Beruflich Dokumente

Kultur Dokumente

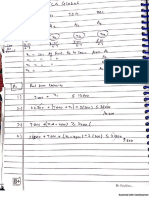

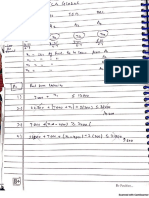

Camels Ratings

Hochgeladen von

Ayush53Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Camels Ratings

Hochgeladen von

Ayush53Copyright:

Verfügbare Formate

Lead Questions for Polaroid Corp.

1. List the recent highlights of Polaroid as a business entity. Comment on its products, innovations,

competitors, investment needs, geographical presence etc.

2. Look into forecast figures in Exhibit 6; what kind of practical uncertainties you can see around the

projections. How these uncertainties could impact firm’s FCF and hence value. Try to see the

upside as well as downside of missing the projections. Which way do you think we may miss more.

3. After analyzing the uncertainties, comment on the value of option to access capital market

qualitatively. This is how we can learn about retaining flexibility by a firm.

4. Analyze debt requirements of firms facing similar circumstances as Polaroid. Reflect upon our

class discussion in the previous class.

5. Looking onto the competitors can we infer something about the existing rating of Polaroid. What

factors might have influenced bond rating of a firm.

6. Try to value the share price using DCF assuming WACC as 10% and growth of FCF after 2000 at

6%. Use FCF from Exhibit 6. Comment on the value you identified after comparing this with current

stock price in the market. Comment/reflect on the assumptions; how wild were those.

7. Use data from Exh 12, 9 and 1 to estimate market based debt/capital ratios. Using current firm

value of Polaroid, estimate the maximum/average debt capacity implied by each rating. Comment

on the current debt capacity employed by Polaroid with respect to the implied capacity for each

rating.

8. Estimate interest expenses by using pre-tax cost of debt and implied debt capacity in previous

question. Use Exh 6 figures for average EBIT of projections as normalized EBIT and downside

EBIT to calculate two different Interest coverage ratios (ICRs) for each rating. Comment on the

existing ICRs.

9. Can we now see which rating is justified for Polaroid? Comment.

10. Use Hudson Guaranty estimates to calculate WACC for each rating. Use weights as estimated in

Q. 7 above. What do we find here for justified rating of Polaroid?

11. What can we infer for the suitable capital structure by the analysis above. Should Polaroid issue

more debt or equity at this stage? What are the pros and cons of issuing any of this.

Das könnte Ihnen auch gefallen

- AsdseDokument14 SeitenAsdseAyush53Noch keine Bewertungen

- Ayush Choudhary 2018PGP084 InsightsDokument1 SeiteAyush Choudhary 2018PGP084 InsightsAyush53Noch keine Bewertungen

- 1.design IoT PDFDokument38 Seiten1.design IoT PDFAyush53Noch keine Bewertungen

- ImmunizeDokument2 SeitenImmunizeAyush53Noch keine Bewertungen

- Stat Vs AnaltyicsDokument6 SeitenStat Vs AnaltyicsAyush53Noch keine Bewertungen

- DescriptionDokument3 SeitenDescriptionAyush53Noch keine Bewertungen

- PreProcess Operations Udaan 2018 R1Dokument1 SeitePreProcess Operations Udaan 2018 R1Ayush53Noch keine Bewertungen

- CH 3 R CodeDokument2 SeitenCH 3 R CodeAyush53Noch keine Bewertungen

- Camels RatingsDokument1 SeiteCamels RatingsAyush53Noch keine Bewertungen

- CAMELS RatingsDokument1 SeiteCAMELS RatingsAyush53Noch keine Bewertungen

- ..-DocumentDownloads-events-DelhiEvent-1.4 CWET Wind Mapping PDFDokument36 Seiten..-DocumentDownloads-events-DelhiEvent-1.4 CWET Wind Mapping PDFAyush53Noch keine Bewertungen

- Crucibles of LeadershipDokument5 SeitenCrucibles of LeadershipAmita Patel100% (2)

- CAMELS RatingsDokument1 SeiteCAMELS RatingsAyush53Noch keine Bewertungen

- Guesstimates PDFDokument12 SeitenGuesstimates PDFAyush53100% (3)

- Receipts Orders InvoicesDokument45 SeitenReceipts Orders InvoicesAyush53Noch keine Bewertungen

- Format For Calculation - Mountain Man CaseDokument2 SeitenFormat For Calculation - Mountain Man CaseAyush53Noch keine Bewertungen

- Business Model Canvas TemplateDokument3 SeitenBusiness Model Canvas TemplatehanadracoNoch keine Bewertungen

- Iqdm 3 PDFDokument12 SeitenIqdm 3 PDFAyush53Noch keine Bewertungen

- Iqdm 3 PDFDokument12 SeitenIqdm 3 PDFAyush53Noch keine Bewertungen

- Bossard - Accv12 - Apparel Classification With Style PDFDokument14 SeitenBossard - Accv12 - Apparel Classification With Style PDFAnonymous wA6NGuyklDNoch keine Bewertungen

- 01e Confessions of A Flipoholic PDFDokument6 Seiten01e Confessions of A Flipoholic PDFAyush53Noch keine Bewertungen

- Bhutan Road Trip ItineraryDokument8 SeitenBhutan Road Trip ItineraryAyush53Noch keine Bewertungen

- Vertical Versus Horizontal Line Extension Strategies - When Do BraDokument142 SeitenVertical Versus Horizontal Line Extension Strategies - When Do BraAyush53Noch keine Bewertungen

- 0 F 317536 Ed 3 e 376505000000Dokument7 Seiten0 F 317536 Ed 3 e 376505000000Ayush53Noch keine Bewertungen

- Project ReportDokument40 SeitenProject ReportAyush53Noch keine Bewertungen

- EndsemDokument4 SeitenEndsemAyush53Noch keine Bewertungen

- 31 Screw Threads and Gear Manufacturing MethodsDokument17 Seiten31 Screw Threads and Gear Manufacturing MethodsPRASAD326100% (8)

- Prohibited Item ListDokument1 SeiteProhibited Item ListAyush53Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)