Beruflich Dokumente

Kultur Dokumente

Finance

Hochgeladen von

DandyOriginaltitel

Copyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFinance

Hochgeladen von

Dandy3/8/2019 BSG Decisions & Reports

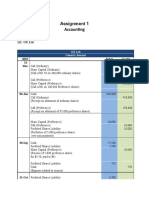

Projected Year 11 Performance

Investor Change

Scoring Measures Year 11 Expectation Other Measures Year 11 from Y10

EPS (earnings per share) $2.22 $2.50 Net Revenues ($000s) 515,891 +19.2%

ROE (return on equity) 19.6% 21.0%

Net Profit ($000s) 44,225 +10.6%

Credit Rating A– B+

Image Rating 83 70 Ending Cash ($000s) 4,901 -1,173

F C F

Sources of 1-Year Bank Loan (7.00% interest) $ 0 Uses for Early Repayment of L-T None

Additional Cash 5-Year Bank Loan (7.50% interest) $ 0 Excess Cash Loans (Balance Sheet Note 8) N/A

($000s) ($000s)

10-Year Bank Loan (8.00% interest) $ 0

Dividend ($/share) Year 10 dividend was $1.00 $ 0.50

Stock Issue (000s of shares at $30.15) 0 Stock Repurchase (000s of shares at $30.15) 100

Maximum share issue in Y11 = 0k Maximum share repurchase in Y11 = 200k

Shares of stock outstanding at the beginning of Year 11 20,000 k Shares of stock outstanding at the end of Year 11 19,900 k

Projected Cash Available in Year 11 $000s Projected Cash Outlays in Year 11 $000s

Beginning Cash Balance (carried over from Year 10) $ 6,074 Cash Payments to Materials Suppliers $ 77,984

Outlays Production Expenses (excluding depreciation) 155,598

Cash Receipts from Footwear Sales 509,248

Inflows Bank Loans 1-Year Loan 0 Distribution and Warehouse Expenses 98,340

5-Year Loan 0 Marketing and Administrative Expenses 97,523

10-Year Loan 0 Capital Facility Expansion (new space) 0

Outlays Equipment Purchases 10,000

Stock Issue (0 shares @ $30.15) 0

Sale of Used Production Equipment 0 Equipment Upgrade Options 13,600

Interest Income on Y10 Cash Balance 121 Energy Efficiency Initiatives 850

Loan to Cover Overdraft (1-year loan @ 9.0%) 0 Bank Loan 1-Year Loan 0

Repayment 5-Year Loans 0

Cash Refund (awarded by instructor) 0

10-Year Loans 15,900

Total Cash Available from All Sources $ 515,443 Interest Bank Loans 8,829

Payments Y10 Overdraft Loan 0

Stock Repurchases (100 shares @ $30.15) 3,015

Income Tax Payments 18,953

Dividend Payments to Shareholders 9,950

Charitable Contributions 0

Cash Fine (assessed by instructor) 0

Total Cash Outlays $ 510,542

If sales targets are not met, an overdraft loan is likely with this low cash balance. Projected Cash Balance at the End of Year 11 ($000s) $ +4,901

Last Year 11 Last Year 11

Other Important Financial Statistics Year (projected) Performance on Credit Rating Measures Year (projected)

Interest Rate Paid on Overdraft Loans 9.0% 9.0% Interest Coverage Ratio (operating profit ÷ interest exp.) 6.62 8.26

Interest Rate Received on Cash Balances 2.0% 2.0% Debt to Assets Ratio (total debt ÷ total assets) 0.39 0.33

Shareholder Equity (mandated minimum = $150 mil.) $210 mil. $241 mil. Risk of Default (based on Y11 default risk ratio of 4.04) Medium Low

https://www.bsg-online.com/users/sim/decisions/finance 1/1

Das könnte Ihnen auch gefallen

- Week 1 MSTA Notes PDFDokument93 SeitenWeek 1 MSTA Notes PDFMohd Najmi HuzaiNoch keine Bewertungen

- CHAPTER 13 Solved Problems PDFDokument8 SeitenCHAPTER 13 Solved Problems PDF7100507100% (2)

- Bond RefundingDokument8 SeitenBond RefundingvanvunNoch keine Bewertungen

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementVon EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNoch keine Bewertungen

- Employee Benefits at HealthCoDokument21 SeitenEmployee Benefits at HealthCoDandy100% (1)

- ACCA F9 Mock Examination 2Dokument5 SeitenACCA F9 Mock Examination 2daria0% (1)

- Horngren: Accounting 6Dokument2 SeitenHorngren: Accounting 6MIKASANoch keine Bewertungen

- Wealth Within EbookDokument24 SeitenWealth Within EbookKhang Nguyen100% (1)

- Scenario ADokument10 SeitenScenario ADandyNoch keine Bewertungen

- LQ 1 - Set B SolutionDokument14 SeitenLQ 1 - Set B SolutionRyan Joseph Agluba Dimacali100% (1)

- Ch7 Problems SolutionDokument22 SeitenCh7 Problems Solutionwong100% (8)

- AP-LIABS-3 (With Answers)Dokument4 SeitenAP-LIABS-3 (With Answers)Kendrew SujideNoch keine Bewertungen

- Final Grading Exam - Key AnswersDokument35 SeitenFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

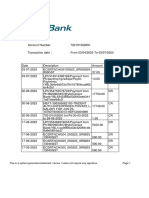

- Transactions History: Account HolderDokument3 SeitenTransactions History: Account Holder13KARATNoch keine Bewertungen

- Ratio Analysis Numericals Including Reverse RatiosDokument6 SeitenRatio Analysis Numericals Including Reverse RatiosFunny ManNoch keine Bewertungen

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDokument6 Seiten027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006Noch keine Bewertungen

- 2 Finalnew Suggans Nov09Dokument16 Seiten2 Finalnew Suggans Nov09spchheda4996Noch keine Bewertungen

- ACCT102 - Principles of Accounting II Practice Exam IDokument6 SeitenACCT102 - Principles of Accounting II Practice Exam IEleanor RoatNoch keine Bewertungen

- Cash Flow - Format & Problems - 2020Dokument3 SeitenCash Flow - Format & Problems - 2020aaryaNoch keine Bewertungen

- Ratio Analysis For CADokument7 SeitenRatio Analysis For CAShahid MahmudNoch keine Bewertungen

- Financial Wellness ExcelDokument7 SeitenFinancial Wellness ExcelnhariNoch keine Bewertungen

- Financial Wellness ExcelDokument7 SeitenFinancial Wellness ExcelnhariNoch keine Bewertungen

- CF-Cost of CapitalDokument3 SeitenCF-Cost of CapitalNoor PervezNoch keine Bewertungen

- Cash Flow Statement: Final ExamDokument4 SeitenCash Flow Statement: Final ExamAiman Abdul QadirNoch keine Bewertungen

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDokument27 SeitenPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNoch keine Bewertungen

- 06 Liquidity & Leverage RatiosDokument4 Seiten06 Liquidity & Leverage RatiosAkansh NuwalNoch keine Bewertungen

- Ch11 PDFDokument6 SeitenCh11 PDFnagendra reddy panyamNoch keine Bewertungen

- Intercorporate InvestmentsDokument14 SeitenIntercorporate InvestmentsYisbel CarrascoNoch keine Bewertungen

- 12 Redemption of DebenturesDokument13 Seiten12 Redemption of DebenturesRohith KumarNoch keine Bewertungen

- Intercompany Indebtedness: Mcgraw-Hill/IrwinDokument39 SeitenIntercompany Indebtedness: Mcgraw-Hill/IrwinamrohnblNoch keine Bewertungen

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingDokument16 SeitenTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingPraveen Reddy DevanapalleNoch keine Bewertungen

- Lyons Document Storage Corporation: Bond Accounting: Lake PushkarDokument9 SeitenLyons Document Storage Corporation: Bond Accounting: Lake PushkarantonioNoch keine Bewertungen

- Unit 6 - Solution Gemini - Assignment3Dokument2 SeitenUnit 6 - Solution Gemini - Assignment3Ivana BalijaNoch keine Bewertungen

- Computation of NAVDokument33 SeitenComputation of NAVMannu SolankiNoch keine Bewertungen

- Chapter 7, Exercise 5Dokument53 SeitenChapter 7, Exercise 5MagdalenaNoch keine Bewertungen

- MODULE 4 - DiscussionDokument11 SeitenMODULE 4 - DiscussionYess poooNoch keine Bewertungen

- E-Book Perfect Practice BooksDokument36 SeitenE-Book Perfect Practice BooksSavit Bansal100% (1)

- Seat Foodie Financial StatementsDokument6 SeitenSeat Foodie Financial Statementsapi-542433757Noch keine Bewertungen

- FM DJB - RTP Nov 21Dokument14 SeitenFM DJB - RTP Nov 21shubhamsingh143deepNoch keine Bewertungen

- Module 7 Loans Receivable and Impairment of ReceivablesDokument10 SeitenModule 7 Loans Receivable and Impairment of Receivablesshaira doctorNoch keine Bewertungen

- Final PB FAR Batch 7 Sept 2023Dokument38 SeitenFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNoch keine Bewertungen

- Kelompok 6 - UTS AKMDokument18 SeitenKelompok 6 - UTS AKM21-010 Desi MailaniNoch keine Bewertungen

- Practice Set: 12 Years 3 Years 3.0373Dokument3 SeitenPractice Set: 12 Years 3 Years 3.0373Michael AninoNoch keine Bewertungen

- AKL - Kasus Chapter 6 (P6-45)Dokument5 SeitenAKL - Kasus Chapter 6 (P6-45)raqhelziuNoch keine Bewertungen

- Perpetual Bank: ReceivablesDokument13 SeitenPerpetual Bank: ReceivablesYes ChannelNoch keine Bewertungen

- Financial Analysis ProblemDokument16 SeitenFinancial Analysis ProblemShreyashi DasNoch keine Bewertungen

- BAT Unit 5 AssignmentDokument14 SeitenBAT Unit 5 AssignmentTalhah WaleedNoch keine Bewertungen

- Ass in Ia 3 Act. 3Dokument7 SeitenAss in Ia 3 Act. 3Resty VillaroelNoch keine Bewertungen

- Cash Flow Statements Interim Check 1 Yolo LTD Question and AnswerDokument5 SeitenCash Flow Statements Interim Check 1 Yolo LTD Question and AnswerjunaidahNoch keine Bewertungen

- Solved Problems: OlutionDokument5 SeitenSolved Problems: OlutionSavoir PenNoch keine Bewertungen

- Lab Pengantar AkuntansiDokument6 SeitenLab Pengantar Akuntansirahadatul aishyNoch keine Bewertungen

- Fund Flow Statement: by Dr. Aleem AnsariDokument18 SeitenFund Flow Statement: by Dr. Aleem AnsariPRIYAL GUPTANoch keine Bewertungen

- Far Situational Solution-1Dokument6 SeitenFar Situational Solution-1Baby BearNoch keine Bewertungen

- Assignment 1 Accounting: Q1: OZ LTDDokument3 SeitenAssignment 1 Accounting: Q1: OZ LTDFaraz BakhshNoch keine Bewertungen

- Ia2 Final Exam A Test Bank - CompressDokument32 SeitenIa2 Final Exam A Test Bank - CompressFiona MiralpesNoch keine Bewertungen

- A Case 1Dokument6 SeitenA Case 1Juan LeonardoNoch keine Bewertungen

- Corporation: SolutionDokument6 SeitenCorporation: Solutionibrahim mohamedNoch keine Bewertungen

- 12 Accounts CBSE Sample Papers 2019 Marking SchemeDokument16 Seiten12 Accounts CBSE Sample Papers 2019 Marking SchemeSalokya KhandelwalNoch keine Bewertungen

- CA Inter Adv. Accounting Top 50 Question May 2021Dokument117 SeitenCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNoch keine Bewertungen

- Ipcc Accouts Solved PaperDokument15 SeitenIpcc Accouts Solved PaperVinod KumarNoch keine Bewertungen

- Chapter 7, Exercise 2Dokument48 SeitenChapter 7, Exercise 2MagdalenaNoch keine Bewertungen

- HW5Dokument6 SeitenHW5SHIVANI SHARMANoch keine Bewertungen

- Chap010 - TaggedDokument44 SeitenChap010 - TaggedKoki HabadiNoch keine Bewertungen

- Motorcycle LoanDokument10 SeitenMotorcycle Loanrowilson reyNoch keine Bewertungen

- Case+Workforce Diversity and Wellness Kel 2 FIXDokument23 SeitenCase+Workforce Diversity and Wellness Kel 2 FIXDandyNoch keine Bewertungen

- HealthCo+Workforce Diversity and Wellness Kel 2 FIXDokument24 SeitenHealthCo+Workforce Diversity and Wellness Kel 2 FIXDandy100% (1)

- CompensationDokument1 SeiteCompensationDandyNoch keine Bewertungen

- BrandedDokument1 SeiteBrandedDandyNoch keine Bewertungen

- Chapter 7Dokument18 SeitenChapter 7DandyNoch keine Bewertungen

- ProductionDokument1 SeiteProductionDandy100% (1)

- WholesaleDokument1 SeiteWholesaleDandyNoch keine Bewertungen

- DistributionDokument1 SeiteDistributionDandyNoch keine Bewertungen

- CelebrityDokument1 SeiteCelebrityDandyNoch keine Bewertungen

- InternetDokument1 SeiteInternetDandyNoch keine Bewertungen

- CSRDokument1 SeiteCSRDandyNoch keine Bewertungen

- Disclosure No. 132 2016 Top 100 Stockholders As of December 31 2015Dokument6 SeitenDisclosure No. 132 2016 Top 100 Stockholders As of December 31 2015Mark AgustinNoch keine Bewertungen

- Complete Annual Report 2006Dokument70 SeitenComplete Annual Report 2006sunny_fzNoch keine Bewertungen

- Gabriel A.D. Preireich - The Nature of Dividends, 1934Dokument248 SeitenGabriel A.D. Preireich - The Nature of Dividends, 1934Pedro GamaNoch keine Bewertungen

- RE 01 11 Pre Sold Condo Units SolutionsDokument5 SeitenRE 01 11 Pre Sold Condo Units SolutionsAnonymous bf1cFDuepPNoch keine Bewertungen

- Pifra Business Finance ProjectDokument17 SeitenPifra Business Finance ProjectWaqas AhmedNoch keine Bewertungen

- Miga Professionals Program PDFDokument2 SeitenMiga Professionals Program PDFPaul Ivan Beppe a Yombo Paul IvanNoch keine Bewertungen

- Chapter 4 - AssigmentDokument2 SeitenChapter 4 - AssigmentKryzzel Anne JonNoch keine Bewertungen

- Loyalty Card Plus: Application FormDokument2 SeitenLoyalty Card Plus: Application FormKillah BeatsNoch keine Bewertungen

- CH 08Dokument51 SeitenCH 08Daniel NababanNoch keine Bewertungen

- Derivatives - AshifHvcDokument51 SeitenDerivatives - AshifHvcadctgNoch keine Bewertungen

- Problem 1-1 To 1-3 Intermediate Accounting (Vol 1)Dokument8 SeitenProblem 1-1 To 1-3 Intermediate Accounting (Vol 1)Margarette TumbadoNoch keine Bewertungen

- Physical Gold Is Not Physical Gold - Swiss GoldplanDokument2 SeitenPhysical Gold Is Not Physical Gold - Swiss GoldplantigerkillerNoch keine Bewertungen

- Characteristics of The Islamic EconomyDokument3 SeitenCharacteristics of The Islamic EconomyJuliyana Jamal100% (3)

- 0304 Boudreau Beyond HRDokument17 Seiten0304 Boudreau Beyond HRasha_tatapudiNoch keine Bewertungen

- Perspectivespaper ESGinBusinessValuationDokument12 SeitenPerspectivespaper ESGinBusinessValuationsreerahNoch keine Bewertungen

- Chapter 11Dokument43 SeitenChapter 11AdityaPutriWibowoNoch keine Bewertungen

- CV Rudi Pasaribu UpdateDokument5 SeitenCV Rudi Pasaribu UpdateDitto Dwi PurnamaNoch keine Bewertungen

- Sohrabi 2019Dokument42 SeitenSohrabi 2019Brayan TillaguangoNoch keine Bewertungen

- Statement 1688358203630Dokument3 SeitenStatement 1688358203630Chinmay RajNoch keine Bewertungen

- CH 13Dokument31 SeitenCH 13Natasha GraciaNoch keine Bewertungen

- Leasing ProblemsDokument11 SeitenLeasing ProblemsAbhishek AbhiNoch keine Bewertungen

- Philander Anver Francois-5k01014Dokument1 SeitePhilander Anver Francois-5k01014ShaneNoch keine Bewertungen

- Transaction 0876004311Dokument3 SeitenTransaction 0876004311โอภาส มหาศักดิ์สวัสดิ์Noch keine Bewertungen

- New BIT Structure For 081 AboveDokument17 SeitenNew BIT Structure For 081 Aboveعلي برادةNoch keine Bewertungen