Beruflich Dokumente

Kultur Dokumente

Innovation

Hochgeladen von

Tony Peterz Kurewa0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten2 Seitentutorial

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldentutorial

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

15 Ansichten2 SeitenInnovation

Hochgeladen von

Tony Peterz Kurewatutorial

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Two schools of thought exist on the drivers of innovation: the

market-based view and resource-based view of innovation. The

market-based view of innovation is founded on the premise that

innovative organisations attempt to exploit changing market

conditions. Market conditions are said to provide the initial

conditions that govern the direction and quantity of an organisations

innovative activities. Tidd et al (2001) assert that innovative

organisations are those that scan their environment to absorb and

process information regarding potential innovation. The ability of the

organisation to align its strategies with identified enablers and

constraints in their environment are found to highly influence its

competitive advantage (Barrett et al. 2001).

The resource-based view of innovation, on the other hand, argues

that the market-based view of innovation offers a weak foundation

for innovative strategies, particularly in dynamic and volatile

markets. Instead, it is believed that the organisations own

resources, such as its assets, capabilities, routines and knowledge

base, may offer a more concrete basis for innovative strategies

(Davies and Brady, 2000). Innovative organisations are those that

utilise their internal resources to develop unique configurations of

resources, thereby building the foundations for successful

innovation (Davies and Brady, 2000).

Indeed, general innovation theory stresses the importance of a

firm’s technological capabilities for its innovative capacity (Baumol,

2002; Rosenberg, 1974). A firm’s technological capabilities are

ultimately defined by its physical and knowledge capital, with

investments in R&D and education of employees as necessary

ingredients to increase and intensify such a capital (Baumol, 2002).

Baumol (2002) emphasise that the higher the technological

capabilities of a firm, the more likely it will develop further innovation

in the future. Baumol (2002) also argues that “innovation breeds

innovation” (p. 284), pointing to the path dependency characteristic

of innovation.

Innovating firms are incentivised to pursue novel products and

processes provided they are able to reap first-mover benefits

(Porter and van der Linde, 1995b). However, the ability of the

innovator to capture the returns of his innovation is often

problematic. Jaffe et al. (2002) assert that“… the creator of an asset

will typically fail to appropriate all or perhaps most of the social

returns it generates”. Therefore, the ability of the firm to minimize

these so-called spill-over effect are particularly important, and

dependent on technological characteristics of the innovation such

as technical complexity, patentability, and lead time as well as the

market structure (Rödiger-Schluga, 2005). Monopolistic market

structures dominated by large firms are the least affected by

appropriation problems due to the limited risk of imitation and the

benefits gained from scale economies related to innovation

(Smolny, 2003).

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Transcript Request FormDokument2 SeitenTranscript Request FormTony Peterz KurewaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hospital Grades June 2019 PDFDokument8 SeitenHospital Grades June 2019 PDFTony Peterz Kurewa67% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- MSCDA 1.1 January 2020 WeekendDokument4 SeitenMSCDA 1.1 January 2020 WeekendTony Peterz KurewaNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- 123 AnalysisDokument2 Seiten123 AnalysisTony Peterz KurewaNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Travel CoverDokument2 SeitenTravel CoverTonderai KurewaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Opticians GweruDokument2 SeitenOpticians GweruTony Peterz KurewaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Report UpdateDokument2 SeitenReport UpdateTony Peterz KurewaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Innovations and Business Development: Task /campaign Update Next Action Timeline /due DateDokument1 SeiteInnovations and Business Development: Task /campaign Update Next Action Timeline /due DateTony Peterz KurewaNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- PROPOSALDokument3 SeitenPROPOSALlulai1895Noch keine Bewertungen

- BudgetDokument2 SeitenBudgetTony Peterz KurewaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Purchase Process Flow DiagramDokument1 SeitePurchase Process Flow DiagramTony Peterz KurewaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- YuiDokument1 SeiteYuiTony Peterz KurewaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Childline OldDokument7 SeitenChildline OldTony Peterz KurewaNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Asssigment LeadershipDokument7 SeitenAsssigment LeadershipTony Peterz KurewaNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- YuiDokument4 SeitenYuiTony Peterz KurewaNoch keine Bewertungen

- YuiDokument4 SeitenYuiTony Peterz KurewaNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- File 1Dokument53 SeitenFile 1Tony Peterz KurewaNoch keine Bewertungen

- FordDokument1 SeiteFordTony Peterz KurewaNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- BonvieDokument1 SeiteBonvieTony Peterz KurewaNoch keine Bewertungen

- Governance Reporting: Management Should Not Be Left Guessing The Information Requirements of The BoardDokument53 SeitenGovernance Reporting: Management Should Not Be Left Guessing The Information Requirements of The BoardSathesh AustinNoch keine Bewertungen

- iGO Product 1 Pager: Issues Identified Proposed ActionDokument1 SeiteiGO Product 1 Pager: Issues Identified Proposed ActionTony Peterz KurewaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- File 1Dokument55 SeitenFile 1Tony Peterz KurewaNoch keine Bewertungen

- Over 65 Years Medical Aid Comparison: Medical Aid Cimas Psmas Generation Health Liberty FMLDokument1 SeiteOver 65 Years Medical Aid Comparison: Medical Aid Cimas Psmas Generation Health Liberty FMLTony Peterz KurewaNoch keine Bewertungen

- Classes Document 1346855496Dokument18 SeitenClasses Document 1346855496Tony Peterz KurewaNoch keine Bewertungen

- Week 55 Stock MarketsDokument55 SeitenWeek 55 Stock MarketsTony Peterz KurewaNoch keine Bewertungen

- 12 Month Sales Forecast PDFDokument1 Seite12 Month Sales Forecast PDFapi-3697282Noch keine Bewertungen

- 12 Month Sales Forecast PDFDokument1 Seite12 Month Sales Forecast PDFapi-3697282Noch keine Bewertungen

- Rescued Document 1Dokument4 SeitenRescued Document 1Tony Peterz KurewaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Competitive Analysis Template 08Dokument34 SeitenCompetitive Analysis Template 08Tony Peterz KurewaNoch keine Bewertungen

- Learning Objectives - VAT (FINAL)Dokument2 SeitenLearning Objectives - VAT (FINAL)Pranay GovenderNoch keine Bewertungen

- SaurabhDokument16 SeitenSaurabhAkshay Singh100% (1)

- Lukoil A-Vertically Integrated Oil CompanyDokument20 SeitenLukoil A-Vertically Integrated Oil CompanyhuccennNoch keine Bewertungen

- Look Beyond ERP - Introducing The DOPDokument10 SeitenLook Beyond ERP - Introducing The DOPolsontd100% (1)

- Accounting Cycle StepsDokument4 SeitenAccounting Cycle StepsAntiiasmawatiiNoch keine Bewertungen

- SAI Employee Retention For HandoutsDokument16 SeitenSAI Employee Retention For Handoutsshindy100% (1)

- Chapter 1 - ThesisDokument8 SeitenChapter 1 - ThesisRed SecretarioNoch keine Bewertungen

- Business EthicsDokument11 SeitenBusiness EthicsMD Saiful IslamNoch keine Bewertungen

- Session 31Dokument25 SeitenSession 31Yashwanth Reddy AnumulaNoch keine Bewertungen

- Group 5 Mittal CaseDokument9 SeitenGroup 5 Mittal CaseaaidanrathiNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Study - On GorfersDokument4 SeitenStudy - On GorfersrashmiNoch keine Bewertungen

- Acca F5Dokument133 SeitenAcca F5Andin Lee67% (3)

- Diamond Eagle Acquisition Corporation S-4Dokument15 SeitenDiamond Eagle Acquisition Corporation S-4Carlos JesenaNoch keine Bewertungen

- Modern Systems Analysis and Design: Structuring System Process RequirementsDokument45 SeitenModern Systems Analysis and Design: Structuring System Process RequirementsBhavikDaveNoch keine Bewertungen

- Job Vacancies in PPB GroupDokument10 SeitenJob Vacancies in PPB GroupFarin MustafaNoch keine Bewertungen

- Public Vs PrivateDokument2 SeitenPublic Vs PrivateVishvasniya RatheeNoch keine Bewertungen

- CAF 3 CMA Autumn 2023Dokument6 SeitenCAF 3 CMA Autumn 2023Hammad ShahidNoch keine Bewertungen

- G12 Principles of Marketing Week 3Dokument9 SeitenG12 Principles of Marketing Week 3Glychalyn Abecia 23Noch keine Bewertungen

- Project Report On Entrepreneurial Journey of A Local EntrepreneurDokument12 SeitenProject Report On Entrepreneurial Journey of A Local EntrepreneurSai KishanNoch keine Bewertungen

- Notice of 103rd AGM of Britannia Industries LimitedDokument20 SeitenNotice of 103rd AGM of Britannia Industries LimitedSag SagNoch keine Bewertungen

- Sam en VattingDokument37 SeitenSam en VattingthomasvandenboschNoch keine Bewertungen

- Kisi-Kisi Uts Enterprise System Tipe I - Kemungkinan Bisa KeluarDokument16 SeitenKisi-Kisi Uts Enterprise System Tipe I - Kemungkinan Bisa KeluarwahyuNoch keine Bewertungen

- Caddesk Course Fee DetailsDokument1 SeiteCaddesk Course Fee Detailsganesh15Noch keine Bewertungen

- BridgestoneDokument1 SeiteBridgestoneRam JainNoch keine Bewertungen

- From Conceptual To Executable BPMN Process ModelsDokument49 SeitenFrom Conceptual To Executable BPMN Process ModelsAlbertiNoch keine Bewertungen

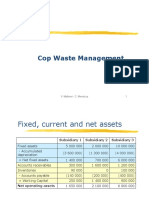

- Cop Waste Management SolutionDokument5 SeitenCop Waste Management SolutionPaul GhanimehNoch keine Bewertungen

- AR 2018 Full PDFDokument222 SeitenAR 2018 Full PDFRaymondNoch keine Bewertungen

- WEX2011InvestorPresentation 2 1 11Dokument23 SeitenWEX2011InvestorPresentation 2 1 11John MiklaNoch keine Bewertungen

- Stuart Larkin RiddDokument69 SeitenStuart Larkin Riddcekk99Noch keine Bewertungen

- Verify Udyam Registration DetailDokument3 SeitenVerify Udyam Registration DetailFinance HubNoch keine Bewertungen

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsVon EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsBewertung: 5 von 5 Sternen5/5 (48)

- Generative AI: The Insights You Need from Harvard Business ReviewVon EverandGenerative AI: The Insights You Need from Harvard Business ReviewBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Von EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Bewertung: 5 von 5 Sternen5/5 (1)

- Sales Pitch: How to Craft a Story to Stand Out and WinVon EverandSales Pitch: How to Craft a Story to Stand Out and WinBewertung: 4.5 von 5 Sternen4.5/5 (2)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerVon EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerBewertung: 4 von 5 Sternen4/5 (121)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Von EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Bewertung: 4.5 von 5 Sternen4.5/5 (11)

- The Ruler's Guide: China's Greatest Emperor and His Timeless Secrets of SuccessVon EverandThe Ruler's Guide: China's Greatest Emperor and His Timeless Secrets of SuccessBewertung: 4.5 von 5 Sternen4.5/5 (14)

- The 10X Rule: The Only Difference Between Success and FailureVon EverandThe 10X Rule: The Only Difference Between Success and FailureBewertung: 4.5 von 5 Sternen4.5/5 (289)