Beruflich Dokumente

Kultur Dokumente

Key Points For Partnership

Hochgeladen von

Ulfat Yousafzai0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

96 Ansichten2 SeitenPartnerships are the most common form of business arrangement in Ireland, apart from companies. But the law applicable to partnerships remains firmly in the last century. A reform of the law is now required in view of the explosion in the number of partnerships and their important role in Irish business life.

Originalbeschreibung:

Originaltitel

Key Points for Partnership

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenPartnerships are the most common form of business arrangement in Ireland, apart from companies. But the law applicable to partnerships remains firmly in the last century. A reform of the law is now required in view of the explosion in the number of partnerships and their important role in Irish business life.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

96 Ansichten2 SeitenKey Points For Partnership

Hochgeladen von

Ulfat YousafzaiPartnerships are the most common form of business arrangement in Ireland, apart from companies. But the law applicable to partnerships remains firmly in the last century. A reform of the law is now required in view of the explosion in the number of partnerships and their important role in Irish business life.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Key points

Part one:

Partnership: A partnership is a strategic alliance or relationship between

two or more people.

Purpose : Partnership is the relation which subsists between persons

carrying on a business in common with a view of profit.

Part Two:

Partnership is the relation which subsists between persons carrying on

a business in common with a view of profit.

But the relation between members of any company or association which

is--

(a) registered as a company under the Companies Act 1862, or any

other Act of Parliament for the time being in force and relating to the

registration of joint stock companies; or

(b) Formed or incorporated by or in pursuance of any other Act of

Parliament or letters patent, or Royal Charter; or

(c) A company engaged in working mines within and subject to the

jurisdiction of the Stannaries;

is not a partnership within the meaning of this Act.

Law sourounding Partnership

Partnerships are the most common form of business arrangement in

Ireland, apart from companies. Yet the law applicable to partnerships

remains firmly in the last century. A reform of the law is now required

in view of the explosion in the number of partnerships and their

important role in Irish business life.

Examples of Partnership

The most common category of partnership is the professional

partnership. Accountants, solicitors, doctors, vets, dentists and other

professionals are not allowed to form companies, as they must be

personally liable to their clients or patients. These types of

partnerships form a large part of the multi-billion pound professional

services industry in Ireland.

The third category of partnership is the investment partnership and the

number of these has exploded in recent years. In film finance schemes,

carpark investments and holiday home schemes, partnerships are

often formed because of their tax advantages over companies.

Another reason partnerships are chosen for such investments is

because, unlike most companies, they do not have to file accounts.

Partnerships are also popular in venture capital investments, since

capital can be invested in, and withdrawn from, a special type of

partnership (known as a limited partnership) without formality, unlike

the situation in a limited liability company.

Advantageous

These limited partnerships have the added advantage of offering

limited liability to some of the partners in the much the same way as

shareholders in a company have limited liability.

For all of these reasons, partnerships have begun to attract more

attention in recent years, yet the law relating to partnerships

remains very much rooted in the last century.

Disadvantageous

Another problem with these implied terms is that they do not entitle

the partners to expel their co-partner, no matter how negligent or

fraudulent he might have been.

Their only option in such a situation is to apply to court for the firm

to be wound up. Instead, the courts should be given the power to

order the buy-out of a partner's share, as happens in company law.

Michael Twomey is a solicitor specialising in partnership law. He is

the author of Partnership Law (Butterworths), a guide to the law of

partnership for accountants, tax consultants and lawyers

Das könnte Ihnen auch gefallen

- European Company Law Week OneDokument22 SeitenEuropean Company Law Week OneAntonio BancicNoch keine Bewertungen

- Introduction to Partnership AccountingDokument10 SeitenIntroduction to Partnership AccountingjeramieNoch keine Bewertungen

- LLP Final Project by Jashan WarraichDokument28 SeitenLLP Final Project by Jashan WarraichJashanNoch keine Bewertungen

- LLPDokument24 SeitenLLPPrashant MauryaNoch keine Bewertungen

- Sole ProprietorshipsDokument2 SeitenSole ProprietorshipsLilkee John100% (2)

- Choosing A Form of Ownership: Lecture: Sana Munir UETDokument39 SeitenChoosing A Form of Ownership: Lecture: Sana Munir UETMuhammad SameerNoch keine Bewertungen

- Partnership Law - English Law NotesDokument24 SeitenPartnership Law - English Law NotesUmair_Nazeer_5430100% (2)

- Demo LectureDokument3 SeitenDemo LectureOsamah BakhshNoch keine Bewertungen

- Entrepreneurship, Sole Proprietorships, and Partnerships: What Type of Business Should I Choose?Dokument10 SeitenEntrepreneurship, Sole Proprietorships, and Partnerships: What Type of Business Should I Choose?Loushayne MolatoNoch keine Bewertungen

- 12.1 Partnership Form of OrganizationDokument8 Seiten12.1 Partnership Form of OrganizationcanteroalexNoch keine Bewertungen

- Nwy Acct II ch-5@2015Dokument19 SeitenNwy Acct II ch-5@2015newaybeyene5Noch keine Bewertungen

- Seminar Report of Partnership ActDokument23 SeitenSeminar Report of Partnership ActDeepika JainNoch keine Bewertungen

- The Law On PartnershipDokument4 SeitenThe Law On Partnership123445Noch keine Bewertungen

- Module in Financial Accounting and Reporting IIDokument149 SeitenModule in Financial Accounting and Reporting IIitsdaloveshot naNANAnanaNoch keine Bewertungen

- Partnership LawDokument8 SeitenPartnership LawFranz LynneNoch keine Bewertungen

- LAW ON PARTNERSHIP AND CORPORATIONDokument4 SeitenLAW ON PARTNERSHIP AND CORPORATIONMyralie SorianoNoch keine Bewertungen

- Review Questions Chap 1 DraftDokument3 SeitenReview Questions Chap 1 DraftShanley Vanna EscalonaNoch keine Bewertungen

- PartnershipDokument44 SeitenPartnershipnormah720100% (1)

- Contracts 2Dokument27 SeitenContracts 2ANJALI KAPOORNoch keine Bewertungen

- Chapter 4Dokument12 SeitenChapter 4Chalachew EyobNoch keine Bewertungen

- Introduction To PartnershipDokument22 SeitenIntroduction To Partnershipgab mNoch keine Bewertungen

- CharlieDokument6 SeitenCharlieLushimba ChileyaNoch keine Bewertungen

- Material Didáctico Unidades 7 A 9Dokument122 SeitenMaterial Didáctico Unidades 7 A 9Romina Soledad KondratiukNoch keine Bewertungen

- Chapter 2 - Forms of Business Ownership Part-IIDokument18 SeitenChapter 2 - Forms of Business Ownership Part-IIQwRasel0% (1)

- Limited PartnershipDokument5 SeitenLimited PartnershipJelena Todorovic100% (1)

- Module Acc102 2nd Sem Ay2021-2022Dokument121 SeitenModule Acc102 2nd Sem Ay2021-2022Isang GuroNoch keine Bewertungen

- Loa Revision QuestionsDokument12 SeitenLoa Revision QuestionsENoch keine Bewertungen

- Forms of Business OrganizationDokument3 SeitenForms of Business OrganizationKaycee NavarroNoch keine Bewertungen

- Class Notes Business Entities, The ChoicesDokument10 SeitenClass Notes Business Entities, The ChoicesLydia.m. Asaba100% (1)

- Content/Discussion Partnership Defined: Attributes of A PartnershipDokument30 SeitenContent/Discussion Partnership Defined: Attributes of A PartnershipAnneShannenBambaDabuNoch keine Bewertungen

- Limited Liability Partnership - A New Business Model - 2005Dokument6 SeitenLimited Liability Partnership - A New Business Model - 2005Aurobindo SaxenaNoch keine Bewertungen

- Entrepreneur Business LawDokument33 SeitenEntrepreneur Business LawKanwal SultanNoch keine Bewertungen

- Free Ebook On Limited Liability Partnership - 2005Dokument0 SeitenFree Ebook On Limited Liability Partnership - 2005Aurobindo SaxenaNoch keine Bewertungen

- Partnership Organization GuideDokument42 SeitenPartnership Organization Guidemubarek oumerNoch keine Bewertungen

- Module For FarDokument114 SeitenModule For FarDannis Anne RegajalNoch keine Bewertungen

- Partnership PresentationDokument128 SeitenPartnership Presentationparv dalalNoch keine Bewertungen

- Comparison of Partnership and Corporation Formation and StructureDokument2 SeitenComparison of Partnership and Corporation Formation and StructureHannah OrosNoch keine Bewertungen

- Prepares Financial Statements of a PartnershipDokument21 SeitenPrepares Financial Statements of a PartnershipMihara AmaratungaNoch keine Bewertungen

- Partnership KarwanDokument7 SeitenPartnership KarwanReving DuskiNoch keine Bewertungen

- Enterpeneurship BIT GS180289BSIT Mercy Nungari Mukuru AssignmentDokument7 SeitenEnterpeneurship BIT GS180289BSIT Mercy Nungari Mukuru AssignmentMERCY-JEDIDIAH-BELOVED OF JEHOVAH Nungari mukuruNoch keine Bewertungen

- Module 1 Partnerships Basic Considerations and OrganizationsDokument48 SeitenModule 1 Partnerships Basic Considerations and Organizationscha11Noch keine Bewertungen

- Public Service - No Less A Public Service Because It May Incidentally Be A Means of LivelihoodDokument7 SeitenPublic Service - No Less A Public Service Because It May Incidentally Be A Means of LivelihoodMarie Ann JoNoch keine Bewertungen

- Limited Liability PartnershipDokument10 SeitenLimited Liability PartnershipPalak GulabaniNoch keine Bewertungen

- Dda 2 12Dokument7 SeitenDda 2 12genius_blueNoch keine Bewertungen

- Legal Aspects of BusinessDokument11 SeitenLegal Aspects of BusinessMostafa KamalNoch keine Bewertungen

- Partnership LawDokument13 SeitenPartnership LawSaslina KamaruddinNoch keine Bewertungen

- Project Report On Partnership FirmDokument3 SeitenProject Report On Partnership FirmSiddhant Sah0% (1)

- Limited Liability PartnershipDokument18 SeitenLimited Liability PartnershipRachit MunjalNoch keine Bewertungen

- Beactg 03 Revised Module 3 Nature of Partnership & AcctgDokument25 SeitenBeactg 03 Revised Module 3 Nature of Partnership & AcctgChristiandale Delos ReyesNoch keine Bewertungen

- Module 1 Partnerships Basic Considerations and OrganizationsDokument33 SeitenModule 1 Partnerships Basic Considerations and OrganizationsKaren Portia50% (2)

- PartnershipDokument16 SeitenPartnershipJasmandeep brar100% (1)

- Partnership Guide: Rights, Duties and TypesDokument128 SeitenPartnership Guide: Rights, Duties and TypesKarl Pantig100% (1)

- Notes PATDokument4 SeitenNotes PATᜉᜂᜎᜊᜒᜀᜃ ᜎᜓᜌᜓᜎNoch keine Bewertungen

- Advantages and disadvantages of running a UK business as a limited companyDokument5 SeitenAdvantages and disadvantages of running a UK business as a limited companyAleh MosqueraNoch keine Bewertungen

- Ziale Lecture Notes On PartnershipDokument13 SeitenZiale Lecture Notes On PartnershipLeonard TemboNoch keine Bewertungen

- How Might The Business Be Structured?Dokument6 SeitenHow Might The Business Be Structured?Raima Ibnat ChoudhuryNoch keine Bewertungen

- PartnershipDokument2 SeitenPartnershipMarc Cj AcloNoch keine Bewertungen

- What Are The Basic Types of Business OrganizationsDokument3 SeitenWhat Are The Basic Types of Business OrganizationsKyla Joy T. SanchezNoch keine Bewertungen

- Nayve, Kimberly IDokument113 SeitenNayve, Kimberly IKim Nayve50% (10)

- Ielts WritingDokument45 SeitenIelts Writingahmed_uet_lahoreNoch keine Bewertungen

- 5000 TOEFL Words PDFDokument36 Seiten5000 TOEFL Words PDFPrudhveeraj Chegu100% (2)

- What Is The IeltsDokument72 SeitenWhat Is The IeltsUlfat YousafzaiNoch keine Bewertungen

- First HR SET UPDokument1 SeiteFirst HR SET UPUlfat YousafzaiNoch keine Bewertungen

- 6 Ways To Improve Your Eye Contact SkillsDokument2 Seiten6 Ways To Improve Your Eye Contact SkillsUlfat YousafzaiNoch keine Bewertungen

- 6 Ways To Improve Your Eye Contact SkillsDokument2 Seiten6 Ways To Improve Your Eye Contact SkillsUlfat YousafzaiNoch keine Bewertungen

- AGI3553 Plant ProtectionDokument241 SeitenAGI3553 Plant ProtectionDK White LionNoch keine Bewertungen

- Receipt Voucher: Tvs Electronics LimitedDokument1 SeiteReceipt Voucher: Tvs Electronics LimitedKrishna SrivathsaNoch keine Bewertungen

- Minnesota Property Tax Refund: Forms and InstructionsDokument28 SeitenMinnesota Property Tax Refund: Forms and InstructionsJeffery MeyerNoch keine Bewertungen

- Voltas Case StudyDokument8 SeitenVoltas Case StudyAlok Mittal100% (1)

- New SSP SpreadsheetDokument20 SeitenNew SSP SpreadsheetAdhitya Dian33% (3)

- NSE ProjectDokument24 SeitenNSE ProjectRonnie KapoorNoch keine Bewertungen

- Contem ReviewerDokument9 SeitenContem ReviewerKenNoch keine Bewertungen

- International Finance - TCS Case StudyDokument22 SeitenInternational Finance - TCS Case StudyPrateek SinglaNoch keine Bewertungen

- Jason HickelDokument1 SeiteJason HickelAlaiza Bea RuideraNoch keine Bewertungen

- FPO Application GuideDokument33 SeitenFPO Application GuideIsrael Miranda Zamarca100% (1)

- Building Economics Complete NotesDokument20 SeitenBuilding Economics Complete NotesManish MishraNoch keine Bewertungen

- Beli TGL 21 Sep 2021Dokument1 SeiteBeli TGL 21 Sep 2021Putri Marissa DilaNoch keine Bewertungen

- Monitoring Local Plans of SK Form PNR SiteDokument2 SeitenMonitoring Local Plans of SK Form PNR SiteLYDO San CarlosNoch keine Bewertungen

- DBBL (Rasel Vai)Dokument1 SeiteDBBL (Rasel Vai)anik1116jNoch keine Bewertungen

- Death by PowerpointDokument12 SeitenDeath by Powerpointapi-251968900Noch keine Bewertungen

- Navi Mumbai MidcDokument132 SeitenNavi Mumbai MidcKedar Parab67% (15)

- PROJECT PROFILE ON SPINNING MILL (14400 SPINDLESDokument6 SeitenPROJECT PROFILE ON SPINNING MILL (14400 SPINDLESAnand Arumugam0% (1)

- Terms of TradeDokument3 SeitenTerms of TradePiyushJainNoch keine Bewertungen

- Senior Development and Communications Officer Job DescriptionDokument3 SeitenSenior Development and Communications Officer Job Descriptionapi-17006249Noch keine Bewertungen

- CH North&south PDFDokument24 SeitenCH North&south PDFNelson Vinod KumarNoch keine Bewertungen

- Partnership Formation Answer KeyDokument8 SeitenPartnership Formation Answer KeyNichole Joy XielSera TanNoch keine Bewertungen

- Description of Empirical Data Sets: 1. The ExamplesDokument3 SeitenDescription of Empirical Data Sets: 1. The ExamplesMANOJ KUMARNoch keine Bewertungen

- BIM Report 2019Dokument31 SeitenBIM Report 2019ziddar100% (1)

- Chapter 7 Variable CostingDokument47 SeitenChapter 7 Variable CostingEden Faith AggalaoNoch keine Bewertungen

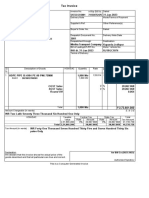

- Tax InvoiceDokument1 SeiteTax Invoicepiyush1809Noch keine Bewertungen

- Practical IFRSDokument282 SeitenPractical IFRSahmadqasqas100% (1)

- MCQs On Transfer of Property ActDokument46 SeitenMCQs On Transfer of Property ActRam Iyer75% (4)

- Addmaths FolioDokument15 SeitenAddmaths Foliomuhd_mutazaNoch keine Bewertungen

- Macro and Micro AnalysisDokument20 SeitenMacro and Micro AnalysisRiya Pandey100% (1)

- Environment PollutionDokument6 SeitenEnvironment PollutionNikko Andrey GambalanNoch keine Bewertungen