Beruflich Dokumente

Kultur Dokumente

Bataan Cigar V CA

Hochgeladen von

Mir SolaimanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bataan Cigar V CA

Hochgeladen von

Mir SolaimanCopyright:

Verfügbare Formate

BATAAN CIGAR AND CIGARETTE FACTORY, INC. v. THE COURT OF APPEALS. G.R. No. 93048.

March 3,

1994.

FACTS: Bataan Cigar & Cigarette Factory, Inc. (BCCFI), engaged with King Tim Pua George, to

deliver 2,000 bales of tobacco leaf. BCCFI issued post dated crossed checks in exchange. Trusting King's

words, BCCFI issued another post-dated cross check for another purchase of tobacco leaves.

During these time, King was dealing with State Investment House Inc.. On two separate occasions King

sold the post-dated cross checks to SIHI, that was drawn by BCCFI in favor of King.

Because King failed to deliver the leaves, BCFI issued a stop payment to all the checks, including those

sold to SIHI.

The RTC held that SIHI had a valid claim of being a holder in due course and to collect the

checks issued by BCCFI. CA affirmed the RTC.

ISSUE: Whether SIHI is a holder in due course.

RULING: No. As preliminary, a check is defined by law as a bill of exchange drawn on a bank

payable on demand. There are a variety of checks, the more popular of which are the memorandum

check, cashier's check, traveler's check and crossed check. Crossed check is one where two parallel lines

are drawn across its face or across a corner thereof. It may be crossed generally or specially.

A check is crossed specially when the name of a particular banker or a company is written between the

parallel lines drawn. It is crossed generally when only the words "and company" are written or nothing is

written at all between the parallel lines. It may be issued so that the presentment can be made only by a

bank. Veritably the Negotiable Instruments Law (NIL) does not mention "crossed checks," although

Article 541 of the Code of Commerce refers to such instruments.

In the Philippine business setting, however, we used to be beset with bouncing checks, forging of

checks, and so forth that banks have become quite guarded in encashing checks, particularly those

which name a specific payee. Unless one is a valued client, a bank will not even accept second

indorsements on checks.

In order to preserve the credit worthiness of checks, jurisprudence has pronounced that crossing of a

check should have the following effects: (a) the check may not be encashed but only deposited in the

bank; (b) the check may be negotiated only once — to one who has an account with a bank; (c) and the

act of crossing the check serves as warning to the holder that the check has been issued for a definite

purpose so that he must inquire if he has received the check pursuant to that purpose, otherwise, he is

not a holder in due course.

It is then settled that crossing of checks should put the holder on inquiry and upon him devolves the

duty to ascertain the indorser's title to the check or the nature of his possession. Failing in this respect,

the holder is declared guilty of gross negligence amounting to legal absence of good faith, contrary to

Sec. 52(c) of the Negotiable Instruments Law, 13 and as such the consensus of authority is to the effect

that the holder of the check is not a holder in due course.

In the present case, BCCFI's defense in stopping payment is as good to SIHI as it is to George King.

The foregoing does not mean, however, that respondent could not recover from the checks. The only

disadvantage of a holder who is not a holder in due course is that the instrument is subject to defenses

as if it were non-negotiable.

Das könnte Ihnen auch gefallen

- Nego Case Digest (CHECKS)Dokument8 SeitenNego Case Digest (CHECKS)jackNoch keine Bewertungen

- Digest NegoDokument16 SeitenDigest Negoiceiceice023Noch keine Bewertungen

- Lim v. CA 1995 (Nego)Dokument2 SeitenLim v. CA 1995 (Nego)Stephanie GriarNoch keine Bewertungen

- Belgian Catholic Missionaries v. Magallanes PressDokument2 SeitenBelgian Catholic Missionaries v. Magallanes PressAgee Romero-Valdes100% (1)

- Office of The Ombudsman V Samaniego 2008Dokument3 SeitenOffice of The Ombudsman V Samaniego 2008Where Did Macky GallegoNoch keine Bewertungen

- Ufemia Mercado V. The Municipal President of Macabebe, Pampanga, and The Secretary of Commerce and CommunicationsDokument1 SeiteUfemia Mercado V. The Municipal President of Macabebe, Pampanga, and The Secretary of Commerce and CommunicationsArah Mae BonillaNoch keine Bewertungen

- Literal Meaning of Immediate and Remote PartiesDokument2 SeitenLiteral Meaning of Immediate and Remote PartiesAxle InsigneNoch keine Bewertungen

- PNB V CA 256 SCRA 491Dokument2 SeitenPNB V CA 256 SCRA 491Angeline RodriguezNoch keine Bewertungen

- MBTC v. IEBDokument2 SeitenMBTC v. IEBDGDelfinNoch keine Bewertungen

- Ramirez Vs OrientalistDokument4 SeitenRamirez Vs OrientalistSherwin LingatingNoch keine Bewertungen

- Fossum v. HermanosDokument1 SeiteFossum v. Hermanosrgtan3Noch keine Bewertungen

- REPUBLIC BANK V CA, First Nat'l City BankDokument2 SeitenREPUBLIC BANK V CA, First Nat'l City BankKevin HernandezNoch keine Bewertungen

- Digest Easement 613 676Dokument41 SeitenDigest Easement 613 676ReyesJosellereyesNoch keine Bewertungen

- Steinberg v. Velasco (1929)Dokument1 SeiteSteinberg v. Velasco (1929)Andre Philippe RamosNoch keine Bewertungen

- Marimperio v. CADokument1 SeiteMarimperio v. CAJustin Dominic ManaogNoch keine Bewertungen

- Bank of America v. CA (Mulingtapang)Dokument4 SeitenBank of America v. CA (Mulingtapang)Jake PeraltaNoch keine Bewertungen

- Areza v. Express Savings BankDokument3 SeitenAreza v. Express Savings Bankelaine bercenioNoch keine Bewertungen

- Zobel V CA DigestDokument2 SeitenZobel V CA DigestJermone MuaripNoch keine Bewertungen

- PNB vs. CA and PCIBDokument2 SeitenPNB vs. CA and PCIBDaniela Erika Beredo InandanNoch keine Bewertungen

- 50) Macalinao vs. Bank of The Philippine Islands, 600 SCRA 67 (2009)Dokument1 Seite50) Macalinao vs. Bank of The Philippine Islands, 600 SCRA 67 (2009)Zyrene CabaldoNoch keine Bewertungen

- Cely Yang Vs CA-1Dokument1 SeiteCely Yang Vs CA-1Mary Joyce Lacambra AquinoNoch keine Bewertungen

- Heirs of Domongo Valientes v. RamasDokument8 SeitenHeirs of Domongo Valientes v. RamasAiyla AnonasNoch keine Bewertungen

- Bpi V CA 232 Scra302Dokument11 SeitenBpi V CA 232 Scra302frank japosNoch keine Bewertungen

- Liability of Persons Secondarily Liable When Instrument Dishonored Garcia Havenlynne F PDFDokument2 SeitenLiability of Persons Secondarily Liable When Instrument Dishonored Garcia Havenlynne F PDFHaven GarciaNoch keine Bewertungen

- Digest Credit Trans CasesDokument7 SeitenDigest Credit Trans CasesGracelyn Enriquez Bellingan100% (1)

- Great Eastern Life Insurance v. Hongkong and Shanghai Bank DigestDokument2 SeitenGreat Eastern Life Insurance v. Hongkong and Shanghai Bank DigestChristine Rose Bonilla LikiganNoch keine Bewertungen

- TRB V RPNDokument1 SeiteTRB V RPNeieipayadNoch keine Bewertungen

- Fortuito Over Which The Common Carrier Did Not Have Any ControlDokument2 SeitenFortuito Over Which The Common Carrier Did Not Have Any ControlNichole Patricia PedriñaNoch keine Bewertungen

- NYCO SALES CORPORATION V BA FINANCE CORPORATIONDokument2 SeitenNYCO SALES CORPORATION V BA FINANCE CORPORATIONColee StiflerNoch keine Bewertungen

- Pal vs. CaDokument1 SeitePal vs. CaattymaryjoyordanezaNoch keine Bewertungen

- De La Victoria V BurgosDokument10 SeitenDe La Victoria V BurgoscmdelrioNoch keine Bewertungen

- CBP Vs CaDokument2 SeitenCBP Vs CaGale Charm SeñerezNoch keine Bewertungen

- Nego Week 6 DigestsDokument6 SeitenNego Week 6 DigestsRealKD30Noch keine Bewertungen

- Republic Bank vs. Ebrada-DigestDokument2 SeitenRepublic Bank vs. Ebrada-DigestNikolaDaikiBorgiaNoch keine Bewertungen

- Bpi Vs Iac 164 Scra 630 1988Dokument5 SeitenBpi Vs Iac 164 Scra 630 1988ShielaMarie MalanoNoch keine Bewertungen

- Dizon Vs Dizon CaseDokument3 SeitenDizon Vs Dizon CaseM Azeneth JJ100% (1)

- Chee Kiong Yam Vs Hon. Malik, G.R. No. L-50550-52 October 31, 1979Dokument2 SeitenChee Kiong Yam Vs Hon. Malik, G.R. No. L-50550-52 October 31, 1979Rizchelle Sampang-ManaogNoch keine Bewertungen

- Robinson & Co. v. Belt, 187 U.S. 41 (1902)Dokument8 SeitenRobinson & Co. v. Belt, 187 U.S. 41 (1902)Scribd Government DocsNoch keine Bewertungen

- NIL Case Digests 2Dokument28 SeitenNIL Case Digests 2Franz Henri de GuzmanNoch keine Bewertungen

- G.R. No. L-30896 - Sia v. PeopleDokument10 SeitenG.R. No. L-30896 - Sia v. PeopleLolersNoch keine Bewertungen

- Bautista V Auto Plus TradersDokument8 SeitenBautista V Auto Plus TradersMarrianne ReginaldoNoch keine Bewertungen

- State Investment v. CADokument1 SeiteState Investment v. CAJm EjeNoch keine Bewertungen

- Pleasantville Dev. Corp. vs. CA, Et Al, G.R. No. 79688, February 1, 1996 ORIGINALDokument10 SeitenPleasantville Dev. Corp. vs. CA, Et Al, G.R. No. 79688, February 1, 1996 ORIGINALJacquelyn AlegriaNoch keine Bewertungen

- Calasanz Vs CommDokument4 SeitenCalasanz Vs CommEANoch keine Bewertungen

- Moralidad V Sps PernesDokument1 SeiteMoralidad V Sps Pernesk santosNoch keine Bewertungen

- DH Overmyer Co. v. Frick Co., 405 U.S. 174 (1972)Dokument14 SeitenDH Overmyer Co. v. Frick Co., 405 U.S. 174 (1972)Scribd Government DocsNoch keine Bewertungen

- Nego - Check CasesDokument3 SeitenNego - Check CasesRizel C. BarsabalNoch keine Bewertungen

- Villar: Guerrero, J.Dokument2 SeitenVillar: Guerrero, J.One TwoNoch keine Bewertungen

- Simex Intl Vs CADokument1 SeiteSimex Intl Vs CAJudee AnneNoch keine Bewertungen

- Calimlim-Canullas vs. FortunDokument2 SeitenCalimlim-Canullas vs. Fortungen1Noch keine Bewertungen

- Wills Case Digest (Batch 2)Dokument34 SeitenWills Case Digest (Batch 2)Juls RxsNoch keine Bewertungen

- Cavite Development Bank Vs SpsDokument2 SeitenCavite Development Bank Vs SpsJug HeadNoch keine Bewertungen

- 10 Ubas V Chan Digest PDFDokument2 Seiten10 Ubas V Chan Digest PDFDamienNoch keine Bewertungen

- BPI v. IAC - Credit TransactionsDokument6 SeitenBPI v. IAC - Credit TransactionsCoby MirandaNoch keine Bewertungen

- Solicitor General V Metropolitan Manila AuthorityDokument10 SeitenSolicitor General V Metropolitan Manila AuthorityDon So HiongNoch keine Bewertungen

- Yau Chu V CADokument1 SeiteYau Chu V CAJaz SumalinogNoch keine Bewertungen

- Bataan Cigar, Banco AtlanticoDokument4 SeitenBataan Cigar, Banco Atlantico유니스Noch keine Bewertungen

- 04 Bataan Cigar Vs CA (G.R. No. 93048 - March 3, 1994)Dokument2 Seiten04 Bataan Cigar Vs CA (G.R. No. 93048 - March 3, 1994)teepeeNoch keine Bewertungen

- Bataan Cigar Vs CA, Nego CaseDokument3 SeitenBataan Cigar Vs CA, Nego Casem_villaparaNoch keine Bewertungen

- 1994-Bataan Cigar and Cigarette Factory Inc. V.Dokument5 Seiten1994-Bataan Cigar and Cigarette Factory Inc. V.Kathleen MartinNoch keine Bewertungen

- Heirs Vs MaramagDokument1 SeiteHeirs Vs MaramagMir SolaimanNoch keine Bewertungen

- Samson V EraDokument2 SeitenSamson V EraMir SolaimanNoch keine Bewertungen

- TORTS 7. DM Consunji V CADokument2 SeitenTORTS 7. DM Consunji V CAMir Solaiman100% (1)

- in Re ArgosinoDokument2 Seitenin Re ArgosinoMir SolaimanNoch keine Bewertungen

- Sunlife Vs CADokument1 SeiteSunlife Vs CAMir SolaimanNoch keine Bewertungen

- Tee Ling Kiat Vs Ayala CorpDokument1 SeiteTee Ling Kiat Vs Ayala CorpMir SolaimanNoch keine Bewertungen

- Wise Holdings Vs GarciaDokument2 SeitenWise Holdings Vs GarciaMir Solaiman100% (2)

- Alawi V AlauyaDokument2 SeitenAlawi V AlauyaMir SolaimanNoch keine Bewertungen

- OCA Vs FloroDokument2 SeitenOCA Vs FloroMir SolaimanNoch keine Bewertungen

- in Rthe Matter of Charges Against Justice Mariano Del CastilloDokument2 Seitenin Rthe Matter of Charges Against Justice Mariano Del CastilloMir Solaiman100% (1)

- People v. CaballeroDokument1 SeitePeople v. CaballeroMir SolaimanNoch keine Bewertungen

- Umale V ASB Realty CorpDokument2 SeitenUmale V ASB Realty CorpMir SolaimanNoch keine Bewertungen

- Irr Ra 7279Dokument16 SeitenIrr Ra 7279Mir SolaimanNoch keine Bewertungen

- Hassan V ComelecDokument2 SeitenHassan V ComelecMir SolaimanNoch keine Bewertungen

- Paguyo V GatbuntonDokument3 SeitenPaguyo V GatbuntonMir SolaimanNoch keine Bewertungen

- Sample COmplaint For Sum of Money HeaderDokument2 SeitenSample COmplaint For Sum of Money HeaderMir SolaimanNoch keine Bewertungen

- Metropolitan Bank & Trust Company vs. Court of AppealsDokument2 SeitenMetropolitan Bank & Trust Company vs. Court of AppealsMir SolaimanNoch keine Bewertungen

- Ututalum V COMELECDokument1 SeiteUtutalum V COMELECMir SolaimanNoch keine Bewertungen

- Tan Vs Comelec 142 SCRA 727 (1986)Dokument1 SeiteTan Vs Comelec 142 SCRA 727 (1986)Mir Solaiman100% (2)

- People Vs ParazoDokument2 SeitenPeople Vs ParazoMir SolaimanNoch keine Bewertungen

- Sarmiento V COMELECDokument1 SeiteSarmiento V COMELECMir SolaimanNoch keine Bewertungen

- PPL V MoralDokument1 SeitePPL V MoralMir SolaimanNoch keine Bewertungen

- People Vs MontesclarosDokument2 SeitenPeople Vs MontesclarosMir SolaimanNoch keine Bewertungen

- Berkenkotter V Cu UnjiengDokument1 SeiteBerkenkotter V Cu UnjiengMir SolaimanNoch keine Bewertungen

- Alfredo Canuto, JR. and Romeo DE LA CORTE, Petitioners, vs. NATIONAL Labor Relations Commission and Colgate Palmolive Philippines, INC., RespondentsDokument4 SeitenAlfredo Canuto, JR. and Romeo DE LA CORTE, Petitioners, vs. NATIONAL Labor Relations Commission and Colgate Palmolive Philippines, INC., RespondentsMir SolaimanNoch keine Bewertungen

- Manila Lodge No. 761 Vs CA 73 SCRA 162Dokument1 SeiteManila Lodge No. 761 Vs CA 73 SCRA 162Mir SolaimanNoch keine Bewertungen

- Krivenko V Register of DeedsDokument1 SeiteKrivenko V Register of DeedsMir SolaimanNoch keine Bewertungen

- Strategic Management IbsDokument497 SeitenStrategic Management IbsGARGI CHAKRABORTYNoch keine Bewertungen

- KTPDokument8 SeitenKTPSahil Shashikant BhosleNoch keine Bewertungen

- Webinar Manajemen Keuangan PerusahaanDokument69 SeitenWebinar Manajemen Keuangan PerusahaanDias CandrikaNoch keine Bewertungen

- Final Brand Building ProjectDokument14 SeitenFinal Brand Building ProjectSarah TantrayNoch keine Bewertungen

- PM-case Study - AaronSide Goes To TeamsDokument2 SeitenPM-case Study - AaronSide Goes To TeamsHassan Akbar SharifzadaNoch keine Bewertungen

- Vault Guide To The Top Financial Services EmployersDokument385 SeitenVault Guide To The Top Financial Services EmployersPatrick AdamsNoch keine Bewertungen

- CH 5 Answers To Homework AssignmentsDokument13 SeitenCH 5 Answers To Homework AssignmentsJan Spanton100% (1)

- Management 10th Edition Daft Test BankDokument34 SeitenManagement 10th Edition Daft Test Bankpatrickpandoradb6i100% (26)

- R26 CFA Level 3Dokument12 SeitenR26 CFA Level 3Ashna0188Noch keine Bewertungen

- MIT CASE Competition 2014 PresentationDokument15 SeitenMIT CASE Competition 2014 PresentationJonathan D SmithNoch keine Bewertungen

- Read This Article and Answer The Questions:: Turnover TurnoverDokument2 SeitenRead This Article and Answer The Questions:: Turnover TurnoverLambourn VoafidisoaNoch keine Bewertungen

- Form I National Cadet Corps SENIOR DIVISION/WING ENROLMENT FORM (See Rules 7 and 11 of NCC Act 1948)Dokument8 SeitenForm I National Cadet Corps SENIOR DIVISION/WING ENROLMENT FORM (See Rules 7 and 11 of NCC Act 1948)Suresh Sankara NarayananNoch keine Bewertungen

- ACC501 Solved Current Papers McqsDokument36 SeitenACC501 Solved Current Papers Mcqssania.mahar100% (2)

- The Bombay Industrial Relations Act 1946Dokument12 SeitenThe Bombay Industrial Relations Act 1946Pooja Bhavar100% (1)

- SAP SD Functional Analyst ResumeDokument10 SeitenSAP SD Functional Analyst ResumedavinkuNoch keine Bewertungen

- Report Sample-Supplier Factory AuditDokument24 SeitenReport Sample-Supplier Factory AuditCarlosSánchezNoch keine Bewertungen

- Group 7 Topic 3Dokument8 SeitenGroup 7 Topic 3Tuyết Nhi ĐỗNoch keine Bewertungen

- BesorDokument3 SeitenBesorPaul Jures DulfoNoch keine Bewertungen

- Facebook (Wikipedia Extract)Dokument1 SeiteFacebook (Wikipedia Extract)sr123123123Noch keine Bewertungen

- Introduction To Corporation AccountingDokument15 SeitenIntroduction To Corporation AccountingAlejandrea Lalata100% (2)

- BBA in Accounting 1Dokument7 SeitenBBA in Accounting 1NomanNoch keine Bewertungen

- IT Continuity, Backup and Recovery PolicyDokument8 SeitenIT Continuity, Backup and Recovery PolicynaveedNoch keine Bewertungen

- Isa 600Dokument27 SeitenIsa 600Anser Raza100% (1)

- 6 Country RiskDokument17 Seiten6 Country RiskvbalodaNoch keine Bewertungen

- Handover NoteDokument3 SeitenHandover NoteEmmNoch keine Bewertungen

- Macro Economics ProjectDokument31 SeitenMacro Economics ProjectChayan SenNoch keine Bewertungen

- A cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFDokument4 SeitenA cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFkartik naikNoch keine Bewertungen

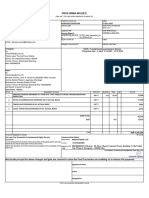

- Service Proforma Invoice - ACCEPTANCE Tata Projects-020Dokument1 SeiteService Proforma Invoice - ACCEPTANCE Tata Projects-020maneesh bhardwajNoch keine Bewertungen

- CH 20Dokument22 SeitenCH 20sumihosaNoch keine Bewertungen

- Knowledgehub SBI A Group For-SbitiansDokument13 SeitenKnowledgehub SBI A Group For-SbitiansdeepaNoch keine Bewertungen