Beruflich Dokumente

Kultur Dokumente

Mba Iv - B Macr - Ms 222 Assignment - 1

Hochgeladen von

Neelu AhluwaliaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mba Iv - B Macr - Ms 222 Assignment - 1

Hochgeladen von

Neelu AhluwaliaCopyright:

Verfügbare Formate

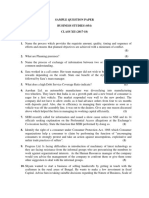

MBA IV - B

MACR – MS 222

Assignment - 1

Q1. Explain Corporate Restructuring. What are various options for corporate restructuring?

Q2. Explain the term “Merger”. Also discuss its various types in detail.

Q3. Explain defensive strategies available against hostile takeover. Briefly discuss the defenses

in the light of their advantages and disadvantages.

Q4. Give an overview of Competition Commission of India (CCI).

Q5. What are various methods available for measuring the success of M&A?

Assignment 2

Q1. Why mergers and Acquisitions (M&A) have become popular among the corporate world in a

contemporary scenario? Explain briefly the various motives for M& A.

Q2. Distinguish between;-

(a) Spin- off and Split Off

(b) LBO and carve Out

(c) Demerger and Reverse Merger

Q3. What are the provisions of Companies Act 1956 regarding Mergers/ Acquisitions?

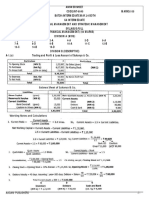

Q4. Quick Ltd. Is planning to acquire Fast Ltd. in order to expand its installed capacity. The

company will then be in a position to cater to increasing demand for its products and services. The

projected equity related cash flows of M/S. Quick Ltd. Before and after merger is given below:-

Rs. In Million

Year 1 2 3 4 5

Projected Cash Flow before Acquisition 14.6 17.1 16.8 20.6 23.9

Projected Cash Flow after Acquisition 21.3 23.4 29.0 35.7 42.5

The cash flow are expected to grow at a rate of 6% beyond year 5 if M/s. Fast Ltd. Is not acquired

and at the rate of 8% of the acquisition takes place. The other relevant data relating to the two

companies is given below:

Company Quick Ltd. Fast Ltd.

No. of outstanding shares 20 10

(million)

Market Price (Rs.) 32.00 26.00

Book Value (s) 28.00 21.00

The cost of equity is 16% . You are required to find out the maximum exchange ration that the

management of Quick Ltd. Can offer to the shareholders of Fast Ltd. So that the present value of

its quity related cash flows is at least 20% more than exisiting level. Whether the exchange ratio

offered by Quicj Ltd. As calculated in sub part (a) above will be acceptable to the shareholders of

Fast Ltd. , if their present value of pre merger cash flows is Rs. 12.5 millions?

Q5. Write short notes on any three of the following:

(a) Spin-off and Carve out

(b) Bootstrapping

(c) Hubris hypothesis

Das könnte Ihnen auch gefallen

- Candle Stick PatternsDokument2 SeitenCandle Stick Patternssteelwin95% (41)

- Money, Banking, Finance Notes For UPSC CSEDokument18 SeitenMoney, Banking, Finance Notes For UPSC CSESuraj ChopadeNoch keine Bewertungen

- Marriott Restructuring Case AnalysisDokument6 SeitenMarriott Restructuring Case AnalysisjaribamNoch keine Bewertungen

- Advanced Accounting NotesDokument19 SeitenAdvanced Accounting NotesTajammul M'd TakiNoch keine Bewertungen

- Bill Poulos - Power Forex Profit Principles PDFDokument98 SeitenBill Poulos - Power Forex Profit Principles PDFNasko R100% (2)

- FFM Summary Notes Free Version 2013Dokument44 SeitenFFM Summary Notes Free Version 2013GuLam Hilal Abdullah AL-Balushi89% (9)

- Interest Rates & HY Returns - JPM StudyDokument12 SeitenInterest Rates & HY Returns - JPM Studyvilnius00Noch keine Bewertungen

- Reverse MergerDokument24 SeitenReverse MergerOmkar PandeyNoch keine Bewertungen

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsVon EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNoch keine Bewertungen

- Questions For Preparation Macr 2019Dokument4 SeitenQuestions For Preparation Macr 2019Abhay PrakashNoch keine Bewertungen

- Project Report On Currency DerivativesDokument61 SeitenProject Report On Currency DerivativesAnkit Kumar75% (8)

- CRVI Question PaperDokument5 SeitenCRVI Question PaperCma SankaraiahNoch keine Bewertungen

- Paper Set1Dokument5 SeitenPaper Set1AVS InfraNoch keine Bewertungen

- E15 CLSDokument2 SeitenE15 CLSnabeelniniNoch keine Bewertungen

- SFM ScannerDokument23 SeitenSFM ScannerArchana KhapreNoch keine Bewertungen

- NOTE: All References To Sections Relate To The Companies Act, 2013 Unless Stated OtherwiseDokument4 SeitenNOTE: All References To Sections Relate To The Companies Act, 2013 Unless Stated OtherwiseBharat ThapaNoch keine Bewertungen

- Corporate Restructuring Law and Practice PDFDokument2 SeitenCorporate Restructuring Law and Practice PDFsumathi psgcasNoch keine Bewertungen

- BST Class 11Dokument4 SeitenBST Class 11AditiAggarwalNoch keine Bewertungen

- CR CS Professional Past PaperDokument7 SeitenCR CS Professional Past PaperAkanksha PareekNoch keine Bewertungen

- Advanced-Auditing-and-Assurance QuestionsDokument64 SeitenAdvanced-Auditing-and-Assurance QuestionsfelixwarindawereNoch keine Bewertungen

- Mba Sem 4 Mergers and Acquisitions Sum 2017Dokument5 SeitenMba Sem 4 Mergers and Acquisitions Sum 2017MANSINoch keine Bewertungen

- Lecture 56 AssignmentDokument4 SeitenLecture 56 AssignmentMuneeb UllahNoch keine Bewertungen

- SLCM Most Important Topics 2022Dokument6 SeitenSLCM Most Important Topics 2022Amit SinghNoch keine Bewertungen

- Q&As On AR - MM2 Asia LTD 2021Dokument5 SeitenQ&As On AR - MM2 Asia LTD 2021JoeKaviNoch keine Bewertungen

- Successful Firms Struggle With Succession: Placement Boot Camp - C11 Assignment - 03Dokument9 SeitenSuccessful Firms Struggle With Succession: Placement Boot Camp - C11 Assignment - 03Amber JainNoch keine Bewertungen

- 27-3-24... 4110 Both... Int-6040... Fm-Sm... AnsDokument10 Seiten27-3-24... 4110 Both... Int-6040... Fm-Sm... Ansnikulgauswami9033Noch keine Bewertungen

- Business Analysis: (B) What Is An Operating Turnaround Strategy ? 4Dokument4 SeitenBusiness Analysis: (B) What Is An Operating Turnaround Strategy ? 4Davies MumbaNoch keine Bewertungen

- Central University of South Bihar: All Questions Carry Equal MarksDokument2 SeitenCentral University of South Bihar: All Questions Carry Equal MarksShazaf KhanNoch keine Bewertungen

- Term 2 Business Studies Class 11Dokument3 SeitenTerm 2 Business Studies Class 11AditiAggarwalNoch keine Bewertungen

- Fs 2Dokument2 SeitenFs 2absharaliks82Noch keine Bewertungen

- Suggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsDokument16 SeitenSuggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsMdAnjum1991Noch keine Bewertungen

- AFM - Mock-Dec18Dokument6 SeitenAFM - Mock-Dec18David LeeNoch keine Bewertungen

- 090617000053Dokument5 Seiten090617000053Shyamsunder SinghNoch keine Bewertungen

- CODE: NF-3006 MARKS: 100 Final Advanced Auditing & Professional Ethics Syllabus:Audit - Module-I (As Per SM)Dokument18 SeitenCODE: NF-3006 MARKS: 100 Final Advanced Auditing & Professional Ethics Syllabus:Audit - Module-I (As Per SM)Devendra PatelNoch keine Bewertungen

- Inancial Ngineering Laybook: Volume #2, 2017Dokument31 SeitenInancial Ngineering Laybook: Volume #2, 2017bobNoch keine Bewertungen

- Important Question by Shantanu & Tanya Academy: Company LAW Important Questions FOR December 2021Dokument7 SeitenImportant Question by Shantanu & Tanya Academy: Company LAW Important Questions FOR December 2021punugauriNoch keine Bewertungen

- SP 25-12-2022Dokument4 SeitenSP 25-12-2022Niranjan JadhavNoch keine Bewertungen

- Assignment MF0001: (2 Credits) Set 1Dokument9 SeitenAssignment MF0001: (2 Credits) Set 1470*Noch keine Bewertungen

- 9th Sem Syllabus AnalysisDokument17 Seiten9th Sem Syllabus AnalysisTanurag GhoshNoch keine Bewertungen

- AMF3872 Compensatory Assignment 1 and 2Dokument3 SeitenAMF3872 Compensatory Assignment 1 and 2SoblessedNoch keine Bewertungen

- Class Lecture - 26Dokument24 SeitenClass Lecture - 26Tanay BansalNoch keine Bewertungen

- © The Institute of Chartered Accountants of IndiaDokument40 Seiten© The Institute of Chartered Accountants of Indiasri valliNoch keine Bewertungen

- Company Law: T I C A PDokument2 SeitenCompany Law: T I C A PadnanNoch keine Bewertungen

- CASE4Dokument3 SeitenCASE4Saumya UpadhyayNoch keine Bewertungen

- Green Channel Approval - KartikayDokument5 SeitenGreen Channel Approval - KartikayKartikay AgarwalNoch keine Bewertungen

- Roll No. ..................................... : Part-I 1Dokument8 SeitenRoll No. ..................................... : Part-I 1ssNoch keine Bewertungen

- Caf 4 Bmbs Autumn 2020Dokument4 SeitenCaf 4 Bmbs Autumn 2020Shamail AsimNoch keine Bewertungen

- Gujarat Technological UnversityDokument20 SeitenGujarat Technological UnversityUrvashi RNoch keine Bewertungen

- 6 Financial Markets Institutions and Services - Prof. Vinay DuttaDokument3 Seiten6 Financial Markets Institutions and Services - Prof. Vinay DuttaParas KhuranaNoch keine Bewertungen

- Adv Ac Case Based MCQs PSB @CAInterLegendsDokument27 SeitenAdv Ac Case Based MCQs PSB @CAInterLegendsgouravsah2003Noch keine Bewertungen

- Audit Mid Spring 24 (V-2)Dokument3 SeitenAudit Mid Spring 24 (V-2)Nouman ShamasNoch keine Bewertungen

- Chapter 2 - Company Accounts Chapter - 2, Unit 1 - Statutory Financial Statements Answer: 1Dokument14 SeitenChapter 2 - Company Accounts Chapter - 2, Unit 1 - Statutory Financial Statements Answer: 1dikpalakNoch keine Bewertungen

- Accounts - Full FledgedDokument5 SeitenAccounts - Full FledgedSukhrut MNoch keine Bewertungen

- Review of Framework For Borrowings by Large CorporatesDokument7 SeitenReview of Framework For Borrowings by Large CorporatesNEEL KAITHNoch keine Bewertungen

- 01 Icai Case Study QuestionDokument16 Seiten01 Icai Case Study QuestionFAMLITNoch keine Bewertungen

- Case Study SolutionDokument40 SeitenCase Study SolutionnaomiNoch keine Bewertungen

- 3 Business Finance12Dokument10 Seiten3 Business Finance12Abdullah al MahmudNoch keine Bewertungen

- Group 1 - 7 (110722)Dokument8 SeitenGroup 1 - 7 (110722)JACOB MAZHANGANoch keine Bewertungen

- Audit Papers DecDokument164 SeitenAudit Papers DecKeshav SethiNoch keine Bewertungen

- End Term Examination MMS - Financial Regulation (2019-21)Dokument3 SeitenEnd Term Examination MMS - Financial Regulation (2019-21)akshu kumarNoch keine Bewertungen

- Cse Dec 21 Free Mock Test Series Subject: Setting Up of Business Entities and ClosureDokument5 SeitenCse Dec 21 Free Mock Test Series Subject: Setting Up of Business Entities and ClosureSimran TrehanNoch keine Bewertungen

- CCI - 2022 - 2023 - Color-17-35Dokument19 SeitenCCI - 2022 - 2023 - Color-17-35Garima BothraNoch keine Bewertungen

- BusinessStudies SQPDokument4 SeitenBusinessStudies SQPSonia barmaseNoch keine Bewertungen

- BMSDokument3 SeitenBMSaliNoch keine Bewertungen

- M.B.A. Degree Examination, May/Ji'Ne 2008Dokument6 SeitenM.B.A. Degree Examination, May/Ji'Ne 2008Jeeva NanthamNoch keine Bewertungen

- Investment Banking QP - PGDM - TRIM 3Dokument6 SeitenInvestment Banking QP - PGDM - TRIM 3SharmaNoch keine Bewertungen

- AFM Model Test PaperDokument16 SeitenAFM Model Test PaperNeelu AhluwaliaNoch keine Bewertungen

- Cfs NumericalsDokument12 SeitenCfs NumericalsNeelu AhluwaliaNoch keine Bewertungen

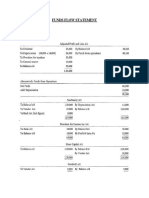

- Funds Flow Statement: Numerical 1Dokument4 SeitenFunds Flow Statement: Numerical 1Neelu AhluwaliaNoch keine Bewertungen

- 15 Factors Affecting Entrepreneurial GrowthDokument22 Seiten15 Factors Affecting Entrepreneurial GrowthNeelu AhluwaliaNoch keine Bewertungen

- 15 Factors Affecting Entrepreneurial GrowthDokument4 Seiten15 Factors Affecting Entrepreneurial GrowthNeelu AhluwaliaNoch keine Bewertungen

- Questionnaire: Personality FactorDokument4 SeitenQuestionnaire: Personality FactorNeelu AhluwaliaNoch keine Bewertungen

- 02 - Investor Acc MethodDokument31 Seiten02 - Investor Acc MethodLukas PrawiraNoch keine Bewertungen

- Business Plan F-WPS OfficeDokument13 SeitenBusiness Plan F-WPS OfficeKristalyn Mary AlcagnoNoch keine Bewertungen

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDokument75 SeitenInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownAmrit KeyalNoch keine Bewertungen

- NYIF Investment Banking Certification Program BrochureDokument18 SeitenNYIF Investment Banking Certification Program BrochureChristian Ezequiel ArmenterosNoch keine Bewertungen

- Investing in Emerging Markets - en - 1590070Dokument14 SeitenInvesting in Emerging Markets - en - 1590070Deepul WadhwaNoch keine Bewertungen

- UFCE - Annex 1 &2Dokument8 SeitenUFCE - Annex 1 &2Salil NagvekarNoch keine Bewertungen

- معادلات قناة يوتكر UTicker EquationDokument5 Seitenمعادلات قناة يوتكر UTicker EquationAtef AlbooqNoch keine Bewertungen

- Econometric Modeling of Euro British Pound and JapDokument30 SeitenEconometric Modeling of Euro British Pound and JapKksksk IsjsjNoch keine Bewertungen

- Securities and Exchange Board of India Final Order: WTM/AB/IVD/ID4/14459/2021-22Dokument91 SeitenSecurities and Exchange Board of India Final Order: WTM/AB/IVD/ID4/14459/2021-22Pratim MajumderNoch keine Bewertungen

- CHAPTER 11 Without AnswerDokument3 SeitenCHAPTER 11 Without Answerlenaka0% (1)

- 33 Sanjay PyasiDokument8 Seiten33 Sanjay PyasiEneng Panyang sibohNoch keine Bewertungen

- Money, Money, Money: Word BankDokument2 SeitenMoney, Money, Money: Word BankabcNoch keine Bewertungen

- Target Capital StructureDokument10 SeitenTarget Capital StructureZyl Apaul CallantaNoch keine Bewertungen

- Green Shoe Option: A Price Stabilization MechanismDokument15 SeitenGreen Shoe Option: A Price Stabilization MechanismvbhvarwlNoch keine Bewertungen

- P QFR 2020 (Eng Conv) 1Q (Web-Lock)Dokument72 SeitenP QFR 2020 (Eng Conv) 1Q (Web-Lock)Chee HernNoch keine Bewertungen

- Daily PostingsDokument33 SeitenDaily PostingsMarinaSubrahmanyeswaraRaoNoch keine Bewertungen

- Zydus Lifesciences LTDDokument7 SeitenZydus Lifesciences LTDMahek SolankiNoch keine Bewertungen

- CA StatementDokument3 SeitenCA Statementapi-3698382Noch keine Bewertungen

- What Is The Meaning of Book Value Per Share?Dokument6 SeitenWhat Is The Meaning of Book Value Per Share?Emely Grace YanongNoch keine Bewertungen

- Risk Mgmt-Including Basel II and NRB DirectivesDokument21 SeitenRisk Mgmt-Including Basel II and NRB Directivesshyam bkNoch keine Bewertungen

- DishtvlofDokument343 SeitenDishtvlofAmeya N. JoshiNoch keine Bewertungen

- 10 Currency MarketsDokument10 Seiten10 Currency MarketsNicole Daphne FigueroaNoch keine Bewertungen

- 2023 Symposium Final AgendaDokument38 Seiten2023 Symposium Final AgendaNishan LeemaNoch keine Bewertungen