Beruflich Dokumente

Kultur Dokumente

Theory of Accounts: Module 1 Overview of Accounting and Introduction To IFRS

Hochgeladen von

Cykee Hanna Quizo LumongsodOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Theory of Accounts: Module 1 Overview of Accounting and Introduction To IFRS

Hochgeladen von

Cykee Hanna Quizo LumongsodCopyright:

Verfügbare Formate

THEORY OF ACCOUNTS

Module 1 Overview of Accounting and Introduction to IFRS

1.1 Overview of Accounting ............................................................................................. 1

1.2 The Accounting Process ............................................................................................. 5

1.3 The Conceptual Framework for Financial Reporting ..................................12

1.4 Preface to International Financial Reporting Standards ............................22

TOAMOD1.1 OVERVIEW OF ACCOUNTING

Definition of Accounting

Accounting is the process of identifying, measuring, and communicating economic information to permit

informed judgment and decisions by users of information.

IDENTIFYING MEASURING COMMUNICATING

Identifying is the process of Measuring is the process of Communicating is the process of

analyzing events and transactions assigning numbers, normally in transforming economic data into

to determine whether or not they monetary terms, to the economic useful accounting information

will be recognized in the books. transactions and events. such as financial statements and

other accounting reports for

Accountable events – recognized Measurement bases: dissemination to users.

in the books through a journal From the Conceptual Framework:

entry made in the books. 1. Historical cost Aspects of the communication

2. Current cost process:

Non-accountable events – not 3. Realizable (settlement) value 1. Recording

recognized but disclosed in the 4. Present value 2. Classifying

notes to financial statements or From the Standards: 3. Summarizing

recorded through a 5. Fair value

memorandum entry when such 6. Fair value less costs to sell Interpreting processed

events have accounting 7. Revalued amount information involves the

relevance. 8. Inflation-adjusted costs computation of financial

statement ratios.

Types of events or transactions: Valuation by fact – items

1. External events measured are unaffected by NOTE: Bookkeeping refers to the

a. Exchange estimates. process of recording the accounts

b. Non-reciprocal transfer or transactions of an entity.

c. Other than transfer Valuation by opinion – items Unlike accounting, it does not

2. Internal events measured are affected by require interpretation of the

a. Production estimates. significance of processed

b. Casualty information.

Basic Purpose of Accounting

The basic purpose of accounting is to provide quantitative financial information about economic activities

intended to be useful in making economic decisions.

Economic entities use accounting Types of information provided by Types of accounting information

to record economic activities, accounting: classified as to users’ needs:

process data, and disseminate 1. Quantitative information – 1. General purpose – designed to

information intended to be useful expressed in numbers, quantities meet the common needs of most

in making economic decisions. or units. financial statement users. It is

2. Qualitative information – governed by GAAP represented

Economic entity – separately expressed in words or descriptive by the IFRSs.

identifiable combination of form. 2. Special purpose – designed to

persons and property that uses or 3. Financial information – meet the specific needs of

controls economic resources to expressed in money. It is also particular financial statement

achieve certain goals or considered a quantitative users. This is provided by other

objectives. Either not-for-profit information. types of accounting other than

or business. financial accounting.

NOTE: To be useful, accounting

Economic activity – affects the information should be stated in a Sources of information in

economic resources and common denominator. For financial statements:

obligations, and consequently, the example, currencies denominated Not obtained exclusively from the

equity of an economic entity. in foreign currencies should be entity’s accounting records. Some

Includes production, exchange, translated to the presentation are obtained from external

consumption, income currency. sources.

distribution, savings and

investment.

Common Branches of Accounting

1. Financial accounting – focuses on general purpose reports of financial position and operating

results known as financial statements.

2. Management accounting – accumulation and communication of information for use by internal

parties or management.

3. Cost accounting – systematic recording and analysis of the costs of materials, labor and overhead

incident to production.

TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS 1

4. Auditing – a systematic process of objectively obtaining and evaluating evidence regarding

assertions about economic actions and events to ascertain the degree of correspondence between

these assertions and established criteria and communicating the results to interested users.

5. Tax accounting – preparation of tax returns and rendering of tax advice, such as determination of

tax consequences of certain proposed business endeavors.

6. Government accounting – accounting for the national government and its instrumentalities,

focusing attention on the custody of public funds and the purpose or purposes to which such funds

are committed.

7. Fiduciary accounting – handling of accounts managed by a person entrusted with the custody and

management of property for the benefit of another.

8. Estate accounting – handling of accounts for fiduciaries who wind up the affairs of a deceased

person.

9. Social accounting – process of communicating the social and environmental effects of

organizations’ economic actions to particular interest groups within society and to society at large.

10. Institutional accounting – accounting for not-for-profit entities other than the government.

11. Accounting systems – installation of accounting procedures for the accumulation of financial data

and designing of accounting forms to be used in data gathering.

Accounting assumptions are the fundamental concepts or principles and basic notions that provide the

foundation of the accounting process.

I. Underlying assumptions – explicitly provided in the Conceptual Framework

1. Going concern assumption – entity is assumed to carry on its operations for an indefinite period

of time

II. Implicit assumptions – not expressly provided in the Conceptual Framework

1. Separate entity – entity is treated separately from its owners

2. Stable monetary unit – items should be stated in terms of a unit of measure (pesos in the

Philippines) and its purchasing power is regarded as stable or constant

3. Time Period – life of the business is divided into series of reporting periods

III. Pervasive – affects all items in the financial statements

1. Materiality concept – information is material if its omission or misstatement could influence

economic decisions, a matter of professional judgment based on information’s size and nature

2. Cost-benefit – cost of processing and communicating information should not exceed the benefits

to be derived from it

IV. Other concepts

1. Accrual basis of accounting – effects of transactions and events are recognized when they occur

2. Concept of articulation – all the components of a complete set of financial statements are

interrelated

3. Full disclosure principle – the nature and amount of information included in financial reports

reflect a series of judgmental trade-offs (sufficient detail vs. sufficient condensation)

4. Consistency concept – financial statements should be prepared on the basis of accounting

principles which are followed consistently from one period to the next

5. Matching – costs are recognized as expenses when the related revenue is recognized

6. Entity theory – accounting objective is geared towards proper income determination (A = L + C)

7. Proprietary theory – accounting objective is geared toward proper valuation of assets (A – L = C)

8. Residual equity theory – applicable where there are two classes of shares issued, ordinary and

preferred (A – L – PSHE = OSHE)

9. Fund theory – accounting objective is neither proper income determination nor proper valuation

of assets but the custody and administration of funds (Cash inflows – Cash outflows = Fund)

10. Realization – process of converting non-cash assets into cash or claims to cash

11. Prudence or Conservatism – inclusion of a degree of caution in the exercise of the judgments

needed in making the estimates required under conditions of uncertainty, such that assets or

income are not overstated and liabilities or expenses are not understated (least effect on equity)

Accountancy refers to the profession or practice of accounting. The practice of accounting can be broadly

subdivided into two – public practice and private practice.

Practice of Public Practice in Commerce Practice in Practice in the

Accountancy and Industry Education/Academe Government

Involves the rendering Refers to employment in Employment in an Employment or

of audit or accounting the private sector in a educational institution appointment to a

related services to more position which involves which involves teaching position in an

than one client on a fee decision making of accounting, auditing, accounting professional

basis. requiring professional management advisory group in government or

knowledge in the services, finance, in a GOCC

science of accounting. business law, taxation.

2 TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS

Accounting standards Accounting standard setting bodies and other

The Generally Accepted Accounting Principles relevant organizations

(GAAP) in the Philippines are represented by the

Philippine Financial Reporting Standards (PFRSs).

PFRSs are Standards and Interpretations adopted by 1. Financial Reporting Standards Council (FRSC)

the Financial Reporting Standards Council (FRSC). - formerly known as Accounting Standards

They comprise: Council (ASC), the official accounting standard

a. Philippine Financial Reporting Standards setting body in the Philippines created under RA

b. Philippine Accounting Standards 9298 by the PRC upon recommendation of BOA

c. Interpretations - composed of 15 individuals – 1 chairperson and

14 members

PFRSs are accompanied by guidance to assist 2. Philippine Interpretations Committee (PIC)

entities in applying their requirements. Guidance - committee formed by the ASC, the predecessor

that is an integral part of the PFRSs is mandatory of FRSC, with the role of reviewing interpretations

while guidance that is not an integral part of the prepared by IFRIC for approval and adoption of

PFRSs does not contain requirements for financial FRSC

statements. 3. Board of Accountancy (BOA)

- professional regulatory board created under RA

Hierarchy of Reporting Standards 9298 to supervise the registration, licensure and

1. PFRSs practice of accountancy in the Philippines

2. In the absence of a Standard or - composed of a chairperson and 6 members

Interpretation that specifically applies to a appointed by the President of the Philippines

transaction, management must use its 4. Securities and Exchange Commission (SEC)

judgment in developing and applying an 5. International Organization of Securities

accounting policy that results in Commission (IOSCO)

information that is relevant and reliable 6. Bureau of Internal Revenue (BIR)

a. Requirements and guidance in 7. Bangko Sentral ng Pilipinas (BSP)

PFRSs dealing with similar and 8. Cooperative Development Authority (CDA)

related issues

b. Conceptual Framework NOTE: Financial reporting standards continuously

c. Most recent pronouncements of change primarily in response to users’ needs.

other standard-setting bodies Changes in financial reporting standards are also

d. Other accounting literature and influenced by legal, political, business and social

accepted industry practices environments.

International Accounting Standards

1. International Accounting Standards Board (IASB) – established in April 2001 as part of the

International Accounting Standards Committee (IASC) Foundation with the responsibility of approving

IFRSs and related documents, such as the Conceptual Framework, exposure drafts and other discussion

documents. The financial reporting standards in the Philippines are adopted from the IASB standards.

NOTE: IFRSs are standards issued by the IASB while IASs are standards issued by the IASC which were

adopted by the IASB.

2. International Financial Reporting Interpretations Committee (IFRIC) – a committee that prepares

interpretations of how specific issues should be accounted for under the application of IFRS where (1) the

standards do not include specific authoritative guidance and (2) there is a risk of divergent and

unacceptable accounting practices. In 2002, IFRIC replaced the former Standing Interpretations Committee

(SIC) which had been created by the IASC.

3. Standards Advisory Council (SAC) – group of organizations and individuals with an interest in

international financial reporting, a body set up to participate in the standard-setting process. Members are

appointed by the IASC Foundation.

4. International Federation of Accountants (IFAC) – a non-profit, non-governmental, non-political

organization of accountancy bodies that represents the worldwide accountancy profession.

Move to IFRSs

Prior to full adoption of the IFRSs in 2005, GAAP in the Philippines were previously based on the

Statements of Financial Accounting Standards (SFAS) issued by Federal Accounting Standards Board

(FASB). The move to IFRSs was primarily brought about by the increasing acceptance of IFRSs worldwide

and increasing internationalization of businesses thereby increasing the need for a common financial

reporting standards that minimizes, if not eliminate, inconsistencies of financial reporting among nations.

The future of IFRSs

In October 2002, FASB and IASB entered into a Memorandum of Understanding (the Norwalk

Agreement), whereby they formalized their commitment to the convergence of US GAAP and IFRSs.

TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS 3

TOAMOD1.2 THE ACCOUNTING PROCESS

Accounting process comprises the activities of identifying, measuring and communicating economic

information that is useful for decision making purposes.

Accounting information system (accounting Management information system is a set of data

system) is the system of collecting and processing gathering, analyzing and reporting functions

transaction data and disseminating financial designed to provide management with the

information to interested parties. It is a subsystem information it needs to carry out its functions.

of MIS. Components are: Components are:

a. Personnel a. Accounting Information System

b. Relevant accounting policies and standards b. Personnel Information System

c. Procedures c. Logistics Information System

d. Equipment and devices

e. Records and reports

Accounting cycle represents the steps or accounting procedures normally used by entities to record

transactions and prepare financial statements. It implements the accounting process.

1. Identifying and analyzing

The accountant gathers information from source documents and determines the impact of the transactions

on the financial position as represented by the basic equation A = L + E.

Accounting records: (1) Source documents, (2) Books of original entry, (3) Books of final entry

Systems of recording transactions: (1) Double-entry system, (2) Single-entry system

2. Journalizing

The process of recording transactions in the journal by means of journal entries.

Journal – a formal record where transactions are initially recorded chronologically through journal entries.

a. General journal – used to record transactions other than those recorded in special journals

b. Special journal – used to record transactions of a similar nature (e.g. Sales journal, Purchase

journal, Cash receipts book, Cash disbursements book)

Type of journal entries:

a. Simple journal entry – single debit and single credit

b. Compound journal entry – two or more debits or credits

c. Adjusting entries – made prior to the preparation of financial statements to update certain

accounts so that they reflect correct balances as at the designated time

d. Closing entries – made at the end of the accounting period after all adjustments have been made to

zero-out the balances of nominal accounts and to update the retained earnings account

e. Reversing entries – entries usually made in the next accounting period to reverse certain adjusting

entries made in the previous accounting period in order to facilitate recording of cash receipts and

disbursements in the next accounting period

f. Correcting entries – made to correct accounting errors committed

g. Reclassification entries – made to transfer an item from one account to another account that better

describes the nature of the item transferred

3. Posting

The process of transferring data from the journal to the appropriate accounts in the ledger. It serves to

classify the effects of transactions on specific asset, liability, equity, income and expense accounts.

Ledger – systematic compilation of a group of accounts.

Kinds of ledger:

a. General ledger – contains all accounts appearing in the financial statements

b. Subsidiary ledger – a supporting ledger consisting of a group of accounts with similar nature, the

total of which is in agreement with the balance of the related controlling account in the general

ledger

Account is the basic storage of information in accounting. Accounts in the ledger follow the format of a T-

account, wherein the left side is called debit and the right side is called credit. Chart of accounts is a list of

all the accounts used by the entity.

a. Real or permanent accounts – not closed at the end of the accounting period

b. Nominal or temporary accounts – closed at the end of the accounting period

c. Mixed accounts – having both statement of financial position and income statement components

d. Contra accounts – offset accounts or accounts which are deducted from the related account

e. Adjunct account – accounts which are added to the related account

4 TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS

4. Unadjusted trial balance (optional)

An internal control as adjusting entries and consequently, financial statements, cannot be prepared unless

the total debits and credits agree.

Trial balance – list of accounts with their balances prepared for the purpose of proving the mathematical

accuracy of the monetary totals of debits and credits in the ledger.

a. Unadjusted trial balance – prepared before the preparation of adjusting entries, contains real,

nominal, and mixed accounts

b. Adjusted trial balance – prepared after the adjusting entries, contains real and nominal accounts

c. Post-closing trial balance – prepared after the closing process, contains real accounts only

Errors revealed by a trial balance:

a. Journalizing or posting one-half of an entry (a debit without credit or vice versa)

b. Recording one part of an entry for a different amount than the other part

c. Errors of transplacement (slide error) on one side of an entry

d. Errors of transposition on one side of an entry

Errors not revealed by a trial balance:

a. Omitting entirely the entry for a transaction

b. Journalizing or posting an entry twice

c. Using wrong account with the same normal balance as the correct account

d. Wrong computation with same erroneous amounts posted to debit and credit sides

5. Adjusting entries

These are made prior to the preparation of the financial statements to update certain asset, liability,

income or expense accounts in order to bring them to their adjusted balances. Involve at least one

statement of financial position account and one statement of profit or loss and other comprehensive

account. All adjusting entries affect the comprehensive income for the period.

a. Accrued expense – expense incurred but not yet paid

b. Accrued income – income earned but not yet received or collected

c. Prepaid expense – expense paid or acquired in advance

d. Unearned income – income already collected but not yet earned

e. Depreciation – systematic allocation of the depreciable amount of an item of property, plant and

equipment over its useful life

f. Uncollectible accounts – customers’ accounts that may no longer be collected or that may possibly

become bad debts

6. Adjusted trial balance (optional)

Worksheet – an analytical device used in accounting to facilitate the gathering of data for adjustments, the

preparation of financial statements, and closing entries. This is optional but usually prepared in practice

using spreadsheet application.

7. Financial statements

These are the means by which the information accumulated and processed in financial accounting is

periodically communicated to the users. These are the end products of the accounting process.

(See Module 2 for a more in-depth discussion)

8. Closing the books

This is the process of preparing closing entries for nominal accounts and ruling and balancing real

accounts. This is an application of the periodicity concept.

Closing entries – prepared at the end of accounting period to “zero out” all temporary or nominal accounts

in the ledger. This is done so that the transactions in a period will not co-mingle with the next period’s

transactions.

9. Post-closing trial balance (optional)

This is prepared after closing the books and contains only statement of financial position accounts since all

income statement accounts would have been closed. This serves as an internal control to ensure the

equality of the debits and credits in the ledger after the closing process.

10. Reversing entries (optional)

Reversing entries – usually made (but not always) on the first day of the next accounting period to reverse

certain adjusting entries made in the immediately preceding period.

Purposes:

a. To facilitate recording of cash receipts and disbursements in the next accounting period

b. For convenience in recording next period’s year-end adjustments for accruals

c. For consistency of accounting procedures

What may be reversed?

a. All accruals, whether for income or expense

b. Prepayments initially recorded using the expense method

c. Unearned income initially recorded using the income method

TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS 5

TOAMOD1.3 THE CONCEPTUAL FRAMEWORK FOR FINANCIAL REPORTING

History of the Framework

Framework for the Preparation and Presentation of Financial Statements (the

1989 April

Framework) was approved by the IASC Board.

1989 July Framework was published.

2001 April Framework adopted by the IASB.

Conceptual Framework for Financial Reporting 2010 (the IFRS Framework) approved

2010 September

by the IASB.

Introduction

A conceptual framework is a coherent system of interrelated basic concepts and propositions that

prescribe objectives, limits, and other fundamentals of financial accounting and serves as a basis for

developing and evaluating accounting principles and resolving accounting and reporting controversies.

Purpose: Authoritative status:

a. Assist the FRSC in developing accounting standards that 1. The Conceptual Framework is not a

represent generally accepted accounting principles in the PFRS and hence does not define

Philippines. standards for any particular

b. Assist the FRSC in its review and adoption of existing measurement or disclosure issue.

international financial reporting standards. 2. In the Conceptual Framework,

c. Assist preparers of financial statements in applying FRSC nothing overrides any specific PFRS.

financial reporting standards and in dealing with topics that 3. If there is a conflict between a

have yet to form the subject of an FRSC statement. requirement of a PFRS and a provision

d. Assist auditors in forming an opinion as to whether financial of the Conceptual Framework, the

statements conform with Philippine generally accepted requirement of the PFRS will prevail.

accounting principles. 4. Hierarchy of guidance:

e. Assist users of financial statements in interpreting the a. PFRSs

information contained in financial statements prepared in b. Similar and related PFRSs

conformity with Philippine generally accepted accounting c. Conceptual Framework

principles. d. Most recent pronouncements of

f. Provide those who are interested in the work of FRSC with other standard-setting bodies

information about its approach to the formation of financial e. Other accounting literature and

reporting standards. accepted industry practices

Scope of the Framework

The framework deals with:

a. The objective of financial reporting

b. The qualitative characteristics of useful information

c. The definition, recognition and measurement of the elements from which financial statements are

constructed

d. Concepts of capital and capital maintenance

Objective of financial reporting

The objective of general purpose financial reporting to provide financial information about the reporting

entity that is useful to existing and potential investors, lenders and other creditors in making decisions

about providing resources to the entity.

Primary users – cannot require reporting entities to provide information directly to them

a. Existing and potential investors

b. Lenders and other creditors

The Framework notes that general purpose financial reports cannot provide all the information that users

may need to make economic decisions. They will need to consider pertinent information from other

sources as well.

Information on economic resources, claims and changes in them

a. Financial position – information on economic resources (assets) and claims against the

reporting entity (liabilities and equity). Assists users to

i. assess that entity's financial strengths and weaknesses

ii. assess liquidity and solvency

iii. assess its need and ability to obtain financing

iv. predict how future cash flows will be distributed among those with a claim on the reporting

entity (information about claims and payment requirements)

b. Changes in economic resources and claims – information on financial performance and other

transactions and events that lead to changes in financial position

i. Financial performance reflected by accrual accounting (statement of comprehensive income)

ii. Financial performance reflected by past cash flows (statement of cash flows)

6 TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS

iii. Changes in economic resources and claims not resulting from financial performance

(statement of changes in equity)

NOTE: To assess future cash flows, all information regarding an entity’s financial position, financial

performance, cash flows, and other changes in financial position must be considered.

Qualitative characteristics of useful information

These identify the types of information that are likely to be most useful to the primary users for making

decisions about the reporting entity on the basis of information in its financial report.

a. Fundamental (Relevance, Faithful representation)

b. Enhancing (Comparability, Verifiability, Timeliness, Understandability)

Fundamental qualitative characteristics

1. Relevance – capability of making a difference in the decisions made by users. Ingredients are:

a. Predictive value – can be used as an input in predicting or forecasting future outcomes.

b. Confirmatory (feedback) value –provides feedback about previous evaluations.

c. Materiality – its omission or misstatement could influence decisions that users make. It is an

entity-specific aspect of relevance based on the nature or magnitude (or both) of the items to which

the information relates in the context of an individual entity's financial report.

2. Faithful representation – financial reports represent economic phenomena in words and in numbers that

it purports to represent. Ingredients are:

a. Completeness – all information necessary for the understanding of the phenomenon being

depicted shall be provided.

b. Neutrality – financial information are selected or presented without bias.

c. Free from error – does not mean accurate in all respects, there are no errors or omissions in the

description of the phenomenon and the process used to produce the reported information has been

selected and applied with no errors in the process.

NOTE: Information must be both relevant and faithfully represented if it is to be useful.

Enhancing qualitative characteristics

1. Comparability – can be compared with similar information about other entities (inter-comparability)

and with similar information about the same entity for another period or another date (intra-

comparability). It enables users to identify and understand similarities in, and differences among, items.

2. Verifiability - different knowledgeable and independent observers could reach consensus, although not

necessarily complete agreement, that a particular depiction is a faithful representation. Verification can be

done through direct observation (direct) or checking inputs to a model, formula and other technique and

recalculating the outputs using the same methodology (indirect).

3. Timeliness - information is available to decision-makers in time to be capable of influencing their

decisions.

4. Understandability – information is classified, characterized and presented clearly and concisely. While

some phenomena are inherently complex and cannot be made easy to understand, to exclude such

information would make financial reports incomplete and potentially misleading. Financial reports are

prepared for users who have a reasonable knowledge of business and economic activities and who

review and analyze the information with diligence.

NOTE: Enhancing qualitative characteristics should be maximized to the extent necessary. However,

enhancing qualitative characteristics (either individually or collectively) cannot make information useful if

that information is irrelevant or not represented faithfully.

The cost constraint on useful financial reporting

Cost is a pervasive constraint on the information that can be provided by general purpose financial

reporting. Reporting such information imposes costs and those costs should be justified by the benefits

of reporting that information. The IASB assesses costs and benefits in relation to financial reporting

generally, and not solely in relation to individual reporting entities. The IASB will consider whether

different sizes of entities and other factors justify different reporting requirements in certain situations.

Underlying assumption

The IFRS Framework states that the going concern assumption is an underlying assumption. Thus, the

financial statements presume that an entity will continue in operation indefinitely or, if that presumption is

not valid, disclosure and a different basis of reporting are required.

Elements of financial statements

TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS 7

1. Elements directly related to financial position (balance sheet):

a. Asset - a resource controlled by the entity as a result of past events and from which future economic

benefits are expected to flow to the entity.

b. Liability - a present obligation of the entity arising from past events, the settlement of which is

expected to result in an outflow from the entity of resources embodying economic benefits.

c. Equity - the residual interest in the assets of the entity after deducting all its liabilities.

2. Elements directly related to performance (income statement):

a. Income - increases in economic benefits during the accounting period in the form of inflows or

enhancements of assets or decreases of liabilities that result in increases in equity, other than those

relating to contributions from equity participants.

i. Revenue – arises in the course of the ordinary activities of an entity and is referred to by a

variety of different names including sales, fees, interest, dividends, royalties and rent.

ii. Gain – other items that meet the definition of income and may, or may not, arise in the course

of the ordinary activities of an entity.

b. Expense - decreases in economic benefits during the accounting period in the form of outflows or

depletions of assets or incurrences of liabilities that result in decreases in equity, other than those

relating to distributions to equity participants.

i. Expense – arise in the course of the ordinary activities of the entity include, for example, cost

of sales, wages and depreciation.

ii. Loss – other items that meet the definition of expenses and may, or may not, arise in the

course of the ordinary activities of the entity.

Recognition of the elements of financial statements

Recognition is the process of incorporating in the balance sheet or income statement an item that meets

the definition of an element and satisfies the following criteria for recognition:

a. It is probable that any future economic benefit associated with the item will flow to or from the

entity; and

b. The item's cost or value can be measured with reliability

Based on these general criteria:

1. An asset is recognized in the balance sheet when it is probable that the future economic benefits will

flow to the entity and the asset has a cost or value that can be measured reliably.

2. A liability is recognized in the balance sheet when it is probable that an outflow of resources

embodying economic benefits will result from the settlement of a present obligation and the amount at

which the settlement will take place can be measured reliably.

3. Income is recognized in the income statement when an increase in future economic benefits related to

an increase in an asset or a decrease of a liability has arisen that can be measured reliably. This means,

in effect, that recognition of income occurs simultaneously with the recognition of increases in assets or

decreases in liabilities (for example, the net increase in assets arising on a sale of goods or services or

the decrease in liabilities arising from the waiver of a debt payable).

4. Expenses are recognized when a decrease in future economic benefits related to a decrease in an asset

or an increase of a liability has arisen that can be measured reliably. This means, in effect, that

recognition of expenses occurs simultaneously with the recognition of an increase in liabilities or a

decrease in assets (for example, the accrual of employee entitlements or the depreciation of equipment).

a. Direct association - costs are recognized as expenses when the related revenue is recognized

b. Systematic and rational allocation – applied when economic benefits are expected to arise over

several accounting periods

c. Immediate recognition

Measurement of the elements of financial statements

Measurement involves assigning monetary amounts at which the elements of the financial statements are

to be recognized and reported. (historical cost, current cost, realizable (settlement) value, present value)

NOTE: Historical cost is the measurement basis most commonly used today, but it is usually combined

with other measurement bases. The IFRS Framework does not include concepts or principles for

selecting which measurement basis should be used for particular elements of financial statements or in

particular circumstances. Individual standards and interpretations do provide this guidance,

however.

Concepts of capital and capital maintenance

1. Concepts of capital

a. Financial concept of capital – capital is synonymous with the net assets or equity of the entity.

b. Physical concept of capital – capital is regarded as the productive capacity of the entity based on,

for example, units of output per day.

2. Concepts of capital maintenance

8 TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS

a. Financial capital maintenance – a profit is earned only if the financial (or money) amount of the

net assets at the end of the period exceeds the financial (or money) amount of the net assets at the

beginning of the period, after excluding any distributions to, and contributions from, owners during

the period. Does not require the use of a particular basis of measurement.

b. Physical capital maintenance – a profit is earned only if the physical productive capacity (or

operating capability) of the entity (or the resources or funds needed to achieve that capacity) at the

end of the period exceeds the physical productive capacity at the beginning of the period, after

excluding any distributions to, and contributions from, owners during the period. Requires the

adoption of the current cost basis of measurement.

NOTE: The principal difference between the two concepts of capital maintenance is the treatment of the

effects of changes in the prices of assets and liabilities of the entity.

TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS 9

TOAMOD1.4 PREFACE TO INTERNATIONAL FINANCIAL REPORTING STANDARDS

History of the Preface to International Financial Reporting Standards

1975 January Preface to International Accounting Standards adopted by IASC

1982 November Preface to International Accounting Standards amended by IASC

2001 July Project to replace the old Preface with a new one was placed on IASB agenda

2001 July Exposure Draft of Preface to International Financial Reporting Standards published

by IASB

2002 May Final Preface to International Financial Reporting Standards published by IASB

2007 December Amendments to Preface approved by the IASB reflecting increase in size of IFRIC to

14 members

Objective of the Preface to IFRS

The objective of the Preface to International Financial Reporting Standards is to set out:

a. the International Accounting Standards Board's (IASB's) mission and objectives

b. the scope of International Financial Reporting Standards (IFRSs)

c. due process for developing IFRSs and Interpretations

d. policies on effective dates, format, and language for IFRSs

Objectives of the IASB

a. to develop, in the public interest, a single set of high quality, understandable, enforceable and

globally accepted financial reporting standards based upon clearly articulated principles. These

standards should require high quality, transparent and comparable information in financial

statements and other financial reporting to help investors, other participants in the world’s capital

markets and other users of financial information make economic decisions;

b. to promote the use and rigorous application of those standards;

c. in fulfilling the objectives associated with (a) and (b), to take account of, as appropriate, the needs

of a range of sizes and types of entities in diverse economic settings; and

d. to promote and facilitate adoption of IFRSs, being the standards and interpretations issued by the

IASB, through the convergence of national accounting standards and IFRSs.

Scope of IFRSs

IASB Standards are known as International Financial Reporting Standards.

All International Accounting Standards (IASs) and Interpretations issued by the former IASC and SIC

continue to be applicable unless and until they are amended or withdrawn.

IFRSs apply to the general purpose financial statements and other financial reporting by profit-

oriented entities – those engaged in commercial, industrial, financial, and similar activities, regardless of

their legal form.

Entities other than profit-oriented business entities may also find IFRSs appropriate.

General purpose financial statements are intended to meet the common needs of shareholders,

creditors, employees, and the public at large for information about an entity's financial position,

performance, and cash flows.

Other financial reporting includes information provided outside financial statements that assists in the

interpretation of a complete set of financial statements or improves users' ability to make efficient

economic decisions.

IFRS apply to individual company and consolidated financial statements.

A complete set of financial statements includes:

a. a statement of financial position

b. a statement of comprehensive income

c. a statement of cash flows

d. a statement of changes in equity

e. a summary of accounting policies, and explanatory notes

When a separate income statement is presented in accordance with IAS 1(2007), it is part of that

complete set.

In developing Standards, IASB intends not to permit choices in accounting treatment. Further, IASB

intends to reconsider the choices in existing IASs with a view to reducing the number of those choices.

IFRS will present fundamental principles in bold face type and other guidance in non-bold type (the

'black-letter'/'grey-letter' distinction). Paragraphs of both types have equal authority.

The provision of IAS 1 Presentation of Financial Statements that conformity with IAS requires compliance

with every applicable IAS and Interpretation requires compliance with all IFRSs as well.

Due process for IFRS

Due process steps for a Standard will normally include the following: (* means required by IFRS

Foundation’s Constitution)

a. staff work to identify and study the issues

b. study of existing national standards and practices

c. IASB consults with Trustees and the Advisory Council about the advisability of adding the project to

the IASB's agenda*

d. IASB normally forms an advisory group

10 TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS

e. IASB publishes a discussion document for comment

f. IASB considers comments received on the discussion document

g. IASB publishes an exposure draft with at least 9 affirmative votes if there are fewer than 16

members, or 10 if there are 16 members* (the exposure draft will include dissenting opinions and

basis for conclusions)

h. IASB considers comments received on the exposure draft*

i. IASB considers the desirability of holding a public hearing and of conducting field tests*

j. IASB approves the final Standard with at least 9 affirmative votes if there are fewer than 16

members, or 10 if there are 16 members* (the Standard will include dissenting opinions and basis

for conclusions)

k. IASB publishes a standard with (i) a basis for conclusions, explaining, among other things, the steps

in the IASB's due process and how the IASB dealt with public comments on the exposure draft, and

(ii) the dissenting opinion of any IASB member*

IASB deliberates in meetings open to public observation

Due process for Interpretations

Interpretations of IFRS will be developed by the IFRS Interpretations Committee for approval by IASB

Due process steps for an Interpretation will normally include: (* means required by IFRS Foundation's

Constitution)

a. staff work to identify and study the issues and existing national standards and practices

b. The IFRS Interpretations Committee studies national standards and practices

c. The IFRS Interpretations Committee publishes a draft Interpretation for comment if no more than 4

Committee members have voted against the proposal*

d. The IFRS Interpretations Committee considers comments received on the draft Interpretation

within a reasonable period of time

e. The IFRS Interpretations Committee approves the final Interpretation if no more than 4

Interpretations Committee members have voted against the proposal and submits it to IASB*

f. IASB approves the final Interpretation by at least 9 affirmative votes of IASB if there are fewer than

16 members, or by 10 of its members if there are 16 members*

The IFRS Interpretations Committee deliberates in meetings open to public observation

Effective dates

Each IFRS and Interpretation will set out its own effective date and transition provisions. New or revised

IFRSs set out transitional provisions to be applied on their initial application.

Language

English is the official language of IASB discussion documents, exposure drafts, IFRSs, and Interpretations.

IASB may approve translations if the process assures the quality of the translation, and IASB may license

other translations.

TOAMOD1 OVERVIEW OF ACCOUNTING AND INTRODUCTION TO IFRS 11

Das könnte Ihnen auch gefallen

- Mas Cpar Reviewer in 5th Year AccDokument67 SeitenMas Cpar Reviewer in 5th Year AccCykee Hanna Quizo Lumongsod100% (1)

- Singleton v. Cannizzaro FILED 10 17 17Dokument62 SeitenSingleton v. Cannizzaro FILED 10 17 17Monique Judge100% (1)

- (Mas) 07 - Capital BudgetingDokument7 Seiten(Mas) 07 - Capital BudgetingCykee Hanna Quizo Lumongsod100% (1)

- (Mas) 07 - Capital BudgetingDokument7 Seiten(Mas) 07 - Capital BudgetingCykee Hanna Quizo Lumongsod100% (1)

- U.S. Individual Income Tax Return: Miller 362-94-3108 DeaneDokument2 SeitenU.S. Individual Income Tax Return: Miller 362-94-3108 DeaneKeith MillerNoch keine Bewertungen

- Code of Ethics 5th Year Acc. ReviewDokument10 SeitenCode of Ethics 5th Year Acc. ReviewCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Lesson 1 CFASDokument14 SeitenLesson 1 CFASkenneth coronelNoch keine Bewertungen

- Audit Sampling Notes and Answers To Quiz. Accounting Help.Dokument17 SeitenAudit Sampling Notes and Answers To Quiz. Accounting Help.Cykee Hanna Quizo LumongsodNoch keine Bewertungen

- The Municipality of Santa BarbaraDokument10 SeitenThe Municipality of Santa BarbaraEmel Grace Majaducon TevesNoch keine Bewertungen

- ACC2023 - CFAS Note 1 Conceptual Framework and Accounting StandardsDokument10 SeitenACC2023 - CFAS Note 1 Conceptual Framework and Accounting StandardsHailsey WinterNoch keine Bewertungen

- Fundamental of Accounting: Chapter 1-2Dokument31 SeitenFundamental of Accounting: Chapter 1-2Renshey Cordova MacasNoch keine Bewertungen

- Basic Accounting Crash CourseDokument5 SeitenBasic Accounting Crash CourseCyra JimenezNoch keine Bewertungen

- UBFHA V S BF HomesDokument11 SeitenUBFHA V S BF HomesMonique LhuillierNoch keine Bewertungen

- Accounts Notes For BCA - IncompleteDokument56 SeitenAccounts Notes For BCA - IncompleteSahil Kumar Gupta100% (1)

- Citizen's Army Training (CAT) Is A Compulsory Military Training For High School Students. Fourth-Year High SchoolDokument2 SeitenCitizen's Army Training (CAT) Is A Compulsory Military Training For High School Students. Fourth-Year High SchoolJgary Lagria100% (1)

- Midterm AcctgDokument47 SeitenMidterm AcctgRie AerisNoch keine Bewertungen

- Notes On Introduction To AccountingDokument6 SeitenNotes On Introduction To AccountingChaaru VarshiniNoch keine Bewertungen

- Accounting 1: Fundamental ofDokument78 SeitenAccounting 1: Fundamental ofLuisitoNoch keine Bewertungen

- English File: Grammar, Vocabulary, and PronunciationDokument4 SeitenEnglish File: Grammar, Vocabulary, and PronunciationFirstName100% (2)

- Business Law Preboard FinalDokument7 SeitenBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Business Law Preboard FinalDokument7 SeitenBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Module 1 - Updates in Financial Reporting StandardsDokument5 SeitenModule 1 - Updates in Financial Reporting StandardsJayaAntolinAyuste100% (1)

- Ifrs 17 Project SummaryDokument16 SeitenIfrs 17 Project Summarymarhadi100% (1)

- Ifrs 17 Project SummaryDokument16 SeitenIfrs 17 Project Summarymarhadi100% (1)

- Ifrs 17 Project SummaryDokument16 SeitenIfrs 17 Project Summarymarhadi100% (1)

- Global Supply Chain Top 25 Report 2021Dokument19 SeitenGlobal Supply Chain Top 25 Report 2021ImportclickNoch keine Bewertungen

- Conceptual-Framework-and-Accounting-Standards-REVIEW-SERIES Part 1Dokument135 SeitenConceptual-Framework-and-Accounting-Standards-REVIEW-SERIES Part 1leahlynsantos14100% (1)

- Chapter 4 Lesson ProperDokument44 SeitenChapter 4 Lesson ProperWenceslao LynNoch keine Bewertungen

- Accounting Notes From MillanDokument14 SeitenAccounting Notes From MillanDovelyn DorinNoch keine Bewertungen

- Academics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerDokument5 SeitenAcademics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerAlexa Abary100% (1)

- TOAMOD1 Overview of Accounting and Introduction To IFRS No AnswerDokument25 SeitenTOAMOD1 Overview of Accounting and Introduction To IFRS No AnswerJessa Mae Legados VillavicencioNoch keine Bewertungen

- Overview of AccountingDokument10 SeitenOverview of AccountingAibee Jeanne RegisNoch keine Bewertungen

- Cfas Lesson 1Dokument5 SeitenCfas Lesson 1Rosemalyn JoseNoch keine Bewertungen

- Cbactg01 Chapter 1 ModuleDokument16 SeitenCbactg01 Chapter 1 ModuleJohn DavisNoch keine Bewertungen

- Conceptual Framework Chapter 1-10Dokument112 SeitenConceptual Framework Chapter 1-10Earone MacamNoch keine Bewertungen

- 1 Introduction To AccountingDokument4 Seiten1 Introduction To AccountingWea AmorNoch keine Bewertungen

- 2nd Term - CFASDokument6 Seiten2nd Term - CFASPam LlanetaNoch keine Bewertungen

- Module 1: Overview of AccountingDokument9 SeitenModule 1: Overview of AccountingMon RamNoch keine Bewertungen

- 11 Accountancy Theory - 2022-23 (EM)Dokument36 Seiten11 Accountancy Theory - 2022-23 (EM)kms195kds2007Noch keine Bewertungen

- Overview of AccountingDokument8 SeitenOverview of Accountingrosemart krangNoch keine Bewertungen

- Overview of AccountingDokument4 SeitenOverview of AccountingheeeyjanengNoch keine Bewertungen

- 3 Important Activities Included in The Definition of AccountingDokument10 Seiten3 Important Activities Included in The Definition of AccountingPrecious ViterboNoch keine Bewertungen

- Introduction To Accounting Basic AccountingDokument16 SeitenIntroduction To Accounting Basic AccountingNiña VelinaNoch keine Bewertungen

- Accounting ReviewerDokument9 SeitenAccounting ReviewerLearni SarabiaNoch keine Bewertungen

- I Am Sharing 'UPDATED' With YouDokument258 SeitenI Am Sharing 'UPDATED' With Youjessamae gundanNoch keine Bewertungen

- Week 1 - Lesson 1 Overview of AccountingDokument10 SeitenWeek 1 - Lesson 1 Overview of AccountingRose RaboNoch keine Bewertungen

- Accounting 1st SemDokument5 SeitenAccounting 1st SemFrancez Sophia BasilioNoch keine Bewertungen

- College of Business and Accountancy: Topic: Overview of Accounting Learning OutcomesDokument10 SeitenCollege of Business and Accountancy: Topic: Overview of Accounting Learning OutcomesYasa ShiNoch keine Bewertungen

- PDF DocumentDokument13 SeitenPDF DocumentMaureen MahusayNoch keine Bewertungen

- Overview of AccountingDokument8 SeitenOverview of AccountingCrystal Irish HilarioNoch keine Bewertungen

- Conceptual Framework and Accounting StandardsDokument35 SeitenConceptual Framework and Accounting StandardsAlyssa MangaoNoch keine Bewertungen

- Chap 1-4Dokument20 SeitenChap 1-4Rose Ann Robante TubioNoch keine Bewertungen

- ACT103 - Topic 1Dokument3 SeitenACT103 - Topic 1Juan FrivaldoNoch keine Bewertungen

- Definition of AccountingDokument3 SeitenDefinition of AccountingMaiNoch keine Bewertungen

- BAM 1 - Fundamentals of AccountingDokument33 SeitenBAM 1 - Fundamentals of AccountingimheziiyyNoch keine Bewertungen

- Cfas NotesDokument15 SeitenCfas NotesGio BurburanNoch keine Bewertungen

- Actg2 At1 Bsa1bDokument6 SeitenActg2 At1 Bsa1bHans Ivan MañuscaNoch keine Bewertungen

- Fabm-1 1Dokument3 SeitenFabm-1 1ignaciorojhieannpelayoNoch keine Bewertungen

- Module 1: Development of The Financial Reporting FrameworkDokument56 SeitenModule 1: Development of The Financial Reporting FrameworkLlyana paula SuyuNoch keine Bewertungen

- ACT103 - Topic 1Dokument3 SeitenACT103 - Topic 1Juan FrivaldoNoch keine Bewertungen

- REVIEWER ACCOUNTING TUTORIAL Chapter 1-4Dokument20 SeitenREVIEWER ACCOUNTING TUTORIAL Chapter 1-4bae joohyunNoch keine Bewertungen

- Lecture Notes OnDokument36 SeitenLecture Notes OnNaresh GuduruNoch keine Bewertungen

- Toa Overview of Accounting FHVDokument41 SeitenToa Overview of Accounting FHVJohn Emerson PatricioNoch keine Bewertungen

- Summary 2Dokument4 SeitenSummary 2Anne Thea AtienzaNoch keine Bewertungen

- Financial Statements of A Company: Earning BjectivesDokument27 SeitenFinancial Statements of A Company: Earning BjectivesGobi DurairajNoch keine Bewertungen

- Term1 Cycle 1 Notes On Chapter 1 Xi AccountancyDokument5 SeitenTerm1 Cycle 1 Notes On Chapter 1 Xi AccountancyCelestialNoch keine Bewertungen

- Introduction To Accounting Discussion: Definition & Nature: Essential ElementsDokument2 SeitenIntroduction To Accounting Discussion: Definition & Nature: Essential Elementsmarygrace carbonelNoch keine Bewertungen

- 01 IntroductionDokument3 Seiten01 IntroductionEdizon De Andres JaoNoch keine Bewertungen

- Notes On Introduction To AccountingDokument6 SeitenNotes On Introduction To AccountingVRINDA TOSHNIWAL DPSN-STDNoch keine Bewertungen

- Financial Accounting BBA MUDokument19 SeitenFinancial Accounting BBA MUbhimNoch keine Bewertungen

- Basic Concepts in Accounting: AbstractDokument7 SeitenBasic Concepts in Accounting: AbstractinChristVeluz AgeasNoch keine Bewertungen

- Accounting NotesDokument71 SeitenAccounting Noteswaseem ahsanNoch keine Bewertungen

- Theory of AccountsDokument8 SeitenTheory of AccountsAcain RolienNoch keine Bewertungen

- Basic ConceptsDokument5 SeitenBasic ConceptsAgatha ApolinarioNoch keine Bewertungen

- SMA Lecture Notes E2Dokument99 SeitenSMA Lecture Notes E2Zill-e-huda hashmiNoch keine Bewertungen

- DBM Employee Sourcing NotesDokument91 SeitenDBM Employee Sourcing Notesjxmzeey420Noch keine Bewertungen

- BKP-Lecture 072328Dokument12 SeitenBKP-Lecture 072328Sandy EdpalinaNoch keine Bewertungen

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Von Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Noch keine Bewertungen

- Afar (Assignment) - Ambus, Daisy JaneDokument9 SeitenAfar (Assignment) - Ambus, Daisy JaneCykee Hanna Quizo LumongsodNoch keine Bewertungen

- 1905 Cash and Accounts ReceivableDokument9 Seiten1905 Cash and Accounts ReceivableCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Cpar P2 07.28.13 PDFDokument6 SeitenCpar P2 07.28.13 PDFJean PaladaNoch keine Bewertungen

- Taxation TRAIN LawDokument48 SeitenTaxation TRAIN LawCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Reflecting About Your Experience - Career and Professional Development - Virginia TechDokument4 SeitenReflecting About Your Experience - Career and Professional Development - Virginia TechCykee Hanna Quizo LumongsodNoch keine Bewertungen

- 1907 Notes Receivable and Loan ImpairmentDokument4 Seiten1907 Notes Receivable and Loan ImpairmentCykee Hanna Quizo Lumongsod100% (2)

- Business Combination - AcquisitionDokument16 SeitenBusiness Combination - AcquisitionAries Gonzales CaraganNoch keine Bewertungen

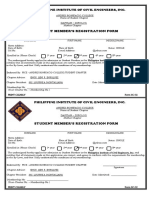

- Student Member'S Registration Form: Philippine Institute of Civil Engineers, IncDokument1 SeiteStudent Member'S Registration Form: Philippine Institute of Civil Engineers, IncCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Business Combination - AcquisitionDokument16 SeitenBusiness Combination - AcquisitionAries Gonzales CaraganNoch keine Bewertungen

- Assignment FARDokument2 SeitenAssignment FARCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Student Member'S Registration Form: Philippine Institute of Civil Engineers, IncDokument1 SeiteStudent Member'S Registration Form: Philippine Institute of Civil Engineers, IncCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Theoretical Framework and Review of Related LiteratureDokument6 SeitenTheoretical Framework and Review of Related LiteratureCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Student Member'S Registration Form: Philippine Institute of Civil Engineers, IncDokument1 SeiteStudent Member'S Registration Form: Philippine Institute of Civil Engineers, IncCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Theoretical Framework and Review of Related LiteratureDokument6 SeitenTheoretical Framework and Review of Related LiteratureCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Financial Statement Presentation. Theory of Accounts GuideDokument20 SeitenFinancial Statement Presentation. Theory of Accounts GuideCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Notes and Summary in Product Costing With QuizzerDokument12 SeitenNotes and Summary in Product Costing With QuizzerCykee Hanna Quizo LumongsodNoch keine Bewertungen

- 1905 Cash and Accounts ReceivableDokument9 Seiten1905 Cash and Accounts ReceivableCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Financial Statement Presentation. Theory of Accounts GuideDokument20 SeitenFinancial Statement Presentation. Theory of Accounts GuideCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Notes and Summary in Product Costing With QuizzerDokument12 SeitenNotes and Summary in Product Costing With QuizzerCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Indian Retail Industry: Structure, Drivers of Growth, Key ChallengesDokument15 SeitenIndian Retail Industry: Structure, Drivers of Growth, Key ChallengesDhiraj YuvrajNoch keine Bewertungen

- Venetian Shipping During The CommercialDokument22 SeitenVenetian Shipping During The Commercialakansrl100% (1)

- Class XI Economics 2011Dokument159 SeitenClass XI Economics 2011Ramita Udayashankar0% (1)

- A Detailed Lesson Plan - The Fundamental Law of ProportionDokument10 SeitenA Detailed Lesson Plan - The Fundamental Law of ProportionPrincess De LeonNoch keine Bewertungen

- Richard Steele: 2 in PoliticsDokument4 SeitenRichard Steele: 2 in PoliticszunchoNoch keine Bewertungen

- Bosaf36855 1409197541817Dokument3 SeitenBosaf36855 1409197541817mafisco3Noch keine Bewertungen

- Soft Skills PresentationDokument11 SeitenSoft Skills PresentationRishabh JainNoch keine Bewertungen

- Chapter 11 Towards Partition Add Pakistan 1940-47Dokument5 SeitenChapter 11 Towards Partition Add Pakistan 1940-47LEGEND REHMAN OPNoch keine Bewertungen

- Portfolio Assignment MaternityDokument2 SeitenPortfolio Assignment Maternityapi-319339803100% (1)

- The Rime of The Ancient Mariner (Text of 1834) by - Poetry FoundationDokument19 SeitenThe Rime of The Ancient Mariner (Text of 1834) by - Poetry FoundationNeil RudraNoch keine Bewertungen

- Solar SystemDokument3 SeitenSolar SystemKim CatherineNoch keine Bewertungen

- The Foundations of Ekistics PDFDokument15 SeitenThe Foundations of Ekistics PDFMd Shahroz AlamNoch keine Bewertungen

- Use Case Diagram ShopeeDokument6 SeitenUse Case Diagram ShopeeAtmayantiNoch keine Bewertungen

- Business Research Chapter 1Dokument27 SeitenBusiness Research Chapter 1Toto H. Ali100% (2)

- Catibog Approval Sheet EditedDokument10 SeitenCatibog Approval Sheet EditedCarla ZanteNoch keine Bewertungen

- Foods: Ffee AdulterationDokument11 SeitenFoods: Ffee AdulterationJpNoch keine Bewertungen

- Minneapolis Police Department Lawsuit Settlements, 2009-2013Dokument4 SeitenMinneapolis Police Department Lawsuit Settlements, 2009-2013Minnesota Public Radio100% (1)

- Poetry Analysis The HighwaymanDokument7 SeitenPoetry Analysis The Highwaymanapi-257262131Noch keine Bewertungen

- Bartolome vs. MarananDokument6 SeitenBartolome vs. MarananStef OcsalevNoch keine Bewertungen

- Hop Movie WorksheetDokument3 SeitenHop Movie WorksheetMARIA RIERA PRATSNoch keine Bewertungen

- Review - ChE ThermoDokument35 SeitenReview - ChE ThermoJerome JavierNoch keine Bewertungen

- The Organization of PericentroDokument33 SeitenThe Organization of PericentroTunggul AmetungNoch keine Bewertungen