Beruflich Dokumente

Kultur Dokumente

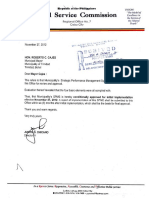

Request Letter To Practice Profession (CPA) - Government Employee

Hochgeladen von

Melissa DomingoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Request Letter To Practice Profession (CPA) - Government Employee

Hochgeladen von

Melissa DomingoCopyright:

Verfügbare Formate

REQUEST LETTER TO ENGAGE IN

PRACTICE OF PUBLIC ACCOUNTANCY

September 4, 2015

XXXXXXXXXXXXXXX

University President

Office of the President

Polytechnic University of the Philippines

Dear Sir:

Greetings in the name of our Lord!

Sir, I am writing to your good office in connection with my intention to engage in the

public practice of my CPA profession, specifically engage in Financial Statement, Tax,

and Audit Services to clients.

I am currently working on General Accounting Department as an Accounting Staff. I

became a Certified Public Accountant on November 2013, and I used to be on Public

Practice of my profession before I started working in the University.

With such intention, worthy of note is the Scope of Practice of Public Accountancy as

stated in Section 4, Republic Act No. 9298, Otherwise known as the “Philippine

Accountancy Act”, where “Practice of Public Accountancy” shall constitute a person, be

it his/her individual capacity, or as a staff member in an accounting or auditing firm,

holding out himself/herself as one skilled in the knowledge, science and practice of

accounting, and as a qualified person to render professional services as a certified public

accountant; or offering or rendering, or both or more than one client on a fee basis or

otherwise, services as such as the audit or verification of financial transaction and

accounting records; or the preparation, signing, or certification for clients of reports of

audit, balance sheet, and other financial, accounting and related schedules, exhibits,

statement of reports which are to be used for publication or for credit purposes, or to be

filed with a court or government agency, or to be used for any other purposes; or to design,

installation, and revision of accounting system; or the preparation of income tax returns

when related to accounting procedures; or when he/she represent clients before

government agencies on tax and other matters relating to accounting or render

professional assistance in matters relating to accounting procedures and the recording

and presentation of financial facts or data.

Meanwhile, Section 7 (b)(2) of RA 6713 (Code of Conduct and Ethical Standards for

Public Officials and Employees) provides:

Section 7. Prohibited Acts and Transactions. – In addition to acts and omissions of

public officials and employees now prescribed in the Constitution and existing laws,

the following shall constitute prohibited acts and transactions of any public official

and employee and are hereby directed to be unlawful:

1

xxx

(b) Outside employment and other activities related thereto. – Public officials and

employees during their incumbency shall not:

xxx

(2) Engage in the private practice of their profession unless authorized by the

Constitution or law, provided, that such practice will not conflict or tend to

conflict with their official functions.

Also important, Section 12, Rule XVIII of the Revised Civil Service Rules states:

Sec. 12. No officer or employee shall engage directly in any private business,

vocation, or profession or be connected with any commercial, credit, agricultural,

or industrial undertaking without a written permission from the head of

Department; Provided, That this prohibition will be absolute in the case of those

officers and employees whose duties and responsibilities require that their entire

time be at the disposal of the Government: Provided, further, That if an

employee is granted permission to engage in outside activities, the time so

devoted outside of office hours should be fixed by the chief of the agency to

the end that it will not impair in any way the efficiency of the other officer or

employee, which do not involve any real or apparent conflict between his

private interests and public duties, or in any way influence him in the discharge

of his duties, and he shall not take part in the management of the enterprise or

become an officer or member of the board of directors.

With this, I promise to engage in my CPA Practice only after office hours or during

weekends or holidays. Rest assured that the privilege requested will not entail any

conflict of interest in so far as the functions of the your good office and public service

are concerned, and it will not in any way affect nor interfere in the discharge of my

duties and responsibilities as a university employee.

Further, being part of your good office, I will firmly observe my limitations and make

sure that my CPA practice will not run contrary to the provision of Code of Conduct and

Ethical Standards for Public Officials and Employees.

In light of the foregoing, I respectfully request that I be given the permission to exercise

my CPA profession in private capacity.

Respectfully,

YYYYYYYYYYY, CPA

Roll No. AAAAAAA

Das könnte Ihnen auch gefallen

- Notarial Practice & Malpractice in the Philippines: Rules, Jurisprudence, & CommentsVon EverandNotarial Practice & Malpractice in the Philippines: Rules, Jurisprudence, & CommentsBewertung: 5 von 5 Sternen5/5 (3)

- Practice of Profession of Government EmployeeDokument2 SeitenPractice of Profession of Government EmployeeSuzanne Pagaduan Cruz50% (2)

- Sample Request Letter For Authority To Practice The Legal ProfessionDokument3 SeitenSample Request Letter For Authority To Practice The Legal ProfessionJOHN VINCENT S FERRER100% (1)

- Sample Request Letter For Authority To Practice The Legal ProfessionDokument3 SeitenSample Request Letter For Authority To Practice The Legal ProfessionArturo Sioson, Jr.81% (26)

- Request Letter To Practice ProfessionDokument2 SeitenRequest Letter To Practice ProfessionJohn Mark Paracad88% (32)

- Letter Request To Engage Private Practice of ProfessionDokument3 SeitenLetter Request To Engage Private Practice of ProfessionMJ100% (3)

- Guidelines On The Authority To Engage in A Limited Practice of Profession by Lawyers Holding Permanent Position in Denr Central OfficeDokument3 SeitenGuidelines On The Authority To Engage in A Limited Practice of Profession by Lawyers Holding Permanent Position in Denr Central OfficeGersonGamas100% (4)

- Memo - Authority To Practice Profession - Template - For SigDokument2 SeitenMemo - Authority To Practice Profession - Template - For SigGeramer Vere DuratoNoch keine Bewertungen

- SAMPLE Request For Authority To Engage in Limited Practice of Law in The PhilippinesDokument1 SeiteSAMPLE Request For Authority To Engage in Limited Practice of Law in The PhilippinesArturo Sioson, Jr.100% (1)

- Nia - Response To AOM HCAAP 2013-008 - Illegal Contract TerminationDokument128 SeitenNia - Response To AOM HCAAP 2013-008 - Illegal Contract TerminationLeo CalejaNoch keine Bewertungen

- Sample Coa Aom Reply PDF FreeDokument1 SeiteSample Coa Aom Reply PDF FreeMoana Katuray100% (3)

- Cos and Jo Filing Coc LoDokument11 SeitenCos and Jo Filing Coc LoGen S.100% (1)

- Request For Authority To PracticeDokument2 SeitenRequest For Authority To PracticeAura Garcia-Gabriel100% (2)

- COA - R2017-021 - Amended To Installment Settlement of ND PDFDokument3 SeitenCOA - R2017-021 - Amended To Installment Settlement of ND PDFMelissa G. Aston - Balmediano100% (2)

- Management Comment AOM No. 2016-11 (2015)Dokument3 SeitenManagement Comment AOM No. 2016-11 (2015)Eppie Severino100% (1)

- Comment To Aom of Coa (Parpo Leo) CanopyDokument2 SeitenComment To Aom of Coa (Parpo Leo) CanopyJohnry ParillaNoch keine Bewertungen

- Authority To Practice ProfessionDokument2 SeitenAuthority To Practice ProfessionMikee Rañola100% (4)

- Office of The Municipal Mayor: Office (Bplo) and Permanent StaffDokument3 SeitenOffice of The Municipal Mayor: Office (Bplo) and Permanent StaffBebie Jorge Maravillo67% (3)

- Policy Guidelines For Hiring of Personnel Under COS, Job Order (DOT)Dokument5 SeitenPolicy Guidelines For Hiring of Personnel Under COS, Job Order (DOT)raineydays67% (3)

- CSC FormDokument3 SeitenCSC FormJhoy Callueng Rey100% (1)

- The Philippine Public Sector Accounting StandardsDokument8 SeitenThe Philippine Public Sector Accounting StandardsRichel ArmayanNoch keine Bewertungen

- AUTHORITY TO RENDER OVERTIME SERVICES FormsDokument6 SeitenAUTHORITY TO RENDER OVERTIME SERVICES FormsJesslie Joy Pablico-BanayoNoch keine Bewertungen

- COA DECISION NO. 2008-126: Facts of The CaseDokument2 SeitenCOA DECISION NO. 2008-126: Facts of The CaseFe M. NguddoNoch keine Bewertungen

- Notice of Formal Charge RRACS - SampleDokument2 SeitenNotice of Formal Charge RRACS - SampleML Banzon100% (2)

- Seminar On Property and Supply Management SystemDokument7 SeitenSeminar On Property and Supply Management SystemCire Etneilav75% (4)

- DILG CIRCULAR No. 2016-14, Issued On August 22, 2016Dokument2 SeitenDILG CIRCULAR No. 2016-14, Issued On August 22, 2016Rafael Solis100% (1)

- Authority To PracticeDokument2 SeitenAuthority To Practiceanthony singzon86% (7)

- Script-Role Play-ProcurementDokument9 SeitenScript-Role Play-ProcurementCruz Isaac Ken100% (3)

- Documentary Requirements For Common Government TransactionsDokument74 SeitenDocumentary Requirements For Common Government TransactionsChristine Meralpes100% (8)

- Enhanced eNGASDokument116 SeitenEnhanced eNGASJo AnnNoch keine Bewertungen

- Government Office Hours DocuDokument6 SeitenGovernment Office Hours DocuChing Romero100% (1)

- Revenue Code of Cebu 2008Dokument150 SeitenRevenue Code of Cebu 2008Clint M. Maratas71% (7)

- COA - M2017-014 Cost of Audit Services Rendered To Water DistrictsDokument5 SeitenCOA - M2017-014 Cost of Audit Services Rendered To Water DistrictsJuan Luis Lusong67% (3)

- AOM IIT Reply Comment 2014 Partial For The ManagementDokument10 SeitenAOM IIT Reply Comment 2014 Partial For The Managementlairah.mananNoch keine Bewertungen

- Certificate of Travel CompletedDokument2 SeitenCertificate of Travel Completedjanquil 25100% (1)

- Falsification of DTRDokument3 SeitenFalsification of DTRChuck Estrada100% (4)

- Selection Process ExperienceDokument1 SeiteSelection Process ExperienceRg Perola67% (3)

- Commission On Audit Circular No 97-002Dokument12 SeitenCommission On Audit Circular No 97-002Jesse JamesNoch keine Bewertungen

- Commonwealth Avenue, Quezon CityDokument3 SeitenCommonwealth Avenue, Quezon CityAngeli Lou Joven VillanuevaNoch keine Bewertungen

- Dao 2007-17 (Sapa)Dokument22 SeitenDao 2007-17 (Sapa)Jat Tabamo89% (9)

- NGAS Manual For Local Government UnitsDokument29 SeitenNGAS Manual For Local Government UnitsChiyobels100% (5)

- Three-Salary Grade LimitationDokument3 SeitenThree-Salary Grade Limitationalmors100% (3)

- Rejoinder On Sedan Corrected - Doc 5.29.17Dokument4 SeitenRejoinder On Sedan Corrected - Doc 5.29.17Hoven Macasinag100% (1)

- JOB ORDER CONTRActDokument4 SeitenJOB ORDER CONTRActBern100% (3)

- Job Order Performance Evaluation FormDokument4 SeitenJob Order Performance Evaluation FormJe-ann H. Gonzales100% (4)

- Guidebook - CSC Spms - Final Page Proof 7-B - 8jul13Dokument56 SeitenGuidebook - CSC Spms - Final Page Proof 7-B - 8jul13Babang100% (3)

- NCIP AO1 Series of 2021 Revised Guidelines For IPMR - 1645666717Dokument16 SeitenNCIP AO1 Series of 2021 Revised Guidelines For IPMR - 1645666717Sonny Madarang Solimen100% (2)

- Reviewer ICLTE 202Dokument4 SeitenReviewer ICLTE 202Angelica Aquino Gasmen100% (6)

- Training Handbook On Property and Supply Management - 2003Dokument220 SeitenTraining Handbook On Property and Supply Management - 2003Charlie Maine100% (3)

- The Local Development Investment Program (LDIP) : - The Main Implementing Tool For The CDPDokument10 SeitenThe Local Development Investment Program (LDIP) : - The Main Implementing Tool For The CDPJpoy OrtizNoch keine Bewertungen

- Study Leave ContractDokument3 SeitenStudy Leave ContractWilma Pereña92% (24)

- Job OrderDokument24 SeitenJob OrdervangieNoch keine Bewertungen

- CS Form No. 212 Attachment - Work Experience SheetDokument2 SeitenCS Form No. 212 Attachment - Work Experience SheetArnel Pablo100% (2)

- SPMS Lgu Trinidad BoholDokument26 SeitenSPMS Lgu Trinidad BoholJoemar Cafranca100% (3)

- AOM-01 - Collecting OfficersDokument2 SeitenAOM-01 - Collecting OfficersClay DelgadoNoch keine Bewertungen

- PAO ReviewerDokument1 SeitePAO ReviewerjustinebetteNoch keine Bewertungen

- Ethics Mar. 5Dokument5 SeitenEthics Mar. 5Fricela KimNoch keine Bewertungen

- Authorityto PracticeDokument2 SeitenAuthorityto PracticeTacloban City Media CenterNoch keine Bewertungen

- DOJ DC No. 30Dokument3 SeitenDOJ DC No. 30Jazztine Masangkay ArtizuelaNoch keine Bewertungen

- 07 Ra 6713 Sec 7Dokument1 Seite07 Ra 6713 Sec 7bchiefulNoch keine Bewertungen

- New Era University: Proposed TitleDokument26 SeitenNew Era University: Proposed TitleKaycee NavarroNoch keine Bewertungen

- Accountable Has An Effect On Assets, Liabilities and EquityDokument5 SeitenAccountable Has An Effect On Assets, Liabilities and EquityJohn Lexter MacalberNoch keine Bewertungen

- Aicpa Reg 6Dokument170 SeitenAicpa Reg 6Natasha Declan100% (1)

- Impact of Accounting Research in The PhilippinesDokument5 SeitenImpact of Accounting Research in The PhilippinesInsatiable LifeNoch keine Bewertungen

- Lesson 2 - The Professional StandardsDokument9 SeitenLesson 2 - The Professional StandardsJoe P PokaranNoch keine Bewertungen

- Accounting Fraud Auditing and The Role of Government Sanctions in China 2015 Journal of Business ResearchDokument10 SeitenAccounting Fraud Auditing and The Role of Government Sanctions in China 2015 Journal of Business ResearchAquamarine EmeraldNoch keine Bewertungen

- Refocusing The Care Programme ApproachDokument64 SeitenRefocusing The Care Programme ApproachMHRED_UOLNoch keine Bewertungen

- Acctg 15 - Final ExamDokument4 SeitenAcctg 15 - Final ExamRannah Raymundo100% (1)

- Kasus ABA 6 - Sarah Russell, Staff AccountantDokument3 SeitenKasus ABA 6 - Sarah Russell, Staff AccountanttabithaNoch keine Bewertungen

- Chapter Four Accounting As A Profession: Characteristics of A ProfessionDokument7 SeitenChapter Four Accounting As A Profession: Characteristics of A Professiondara ibthiaNoch keine Bewertungen

- HKICPA Capstone P1 (Ch1-7)Dokument365 SeitenHKICPA Capstone P1 (Ch1-7)Cheung Ka heiNoch keine Bewertungen

- Preboard 1Dokument9 SeitenPreboard 1Janica Berba100% (1)

- 01 Accounting & Its EnvironmentDokument4 Seiten01 Accounting & Its EnvironmentRewsEn100% (1)

- Soc2 Vs Soc For Cyber BrochureDokument2 SeitenSoc2 Vs Soc For Cyber BrochurepaxcopyrightNoch keine Bewertungen

- Arens Aas17 PPT 01Dokument38 SeitenArens Aas17 PPT 01massNoch keine Bewertungen

- (INTL) (Brody Et Al., 2016) Beyond The CPA - Student Awareness of Accounting CertificationsDokument17 Seiten(INTL) (Brody Et Al., 2016) Beyond The CPA - Student Awareness of Accounting CertificationsDark ShadowNoch keine Bewertungen

- Management AccountingDokument188 SeitenManagement Accountingabdul100% (1)

- The Making of A CpaDokument46 SeitenThe Making of A CpaMark Alyson NginaNoch keine Bewertungen

- BX Directory 2013-12 - Business Exchange DirectoryDokument75 SeitenBX Directory 2013-12 - Business Exchange DirectoryKevin HedgecockNoch keine Bewertungen

- Understanding Financial Accounting Canadian 2nd Edition Burnley Test BankDokument25 SeitenUnderstanding Financial Accounting Canadian 2nd Edition Burnley Test BankJamesFowlertmnf100% (27)

- Audit TheoryDokument6 SeitenAudit TheoryVon Lloyd Ledesma LorenNoch keine Bewertungen

- Chapter 1 & 2Dokument13 SeitenChapter 1 & 2Ali100% (1)

- At 1 Theory Palang With Questions 1Dokument12 SeitenAt 1 Theory Palang With Questions 1Sharmaine JoyceNoch keine Bewertungen

- UT Dallas Syllabus For Acct6334.0g1.11f Taught by Tiffany Bortz (Tabortz)Dokument9 SeitenUT Dallas Syllabus For Acct6334.0g1.11f Taught by Tiffany Bortz (Tabortz)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- Marta Alfonso To Speak at The New York State Society of CPADokument2 SeitenMarta Alfonso To Speak at The New York State Society of CPAmbafcpaNoch keine Bewertungen

- CA Codes (Gov - 6500-6536)Dokument31 SeitenCA Codes (Gov - 6500-6536)Brian DaviesNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Dokument18 SeitenCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Annalou TaditNoch keine Bewertungen

- Application Letter - CebuDokument3 SeitenApplication Letter - CebuRussel SarachoNoch keine Bewertungen

- Annex A Boa Form For Partnership 1Dokument3 SeitenAnnex A Boa Form For Partnership 1veraNoch keine Bewertungen

- Sanksi PCAOB KAP Imelda Dan Rekan Tahun 2024 Deloitte Indonesia, Deloitte Touche Tohmatsu Limited, Deloitte Global NetworkDokument8 SeitenSanksi PCAOB KAP Imelda Dan Rekan Tahun 2024 Deloitte Indonesia, Deloitte Touche Tohmatsu Limited, Deloitte Global NetworkAnonymous MPPD6BU6Noch keine Bewertungen