Beruflich Dokumente

Kultur Dokumente

Taxes: Gift and Estate: Co A Dition Lly A Ret RN Preparer Wiu Be L Y T D

Hochgeladen von

Zeyad El-sayedOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Taxes: Gift and Estate: Co A Dition Lly A Ret RN Preparer Wiu Be L Y T D

Hochgeladen von

Zeyad El-sayedCopyright:

Verfügbare Formate

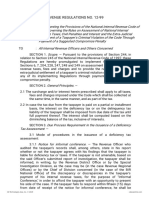

MODULE 37 TAXES: GIFT AND ESTATE , 671

a court, Additionally, a return preparer wiU be subject to of tax return information without the taxpayer's consent.

penalty if any part of an understatement of liability with Generally, a tax return preparer who knowingly or recklessly

respect to a return or refund claim is due to the preparer's discloses any information furnished to him in connection

willful attempt to understate tax liability, or to any reckless with the preparation of a return, or uses any such informa-

or intentional disregard of rules and regulations, tion other than to prepare, or to assist in preparing a return,

is guilty of a misdemeanor, and upon conviction may be

43. (d) The requirement is to determine Water's re-

subject to fine and/or imprisonment. A limited exception

sponsibility regarding Vee' s unfiled 2003 income tax return,

permits the disclosure or use of tax return information for

A CP A should promptly inform the client upon becoming

purposes of being evaluated by quality or peer reviews.

aware of the client's failure to file a required return for a

prior year, However, the CPA is not obligated to inform the 49. (d) A penalty of up to $1,000 may be assessed

IRS and the CPA may not do so without the client's permis- against a tax return preparer who knowingly or recklessly

sion, except where required by law, If the CP A is requested discloses or uses any tax return information other than to

to prepare the current year's return (2008) and the client has prepare, or assist in preparing a return. Additionally, a pen-

nol t. "CD tion to file tJie Rt:t'mz7! Eorr dAc C3Tficr year (2()()3), alty equal to the greater of $5,000, or 50% of the income to

the CPA should consider whether to withdraw from prepar- be derived by the return preparer from the return or refund

ing the current year's return and whether to continue a pro- claim will be assessed against a return preparer who

fessional relationship with the client. Also, note that the willfully attempts to understate any client's tax liability on a

normal statue of limitations for the assessment of a tax defi- return or claim for refund,

ciency is three years after the due date of the return or three

years after the return is filed, whichever is later. Thus, the 50. (a) Under Internal Revenue Code Section 6695(f)

statute of limitations is still open with regard to 2003 since any person who is an income tax return preparer who en-

there is no time limit for the assessment of tax if no tax re- dorses or otherwise negotiates any check which is issued to a

turn was filed, taxpayer shall pay a penalty of $500.

44. (c) The requirement is to determine which action a 51. (b) A CP A who prepares a federal income tax return

tax return preparer must take to avoid tax preparer penalties for a fee must keep a completed copy of the return for a

for a return's understated tax liability due to a taxpayer's minimum of three years. Answer (a) is incorrect because

intentional disregard of regulations, A return preparer may, prior to preparing a tax return the CP A would not be re-

in good faith, rely without verification upon information quired to file certain notices and powers of attorney with the

furnished by the client or by third parties, and is not required IRS. Answer (c) is incorrect because a CPA' would only be

to audit, examine, or review books, records, or documents in required to ask the client if documentation of these expenses

order to independently verify the taxpayer's information, exists. The CPA would not have to actually receive and

However, the preparer should not ignore the implications of examine this documentation. Answer (d) is incorrect be-

information furnished and should make reasonable inquiries cause the CPA's federal identification number would be

if the furnished information appears incorrect, incomplete, required on any federal income tax return prepared for a fee.

or inconsistent.

52. (b) A CPA.generally does owe a duty to inform a

45. (d) According to the Statements on Standards for client that there are errors in a previously filed tax return so

Tax Services, in preparing a tax return a CP A may in good that the client may file an amended tax return. Answer (a) is

faith rely upon information furnished by the client or third incorrect because the client chooses hislher own CP A. An-

parties without further verification. . swer (c) is incorrect because CPAs are not required to dis-

close fraud by the client but are usually engaged to give an

46. (d) The requirement is to determine the correct opinion on the fairness of the financial statements.' An-

statement regarding the imposition of a preparer penalty for swer (d) is incorrect because although the CPA has a duty to

understated corporate tax liability. A return preparer may in perform an audit in accordance with GAAS and consistent

good faith rely without verification upon information fur- with GAAP, the CPA is not under a duty to discover fraud

nished, and is not required to audit, examine, or review in the audit unless the fraud would have been uncovered in

books, records, or documents in order to independently ver- the process of an ordinary audit or unless the CP A agreed to

ify a taxpayer's information. However, the preparer should greater responsibility to uncover fraud.

not ignore the implications of information furnished and

should make reasonable inquiries if information appears 53. (b) If the IRS issues a thirty-day letter to an individ-

incorrect, incomplete, or inconsistent. ual taxpayer who wishes to dispute the assessment, the tax-

payer may ignore the thirty-day letter and wait to receive a

47. (a) A tax return preparer is subject to a penalty for

ninety-day letter. Answer (a) is incorrect because a taxpayer

knowingly or recklessly disclosing corporate tax return in-

must receive a ninety-day letter before a petition can be filed

formation, if the disclosure is made to enable a third party to

in Tax Court. Answer (c) is incorrect because a taxpayer has

solicit business from the taxpayer. Taxpayer return infor-

a thirty-day period during which to file a written protest.

mation can be disclosed by the preparer without penalty if

Answer (d) is incorrect because a taxpayer is not required to

the disclosure is made to enable the tax processor to elec-

pay the taxes and commence an action in federal district

tronically compute the taxpayer's liability, for purposes of

court.

the tax return preparer's peer review, or if the disclosure is

Generally, upon the receipt of a thirty-day letter, a tax-

made under an administrative order by a state agency that

payer who wishes to dispute the fin'dings has thirty days to

registers tax return preparers.

(1) request a conference with an appeals officer or file a

48. Cc) The requirement is to determine the correct written protest letter, or (2) may elect to do nothing during

statement regarding a tax return preparer's disclosure or use the thirty-day period and await a ninety-day letter. The tax-

Das könnte Ihnen auch gefallen

- Module 40 Taxes: Gift and EstateDokument2 SeitenModule 40 Taxes: Gift and EstateZeyad El-sayedNoch keine Bewertungen

- Module 40 Taxes: Gift and EstateDokument3 SeitenModule 40 Taxes: Gift and EstateZeyad El-sayedNoch keine Bewertungen

- Taxes: Gift and EstateDokument2 SeitenTaxes: Gift and EstateZeyad El-sayedNoch keine Bewertungen

- Scan 0098Dokument2 SeitenScan 0098El-Sayed MohammedNoch keine Bewertungen

- Suspension of Running of Statute of Limitations. Sec. 223, NIRCDokument2 SeitenSuspension of Running of Statute of Limitations. Sec. 223, NIRCshiejingNoch keine Bewertungen

- Income Taxation (Old Standard) RemediesDokument2 SeitenIncome Taxation (Old Standard) RemediesKenneth CalzadoNoch keine Bewertungen

- Scan 0011Dokument2 SeitenScan 0011Zeyad El-sayedNoch keine Bewertungen

- Title VIII Tax Remedies NotesDokument7 SeitenTitle VIII Tax Remedies NotesAnthony Yap100% (1)

- Wassim Zhani Income Taxation of Corporations (Chapter 18)Dokument14 SeitenWassim Zhani Income Taxation of Corporations (Chapter 18)wassim zhaniNoch keine Bewertungen

- Procedural Aspects of Preparing Returns: 654 Taxes: Gift and EstateDokument2 SeitenProcedural Aspects of Preparing Returns: 654 Taxes: Gift and EstateEl-Sayed MohammedNoch keine Bewertungen

- Taxation) Remedies) Made 1998 Early Part (Est) ) by UP) 14 PagesDokument13 SeitenTaxation) Remedies) Made 1998 Early Part (Est) ) by UP) 14 PagesbubblingbrookNoch keine Bewertungen

- Pdfdownloader - Lain.in 150469451 2012 Ateneo LawTaxation Law Summer Reviewer 2 PDFDokument13 SeitenPdfdownloader - Lain.in 150469451 2012 Ateneo LawTaxation Law Summer Reviewer 2 PDFJericho PedragosaNoch keine Bewertungen

- NIRC Tax RemediesDokument27 SeitenNIRC Tax RemediesNodlesde Awanab ZurcNoch keine Bewertungen

- Remedies Under NIRCDokument14 SeitenRemedies Under NIRCcmv mendoza100% (3)

- Taxrev Case DigestsDokument6 SeitenTaxrev Case DigestsGabby PundavelaNoch keine Bewertungen

- CIR v. Univation, GR 231581, 10 Apr 2019Dokument4 SeitenCIR v. Univation, GR 231581, 10 Apr 2019Dan Millado100% (2)

- Tax RemediesDokument5 SeitenTax RemediesNoroNoch keine Bewertungen

- Filipinas Synthetic Fiber Corp V CADokument2 SeitenFilipinas Synthetic Fiber Corp V CAPhillipCachaperoNoch keine Bewertungen

- Assessments Case DoctrinesDokument9 SeitenAssessments Case DoctrinesgooNoch keine Bewertungen

- An T N D Ic T Lients: Taxes: Gift EstateDokument2 SeitenAn T N D Ic T Lients: Taxes: Gift EstateEl-Sayed MohammedNoch keine Bewertungen

- Tax RemediesDokument15 SeitenTax RemediesChristopher Jan DotimasNoch keine Bewertungen

- REMEDIES by J. DimaampaoDokument2 SeitenREMEDIES by J. DimaampaoJeninah Arriola CalimlimNoch keine Bewertungen

- Q: What Is The Difference Between These Administrative and Judicial Remedies?Dokument11 SeitenQ: What Is The Difference Between These Administrative and Judicial Remedies?Kharen ValdezNoch keine Bewertungen

- Uniform LayoutDokument7 SeitenUniform LayoutJade CoritanaNoch keine Bewertungen

- 2021 Remedies of Government PDFDokument44 Seiten2021 Remedies of Government PDFGideon Tangan Ines Jr.Noch keine Bewertungen

- Tax RemediesDokument10 SeitenTax RemediesBryan CatungalNoch keine Bewertungen

- Refund of Taxes: in GeneralDokument3 SeitenRefund of Taxes: in GeneralAileen Love ReyesNoch keine Bewertungen

- Taxation Doctrines 2Dokument18 SeitenTaxation Doctrines 2KCNoch keine Bewertungen

- Tax 3 - Unit 3 Chapter 10 Tax Remedies of TaxpayersDokument7 SeitenTax 3 - Unit 3 Chapter 10 Tax Remedies of TaxpayersJeni ManobanNoch keine Bewertungen

- Commissioner of Internal Revenue, Petitioner vs. Univation Motor Philippines, Inc. (Formerly NISSAN MOTOR PHILIPPINES, INC.), RespondentDokument93 SeitenCommissioner of Internal Revenue, Petitioner vs. Univation Motor Philippines, Inc. (Formerly NISSAN MOTOR PHILIPPINES, INC.), RespondentJv FerminNoch keine Bewertungen

- Q & A 2018 Mock BarDokument6 SeitenQ & A 2018 Mock BarAbhor TyrannyNoch keine Bewertungen

- Module 6 Tax Remedies ReviewerDokument11 SeitenModule 6 Tax Remedies ReviewerburgerpattygirlNoch keine Bewertungen

- Tax REv NotesDokument23 SeitenTax REv NotesCti Ahyeza DMNoch keine Bewertungen

- 2async023 REMEDIESDokument27 Seiten2async023 REMEDIESBogs QuitainNoch keine Bewertungen

- Finals Handout TaxDokument3 SeitenFinals Handout TaxFlorenz AmbasNoch keine Bewertungen

- Tax Review Assignment - ABANGANDokument24 SeitenTax Review Assignment - ABANGANSteph RentNoch keine Bewertungen

- Notes On Taxation RemediesDokument13 SeitenNotes On Taxation RemediesJuris GempisNoch keine Bewertungen

- Module 21 P Fessional Responsi I ES: RO B LitiDokument2 SeitenModule 21 P Fessional Responsi I ES: RO B LitiHazem El SayedNoch keine Bewertungen

- CIR Vs Smart CommunicationsDokument1 SeiteCIR Vs Smart CommunicationsHoreb FelixNoch keine Bewertungen

- PLDT v. CIRDokument10 SeitenPLDT v. CIRJohn FerarenNoch keine Bewertungen

- 5 Philippine Guaranty Co Vs CIR, GGR L-22074, Sept 6, 1965Dokument5 Seiten5 Philippine Guaranty Co Vs CIR, GGR L-22074, Sept 6, 1965Seok Gyeong KangNoch keine Bewertungen

- 2Dokument2 Seiten2maeNoch keine Bewertungen

- XDokument2 SeitenXSophiaFrancescaEspinosaNoch keine Bewertungen

- RR 12-99Dokument16 SeitenRR 12-99doraemoanNoch keine Bewertungen

- 30 2002 Revenue - Regulations - Implementing - Sections20181220 5466 Ew6q98Dokument6 Seiten30 2002 Revenue - Regulations - Implementing - Sections20181220 5466 Ew6q98Milane Anne CunananNoch keine Bewertungen

- Tax 2 Questions and Answers: Search For Papers, People, and InterestsDokument10 SeitenTax 2 Questions and Answers: Search For Papers, People, and InterestsAnjelica PicarNoch keine Bewertungen

- MOD E T Gift A DE Tate: UL Axes: N SDokument2 SeitenMOD E T Gift A DE Tate: UL Axes: N SEl-Sayed MohammedNoch keine Bewertungen

- LEGAL REMEDIES TAX REVIEW FinalDokument266 SeitenLEGAL REMEDIES TAX REVIEW FinalAlgen S. Gomez100% (1)

- Relevant Provisions Assessment & CollectionDokument6 SeitenRelevant Provisions Assessment & CollectionBryan Yabo RubioNoch keine Bewertungen

- Taxation LawDokument10 SeitenTaxation LawflorNoch keine Bewertungen

- Garnishment Policy: Tax Administration JamaicaDokument23 SeitenGarnishment Policy: Tax Administration JamaicaVaughn HenryNoch keine Bewertungen

- Tax Remedies Under The NIRCDokument7 SeitenTax Remedies Under The NIRCmaeprincess100% (1)

- Tax Collection Systems: Withholding Taxes Collected Under This SystemDokument9 SeitenTax Collection Systems: Withholding Taxes Collected Under This Systememielyn lafortezaNoch keine Bewertungen

- CIR v. Univation Motor Philippines, Inc. G.R. No. 231581, April 10, 2019 FactsDokument4 SeitenCIR v. Univation Motor Philippines, Inc. G.R. No. 231581, April 10, 2019 FactsIsabel Claire OcaNoch keine Bewertungen

- Tax CasesDokument43 SeitenTax CasesArlando G. ArlandoNoch keine Bewertungen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- 1st Sec LowoodDokument1 Seite1st Sec LowoodZeyad El-sayedNoch keine Bewertungen

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDokument3 SeitenSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNoch keine Bewertungen

- Fede Al Securities Acts: OvervieDokument2 SeitenFede Al Securities Acts: OvervieZeyad El-sayedNoch keine Bewertungen

- Scan 0013Dokument2 SeitenScan 0013Zeyad El-sayedNoch keine Bewertungen

- Scan 0001Dokument2 SeitenScan 0001Zeyad El-sayedNoch keine Bewertungen

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDokument3 SeitenP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNoch keine Bewertungen

- Consent Dividends: Module 36 Taxes: CorporateDokument2 SeitenConsent Dividends: Module 36 Taxes: CorporateEl-Sayed MohammedNoch keine Bewertungen

- Scan 0001Dokument2 SeitenScan 0001Zeyad El-sayedNoch keine Bewertungen

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDokument2 Seiten80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNoch keine Bewertungen

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDokument2 SeitenI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedNoch keine Bewertungen

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDokument3 SeitenS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedNoch keine Bewertungen

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Dokument2 SeitenModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedNoch keine Bewertungen

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDokument2 SeitenModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNoch keine Bewertungen

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDokument2 SeitenModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNoch keine Bewertungen

- Taxable As A Dividend: 'Ss o %,, 'S eDokument2 SeitenTaxable As A Dividend: 'Ss o %,, 'S eEl-Sayed MohammedNoch keine Bewertungen

- Carryover of Tax Attributes NOL: S (,, S R S, T-I, C) A S V A I y I S T X Yea F e SDokument2 SeitenCarryover of Tax Attributes NOL: S (,, S R S, T-I, C) A S V A I y I S T X Yea F e SEl-Sayed MohammedNoch keine Bewertungen

- Scan 0012Dokument2 SeitenScan 0012Zeyad El-sayedNoch keine Bewertungen

- Scan 0010Dokument3 SeitenScan 0010Zeyad El-sayedNoch keine Bewertungen

- Deduct From Book Income: - B - T F Dul - .Dokument2 SeitenDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNoch keine Bewertungen

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDokument3 SeitenModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNoch keine Bewertungen

- Revocation of Discharge: 2M Module27 BankruptcyDokument2 SeitenRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNoch keine Bewertungen

- AMTs - Individual vs. CorporationDokument3 SeitenAMTs - Individual vs. CorporationZeyad El-sayedNoch keine Bewertungen

- B Nkruptcy: Discharge of A BankruptDokument2 SeitenB Nkruptcy: Discharge of A BankruptZeyad El-sayedNoch keine Bewertungen

- Scan 0010Dokument2 SeitenScan 0010Zeyad El-sayedNoch keine Bewertungen

- Scan 0018Dokument1 SeiteScan 0018Zeyad El-sayedNoch keine Bewertungen

- Bankruptcy:: y y S e S Owed SDokument3 SeitenBankruptcy:: y y S e S Owed SZeyad El-sayedNoch keine Bewertungen

- Tax Planning and Strategic ManagDokument2 SeitenTax Planning and Strategic ManagEl-Sayed MohammedNoch keine Bewertungen

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Dokument2 SeitenThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNoch keine Bewertungen

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDokument2 SeitenProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedNoch keine Bewertungen

- Article I Responsibilities. Article Il-The Public InterestDokument2 SeitenArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedNoch keine Bewertungen

- Memo of LawDokument24 SeitenMemo of LawAdam PhillipsNoch keine Bewertungen

- Quarter 4 Summative Test 2Dokument1 SeiteQuarter 4 Summative Test 2Rhoda May Bermejo TrompetaNoch keine Bewertungen

- Law Mantra: (National Monthly Journal, I.S.S.N 2321-6417)Dokument11 SeitenLaw Mantra: (National Monthly Journal, I.S.S.N 2321-6417)LAW MANTRA100% (1)

- The Virtue of HopeDokument7 SeitenThe Virtue of HopeJayson Resol Resurreccion100% (1)

- SecretsDokument2 SeitenSecretsirynNoch keine Bewertungen

- HandOuts For John of SalisburyDokument3 SeitenHandOuts For John of SalisburyMelchizedek Beton OmandamNoch keine Bewertungen

- Ethical Issues in Qualitative Research PDFDokument2 SeitenEthical Issues in Qualitative Research PDFJennaNoch keine Bewertungen

- Locus Standi in Company LawDokument3 SeitenLocus Standi in Company LawlucindaNoch keine Bewertungen

- Proposal - Short FilmDokument1 SeiteProposal - Short Filmapi-568114485Noch keine Bewertungen

- Assistant Professor, School of Management, Institute of Business Administration, KarachiDokument17 SeitenAssistant Professor, School of Management, Institute of Business Administration, Karachifx_ww2001Noch keine Bewertungen

- Psychotherapy With Schizophrenic PatientsDokument49 SeitenPsychotherapy With Schizophrenic PatientsMohith Maha100% (1)

- Memorandum On Behalf of The RespondentDokument43 SeitenMemorandum On Behalf of The RespondentKabir Jaiswal50% (2)

- COT LarpDokument78 SeitenCOT LarpRebebeNoch keine Bewertungen

- Consignee Copy: ClothDokument1 SeiteConsignee Copy: ClothhafsaNoch keine Bewertungen

- Aquino Administration and The Bill of RightsDokument2 SeitenAquino Administration and The Bill of RightsAndrea Hana DevezaNoch keine Bewertungen

- Oposa Vs Factoran DigestDokument2 SeitenOposa Vs Factoran Digestjireh100% (1)

- Levinas DissertationDokument299 SeitenLevinas DissertationEmeth Cordovero100% (2)

- Legend Hotel Case DigestDokument2 SeitenLegend Hotel Case DigestKian Fajardo100% (1)

- What Is The Social Responsibility of Corporate ManagementDokument8 SeitenWhat Is The Social Responsibility of Corporate Management38runnermomNoch keine Bewertungen

- Deloitte NL Risk Compliance Risk AssessmentsDokument8 SeitenDeloitte NL Risk Compliance Risk AssessmentsEwan PowrieNoch keine Bewertungen

- Methods of Philosophizing 1. The Dialectic MethodDokument2 SeitenMethods of Philosophizing 1. The Dialectic MethodZymer TarreNoch keine Bewertungen

- Critical ReadingDokument2 SeitenCritical ReadingEdi Galih SantosoNoch keine Bewertungen

- Ethics 2 PDFDokument203 SeitenEthics 2 PDFLukmaan IasNoch keine Bewertungen

- The Phenomenology of Internal Time-ConsciousnessDokument11 SeitenThe Phenomenology of Internal Time-ConsciousnessアダムNoch keine Bewertungen

- WordChaptersMerged. SHUBHAMDokument523 SeitenWordChaptersMerged. SHUBHAMRonit RayNoch keine Bewertungen

- Bsw3703 Presentation Notes 3 - Community Work PrinciplesDokument12 SeitenBsw3703 Presentation Notes 3 - Community Work Principlesronel barnard100% (1)

- Monster Unit AssessmentDokument4 SeitenMonster Unit AssessmentLatacha HardnettNoch keine Bewertungen

- Online Agenda: Zoom (Tunis, Time)Dokument3 SeitenOnline Agenda: Zoom (Tunis, Time)ALINoch keine Bewertungen

- Rates of Additional Compensation A. Night Shift DifferentialDokument14 SeitenRates of Additional Compensation A. Night Shift DifferentialJudith AlisuagNoch keine Bewertungen

- AAA Journal Volume 26 Issue 5 2013 - Mainstreaming Biodiversity Accounting - Potential ImplicationsDokument28 SeitenAAA Journal Volume 26 Issue 5 2013 - Mainstreaming Biodiversity Accounting - Potential ImplicationsKSatria BerGitarNoch keine Bewertungen