Beruflich Dokumente

Kultur Dokumente

DPWH Vs Tecson, G.R. No. 179334

Hochgeladen von

sandrex67%(3)67% fanden dieses Dokument nützlich (3 Abstimmungen)

888 Ansichten2 SeitenThe Supreme Court ruled that just compensation for property taken by the government through eminent domain should be based on the current market value of the property, not the value at the time of the original taking. The court awarded the respondents the current market value of their property taken in 1940 to build a highway, plus interest computed from the date of taking until payment based on changing interest rates. Additional compensation of exemplary damages and attorney's fees were also awarded due to the taking occurring without expropriation proceedings. The total amount due to the respondents as of 2014 was over 1.7 million pesos.

Originalbeschreibung:

EMENINT DOMAIN CASE DIGEST

Originaltitel

DPWH vs Tecson, G.R. No. 179334

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe Supreme Court ruled that just compensation for property taken by the government through eminent domain should be based on the current market value of the property, not the value at the time of the original taking. The court awarded the respondents the current market value of their property taken in 1940 to build a highway, plus interest computed from the date of taking until payment based on changing interest rates. Additional compensation of exemplary damages and attorney's fees were also awarded due to the taking occurring without expropriation proceedings. The total amount due to the respondents as of 2014 was over 1.7 million pesos.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

67%(3)67% fanden dieses Dokument nützlich (3 Abstimmungen)

888 Ansichten2 SeitenDPWH Vs Tecson, G.R. No. 179334

Hochgeladen von

sandrexThe Supreme Court ruled that just compensation for property taken by the government through eminent domain should be based on the current market value of the property, not the value at the time of the original taking. The court awarded the respondents the current market value of their property taken in 1940 to build a highway, plus interest computed from the date of taking until payment based on changing interest rates. Additional compensation of exemplary damages and attorney's fees were also awarded due to the taking occurring without expropriation proceedings. The total amount due to the respondents as of 2014 was over 1.7 million pesos.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

SECRETARY OF THE DEPARTMENT OF PUBLIC WORKS AND HIGHWAYS AND DISTRICT

ENGINEER CELESTINO R. CONTRERAS, Petitioners, v. SPOUSES HERACLEO AND

RAMONA TECSON, Respondents.

G.R. No. 179334, April 21, 2015

Facts: In 1940, Department of Public Works and Highways (DPWH) took

respondents-movants' subject property without the benefit of expropriation

proceedings for the construction of the MacArthur Highway. In 1994, upon a letter

submitted by the respondents, DPWH offered to pay P0.70 per square meter of the

property, the fair market value of the property at the time of taking on 1940.

Unsatisfied with the offer, the respondent-movantsdemanded the return of their

property, or the payment of compensation at the current fair market value, with P1,

500 per square meter.

The decision of the RTC and CA were in favor of the respondent-movants for the

payment of the current fair market value with P 1, 500 per square meter. The

petitioner, on the other hand, elevated the matter to the Supreme Court in a

petition for review on certiorari that just compensation should be based on the

value of the property at the time of taking in 1940.

Issue: Whether or not the valuation would be based on the corresponding value at

the time of the taking or at the time of the filing of the action

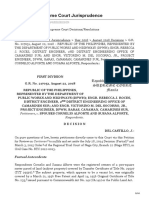

Held: Current Market Value. At the outset, it should be stressed that the matter of

the validity of the State's exercise of the power of eminent domain has long been

settled. Notwithstanding the foregoing, the court also recognize that the owner's

loss is not only his property but also its income-generating potential. Thus, when

property is taken, full and just compensation of its value must immediately be paid

to achieve a fair exchange for the property and the potential income lost.

The just compensation due to the landowners amounts to an effective forbearance

on the part of the State—a proper subject of interest computed from the time the

property was taken until the full amount of just compensation is paid—in order to

eradicate the issue of the constant variability of the value of the currency over time.

The interest rates applicable to loans and forbearance of money for the period of

1940 to present are as follows:

Law, Rule and Regulations, BSP Issuances Date of Effectivity Interest Rate

Act No. 2655 May 1, 1916 6%

CB Circular No. 416 July 29, 1974 12%

CB Circular No. 905 December 22, 1982 12%

CB Circular No. 799 July 1, 2013 6%

Applying the foregoing law respondents-movants are entitled to interest in the

amount of One Million Seven Hundred Eighteen Thousand Eight Hundred Forty-Eight

Pesos and Thirty-Two Centavos (P1,718,848.32) as of September 30, 2014,

computed as follows:

January 1, 1940 to July 28, 1974 P 10,553.4937

July 29, 1974 to March 16, 1995 P 26,126.3138

March 17, 199536 to June 30, 2013 P 232,070.3339

July 1, 2013 to September 30, 2014 P 250,098.1940

Market Value of the Property at the time of taking including interest P

518,848.32

In addition to the foregoing interest, additional compensation shall be awarded to

respondents-movants by way of exemplary damages and attorney's fees in view of

the government's taking without the benefit of expropriation proceedings.

Market value of the property at the time of taking including interest P

518,848.32

Add: Exemplary damages P 1,000,000.00

Attorney's fees P

200,000.00

Total Amount of Interest due to Respondents as of September 30, 2014

P1,718,848.16

WHEREFORE, the motion for reconsideration of the petitioner is hereby DENIED for

lack of merit.

Das könnte Ihnen auch gefallen

- 48 - Insular Life Assurance Co., Ltd. Vs Toyota Bel-Air, Inc. (550 SCRA 70)Dokument9 Seiten48 - Insular Life Assurance Co., Ltd. Vs Toyota Bel-Air, Inc. (550 SCRA 70)Jessie Marie dela PeñaNoch keine Bewertungen

- STATCON Latin Maxims and Phrases - FOR PRINTINGDokument10 SeitenSTATCON Latin Maxims and Phrases - FOR PRINTINGEsCil MoralesNoch keine Bewertungen

- Genuine Necessity - PEPITODokument4 SeitenGenuine Necessity - PEPITOMike KryptoniteNoch keine Bewertungen

- Guevarra Vs Sandiganbayan G.R. No 138792 804Dokument6 SeitenGuevarra Vs Sandiganbayan G.R. No 138792 804Raymond100% (1)

- G.R. No. 171101 - Pacpaco, Loise (Political)Dokument3 SeitenG.R. No. 171101 - Pacpaco, Loise (Political)Lj Anne PacpacoNoch keine Bewertungen

- Constitutional Law2 Secretary of DPWH Vs Spouses Heracleo and Ramona Tecson GR No 179334 January 30, 2020 CASE DIGESTDokument2 SeitenConstitutional Law2 Secretary of DPWH Vs Spouses Heracleo and Ramona Tecson GR No 179334 January 30, 2020 CASE DIGESTBrenda de la GenteNoch keine Bewertungen

- G.R. No. 179267Dokument23 SeitenG.R. No. 179267Aiyla AnonasNoch keine Bewertungen

- Secretary of DPWH Vs TECSONDokument2 SeitenSecretary of DPWH Vs TECSONChloe Hernane100% (3)

- Legal Ethics - Course Syllabus - CJC 2Dokument10 SeitenLegal Ethics - Course Syllabus - CJC 2King Ronne TingzonNoch keine Bewertungen

- STATCON - Director of Lands Vs Court of Appeals Case DigestDokument1 SeiteSTATCON - Director of Lands Vs Court of Appeals Case Digestlaura100% (11)

- Case Digest of Dissenting OpinionDokument4 SeitenCase Digest of Dissenting OpinionPatrick RamosNoch keine Bewertungen

- Pena V GsisDokument9 SeitenPena V GsisarnyjulesmichNoch keine Bewertungen

- Criminal Procedure List of CAsesDokument5 SeitenCriminal Procedure List of CAsesClark LimNoch keine Bewertungen

- For Case Digest in Statutory ConstructionDokument2 SeitenFor Case Digest in Statutory ConstructionRichard C. AmoguisNoch keine Bewertungen

- People Vs BerangDokument3 SeitenPeople Vs BerangClaudia Rina LapazNoch keine Bewertungen

- Air Transportation Office vs. Apolonio Gopuco, GR 158563, 6-30-2005Dokument2 SeitenAir Transportation Office vs. Apolonio Gopuco, GR 158563, 6-30-2005fmquitcoNoch keine Bewertungen

- Halili Vs Public Service CommissionDokument2 SeitenHalili Vs Public Service CommissionRon AceNoch keine Bewertungen

- pp7301 P V Tiu SanDokument2 Seitenpp7301 P V Tiu SanRowena Imperial RamosNoch keine Bewertungen

- Criminal ProcedureDokument50 SeitenCriminal ProcedureBREL GOSIMATNoch keine Bewertungen

- Magtajas v. Pryce Properties - Case Digest - Constitutional LawDokument11 SeitenMagtajas v. Pryce Properties - Case Digest - Constitutional LawVic FrondaNoch keine Bewertungen

- 1people V Sandiganbayan - Ex Post Facto Law and Bills of AttainderDokument2 Seiten1people V Sandiganbayan - Ex Post Facto Law and Bills of AttainderIanNoch keine Bewertungen

- Secretary of DPWH v. Tecson GR No. 179334Dokument2 SeitenSecretary of DPWH v. Tecson GR No. 179334Ei Bin100% (6)

- CrimPro - Cases - PDF Filename UTF-8''CrimPro CasesDokument1 SeiteCrimPro - Cases - PDF Filename UTF-8''CrimPro CasesMark Catabijan CarriedoNoch keine Bewertungen

- Napocor Vs Ileto 1Dokument3 SeitenNapocor Vs Ileto 1kaizen shinichiNoch keine Bewertungen

- U.S. v. Tamparong, G.R. No. 9527, August 23, 1915Dokument2 SeitenU.S. v. Tamparong, G.R. No. 9527, August 23, 1915The Money FAQsNoch keine Bewertungen

- AmendmentsDokument4 SeitenAmendmentsMer Manguera100% (1)

- Oposa vs. FactoranDokument8 SeitenOposa vs. Factoranai ningNoch keine Bewertungen

- Philippine Lawyer's Association Vs Agrava 1959Dokument6 SeitenPhilippine Lawyer's Association Vs Agrava 1959MelvzNoch keine Bewertungen

- Balibago Faith Baptist Church Vs Faith in Christ JesusDokument1 SeiteBalibago Faith Baptist Church Vs Faith in Christ JesusErik Celino100% (1)

- Ramos Vs EscobalDokument2 SeitenRamos Vs EscobalCecille Garces-SongcuanNoch keine Bewertungen

- Statcon Digest Necessary Implication - Noscitur A SociisDokument6 SeitenStatcon Digest Necessary Implication - Noscitur A SociisAirelle AvilaNoch keine Bewertungen

- Criminal Law Adultery and Concubinage Prosecution of Offense Upon Complaint of Offended Spouse RationaleDokument7 SeitenCriminal Law Adultery and Concubinage Prosecution of Offense Upon Complaint of Offended Spouse RationaleJp BeltranNoch keine Bewertungen

- People Vs SB - Paredes - Ex Post FactoDokument2 SeitenPeople Vs SB - Paredes - Ex Post FactoMara Aleah CaoileNoch keine Bewertungen

- In Re Petitioner-Appellant Vs Vs Opponent Appellant: Second DivisionDokument3 SeitenIn Re Petitioner-Appellant Vs Vs Opponent Appellant: Second DivisionjackyNoch keine Bewertungen

- Case No. 2 PEOPLE OF THE PHILIPPINES Vs - REYNALDO CORDOVADokument2 SeitenCase No. 2 PEOPLE OF THE PHILIPPINES Vs - REYNALDO CORDOVACarmel Grace Kiwas100% (1)

- Romero vs. Tan PDFDokument21 SeitenRomero vs. Tan PDFRobby DelgadoNoch keine Bewertungen

- 07-Natauanan v. Atty. Tolentino A.C. No. 4269 October 11, 2016 PDFDokument9 Seiten07-Natauanan v. Atty. Tolentino A.C. No. 4269 October 11, 2016 PDFJopan SJNoch keine Bewertungen

- Malinias vs. COMELEC - StatConAssignDigestDokument2 SeitenMalinias vs. COMELEC - StatConAssignDigestRy Astete100% (3)

- Case Digest, JD2B, BPI VS - Court of Appeals, 1998, JamerDokument2 SeitenCase Digest, JD2B, BPI VS - Court of Appeals, 1998, JamerPaolo JamerNoch keine Bewertungen

- De Ramas V CAR and Ramos, GR NO. L-19555..Dokument1 SeiteDe Ramas V CAR and Ramos, GR NO. L-19555..ElleNoch keine Bewertungen

- CASE #19 Consolacion P. Chavez, Et - Al. Vs Maybank Philippines, Inc. G.R. No. 242852, July 29, 2019 FactsDokument1 SeiteCASE #19 Consolacion P. Chavez, Et - Al. Vs Maybank Philippines, Inc. G.R. No. 242852, July 29, 2019 FactsHarlene HemorNoch keine Bewertungen

- Chavez V Romulo - GR 157036 - LegRes DigestDokument2 SeitenChavez V Romulo - GR 157036 - LegRes DigestHannah IbarraNoch keine Bewertungen

- Obligations and ContractsDokument84 SeitenObligations and ContractsEA EncoreNoch keine Bewertungen

- JIL vs. City of Pasig G.R. No. 152230. August 9, 2005Dokument6 SeitenJIL vs. City of Pasig G.R. No. 152230. August 9, 2005Renerio de Dios Jr100% (1)

- GR No 116719Dokument2 SeitenGR No 116719Ryan MostarNoch keine Bewertungen

- Padcom vs. Ortigas 382 Scra 222Dokument8 SeitenPadcom vs. Ortigas 382 Scra 222Aerith AlejandreNoch keine Bewertungen

- US Vs Tamparong Case DigestDokument1 SeiteUS Vs Tamparong Case DigestKurt Young100% (2)

- Obligations and Contracts CasesDokument67 SeitenObligations and Contracts CasesTin-tin Aquino100% (4)

- Koh V IACDokument3 SeitenKoh V IACGeorgia PerralNoch keine Bewertungen

- Consti - Handwritten DigestsDokument4 SeitenConsti - Handwritten DigestsDomski Fatima CandolitaNoch keine Bewertungen

- PEOPLE Vs AspirasDokument10 SeitenPEOPLE Vs AspirasRaymondNoch keine Bewertungen

- Isidro Cariño Vs The Commission On Human RightsDokument6 SeitenIsidro Cariño Vs The Commission On Human RightsJoseph GandiaNoch keine Bewertungen

- Corpuz vs. PeopleDokument2 SeitenCorpuz vs. PeopleNoreenesse Santos100% (2)

- 2015-2016 Criminal LawDokument19 Seiten2015-2016 Criminal LawKatherine DizonNoch keine Bewertungen

- Ethics 4-7 (Pasia) PDFDokument24 SeitenEthics 4-7 (Pasia) PDFPammyNoch keine Bewertungen

- Criminal Procedure SyllabusDokument8 SeitenCriminal Procedure SyllabusSCFNoch keine Bewertungen

- NPC vs. Manalastas Full TextDokument5 SeitenNPC vs. Manalastas Full TextAnalou Agustin VillezaNoch keine Bewertungen

- NPC v. ManalastasDokument2 SeitenNPC v. ManalastasKaren Joy MasapolNoch keine Bewertungen

- G.R. No. 196140, January 27, 2016 National Power Corporation, Petitioner, V. Elizabeth Manalastas and Bea CastilloDokument4 SeitenG.R. No. 196140, January 27, 2016 National Power Corporation, Petitioner, V. Elizabeth Manalastas and Bea CastilloRay ConsolacionNoch keine Bewertungen

- 5.23 Nepomuceno Vs Surigao PDFDokument8 Seiten5.23 Nepomuceno Vs Surigao PDFEvan NervezaNoch keine Bewertungen

- Crim Digest Isu LawDokument45 SeitenCrim Digest Isu LawEmilio Aguinaldo80% (5)

- Action Research On TardinessDokument13 SeitenAction Research On TardinessIan Khay Castro70% (10)

- Sales de Leon Compiled IncDokument55 SeitenSales de Leon Compiled Incvenus mae b caulinNoch keine Bewertungen

- Domingo vs. COA G.R. No. 112371Dokument3 SeitenDomingo vs. COA G.R. No. 112371sandrexNoch keine Bewertungen

- UP LAE ReviewerDokument53 SeitenUP LAE ReviewerJDR JDR74% (34)

- Ramirez vs. CA G.R. No. L 38185Dokument4 SeitenRamirez vs. CA G.R. No. L 38185sandrexNoch keine Bewertungen

- B001 Lorenzo vs. Director OfHealth GR 27484Dokument2 SeitenB001 Lorenzo vs. Director OfHealth GR 27484Ma AleNoch keine Bewertungen

- Paul Seymour, Assistant Professor: A Dilemma Case in TeachingDokument2 SeitenPaul Seymour, Assistant Professor: A Dilemma Case in TeachingsandrexNoch keine Bewertungen

- NPC Vs Borbon, G.R. No. 165354Dokument2 SeitenNPC Vs Borbon, G.R. No. 165354Aileen Peñafil0% (1)

- Usury LawDokument6 SeitenUsury LawBory SanotsNoch keine Bewertungen

- Ivy Adlawan Gayol: Career ObjectiveDokument2 SeitenIvy Adlawan Gayol: Career ObjectivesandrexNoch keine Bewertungen

- School FinanceDokument12 SeitenSchool FinancesandrexNoch keine Bewertungen

- Republic Vs Cebuan, G.R. No. 206702Dokument3 SeitenRepublic Vs Cebuan, G.R. No. 206702Aileen PeñafilNoch keine Bewertungen

- Curriculum TaskDokument4 SeitenCurriculum TasksandrexNoch keine Bewertungen

- School FinanceDokument12 SeitenSchool FinancesandrexNoch keine Bewertungen

- Application Form: Professional Regulation CommissionDokument1 SeiteApplication Form: Professional Regulation CommissionsandrexNoch keine Bewertungen

- Img 20190331 0002 PDFDokument57 SeitenImg 20190331 0002 PDFsandrexNoch keine Bewertungen

- Paggugol Na Matuwid:: Saligan NG Tuloy-Tuloy Na KaunlaranDokument2 SeitenPaggugol Na Matuwid:: Saligan NG Tuloy-Tuloy Na KaunlaransandrexNoch keine Bewertungen

- 4.lesson Plan Model - Madeline Hunter's Seven Step Lesson PlanDokument1 Seite4.lesson Plan Model - Madeline Hunter's Seven Step Lesson PlansandrexNoch keine Bewertungen

- Ramirez vs. CA G.R. No. L 38185Dokument4 SeitenRamirez vs. CA G.R. No. L 38185sandrexNoch keine Bewertungen

- NPC Vs Borbon, G.R. No. 165354Dokument2 SeitenNPC Vs Borbon, G.R. No. 165354Aileen Peñafil0% (1)

- Curriculum TaskDokument4 SeitenCurriculum TasksandrexNoch keine Bewertungen

- Republic Vs Fernandez, G.R. No. 175493Dokument2 SeitenRepublic Vs Fernandez, G.R. No. 175493andek onibla0% (1)

- People V SorianoDokument1 SeitePeople V SorianosandrexNoch keine Bewertungen

- Tenses Guide PDFDokument2 SeitenTenses Guide PDFarslanNoch keine Bewertungen

- Sea Lion Vs People Case DigestDokument1 SeiteSea Lion Vs People Case Digestdiamajolu gaygons100% (1)

- Sample Case People Vs Naquita G R No 180511 PDFDokument16 SeitenSample Case People Vs Naquita G R No 180511 PDFsandrexNoch keine Bewertungen

- School Form 2 (SF2) Daily Attendance Report of LearnersDokument2 SeitenSchool Form 2 (SF2) Daily Attendance Report of LearnersRommel Urbano YabisNoch keine Bewertungen

- Republic Vs Soriano, G. R. No. 211666Dokument1 SeiteRepublic Vs Soriano, G. R. No. 211666sandrexNoch keine Bewertungen

- People V AndanDokument1 SeitePeople V AndanKat Jolejole100% (1)

- Arellano University School of Law: Civil Law Review IiDokument88 SeitenArellano University School of Law: Civil Law Review IiNEWBIENoch keine Bewertungen

- Republic v. LimDokument1 SeiteRepublic v. LimAdrian Jeremiah VargasNoch keine Bewertungen

- Lubrica VS LBP Case DigestDokument9 SeitenLubrica VS LBP Case DigestWeena LegalNoch keine Bewertungen

- Secretary of DPWH v. SPS TecsonDokument10 SeitenSecretary of DPWH v. SPS TecsonOceane AdolfoNoch keine Bewertungen

- Manila Memorial V DSWDDokument1 SeiteManila Memorial V DSWDRon ValenzuelaNoch keine Bewertungen

- NTC V Oroville Development Corp - DigestDokument4 SeitenNTC V Oroville Development Corp - DigestGem AusteroNoch keine Bewertungen

- Republic Vs Castellvi DigestDokument3 SeitenRepublic Vs Castellvi DigestQue EbalNoch keine Bewertungen

- G.R. No. 217051Dokument16 SeitenG.R. No. 217051Vince Anuta SalanapNoch keine Bewertungen

- I Am Sharing 'Bar Ops 2' With YouDokument27 SeitenI Am Sharing 'Bar Ops 2' With YouYsabelleNoch keine Bewertungen

- RULE 67 ExpropriationDokument50 SeitenRULE 67 ExpropriationInna De LeonNoch keine Bewertungen

- EPZA V DULAYDokument7 SeitenEPZA V DULAYCamella AgatepNoch keine Bewertungen

- G.R. NO. 161656 JUNE 29, 2005: Republic V. LimDokument1 SeiteG.R. NO. 161656 JUNE 29, 2005: Republic V. LimAnarchyNoch keine Bewertungen

- Sec 3Dokument11 SeitenSec 3Melanie BiongNoch keine Bewertungen

- G.R. No. 186069 January 30, 2013 Spouses Jesus L. Cabahug and Coronacion M. Cabahug, Petitioners, National Power Corporation, RespondentDokument5 SeitenG.R. No. 186069 January 30, 2013 Spouses Jesus L. Cabahug and Coronacion M. Cabahug, Petitioners, National Power Corporation, RespondentfullpizzaNoch keine Bewertungen

- South Luzon Drug Vs DSWDDokument4 SeitenSouth Luzon Drug Vs DSWDPatricia Blanca RamosNoch keine Bewertungen

- Fundamental Powers of The StateDokument7 SeitenFundamental Powers of The Statepaulaplaza_7Noch keine Bewertungen

- 14 NIA Vs Rural Bank of Kabacan Et Al.Dokument19 Seiten14 NIA Vs Rural Bank of Kabacan Et Al.Vianice BaroroNoch keine Bewertungen

- Assignment No. 8 Ownership in General Case Nos. 1 To 8Dokument25 SeitenAssignment No. 8 Ownership in General Case Nos. 1 To 8yetyetNoch keine Bewertungen

- Article XIII Social Justice and Human Rights PDFDokument23 SeitenArticle XIII Social Justice and Human Rights PDFRAINBOW AVALANCHE100% (15)

- LBP Vs Sps Placido OrillaDokument2 SeitenLBP Vs Sps Placido OrillaJasfher CallejoNoch keine Bewertungen

- LBP-VS-DALAUTA-Case DIGESTDokument3 SeitenLBP-VS-DALAUTA-Case DIGESTRheymar Ong75% (4)

- Dar vs. GoducoDokument3 SeitenDar vs. GoducoWayne Libao ForbesNoch keine Bewertungen

- Case DIgest - DAR v. BeriÑa GR 183901 July 9, 2014Dokument2 SeitenCase DIgest - DAR v. BeriÑa GR 183901 July 9, 2014Lu CasNoch keine Bewertungen

- January 29Dokument79 SeitenJanuary 29stephen augurNoch keine Bewertungen

- Reyes V NHA G.R. No. 147511Dokument6 SeitenReyes V NHA G.R. No. 147511Glen MaullonNoch keine Bewertungen

- Hermano Oil Manufacturing & Sugar Corporation V. Toll Regulatory Board Et Al. FactsDokument5 SeitenHermano Oil Manufacturing & Sugar Corporation V. Toll Regulatory Board Et Al. FactsmillerNoch keine Bewertungen

- Case Digest: Assoc of Small Landowners vs. Sec. of Agrarian ReformDokument2 SeitenCase Digest: Assoc of Small Landowners vs. Sec. of Agrarian ReformMaria Anna M Legaspi100% (3)

- Berkenkotter v. CADokument5 SeitenBerkenkotter v. CAjealousmistressNoch keine Bewertungen

- Agrarian Law Case DigestDokument8 SeitenAgrarian Law Case DigestPia PandoroNoch keine Bewertungen

- Heirs of Tancoco v. CADokument28 SeitenHeirs of Tancoco v. CAChris YapNoch keine Bewertungen