Beruflich Dokumente

Kultur Dokumente

Greenville Americas Alliance MarketBeat Office Q4 2018

Hochgeladen von

William HarrisCopyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenGreenville Americas Alliance MarketBeat Office Q4 2018

Hochgeladen von

William HarrisMARKETBEAT

MARKETBEAT

Greenville, SC

Office Q42018

Office Q1 2018

GREENVILLE, SC OFFICE Economy

In the United States, 2018 was a strong year including a GDP growth

Economic Indicators

measure over 4% in Q2 and 3.5% in Q3 with more mild expectations

12-Month in Q4. The local economy continued to expand with unemployment

Q4 17 Q4 18

Forecast

Greenville | Spartanburg

that continues to hover under 4% and continued pressure on prices

572k 578k

Employment from homes to autos based on interest rates that are 100 basis

Greenville | Spartanburg

Unemployment

4.1% 3.2% points (bps) higher than a year ago. Tailwinds for the economy

U.S. Unemployment 4.1% 3.7% include meaningful work for most, cheaper gas prices at the pump

Numbers above are quarterly averages; Nov 2018 data used to represent Q4 2018 and an economy that continues to create out new jobs including over

300,000 in December 2018.

Market Indicators (Overall, All Classes)

12-Month Market Overview

Q4 17 Q4 18 Forecast Given the amount of large block vacancies in Greenville, the office

Vacancy 7.8 8.1% market is shifting in favor of occupiers and is creating an opportunity

YTD Net Absorption (sf) 232.7k -43.3k for the market to attract new users to Greenville.

Under Construction (sf) 414k 143k

Average Asking Rent* $18.54 $19.37

Landlords continue to get creative in order to attract new tenants.

Landlords recognize the demand of amenities like fitness centers

*Rental rates reflect gross asking $psf/year

and on-site cafeterias by tenants and are focusing on elevating the

experience for their tenants. In order to stay competitive, office

landlords in both the CBD and suburban markets have begun

Overall Net Absorption/Overall Asking Rent

4-QTR TRAILING AVERAGE

renovating or are in the process of beginning renovations. For

example in the CBD, 220 N. Main Street also known as NOMA

Tower is in the process of renovating its entire building in order to

$20.00 12%

further attract new tenants. With the tight labor market in Greenville,

tenants are demanding higher quality spaces in order to attract and

$18.00 10% retain employees. Tenants are continuing to utilize their space more

efficiently in turn allowing them to leverage those savings into

$16.00 8% upgrading their offices.

$14.00 6%

Outlook

Given the current market conditions due to the new construction,

large availabilities, and incentives, we expect to attract occupiers

$12.00 4% who may have not considered Greenville before to take advantage of

2013 2014 2015 2016 2017 2018

Asking Rent, $PSF Vacancy %

this opportunity and relocate to Greenville.

About Cushman & Wakefield

Cushman & Wakefield | Thalhimer For more information, contact: Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value by putting ideas into

action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000

Wells Fargo Center Jonathan Koes

employees in approximately 400 offices and 70 countries. In 2017, the firm had revenue of $6.9 billion across core services of

15 South Main St. Suite 502 Research Manager property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit

Greenville, SC 29601 Tel: +1 804 697 3408 www.cushmanwakefield.com or follow @CushWake on Twitter.

www.thalhimer.com jonathan.koes@thalhimer.com ©2019 Cushman & Wakefield. All rights reserved. The information contained within this report is gathered from multiple sources

believed to be reliable. The information may contain errors or omissions and is presented without any warranty or representations as

to its accuracy.

Das könnte Ihnen auch gefallen

- Triple Net Lease Cap Rate ReportDokument3 SeitenTriple Net Lease Cap Rate ReportnetleaseNoch keine Bewertungen

- 1Q24 Earnings Slides - FINALDokument38 Seiten1Q24 Earnings Slides - FINALZerohedgeNoch keine Bewertungen

- The Cost of Doing Business Study, 2019 EditionVon EverandThe Cost of Doing Business Study, 2019 EditionNoch keine Bewertungen

- 2023 Fast 500 Winners List v1.1Dokument16 Seiten2023 Fast 500 Winners List v1.1William HarrisNoch keine Bewertungen

- Gun TypesDokument125 SeitenGun Typesdewaaaaa-76100% (2)

- Q1 2023 AcquisitionsDokument28 SeitenQ1 2023 AcquisitionsWilliam HarrisNoch keine Bewertungen

- Chapter 1 What Is Data Engineering PDFDokument79 SeitenChapter 1 What Is Data Engineering PDFChandra PutraNoch keine Bewertungen

- Rescue Plan Sample (Derrick)Dokument4 SeitenRescue Plan Sample (Derrick)Anil CNoch keine Bewertungen

- Q2 2018 ColliersQuarterly JakartaDokument46 SeitenQ2 2018 ColliersQuarterly JakartaBramono DwiedjantoNoch keine Bewertungen

- Q2 2017 ColliersQuarterly JakartaDokument46 SeitenQ2 2017 ColliersQuarterly JakartadetrutamiNoch keine Bewertungen

- Greenville Americas Alliance MarketBeat Office Q12018Dokument1 SeiteGreenville Americas Alliance MarketBeat Office Q12018Anonymous Feglbx5Noch keine Bewertungen

- Greenville Americas Alliance MarketBeat Office Q32018Dokument1 SeiteGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Noch keine Bewertungen

- Greenville Americas Alliance MarketBeat Office Q32019Dokument1 SeiteGreenville Americas Alliance MarketBeat Office Q32019Anonymous miTy1hNoch keine Bewertungen

- Greenville Americas Alliance MarketBeat Industrial Q22017Dokument2 SeitenGreenville Americas Alliance MarketBeat Industrial Q22017Anonymous Feglbx5Noch keine Bewertungen

- Offi Ce: ResearchDokument4 SeitenOffi Ce: ResearchAnonymous Feglbx5Noch keine Bewertungen

- PDF To WordDokument4 SeitenPDF To WordWilliam HarrisNoch keine Bewertungen

- Greenville Americas Alliance MarketBeat Office Q42019Dokument1 SeiteGreenville Americas Alliance MarketBeat Office Q42019Kevin ParkerNoch keine Bewertungen

- Colliers Quarterly Manila Q4 2018 ResidentialDokument5 SeitenColliers Quarterly Manila Q4 2018 ResidentialLemuel Bryan Gonzales DenteNoch keine Bewertungen

- Greenville Americas Alliance MarketBeat Industrial Q22018Dokument2 SeitenGreenville Americas Alliance MarketBeat Industrial Q22018Anonymous Feglbx5Noch keine Bewertungen

- AtlantaDokument4 SeitenAtlantaAnonymous Feglbx5Noch keine Bewertungen

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Dokument2 SeitenHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Noch keine Bewertungen

- Demand To Continue To Rise: Summary & RecommendationsDokument4 SeitenDemand To Continue To Rise: Summary & RecommendationsbiswasjpNoch keine Bewertungen

- Colliers Market Report Q2 2018Dokument73 SeitenColliers Market Report Q2 2018evy nurlailyNoch keine Bewertungen

- CAN Toronto Office Insight Q2 2018 JLL PDFDokument4 SeitenCAN Toronto Office Insight Q2 2018 JLL PDFMichaelNoch keine Bewertungen

- 2Q19 Washington DC Local Apartment ReportDokument4 Seiten2Q19 Washington DC Local Apartment ReportWilliam HarrisNoch keine Bewertungen

- Colliers Quarterly Manila Q4 2018 OfficeDokument5 SeitenColliers Quarterly Manila Q4 2018 OfficeLemuel Bryan Gonzales DenteNoch keine Bewertungen

- Philadelphia Americas MarketBeat Office CBD Q32019 PDFDokument2 SeitenPhiladelphia Americas MarketBeat Office CBD Q32019 PDFAnonymous zvbo2yJNoch keine Bewertungen

- Washington, D.C.: Availability Holds Steady, Even As Leasing Activity BoomsDokument2 SeitenWashington, D.C.: Availability Holds Steady, Even As Leasing Activity BoomsAnonymous lQgmczOLNoch keine Bewertungen

- Chicago - Retail - 4/1/2008Dokument4 SeitenChicago - Retail - 4/1/2008Russell KlusasNoch keine Bewertungen

- BostonDokument4 SeitenBostonAnonymous Feglbx5Noch keine Bewertungen

- Indianapolis - Office - 1/1/2008Dokument1 SeiteIndianapolis - Office - 1/1/2008Russell KlusasNoch keine Bewertungen

- Dallas-Fort Worth 1Q11AptDokument2 SeitenDallas-Fort Worth 1Q11AptAnonymous Feglbx5Noch keine Bewertungen

- Q1 2021 Dallas Industrial Market ReportDokument4 SeitenQ1 2021 Dallas Industrial Market Reportbernardo95Noch keine Bewertungen

- High Growth in Gross Absorption: Summary & RecommendationsDokument4 SeitenHigh Growth in Gross Absorption: Summary & RecommendationsbiswasjpNoch keine Bewertungen

- Q3 2017 ColliersQuarterly JakartaDokument43 SeitenQ3 2017 ColliersQuarterly JakartaNovia PutriNoch keine Bewertungen

- 3Q18 Atlanta LARDokument4 Seiten3Q18 Atlanta LARAnonymous Feglbx5Noch keine Bewertungen

- Colliers Toronto Office MR 2022 Q2Dokument5 SeitenColliers Toronto Office MR 2022 Q2jihaneNoch keine Bewertungen

- Earnings Conference Call: Q4 Fiscal Year 2021Dokument25 SeitenEarnings Conference Call: Q4 Fiscal Year 2021sl7789Noch keine Bewertungen

- Multifamily Research: Record-Setting Hiring Supporting Rent Growth Despite Rising SupplyDokument2 SeitenMultifamily Research: Record-Setting Hiring Supporting Rent Growth Despite Rising SupplyPhilip Maxwell AftuckNoch keine Bewertungen

- It-Ites Sector To Drive Demand: Summary & RecommendationsDokument4 SeitenIt-Ites Sector To Drive Demand: Summary & RecommendationsbiswasjpNoch keine Bewertungen

- Singapore Market Outlook 2017Dokument36 SeitenSingapore Market Outlook 2017rennieNoch keine Bewertungen

- Hampton Roads Americas Alliance MarketBeat Retail Q12018Dokument2 SeitenHampton Roads Americas Alliance MarketBeat Retail Q12018Anonymous Feglbx5Noch keine Bewertungen

- BAMODokument4 SeitenBAMOKevin ParkerNoch keine Bewertungen

- Bengaluru Off 2q19Dokument2 SeitenBengaluru Off 2q19Harsh SawhneyNoch keine Bewertungen

- Multifamily ResearchDokument4 SeitenMultifamily ResearchNephenteNoch keine Bewertungen

- FY 2018 Results: Delivering A World-Class Investment CaseDokument15 SeitenFY 2018 Results: Delivering A World-Class Investment Casejason6686pNoch keine Bewertungen

- Name: Mohit Marhatta Roll No: B19148 Section: C Selected Company: VRL Logistics LimitedDokument9 SeitenName: Mohit Marhatta Roll No: B19148 Section: C Selected Company: VRL Logistics LimitedMOHIT MARHATTANoch keine Bewertungen

- Firstsource Solutions (FIRSOU) : H2FY17E Expected To Be BetterDokument12 SeitenFirstsource Solutions (FIRSOU) : H2FY17E Expected To Be BetterDeep Run WatersNoch keine Bewertungen

- Richmond AMERICAS Alliance MarketBeat Industrial Q12019Dokument2 SeitenRichmond AMERICAS Alliance MarketBeat Industrial Q12019William HarrisNoch keine Bewertungen

- Park Hotels & Resorts 2018 Annual ReportDokument126 SeitenPark Hotels & Resorts 2018 Annual ReportSwapna Wedding Castle EramaloorNoch keine Bewertungen

- Q1 2020 NJIndustrialMarketViewDokument7 SeitenQ1 2020 NJIndustrialMarketViewKevin ParkerNoch keine Bewertungen

- Miami Americas Market BeatOfficeDokument2 SeitenMiami Americas Market BeatOfficenmmng2011Noch keine Bewertungen

- Indianapolis - Retail - 4/1/2008Dokument4 SeitenIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- 2019 Q4 Jakarta Office Market Report ColliersDokument4 Seiten2019 Q4 Jakarta Office Market Report Colliersluthfi anshariNoch keine Bewertungen

- IDirect PrimaPlastics CoUpdate Jun19Dokument4 SeitenIDirect PrimaPlastics CoUpdate Jun19Alokesh PhukanNoch keine Bewertungen

- Inditex: Deconstructing The DataDokument18 SeitenInditex: Deconstructing The DataTung NgoNoch keine Bewertungen

- CMR EnterprisesDokument5 SeitenCMR EnterprisesPraveen Sangwan100% (2)

- TSM Data Center Development Model PreviewDokument21 SeitenTSM Data Center Development Model PreviewDilip PaliwalNoch keine Bewertungen

- Mack-Cali Realty Corporation Reports Second Quarter 2018 ResultsDokument9 SeitenMack-Cali Realty Corporation Reports Second Quarter 2018 ResultsAnonymous FKX39Z0Noch keine Bewertungen

- 1 Jacobs Transformation 02-Jacobs - Q1-2019-Investor-PresentationDokument19 Seiten1 Jacobs Transformation 02-Jacobs - Q1-2019-Investor-PresentationALNoch keine Bewertungen

- Richmond AMERICAS Alliance MarketBeat Industrial Q32017Dokument2 SeitenRichmond AMERICAS Alliance MarketBeat Industrial Q32017Anonymous Feglbx5Noch keine Bewertungen

- Colliers AsiaTalking PointsLH20200713Dokument4 SeitenColliers AsiaTalking PointsLH20200713tuong vyNoch keine Bewertungen

- 2017-18 Third Quarter Report Fiscal UpdateDokument18 Seiten2017-18 Third Quarter Report Fiscal UpdateCTV CalgaryNoch keine Bewertungen

- Contact Annual Report 2014Dokument54 SeitenContact Annual Report 2014Gary McKayNoch keine Bewertungen

- Sharekhan Sees 21% UPSIDE in GNA AxlesDokument7 SeitenSharekhan Sees 21% UPSIDE in GNA AxlesHarsimran SinghNoch keine Bewertungen

- April 2024 CPRA Board Simoneaux 20240415 CompressedDokument37 SeitenApril 2024 CPRA Board Simoneaux 20240415 CompressedWilliam HarrisNoch keine Bewertungen

- QR 3 - FinalDokument20 SeitenQR 3 - FinalWilliam HarrisNoch keine Bewertungen

- Market Report 2023 Q1 Full ReportDokument17 SeitenMarket Report 2023 Q1 Full ReportKevin ParkerNoch keine Bewertungen

- 2023 ASI Impact ReportDokument43 Seiten2023 ASI Impact ReportWilliam HarrisNoch keine Bewertungen

- Industry Update H2 2021 in Review: Fairmount PartnersDokument13 SeitenIndustry Update H2 2021 in Review: Fairmount PartnersWilliam HarrisNoch keine Bewertungen

- Pebblebrook Update On Recent Operating TrendsDokument10 SeitenPebblebrook Update On Recent Operating TrendsWilliam HarrisNoch keine Bewertungen

- 2022 Abell Foundation Short Form Report 8yrDokument36 Seiten2022 Abell Foundation Short Form Report 8yrWilliam HarrisNoch keine Bewertungen

- Development: Washington, DCDokument96 SeitenDevelopment: Washington, DCWilliam HarrisNoch keine Bewertungen

- 2020 Q3 Industrial Houston Report ColliersDokument7 Seiten2020 Q3 Industrial Houston Report ColliersWilliam HarrisNoch keine Bewertungen

- FP - CTS Report H1.21Dokument13 SeitenFP - CTS Report H1.21William HarrisNoch keine Bewertungen

- Atlanta 2022 Multifamily Investment Forecast ReportDokument1 SeiteAtlanta 2022 Multifamily Investment Forecast ReportWilliam HarrisNoch keine Bewertungen

- Copt 2021Dokument44 SeitenCopt 2021William HarrisNoch keine Bewertungen

- FP Pharmaceutical Outsourcing Monitor 08.30.21Dokument30 SeitenFP Pharmaceutical Outsourcing Monitor 08.30.21William HarrisNoch keine Bewertungen

- DSB Q3Dokument8 SeitenDSB Q3William HarrisNoch keine Bewertungen

- 3Q21 I81 78 Industrial MarketDokument5 Seiten3Q21 I81 78 Industrial MarketWilliam HarrisNoch keine Bewertungen

- Manhattan RetailDokument9 SeitenManhattan RetailWilliam HarrisNoch keine Bewertungen

- FP - CTS Report Q3.20Dokument13 SeitenFP - CTS Report Q3.20William HarrisNoch keine Bewertungen

- For Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentDokument5 SeitenFor Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentWilliam HarrisNoch keine Bewertungen

- TROW Q3 2020 Earnings ReleaseDokument15 SeitenTROW Q3 2020 Earnings ReleaseWilliam HarrisNoch keine Bewertungen

- Regional Surveys of Business ActivityDokument2 SeitenRegional Surveys of Business ActivityWilliam HarrisNoch keine Bewertungen

- Comms Toolkit For MD Clean Energy Town HallDokument4 SeitenComms Toolkit For MD Clean Energy Town HallWilliam HarrisNoch keine Bewertungen

- Healthcare Technology Mailer v14Dokument4 SeitenHealthcare Technology Mailer v14William HarrisNoch keine Bewertungen

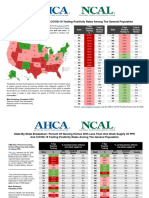

- State-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationDokument2 SeitenState-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationWilliam HarrisNoch keine Bewertungen

- Richmond Office Performance in DownturnsDokument1 SeiteRichmond Office Performance in DownturnsWilliam HarrisNoch keine Bewertungen

- Gun Stocks: Fear Fires Up Investors To Purchase Gun StocksDokument14 SeitenGun Stocks: Fear Fires Up Investors To Purchase Gun StocksWilliam HarrisNoch keine Bewertungen

- Product PolyolDokument1 SeiteProduct PolyolAgung SiswahyuNoch keine Bewertungen

- Geography Chapter 2 - Land, Soil, Water, Natural Vegetation & Wildlife ResourcesDokument3 SeitenGeography Chapter 2 - Land, Soil, Water, Natural Vegetation & Wildlife ResourcesGarvit BilewalNoch keine Bewertungen

- Tutorial Week 10 (Group 2)Dokument4 SeitenTutorial Week 10 (Group 2)Nuranis QhaleedaNoch keine Bewertungen

- Getting A Number From A Textbox: Computer Programming 1 Inputting From TextboxesDokument1 SeiteGetting A Number From A Textbox: Computer Programming 1 Inputting From TextboxesZarif ZulkafliNoch keine Bewertungen

- Z370 AORUS Gaming 3: User's ManualDokument48 SeitenZ370 AORUS Gaming 3: User's ManualAtrocitus RedNoch keine Bewertungen

- Security Analysis: Kumar SaurabhDokument11 SeitenSecurity Analysis: Kumar Saurabhakhil vermaNoch keine Bewertungen

- Qualities of Effective Business LettersDokument39 SeitenQualities of Effective Business Letterskrystel0% (1)

- The Story of MacroeconomicsDokument32 SeitenThe Story of MacroeconomicsMohammadTabbalNoch keine Bewertungen

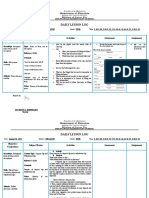

- Coverpage BLDG Projects F.Y. 2021Dokument4 SeitenCoverpage BLDG Projects F.Y. 2021Adrian PachecoNoch keine Bewertungen

- Unit 8 Technical Analysis: ObjectivesDokument13 SeitenUnit 8 Technical Analysis: Objectivesveggi expressNoch keine Bewertungen

- Transient Torque Rise of A Modern Light Duty Diesel Engine With Variable Valve ActuationDokument12 SeitenTransient Torque Rise of A Modern Light Duty Diesel Engine With Variable Valve ActuationdheepanasNoch keine Bewertungen

- MGM College of Engineering and Pharmaceutical Sciences: First Internal ExaminationDokument2 SeitenMGM College of Engineering and Pharmaceutical Sciences: First Internal ExaminationNandagopan GNoch keine Bewertungen

- 2014-05-13-VGT Press Release - Swiss SigningDokument1 Seite2014-05-13-VGT Press Release - Swiss SigningSwissmissionEUNoch keine Bewertungen

- Goodman and Gilman's Sample ChapterDokument17 SeitenGoodman and Gilman's Sample Chapteradnankhan20221984Noch keine Bewertungen

- Original PDFDokument37 SeitenOriginal PDFAhmadS.Alosta50% (2)

- Negative Effects of Social Media AddictionDokument2 SeitenNegative Effects of Social Media AddictionTubagus Fikih AriansyahNoch keine Bewertungen

- August 30-Filling Out FormsDokument3 SeitenAugust 30-Filling Out FormsJocelyn G. EmpinadoNoch keine Bewertungen

- Previous HSE Questions and Answers of The Chapter "SOLUTIONS"Dokument97 SeitenPrevious HSE Questions and Answers of The Chapter "SOLUTIONS"ABDUL RAZACKNoch keine Bewertungen

- Strategic Planning For Implementing E-Government in Iran: Formulating The StrategiesDokument8 SeitenStrategic Planning For Implementing E-Government in Iran: Formulating The StrategiesTantri Mulia KarinaNoch keine Bewertungen

- Methods of Determining Thermal Efficiency in Spray Drying ProcessDokument3 SeitenMethods of Determining Thermal Efficiency in Spray Drying ProcessDfunz WilphenNoch keine Bewertungen

- Basso - 2001 - Neurobiological Relationships Between Ambient Ligh PDFDokument11 SeitenBasso - 2001 - Neurobiological Relationships Between Ambient Ligh PDFVíctor MJNoch keine Bewertungen

- Karl Storz Endoscopy-America v. Stryker Et. Al.Dokument9 SeitenKarl Storz Endoscopy-America v. Stryker Et. Al.Patent LitigationNoch keine Bewertungen

- Tense Use in The AbstractDokument1 SeiteTense Use in The AbstractVictoria BerlianiNoch keine Bewertungen

- International Financial Regulation Seminar QuestionsDokument2 SeitenInternational Financial Regulation Seminar QuestionsNicu BotnariNoch keine Bewertungen

- Assignment 1Dokument2 SeitenAssignment 1Nayyar AbbasiNoch keine Bewertungen

- What You Need To Know First: No Luck RequiredDokument8 SeitenWhat You Need To Know First: No Luck RequiredEvangielyn ArenasNoch keine Bewertungen

- Descriptive Lab Report GuideDokument3 SeitenDescriptive Lab Report GuideOluwafisayomi LawaniNoch keine Bewertungen