Beruflich Dokumente

Kultur Dokumente

Reviwer - Nil

Hochgeladen von

Mel paloma0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten2 SeitenThis document provides an overview of negotiable instruments law, including promissory notes, bills of exchange, and checks. It defines key terms like negotiable vs. non-negotiable instruments, and outlines the phases in the life of a negotiable instrument from issuance to discharge. The document also examines the requisites of negotiability for an instrument to be negotiable under the Negotiable Instruments Law, such as containing an unconditional promise to pay a sum certain at a determinable future time.

Originalbeschreibung:

Originaltitel

REVIWER -NIL.docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides an overview of negotiable instruments law, including promissory notes, bills of exchange, and checks. It defines key terms like negotiable vs. non-negotiable instruments, and outlines the phases in the life of a negotiable instrument from issuance to discharge. The document also examines the requisites of negotiability for an instrument to be negotiable under the Negotiable Instruments Law, such as containing an unconditional promise to pay a sum certain at a determinable future time.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten2 SeitenReviwer - Nil

Hochgeladen von

Mel palomaThis document provides an overview of negotiable instruments law, including promissory notes, bills of exchange, and checks. It defines key terms like negotiable vs. non-negotiable instruments, and outlines the phases in the life of a negotiable instrument from issuance to discharge. The document also examines the requisites of negotiability for an instrument to be negotiable under the Negotiable Instruments Law, such as containing an unconditional promise to pay a sum certain at a determinable future time.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

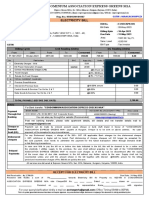

NEGOTIABLE INSTRUMENTS LAW and Negotiable vs. Non-negotiable What is a PN? BoE?

BOUNCING CHECKS LAW Negotiable Non-negotiable Promissory Note Bill of exchange

REVIEW and final details instruments instruments Contains an Contains an

Contains all the Does not contain all unconditional unconditional order

Basic Concepts requisites of Sec. 1 of the requisites of Sec. promise to pay to pay

What are negotiable instruments? the NIL 1 of the NIL Involves two (2) Involves three (3)

Characteristics of negotiable Transferred by Transferred by parties parties

negotiation assignment Maker primarily Drawer only

instruments

Holder in due course Transferee acquires liable secondarily liable

What are the phases in the life of a

may have better rights only of his Only one Generally two

negotiable instrument? rights than transferor transferor presentment needed presentments

Prior parties warrant Prior parties merely – for payment needed – for

Phases in the life of a negotiable instrument payment warrant legality of acceptance and for

Issuance – first delivery of the instrument, title payment

complete in form, to a person who takes it as a Transferee has right Transferee has no

holder (Sec. 191) of recourse against right of recourse What is a Check?

Negotiation – transfer of the instrument and intermediate parties Check Bill of exchange

title thereof to another person Indorsement. Always drawn upon a May or may not be

with delivery, in case of order instruments. Negotiable instruments vs. Negotiable bank or a banker drawn against a bank

Indorsement – a signature on the instrument by documents of title Always payable on May be payable on

the previous holder thereof with the intent of Negotiable Negotiable demand demand or at a fixed

transferring title thereto to a subsequent party. instruments documents of title or determinable

Mere delivery – In case of bearer instruments. Contains all the Does not contain all future time

requisites of Sec. 1 of the requisites of Sec. Not necessary that it Necessary that it be

Phases in the life of a negotiable instrument the NIL 1 of the NIL be presented for presented for

Have right of No secondary liability acceptance acceptance

Presentment for acceptance in certain bills

recourse against of intermediate Drawn on a deposit Not drawn on a

(Sec. 143)

intermediate parties parties deposit

Acceptance – one completed by delivery and

who are secondarily The death of a The death of the

notification (Sec. 191)

liable drawer of a check, drawer of the

Dishonor by non-acceptance Holder in due course Transferee merely with knowledge by ordinary bill does not

Presentment for payment may have better steps into the shoes the banks, revokes revoke the authority

Dishonor by non-payment rights than transferor of transferor the authority of the of the drawee to pay

Notice of dishonor Subject is money Subject is goods banker to pay

Protest in certain cases (Sec. 118, 152 Instrument itself is Instrument is merely Must be presented May be presented for

and 167) property of value evidence of title; for payment within a payment within a

Discharge (Sec. 51, 119) thing of value are the reasonable time after reasonable time after

goods mentioned in its issue (6 months) its last negotiation

the document

What is a Check? HOW NEGOTIABILITY DETERMINED is drawn or the place where it is payable (Sec.

Promissory note Check 1. by the provisions of the NIL, particularly 73) bears a seal (see Art. 2244[4], NCC)

There are two (2) There are three (3) Sec. 1 thereof; designates a particular kind of current money in

parties: the maker parties: the drawer, 2. By considering the whole instrument; which payment is to be made

and the payee the drawee bank and 3. By what appears on the face of the

the payee instrument and not elsewhere. When is an instrument payable on

May be drawn Always drawn against demand?

against any person, a bank SUM CERTAIN When is an instrument payable to

not necessarily a

Determine from the instrument itself order?

bank

May be payable on Always payable on

the amount he is entitled to receive at When is an instrument payable to

demand or at a fixed demand maturity CERTAIN EVEN IF? bearer?

or determinable

future time PROMISE OR ORDER TO PAY UNCONDITIONAL Deficiencies in the Instrument

Contains a promise Contains an order to Unqualified and not dependent on any Issuance

to pay pay uncertain, contingent event. See Sec 3. Mechanical Act of writing (Sec

1)

Check PAYABLE AT A DETERMINABLE FUTURE TIME Delivery (Not affected by: Sec

Crossed check See Sec 4. Determinable even if? 14, 16, 28 124, 193 – personal

Certified check defenses)

General rule: If some other act is required other These deficiencies affect HDC when:

Other negotiable instruments than the payment of money, the instrument is Real defense: S15, 23, 124, 125

non-negotiable.

1. certificates of deposits Ambiguities in the Instrument Sec 17

2. trade acceptances Exceptions: sale of collateral securities if the Signatures in the Instrument

3. bonds in the nature of promissory notes instrument is not paid at maturity confession of General rule: A person whose signature

4. drafts which are bills of exchange judgment if the instrument is not paid at does not appear on the instrument is

drawn by one bank on another maturity waiver of benefit granted by law not liable.

5. letters of credit election of holder to require some other act E:

6. trust receipt S18, 19 [E:S20], 21, rules on agents, 23 –

Validity or negotiability of an instrument is not

REQUISITES OF NEGOTIABILITY affected by (Sec 6) RULES ON FORGERY 134, 135, 22, 29

Not dated (Sec. 17[c]); (Sec. 191, par. 6), Sec. (accommodation party), rules on

Section 1 13, Sec. 17[b], (Sec. 70, 71), (Sec. 144), (Sec. 12) indorsements

PN – WUPO …until Disccharge of Instruments.

BoE – WUPOA Does not specify the value given, or that any

value has been given therefor (Sec. 24; see Art.

1354, NCC) does not specify the place where it

Das könnte Ihnen auch gefallen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Negotiable Instruments Law Reviewer - For CPA Board ExamineesDokument16 SeitenNegotiable Instruments Law Reviewer - For CPA Board ExamineesGlen Ardona100% (2)

- Convention on International Interests in Mobile Equipment - Cape Town TreatyVon EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNoch keine Bewertungen

- NegoDokument2 SeitenNegoYasser AureadaNoch keine Bewertungen

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsVon EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNoch keine Bewertungen

- RFBT Reviewer Nego FreeDokument5 SeitenRFBT Reviewer Nego FreeANNE GRACE MOSQUEDANoch keine Bewertungen

- Binding Promises: The Late 20th-Century Reformation of Contract LawVon EverandBinding Promises: The Late 20th-Century Reformation of Contract LawNoch keine Bewertungen

- Negotiable Instruments Law (Act No. 2031)Dokument5 SeitenNegotiable Instruments Law (Act No. 2031)Laila Ismael SalisaNoch keine Bewertungen

- Negotiable Instruments LawDokument50 SeitenNegotiable Instruments LawAbigail Faye Roxas100% (1)

- Negotiable InstrumentsDokument34 SeitenNegotiable InstrumentsdreaNoch keine Bewertungen

- Negotiable Instruments Law (Sec1-23)Dokument11 SeitenNegotiable Instruments Law (Sec1-23)Julienne GayondatoNoch keine Bewertungen

- For This FridayDokument9 SeitenFor This FridayGlaiee Xiel OlisNoch keine Bewertungen

- Negotiable Instruments ReviewerDokument9 SeitenNegotiable Instruments ReviewerAlyssa MabalotNoch keine Bewertungen

- Nil QuestionsDokument17 SeitenNil QuestionsMark Hiro NakagawaNoch keine Bewertungen

- Introduction Negotiable Instruments LawDokument18 SeitenIntroduction Negotiable Instruments LawcornandpurplecrabNoch keine Bewertungen

- Negotin ReviewerDokument11 SeitenNegotin ReviewerDanaNoch keine Bewertungen

- Negotiable Instruments Law Reviewer MagzDokument15 SeitenNegotiable Instruments Law Reviewer MagzCorneliaAmarraBruhildaOlea-VolterraNoch keine Bewertungen

- Negotiable Instruments Negotiable Documents of TitleDokument33 SeitenNegotiable Instruments Negotiable Documents of TitleMary Grace Peralta ParagasNoch keine Bewertungen

- Negotiable Instruments Law - Philippine Law ReviewersDokument49 SeitenNegotiable Instruments Law - Philippine Law ReviewersRenalyn DarioNoch keine Bewertungen

- Negotiable Instrument Law ReviewerDokument22 SeitenNegotiable Instrument Law ReviewerChris Javier100% (1)

- COMLAW3 Module1 Negotiable Instruments Law A PrimerDokument21 SeitenCOMLAW3 Module1 Negotiable Instruments Law A PrimerAccounting 201Noch keine Bewertungen

- RFBT - Negotiable InstrumentsDokument3 SeitenRFBT - Negotiable InstrumentsMarilyn Cercado FernandezNoch keine Bewertungen

- Mercantile Law Notes PDFDokument34 SeitenMercantile Law Notes PDFtoktor toktorNoch keine Bewertungen

- Negotiable InstrumentDokument4 SeitenNegotiable InstrumentOCAMPO Aubrey HeartNoch keine Bewertungen

- Negotiable Instruments LawDokument45 SeitenNegotiable Instruments LawKate MontenegroNoch keine Bewertungen

- Lecture Notes On Negotiable InstrumentsDokument72 SeitenLecture Notes On Negotiable InstrumentsAmarra Astudillo RoblesNoch keine Bewertungen

- Negotiable Instruments Law NotesDokument16 SeitenNegotiable Instruments Law NotesernestomalupetNoch keine Bewertungen

- Negotiable InstrumentsDokument36 SeitenNegotiable InstrumentsPammyNoch keine Bewertungen

- Commercial Law, Professors Sundiang and Aquino) : Promissory Note Bill of ExchangeDokument10 SeitenCommercial Law, Professors Sundiang and Aquino) : Promissory Note Bill of Exchangeroa yusonNoch keine Bewertungen

- Negotiable Instruments Non-Negotiable InstrumentsDokument3 SeitenNegotiable Instruments Non-Negotiable InstrumentsJi YuNoch keine Bewertungen

- Negotiable Instruments LawDokument41 SeitenNegotiable Instruments LawMiguel Ancheta94% (18)

- Negotiable Instruments LawDokument41 SeitenNegotiable Instruments LawAshAngeLNoch keine Bewertungen

- LAw Course OutlineDokument24 SeitenLAw Course OutlineJhanelle MarquezNoch keine Bewertungen

- Negotiable Instruments Law Notes Atty Zarah Villanueva Castro PDFDokument16 SeitenNegotiable Instruments Law Notes Atty Zarah Villanueva Castro PDFAenacia ReyeaNoch keine Bewertungen

- Negotiable Instruments Law 2003Dokument17 SeitenNegotiable Instruments Law 2003Aejay Villaruz BariasNoch keine Bewertungen

- Negotiable Instruments Law Notes Atty Zarah Villanueva CastroDokument16 SeitenNegotiable Instruments Law Notes Atty Zarah Villanueva CastroMarcelino CasilNoch keine Bewertungen

- Rfbt3 Negoin Lecture NotesDokument14 SeitenRfbt3 Negoin Lecture NotesWilmar Abriol100% (1)

- Law On Negotiable InstrumentsDokument7 SeitenLaw On Negotiable InstrumentsHannah Loren ComendadorNoch keine Bewertungen

- Nego Notes PDFDokument51 SeitenNego Notes PDFSandra DomingoNoch keine Bewertungen

- Negotiable Instruments LawDokument16 SeitenNegotiable Instruments LawgladsNoch keine Bewertungen

- Nego GN 2021Dokument59 SeitenNego GN 2021Envy LaceNoch keine Bewertungen

- Philippine Law Reviewers: Commercial Law - Negotiable Instruments LawDokument47 SeitenPhilippine Law Reviewers: Commercial Law - Negotiable Instruments Lawlebron JamesNoch keine Bewertungen

- NIL WK 1 2Dokument123 SeitenNIL WK 1 2Jeanette Formentera100% (1)

- Personal Notes Nego Law ReviewerDokument11 SeitenPersonal Notes Nego Law ReviewerCherry Pie PoleaNoch keine Bewertungen

- Negotiable Instruments Law Notes Atty Zarah Villanueva CastroDokument16 SeitenNegotiable Instruments Law Notes Atty Zarah Villanueva CastroMadielyn Santarin MirandaNoch keine Bewertungen

- Instruments Law ReviewerDokument11 SeitenInstruments Law ReviewerSam MaligatNoch keine Bewertungen

- Commercial Law - Negotiable Instruments LawDokument9 SeitenCommercial Law - Negotiable Instruments LawMunchie MichieNoch keine Bewertungen

- Negotiable Instruments Prelim Reviewer FinalDokument78 SeitenNegotiable Instruments Prelim Reviewer FinalGrace GamboaNoch keine Bewertungen

- Nego PrelimsDokument117 SeitenNego PrelimsAaron ReyesNoch keine Bewertungen

- Commercial Law-Green-NotesDokument228 SeitenCommercial Law-Green-NotesRalph ValdezNoch keine Bewertungen

- Negotiable Instruments Law (Nil) : (Act No. 2031, Effective June 2, 1911Dokument24 SeitenNegotiable Instruments Law (Nil) : (Act No. 2031, Effective June 2, 1911David MesaNoch keine Bewertungen

- Negotiable Inctruments LawDokument15 SeitenNegotiable Inctruments LawAr Di SagamlaNoch keine Bewertungen

- NOTES IN NEGOTIABLE INSTRUMENTS LAW ClasDokument16 SeitenNOTES IN NEGOTIABLE INSTRUMENTS LAW ClasJohn Carlo MarasiganNoch keine Bewertungen

- Negotiable Instrument: Promissory Note Bill of ExchangeDokument24 SeitenNegotiable Instrument: Promissory Note Bill of ExchangeLuiNoch keine Bewertungen

- Commercial Paper and Credit and Secured Transaction MORESDokument20 SeitenCommercial Paper and Credit and Secured Transaction MORESReymark Mores100% (2)

- Atty. D Old Topics in RFBTDokument51 SeitenAtty. D Old Topics in RFBTKathleen MirallesNoch keine Bewertungen

- Negotiable Instruments Law Reviewer PDFDokument51 SeitenNegotiable Instruments Law Reviewer PDFKarla Mae RicardeNoch keine Bewertungen

- Negotiable InstrumentsDokument60 SeitenNegotiable InstrumentsTrem GallenteNoch keine Bewertungen

- Nego San BedaDokument24 SeitenNego San BedaPrincess BanquilNoch keine Bewertungen

- 12 Business Combination Pt2Dokument1 Seite12 Business Combination Pt2Mel paloma0% (1)

- 1 - Mlqu 18-00306: 1) As Against Party Primarily Liable 2) As Against Persons Secondarily LiableDokument3 Seiten1 - Mlqu 18-00306: 1) As Against Party Primarily Liable 2) As Against Persons Secondarily LiableMel palomaNoch keine Bewertungen

- Audit of InventoryDokument8 SeitenAudit of InventoryMel palomaNoch keine Bewertungen

- Audit of InventoryDokument8 SeitenAudit of InventoryMel palomaNoch keine Bewertungen

- As Against Party Primarily LiableDokument5 SeitenAs Against Party Primarily LiableMel palomaNoch keine Bewertungen

- Everyone Been Tricked Into SlaveryDokument1 SeiteEveryone Been Tricked Into Slavery9REAL9NEWZ9Noch keine Bewertungen

- Internal Factor Evaluation (Ife) of Kotak Mahindra: Key Success Factors Weight Rate ScoreDokument9 SeitenInternal Factor Evaluation (Ife) of Kotak Mahindra: Key Success Factors Weight Rate Scoresimran punjabiNoch keine Bewertungen

- UdaanDokument39 SeitenUdaanAnkit ButtoliaNoch keine Bewertungen

- Brief Case Study On ESEWADokument13 SeitenBrief Case Study On ESEWADear World0% (1)

- Project Report On BFLDokument33 SeitenProject Report On BFLSaurabh BhagatNoch keine Bewertungen

- Brenda Gaba 2021 Electronic Banking ProjectDokument49 SeitenBrenda Gaba 2021 Electronic Banking ProjectsamuelNoch keine Bewertungen

- CCE Quiz Batasan Set - SolutionDokument4 SeitenCCE Quiz Batasan Set - SolutionJoovs JoovhoNoch keine Bewertungen

- Memo of UnderstandingDokument4 SeitenMemo of UnderstandingRaheem Drayton100% (1)

- Saptg ReportDokument3 SeitenSaptg ReportThabo MoalusiNoch keine Bewertungen

- Online Non Bank Finance LandscapeDokument116 SeitenOnline Non Bank Finance LandscapeCrowdfundInsiderNoch keine Bewertungen

- Jose C. Tupaz Iv and Petronila C. Tupaz vs. Ca and BpiDokument7 SeitenJose C. Tupaz Iv and Petronila C. Tupaz vs. Ca and BpiTrem GallenteNoch keine Bewertungen

- Ajay Summer Project Report at AU FINANCIERS PDFDokument71 SeitenAjay Summer Project Report at AU FINANCIERS PDFLekha BorleNoch keine Bewertungen

- Risk Management in E-BankingDokument94 SeitenRisk Management in E-Bankingfrompooja20Noch keine Bewertungen

- Thailand Package - Mr. VinayDokument6 SeitenThailand Package - Mr. Vinayganiguruprasad1_2582Noch keine Bewertungen

- Electricity Bill-35Dokument1 SeiteElectricity Bill-35geswanthuppalNoch keine Bewertungen

- IDFC FIRST Bank Limited Sixth Annual Report FY 2019 20Dokument273 SeitenIDFC FIRST Bank Limited Sixth Annual Report FY 2019 20Sourabh PorwalNoch keine Bewertungen

- The Mystery of Money by Allyn YoungDokument57 SeitenThe Mystery of Money by Allyn YoungLDaggersonNoch keine Bewertungen

- The Global Financial Crisis: Module 3 Housing and MortgagesDokument30 SeitenThe Global Financial Crisis: Module 3 Housing and MortgagesAlanNoch keine Bewertungen

- Session Readings (Euro Issues)Dokument8 SeitenSession Readings (Euro Issues)Arathi SundarramNoch keine Bewertungen

- Acc106 Rubrics For Simulation - Project - 2017Dokument3 SeitenAcc106 Rubrics For Simulation - Project - 2017noordalilarazaliNoch keine Bewertungen

- PNBDokument20 SeitenPNBShuchita BhutaniNoch keine Bewertungen

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Dokument2 SeitenIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)prateekNoch keine Bewertungen

- Cfa CalculatorDokument33 SeitenCfa CalculatorTanvir Ahmed Syed100% (2)

- A Case Study On FINODokument9 SeitenA Case Study On FINOPiyush Singh PrasannaNoch keine Bewertungen

- CurrenciesDokument32 SeitenCurrenciesGenelyn RodriguezNoch keine Bewertungen

- Dork Carding 2017Dokument6 SeitenDork Carding 2017owen011111Noch keine Bewertungen

- Sage 50Dokument68 SeitenSage 50Pau Jagna-anNoch keine Bewertungen

- Punjab National BankDokument4 SeitenPunjab National BankRicky KishoreNoch keine Bewertungen

- Answers To Chapter 27 and 28 CasesDokument4 SeitenAnswers To Chapter 27 and 28 CasesVic RabayaNoch keine Bewertungen

- Risk Parameters and Currency RiskDokument8 SeitenRisk Parameters and Currency RiskaishwaryadoshiNoch keine Bewertungen