Beruflich Dokumente

Kultur Dokumente

RMC 10-2017 Bookkeeping Requirements of NGAs, GAIs, and GOCCs

Hochgeladen von

Mark Lord Morales Bumagat0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten1 SeiteRMC 10-2017 Bookkeeping Requirements of NGAs, GAIs, And GOCCs

Originaltitel

RMC 10-2017 Bookkeeping Requirements of NGAs, GAIs, And GOCCs

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenRMC 10-2017 Bookkeeping Requirements of NGAs, GAIs, And GOCCs

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten1 SeiteRMC 10-2017 Bookkeeping Requirements of NGAs, GAIs, and GOCCs

Hochgeladen von

Mark Lord Morales BumagatRMC 10-2017 Bookkeeping Requirements of NGAs, GAIs, And GOCCs

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

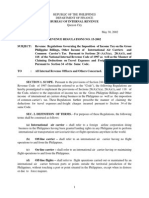

REPUBLIC OF THE PHILIPPINES

‘DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE,

Quezon City

January 19, 2017

REVENUE MEMORANDUM CIRCULAR NO._10- 3017

SUBJECT : Clarification on Bookkeeping Requirements of National Government Agencies,

Government Agencies and Instrumentalities ard Government-Owned,

and ~Controlled Corporations

To

+ All Internal Revenue Officers and Others Concerned

This Circular is being issued to clarify the bookkeeping requirements of National Government

Agencies (NGAs), Government Agencies and Instrumentalities (GAls) and Government-Owned

and -Controlled Corporations (GOCCS).

Section 232 of National Internal Revenue Code, as amended provides:

“ Sec. 232. Keeping of Books of Accounts —

(4) Corporations, Companies, Partnerships or Persons Required to Keep Books

of Accounts, - All corporations, companies, parmerships or persons required

By law to pay internal revenue taxes shall keep a journal and a ledger or their

equivalents: xxx"

‘Batas Pambansa Bilang 68 (The Corporation Code of the Philippines) provides:

“Section 2. Corporation defined. A corporation is an artificial being created by

operation of law, having the right of succession and the powers, attributes and properties

expressly authorized by law or incident to its existence.

wo

Section 4. Corporations created by special laws or charters. ~ Corporations created by

~ ‘special laws or charters shall be governed primarily by the provisions of the special law

or charter creating them or applicable to them, supplemented by the provisions of this

Code, insofar as they are applicable.”

In view of the foregoing, NGAs, Gls, and GOCCs fall under the term ‘corporation’ created by

special law or charter. Thus, NGAs, GAls, and GOCCs vested with function

‘whether governmental or proprietary in nature are required to register and keep

relating to public needs

ir books of accounts.

(1) Those who are using the Commission on Audit (COA)-developed

Government Accounting System (eNGAS) are not required to apply

Use. Considering however, the requirement for paymenvremittance and verification of

tax liabilities, these entities shall submit the eNGAS in electronic format.

(2) Those who are using a computerized accounting system and/or components thereof

other than the eNGAS are required to apply for Permit to Use and shall submit and

register the same in electronic format.

‘The submission is to the RDO having jurisdiction over the principal place of business or to the

gee ees TADELTRD/ETD-Cebulb TD-Davao where the head office is duly registered within thirty (30) days from

‘the tlgse’of eath taxable year or within 30 days upon the termination of its use, following the existing revenue

<{pyprissuances on compiterized Accounting system,

Das könnte Ihnen auch gefallen

- PR14FEB1924 v2Dokument1 SeitePR14FEB1924 v2Mark Lord Morales BumagatNoch keine Bewertungen

- TMAP Tax Updates for November 2017Dokument13 SeitenTMAP Tax Updates for November 2017Mark Lord Morales BumagatNoch keine Bewertungen

- Techniques Used by the BIR in Tax Audit and InvestigationDokument131 SeitenTechniques Used by the BIR in Tax Audit and InvestigationMark Lord Morales Bumagat100% (1)

- BIR Focuses On Taxpayer's Lifestyles PDFDokument62 SeitenBIR Focuses On Taxpayer's Lifestyles PDFMark Lord Morales BumagatNoch keine Bewertungen

- WT - Alphalist Jobaid Annex ADokument2 SeitenWT - Alphalist Jobaid Annex AMark Lord Morales BumagatNoch keine Bewertungen

- List of Acc Crm-Pos and ObmDokument33 SeitenList of Acc Crm-Pos and ObmMark Lord Morales BumagatNoch keine Bewertungen

- RMC 54-2014 Annex BDokument1 SeiteRMC 54-2014 Annex BArgie Capuli RapisuraNoch keine Bewertungen

- Validate 1601E and 2550Q FilesDokument6 SeitenValidate 1601E and 2550Q FilesMark Lord Morales BumagatNoch keine Bewertungen

- Alphalist Data EntryDokument20 SeitenAlphalist Data EntryMark Lord Morales BumagatNoch keine Bewertungen

- 2031rr15 02Dokument8 Seiten2031rr15 02KatharosJaneNoch keine Bewertungen

- RMC 37-2012Dokument0 SeitenRMC 37-2012Peggy SalazarNoch keine Bewertungen

- Vat - RMC 39-2007 Annex ADokument1 SeiteVat - RMC 39-2007 Annex AMark Lord Morales BumagatNoch keine Bewertungen

- Announcement EfPSDokument1 SeiteAnnouncement EfPSGreg AustralNoch keine Bewertungen

- Estate and Donors Tax - New and OldDokument2 SeitenEstate and Donors Tax - New and OldMark Lord Morales BumagatNoch keine Bewertungen

- Atty Velonco Vs Atty RoxasDokument7 SeitenAtty Velonco Vs Atty RoxasJanMikhailPanerioNoch keine Bewertungen

- Team Sual Corporation v. CIRDokument16 SeitenTeam Sual Corporation v. CIRJoyceNoch keine Bewertungen

- Sample Premium Computation of The Formal SectorDokument2 SeitenSample Premium Computation of The Formal SectorFrancis MacasaetNoch keine Bewertungen

- 1701Q 2Dokument1 Seite1701Q 2Mark Lord Morales BumagatNoch keine Bewertungen

- CTA resolves motions for partial reconsideration in case involving documentary stamp taxDokument11 SeitenCTA resolves motions for partial reconsideration in case involving documentary stamp taxMark Lord Morales BumagatNoch keine Bewertungen

- Second Division: Petitioners VersusDokument32 SeitenSecond Division: Petitioners VersusMark Lord Morales BumagatNoch keine Bewertungen

- Bir Form No. 1907Dokument1 SeiteBir Form No. 1907Kim ValenciaNoch keine Bewertungen

- BIR Ruling DA - C-018 075-10Dokument2 SeitenBIR Ruling DA - C-018 075-10Mark Lord Morales BumagatNoch keine Bewertungen

- RR 05-2010 (Rules On Transfer of RegistrationDokument6 SeitenRR 05-2010 (Rules On Transfer of RegistrationMary Rose BarotNoch keine Bewertungen

- List of ATC Codes Extracted from 1601EQ Offline eBIRForms PackageDokument9 SeitenList of ATC Codes Extracted from 1601EQ Offline eBIRForms PackageMark Lord Morales BumagatNoch keine Bewertungen

- General Audit Procedures and DocumentationDokument7 SeitenGeneral Audit Procedures and DocumentationCaroline MastersNoch keine Bewertungen

- Keeping, Maintaining and Registering Books of AccountsDokument2 SeitenKeeping, Maintaining and Registering Books of AccountsAmberlyNoch keine Bewertungen

- Bir - Train - It - WT - Tmap 04262018Dokument74 SeitenBir - Train - It - WT - Tmap 04262018Mark Lord Morales Bumagat100% (1)

- RR 4-2000 Issuance of SI-OR-CI PDFDokument1 SeiteRR 4-2000 Issuance of SI-OR-CI PDFMark Lord Morales BumagatNoch keine Bewertungen

- RMC No 37-2016Dokument6 SeitenRMC No 37-2016sandra100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)