Beruflich Dokumente

Kultur Dokumente

VAT and business tax questions

Hochgeladen von

Ivy SaliseOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

VAT and business tax questions

Hochgeladen von

Ivy SaliseCopyright:

Verfügbare Formate

Name: Date:

I. Write True if statement is correct or False if incorrect.

1. A single income activity rendered by a resident person such as selling his family home is a business.

2. A non-stock and non-profit educational institution is engaged into business.

3. A sale of company cars to its employee officers is considered a business transaction.

4. A Filipino citizen who rendered regular services for a profit to an employer is considered business.

5. Casual sales are not subject to business tax but subject to income tax.

6. Only VAT-registered business is subject to VAT.

7. Only one TIN is to be assigned for every business by a sole proprietor taxpayer.

8. A business should register before the start of its operation.

9. A business should renew its registration annually before the end of the year.

10. A non-VAT person collecting VAT from customers is liable to pay percentage tax plus the VAT he collected with surcharge of

25%.

11. A taxpayer shall apply for the authority to print with the BIR before the printing of his business invoice and receipts.

12. In case of VAT invoice, the amount of tax shall be shown as separate time in the invoice or receipt.

13. A business implies regularity of transaction; hence, a non-resident alien that has a single business transaction in the

Philippines is considered not engaged in business.

14. In accordance with TRAIN, the registration threshold for VAT business is P2,999,999 of its sales or receipts per year.

15. All taxpayers should have their own TIN.

16. Cooperatives are business tax exempt , but subject to registration fee.

17. In general, the sales invoice of a VAT-registered business shall include the amount of VAT.

18. A non VAT person can only shift to VAT after 3 years upon registration as non VAT.

19. Excise tax regulates the excessive consumption of sin products.

20. The taxpayer is required to pay annual registration fee of P500 for each distinct and separate business.

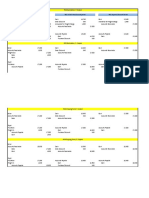

II. PROBLEM-SOLVING. Show your solution in the separate sheet of paper.

1. The VAT registered business reported a VAT purchase invoice amounting to P84,000. The same goods were sold at 120% of

cost. How much would be the total VAT sales invoice amount?

2. A trading business with annual sales of P400,000 is registered as VAT. For its sale of P50,000, how much should be the total

amount indicated in its invoice?

3. A multi purpose cooperative is registered with the SEC and the CDA. It has a main office, a sales office and a warehouse. For

the year, it has P5,000,000 total collection from its members. The annual registration fee of the cooperative would be.

4. Dok Ling, a sole proprietor, opted to register as VAT. His transactions during the first quarter show the following:

Sales P300,000

Cost of Sales 200,000

Ending Inventory 100,000

If all of the purchases of merchandise were purchase from a VAT-registered business, how much is the VAT payable of Dok

Ling?

5. A is a non-VAT business with a total sales of P1,919,500 of which 70% has been collected. Its total purchases inclusive of

VAT is P1,120,000. How much is the business tax of A?

6. Iyona Trading, a non-VAT business, sold the P200,000 products to AKina Enterprises. If Iyona’s purchase during the taxable

period amounts to P224,000, inclusive of VAT, and the cost of sales is P89,600, how much is the amount of business tax

payable?

7. A VAT registered business reported total sales of P300,000 for the year. How much would be its net business tax payable if its

VAT purchase invoices’ aggregate amount is P268,800?

8. Lito, a VAT registered person, shows the following sales and purchases during the year:

Sales P2,500,000

Purchases from:

VAT supplier inclusive of VAT 1,120,000

Non VAT supplier inclusive of VAT 560,000

Non-VAT supplier 200,000

Cost of sales 1,400,000

The net VAT payable of Lito would be?

9. Sung, Filipino-Chinese, is a VAT registered person. The records of his business transactions during the year were as follows:

Purchases from VAT registered supplier P 800,000

Purchases from non VAT registered supplier 200,000

Sales 1,000,000

Cost of Sales 600,000

Ending Inventory 400,000

How much is the net VAT payable?

10. Camella realty corporation sold the following real properties during the taxable year:

2 units of residential house and lot at 3M each P6,000,000

4 residential lots at 2M each 8,000,000

1 commercial lot at 3M 3,000,000

How much is the total transactions subject to VAT?

Das könnte Ihnen auch gefallen

- MorrisBreann Fall 2020 MGMT 343 Exam #1Dokument4 SeitenMorrisBreann Fall 2020 MGMT 343 Exam #1Breann MorrisNoch keine Bewertungen

- Case 10 - Office Depot, Inc - 2011Dokument27 SeitenCase 10 - Office Depot, Inc - 2011Tan Theam Ping100% (6)

- Financial Management September 2013 Mark Plan ICAEW PDFDokument9 SeitenFinancial Management September 2013 Mark Plan ICAEW PDFMuhammad Ziaul HaqueNoch keine Bewertungen

- Question and Answer - 12Dokument31 SeitenQuestion and Answer - 12acc-expert0% (1)

- 8.0 TVM Financial PlanningDokument2 Seiten8.0 TVM Financial PlanningYashvi MahajanNoch keine Bewertungen

- Kmart FraudDokument17 SeitenKmart FraudDiana RoșcaNoch keine Bewertungen

- Form A Form A - Annual Return of Company Having Share CapitalDokument4 SeitenForm A Form A - Annual Return of Company Having Share CapitalAimanNoch keine Bewertungen

- IFRS-15-Problem-Set 2Dokument4 SeitenIFRS-15-Problem-Set 2FayehAmantilloBingcangNoch keine Bewertungen

- 5.a in The Case That The AI Were To Have Made The Entries Themselves, It Would Ruin Their Function andDokument2 Seiten5.a in The Case That The AI Were To Have Made The Entries Themselves, It Would Ruin Their Function andAngeloNoch keine Bewertungen

- Consolidated Problems TestbankDokument6 SeitenConsolidated Problems TestbankIvy Salise0% (1)

- EXCEL Lab ExerciseDokument20 SeitenEXCEL Lab ExerciseMohit SainiNoch keine Bewertungen

- Event Contract - TemplateDokument17 SeitenEvent Contract - Templatenoel damotNoch keine Bewertungen

- Name: Kimberly Anne P. Caballes Year and CourseDokument12 SeitenName: Kimberly Anne P. Caballes Year and CourseKimberly Anne CaballesNoch keine Bewertungen

- Bustamante TAX CDokument19 SeitenBustamante TAX CJean Rose Tabagay BustamanteNoch keine Bewertungen

- TASK 1 - Gather RRL About Tax Compliance and Self EmployedDokument3 SeitenTASK 1 - Gather RRL About Tax Compliance and Self Employedzee abadillaNoch keine Bewertungen

- AC 3101 Discussion ProblemDokument1 SeiteAC 3101 Discussion ProblemYohann Leonard HuanNoch keine Bewertungen

- SVFC Management Consultancy Midterm ExamDokument3 SeitenSVFC Management Consultancy Midterm ExamRannah RaymundoNoch keine Bewertungen

- TBCH01Dokument6 SeitenTBCH01Arnyl ReyesNoch keine Bewertungen

- Sol Man - MC PTXDokument5 SeitenSol Man - MC PTXiamjan_101Noch keine Bewertungen

- Partnership Accounting QuestionsDokument15 SeitenPartnership Accounting QuestionsNhel AlvaroNoch keine Bewertungen

- AudDokument46 SeitenAudJane ConstantinoNoch keine Bewertungen

- Semis Tax PPTSDokument271 SeitenSemis Tax PPTSTeam MindanaoNoch keine Bewertungen

- A Government Employee May Claim The Tax InformerDokument3 SeitenA Government Employee May Claim The Tax InformerYuno NanaseNoch keine Bewertungen

- PUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredDokument12 SeitenPUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredGabrielle Marie RiveraNoch keine Bewertungen

- AC 510 Kimwell Chapter 5 Solutions 1Dokument134 SeitenAC 510 Kimwell Chapter 5 Solutions 1Jeston TamayoNoch keine Bewertungen

- Module 2 - Strat ManDokument4 SeitenModule 2 - Strat ManElla MaeNoch keine Bewertungen

- Chapter 11 Prob 11-27Dokument8 SeitenChapter 11 Prob 11-27CelineAbbeyMangalindanNoch keine Bewertungen

- 3.2. Profit or Loss StatementDokument10 Seiten3.2. Profit or Loss StatementSayaNoch keine Bewertungen

- Government GrantsDokument9 SeitenGovernment Grantssorin8488100% (1)

- Understanding VAT: A Business Tax, Its Computation, Registration RequirementsDokument24 SeitenUnderstanding VAT: A Business Tax, Its Computation, Registration RequirementsPeter AhNoch keine Bewertungen

- DeductionsDokument4 SeitenDeductionsDianna RabadonNoch keine Bewertungen

- Assignment Transfer Tax ComputationDokument3 SeitenAssignment Transfer Tax ComputationAngelyn SamandeNoch keine Bewertungen

- A1 Installment SalesDokument3 SeitenA1 Installment SalesMae0% (1)

- Income Taxes - AssessmentDokument5 SeitenIncome Taxes - Assessmentglobeth berbanoNoch keine Bewertungen

- Partnership Liquidation Quiz AnswersDokument4 SeitenPartnership Liquidation Quiz AnswersMikaella BengcoNoch keine Bewertungen

- Accounting For Business Combination - Quiz 2Dokument1 SeiteAccounting For Business Combination - Quiz 2Hey BuddyNoch keine Bewertungen

- Tax 2Dokument3 SeitenTax 2Emmanuel DiyNoch keine Bewertungen

- Final 2 2Dokument3 SeitenFinal 2 2RonieOlarteNoch keine Bewertungen

- This Study Resource Was: Lecture NotesDokument9 SeitenThis Study Resource Was: Lecture NotesKristine Lirose BordeosNoch keine Bewertungen

- MQ1Dokument8 SeitenMQ1alellieNoch keine Bewertungen

- SVFC BS Accountancy - 2nd Set Online Resources SY20-19 2nd Semester PDFDokument14 SeitenSVFC BS Accountancy - 2nd Set Online Resources SY20-19 2nd Semester PDFLorraine TomasNoch keine Bewertungen

- (Fingerprints Group) 2011 CIMA Global Business Challenge ReportDokument23 Seiten(Fingerprints Group) 2011 CIMA Global Business Challenge Reportcrazyfrog1991Noch keine Bewertungen

- Refer To The Accounting Change by Wertz Construction Company in PDFDokument1 SeiteRefer To The Accounting Change by Wertz Construction Company in PDFAnbu jaromiaNoch keine Bewertungen

- Discuss The Components and Characteristics of Maximization and Minimization ModelDokument5 SeitenDiscuss The Components and Characteristics of Maximization and Minimization ModelNicole AutrizNoch keine Bewertungen

- 1 - p.3 7 8 Week 5 Financial AnalysisDokument4 Seiten1 - p.3 7 8 Week 5 Financial AnalysisTamoor BaigNoch keine Bewertungen

- Chapter 2 Partnership OperationsDokument24 SeitenChapter 2 Partnership OperationsChelsy SantosNoch keine Bewertungen

- Seatwork-Hedging of A Net Investment in Foreign OperationDokument1 SeiteSeatwork-Hedging of A Net Investment in Foreign OperationAnthony Tunying MantuhacNoch keine Bewertungen

- Spice Is Right ImportsDokument2 SeitenSpice Is Right ImportsLaiza Grace FabreNoch keine Bewertungen

- Job OrderDokument7 SeitenJob OrderFrances Alandra SorianoNoch keine Bewertungen

- Calculate Estate Tax for Married Filipino DecedentDokument14 SeitenCalculate Estate Tax for Married Filipino DecedentLea ChermarnNoch keine Bewertungen

- Measures of Central TendencyDokument21 SeitenMeasures of Central TendencyRanier Factor AguilarNoch keine Bewertungen

- Practice Quiz NonFinlLiabDokument15 SeitenPractice Quiz NonFinlLiabIsabelle GuillenaNoch keine Bewertungen

- Joint-ArrangementsDokument2 SeitenJoint-ArrangementsRenalyn Esteban EsparteroNoch keine Bewertungen

- BAC 318 Final Examination With AnswersDokument10 SeitenBAC 318 Final Examination With Answersjanus lopez100% (1)

- Partnership Dissolution and Liquidation DrillsDokument6 SeitenPartnership Dissolution and Liquidation DrillsMa. Yelena Italia TalabocNoch keine Bewertungen

- FinaleDokument22 SeitenFinaleJolina ManceraNoch keine Bewertungen

- Business TaxationDokument6 SeitenBusiness TaxationMandy BloomNoch keine Bewertungen

- Sample Problems in PartnershipDokument6 SeitenSample Problems in PartnershipAina OracionNoch keine Bewertungen

- UCP Tax Guide: Income Tax for IndividualsDokument9 SeitenUCP Tax Guide: Income Tax for IndividualsDin Rose GonzalesNoch keine Bewertungen

- Prelim Exam - Special TopicsDokument9 SeitenPrelim Exam - Special TopicsCaelah Jamie TubleNoch keine Bewertungen

- MODULE 1 2 Bonds PayableDokument10 SeitenMODULE 1 2 Bonds PayableFujoshi BeeNoch keine Bewertungen

- Long Term Construction Contract Quiz2020Dokument10 SeitenLong Term Construction Contract Quiz2020Riza Mae AlceNoch keine Bewertungen

- There May Be A Property Relationship of Conjugal PDokument6 SeitenThere May Be A Property Relationship of Conjugal PJunho ChaNoch keine Bewertungen

- Audit Quiz 2Dokument1 SeiteAudit Quiz 2Von Andrei MedinaNoch keine Bewertungen

- Chapter 1 Introduction To Business TaxDokument16 SeitenChapter 1 Introduction To Business TaxJerome EspinaNoch keine Bewertungen

- Course Guide Course Title: Accounting For Government and Non-Profit Organization Course Code: Credit Units: Course DescriptionDokument2 SeitenCourse Guide Course Title: Accounting For Government and Non-Profit Organization Course Code: Credit Units: Course DescriptionIvy SaliseNoch keine Bewertungen

- Chapter 5 Final Withholding Tax HandoutsDokument1 SeiteChapter 5 Final Withholding Tax HandoutsIvy SaliseNoch keine Bewertungen

- Acctg 11 Q1 - FinalsDokument8 SeitenAcctg 11 Q1 - FinalsIvy SaliseNoch keine Bewertungen

- Law On Sales 01 DiscussionDokument13 SeitenLaw On Sales 01 DiscussionIvy SaliseNoch keine Bewertungen

- TaxationDokument1 SeiteTaxationIvy SaliseNoch keine Bewertungen

- Book Value Per Share TQDokument6 SeitenBook Value Per Share TQIvy SaliseNoch keine Bewertungen

- SaleDokument2 SeitenSaleIvy SaliseNoch keine Bewertungen

- Inventories QuizDokument4 SeitenInventories QuizIvy Salise100% (1)

- Shipping Entries PDF 12345Dokument2 SeitenShipping Entries PDF 12345Ivy SaliseNoch keine Bewertungen

- OPT SummaryDokument5 SeitenOPT SummaryIvy SaliseNoch keine Bewertungen

- Acctg1 HandoutsDokument3 SeitenAcctg1 HandoutsIvy SaliseNoch keine Bewertungen

- 5-Year Development Plan GuideDokument2 Seiten5-Year Development Plan GuideIvy SaliseNoch keine Bewertungen

- Escom EhpumDokument1 SeiteEscom EhpumSin Chi ManNoch keine Bewertungen

- Introduction To Pfrs 9Dokument36 SeitenIntroduction To Pfrs 9Natalie SerranoNoch keine Bewertungen

- Tor PMSC UndipDokument22 SeitenTor PMSC UndipSigit Nur WaskitoNoch keine Bewertungen

- Business Plan (OASIS)Dokument41 SeitenBusiness Plan (OASIS)uzair97Noch keine Bewertungen

- Profitability Analysis - Product Wise/ Segment Wise/ Customer WiseDokument10 SeitenProfitability Analysis - Product Wise/ Segment Wise/ Customer WisecasarokarNoch keine Bewertungen

- SWOT Analysis of Toyota in 40 CharactersDokument4 SeitenSWOT Analysis of Toyota in 40 Characterssubgad0% (1)

- Black Money-Part-1Dokument9 SeitenBlack Money-Part-1silvernitrate1953Noch keine Bewertungen

- Q1 Exports: Bed Wear Cotton ClothDokument10 SeitenQ1 Exports: Bed Wear Cotton ClothSaqib RehanNoch keine Bewertungen

- Madrigal vs. RaffertyDokument4 SeitenMadrigal vs. RaffertyMj BrionesNoch keine Bewertungen

- Ratio Analysis of Sainsbury PLCDokument4 SeitenRatio Analysis of Sainsbury PLCshuvossNoch keine Bewertungen

- International Capital MarketDokument2 SeitenInternational Capital MarketPhuc LeNoch keine Bewertungen

- Buy Back Article PDFDokument12 SeitenBuy Back Article PDFRavindra PoojaryNoch keine Bewertungen

- Oracle Financials TheoryDokument173 SeitenOracle Financials TheoryUdayraj SinghNoch keine Bewertungen

- Earnings Per ShareDokument15 SeitenEarnings Per ShareMuhammad SajidNoch keine Bewertungen

- Trading Plan TemplateDokument18 SeitenTrading Plan TemplateGuyEye100% (3)

- Meralco Securities Pipeline Subject to Realty TaxDokument2 SeitenMeralco Securities Pipeline Subject to Realty TaxMariano RentomesNoch keine Bewertungen

- MCS-Responsibility Centres & Profit CentresDokument24 SeitenMCS-Responsibility Centres & Profit CentresAnand KansalNoch keine Bewertungen

- Renunciation of POA PowersDokument2 SeitenRenunciation of POA PowersJatin SharanNoch keine Bewertungen

- Internship Report On "General Banking, Investment Mode & Foreign Exchange Activities of Al-Arafah Islami Bank Limited"Dokument84 SeitenInternship Report On "General Banking, Investment Mode & Foreign Exchange Activities of Al-Arafah Islami Bank Limited"Rayhan Zahid Hasan100% (1)

- P2P Interview Questions and Answer 3Dokument13 SeitenP2P Interview Questions and Answer 3Raju Bothra100% (2)

- Saddam STPRDokument94 SeitenSaddam STPRSumit GuptaNoch keine Bewertungen

- Trust Deed FormatDokument6 SeitenTrust Deed Formatchandraadv100% (4)

- Control Design Effectiveness Quality Review ChecklistDokument6 SeitenControl Design Effectiveness Quality Review ChecklistRodney LabayNoch keine Bewertungen

- Sample Question AnswerDokument57 SeitenSample Question Answerসজীব বসুNoch keine Bewertungen

- Soy Flour Project Report SummaryDokument8 SeitenSoy Flour Project Report SummaryAkhilesh KumarNoch keine Bewertungen