Beruflich Dokumente

Kultur Dokumente

Solution - 08.42

Hochgeladen von

sanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Solution - 08.42

Hochgeladen von

sanCopyright:

Verfügbare Formate

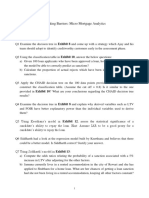

SOLUTION: 8-42

ABSORPTION-COSTING OPERATING INCOME STATEMENTS:

Year 1 Year 2

Sales revenue ............................................................................... $62,500a $62,500d

Less: Cost of goods sold:

Beginning finished-goods inventory .............................. $ 0 $ 5,250e

Cost of goods manufactured .......................................... 31,500b 28,000f

Cost of goods available for sale ..................................... $31,500 $33,250

Ending finished-goods inventory ................................... 5,250c 0

Cost of goods sold .......................................................... $26,250 $33,250

Gross margin ............................................................................... $36,250 $29,250

Selling and administrative expenses ......................................... 22,500 22,500

Operating income ........................................................................ $13,750 $ 6,750

a2,500 units $25 per unit

b$10,500 + $21,000 (i.e., both variable and fixed costs)

c500 units ($31,500/3,000 units)

d2,500 units $25 per unit

eSame as year 1 ending inventory

f$7,000 + $21,000 (i.e., both variable and fixed costs)

1. Variable-costing operating income statements:

Year 1 Year 2

Sales revenue ............................................................................... $62,500a $62,500d

Less: Cost of goods sold:

Beginning finished-goods inventory .............................. $ 0 $ 1,750e

Cost of goods manufactured .......................................... 10,500b 7,000f

Cost of goods available for sale ..................................... $10,500 $ 8,750

Ending finished-goods inventory ................................... 1,750c 0

Cost of goods sold .......................................................... $ 8,750 $ 8,750

Variable selling and administrative costs ...................... $12,500 $12,500

Total variable costs: .................................................................... $21,250 $21,250

Contribution margin .................................................................... $41,250 $41,250

Less: Fixed costs:

Manufacturing .................................................................. $21,000 $21,000

Selling and administrative .............................................. 10,000 10,000

Total fixed costs .............................................................. $31,000 $31,000

Operating income ........................................................................ $10,250 $10,250

a2,500 units $25 per unit

bThe variable manufacturing cost only, $10,500

c500 units ($10,500/3,000 units)

d2,500 units $25 per unit

eSame as year 1 ending inventory

fThe variable manufacturing cost only, $7,000

2. Reconciliation of reported operating income under absorption and variable costing:

Actual Difference in Absorption-

Change in Fixed- Fixed Minus Variable-

Inventory Overhead Overhead Costing

Year (in units) Rate Expensed Op’g Income

1 500 increase $7 $ 3,500 $3,500

2 500 decrease $7* $(3,500) (3,500)

*The 500 units which were sold in year 2, but which were manufactured in year 1,

include an absorption-costing product cost of $7 per unit for fixed overhead. Since

these 500 units were manufactured in year 1, it is the year 1 fixed-overhead rate that is

relevant to this calculation, not the year 2 rate.

Explanation: At the end of year 1, under absorption costing, $3,500 of fixed overhead

remained stored in finished-goods inventory as a product cost (year 1 fixed-overhead rate of

$7 per unit 500 units = $3,500). However, in year 1, under variable costing, that fixed

overhead was expensed as a period cost.

In year 2, under absorption costing, that same $3,500 of fixed overhead was expensed when

the units were sold. However, under variable costing, that $3,500 of fixed overhead cost had

already been expensed in year 1 as a period cost.

Das könnte Ihnen auch gefallen

- Corporate StrategyDokument35 SeitenCorporate StrategyAnonymous 5GHZXlNoch keine Bewertungen

- Retail MGMT InformationDokument21 SeitenRetail MGMT InformationsanNoch keine Bewertungen

- Chapter 2 Strategy, Organization Design and EffectivenessDokument20 SeitenChapter 2 Strategy, Organization Design and EffectivenessNeach Gaoil100% (2)

- Daft OT11e PPT Ch01Dokument18 SeitenDaft OT11e PPT Ch01Jason Higgins100% (1)

- Impacts of GSTDokument41 SeitenImpacts of GSTsanNoch keine Bewertungen

- Contract Management For Procurement and Materials ManagementDokument37 SeitenContract Management For Procurement and Materials ManagementsanNoch keine Bewertungen

- Microeconomics Practice Problem Set #3: TC (Q) 20q TC (Q) 20q P (Q) 200 - QDokument3 SeitenMicroeconomics Practice Problem Set #3: TC (Q) 20q TC (Q) 20q P (Q) 200 - QsanNoch keine Bewertungen

- Innovation-Oriented Operations Strategy Typology and Stage-Based ModelDokument15 SeitenInnovation-Oriented Operations Strategy Typology and Stage-Based ModelsanNoch keine Bewertungen

- The Effectiveness of The Promotional Program: MeasuringDokument30 SeitenThe Effectiveness of The Promotional Program: MeasuringWendy Priscilia ManayangNoch keine Bewertungen

- The Internet Media Utterz, Mocospace, Twango, Mosh: and InteractiveDokument32 SeitenThe Internet Media Utterz, Mocospace, Twango, Mosh: and InteractivesanNoch keine Bewertungen

- Chapter 18Dokument30 SeitenChapter 18sanNoch keine Bewertungen

- Session 15 Role of Leadership in Managing ProjectsDokument17 SeitenSession 15 Role of Leadership in Managing ProjectssanNoch keine Bewertungen

- Aftermarket - MFCW Caselet - Mwr2019 - 24jul19-Release1.0 - 10aug19 - Mwrcal19 - 391Dokument6 SeitenAftermarket - MFCW Caselet - Mwr2019 - 24jul19-Release1.0 - 10aug19 - Mwrcal19 - 391sanNoch keine Bewertungen

- Chapter 16Dokument34 SeitenChapter 16sanNoch keine Bewertungen

- The Internet Media Utterz, Mocospace, Twango, Mosh: and InteractiveDokument32 SeitenThe Internet Media Utterz, Mocospace, Twango, Mosh: and InteractivesanNoch keine Bewertungen

- Break Even AnalysisDokument1 SeiteBreak Even AnalysissanNoch keine Bewertungen

- Public Relations, Publicity, and Corporate Advertising: Mcgraw-Hill/IrwinDokument50 SeitenPublic Relations, Publicity, and Corporate Advertising: Mcgraw-Hill/IrwinJericho ManiegoNoch keine Bewertungen

- Stress: A Demand On Mind and BodyDokument13 SeitenStress: A Demand On Mind and BodysanNoch keine Bewertungen

- You Either Disrupt Your Own Company, or Someone Else Will!Dokument6 SeitenYou Either Disrupt Your Own Company, or Someone Else Will!sanNoch keine Bewertungen

- Chapter 16Dokument34 SeitenChapter 16sanNoch keine Bewertungen

- Sales & Distribution TextDokument16 SeitenSales & Distribution Textchandankbanerje7785100% (1)

- Sessions 1-5Dokument91 SeitenSessions 1-5sanNoch keine Bewertungen

- Innovation and Change: Organization Theory and DesignDokument23 SeitenInnovation and Change: Organization Theory and Designsan100% (1)

- Case QuestionsDokument2 SeitenCase Questionssan75% (4)

- Team Roles in A NutshellDokument2 SeitenTeam Roles in A NutshellsanNoch keine Bewertungen

- Strategic Brand Management Chapter 02Dokument30 SeitenStrategic Brand Management Chapter 02Bilawal Shabbir60% (5)

- Team 3 Presentation On A&d Tech CaseDokument6 SeitenTeam 3 Presentation On A&d Tech CasesanNoch keine Bewertungen

- Case QuestionsDokument2 SeitenCase Questionssan75% (4)

- New Product Forecasting: The Bass ModelDokument4 SeitenNew Product Forecasting: The Bass ModelsanNoch keine Bewertungen

- De Bono Six Thinking HatsDokument3 SeitenDe Bono Six Thinking HatssanNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Alliance Portfolios and Shareholder Value in post-IPO Firms The Moderating Roles of Portfolio Structure and Firm-Level UncertaintyDokument17 SeitenAlliance Portfolios and Shareholder Value in post-IPO Firms The Moderating Roles of Portfolio Structure and Firm-Level Uncertaintygogayin869Noch keine Bewertungen

- Igcse Economics Revision NotesDokument11 SeitenIgcse Economics Revision NotesJakub Kotas-Cvrcek100% (1)

- Final Case Study Reqmt UnileverDokument18 SeitenFinal Case Study Reqmt UnileverEarl Condeza100% (1)

- QUESTIONNAIRE - With AnswersDokument2 SeitenQUESTIONNAIRE - With Answerskeerthi Gopinath100% (1)

- Convention Centre Mohali SiteDokument5 SeitenConvention Centre Mohali SiteBharat Ahuja100% (1)

- Public Budget Line Item WiseDokument5 SeitenPublic Budget Line Item WiseNavin GolyanNoch keine Bewertungen

- Steampunk Settlement: Cover Headline Here (Title Case)Dokument16 SeitenSteampunk Settlement: Cover Headline Here (Title Case)John DeeNoch keine Bewertungen

- What Is A Business Model?Dokument9 SeitenWhat Is A Business Model?Analyn SolitoNoch keine Bewertungen

- CIR v. MarubeniDokument3 SeitenCIR v. MarubeniCharmila SiplonNoch keine Bewertungen

- Philo Task 1Dokument1 SeitePhilo Task 1BABYLYN ENDRINALNoch keine Bewertungen

- Annual Report 2015-2016: Our MissionDokument219 SeitenAnnual Report 2015-2016: Our MissionImtiaz ChowdhuryNoch keine Bewertungen

- Value Based Management Research Article PDFDokument15 SeitenValue Based Management Research Article PDFDr. Purvi DerashriNoch keine Bewertungen

- Public EnterpriseDokument8 SeitenPublic Enterpriseraiac047Noch keine Bewertungen

- Strategy Implementation - WalMartDokument11 SeitenStrategy Implementation - WalMartSatyajitBeheraNoch keine Bewertungen

- Consumer Durables December 2023Dokument33 SeitenConsumer Durables December 2023raghunandhan.cvNoch keine Bewertungen

- Quezon City Polytechnic University: Entrepreneurial BehaviorDokument30 SeitenQuezon City Polytechnic University: Entrepreneurial BehaviorMarinel CorderoNoch keine Bewertungen

- Values and Mission of Coca ColaDokument2 SeitenValues and Mission of Coca ColaUjjwal AryalNoch keine Bewertungen

- Test Bank For Operations and Supply Chain Management The Core 2nd Canadian Edition by JacobsDokument26 SeitenTest Bank For Operations and Supply Chain Management The Core 2nd Canadian Edition by Jacobsa852137207Noch keine Bewertungen

- Pricing Analysis For Merrill Lynch Integrated ChoiceDokument15 SeitenPricing Analysis For Merrill Lynch Integrated ChoiceHealth & WellnessNoch keine Bewertungen

- Arab-Malaysian Merchant Bank BHD V Silver CoDokument11 SeitenArab-Malaysian Merchant Bank BHD V Silver CoSheera Starry0% (1)

- Agreement 2006 Bank of AmericaDokument19 SeitenAgreement 2006 Bank of AmericaNora WellerNoch keine Bewertungen

- Digital Divide - The NoteDokument5 SeitenDigital Divide - The NoteKelvin NTAHNoch keine Bewertungen

- 4strategic Analysis ToolsDokument14 Seiten4strategic Analysis ToolsHannahbea LindoNoch keine Bewertungen

- B.Voc II (Fundamentals in Accouting and Technology (Computer Skill) - IIDokument165 SeitenB.Voc II (Fundamentals in Accouting and Technology (Computer Skill) - IIsharmarohtashNoch keine Bewertungen

- Community Driven Development Vs Community Based Development 1 FinalDokument19 SeitenCommunity Driven Development Vs Community Based Development 1 FinalDona Ameyria75% (4)

- CH 8 Prospects Barriersand Impedimentsto Islamic Bankingin LibyaDokument9 SeitenCH 8 Prospects Barriersand Impedimentsto Islamic Bankingin LibyaMaalejNoch keine Bewertungen

- A Nexteer (34200865SMT) KEPSDokument6 SeitenA Nexteer (34200865SMT) KEPSmonutilisation0Noch keine Bewertungen

- P&GDokument10 SeitenP&GSameed RiazNoch keine Bewertungen

- Consumer ChoiceDokument45 SeitenConsumer ChoiceFazlul Amin ShuvoNoch keine Bewertungen

- Using Financial Statement Information: Electronic Presentations For Chapter 3Dokument47 SeitenUsing Financial Statement Information: Electronic Presentations For Chapter 3Rafael GarciaNoch keine Bewertungen