Beruflich Dokumente

Kultur Dokumente

Well Cost, USD Activity Tangible Intangible Total

Hochgeladen von

rajes0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten2 SeitenThis document provides economic and commercial data for a PSC (production sharing contract), including:

1) Key terms of the PSC such as a 30-year contract period, a 10% non-shareable first tranche petroleum, and a 56% government share before taxes.

2) Estimates of capital costs for drilling, well services, and facilities. It provides a table of well costs and assumes facility CAPEX based on design capacity.

3) Operating costs of $3 million fixed per year plus $10/bbl variable, escalating at 3% annually. It also provides ASR costs per well and for surface facilities.

4) Assumptions of $50/

Originalbeschreibung:

pod

Originaltitel

6. Economic Data

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides economic and commercial data for a PSC (production sharing contract), including:

1) Key terms of the PSC such as a 30-year contract period, a 10% non-shareable first tranche petroleum, and a 56% government share before taxes.

2) Estimates of capital costs for drilling, well services, and facilities. It provides a table of well costs and assumes facility CAPEX based on design capacity.

3) Operating costs of $3 million fixed per year plus $10/bbl variable, escalating at 3% annually. It also provides ASR costs per well and for surface facilities.

4) Assumptions of $50/

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten2 SeitenWell Cost, USD Activity Tangible Intangible Total

Hochgeladen von

rajesThis document provides economic and commercial data for a PSC (production sharing contract), including:

1) Key terms of the PSC such as a 30-year contract period, a 10% non-shareable first tranche petroleum, and a 56% government share before taxes.

2) Estimates of capital costs for drilling, well services, and facilities. It provides a table of well costs and assumes facility CAPEX based on design capacity.

3) Operating costs of $3 million fixed per year plus $10/bbl variable, escalating at 3% annually. It also provides ASR costs per well and for surface facilities.

4) Assumptions of $50/

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Economic and Commercial Data

Economic & Commercial Data

PSC FISCAL REGIME

The basis of any economic evaluation is the fiscal terms contained in the PSC itself.

The fiscal terms of oil production are:

PSC Contract Period 30 Years (Currently in 2016, the contract

was going 4 years)

First Tranche Petroleum (Oil) 10% non-shareable

Contractor share before tax 44%

Government share before tax 56%

Depreciation 5 years – 25%

DMO Obligation / Compensation 25% / 25% (DMO holiday start from first oil

until 60 months as stated on section V)

12.1. CAPITAL COSTS

Drilling and workover/wellservices CAPEX

Tabel Drilling and Completion Cost/well

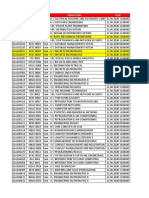

Well Cost, USD

Activity Tangible Intangible Total

Workover 250,000 50,000 300,000

Wellservice 150,000 150,000

Drilling 230,000 1,270,000 1,500,000

Facility CAPEX

Assume as per the the design capacity

12.4.1. Operating Costs (OPEX)

Fix Cost USD 3,000,000 /year

Variable Cost 10 $/Bbl with escalation factor 3% annualy.

12.4.2. ASR Cost

ASR per well = $ 250 k

ASR for surface facility 10% from total investment

______________________________________________________________________________________

12- 1

Economic and Commercial Data

12.2. OIL PRICE & GAS PRICE

Based on current word condition, we assume an oil price of US$50/bbl flat (refer

to WTI Crude Oil sept 2016).

Gas Price is 6 US$/MMBTU with escalation 3%/year.

12.3. SUNK COST

The total sunk cost is US$ 30 million, in this project sunk cost is all of the cost

that already expensed before 2017 which are consist of 3D&2D Seismic cost,

G&G study, Re-entry Beta-01 well and Beta-02, Exploratory drilling Beta-03,

Beta-04 and Beta-05 well, and SG&A.

______________________________________________________________________________________

12- 2

Das könnte Ihnen auch gefallen

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDokument7 SeitenTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversNoch keine Bewertungen

- Refinery Operating Cost: Chapter NineteenDokument10 SeitenRefinery Operating Cost: Chapter NineteenJuan Manuel FigueroaNoch keine Bewertungen

- solution-CEL 779 Abid HasanDokument36 Seitensolution-CEL 779 Abid HasanM M100% (2)

- CST STUDIO SUITE - High Frequency Simulation PDFDokument128 SeitenCST STUDIO SUITE - High Frequency Simulation PDFGenik Podunay100% (2)

- CGE 660 March - June 2018 ProjectDokument2 SeitenCGE 660 March - June 2018 ProjectPejal SahakNoch keine Bewertungen

- Economics Training ManualDokument157 SeitenEconomics Training ManualJesus Ponce GNoch keine Bewertungen

- (IE) Chapter 4 - Investment EfficiencyDokument88 Seiten(IE) Chapter 4 - Investment EfficiencyJane VickyNoch keine Bewertungen

- S/N Name Registration No Sex Sign: January 2023Dokument6 SeitenS/N Name Registration No Sex Sign: January 2023Sam DizongaNoch keine Bewertungen

- Lecture 12 Benefit Cost AnalysisDokument25 SeitenLecture 12 Benefit Cost AnalysisHamad RazaNoch keine Bewertungen

- Af 317 Assignment AnswersDokument5 SeitenAf 317 Assignment Answersannampunga25Noch keine Bewertungen

- Final Exam EconomicsDokument1 SeiteFinal Exam Economicsasel ElmadneNoch keine Bewertungen

- AssignmentDokument7 SeitenAssignmentsmmehedih008Noch keine Bewertungen

- Petroleum Economic EvaluationDokument24 SeitenPetroleum Economic EvaluationSanjeev Singh NegiNoch keine Bewertungen

- BSR3B AO1 2018 Final - ModeratedDokument8 SeitenBSR3B AO1 2018 Final - Moderatedsabelo.j.nkosi.5Noch keine Bewertungen

- Chapter III: Commercial Data: Pre Development CostDokument1 SeiteChapter III: Commercial Data: Pre Development CostGhifahri DamaraNoch keine Bewertungen

- Project Managemnt 2Dokument11 SeitenProject Managemnt 2Estefani GuzmanNoch keine Bewertungen

- Problems On PPEDokument8 SeitenProblems On PPEDibyansu KumarNoch keine Bewertungen

- BP Third Quarter 2010 ResultsDokument38 SeitenBP Third Quarter 2010 ResultsPratik ChavanNoch keine Bewertungen

- Lecture 7 NotesDokument6 SeitenLecture 7 NotesAna-Maria GhNoch keine Bewertungen

- Examen Gestion Financiere Gestion Ratt 2021 EBDokument5 SeitenExamen Gestion Financiere Gestion Ratt 2021 EBanass zidiNoch keine Bewertungen

- Exercise On Capital Budgeting-BSLDokument19 SeitenExercise On Capital Budgeting-BSLShafiul AzamNoch keine Bewertungen

- Cost Premise - 2011Dokument17 SeitenCost Premise - 2011Olusegun OyebanjiNoch keine Bewertungen

- Petroleum Economics 1Dokument78 SeitenPetroleum Economics 1Eya HentatiNoch keine Bewertungen

- Pages From Cost Management For Engineers 01-5Dokument50 SeitenPages From Cost Management For Engineers 01-5Lam NguyenNoch keine Bewertungen

- Republic of The PhilippinesDokument5 SeitenRepublic of The Philippinesjie yinNoch keine Bewertungen

- Malaysia PSCDokument19 SeitenMalaysia PSCRedzuan Ngah100% (1)

- Do 22 DPWHDokument6 SeitenDo 22 DPWHEngineering OfficeNoch keine Bewertungen

- Topic7A Capital Allowances Solutions 2021Dokument8 SeitenTopic7A Capital Allowances Solutions 2021HA Research ConsultancyNoch keine Bewertungen

- Cost Accounting-2 QPDokument7 SeitenCost Accounting-2 QPMohammed MidlajNoch keine Bewertungen

- Cost Load For USACE PDFDokument29 SeitenCost Load For USACE PDFSufi Shah Hamid JalaliNoch keine Bewertungen

- Course Project ReportDokument37 SeitenCourse Project ReportHans SamNoch keine Bewertungen

- (Chapter 6) Gael D Ulrich - A Guide To Chemical Engineering Process Design and Economics (1984, Wiley)Dokument19 Seiten(Chapter 6) Gael D Ulrich - A Guide To Chemical Engineering Process Design and Economics (1984, Wiley)Rosa BrilianaNoch keine Bewertungen

- Capítulo 6 Cálculo Del Costo de Fabricación PDFDokument25 SeitenCapítulo 6 Cálculo Del Costo de Fabricación PDFFrancisco QuirogaNoch keine Bewertungen

- SM CHDokument53 SeitenSM CHInderjeet JeedNoch keine Bewertungen

- Group-7 DPM Phase-1 Rev07Dokument12 SeitenGroup-7 DPM Phase-1 Rev07Riski WijokongkoNoch keine Bewertungen

- Engineering Economics and Finacial Management (HUM 3051)Dokument5 SeitenEngineering Economics and Finacial Management (HUM 3051)uday KiranNoch keine Bewertungen

- Engineering Econs - Project AnalysisDokument15 SeitenEngineering Econs - Project AnalysisClarence AG YueNoch keine Bewertungen

- Indian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaDokument7 SeitenIndian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaRITZ BROWNNoch keine Bewertungen

- Economic Analysis A. Macroeconomic Context: Yap Renewable Energy Development Project (RRP FSM 44469)Dokument5 SeitenEconomic Analysis A. Macroeconomic Context: Yap Renewable Energy Development Project (RRP FSM 44469)AhmedNoch keine Bewertungen

- Depreciation, Depletion and Amortization (Sas 9)Dokument3 SeitenDepreciation, Depletion and Amortization (Sas 9)SadeeqNoch keine Bewertungen

- Cost Workshops On MPWSP (Dec2012) Presentation 3Dokument26 SeitenCost Workshops On MPWSP (Dec2012) Presentation 3L. A. PatersonNoch keine Bewertungen

- Fin304 (Mid-Sem Answers 2021)Dokument9 SeitenFin304 (Mid-Sem Answers 2021)sha ve3Noch keine Bewertungen

- Chapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Dokument31 SeitenChapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNoch keine Bewertungen

- Merak Fiscal Model Library: Trinidad PSC (2005)Dokument3 SeitenMerak Fiscal Model Library: Trinidad PSC (2005)Libya TripoliNoch keine Bewertungen

- Financial Management V2 PDFDokument28 SeitenFinancial Management V2 PDFNeeraj SinghNoch keine Bewertungen

- Engineering EconomyDokument1 SeiteEngineering EconomyLilian Mae Lacno AdanNoch keine Bewertungen

- 3.2 Time Value of Money Inflation EscalationDokument10 Seiten3.2 Time Value of Money Inflation EscalationPrime ShineNoch keine Bewertungen

- Solution Cel 779 Abid Hasan CompressDokument36 SeitenSolution Cel 779 Abid Hasan CompresscricketloversiitNoch keine Bewertungen

- 3415 Corporate Finance Assignment 2: Dean CulliganDokument13 Seiten3415 Corporate Finance Assignment 2: Dean CulliganAdam RogersNoch keine Bewertungen

- Practice Exam #2Dokument12 SeitenPractice Exam #2Mat MorashNoch keine Bewertungen

- Depletion Premium ApplicationDokument10 SeitenDepletion Premium Applicationahmad faisalNoch keine Bewertungen

- CSTUDY Jul23 BACC MAF3A7 Final 20230629202826RDokument3 SeitenCSTUDY Jul23 BACC MAF3A7 Final 20230629202826Rnsibiya18Noch keine Bewertungen

- منهج اقتصاد هندسة نفطDokument5 Seitenمنهج اقتصاد هندسة نفطAhmed BeNoch keine Bewertungen

- Chapter # 07: Long Term Investment and Capital BudgetingDokument73 SeitenChapter # 07: Long Term Investment and Capital BudgetingshakilhmNoch keine Bewertungen

- Merak Fiscal Model Library: Trinidad PSC (2006)Dokument6 SeitenMerak Fiscal Model Library: Trinidad PSC (2006)Libya TripoliNoch keine Bewertungen

- PTTEP - Analyst Meeting 1Q13Dokument31 SeitenPTTEP - Analyst Meeting 1Q13spmzNoch keine Bewertungen

- ICDS - 3 Construction ContractsDokument13 SeitenICDS - 3 Construction Contractskavita.m.yadavNoch keine Bewertungen

- Site C - Summary Report by Special Advisor Peter MilburnDokument46 SeitenSite C - Summary Report by Special Advisor Peter MilburnAlaskaHighwayNews100% (1)

- Ce 8328: Construction Management: Assignment 02Dokument9 SeitenCe 8328: Construction Management: Assignment 02Chiranjaya HulangamuwaNoch keine Bewertungen

- 2017 Aust ProjectDokument1 Seite2017 Aust ProjectMusa MohammadNoch keine Bewertungen

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryVon EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNoch keine Bewertungen

- 159 SnackDokument97 Seiten159 SnackGuy PlaterNoch keine Bewertungen

- Katalog - Rexroth - Bosch - 2016Dokument76 SeitenKatalog - Rexroth - Bosch - 2016sava88Noch keine Bewertungen

- An Overview of The IEEE Color BooksDokument6 SeitenAn Overview of The IEEE Color BooksOhm666Noch keine Bewertungen

- Model A SOLUTIONSDokument8 SeitenModel A SOLUTIONSasdfNoch keine Bewertungen

- Donali Lalich Literature ReviewDokument4 SeitenDonali Lalich Literature Reviewapi-519746057Noch keine Bewertungen

- EV Connect What Is EVSE White PaperDokument13 SeitenEV Connect What Is EVSE White PaperEV ConnectNoch keine Bewertungen

- Acute Coronary Syndrome: Diagnosis and Initial Management: Each YearDokument9 SeitenAcute Coronary Syndrome: Diagnosis and Initial Management: Each YearGabriela Pacheco0% (1)

- RA - Ducting WorksDokument6 SeitenRA - Ducting WorksResearcherNoch keine Bewertungen

- Handbook (P)Dokument224 SeitenHandbook (P)Joe80% (5)

- Journal Homepage: - : IntroductionDokument9 SeitenJournal Homepage: - : IntroductionIJAR JOURNALNoch keine Bewertungen

- Materi B.inggris SMP Kelas 9 Kurikulum 2013Dokument21 SeitenMateri B.inggris SMP Kelas 9 Kurikulum 2013Siti DianurNoch keine Bewertungen

- Dynamic-Light-Scattering - MDLDokument5 SeitenDynamic-Light-Scattering - MDLJose Daniel Izquierdo MorenoNoch keine Bewertungen

- Manual Elspec SPG 4420Dokument303 SeitenManual Elspec SPG 4420Bairon Alvira ManiosNoch keine Bewertungen

- 120 BE5678 CenterDokument2 Seiten120 BE5678 CenterDipika GuptaNoch keine Bewertungen

- 2014 Catbalogan Landslide: September, 17, 2014Dokument6 Seiten2014 Catbalogan Landslide: September, 17, 2014Jennifer Gapuz GalletaNoch keine Bewertungen

- Anish Pandey ResumeDokument4 SeitenAnish Pandey ResumeAnubhav ChaturvediNoch keine Bewertungen

- EE 411-Digital Signal Processing-Muhammad TahirDokument3 SeitenEE 411-Digital Signal Processing-Muhammad TahirQasim FarooqNoch keine Bewertungen

- Ground PlaneDokument1 SeiteGround Planeaeronautical rajasNoch keine Bewertungen

- Indian Standard: Application Guide For Voltage TransformersDokument16 SeitenIndian Standard: Application Guide For Voltage TransformersGnanavel GNoch keine Bewertungen

- Citadel of Kirkuk 1Dokument17 SeitenCitadel of Kirkuk 1ArézAzadNoch keine Bewertungen

- Homoeopathy and MigraineDokument4 SeitenHomoeopathy and MigraineEditor IJTSRDNoch keine Bewertungen

- The Sparkle EffectDokument22 SeitenThe Sparkle EffectVida Betances-ReyesNoch keine Bewertungen

- Alternatives To Shifting Cultivation-248Dokument9 SeitenAlternatives To Shifting Cultivation-248Chandrashekhar KhobragadeNoch keine Bewertungen

- 7MBR75VB120-50: IGBT MODULE (V Series) 1200V / 75A / PIMDokument8 Seiten7MBR75VB120-50: IGBT MODULE (V Series) 1200V / 75A / PIMDanielle ButlerNoch keine Bewertungen

- Staff Code Subject Code Subject Data FromDokument36 SeitenStaff Code Subject Code Subject Data FromPooja PathakNoch keine Bewertungen

- Study Antimicrobial Activity of Lemon (Citrus Lemon L.) Peel ExtractDokument5 SeitenStudy Antimicrobial Activity of Lemon (Citrus Lemon L.) Peel ExtractLoredana Veronica ZalischiNoch keine Bewertungen

- How To Build A GreenhouseDokument67 SeitenHow To Build A GreenhouseBolarinwaNoch keine Bewertungen

- Nanotechnology ApplicationsDokument11 SeitenNanotechnology ApplicationsDivya DivyachilaNoch keine Bewertungen

- Pastor O. I. Kirk, SR D.D LIFE Celebration BookDokument63 SeitenPastor O. I. Kirk, SR D.D LIFE Celebration Booklindakirk1100% (1)