Beruflich Dokumente

Kultur Dokumente

Opening of A - TDR Account: State Bank of India

Hochgeladen von

SIDDHARTH NURSING RATHODOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Opening of A - TDR Account: State Bank of India

Hochgeladen von

SIDDHARTH NURSING RATHODCopyright:

Verfügbare Formate

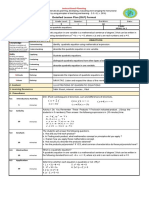

For in-house circulation only)

STATE BANK OF INDIA

STAFF TRAINING CENTRE

PANCHKULA

(An ISO 9001:2000 Training Institute)

CORE BANKING SOLUTION SERIES - 18

OPENING OF A ---TDR ACCOUNT

( PERSONAL - PUBLIC - GENERAL)

Pre Conditions---Customer’s CIF must exist before opening an account..

Navigation---

i. On main menu click on “Deposit/CC/OD Accounts &Services”.

ii. Click on “Create”

iii. Click on “New Deposit Account”.

iv. Screen” “SCR: 002000 pmt. CIF: “Create Account” will appear.

Type CIF Number of the Customer OR searches his/her CIF

number with the help of Search.

v. Transmit.

b. Screen “SCR:02000: Create Deposit Account” will be displayed. It is a

multi page screen having 5 Tabbed Screens. The screen on display is the

first screen “Core Options”. Other are Statement/Mail Options, Term A/C

Options and Credit Card Options & Miscellaneous respectively. These are

displayed on upper end of the screen.

c. In “Acct Segt Code” from drop down select the relevant code e.g. “706:

Per Dom Public”.

d. Product---Select from drop down “ 20:TDR”

e. Type ----Select from drop down the relevant type e.g. “11: General”

f. Customer Category—Select from drop down the appropriate category e.g.

“ 1: Public

g. Individual ”.

h. Location/Term---- select applicable period from the drop down11to

17.E.g. 15=1y-<2y, 16= 2y-<3y, 17=3y&above. Etc.

i. Currency--- It should be 1=INR, for domestic customers.

j. Interest. Options - Select from drop down as desired by the account holder

out of A: Cheque, B: Demand Draft, G: Transfer to BG L OR

k. T: Transfer. In case T: Transfer has been selected, then also furnish the

account number of the account holder in the next column.

l. DO NOT TRANSMIT

m. Now open the other tabbed screen by click on “ Term A/C Options”. For

all time deposit accounts, this screen will be used .It is a multi option

screen, so all the columns are not required be filled for every product. .

Although the fields are in white co lour, but are required to be filled in as

per the product as in the case of mandatory fields (Blue Fields).

n. Term Length = (A) 1 Term Days ; 2 Term Months ; 3 Term Years OR

(B) Date of Maturity. Fill in data only in A or B & not in both the

fields.

o. Term Basis--- Select “D: Days” only from drop down.

p. Term Value Deposited---Fill the amount of TDR to be issued .

q. Interest Frequency--- Select “1A:AnniversaryMonthly, 3A:Anniversary

Quarterly,

r. 6A:Anniversary Six monthly, YA: Anniversary Yearly OR M: Maturity”

from drop down.

s. Transmit, as no other fields are required to be filled in case a TDR

account.

t. A Queue number will be generated on the screen of the maker. On

successful checking, OK message along with account number will be

displayed on the screen of the checker. This number is to be noted on the

account opening form as well as on the voucher. A voucher of TDR is to

prepare for receipt of funds.

Q : An error messages ‘STOP – 201’ INVALID ACCT TYPE, INT CAT

OR CURRENCY’ and ‘STOP – 178’ INTEREST FREQ/CODE

INCONSISTENT WITH PRODUCT RULES’ reflected on the screen

instead of reflecting of the new account number?

Ans : The selected combination of Account Type and Sub Type will be validated against

the product parameters set up at CDC level. This means that the system will accept only

such combination of account type and sub type as available in the product parameter at

CDC. An invalid code entered will generated an error messages as above. Therefore

please select the right combination of Account Type and Sub Type only.

Q : What should be incorporated in the field ‘Term Basis’ in respect of TDR/STDR

Account?

Ans : Please always incorporate Term basis as ‘Day’ for the TDR/STDR Accounts as

‘Months’ are in respect of RD accounts only.

Q : What the term length should be mentioned for TDR/STDR to be issued for 30

months?

Ans : It should be mentioned as Terms Years:2 and Term months:6 instead of mentioning

Term month as 30.

Das könnte Ihnen auch gefallen

- 01.03-Deposit Accounts OpeningDokument38 Seiten01.03-Deposit Accounts Openingmevrick_guy0% (1)

- F 32 UserManualForFranking PhilatelyCustomerSettlementProcessDokument4 SeitenF 32 UserManualForFranking PhilatelyCustomerSettlementProcesssushant3333Noch keine Bewertungen

- Account Receivable CompleteDokument46 SeitenAccount Receivable Completesibaprasad1inNoch keine Bewertungen

- 01.10 RemittancesDokument40 Seiten01.10 Remittancesmevrick_guyNoch keine Bewertungen

- Practice Questions For MB7-701 Microsoft Dynamics NAV 2013 Core Setup and FinanceDokument28 SeitenPractice Questions For MB7-701 Microsoft Dynamics NAV 2013 Core Setup and FinanceNymeria8755550% (1)

- DunningDokument15 SeitenDunningsapfihanaNoch keine Bewertungen

- TFIN50 1 Chap06 Templ V0.1Dokument8 SeitenTFIN50 1 Chap06 Templ V0.1Michelle McdonaldNoch keine Bewertungen

- Cash JRNLDokument15 SeitenCash JRNLJayakumar NatarajanNoch keine Bewertungen

- SAP FI Interview Question and AnswerDokument39 SeitenSAP FI Interview Question and AnswershivanshuNoch keine Bewertungen

- Lock Box File2Dokument5 SeitenLock Box File2SATYANARAYANA MOTAMARRINoch keine Bewertungen

- 01.19 Safe CustodyDokument9 Seiten01.19 Safe Custodymevrick_guyNoch keine Bewertungen

- AR PENCOM Training ManualDokument31 SeitenAR PENCOM Training ManualOgwuche Oche SimonNoch keine Bewertungen

- PDF1Dokument17 SeitenPDF1praseedaNoch keine Bewertungen

- 01 21-RBIremittanceDokument11 Seiten01 21-RBIremittancemevrick_guyNoch keine Bewertungen

- Finance Training ManualDokument94 SeitenFinance Training ManualSanju Dani100% (1)

- Credit Card ConfigurationDokument5 SeitenCredit Card ConfigurationdaeyongNoch keine Bewertungen

- Tally TutorialDokument53 SeitenTally TutorialN Gopi KrishnaNoch keine Bewertungen

- Year Closing 2010 FSIBLDokument5 SeitenYear Closing 2010 FSIBLHasanul HoqueNoch keine Bewertungen

- User Manual GL Cash Journal FBCJDokument10 SeitenUser Manual GL Cash Journal FBCJGlowly bslNoch keine Bewertungen

- ATM ProjectDokument7 SeitenATM ProjectHAMAD MOIZ CHODHRYNoch keine Bewertungen

- Ctfin 5066Dokument5 SeitenCtfin 5066hfiehfhejfhneifNoch keine Bewertungen

- End User Training For Bank RecoDokument114 SeitenEnd User Training For Bank Recorohitmandhania100% (1)

- SAP Credit Card Configuration: Set Up Credit Control AreasDokument5 SeitenSAP Credit Card Configuration: Set Up Credit Control Areasdd_reddy5192Noch keine Bewertungen

- Job Card Written Off AccountsDokument13 SeitenJob Card Written Off AccountsAmala Kalathi100% (1)

- Sap-Fi/Co - 7 Cont : Accounts Receivable (A/R)Dokument20 SeitenSap-Fi/Co - 7 Cont : Accounts Receivable (A/R)krishna_1238Noch keine Bewertungen

- Sap-Fi/Co - 6 Cont : Accounts Receivable (A/R)Dokument127 SeitenSap-Fi/Co - 6 Cont : Accounts Receivable (A/R)krishna_1238Noch keine Bewertungen

- 01.20 Government BusinessDokument48 Seiten01.20 Government Businessmevrick_guyNoch keine Bewertungen

- 1ACC012 - Cargowise Learning Manual - Receivables InvoiceDokument6 Seiten1ACC012 - Cargowise Learning Manual - Receivables InvoiceAbdur Rahman CassimNoch keine Bewertungen

- ManualDokument70 SeitenManualNithin MohanNoch keine Bewertungen

- SAP Manejo de CréditoDokument15 SeitenSAP Manejo de CréditoGiancarlo Hercilla PinedaNoch keine Bewertungen

- FI AP - Master DataDokument16 SeitenFI AP - Master DataAhmed AshrafNoch keine Bewertungen

- 12 House+Bank+APPDokument36 Seiten12 House+Bank+APPArben LaçiNoch keine Bewertungen

- (M2) Jurnal - Accounts ReceivableDokument26 Seiten(M2) Jurnal - Accounts ReceivableMichael ChristensenNoch keine Bewertungen

- CRM OverviewDokument61 SeitenCRM OverviewRamesh NikamNoch keine Bewertungen

- Set Up Earnest Money DepositDokument24 SeitenSet Up Earnest Money DepositPasupuleti Veera100% (1)

- ERPDokument5 SeitenERPSalma Tanisya KamilaNoch keine Bewertungen

- CBS Navigation MenuDokument34 SeitenCBS Navigation MenuShailaja Thakur67% (6)

- Atm Software: No Plagiarism Strict Disciplinary Action Will Be Taken If Involved in PlagiarismDokument10 SeitenAtm Software: No Plagiarism Strict Disciplinary Action Will Be Taken If Involved in PlagiarismMaqsoodNoch keine Bewertungen

- Bad Debt ConfigrationDokument4 SeitenBad Debt Configrationsudershan9Noch keine Bewertungen

- Exam 1z0-1056Dokument21 SeitenExam 1z0-1056JanardhanNoch keine Bewertungen

- Advanced Accounting in Tally ERP 9Dokument30 SeitenAdvanced Accounting in Tally ERP 9Nam NamNoch keine Bewertungen

- Advanced Accounting in Tally ERP 9Dokument30 SeitenAdvanced Accounting in Tally ERP 9Nam NamNoch keine Bewertungen

- SAP - Order To Cash - AR StepsDokument34 SeitenSAP - Order To Cash - AR Stepsmurthypsn3886Noch keine Bewertungen

- Assignment # 1: ATM SoftwareDokument9 SeitenAssignment # 1: ATM SoftwareAshish ShindeNoch keine Bewertungen

- SAP FICO Master Data NotesDokument34 SeitenSAP FICO Master Data NotesSoru SaxenaNoch keine Bewertungen

- JAWABAN UAS FINANCING AC010 (Elang SAP-AC10 Dua Jawatengah Bandung)Dokument16 SeitenJAWABAN UAS FINANCING AC010 (Elang SAP-AC10 Dua Jawatengah Bandung)REG.A/0117101094/SITI SOBARIAH63% (8)

- Dealer DepositsDokument7 SeitenDealer Depositsmehar mNoch keine Bewertungen

- Inter Company Billing Automatic Posting To Vendor Account SAP EDIDokument17 SeitenInter Company Billing Automatic Posting To Vendor Account SAP EDIRAGHU BALAKRISHNANNoch keine Bewertungen

- Inter-Company Billing - Automatic Posting To Vendor Account (SAP-EDI)Dokument17 SeitenInter-Company Billing - Automatic Posting To Vendor Account (SAP-EDI)pavan.mstNoch keine Bewertungen

- F-03 Clear GL Account Open ItemsDokument8 SeitenF-03 Clear GL Account Open ItemsP Rajendra0% (1)

- Fi AP Config Guide Apps VBDokument51 SeitenFi AP Config Guide Apps VBwindsor2004Noch keine Bewertungen

- Chapter 2Dokument14 SeitenChapter 2kedirNoch keine Bewertungen

- SAP AR ConfigDokument29 SeitenSAP AR ConfigAvinash Malladhi100% (1)

- TPH Day3Dokument114 SeitenTPH Day3adyani_0997100% (4)

- 01.13 ClearingDokument38 Seiten01.13 Clearingmevrick_guy0% (1)

- Online Exam DiptiDokument9 SeitenOnline Exam Diptimahin rayhanNoch keine Bewertungen

- Term DepositsDokument12 SeitenTerm DepositsRaj Bahadur SinghNoch keine Bewertungen

- Test Papers For FICODokument4 SeitenTest Papers For FICOManohar G ShankarNoch keine Bewertungen

- Latihan Ac010 FicoDokument3 SeitenLatihan Ac010 Ficonanasari85Noch keine Bewertungen

- 2.motor Starters - Enclosed VersionsDokument106 Seiten2.motor Starters - Enclosed VersionsRAmesh SrinivasanNoch keine Bewertungen

- Capacitors and Dielectrics: Major PointsDokument18 SeitenCapacitors and Dielectrics: Major Points陳慶銘Noch keine Bewertungen

- Yagi Antenna Desig 00 Un SeDokument232 SeitenYagi Antenna Desig 00 Un Sefrankmhowell100% (1)

- General Systems Theory A Mathematical ApproachDokument385 SeitenGeneral Systems Theory A Mathematical Approachselotejp7100% (4)

- Solutions Manual 4th EditionDokument57 SeitenSolutions Manual 4th Editionabdul5721100% (6)

- GCT 2015-16 - Final Exam - 2015-12-18 - SolutionDokument9 SeitenGCT 2015-16 - Final Exam - 2015-12-18 - SolutionpadrefloNoch keine Bewertungen

- AR-725 (E-V2-M) : Access Control SystemDokument8 SeitenAR-725 (E-V2-M) : Access Control SystemIrvan SeptianNoch keine Bewertungen

- Downloaded From Manuals Search EngineDokument13 SeitenDownloaded From Manuals Search EngineSandro CoelhoNoch keine Bewertungen

- Skewed Bridges: Effect of SkewDokument2 SeitenSkewed Bridges: Effect of SkewArun K RajNoch keine Bewertungen

- D82167GC10-Practices For Lesson 8Dokument36 SeitenD82167GC10-Practices For Lesson 8ChristianQuirozPlefkeNoch keine Bewertungen

- PlaxisDokument6 SeitenPlaxisRehan HakroNoch keine Bewertungen

- Detailed Lesson Plan (DLP) Format: Nowledge ObjectivesDokument2 SeitenDetailed Lesson Plan (DLP) Format: Nowledge ObjectivesErwin B. NavarroNoch keine Bewertungen

- Exambank HigherDokument62 SeitenExambank HigherJust WadeNoch keine Bewertungen

- Mech CVTDokument15 SeitenMech CVTsachin guptaNoch keine Bewertungen

- IQan Trouble Shooting-RockDokument20 SeitenIQan Trouble Shooting-RockВячеслав РубцовNoch keine Bewertungen

- Tundish RefractoryDokument15 SeitenTundish RefractoryMashiur RahmanNoch keine Bewertungen

- ISO 3384 2005-Stress RelaxationDokument18 SeitenISO 3384 2005-Stress RelaxationshashaNoch keine Bewertungen

- Ch23 Review ProblemsDokument25 SeitenCh23 Review ProblemsحمدةالنهديةNoch keine Bewertungen

- First Year 1A Model Papers and Board Model Guess PapersDokument44 SeitenFirst Year 1A Model Papers and Board Model Guess PapersSalmanAnjans0% (1)

- The Logic of Faith Vol. 1Dokument39 SeitenThe Logic of Faith Vol. 1Domenic Marbaniang100% (2)

- Chapter 08Dokument30 SeitenChapter 08MaxNoch keine Bewertungen

- RC2 22873Dokument2 SeitenRC2 22873Henok AlemayehuNoch keine Bewertungen

- R3.105 Final Report UpdatedDokument77 SeitenR3.105 Final Report UpdatedSamNoch keine Bewertungen

- Transformer Health IndicesDokument12 SeitenTransformer Health IndicesIngenieria APANoch keine Bewertungen

- Jadual Seminar 1 0910Dokument24 SeitenJadual Seminar 1 0910ScalperNoch keine Bewertungen

- Class 8 Aakash JEE MAINDokument9 SeitenClass 8 Aakash JEE MAINrohitNoch keine Bewertungen

- MD Boiler Asme WTDokument159 SeitenMD Boiler Asme WTdodikNoch keine Bewertungen

- Principles of Communication Systems LAB: Lab Manual (EE-230-F) Iv Sem Electrical and Electronics EngineeringDokument87 SeitenPrinciples of Communication Systems LAB: Lab Manual (EE-230-F) Iv Sem Electrical and Electronics Engineeringsachin malikNoch keine Bewertungen

- Beam Number: Project Name: 17-Mar-20 Engr. Mark Christian D. Esguerra Passed Engineer: DateDokument1 SeiteBeam Number: Project Name: 17-Mar-20 Engr. Mark Christian D. Esguerra Passed Engineer: DateMark Christian EsguerraNoch keine Bewertungen

- ACI 305 Hot Weather Concrete PDFDokument9 SeitenACI 305 Hot Weather Concrete PDFCristhian MartinezNoch keine Bewertungen

- Learn Power BI: A beginner's guide to developing interactive business intelligence solutions using Microsoft Power BIVon EverandLearn Power BI: A beginner's guide to developing interactive business intelligence solutions using Microsoft Power BIBewertung: 5 von 5 Sternen5/5 (1)

- Linux For Beginners: The Comprehensive Guide To Learning Linux Operating System And Mastering Linux Command Line Like A ProVon EverandLinux For Beginners: The Comprehensive Guide To Learning Linux Operating System And Mastering Linux Command Line Like A ProNoch keine Bewertungen

- Data Visualization: A Practical IntroductionVon EverandData Visualization: A Practical IntroductionBewertung: 5 von 5 Sternen5/5 (2)

- Excel Essentials: A Step-by-Step Guide with Pictures for Absolute Beginners to Master the Basics and Start Using Excel with ConfidenceVon EverandExcel Essentials: A Step-by-Step Guide with Pictures for Absolute Beginners to Master the Basics and Start Using Excel with ConfidenceNoch keine Bewertungen

- Skulls & Anatomy: Copyright Free Vintage Illustrations for Artists & DesignersVon EverandSkulls & Anatomy: Copyright Free Vintage Illustrations for Artists & DesignersNoch keine Bewertungen

- The Designer’s Guide to Figma: Master Prototyping, Collaboration, Handoff, and WorkflowVon EverandThe Designer’s Guide to Figma: Master Prototyping, Collaboration, Handoff, and WorkflowNoch keine Bewertungen

- NFT per Creators: La guida pratica per creare, investire e vendere token non fungibili ed arte digitale nella blockchain: Guide sul metaverso e l'arte digitale con le criptovaluteVon EverandNFT per Creators: La guida pratica per creare, investire e vendere token non fungibili ed arte digitale nella blockchain: Guide sul metaverso e l'arte digitale con le criptovaluteBewertung: 5 von 5 Sternen5/5 (15)

- Tableau Your Data!: Fast and Easy Visual Analysis with Tableau SoftwareVon EverandTableau Your Data!: Fast and Easy Visual Analysis with Tableau SoftwareBewertung: 4.5 von 5 Sternen4.5/5 (4)

- 2022 Adobe® Premiere Pro Guide For Filmmakers and YouTubersVon Everand2022 Adobe® Premiere Pro Guide For Filmmakers and YouTubersBewertung: 5 von 5 Sternen5/5 (1)

- Animation for Beginners: Getting Started with Animation FilmmakingVon EverandAnimation for Beginners: Getting Started with Animation FilmmakingBewertung: 3 von 5 Sternen3/5 (1)

- Architectural Design with SketchUp: 3D Modeling, Extensions, BIM, Rendering, Making, and ScriptingVon EverandArchitectural Design with SketchUp: 3D Modeling, Extensions, BIM, Rendering, Making, and ScriptingNoch keine Bewertungen

- Blender 3D for Jobseekers: Learn professional 3D creation skills using Blender 3D (English Edition)Von EverandBlender 3D for Jobseekers: Learn professional 3D creation skills using Blender 3D (English Edition)Noch keine Bewertungen

- iPhone X Hacks, Tips and Tricks: Discover 101 Awesome Tips and Tricks for iPhone XS, XS Max and iPhone XVon EverandiPhone X Hacks, Tips and Tricks: Discover 101 Awesome Tips and Tricks for iPhone XS, XS Max and iPhone XBewertung: 3 von 5 Sternen3/5 (2)

- How to Create Cpn Numbers the Right way: A Step by Step Guide to Creating cpn Numbers LegallyVon EverandHow to Create Cpn Numbers the Right way: A Step by Step Guide to Creating cpn Numbers LegallyBewertung: 4 von 5 Sternen4/5 (27)

- Excel : The Ultimate Comprehensive Step-By-Step Guide to the Basics of Excel Programming: 1Von EverandExcel : The Ultimate Comprehensive Step-By-Step Guide to the Basics of Excel Programming: 1Bewertung: 4.5 von 5 Sternen4.5/5 (3)

- AI Monetization of your Faceless YouTube Channel: Ai Side Hustle NicheVon EverandAI Monetization of your Faceless YouTube Channel: Ai Side Hustle NicheNoch keine Bewertungen

- Autodesk 3ds Max 2020: A Detailed Guide to Modeling, Texturing, Lighting, and RenderingVon EverandAutodesk 3ds Max 2020: A Detailed Guide to Modeling, Texturing, Lighting, and RenderingBewertung: 5 von 5 Sternen5/5 (4)

- Photoshop: A Step by Step Ultimate Beginners’ Guide to Mastering Adobe Photoshop in 1 WeekVon EverandPhotoshop: A Step by Step Ultimate Beginners’ Guide to Mastering Adobe Photoshop in 1 WeekNoch keine Bewertungen

- Beginning AutoCAD® 2022 Exercise Workbook: For Windows®Von EverandBeginning AutoCAD® 2022 Exercise Workbook: For Windows®Noch keine Bewertungen

- YouTube Takeover - How You Can Grow Your YouTube Channel Into A Regular IncomeVon EverandYouTube Takeover - How You Can Grow Your YouTube Channel Into A Regular IncomeBewertung: 4 von 5 Sternen4/5 (2)