Beruflich Dokumente

Kultur Dokumente

Business Unit Overview:: Global Risk - Market Data Analyst

Hochgeladen von

Amit KumarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Business Unit Overview:: Global Risk - Market Data Analyst

Hochgeladen von

Amit KumarCopyright:

Verfügbare Formate

Global Risk - Market Data Analyst

Business Unit Overview:

The Historical Market Data (HMD) Group is a significant part of global HMD within the Risk

Methodology Group. HMD is responsible for the maintenance of the historical market data used in the

strategic risk systems -- both market risk and credit risk. The team is responsible for all operational

activities related to maintaining historical data for different categories of time series as well as the

mapping to the various risk sensitivities. The team coordinates with risk managers and middle-office

teams globally as well as the wider risk methodology group. Further, the group is also leading multiple

efficiency and control initiatives by way of automation, process improvements and driving IT

enhancements.

Role & Responsibilities:

Diligently source and maintain historical market data for VaR / Stressed-VaR / expected

shortfall and other risk models

Update VaR window and analyze change in VaR due to market data changes

Review optimal window for Stressed-VaR and analyze impact of change in optimal window

Provide impact analyses around changes in time series data including review of various input

parameters

Set criteria and identify appropriate proxy for time series data

Build expertise around market data for one / more asset classes (Equity, Rates, Credit, FX,

Commodities, Securitized Products. etc.) to undertake ad hoc analyses

Connect and coordinate with risk managers and market risk middle office across all regions to

support ad hoc requirements

Help achieve operational efficiencies through process re-engineering and automation

Mind Set:

Mandatory Desired

Good knowledge of risk Excellent verbal and written

management including a fair communication skills, excellent

understanding of financial derivatives organization skills

and risk sensitivities (Greeks)

Exposure to Bloomberg terminal and

Python, SQL / Oracle database other market data products will be

Domain

query writing helpful.

Experience of managing historical Exposure to data science /machine

market data is preferred. learning is desirable.

Proficiency with programming

languages – for instance, VBA /

MATLAB / R -- is a big plus.

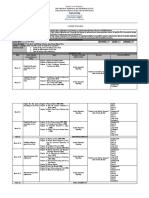

Core Competencies (Soft Skills):

Competencies Behavioral Indicators

Culture & Conduct Contributes to desired culture

Building Nomura’s Culture Diversity & Inclusion Sets positive example

Professional Integrity Self-Awareness Aware of different values/styles

Holds high standards of behaviour

Aware of own strengths/weaknesses

Client-Centricity & Business Acumen Understands current market

Commerciality Client-Centricity Analytical Anticipates client needs

Thinking & Problem Solving Pays attention to detail

Sees problems, recommends solutions

Strategy & Innovation Balances alternative views

Strategic Thinking & Change Decision Making & Knows when to decide/when to escalate

Judgement Agility Champions new ideas

Is both disciplined and entrepreneurial

Sees when to escalate

Leadership & Collaboration Thinks differently

Managing Talent Recognising and Motivating Balances alternative views

Supporting, Developing & Collaborating with Knows when/how to compromise

others Managing Conflict Learns from experience

Seeks to develop

Communication & Connectivity Assists in recruiting

Articulation & Receptiveness Impact Connectivity Gives credit

Builds productive working relationships

Provides constructive, timely and specific

feedback

Communication & Influence Adjusts style to suit topic

Articulation and Receptiveness Impact Balances listening/talking

Connectivity Communicates with clarity and consideration

Is a proven and credible resource

Questions to understand others’ views

Builds internal contact network

Willingly effectively works across teams

Execution & Delivery Demonstrates accountability/commitment

Driving Performance Execution-Focus Planning & Takes on challenging assignments

Organising Adaptability Executes priority actions on-time

Keeps stakeholders updated

Manages expectations

Persists when confronted with resistance

FORWARD CONTRACTS

It is an agreement to buy or sell an asset at a certain future time for a certain price.

A forward contract is traded in the over-the-counter market—usually between two financial institutions

or between a financial institution and one of its clients.

FUTURES CONTRACTS

A futures contract is an agreement between two parties to buy or sell an asset at a certain time in the

future for a certain price. Futures contracts are normally traded on an exchange.

OPTIONS

An option gives the holder the right to buy/sell the underlying asset by a certain date for a certain

price.

A call option gives the holder the right to buy the underlying asset by a certain date for a certain price.

A put option gives the holder the right to sell the underlying asset by a certain date for a certain price.

Options are traded both on exchanges and in the over-the-counter market.

Das könnte Ihnen auch gefallen

- The Multiproject Manager's Playbook: Strategies for Simultaneous SuccessVon EverandThe Multiproject Manager's Playbook: Strategies for Simultaneous SuccessNoch keine Bewertungen

- JD - Market Risk-Traded CreditDokument5 SeitenJD - Market Risk-Traded CreditMayank RajNoch keine Bewertungen

- Prime EQ AnalystDokument4 SeitenPrime EQ AnalystR RATED GAMERNoch keine Bewertungen

- Nomura - QA Automation - MumbaiDokument4 SeitenNomura - QA Automation - MumbaiBhavin PanchalNoch keine Bewertungen

- JD - Group Data Office - Data Governance - Associate - Manager - 8169Dokument3 SeitenJD - Group Data Office - Data Governance - Associate - Manager - 8169Vandan WankhedeNoch keine Bewertungen

- Global Risk Risk Methodology - Model Validation Risk Stress TestingDokument4 SeitenGlobal Risk Risk Methodology - Model Validation Risk Stress TestingRaj AgarwalNoch keine Bewertungen

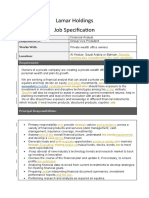

- Job Specification: Position Level of Position Division / DepartmentDokument3 SeitenJob Specification: Position Level of Position Division / Departmentshahamit1404Noch keine Bewertungen

- Collateral Management - AM RoleDokument4 SeitenCollateral Management - AM RolemaheshjgehaniNoch keine Bewertungen

- Global Markets - Prime Services - FO Risk JDDokument3 SeitenGlobal Markets - Prime Services - FO Risk JDKushagroDharNoch keine Bewertungen

- JD - Sr. Product Manager - Digital LendingDokument3 SeitenJD - Sr. Product Manager - Digital Lendingparth mehtaNoch keine Bewertungen

- Lamar Holdings - Job Specification - Financial Analyst - 8 Nov 20Dokument3 SeitenLamar Holdings - Job Specification - Financial Analyst - 8 Nov 20abhinavg_9Noch keine Bewertungen

- Senior Technical Business AnalystDokument10 SeitenSenior Technical Business AnalystPrasad DesaiNoch keine Bewertungen

- Credit Suisse IWM Summer Associate ProgramDokument1 SeiteCredit Suisse IWM Summer Associate ProgramWilson Guillaume ZhouNoch keine Bewertungen

- Nomura HR Campus - People Analytics and Comp AnalyticsDokument3 SeitenNomura HR Campus - People Analytics and Comp AnalyticsSnehansh KishoreNoch keine Bewertungen

- Manager ICT Governance Security and RiskDokument5 SeitenManager ICT Governance Security and Riskkumusha123Noch keine Bewertungen

- Static Equipment Maintenance Engineer: Duties and ResponsibilitiesDokument3 SeitenStatic Equipment Maintenance Engineer: Duties and ResponsibilitiesAniekanNoch keine Bewertungen

- Integrated Leadership Strategy OutlineDokument7 SeitenIntegrated Leadership Strategy OutlineAhmad HajaliNoch keine Bewertungen

- JD - Nomura Global Markets - BM - IIMK - v3 PDFDokument3 SeitenJD - Nomura Global Markets - BM - IIMK - v3 PDFRiturajPaulNoch keine Bewertungen

- Role PurposeDokument3 SeitenRole PurposeEduardo Puga JimenezNoch keine Bewertungen

- Assessment CoachingDokument3 SeitenAssessment CoachingMrinal Anand PradhanNoch keine Bewertungen

- Senior Systems AdministratorDokument5 SeitenSenior Systems AdministratorBrijesh PatilNoch keine Bewertungen

- Ilsel 1 ProfileDokument7 SeitenIlsel 1 ProfileACBNoch keine Bewertungen

- Prep - UCDokument29 SeitenPrep - UCPrakash KakaniNoch keine Bewertungen

- A) Case ScenarioDokument2 SeitenA) Case ScenarioSheikh MuneebNoch keine Bewertungen

- NSWDokument6 SeitenNSWRam PNoch keine Bewertungen

- Dolly Gupta - Resume PDFDokument2 SeitenDolly Gupta - Resume PDFMaarid FaziliNoch keine Bewertungen

- Competency Model Investment Analyst Aug2021 PDFDokument20 SeitenCompetency Model Investment Analyst Aug2021 PDFDea ElmasNoch keine Bewertungen

- CLC Communications Competency Overview Johnson JohnsonDokument20 SeitenCLC Communications Competency Overview Johnson JohnsonNAUFAL RUZAINNoch keine Bewertungen

- Job Description-SBI SecuritiesDokument3 SeitenJob Description-SBI SecuritiesDeepak ChaudharyNoch keine Bewertungen

- Role Description: Administration Officer (S &I)Dokument4 SeitenRole Description: Administration Officer (S &I)cyberdonNoch keine Bewertungen

- Paraplanner JDDokument6 SeitenParaplanner JDJames AntiquinaNoch keine Bewertungen

- The Performance Criteria Matrix For Investment BankingDokument5 SeitenThe Performance Criteria Matrix For Investment BankingVer2go111Noch keine Bewertungen

- Bail Coordinator CLK 5-6 (June19)Dokument4 SeitenBail Coordinator CLK 5-6 (June19)Aramã Aragão AntunesNoch keine Bewertungen

- Worksheet Competency Gap Assessment Form (English)Dokument4 SeitenWorksheet Competency Gap Assessment Form (English)Roosy RoosyNoch keine Bewertungen

- Competency BankDokument8 SeitenCompetency BankGodsonNoch keine Bewertungen

- Solution Architect: Role DescriptionDokument4 SeitenSolution Architect: Role DescriptionrohitandaniNoch keine Bewertungen

- Manager - ITDokument3 SeitenManager - ITdd ddNoch keine Bewertungen

- Skills and CompetenciesDokument55 SeitenSkills and Competenciess.toubi411Noch keine Bewertungen

- REQ73098 Data Integrity OfficerDokument5 SeitenREQ73098 Data Integrity OfficerDeep ShahNoch keine Bewertungen

- Senior Application Developer JDDokument5 SeitenSenior Application Developer JDcreative video logicNoch keine Bewertungen

- Assessing High Potential EmployeesDokument5 SeitenAssessing High Potential EmployeescommentbNoch keine Bewertungen

- List of Competencies For RankingDokument7 SeitenList of Competencies For RankingJacob BlackNoch keine Bewertungen

- Australian Gov. DictionariessDokument5 SeitenAustralian Gov. Dictionariessroseno hendratmojoNoch keine Bewertungen

- Transferable Skills HandoutDokument1 SeiteTransferable Skills HandoutOmarNoch keine Bewertungen

- Capability Matrix: For Professional StaffDokument14 SeitenCapability Matrix: For Professional StaffnaveedNoch keine Bewertungen

- Administration Support Officer: Role DescriptionDokument4 SeitenAdministration Support Officer: Role DescriptioncyberdonNoch keine Bewertungen

- Administrative Support Officer RD 20150724Dokument3 SeitenAdministrative Support Officer RD 20150724Adiyasa M ZannatanNoch keine Bewertungen

- Competency Framework - ManufactureDokument7 SeitenCompetency Framework - ManufactureTai BausekaliNoch keine Bewertungen

- Business Analyst - 1st MarchDokument2 SeitenBusiness Analyst - 1st MarchMulayam Singh ChoudharyNoch keine Bewertungen

- Chapter 4 Professional Attributes of Management ConsultantsDokument1 SeiteChapter 4 Professional Attributes of Management ConsultantsLeonilaEnriquezNoch keine Bewertungen

- 3 Mergers and Acquisitions ManagerDokument2 Seiten3 Mergers and Acquisitions ManagerpowerfulpendulumNoch keine Bewertungen

- JD AdvisorDokument3 SeitenJD AdvisorAli AhmedNoch keine Bewertungen

- SOC Project Associate - TOR For NPSA - 2022Dokument4 SeitenSOC Project Associate - TOR For NPSA - 2022Mianzini PhramcyNoch keine Bewertungen

- Transferable Skills Checklist 2Dokument3 SeitenTransferable Skills Checklist 2api-329306542Noch keine Bewertungen

- Job Profile / DescriptionDokument2 SeitenJob Profile / DescriptionSachin VashishthaNoch keine Bewertungen

- Senior Systems Administrator-RD Nov2019Dokument6 SeitenSenior Systems Administrator-RD Nov2019angladaxNoch keine Bewertungen

- Contracts Engineer - Engineer Level 1-2 - RD Oct 19Dokument5 SeitenContracts Engineer - Engineer Level 1-2 - RD Oct 19Mohammed RayesNoch keine Bewertungen

- Leadership Competency FrameworkDokument27 SeitenLeadership Competency FrameworkNitinNoch keine Bewertungen

- HBS107 AT1 Skills AuditDokument5 SeitenHBS107 AT1 Skills Auditcaleb mwanziaNoch keine Bewertungen

- Part Ii: Competencies: Core Behavioral Competencies Core SkillsDokument1 SeitePart Ii: Competencies: Core Behavioral Competencies Core SkillsYan Art Genciana100% (1)

- Python Financial Modelling PDFDokument54 SeitenPython Financial Modelling PDFAmit KumarNoch keine Bewertungen

- Cover LetterDokument2 SeitenCover LetterAmit KumarNoch keine Bewertungen

- NiftyDokument32 SeitenNiftyAmit KumarNoch keine Bewertungen

- Glossory A AccumulationDokument33 SeitenGlossory A AccumulationAmit KumarNoch keine Bewertungen

- Template of ResumefresherDokument2 SeitenTemplate of ResumefresherAmit KumarNoch keine Bewertungen

- ZT-Spread Orders: Date Posted: 23 Hours, 38 Minutes AgoDokument6 SeitenZT-Spread Orders: Date Posted: 23 Hours, 38 Minutes AgoAmit KumarNoch keine Bewertungen

- Buy Call: Top 9 Trading Strategies in DerivativesDokument12 SeitenBuy Call: Top 9 Trading Strategies in DerivativesAmit KumarNoch keine Bewertungen

- Business PlanDokument22 SeitenBusiness PlanAmit KumarNoch keine Bewertungen

- Lane Graves Perry III CV 2024Dokument31 SeitenLane Graves Perry III CV 2024api-446526696Noch keine Bewertungen

- Handout For Inquiries Investigations and ImmersionDokument5 SeitenHandout For Inquiries Investigations and Immersionapollo100% (1)

- Syllabus in Forensic 4Dokument8 SeitenSyllabus in Forensic 4alican karimNoch keine Bewertungen

- The Eight Basic Principles of TestingDokument4 SeitenThe Eight Basic Principles of TestingBahadur AsherNoch keine Bewertungen

- PGPpro Brochure 2020 2021Dokument32 SeitenPGPpro Brochure 2020 2021prasadbsnvNoch keine Bewertungen

- A Magazine For Chief Human Resource Officers and Their TeamsDokument20 SeitenA Magazine For Chief Human Resource Officers and Their TeamsLama SayariNoch keine Bewertungen

- English 2Dokument12 SeitenEnglish 2MAS Wali SongoNoch keine Bewertungen

- Chapter 2-Preparetion of Research ProposalDokument34 SeitenChapter 2-Preparetion of Research ProposalStivanos HabtamuNoch keine Bewertungen

- History of Social Reponsiblity TheoryDokument14 SeitenHistory of Social Reponsiblity TheorySyed Yasir InamNoch keine Bewertungen

- Yamashita 2008 SystemDokument13 SeitenYamashita 2008 Systemzekiye seisNoch keine Bewertungen

- Workshop 6Dokument6 SeitenWorkshop 6Gabriela Bravo TorresNoch keine Bewertungen

- Urvi DawdraDokument1 SeiteUrvi DawdraKhushi PatelNoch keine Bewertungen

- Assignment No. 1 Internal and External CriticismDokument1 SeiteAssignment No. 1 Internal and External CriticismchayrenetNoch keine Bewertungen

- Doubleentryjournalsrev 1009Dokument6 SeitenDoubleentryjournalsrev 1009api-280442285Noch keine Bewertungen

- The Eagle Lesson PlanDokument33 SeitenThe Eagle Lesson PlanJohn Perseus Lee0% (1)

- Syllabus - GE 9 - Rizal 1Dokument4 SeitenSyllabus - GE 9 - Rizal 1Roger Yatan Ibañez Jr.Noch keine Bewertungen

- The Napping House ActivitiesDokument2 SeitenThe Napping House ActivitiesDebbie Collette Giroux100% (1)

- Pre DefenseDokument19 SeitenPre DefenseTasi Alfrace CabalzaNoch keine Bewertungen

- Conflict Resolution Lesson Plan 03Dokument4 SeitenConflict Resolution Lesson Plan 03api-396219108Noch keine Bewertungen

- Morphology Revision and Sample Mid-Term TestDokument7 SeitenMorphology Revision and Sample Mid-Term TestPhương ThẻoNoch keine Bewertungen

- Lost in TranslationDokument2 SeitenLost in TranslationNikkan VillaNoch keine Bewertungen

- There Are Many Benefits of Using Animation in Teaching and Learning Process But It Must Be Appropriate To The Subject Being TaughtDokument2 SeitenThere Are Many Benefits of Using Animation in Teaching and Learning Process But It Must Be Appropriate To The Subject Being TaughtMOHD ZULKARNAIN SAMRINoch keine Bewertungen

- Name NumerologyDokument1 SeiteName NumerologyGovinda_Mahajan100% (1)

- Factors That Affect IQDokument3 SeitenFactors That Affect IQnoor ainNoch keine Bewertungen

- Group 2 Practical Research 2 Grade 12Dokument7 SeitenGroup 2 Practical Research 2 Grade 12Cristel Mae Concon SalangNoch keine Bewertungen

- Mirativity As Realization Marking: A Cross-Linguistic StudyDokument73 SeitenMirativity As Realization Marking: A Cross-Linguistic StudylauraunicornioNoch keine Bewertungen

- Statement of PurposeDokument1 SeiteStatement of PurposeFaheem TariqNoch keine Bewertungen

- Etech Cot 2nd SemDokument2 SeitenEtech Cot 2nd SemAbraham BojosNoch keine Bewertungen

- A Study of Creating Culture in The Bank of The Philippine Islands (Bpi-Gensan)Dokument34 SeitenA Study of Creating Culture in The Bank of The Philippine Islands (Bpi-Gensan)Daisyreel TomaquinNoch keine Bewertungen

- Polisci490 2Dokument5 SeitenPolisci490 2Mustazhar NaushahiNoch keine Bewertungen