Beruflich Dokumente

Kultur Dokumente

7-14 A. The Bond Is Selling at A Large Premium, Which Means That Its Coupon Rate Is Much Higher Than The

Hochgeladen von

Evince Earl0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten1 SeiteOriginaltitel

calcu.docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten1 Seite7-14 A. The Bond Is Selling at A Large Premium, Which Means That Its Coupon Rate Is Much Higher Than The

Hochgeladen von

Evince EarlCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

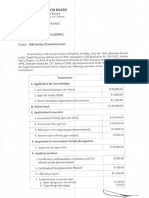

The problem asks you to solve for the YTM and Price, given the following facts:

N = 5 2 = 10, PMT = 80/2 = 40, and FV = 1000. In order to solve for I/YR we need PV.

However, you are also given that the current yield is equal to 8.21%. Given this information, we can

find PV (Price).

Current yield = Annual interest/Current price

0.0821 = $80/PV

PV = $80/0.0821 = $974.42.

Now, solve for the YTM with a financial calculator:

N = 10, PV = -974.42, PMT = 40, and FV = 1000. Solve for I/YR = YTM = 4.32%. However, this is a

periodic rate so the nominal YTM = 4.32%(2) = 8.64%.

7-14 a. The bond is selling at a large premium, which means that its coupon rate is much higher than the

going rate of interest. Therefore, the bond is likely to be called—it is more likely to be called than

to remain outstanding until it matures. Therefore, the likely life remaining on these bonds is 5

years (the time to call).

Das könnte Ihnen auch gefallen

- 12.5 - Practice Test SolutionsDokument15 Seiten12.5 - Practice Test SolutionsCamilo ToroNoch keine Bewertungen

- FI515 Homework3Dokument4 SeitenFI515 Homework3Afifuddin SuhaeliNoch keine Bewertungen

- BKMPR Chapter 12 Posted SolutionsDokument4 SeitenBKMPR Chapter 12 Posted Solutionsamanda_fnsjk7y49234y100% (1)

- Solution Manual For Fundamentals of Corporate Finance 7th Canadian Edition Richard A BrealeyDokument22 SeitenSolution Manual For Fundamentals of Corporate Finance 7th Canadian Edition Richard A BrealeyKarinaMasonprdbc100% (46)

- Bond SolutionDokument13 SeitenBond Solution신동호100% (1)

- Assignment # 5Dokument6 SeitenAssignment # 5Muqaddas Zulfiqar100% (2)

- Chapter 10 - Time Value of MoneyDokument4 SeitenChapter 10 - Time Value of MoneyHannah Mae MoratallaNoch keine Bewertungen

- People Vs AustriaDokument3 SeitenPeople Vs AustriaEvince EarlNoch keine Bewertungen

- Chapter 7 Bonds and Their ValuationDokument8 SeitenChapter 7 Bonds and Their Valuationfarbwn50% (2)

- Homework Solutions (Fundamental of Financial Management)Dokument3 SeitenHomework Solutions (Fundamental of Financial Management)angelvoice89Noch keine Bewertungen

- Solutions Chapter 7Dokument7 SeitenSolutions Chapter 7Judy Anne SalucopNoch keine Bewertungen

- Bond ValuationDokument4 SeitenBond Valuationmanoranjan838241Noch keine Bewertungen

- Ch09 Solations Brigham 10th EDokument12 SeitenCh09 Solations Brigham 10th ERafay HussainNoch keine Bewertungen

- Yield To Maturity Answer KeyDokument2 SeitenYield To Maturity Answer KeyBrandon LumibaoNoch keine Bewertungen

- Solutions Paper - TVMDokument4 SeitenSolutions Paper - TVMsanchita mukherjeeNoch keine Bewertungen

- CH 5 SNDokument17 SeitenCH 5 SNSam TnNoch keine Bewertungen

- Chapter FourDokument14 SeitenChapter FourRawan YasserNoch keine Bewertungen

- Yield To Maturity Yield To CallDokument14 SeitenYield To Maturity Yield To CallAdamNoch keine Bewertungen

- GF520 Unit2 Assignment CorrectionsDokument7 SeitenGF520 Unit2 Assignment CorrectionsPriscilla Morales86% (7)

- Week 3Dokument13 SeitenWeek 3sdfklmjsdlklskfjdNoch keine Bewertungen

- Chapter 5: How To Value Bonds and StocksDokument16 SeitenChapter 5: How To Value Bonds and StocksmajorkonigNoch keine Bewertungen

- Chapter 4. The Time Value of Money and Discounted Cash Flow AnalysisDokument15 SeitenChapter 4. The Time Value of Money and Discounted Cash Flow Analysisw4termel0n33Noch keine Bewertungen

- Chap 005Dokument11 SeitenChap 005Thanh Tung NgNoch keine Bewertungen

- Hashim Imran Wahla InvestmentDokument6 SeitenHashim Imran Wahla Investmentھاشم عمران واھلہNoch keine Bewertungen

- Easy Problem Chapter 9Dokument4 SeitenEasy Problem Chapter 9Natally LangfeldtNoch keine Bewertungen

- Introduction To Valuation: The Time Value of MoneyDokument12 SeitenIntroduction To Valuation: The Time Value of Moneyzahida pervaizNoch keine Bewertungen

- Tutorial Chapter 4Dokument7 SeitenTutorial Chapter 4Dickson WongNoch keine Bewertungen

- Managerial Finance - Session 3Dokument6 SeitenManagerial Finance - Session 3Ahmed el GhandourNoch keine Bewertungen

- FCF Age Chap05smDokument12 SeitenFCF Age Chap05smKinglam Tse100% (2)

- Interest Rates and Bond Valuation: Solutions To Questions and ProblemsDokument7 SeitenInterest Rates and Bond Valuation: Solutions To Questions and ProblemsFelipeNoch keine Bewertungen

- Financial Management Lecture 4thDokument34 SeitenFinancial Management Lecture 4thMansour NiaziNoch keine Bewertungen

- Time Value SolnDokument34 SeitenTime Value SolnAlim Ahmed Ansari100% (1)

- Topic 4 - Time Value of MoneyDokument64 SeitenTopic 4 - Time Value of MoneyHisyam SeeNoch keine Bewertungen

- Yield To Maturit Y: Katherine Joy C. MiclatDokument38 SeitenYield To Maturit Y: Katherine Joy C. MiclatMavis Luna100% (1)

- Chapter 05Dokument6 SeitenChapter 05Nguyễn Ngọc Hoài ThươngNoch keine Bewertungen

- Chapter 2 Time Value of MoneyDokument50 SeitenChapter 2 Time Value of MoneyAMER KHALIQUENoch keine Bewertungen

- RWJ Chapter 4Dokument52 SeitenRWJ Chapter 4Parth ParthNoch keine Bewertungen

- ANSWERS To CHAPTER 6 (Interest Rates and Bond Valuation)Dokument7 SeitenANSWERS To CHAPTER 6 (Interest Rates and Bond Valuation)Jhayzon Ocampo0% (1)

- Selected QuestionsDokument5 SeitenSelected QuestionsMazhar AliNoch keine Bewertungen

- Finance Homework 1Dokument6 SeitenFinance Homework 1Ardian Widi100% (1)

- Lecture 2 Time Value of MoneyDokument52 SeitenLecture 2 Time Value of MoneyMuhammad YahyaNoch keine Bewertungen

- Chapter 7: Interest Rates and Bond ValuationDokument36 SeitenChapter 7: Interest Rates and Bond ValuationHins LeeNoch keine Bewertungen

- The Time Value of Money (Part Two)Dokument41 SeitenThe Time Value of Money (Part Two)TakouhiNoch keine Bewertungen

- Tugas 5 - 08 - Fandy Hidayat NugrahaDokument6 SeitenTugas 5 - 08 - Fandy Hidayat NugrahaFandy Hidayat NNoch keine Bewertungen

- Time Value of Money: Future Value Present Value Annuities Rates of Return AmortizationDokument56 SeitenTime Value of Money: Future Value Present Value Annuities Rates of Return Amortizationsii raiiNoch keine Bewertungen

- Solutions To Problems : Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 11Dokument6 SeitenSolutions To Problems : Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 11Ahmed El KhateebNoch keine Bewertungen

- Planning and Evaluationl English 4Dokument40 SeitenPlanning and Evaluationl English 4Absa TraderNoch keine Bewertungen

- Chapter 4 - Time Value of MoneyDokument8 SeitenChapter 4 - Time Value of MoneyGalindo, Justine Mae M.Noch keine Bewertungen

- Assignment 1 FinDokument23 SeitenAssignment 1 Finritesh0% (1)

- FinMan - Chapter 10 - Time Value of MoneyDokument4 SeitenFinMan - Chapter 10 - Time Value of MoneyHannah Mae MoratallaNoch keine Bewertungen

- CH 5b Extra Problems SolnsDokument8 SeitenCH 5b Extra Problems SolnsDeepak SandhuNoch keine Bewertungen

- Present and Future ValueDokument11 SeitenPresent and Future Valuetazeen fatima RizviNoch keine Bewertungen

- Chapter 5, Time Value of Money - Advanced TopicsDokument60 SeitenChapter 5, Time Value of Money - Advanced Topicslinda zyongweNoch keine Bewertungen

- Chapter 5 FinanceDokument9 SeitenChapter 5 Financexuzhu5Noch keine Bewertungen

- Solutions Guide:: N N D T DDokument1 SeiteSolutions Guide:: N N D T DNahidul Islam IUNoch keine Bewertungen

- 2018 HW2 SolutionDokument5 Seiten2018 HW2 SolutionAhmad Bhatti100% (1)

- 1.3 Time Value of MoneyDokument27 Seiten1.3 Time Value of Moneyafiman1725Noch keine Bewertungen

- CAIIB Retail Banking - Session 1& IIDokument47 SeitenCAIIB Retail Banking - Session 1& IIbhavanakanisettyNoch keine Bewertungen

- Time Value of Money: The Language of Finance The Most Important LessonDokument36 SeitenTime Value of Money: The Language of Finance The Most Important LessonRahmatullah MardanviNoch keine Bewertungen

- High-Q Financial Basics. Skills & Knowlwdge for Today's manVon EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manNoch keine Bewertungen

- G.R. No. L-1571Dokument1 SeiteG.R. No. L-1571Evince EarlNoch keine Bewertungen

- ZZZDokument1 SeiteZZZEvince EarlNoch keine Bewertungen

- ZZZDokument9 SeitenZZZEvince EarlNoch keine Bewertungen

- G.R. No. L-25899Dokument3 SeitenG.R. No. L-25899Evince EarlNoch keine Bewertungen

- 08 069 Fair Trade Coffee The Mainstream Debate Locke PDFDokument23 Seiten08 069 Fair Trade Coffee The Mainstream Debate Locke PDFEvince EarlNoch keine Bewertungen

- Conflict of Laws Notes JURISDICTION LectureDokument2 SeitenConflict of Laws Notes JURISDICTION LectureEvince EarlNoch keine Bewertungen

- Batas 1Dokument2 SeitenBatas 1Evince EarlNoch keine Bewertungen

- Magdalena Obrero, Complainant, vs. Atty. Efren TagalaDokument6 SeitenMagdalena Obrero, Complainant, vs. Atty. Efren TagalaEvince EarlNoch keine Bewertungen

- ZbigzDokument1 SeiteZbigzEvince EarlNoch keine Bewertungen

- Antecedent FactsDokument3 SeitenAntecedent FactsEvince EarlNoch keine Bewertungen

- Antecedent Facts: Tagapamayapa Issued A Certification To File Action in Court in Favor of The PetitionerDokument13 SeitenAntecedent Facts: Tagapamayapa Issued A Certification To File Action in Court in Favor of The PetitionerEvince EarlNoch keine Bewertungen

- Affidavit TemplateDokument1 SeiteAffidavit TemplateEvince EarlNoch keine Bewertungen

- G.R. No. 1755, April 19, 1905: Arellano, C.J.Dokument2 SeitenG.R. No. 1755, April 19, 1905: Arellano, C.J.Evince EarlNoch keine Bewertungen

- G. R. No. 37196, December 23, 1932: HULL, J.Dokument3 SeitenG. R. No. 37196, December 23, 1932: HULL, J.Evince EarlNoch keine Bewertungen

- Tariff of Refill RatesDokument2 SeitenTariff of Refill RatesEvince EarlNoch keine Bewertungen

- First Division G.R. Nos. 38551-53, February 27, 1987: CRUZ, J.Dokument7 SeitenFirst Division G.R. Nos. 38551-53, February 27, 1987: CRUZ, J.Evince EarlNoch keine Bewertungen

- People of The Philippines, Plaintiff-Appellee, vs. Wilfredo Rojas, Teodoro Villarin, Solomon Totoy, Gregorio Tundag and Sinfroso Masong, Defendants-Appellants.Dokument13 SeitenPeople of The Philippines, Plaintiff-Appellee, vs. Wilfredo Rojas, Teodoro Villarin, Solomon Totoy, Gregorio Tundag and Sinfroso Masong, Defendants-Appellants.Evince EarlNoch keine Bewertungen

- Antecedent Facts: Tagapamayapa Issued A Certification To File Action in Court in Favor of The PetitionerDokument13 SeitenAntecedent Facts: Tagapamayapa Issued A Certification To File Action in Court in Favor of The PetitionerEvince EarlNoch keine Bewertungen

- Scribd 1Dokument3 SeitenScribd 1Evince EarlNoch keine Bewertungen

- AC FIN ED 121 AnnouncementDokument1 SeiteAC FIN ED 121 AnnouncementEvince EarlNoch keine Bewertungen

- Criteria For Oral PresentationDokument3 SeitenCriteria For Oral PresentationEvince EarlNoch keine Bewertungen

- ZbigzDokument18 SeitenZbigzEvince EarlNoch keine Bewertungen

- People Vs AustriaDokument24 SeitenPeople Vs AustriaEvince EarlNoch keine Bewertungen

- Ec Water Plus Ec Water Plus: Refilling Station Refilling StationDokument1 SeiteEc Water Plus Ec Water Plus: Refilling Station Refilling StationEvince EarlNoch keine Bewertungen

- Quinagoran VsDokument1 SeiteQuinagoran VsEvince EarlNoch keine Bewertungen

- Lebmo No. 12 Series of 2018Dokument2 SeitenLebmo No. 12 Series of 2018Evince EarlNoch keine Bewertungen

- Business Process Improvement/ReengineeringDokument1 SeiteBusiness Process Improvement/ReengineeringEvince EarlNoch keine Bewertungen

- International Research Journal of Applied FinanceDokument11 SeitenInternational Research Journal of Applied FinanceEvince EarlNoch keine Bewertungen

- 26th ATC Conference GuideDokument8 Seiten26th ATC Conference GuideEvince EarlNoch keine Bewertungen

- ΑΔΕΙΟΔΟΤΗΜΕΝΕΣ ΚΕΠΕΥ ΣΤΙΣ 8 ΑΥΓΟΥΣΤΟΥ 2022Dokument12 SeitenΑΔΕΙΟΔΟΤΗΜΕΝΕΣ ΚΕΠΕΥ ΣΤΙΣ 8 ΑΥΓΟΥΣΤΟΥ 2022Ahmad WaloNoch keine Bewertungen

- Integrated Marketing Communication in CementDokument2 SeitenIntegrated Marketing Communication in CementShimondiNoch keine Bewertungen

- Consumer BehaviorDokument42 SeitenConsumer BehaviorAmeer HamzaNoch keine Bewertungen

- FX Product GuideDokument99 SeitenFX Product GuideVikram SuranaNoch keine Bewertungen

- InvestDokument7 SeitenInvestsweetyNoch keine Bewertungen

- Target Marketing StrategyDokument5 SeitenTarget Marketing StrategyGokul RajendranNoch keine Bewertungen

- OPERATION PLAN HaziqDokument16 SeitenOPERATION PLAN HaziqHaziq Mir100% (1)

- Bus 525 Me l2Dokument41 SeitenBus 525 Me l2Navid Al GalibNoch keine Bewertungen

- Importance of Mass Media in Business: Group 5 PresentersDokument11 SeitenImportance of Mass Media in Business: Group 5 PresentersBibek ThapaNoch keine Bewertungen

- The Effect of Marketing Strategy On Organizational Profitability in The Case of Ontex EthiopiaDokument91 SeitenThe Effect of Marketing Strategy On Organizational Profitability in The Case of Ontex EthiopiaYonasBirhanuNoch keine Bewertungen

- Brand (MarketingDokument20 SeitenBrand (MarketingGrateful CloneNoch keine Bewertungen

- Trader's Journal Cover - Brandon Wendell August 2010Dokument6 SeitenTrader's Journal Cover - Brandon Wendell August 2010mleefxNoch keine Bewertungen

- TOWS MatrixDokument1 SeiteTOWS Matrixangie rosalesNoch keine Bewertungen

- Monopoly - Multiple Choice Questions: Monopoly Online Lesson: MCQ TestDokument7 SeitenMonopoly - Multiple Choice Questions: Monopoly Online Lesson: MCQ TestjeetenjsrNoch keine Bewertungen

- Mid-Term Revision - AnsweredDokument13 SeitenMid-Term Revision - Answeredtoaa ahmedNoch keine Bewertungen

- Presentation TIEDokument13 SeitenPresentation TIEtricia0910Noch keine Bewertungen

- Unit 2 KMBN MK02Dokument36 SeitenUnit 2 KMBN MK02RATANNoch keine Bewertungen

- The Liquidity Time Bomb by Nouriel Roubini - Project SyndicateDokument3 SeitenThe Liquidity Time Bomb by Nouriel Roubini - Project SyndicateNickmann Ba'alNoch keine Bewertungen

- Practice Perf CompDokument28 SeitenPractice Perf CompsooguyNoch keine Bewertungen

- TOS Midterm Applied EconomicsDokument3 SeitenTOS Midterm Applied EconomicsJemimah Corporal100% (1)

- Gitman Chapter1Dokument11 SeitenGitman Chapter1Jehad SelaweNoch keine Bewertungen

- Chapter 04 Testbank: of Mcgraw-Hill EducationDokument59 SeitenChapter 04 Testbank: of Mcgraw-Hill EducationshivnilNoch keine Bewertungen

- Class 12 - Payout Policy - 1Dokument1 SeiteClass 12 - Payout Policy - 1Stepan MaykovNoch keine Bewertungen

- Group Assignment On Variable PricingDokument1 SeiteGroup Assignment On Variable PricingKowshik MoyyaNoch keine Bewertungen

- IA EconomicsDokument3 SeitenIA EconomicsElisa ElisaNoch keine Bewertungen

- IMT Covid19Dokument17 SeitenIMT Covid19ShaileshNoch keine Bewertungen

- Microeconomics 9th Edition Pindyck Solutions ManualDokument35 SeitenMicroeconomics 9th Edition Pindyck Solutions Manualdisponersoosooxlqb100% (30)

- Updated CV Ajmal Dec 2019Dokument2 SeitenUpdated CV Ajmal Dec 2019Abhishek aby5100% (1)

- Matematika Ekonomi Dan BisnisDokument76 SeitenMatematika Ekonomi Dan BisnisSalman Al-fariziNoch keine Bewertungen

- Solved The Marginal and Average Cost Curves of Taxis in MetropolisDokument1 SeiteSolved The Marginal and Average Cost Curves of Taxis in MetropolisM Bilal SaleemNoch keine Bewertungen