Beruflich Dokumente

Kultur Dokumente

BMO Account Application - Samantha Rice

Hochgeladen von

Bob LoblawCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BMO Account Application - Samantha Rice

Hochgeladen von

Bob LoblawCopyright:

Verfügbare Formate

Everyday Banking Account Opening

We’re here to help.

About You

MS. SAMANTHA RICE

504 DOVERCOURT RD

TORONTO ON M6H 2W4 CANADA

Home: 705-999-8755 Mobile: 705-999-8755

Email: samanthadoreen@ruru.be

Your Products and Services Summary

Primary Chequing Account 42015 3616234

Premium Rate Savings Account 42015 8728649

BMO Debit Card 45510 29** **** 1145

Your Products and Services Details

Primary Chequing Account

Interest : No interest is paid.

Premium Rate Savings Account

Interest : Today’s rates

On the portion of your balance up to $59,999.99, you earn 0.050%

On the portion of your balance that is $60,000.00 and over, you earn 0.050%

Interest is calculated on your daily closing balance and paid monthly. Interest rates are per annum and subject to change.

Current rates can be found at bmo.com/rates, at BMO branches, or by calling 1-877-225-5266 (TTY 1-866-889-0889).

Your Account Details

Transit/Account Number 4 2015 3616234

Selected Options 4 eStatement

Transit/Account Number 4 2015 8728649

Selected Options 4 eStatement

Holding of Funds

Transit/Account Number: 2015 3616234

New Account Hold Funds

For accounts open less than 90 days, the funds for each non-cash deposit made in a branch will be placed on hold in accordance

with our Cheque Hold Policy, found in the Agreements, Bank Plans and Fees for Everyday Banking.

90104 (Jan 2018) February 05, 2018 Page 1 of 5

Holding of Funds

Transit/Account Number: 2015 8728649

New Account Hold Funds

For accounts open less than 90 days, the funds for each non-cash deposit made in a branch will be placed on hold in accordance

with our Cheque Hold Policy, found in the Agreements, Bank Plans and Fees for Everyday Banking.

Your Bank Plan

Plus Plan

Features and Benefits

30 transactions per month

Great for everyday use at a competitive price

Monthly Fee

$0.00 per month

Your Plan Fee will begin on 1 FEBRUARY 2018. If you have selected a Primary Chequing Account as your lead account for your

monthly Plan, the monthly Plan fee can be eliminated by maintaining a balance of $3,000.00 or more at all times throughout

the month.

Details :

Lead Account 4 2015 3616234

Other Accounts 4 2015 8728649

Your BMO Debit Card

Name on Card

SAMANTHA RICE

Card Number

5510 29** **** 1145

Your Card Links To:

Primary Chequing Account No. 2015 3616234

Premium Rate Saving Account. 2015 8728649

Interac Flash®‡ 4 Yes

What You Need to Know About Your BMO Debit Card

Protect Yourself

< Change your PIN regularly and always keep it confidential.

< Do not keep your PIN and card in the same location.

< CALL 1-877 CALL BMO (225-5266) if your card is lost or stolen. Associates are available 24 hours a day.

90104 (Jan 2018) February 05, 2018 Page 2 of 5

What You Need to Know About Your BMO Debit Card

Holds on BMO ATM Deposits

< For accounts open less than 90 days, the full amount of any deposit may be held for up to seven business days1. Once your

account has been open for at least 90 days, the regular hold period, as described above will apply.

< Detailed information about your account balance or funds available can be viewed in BMO Online, BMO Mobile and BMO

Tablet Banking.

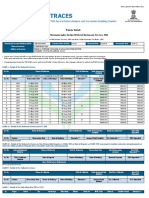

Your Daily Limits

ATM Transactions Interac e-Transfer®‡ Transactions5

Deposits $100,000 Receiving $10,000

Withdrawals2 $1,000 Sending $3,000

ATM, Telephone , and Digital Banking

3 4

Interac ®‡

Online6

Bill Payments $32,000 Purchases $2,500

Merchant Debit Card Transactions 2

Card Not Present7

Purchases $10,000 Purchases $2,500

Limits are in Canadian dollars/Canadian dollar equivalent. Convenience fees that may be charged by non-BMO ATMs or merchants are included

in the transaction limit. Limits and availability of service may be restricted when systems are down. Limits may be changed at any time.

Current limits are available at BMO branches. All debit transactions are subject to cleared funds being available in your account. Service

charges may apply.

1. “Business” day means Monday to Friday; excluding holidays when your branch is closed. Holds take effect immediately; the hold duration begins to count the

first business day after the day of deposit. 2. Access is available wherever an Interac, Cirrus®*, Maestro®* or MasterCard®* logo is displayed. 3. Includes

transactions completed by a customer contact centre associate. 4. Digital Banking includes BMO Online, BMO Mobile and BMO Tablet Banking. 5. The maximum

daily sent limit for Interac e-Transfer is restricted to the unused portion of your daily Bill Payments Limit. Weekly and Monthly limits apply. 6. Interac Online

Transactions available for BMO Debit Card without MasterCard Logo. 7. Card Not Present Transactions available for BMO Debit Card with MasterCard Logo and

includes Online, Mail Order, Telephone Order and Recurring transactions.

BDC-02

Agreement and Consent

Privacy Disclosure & Consent - Your Personal Information

What is Personal Information?

Personal Information is information about an identifiable individual. It includes information that you have provided to us or was

collected by us from other sources. It may include details such as your name and address, age and gender, personal financial

records, identification numbers including your Social Insurance Number, personal references, and employment records.

Why Does the Bank Ask You For Your Personal Information?

When we collect your Personal Information, we may use or disclose it to:

< verify your identity;

< provide and manage products and services you have requested;

< understand your financial services requirements;

< protect against fraud and manage risk;

< determine suitability of products and services for you;

< better manage your relationship with us;

< determine your eligibility for certain of our products and services, or products or services of others;

< comply with legal or regulatory requirements, or as otherwise permitted by law;

< communicate with you regarding products and services that may be of interest;

90104 (Jan 2018) February 05, 2018 Page 3 of 5

Agreement and Consent

< understand our customers and to develop and tailor our products and services, and

< respond to any questions you may have.

If a new purpose for using your Personal Information develops, we will identify that purpose.

Sharing Your Personal Information

We may share your Personal Information within BMO Financial Group, including locations outside of Canada where we do

business, for legal and regulatory purposes, to manage credit risk and other business risks, to perform analytics, to ensure we

have correct or up to date information about you (such as your current address or date of birth) and to better manage your

relationship with us.

Your Choices

If you prefer not to receive our Direct Marketing communications and/or not have your Personal Information shared among the

members of BMO Financial Group for the purpose of marketing, you can have your name deleted from our Direct Marketing

and/or shared information lists.

Also, if you would prefer not to have us use your SIN for administrative purposes, just ask us. This option does not apply where

we are required to use your SIN for income tax reporting purposes.

For complete details on our commitment to respect and protect the privacy of your Personal Information, please refer to our

Privacy Code which is available at bmo.com/privacy, upon request at any branch of BMO Bank of Montreal, or by calling

1-877-225-5266 (TTY: 1-866-889-0889).

Credit Bureau Authorization

You agree that Bank of Montreal and its agents may use your Personal Information provided to obtain credit information,

other financially related information about you at any time, from a registry, from your employer(s), any credit bureau, any

person who has or may have financial dealings with you, and any references that you have provided to the Bank of

Montreal. You agree that Bank of Montreal and its agents may, in its discretion, update this information at any time during

the time you are a Bank of Montreal customer. You also agree that Bank of Montreal may share your Personal Information

within BMO Financial Group or with credit reporting agencies or with persons with whom you have or may have financial

dealings.

Terms and Conditions Applicable to Your BMO Bank Account Application

Agreements, Bank Plans and Fees for Everyday Banking

You agree to the terms and conditions contained in the Agreements, Bank Plans and Fees for Everyday Banking, which among

other things, sets out the terms and conditions applicable to your BMO bank account, Bank Plan, holding of funds, fees, charges,

use of your BMO Debit Card, use of BMO’s electronic services and BMO’s 100% Electronic Banking Guarantee.

The brochure for Agreements, Bank Plans and Fees for Everyday Banking is available at any BMO Branch and online at

bmo.com/agreements.

Third Party Account Acknowledgment and Confirmation

You confirm that your bank account(s) will only be used by you and will not be used by, or for, anyone else.

Interest Rates

The interest rate applicable to your account may be found at bmo.com/rates. Interest rates are per annum

and are calculated on the daily closing balance of your account and paid monthly on the last business day of the month. Interest

rates and balance tiers are subject to change without notice.

General

90104 (Jan 2018) February 05, 2018 Page 4 of 5

Agreement and Consent

Terms and Conditions Applicable to Your BMO Bank Account Application

You certify the information provided in this application is true and correct.

Please Read The Following Important Agreement And Sign Where Indicated

In the following agreement, “you” means each person who signs below.

< You agree to the Privacy Disclosure and Consent above

< You agree to the Credit Bureau Authorization above

< You acknowledge that you have requested a BMO Debit Card and Personal Identification Number (PIN)

< You agree to the Terms and Conditions Applicable to Your BMO Bank Account Application above

Applicable in the Province of Québec Only: You agree that this Agreement and any related documents be written in

English. Vous acceptez que la présente convention et tous les documents connexes soient rédigés en anglais.

Applicant Signature

[343218269452088.Capture1] [343218269452088.Capture1.label1.Date]

MS. SAMANTHA RICE 1 Date

Contact Us

BMO Bank of Montreal Customer Contact Centre

Digital Sales Tel.: 1-877 CALL BMO (225-5266)

Transit: 2015 TTY: 1-866-889-0889

Visit: bmo.com

®* MasterCard and the MasterCard brand mark are registered trademarks of MasterCard International Incorporated. Used under license.

®† Trademarks of AIR MILES International Trading B.V. used under license by LoyaltyOne, Co. and Bank of Montreal.

®‡ Interac, the Interac logo, Interac e-Transfer and Interac Flash are registered trademarks of Interac Inc. Used under license.

The Contactless Indicator is a trademark of EMVCo. LLC. Used under license.

90104 (Jan 2018) February 05, 2018 Page 5 of 5

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Advising - Payslip - 20309012 - Shamim Ara Jahan SharnaDokument2 SeitenAdvising - Payslip - 20309012 - Shamim Ara Jahan SharnaFardin Ibn ZamanNoch keine Bewertungen

- Form - I (A) : Department of Commercial Taxes, Government of Uttar PradeshDokument4 SeitenForm - I (A) : Department of Commercial Taxes, Government of Uttar PradeshPrakhar JainNoch keine Bewertungen

- Unit 14 - Essay BVC QuestionsDokument28 SeitenUnit 14 - Essay BVC Questionsايهاب العنبوسيNoch keine Bewertungen

- Finacle 10 2019Dokument40 SeitenFinacle 10 2019Vikram ShrivastavaNoch keine Bewertungen

- Ameer HamzaDokument2 SeitenAmeer Hamzaarshad khanNoch keine Bewertungen

- Rossana JounalDokument20 SeitenRossana JounalayuNoch keine Bewertungen

- COMMISSION ON AUDIT CIRCULAR NO. 90-326 February 22, 1990 TODokument7 SeitenCOMMISSION ON AUDIT CIRCULAR NO. 90-326 February 22, 1990 TObolNoch keine Bewertungen

- Econ 102 Final Exam NotesDokument12 SeitenEcon 102 Final Exam NotesRohith NiranjanNoch keine Bewertungen

- Chapter 1 Saunders Cornett McGrawDokument58 SeitenChapter 1 Saunders Cornett McGrawAlice WenNoch keine Bewertungen

- Banker Customer RelationshipDokument4 SeitenBanker Customer RelationshipSaadat Ullah KhanNoch keine Bewertungen

- SBSA Statement 2023-02-02Dokument3 SeitenSBSA Statement 2023-02-02Melissa Albertyn-BrowneNoch keine Bewertungen

- Terms and Conditions: (Applicable To All Deposit Accounts)Dokument5 SeitenTerms and Conditions: (Applicable To All Deposit Accounts)Jeramie ErpeloNoch keine Bewertungen

- Metropolitan Bank vs. CA (194 SCRA 169, 18 February 1991)Dokument2 SeitenMetropolitan Bank vs. CA (194 SCRA 169, 18 February 1991)Howard ClarkNoch keine Bewertungen

- GLC Legal Profession Accounts and Records Regulations Consolidated 2017Dokument20 SeitenGLC Legal Profession Accounts and Records Regulations Consolidated 2017tajhtechzNoch keine Bewertungen

- Wallace v. National Bank of Commerce - 938 S.W.2d 684Dokument7 SeitenWallace v. National Bank of Commerce - 938 S.W.2d 684AllyNoch keine Bewertungen

- 20150605-G. H. Schorel-Hlavka O.W.B. To MR TONY ABBOTT PM-Re 'BAIL In' Violation of Commonwealth Payments of Pensions-EtcDokument13 Seiten20150605-G. H. Schorel-Hlavka O.W.B. To MR TONY ABBOTT PM-Re 'BAIL In' Violation of Commonwealth Payments of Pensions-EtcGerrit Hendrik Schorel-HlavkaNoch keine Bewertungen

- Banking 18-4-2022Dokument17 SeitenBanking 18-4-2022KAMLESH DEWANGANNoch keine Bewertungen

- Confidential Fillable FormatDokument6 SeitenConfidential Fillable Formatkumar_tarunNoch keine Bewertungen

- Working Capital Management Unit - IVDokument52 SeitenWorking Capital Management Unit - IVthilagaashiv_43Noch keine Bewertungen

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Dokument4 SeitenForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AartiNoch keine Bewertungen

- Summer Internship ReportDokument31 SeitenSummer Internship ReportHimanshi SinghNoch keine Bewertungen

- Habib Bank LimitedDokument16 SeitenHabib Bank Limitedhasanqureshi3949100% (2)

- Internship Report of National Bank of PakistanDokument104 SeitenInternship Report of National Bank of PakistanHusnain BalochNoch keine Bewertungen

- ACCO 20053 Lecture Notes 2 - Imprest System and Petty Cash FundDokument7 SeitenACCO 20053 Lecture Notes 2 - Imprest System and Petty Cash FundVincent Luigil AlceraNoch keine Bewertungen

- SSRN-id3099337 FinTech ResearchDokument38 SeitenSSRN-id3099337 FinTech ResearchSHAME BOPENoch keine Bewertungen

- Axis Bank Debit and Credit Card SonamDokument81 SeitenAxis Bank Debit and Credit Card SonamsonamNoch keine Bewertungen

- Internship Report On General Banking of Agrani Bank LimitedDokument50 SeitenInternship Report On General Banking of Agrani Bank Limitedashique50% (4)

- SUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowDokument2 SeitenSUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowSayanta Biswas100% (1)

- Deposit Scheme For Retiring PDFDokument4 SeitenDeposit Scheme For Retiring PDFSuresh SharmaNoch keine Bewertungen

- Tacn 1 RevisionDokument17 SeitenTacn 1 Revisionk61.2212250027Noch keine Bewertungen