Beruflich Dokumente

Kultur Dokumente

Bulacan State University: College of Business Administration

Hochgeladen von

elaine olivaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bulacan State University: College of Business Administration

Hochgeladen von

elaine olivaCopyright:

Verfügbare Formate

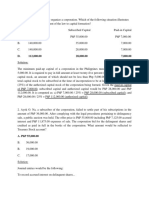

Republic of the Philippines

BULACAN STATE UNIVERSITY

COLLEGE OF BUSINESS ADMINISTRATION

City of Malolos, Bulacan

Telephone Number : 7964131 or 919-7800 loc 1058, 1057

Webpage: www.bulsu.edu.ph

PARTNERSHIP AND CORPORATION ACCOUNTING

1st Long Quiz

PARTNERSHIP FORMATION

A, B, and C formed a partnership, named as ABC and Co., on January 1, 2017. A contributed 50% equivalent to the

capital credit of B. B contributed 75% equivalent to capital credit of C. C, a sole proprietor has the following

information:

Cash P 70,000

Accounts Receivable 80,000

Inventories 90,000

Land 200,000

Building 99,000

Accumulated Depreciation – Building 9,000

Equipment 98,000

Accumulated Depreciation – Equipment 8,000

Accounts Payable 95,000

The partners agreed that C’s Receivables collectability is 90%, inventories to be valued at P 100,000, Land and

Building to be valued at P 350,000, and Equipment at P 95,000

Required: All necessary adjusting entries for C’s books before partnership formation and all journal entries in the

partnership books for the partnership formation

PARTNERSHIP OPERATION

XXX and Co. was formed on January 1, 2017 with a capital contribution from X1, P 500,000, X2, P 700,000, X3, P

800,000. The partners agreed to have a regular drawing amounting to P 2,000 per month. These drawings are debited

to drawing account for that it will not affect the capital ratio of the partners. The partners also agreed to give salary

allowance for X1 as a managing partner equivalent to 30% of net profit after salaries, interest at 15% of average capital

balances, and a bonus of 15% of profit after salaries and interest and before bonus to X2, and a bonus of 25% of profit

after salaries, interest, and bonus to X1 and AFTER X2’s bonus to X2. On, January 15, 2017 X1 invested P 100,000

to the partnership, while X2 and X3 withdrew P 50,000 and P 100,000 respectively.

Given below is the trial balance of the partnership

XXX and Co.

Trial Balance

For the month ended January 31, 2017

Account Titles Debit Credit

Cash P ?

Accounts Receivable 50,000

Office Supplies 10,000

Land 500,000

Building 300,000

Accumulated Depreciation P 15,000

Accounts Payable 85,000

X1, Drawings ?

X2, Drawings ?

X3, Drawings ?

X1, Capital ?

X2, Capital ?

X3, Capital ?

Service Fees 1,000,000

Cost of Services 500,000

Depreciation Expense 15,000

Operating Expenses 100,000

Total ? ?

Required: Complete all the data missing in the Trial Balance provided above. Compute for the participation of the

partners to the profit/loss in good form. Prepare Closing entries for the partnership books, including the profit/loss

allocation entries.

Good Luck

Page 1 of 1

Das könnte Ihnen auch gefallen

- ParCor ReviewerDokument6 SeitenParCor Reviewerjhean dabatosNoch keine Bewertungen

- ParCor Chapter 1 - Ballada 2016 PDFDokument26 SeitenParCor Chapter 1 - Ballada 2016 PDFJunelito Oga Jr.Noch keine Bewertungen

- Chapter 2: Essential Requisites of Contracts Article 1328-1346Dokument3 SeitenChapter 2: Essential Requisites of Contracts Article 1328-1346Christine SuarezNoch keine Bewertungen

- Obligations and Contracts SeatworkDokument3 SeitenObligations and Contracts SeatworkShaneeeeyNoch keine Bewertungen

- Leila Durkin An Architect Opened An Office On May 1Dokument1 SeiteLeila Durkin An Architect Opened An Office On May 1M Bilal SaleemNoch keine Bewertungen

- ParCor QuizDokument4 SeitenParCor QuizJinx Cyrus Rodillo0% (1)

- Governance, Business Ethics, Risk Management and Control: GGSRDokument15 SeitenGovernance, Business Ethics, Risk Management and Control: GGSRLysss EpssssNoch keine Bewertungen

- Key OB issues at Brussels & BradshawDokument5 SeitenKey OB issues at Brussels & BradshawJohn AlexanderNoch keine Bewertungen

- Discovering The Factors That Shape The SelfDokument11 SeitenDiscovering The Factors That Shape The SelfTEAM KnightzNoch keine Bewertungen

- Financial Transaction WorksheetDokument3 SeitenFinancial Transaction Worksheetjen 01Noch keine Bewertungen

- Pre-Test (21st Century)Dokument3 SeitenPre-Test (21st Century)Honey AresgadoNoch keine Bewertungen

- GEETHIC SynthesisPaper MadrazoDokument5 SeitenGEETHIC SynthesisPaper MadrazoJayann Danielle MadrazoNoch keine Bewertungen

- The Role of Strategic Planning On The Sustainability of Selected MSMEs in The 2nd District of AlbayDokument7 SeitenThe Role of Strategic Planning On The Sustainability of Selected MSMEs in The 2nd District of AlbayInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- ACCCOB1 Module 2Dokument57 SeitenACCCOB1 Module 2Ayanna CameroNoch keine Bewertungen

- CredTrans 2 FinalDokument7 SeitenCredTrans 2 FinaltheamorerosaNoch keine Bewertungen

- Prepare Income Statement using provided accountsDokument4 SeitenPrepare Income Statement using provided accountsmila dacarNoch keine Bewertungen

- Chapter 1: Simple InterestDokument2 SeitenChapter 1: Simple InterestLorraine Tio100% (1)

- Finals - Fina 221Dokument14 SeitenFinals - Fina 221MARITONI MEDALLANoch keine Bewertungen

- Microeconomics Spoken PoetryDokument2 SeitenMicroeconomics Spoken PoetryChris AnnNoch keine Bewertungen

- CCTV Price List - 02!01!18 DPDokument10 SeitenCCTV Price List - 02!01!18 DPmynel2008Noch keine Bewertungen

- Module 4 - Problem 5Dokument1 SeiteModule 4 - Problem 5Lycksele RodulfaNoch keine Bewertungen

- Module For Chapter 2 - Strategic Human Resource Management - MGT101-HRMDokument5 SeitenModule For Chapter 2 - Strategic Human Resource Management - MGT101-HRMTricia Claire BarraquioNoch keine Bewertungen

- Legal Writing SOGIE BillDokument3 SeitenLegal Writing SOGIE BillTrisha SingsonNoch keine Bewertungen

- How Is Art Related To Humanities?Dokument5 SeitenHow Is Art Related To Humanities?Winter SummerNoch keine Bewertungen

- G1 - Report in ODDokument17 SeitenG1 - Report in ODChriz ChanNoch keine Bewertungen

- Philippine Banking Laws and JurisprudenceDokument5 SeitenPhilippine Banking Laws and JurisprudenceMichelle Marie TablizoNoch keine Bewertungen

- Tata SeloDokument4 SeitenTata SeloMoon Min RaNoch keine Bewertungen

- Business Law 2Dokument6 SeitenBusiness Law 2JavidNoch keine Bewertungen

- Partnership Formation and Operation.Dokument4 SeitenPartnership Formation and Operation.May RamosNoch keine Bewertungen

- Law 22Dokument6 SeitenLaw 22ram RedNoch keine Bewertungen

- SOLMAN Chapter 8Dokument12 SeitenSOLMAN Chapter 8Na JaeminNoch keine Bewertungen

- BSUNIV Accounting Practices AssessmentDokument2 SeitenBSUNIV Accounting Practices AssessmentLerma Corachea MaralitNoch keine Bewertungen

- Finals On Purposive Communication 2Dokument4 SeitenFinals On Purposive Communication 2Domilyn Zantua BallaNoch keine Bewertungen

- LOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepDokument4 SeitenLOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepElla Marie LopezNoch keine Bewertungen

- Activity PrefinalDokument2 SeitenActivity PrefinalRoNnie RonNie100% (1)

- Partnership Dissolution LiquidationDokument14 SeitenPartnership Dissolution Liquidationmartinez2331999Noch keine Bewertungen

- (02D) Demonstration Trial BalanceDokument22 Seiten(02D) Demonstration Trial BalanceGabriella JNoch keine Bewertungen

- Baliktanawan 3Dokument45 SeitenBaliktanawan 3Erika May RamirezNoch keine Bewertungen

- Stabilization of Soil Using Rice Husk AshDokument9 SeitenStabilization of Soil Using Rice Husk AshRichard OliverNoch keine Bewertungen

- Swot MatrixDokument11 SeitenSwot Matrixparvin akhter evaNoch keine Bewertungen

- Obligations in GeneralDokument26 SeitenObligations in GeneralMajorie ArimadoNoch keine Bewertungen

- Diamond Trading CuasayDokument2 SeitenDiamond Trading CuasayBhabes M. TuralloNoch keine Bewertungen

- Contemporary Models of DevelopmentDokument45 SeitenContemporary Models of DevelopmentUmair UsmanNoch keine Bewertungen

- FUNDACC1 - Reviewer (Theories)Dokument12 SeitenFUNDACC1 - Reviewer (Theories)MelvsNoch keine Bewertungen

- Patterns and IsometriesDokument3 SeitenPatterns and IsometriesHannah Jane ToribioNoch keine Bewertungen

- How Society Impacts Character and BeingDokument2 SeitenHow Society Impacts Character and BeingAeri SadadaNoch keine Bewertungen

- Laforge Company SolDokument3 SeitenLaforge Company SolPanini KNoch keine Bewertungen

- JG Summit Holdings, Inc.: Company ProfileDokument13 SeitenJG Summit Holdings, Inc.: Company ProfilemnmusorNoch keine Bewertungen

- General ProvisionsDokument15 SeitenGeneral ProvisionsCharish BonielNoch keine Bewertungen

- Farparcor 2 Chapter 1 Exercises Problem AnswersDokument10 SeitenFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNoch keine Bewertungen

- Exercise 5 - Journalizing TransactionsDokument10 SeitenExercise 5 - Journalizing TransactionsMichael DiputadoNoch keine Bewertungen

- The Evolution of Entrepreneurship ThoughtDokument8 SeitenThe Evolution of Entrepreneurship ThoughtTomato Menudo100% (1)

- Explain and Assess The Major Areas of Organizational Life Affected by Issues in CGDokument3 SeitenExplain and Assess The Major Areas of Organizational Life Affected by Issues in CGGenicallyAudeNoch keine Bewertungen

- Module 6 FINP1 Financial ManagementDokument28 SeitenModule 6 FINP1 Financial ManagementChristine Jane LumocsoNoch keine Bewertungen

- PF06 Task Performance 1 BusTaxDokument1 SeitePF06 Task Performance 1 BusTaxArgie Mae SalvadorNoch keine Bewertungen

- Analyze SME Statement of Financial PositionDokument2 SeitenAnalyze SME Statement of Financial PositionZeniah LouiseNoch keine Bewertungen

- This Study Resource Was: Journal EntryDokument8 SeitenThis Study Resource Was: Journal EntryLoiz Santos Trinidad100% (4)

- Problem No 5 (Acctg. 1)Dokument5 SeitenProblem No 5 (Acctg. 1)Ash imoNoch keine Bewertungen

- 162 PresummativeDokument5 Seiten162 PresummativeMeichigo SwadeeNoch keine Bewertungen

- First Activity - Basic Accounting - Accounting EquationDokument14 SeitenFirst Activity - Basic Accounting - Accounting EquationKyleZapantaNoch keine Bewertungen

- Quiz KeyDokument6 SeitenQuiz Keyelaine olivaNoch keine Bewertungen

- Acctg QuizDokument6 SeitenAcctg Quizelaine olivaNoch keine Bewertungen

- Bulacan State University: College of Business AdministrationDokument1 SeiteBulacan State University: College of Business Administrationelaine olivaNoch keine Bewertungen

- Acctg QuizDokument6 SeitenAcctg Quizelaine olivaNoch keine Bewertungen

- Bulacan State University: College of Business AdministrationDokument1 SeiteBulacan State University: College of Business Administrationelaine olivaNoch keine Bewertungen

- 25 Aspirations For BulsuDokument1 Seite25 Aspirations For Bulsuelaine oliva100% (1)

- Acctg Quiz PDFDokument51 SeitenAcctg Quiz PDFelaine olivaNoch keine Bewertungen

- 25 Aspirations For BulsuDokument1 Seite25 Aspirations For Bulsuelaine oliva100% (1)

- Bills of ExchangeDokument31 SeitenBills of ExchangeViransh Coaching ClassesNoch keine Bewertungen

- Supply Chain Management Course Syllabus for Integrated MBADokument4 SeitenSupply Chain Management Course Syllabus for Integrated MBAJay PatelNoch keine Bewertungen

- VivithaDokument53 SeitenVivithavajoansaNoch keine Bewertungen

- Suzuki Project NewDokument98 SeitenSuzuki Project NewRohan Somanna67% (3)

- Βιογραφικά ΟμιλητώνDokument33 SeitenΒιογραφικά ΟμιλητώνANDREASNoch keine Bewertungen

- Subcontracting Process in Production - SAP BlogsDokument12 SeitenSubcontracting Process in Production - SAP Blogsprasanna0788Noch keine Bewertungen

- Corpo Bar QsDokument37 SeitenCorpo Bar QsDee LM100% (1)

- GPETRO Scope TenderDokument202 SeitenGPETRO Scope Tendersudipta_kolNoch keine Bewertungen

- CH 07Dokument50 SeitenCH 07Anonymous fb7C3tcNoch keine Bewertungen

- SAVAYA The Martinez-Brothers PriceListDokument2 SeitenSAVAYA The Martinez-Brothers PriceListnataliaNoch keine Bewertungen

- PWC High Frequency Trading Dark PoolsDokument12 SeitenPWC High Frequency Trading Dark PoolsAnish TimsinaNoch keine Bewertungen

- AgribusinessDokument6 SeitenAgribusinessshevadanzeNoch keine Bewertungen

- 5 Why AnalysisDokument2 Seiten5 Why Analysislnicolae100% (2)

- Human Resourse Management 1Dokument41 SeitenHuman Resourse Management 1Shakti Awasthi100% (1)

- Service Supreme: A Born BusinessmanDokument112 SeitenService Supreme: A Born BusinessmanPumper MagazineNoch keine Bewertungen

- Acca FeeDokument2 SeitenAcca FeeKamlendran BaradidathanNoch keine Bewertungen

- Financial Ratio Analysis and Working Capital ManagementDokument26 SeitenFinancial Ratio Analysis and Working Capital Managementlucky420024Noch keine Bewertungen

- Expertise in trade finance sales and distributionDokument4 SeitenExpertise in trade finance sales and distributionGabriella Njoto WidjajaNoch keine Bewertungen

- Customs RA ManualDokument10 SeitenCustoms RA ManualJitendra VernekarNoch keine Bewertungen

- LawBO (Students'Copy)Dokument3 SeitenLawBO (Students'Copy)JImlan Sahipa IsmaelNoch keine Bewertungen

- NSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedDokument24 SeitenNSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedSamaan RishadNoch keine Bewertungen

- Review of Financial Statements PDFDokument13 SeitenReview of Financial Statements PDFMartin EgozcueNoch keine Bewertungen

- 1 - Impact of Career Development On Employee Satisfaction in Private Banking Sector Karachi - 2Dokument8 Seiten1 - Impact of Career Development On Employee Satisfaction in Private Banking Sector Karachi - 2Mirza KapalNoch keine Bewertungen

- My Project Report On Reliance FreshDokument67 SeitenMy Project Report On Reliance FreshRajkumar Sababathy0% (1)

- Application of Game TheoryDokument65 SeitenApplication of Game Theorymithunsraj@gmail.com100% (2)

- AWS Compete: Microsoft's Response to AWSDokument6 SeitenAWS Compete: Microsoft's Response to AWSSalman AslamNoch keine Bewertungen

- InventoryDokument53 SeitenInventoryVinoth KumarNoch keine Bewertungen

- Australian Japan CableDokument33 SeitenAustralian Japan CableSourabh Dhawan100% (2)

- ACCOUNTING CONTROL ACCOUNTSDokument8 SeitenACCOUNTING CONTROL ACCOUNTSMehereen AubdoollahNoch keine Bewertungen

- Allen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Dokument9 SeitenAllen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Chandra KumarNoch keine Bewertungen

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 5 von 5 Sternen5/5 (13)

- Profit First for Therapists: A Simple Framework for Financial FreedomVon EverandProfit First for Therapists: A Simple Framework for Financial FreedomNoch keine Bewertungen

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- A Place of My Own: The Architecture of DaydreamsVon EverandA Place of My Own: The Architecture of DaydreamsBewertung: 4 von 5 Sternen4/5 (241)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetVon EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNoch keine Bewertungen

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- An Architect's Guide to Construction: Tales from the Trenches Book 1Von EverandAn Architect's Guide to Construction: Tales from the Trenches Book 1Noch keine Bewertungen

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- Building Construction Technology: A Useful Guide - Part 2Von EverandBuilding Construction Technology: A Useful Guide - Part 2Bewertung: 5 von 5 Sternen5/5 (1)

- Piping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationVon EverandPiping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationBewertung: 4 von 5 Sternen4/5 (18)

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedVon EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedBewertung: 5 von 5 Sternen5/5 (1)

- Civil Engineer's Handbook of Professional PracticeVon EverandCivil Engineer's Handbook of Professional PracticeBewertung: 4.5 von 5 Sternen4.5/5 (2)

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionVon EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Von EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Bewertung: 5 von 5 Sternen5/5 (1)

- The Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsVon EverandThe Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsBewertung: 4.5 von 5 Sternen4.5/5 (6)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesVon EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesBewertung: 4.5 von 5 Sternen4.5/5 (30)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)