Beruflich Dokumente

Kultur Dokumente

109 04 Simple LBO Model

Hochgeladen von

Satyam Mohla0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten2 SeitenLBO LBO

Copyright

© © All Rights Reserved

Verfügbare Formate

XLSX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenLBO LBO

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten2 Seiten109 04 Simple LBO Model

Hochgeladen von

Satyam MohlaLBO LBO

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

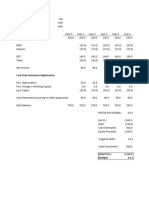

Beginning Debt: 750

Interest: 10%

Tax Rate: 40%

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

EBITDA: 250.0 250.0 250.0 250.0 250.0 250.0

D&A: (35.0) (35.0) (35.0) (35.0) (35.0)

Interest: (75.0) (75.0) (75.0) (75.0) (75.0)

EBT: 140.0 140.0 140.0 140.0 140.0

Taxes: (56.0) (56.0) (56.0) (56.0) (56.0)

Net Income: 84.0 84.0 84.0 84.0 84.0

Cash Flow Statement Adjustments:

Plus: Depreciation: 35.0 35.0 35.0 35.0 35.0

Plus: Change in Working Capital: 6.0 6.0 6.0 6.0 6.0

Less: CapEx: (35.0) (35.0) (35.0) (35.0) (35.0)

Cash Generated (assuming no debt repayment): 90.0 90.0 90.0 90.0 90.0

Debt Balance: 750.0 750.0 750.0 750.0 750.0 750.0

EBITDA Exit Multiple: 6.0 x

Exit EV: 1,500.0

Debt: (750.0)

Cash Generated: 450.0

Equity Proceeds: 1,200.0

Targeted MOIC: 3.0 x

Initial Investment: 400.0

Initial Price: 1,150.0

Multiple: 4.6 x

EBITDA constant.

CapEx = D&A = 35MM (since PP&E stays constant)

CapEx = D&A = 35MM (since PP&E stays constant)

"Source of Funds" at 6MM per year.

CapEx = D&A = 35MM (since PP&E stays constant)

So the initial investment is $400MM to get a 3x MOIC… they used $750MM of debt, so

the total initial purchase price = $400 + $750 = $1150

Das könnte Ihnen auch gefallen

- Calculate MOIC and equity value given constant EBITDA, debt, tax rate and CapExDokument2 SeitenCalculate MOIC and equity value given constant EBITDA, debt, tax rate and CapExTrần Bảo YếnNoch keine Bewertungen

- 109 04 Simple LBO ModelDokument2 Seiten109 04 Simple LBO ModelviktorNoch keine Bewertungen

- 109 04 Simple LBO ModelDokument2 Seiten109 04 Simple LBO ModelTrần Bảo YếnNoch keine Bewertungen

- Case 1 - Tutor GuideDokument3 SeitenCase 1 - Tutor GuideKAR ENG QUAHNoch keine Bewertungen

- Five Year Plan (Service Industry) Model Inputs and Investor ScenarioDokument4 SeitenFive Year Plan (Service Industry) Model Inputs and Investor Scenariomary34d100% (1)

- Debt Policy and ValueDokument7 SeitenDebt Policy and ValueMuhammad Nabil EzraNoch keine Bewertungen

- How leverage affects firm valueDokument5 SeitenHow leverage affects firm valuevinneNoch keine Bewertungen

- Case 26 An Introduction To Debt Policy ADokument5 SeitenCase 26 An Introduction To Debt Policy Amy VinayNoch keine Bewertungen

- Market Value (No Leverage) $60,000/0.10 $600,000Dokument1 SeiteMarket Value (No Leverage) $60,000/0.10 $600,000Kyla Ramos DiamsayNoch keine Bewertungen

- Assumptions:: Simple LBO Model - Key Drivers and Rules of ThumbDokument2 SeitenAssumptions:: Simple LBO Model - Key Drivers and Rules of Thumbw_fibNoch keine Bewertungen

- Sunrise Bakery NPV AnalysisDokument4 SeitenSunrise Bakery NPV Analysisrutvik55% (11)

- Valcon 4Dokument153 SeitenValcon 4Kim BihagNoch keine Bewertungen

- Debt and Policy Value CaseDokument6 SeitenDebt and Policy Value CaseUche Mba100% (2)

- Case Study 2Dokument5 SeitenCase Study 2Tabish Iftikhar SyedNoch keine Bewertungen

- Shivani Khare - Financial Management Assignment 1Dokument18 SeitenShivani Khare - Financial Management Assignment 1shivani khareNoch keine Bewertungen

- CAPITAL STRUCTURE Sums OnlinePGDMDokument6 SeitenCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNoch keine Bewertungen

- 9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsDokument4 Seiten9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsRyan CartaNoch keine Bewertungen

- Capital StructureDokument9 SeitenCapital StructureDEVNoch keine Bewertungen

- Solution Manual For Cfin 5Th Edition by Besley and Brigham Isbn 1305661656 9781305661653 Full Chapter PDFDokument36 SeitenSolution Manual For Cfin 5Th Edition by Besley and Brigham Isbn 1305661656 9781305661653 Full Chapter PDFtiffany.kunst387100% (9)

- FM DJB - RTP Nov 21Dokument14 SeitenFM DJB - RTP Nov 21shubhamsingh143deepNoch keine Bewertungen

- Introduction To Debt PolicyDokument8 SeitenIntroduction To Debt PolicyRatnesh DubeyNoch keine Bewertungen

- Improve ROE with Debt: How Using More Debt Can Help Increase Return on EquityDokument1 SeiteImprove ROE with Debt: How Using More Debt Can Help Increase Return on EquityMaribel ZafeNoch keine Bewertungen

- Case 7 - An Introduction To Debt Policy and ValueDokument5 SeitenCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- Entity Tax Exam ReviewDokument7 SeitenEntity Tax Exam ReviewWesley JacksonNoch keine Bewertungen

- Tarea - 2 Bis - Caso - Hemingway - CorporationDokument8 SeitenTarea - 2 Bis - Caso - Hemingway - CorporationMiguel VázquezNoch keine Bewertungen

- What Is Leveraged Buyout Model Aka LBO Model?Dokument5 SeitenWhat Is Leveraged Buyout Model Aka LBO Model?bhumiklalka999Noch keine Bewertungen

- CA Inter FM Super 50 Q by Sanjay Saraf SirDokument129 SeitenCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNoch keine Bewertungen

- EBIT-EPS AnalysisDokument15 SeitenEBIT-EPS AnalysisKailas Sree ChandranNoch keine Bewertungen

- Pln-Cmams - Capital Structure Impact On ReturnDokument31 SeitenPln-Cmams - Capital Structure Impact On Returndwi suhartantoNoch keine Bewertungen

- Solution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFDokument30 SeitenSolution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFtiffany.kunst387100% (11)

- FormulasDokument9 SeitenFormulasYajZaragozaNoch keine Bewertungen

- CFIN 4th Edition Besley by Besley and Brigham ISBN Solution ManualDokument9 SeitenCFIN 4th Edition Besley by Besley and Brigham ISBN Solution Manualrussell100% (25)

- AN INTRODUCTION TO DEBT POLICY AND VALUE Case Syndicate 1 Cliff, Uri, Ary, KevinDokument7 SeitenAN INTRODUCTION TO DEBT POLICY AND VALUE Case Syndicate 1 Cliff, Uri, Ary, KevinAntonius CliffSetiawanNoch keine Bewertungen

- Financial Analysis of Banking DocumentsDokument3 SeitenFinancial Analysis of Banking Documentsrifat AlamNoch keine Bewertungen

- Traditional Theory Approach: Illustrations 1Dokument7 SeitenTraditional Theory Approach: Illustrations 1PRAMOD VNoch keine Bewertungen

- Accounting 2Dokument2 SeitenAccounting 2Charlene RobleNoch keine Bewertungen

- AB Limited Provides You The Following DataDokument2 SeitenAB Limited Provides You The Following DataRajarshi DaharwalNoch keine Bewertungen

- Practical Practice QuestionsDokument17 SeitenPractical Practice QuestionsGungun SharmaNoch keine Bewertungen

- Consolidation Report (Service Industry)Dokument11 SeitenConsolidation Report (Service Industry)Che PabloNoch keine Bewertungen

- Better Mousetraps ExerciseDokument11 SeitenBetter Mousetraps ExerciseBrl Gnsn0% (1)

- Finlord Traders RatiosDokument6 SeitenFinlord Traders RatiosMUINDI MUASYA KENNEDY D190/18836/2020Noch keine Bewertungen

- Afar Quiz 5 Probs Subsequent To Acqui DateDokument13 SeitenAfar Quiz 5 Probs Subsequent To Acqui DatejajajaredredNoch keine Bewertungen

- Net Present Value Calculator V1.0Dokument1 SeiteNet Present Value Calculator V1.0EyeoSkyNoch keine Bewertungen

- Solution Manual - Capital Budgeting Part 2Dokument21 SeitenSolution Manual - Capital Budgeting Part 2Lab Dema-alaNoch keine Bewertungen

- LU5 Homework AnswersDokument15 SeitenLU5 Homework Answersh9rkbdhx57Noch keine Bewertungen

- Dwnload Full Cfin 4 4th Edition Besley Solutions Manual PDFDokument35 SeitenDwnload Full Cfin 4 4th Edition Besley Solutions Manual PDFbrandihansenjoqll2100% (13)

- Cfin 4 4th Edition Besley Solutions ManualDokument35 SeitenCfin 4 4th Edition Besley Solutions Manualghebre.comatula.75ew100% (22)

- Capital Structure & Dividend ImputationDokument53 SeitenCapital Structure & Dividend Imputationsir bookkeeperNoch keine Bewertungen

- KKTiwari - 18214263 - Worldwide Paper Company-2016Dokument5 SeitenKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNoch keine Bewertungen

- M3 Activity 1Dokument6 SeitenM3 Activity 1Ruffa May GonzalesNoch keine Bewertungen

- Birdie Golf-Hybrid Golf Merger AnalysisDokument8 SeitenBirdie Golf-Hybrid Golf Merger AnalysisSiska Kurniawan0% (1)

- Fall FIN 254.10 Mid QuestionsDokument2 SeitenFall FIN 254.10 Mid QuestionsShariar NehalNoch keine Bewertungen

- Afm Long - Term Financing - LeveragesDokument8 SeitenAfm Long - Term Financing - LeveragesDaniel HaileNoch keine Bewertungen

- Valuing Capital Investment ProjectsDokument16 SeitenValuing Capital Investment ProjectsMetta AprilianaNoch keine Bewertungen

- CA Intermediate - Financial Management Solve Any 3 Questions From The Following 4 Questions Total Marks - 48 Q1)Dokument12 SeitenCA Intermediate - Financial Management Solve Any 3 Questions From The Following 4 Questions Total Marks - 48 Q1)Sohail Ahmed KhiljiNoch keine Bewertungen

- Valuing Capital Investment ProjectsDokument13 SeitenValuing Capital Investment ProjectsSiddhesh MahadikNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Santa’s Bringing Closed-End Funds for Christmas: Financial Freedom, #216Von EverandSanta’s Bringing Closed-End Funds for Christmas: Financial Freedom, #216Noch keine Bewertungen

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsVon EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNoch keine Bewertungen

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- Con PhilDokument48 SeitenCon PhilConica BurgosNoch keine Bewertungen

- Fabric Test ReportDokument4 SeitenFabric Test ReportHasan MustafaNoch keine Bewertungen

- JAR23 Amendment 3Dokument6 SeitenJAR23 Amendment 3SwiftTGSolutionsNoch keine Bewertungen

- Conference ListDokument48 SeitenConference ListDebopriya MajumderNoch keine Bewertungen

- Construct Basic Sentence in TagalogDokument7 SeitenConstruct Basic Sentence in TagalogXamm4275 SamNoch keine Bewertungen

- Insurance Notes - TambasacanDokument13 SeitenInsurance Notes - TambasacanGeymer IhmilNoch keine Bewertungen

- Court rules on nullification of title in ejectment caseDokument1 SeiteCourt rules on nullification of title in ejectment caseNapolyn FernandezNoch keine Bewertungen

- Some People Think We Should Abolish All Examinations in School. What Is Your Opinion?Dokument7 SeitenSome People Think We Should Abolish All Examinations in School. What Is Your Opinion?Bach Hua Hua100% (1)

- JNMF Scholarship Application Form-1Dokument7 SeitenJNMF Scholarship Application Form-1arudhayNoch keine Bewertungen

- Battle of Qadisiyyah: Muslims defeat Sassanid PersiansDokument22 SeitenBattle of Qadisiyyah: Muslims defeat Sassanid PersiansMustafeez TaranNoch keine Bewertungen

- Bernardo Motion For ReconsiderationDokument8 SeitenBernardo Motion For ReconsiderationFelice Juleanne Lador-EscalanteNoch keine Bewertungen

- Management of HBLDokument14 SeitenManagement of HBLAnnaya AliNoch keine Bewertungen

- LG 2 06 Disomangcop V Secretary of Public Works PDFDokument1 SeiteLG 2 06 Disomangcop V Secretary of Public Works PDFirene ibonNoch keine Bewertungen

- Music Business PlanDokument51 SeitenMusic Business PlandrkayalabNoch keine Bewertungen

- Chaitanya Candra KaumudiDokument768 SeitenChaitanya Candra KaumudiGiriraja Gopal DasaNoch keine Bewertungen

- How To Configure User Accounts To Never ExpireDokument2 SeitenHow To Configure User Accounts To Never ExpireAshutosh MayankNoch keine Bewertungen

- Regulatory Framework in Business Transactions: Law On PartnershipDokument16 SeitenRegulatory Framework in Business Transactions: Law On PartnershipDan DiNoch keine Bewertungen

- Causation in CrimeDokument15 SeitenCausation in CrimeMuhammad Dilshad Ahmed Ansari0% (1)

- Carlos Hidalgo (Auth.) - Driving Demand - Transforming B2B Marketing To Meet The Needs of The Modern Buyer-Palgrave Macmillan US (2015)Dokument200 SeitenCarlos Hidalgo (Auth.) - Driving Demand - Transforming B2B Marketing To Meet The Needs of The Modern Buyer-Palgrave Macmillan US (2015)Marko Grbic100% (2)

- E-Mobility - Ladestation - Charging Station in Thalham - Raspberry Pi OCPPDokument8 SeitenE-Mobility - Ladestation - Charging Station in Thalham - Raspberry Pi OCPPjpcmeNoch keine Bewertungen

- 11 Days Banner Advertising Plan for Prothom AloDokument4 Seiten11 Days Banner Advertising Plan for Prothom AloC. M. Omar FaruqNoch keine Bewertungen

- United States v. Hernandez-Maldonado, 1st Cir. (2015)Dokument9 SeitenUnited States v. Hernandez-Maldonado, 1st Cir. (2015)Scribd Government DocsNoch keine Bewertungen

- In Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghDokument1 SeiteIn Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghRohith KumarNoch keine Bewertungen

- ACADEMIC CALENDAR DEGREE AND POSTGRADUATE 2023 2024 1 - Page - 1Dokument2 SeitenACADEMIC CALENDAR DEGREE AND POSTGRADUATE 2023 2024 1 - Page - 1cklconNoch keine Bewertungen

- Demonetisation IndiaDokument71 SeitenDemonetisation IndiaVinay GuptaNoch keine Bewertungen

- Pharma: Conclave 2018Dokument4 SeitenPharma: Conclave 2018Abhinav SahaniNoch keine Bewertungen

- Lucifer Is A Latin Word (From The Words Lucem Ferre), Literally Meaning "Light-Bearer", Which inDokument3 SeitenLucifer Is A Latin Word (From The Words Lucem Ferre), Literally Meaning "Light-Bearer", Which inHendry HuangNoch keine Bewertungen

- International Buffet Menu Rm45.00Nett Per Person Appertizer and SaladDokument3 SeitenInternational Buffet Menu Rm45.00Nett Per Person Appertizer and SaladNorasekin AbdullahNoch keine Bewertungen

- Charity Extends Help To Seniors: Donating Is Made EasierDokument16 SeitenCharity Extends Help To Seniors: Donating Is Made EasierelauwitNoch keine Bewertungen

- Cover Letter For Post of Business Process Improvement CoordinatorDokument3 SeitenCover Letter For Post of Business Process Improvement Coordinatorsandeep salgadoNoch keine Bewertungen