Beruflich Dokumente

Kultur Dokumente

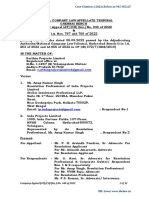

Cyber Law Case List

Hochgeladen von

Anushka ChaturvediCopyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCyber Law Case List

Hochgeladen von

Anushka ChaturvediSl Case Title Case Briefs Remarks

No.

1. Revision Bank had issued a duplicate (1) Bank was held liable.

Petition: 4806 of passbook to a “third person” (2) Ground was negligence of bank to

2008 of a joint savings bank issue duplicate passbook resulting in

account, without her data breach.

Rupa Mahajan authority, which resulted in (3) Financial details under purview of

Pahwa Vs. the release of all confidential Rule 3 IT( SPDI) Rules, 2011.

Punjab National financial details of the

Bank complainant.

Held:- Initially 50,000 cost to

respondent. Appeal by

Respondent in NCDRC.

Additional 25000 awarded to

petitioner along with lump

sum.

2. Civil Jurisdiction Petitioner received mail Bank was held liable even if it was case of

Petition No 2462 regarding update of account phishing. Data theft was established, as well

of 2008 via presumably routine mail. as Bank was incompetent to adhere to

Financial details given, and Reasonable Security Measures and Practices.

Shri Umashankar was duped an amount of

Sivasubramanian over 6 lakhs from the

Vs. ICIC Bank. account, of which over than

4 lakhs was withdrawn by

self-cheque.

Held:- Bank contravened the

trust and reliability offered

to the petitioner providing

secure transactions over the

Internet. Unauthorised

access to petitioner’s

account was established.

Bank’s due diligence and

reasonable security and

practices to be undertaken

were found lacking. Effective

KYC Norms were found

lacking. Sec 85/47(b)/43 read

with 46 of IT Act, 2000 along

with CPA,1986.

3. Mphasis BPO In December 2004, four call Arrest was made.

Fraud: 2005 centre employees, working

at an outsourcing facility

operated by MphasiS in

India, obtained PIN codes

from four customers of

MphasiS’ client, Citi Group.

These employees were not

authorized to obtain the

PINs. In association with

others, the call centre

employees opened new

accounts at Indian banks

using false identities. Within

two months, they used the

PINs and account

information gleaned during

their employment at

MphasiS to transfer money

from the bank accounts of

CitiGroup customers to the

new accounts at Indian

banks. By April 2005, the

Indian police had tipped off

to the scam by a U.S. bank,

and quickly identified the

individuals involved in the

scam. Arrests were made

when those individuals

attempted to withdraw cash

from the falsified accounts,

$426,000 was stolen; the

amount recovered was

$230,000.

Held:- Court held that

Section 43(a) was

applicable here due to the

nature of unauthorized

access involved to commit

transactions.

4. Syed Asifuddin In this case, Tata Indicom They were arrested after investigation. IT Act

and Ors. Vs. employees were arrested was invoked which led to the question of

The State of for manipulation of the sensitive data being manipulated. ESN comes

Andhra electronic 32- bit number within the purview of SPDI Rule 3 of IT(SPDI)

Pradesh (ESN) programmed into cell

Rules, 2011. Additionally, sec 65 of IT Act,

phones theft were

exclusively franchised to 2000 provides for punishment either of

Reliance Infocomm. imprisonment upto three years or fine upto 2

lakh rupees or both when there is tampering

The main allegation against with computer source documents.

the petitioners is that the

MIN of Reliance phone is

irreversibly integrated with

ESN and the petitioners

hacked ESN so as to wean

away RIM customers to

TATA Indicom service.

Syed Asifuddin and Ors. vs.

The State of Andhra

Pradesh and Anr.

(29.07.2005 - APHC) :

MANU/AP/0660/2005

Held:- Court held that

tampering with source code

invokes Section 65 of the

Information Technology Act.

5. Poona Auto Complainant held a current Well planned conspiracy and not one person

Ancillaries Pvt. account for corporate act Para 16(b) . Hence can be considered

Ltd Pune Vs. purpose but did not have within the term Body Corporate, under Rule 8

Punjab National SMS alert service enabled. of IT (SPDI) Rules, 2011.

Bank Further he responded to a

Complaint 4 of phishing mail . Criminals 43,43A,85 of IT Act, 2000.

2011. used accounts of PNB

opened on fake papers to

defraud complainant

Office of indicating PNB’s lax with KYC

Adjudicating norms. Major cash

Officer, withdrawal were allowed.

Secretary,

Government of Held: PNB to pay damages to

Maharashtra. the tune of 45,00,000 by way

of compensation.

6. Aconsoft Eserve Sarang Shekhar, Firdaus They were arrested, kept in judicial custody

India Ltd. Haq, Toton Haq & Prosenjit but was freed since proper collection of

Manna — opened four BPO evidence by the police was not carried out.

companies. All the 65B certificate not provided while preparing

companies were the charge sheet. Court was unable to

incorporated in Salt Lake in prosecute completely since collected

2011. Manna was director evidence was not adhering to Evidence Act.

of a company named

Aconsoft E Serve India

Limited. The group began

offering cheap debugging

solutions and branched out

to installing online software

solutions. They also

provided services like

entering annual

maintenance contracts,

installing simple anti-virus

programmes for clients in

foreign shores. Online

transfer of money, offered

at very cheap rates.

TeamViewer installed

allowing perpetrator to take

control of client’s desktop

without the client’s

consent.

Manna would mail a

lengthy form to client

asking him to fill it before

completing the online

payments. As the client was

busy filling up details in

form, Manna’s people were

able to see the exact

amount being entered for

payment. Once the amount

was known they would add

a zero to the original

amount. $9 turned into $90

before clicking the

transaction button. Clients

barely realized that they

had been duped. For this to

happen, it is crucial that the

accused know precisely

when the client filled up the

online form. Team viewer

meetings were arranged to

extend support to the

clients in form filling.

BPO employees duped their

clients in many countries. In

every country they

appointed an agent. Agents

had access to several bank

accounts operated from

their respective countries.

The amount that was

amassed fraudulently

would be transferred to

such accounts and the

agents would withdraw the

money within 30 minutes of

it being deposited. The

agent kept 40% and sent

the rest through hawala

channels of Mumbai and

Kolkata and Hundi channels

of Bangladesh.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Commercial LiensDokument91 SeitenCommercial LiensMichael KovachNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Rebounding Drills SampleDokument12 SeitenRebounding Drills SampleJeff Haefner95% (20)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Pantaleon v. AMEX credit card approval disputeDokument3 SeitenPantaleon v. AMEX credit card approval disputeJet SiangNoch keine Bewertungen

- Atmospheric Corrosion Resisting Structural Steel: National Standard of The People'S Republic of ChinaDokument6 SeitenAtmospheric Corrosion Resisting Structural Steel: National Standard of The People'S Republic of ChinaBaoNoch keine Bewertungen

- Legal Considerations for Maternal and Child NursesDokument6 SeitenLegal Considerations for Maternal and Child NursesA C100% (2)

- RSBSA Enrollment Form SummaryDokument2 SeitenRSBSA Enrollment Form Summaryanon_28428654175% (133)

- Oracle WMS WIP (White Paper)Dokument4 SeitenOracle WMS WIP (White Paper)floatingbrain67% (3)

- OCA Vs GarongDokument3 SeitenOCA Vs GarongJeraldine Mae RaotraotNoch keine Bewertungen

- Legal Updates March 2017Dokument3 SeitenLegal Updates March 2017Sambhav JainNoch keine Bewertungen

- Legal Updates January 2017Dokument2 SeitenLegal Updates January 2017Anushka ChaturvediNoch keine Bewertungen

- The Biological Diversity Act, 2002 PDFDokument28 SeitenThe Biological Diversity Act, 2002 PDFSamuel BhukyaNoch keine Bewertungen

- BbaDokument1 SeiteBbaAnushka ChaturvediNoch keine Bewertungen

- Criminal Law Case Digest CompilationDokument4 SeitenCriminal Law Case Digest CompilationJohnson YaplinNoch keine Bewertungen

- Pornography LawsDokument177 SeitenPornography Lawsvishnu000Noch keine Bewertungen

- Cheapest Countries To Live in 2021Dokument1 SeiteCheapest Countries To Live in 2021Jindd JaanNoch keine Bewertungen

- NCLAT OrderDokument32 SeitenNCLAT OrderShiva Rama Krishna BeharaNoch keine Bewertungen

- Lecture 04Dokument14 SeitenLecture 04Parvaiz Ali Naat OfficialNoch keine Bewertungen

- Here are the free-body and kinetic diagrams:Block A:yBlock B:yFBD:FBD:NNμkNμkNWWKD:KD:mamaxxDokument50 SeitenHere are the free-body and kinetic diagrams:Block A:yBlock B:yFBD:FBD:NNμkNμkNWWKD:KD:mamaxxMuhd Salman FarisiNoch keine Bewertungen

- Georgian Economy: Every Cloud Has A Silver LiningDokument7 SeitenGeorgian Economy: Every Cloud Has A Silver LiningGiorgiKaralashviliNoch keine Bewertungen

- TDS-466 Chembetaine CGFDokument1 SeiteTDS-466 Chembetaine CGFFabianoNoch keine Bewertungen

- Joseph Resler - Vice President - First American Bank - LinkedInDokument5 SeitenJoseph Resler - Vice President - First American Bank - LinkedInlarry-612445Noch keine Bewertungen

- United States v. Leonard J. Messina, 104 F.3d 354, 2d Cir. (1996)Dokument3 SeitenUnited States v. Leonard J. Messina, 104 F.3d 354, 2d Cir. (1996)Scribd Government Docs100% (1)

- Preliminary Offering Memorandum - Offering 2117Dokument290 SeitenPreliminary Offering Memorandum - Offering 2117ElDisenso.com100% (1)

- Avaya AuraDokument94 SeitenAvaya AuraVladimir DikosavljevicNoch keine Bewertungen

- English Department Phrasal Verbs LessonDokument6 SeitenEnglish Department Phrasal Verbs LessonCarolina AndreaNoch keine Bewertungen

- Module 3 Lea 1 PDFDokument18 SeitenModule 3 Lea 1 PDFjerick gasconNoch keine Bewertungen

- Community Participation and Institutional Experiences in School Education: School Development and Monitoring Committees in KarnatakaDokument28 SeitenCommunity Participation and Institutional Experiences in School Education: School Development and Monitoring Committees in KarnatakaOxfamNoch keine Bewertungen

- Nepal p4-6Dokument3 SeitenNepal p4-6Ayushonline442Noch keine Bewertungen

- Purisima Vs Phil TobaccoDokument4 SeitenPurisima Vs Phil TobaccoJohnde Martinez100% (1)

- Well Completion ReportDokument2 SeitenWell Completion ReportAsif KhanzadaNoch keine Bewertungen

- Cambridge IGCSE: 0450/22 Business StudiesDokument4 SeitenCambridge IGCSE: 0450/22 Business StudiesJuan GonzalezNoch keine Bewertungen

- NOUN VERB ADJECTIVE ADVERB PREPOSITION CONJUNCTION 2000KATADokument30 SeitenNOUN VERB ADJECTIVE ADVERB PREPOSITION CONJUNCTION 2000KATAazadkumarreddy100% (1)

- Electra™ 8000: Installation GuideDokument81 SeitenElectra™ 8000: Installation GuideengineerNoch keine Bewertungen

- GE122-HIST Readings in Philippine History: Rosalejos, Mary Ann Allyn BDokument4 SeitenGE122-HIST Readings in Philippine History: Rosalejos, Mary Ann Allyn BMary Ann RosalejosNoch keine Bewertungen