trading Advisor and a Chartered

Market Technician.

He is the author of the books, Essentials of Foreign Exchange

Trading (John Wiley & Sons, 2009) and Essentials of Technical Analysis for

Financial Markets (John Wiley & Sons, 2010), as well as author of the

instructional video DVD set, High-Probability Trend Following in the Forex

Market (FXstreet, 2010).

Mr. Chen contributes daily and intraday technical analysis to key financial

media, is a frequent speaker at trading seminars, and has authored numerous

articles on forex trading strategies and technical analysis in major financial

publications.

He has been quoted by:

- Reuters News

- Dow Jones Newswires

- The Associated Press (AP)

- International Herald Tribune

And his feature articles have been published in:

- Forbes.com

- Futures Magazine

- Technical Analysis of Stocks and Commodities Magazine

- Stocks, Futures and Options (SFO) Magazine

- Forbes Media’s Investopedia

- International Business Times

- FX Street

Mr. Chen graduated from Tufts University with a degree in social

psychology, and has been a currency trader and market analyst since the

inception of the retail forex market.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 3

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

Forex 3T Trading Strategy

The Forex 3T Trading Strategy is a high-probability

approach to trading in the forex market. “3T” can either

represent “three timeframes” to denote the multiple

timeframe aspect of this approach, or it can represent the

three T’s of “Trend,” “Turn,” and “Trailed-entry,” which

together describe the strategy’s methodological process.

The variation of multiple timeframe trading that will be

described here is loosely-based upon a time-tested trading

approach that originates from Dr. Alexander Elder’s Triple

Screen methodology. The 3T strategy has been customized

and enhanced for trading in the forex market. Although

primarily a discretionary trading strategy, 3T’s rules can be

customized to be as rigid or as flexible as required by each

specific trader or trading style.

As with other trend-following strategies, this trading

approach tends to thrive in trending conditions while

attempting to avoid choppy, whipsaw markets. Since

currencies are well known to have a tendency towards

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 4

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

frequent and prolonged trending, the multiple timeframe

trading approach is well-suited to the forex market. Of

course, this is not to say that currencies are always trending,

as they most certainly are not. But the instances where one

may find a currency pair in trending mode, whether bullish

or bearish, are relatively frequent. And when trends do

occur, they often tend to endure for prolonged periods.

The 3T strategy of multiple timeframe trading that will be

described in this e-book is a time-tested methodology. The

key concept behind this multiple timeframe approach is that

an intelligent trader should view the market from different

angles in order to understand and apply the critical strategic

elements of (1) trend, (2) retracement/correction (turn), and

(3) breakout entry (trailing-entry). The primary objective of

3T trading is to enter into a strong trend at the most

opportune time and price – after a minor countertrend

retracement/correction (or turn) ends, and then price breaks

out to resume momentum in the direction of the trend.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 5

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

The process of implementing an effective 3T strategy

begins with a simple choice of which timeframes to use.

Three timeframes, as the name of the strategy suggests,

should ultimately be chosen to execute the strategy. The

easiest way to approach this choice is first to identify one’s

customarily preferred timeframe, and label it as the

intermediate timeframe. For example, if one is accustomed

to trading most frequently on 4-hour (240 minute) charts,

one would label that timeframe as “intermediate.”

To derive the long-term timeframe, one would simply take

one’s intermediate timeframe and multiply it by 4, 5, or 6.

This range of multipliers provides flexibility for the trader

to fine-tune the choice of timeframes. As an example of the

long-term timeframe, the aforementioned 4-hour chart

trader might multiply by 6 to choose the 24-hour chart (or

the daily chart in forex) as the long-term timeframe.

Similarly, to derive the short-term timeframe, one would

simply take one’s intermediate timeframe and divide it by 4,

5, or 6. To use the 4-hour trader as an example once again,

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 6

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

that trader might divide the 4 hours by 4 to choose the 1-

hour (60 minute) chart as the short-term timeframe.

Besides the example given above of the Daily/4-Hour/1-

Hour combination, other possibilities include

Weekly/Daily/4-Hour, 4-Hour/1-Hour/15-Minute, 1-

Hour/15-Minute/3-Minute, and really any combination that

can be imagined.

Once the three timeframes are determined, 3T analysis and

trading can begin, starting with a look at the long-term

timeframe. This timeframe represents the strategic element

of trend. The sole function of this timeframe is to determine

the overall trend conditions – if the current market is

trending up, trending down, or non-trending. If a certain

market is determined to be non-trending, a decision should

be made to refrain from trading that particular currency pair

at that particular time. If the market is determined to be

trending up, only long trades should be taken. And if the

market is determined to be trending down, only short trades

should be taken.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 7

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

But how exactly can trend conditions be determined? If one

is trading manually on a discretionary basis, the trend can

readily be determined through several subjective, yet

effective, methods. One of these methods is to draw simple

dynamic trendlines – primarily uptrend support or

downtrend resistance. If a trendline can be drawn

convincingly to connect higher lows in an uptrend or lower

highs in a downtrend, there is a good chance that a trend is

indeed present. If not, that market should probably be

avoided for the time being.

Another rather subjective method of determining the trend

is through the visual assessment of a single moving average.

After choosing the period of the moving average, a trader

could assess the presence and magnitude of slope on the

single moving average to determine the presence and

magnitude of the trend, or the lack thereof.

A better, more concrete method to denote trend on the

long-term timeframe also employs moving averages, but

multiple versions of them. Please see chart below.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 8

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

Daily Chart with Multiple Exponential Moving Averages (periods of 10, 20,

30, 50, and 100)

If all of the exponential moving averages (EMAs) in a

multiple set (e.g., 10-, 20-, 30-, 50-, and 100- periods) are

in the correct order for an uptrend (shorter period moving

averages on top followed progressively by longer periods

towards the bottom), with no current crossing of those

EMAs, price can be considered to be in an entrenched

uptrend on a longer-term basis. Conversely, if all the

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 9

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

moving averages are in the correct order for a downtrend

(shorter period moving averages on the bottom followed

progressively by longer periods towards the top), with no

current crossing of those EMAs, price can be considered to

be in an entrenched downtrend on a longer-term basis. Any

situation where there are EMA crosses and a lack of correct

order would signify a market that is non-trending, and

therefore a market to stay away from.

Once the presence and direction of the trend is determined

on the longest timeframe using the trader’s method of

choice, the focus would then turn to the intermediate

timeframe. This timeframe represents the strategic element

of retracement/correction, or turn. A minor dip in an

uptrend or a minor rally in a downtrend both represent ideal

locations for getting in on high-probability, risk-controlled

trades.

But how does a trader locate and identify these dips and

rallies on the intermediate timeframe? Simply, with the

intelligent use of oscillators. Please see chart below.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 10

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

4-Hour Chart with Slow Stochastics

Oscillators help confirm overbought and oversold

conditions, and give readings of overall price momentum.

There are countless variations of oscillators available to

traders, but only a handful that are most commonly used.

These include Relative Strength Index (RSI), Stochastics

(both Slow and Fast), Rate of Change (ROC), and

Commodity Channel Index (CCI), among others.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 11

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

A 3T trader viewing the intermediate timeframe would scan

for instances when the countertrend retracement move

within the longer-term trend becomes exhausted. The

method by which this exhaustion is measured relies on

crosses of the oscillator over the horizontal lines of

demarcation between the overbought/oversold regions and

the middle region of the oscillator range.

To illustrate, suppose a currency pair has been determined

by analyzing the daily chart (the long-term timeframe in

this example) to be firmly entrenched in a strong uptrend.

This is evidenced both by a clearly-drawn uptrend support

line as well as a correct order of five exponential moving

averages. Turning next to the 4-hour chart (the intermediate

timeframe in this example), the trader utilizes the Slow

Stochastics oscillator to locate an exhaustion of a

countertrend retracement/correction within the uptrend. The

chart event that would confirm this countertrend exhaustion

is a cross of the Slow Stochastics %K line above the

oversold barrier at the 20 level, indicating that price is

emerging up from oversold.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 12

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

Once the long-term timeframe is showing a significant

trend and the intermediate timeframe is indicating that price

may be in the process of resuming the prevailing trend after

a countertrend retracement/correction, the final step is to

drill down to the third, and shortest, timeframe.

The sole purpose of this short-term timeframe is to seek the

most opportune entry point possible. This is accomplished

by implementing a trailing entry stop strategy, in search of

a strong momentum breakout where price takes off in the

direction of the trend. At this point in the 3T trading

process, the trader has already been assured that a trend is

indeed in place and that any trading will be in the direction

of this primary trend. The trader also knows that a

countertrend retracement/correction, or turn, within the

trend has occurred, and that price is in the process of

recovering from this trend setback.

This constitutes a classic high-probability trading setup.

The only remaining consideration before committing to this

trade is planning the actual execution of the entry. Using

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 13

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

the mentioned trailing entry stop methodology, the trader

wisely waits for price momentum to breakout in the

direction of the trend.

As mentioned, a trailing entry stop as it relates to the 3T

trading strategy is a type of breakout entry in the direction

of the overall long-term trend. It is a dynamic entry because

the breakout entry price level is progressively moved to

“better” prices if the trade is not triggered immediately. In

the case of potential buy (long) trades, progressively better

prices refers to progressively lower prices. In the case of

potential sell (short) trades, progressively better prices

refers to progressively higher prices.

As an example, on buy signals from the two longer

timeframes, a 3T trader would begin looking immediately

on the shortest timeframe (e.g., a 1-hour chart in a daily/4-

hour/1-hour timeframe set) for potential opportunities to

enter into buy trades. This entire process would be reversed

for sell signals identified on the longer timeframes. Please

see the chart below.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 14

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

1-Hour Chart with a Trailing Entry Stop and an Initial Stop Loss

The 3T trader who has just identified the buy signals on the

two longer timeframes would plan on looking to the short-

term timeframe to enter the market on a breakout above the

previous bar’s high. If the current bar closes without

breaking the previous bar’s high, the breakout level for the

next bar would effectively be lowered to the current bar’s

high. If, in turn, the next bar does not violate the new

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 15

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

breakout level, yet another even lower breakout level is set

for the following bar.

This process of setting the trade entry level at progressively

better prices allows the trader to stay out of trades where

the price momentum is not optimal for breaking out in the

direction of the trend. Re-setting of the entry breakout level

at progressively better prices continues until a breakout in

the direction of the trend actually occurs, or the trade setup

simply becomes invalid. This latter condition where the

trade setup becomes invalid can occur if the original signals

on the two longer timeframes no longer apply. Perhaps a

breakout on the short-term timeframe fails to occur for so

long that the long-term timeframe begins showing a change

in the long-term trend (e.g., the multiple EMAs begin

crossing). Or maybe the oscillator on the intermediate

timeframe begins showing that the original momentum is

becoming exhausted as the opposite extremity of

overbought/oversold is quickly being approached.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 16

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

If the trade is not invalidated, and an entry is executed on a

short-term breakout that triggers the trailing entry stop, the

initial stop loss for the trade can prudently be placed (for a

buy trade) directly underneath the lowest low of the

intermediate timeframe’s retracement move. Likewise, for

a sell trade, the initial stop loss can be placed directly above

the highest high of the intermediate timeframe’s

retracement move.

The logic behind this stop-loss placement is classically

technical in nature. If the reasons for getting into a trade are

no longer valid (e.g., the expected dip becomes a potential

reversal), the prudent reaction is to get out of the failed

trade as quickly as possible.

After entry into a trade using this 3T strategy, price may

perform one of three actions. It may hit the stop loss,

confirming that the expected retracement/correction could

in fact be a potential reversal, and thereby exiting the trade

for a controlled loss. It may consolidate for a period of time

without hitting the stop-loss. And finally, the best possible

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 17

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

outcome is clearly for price to move strongly in the

direction of the trend after the breakout entry, placing the

3T trader in a favorable position.

Since 3T trading is a form of trend-trading, one of the best

ways to manage an open trade is with a trailing stop-loss

methodology (this is a position-exiting strategy in contrast

to the previously-mentioned trailing entry stop, which is a

position-entering strategy). This trailing stop-loss exit

strategy potentially allows the 3T trader to lock-in

progressively greater profits while dynamically managing

risk.

There are a couple of different variations of the trailing

stop-loss – automated and manual. An automated trailing

stop-loss follows price by a pre-determined number of pips.

In contrast, a manual trailing stop-loss is actually moved

manually by the trader. In the case of a long (buy) trade, the

trader would progressively move the stop-loss up in the

direction of profit as price moved in the trade’s favor,

effectively locking-in those profits. Technically, the most

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 18

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

logical locations to move stop-losses (in long trades) reside

right under the most recent swing low retracements. These

areas are the most reasonable locations for initial stop-

losses, and they are also the most reasonable locations for

manually-trailed stop-losses. The same holds true, but in

reverse, for short (sell) trades.

Using the high-probability techniques of 3T analysis and

trading, forex traders know from the very beginning that

they are on the right side of the trade – the side that moves

with the dominant, prevailing trend. 3T traders can also be

assured that they are taking advantage of optimal trade

entry opportunities, right after corrective turns, or

retracements. Finally, 3T traders also know that they are on

the right side of short-term momentum, as they wait to get

into high-probability trades with a trailing entry stop

methodology, triggering trades only when price carries

enough momentum to breakout in the direction of the trend.

The Forex 3T Trading Strategy is not only a high-

probability method for trading forex. It is also an extremely

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 19

FXpath.com Presents: Forex 3T Trading Strategy eBook by James Chen, CTA, CMT

flexible and customizable approach to viewing the currency

markets. With proper practice and experimentation, as well

as fine-tuning of the 3T strategy to one’s own individual

trading style and personality, each forex trader potentially

holds a key to attaining greater success in the forex market.

Good Trading,

James Chen, CTA, CMT

IMPORTANT NOTE: Please direct all inquiries regarding this document and all requests for this

document to the website: FXpath.com, or to the email address: ebooks@fxpath.com.

FXpath.com | Copyright 2010 James Chen, CTA, CMT Page 20

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Hotel PlanDokument19 SeitenHotel Planlucky zee100% (2)

- Authors LibraryDokument1.128 SeitenAuthors Libraryauthoritybonus75% (12)

- Betfair Football StrategyDokument23 SeitenBetfair Football Strategyxavros67% (6)

- Betfair Football StrategyDokument23 SeitenBetfair Football Strategyxavros67% (6)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Stocks&Commodities S&C 03-2017Dokument64 SeitenStocks&Commodities S&C 03-2017Edgar Santiesteban Collado50% (2)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Subcontracting Process in Production - SAP BlogsDokument12 SeitenSubcontracting Process in Production - SAP Blogsprasanna0788Noch keine Bewertungen

- 4 Hour MACD Forex StrategyDokument20 Seiten4 Hour MACD Forex Strategyanzraina100% (8)

- Corpo Bar QsDokument37 SeitenCorpo Bar QsDee LM100% (1)

- Winning Chart Patterns With Ed Downs PDFDokument71 SeitenWinning Chart Patterns With Ed Downs PDFbinosp2100% (1)

- Congson Vs NLRCDokument2 SeitenCongson Vs NLRCDan Christian Dingcong CagnanNoch keine Bewertungen

- Swift MessageDokument29 SeitenSwift MessageAbinath Stuart0% (1)

- Umjetnost PDFDokument92 SeitenUmjetnost PDFJuanRodriguezNoch keine Bewertungen

- Management TheoryDokument63 SeitenManagement TheoryFaisal Ibrahim100% (2)

- Ctpat Prog Benefits GuideDokument4 SeitenCtpat Prog Benefits Guidenilantha_bNoch keine Bewertungen

- AM.012 - Manual - UFCD - 0402Dokument23 SeitenAM.012 - Manual - UFCD - 0402Luciana Pinto86% (7)

- Sites ForexDokument1 SeiteSites ForexmeirelesunivixNoch keine Bewertungen

- 133trading TipsDokument13 Seiten133trading Tipsansar99Noch keine Bewertungen

- YouTube Channels for Forex Trading StrategiesDokument1 SeiteYouTube Channels for Forex Trading StrategiesmeirelesunivixNoch keine Bewertungen

- Concerto de CelularDokument1 SeiteConcerto de CelularmeirelesunivixNoch keine Bewertungen

- (Ebook) Murphy, John J. - Technical Analysis of The Financia (001-240)Dokument240 Seiten(Ebook) Murphy, John J. - Technical Analysis of The Financia (001-240)meirelesunivixNoch keine Bewertungen

- Mba-Cm Me Lecture 1Dokument17 SeitenMba-Cm Me Lecture 1api-3712367Noch keine Bewertungen

- Ghuirani Syabellail Shahiffa/170810301082/Class X document analysisDokument2 SeitenGhuirani Syabellail Shahiffa/170810301082/Class X document analysisghuirani syabellailNoch keine Bewertungen

- How industrial engineering can optimize mining operationsDokument6 SeitenHow industrial engineering can optimize mining operationsAlejandro SanchezNoch keine Bewertungen

- Βιογραφικά ΟμιλητώνDokument33 SeitenΒιογραφικά ΟμιλητώνANDREASNoch keine Bewertungen

- Icade Annual Report 2012 Reference DocumentDokument470 SeitenIcade Annual Report 2012 Reference DocumentIcadeNoch keine Bewertungen

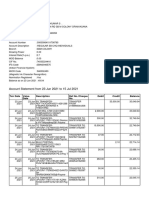

- Account Statement From 23 Jun 2021 To 15 Jul 2021Dokument8 SeitenAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNoch keine Bewertungen

- Refunds Maceda Law and PD957Dokument2 SeitenRefunds Maceda Law and PD957QUINTO CRISTINA MAENoch keine Bewertungen

- Filipino Terminologies For Accountancy ADokument27 SeitenFilipino Terminologies For Accountancy ABy SommerholderNoch keine Bewertungen

- Compare Q1 and Q2 productivity using partial factor productivity analysisDokument3 SeitenCompare Q1 and Q2 productivity using partial factor productivity analysisDima AbdulhayNoch keine Bewertungen

- A Presentation On NokiaDokument16 SeitenA Presentation On Nokiajay2012jshmNoch keine Bewertungen

- AdvancingDokument114 SeitenAdvancingnde90Noch keine Bewertungen

- Pandit Automotive Tax Recovery ProcessDokument6 SeitenPandit Automotive Tax Recovery ProcessJudicialNoch keine Bewertungen

- Solved in A Manufacturing Plant Workers Use A Specialized Machine ToDokument1 SeiteSolved in A Manufacturing Plant Workers Use A Specialized Machine ToM Bilal SaleemNoch keine Bewertungen

- Take RisksDokument3 SeitenTake RisksRENJITH RNoch keine Bewertungen

- Audit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryDokument24 SeitenAudit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryrockyrrNoch keine Bewertungen

- Client Reacceptance Checklist - DR - FagihDokument1 SeiteClient Reacceptance Checklist - DR - FagihAlizer AbidNoch keine Bewertungen

- Contract: Organisation Details Buyer DetailsDokument4 SeitenContract: Organisation Details Buyer DetailsMukhiya HaiNoch keine Bewertungen

- Jesd 48 BDokument10 SeitenJesd 48 BLina GanNoch keine Bewertungen

- Cabanlit - Module 2 SPDokument2 SeitenCabanlit - Module 2 SPJovie CabanlitNoch keine Bewertungen