Beruflich Dokumente

Kultur Dokumente

Whitman County 2017 Accountability Audit Management Letter, April 1, 2019

Hochgeladen von

Whitman County Watch100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

188 Ansichten6 SeitenWhitman County 2017 Accountability audit management letter, April 1, 2019

Originaltitel

Whitman County 2017 Accountability audit management letter, April 1, 2019

Copyright

© © All Rights Reserved

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenWhitman County 2017 Accountability audit management letter, April 1, 2019

Copyright:

© All Rights Reserved

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

188 Ansichten6 SeitenWhitman County 2017 Accountability Audit Management Letter, April 1, 2019

Hochgeladen von

Whitman County WatchWhitman County 2017 Accountability audit management letter, April 1, 2019

Copyright:

© All Rights Reserved

Sie sind auf Seite 1von 6

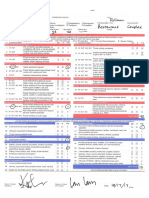

Office of the Washington State Auditor

Pat McCarthy

April 1, 2019

Board of Commissioners

Whitman County

Colfax, Washington

‘Management Letter

This letter includes a summary of specific matters that we identified in planning and performing

our accountability audit of Whitman County from January 1, 2017 through December 31, 2017.

We believe our recommendations will assist you in improving the County’s intemal controls in

these areas.

We will review the status of these matters during our next audit. We have already discussed our

comments with and made suggestions for improvements to Whitman County officials and

personnel. If you have any further questions, please contact me at (509) 329-3701 ext. 102.

This letter is intended for the information and use of management and the governing body and is

not suitable for any other purpose. However, this letter is a matter of public record and its

distribution is not limited.

We would also like to take this opportunity to extend our appreciation to your staff for the

cooperation and assistance given during the course of the audit.

Sincerely,

Vdla Saw)

Alisha Shaw, Audit Manager

Attachment

9

Inourance Building, P.O. Box 40021 + Olympia, Washington 88504-0021 « (360) 902.0570 + Pet McCarthy @sao.wa.gov

Management Letter

‘Whitman County

January 1, 2017 through December 31, 2017

Credit card and fuel card purchases

State law (RCW 43.09.2855) allows local governments to issue credit cards, provided they adopt

a system for distribution, authorization, control, and use of the credit cards and payment of the

bills. County management is responsible for designing and following internal controls that provide

reasonable assurance regarding compliance with state laws and County policies, and safeguarding,

of public resources. However, the County has not established adequate internal controls over credit

card and fuel card purchases and storage of unused cards.

During 2017, the County's operating expenditures totaled $35 mil

fuel-card purchases totaled $281,592 and $490,593, respectively.

ion and its credit-card and

We tested all 132 credit card purchases from April 2017, totaling $23,937, and found:

‘+ 53 purchases tested (40 percent), totaling $11,609, did not have adequate documentation

to demonstrate the purchases were for valid business purposes

‘+ 14 purchases tested (10.6 percent), totaling $1,439, did not have sufficient documentation

required by County policy or state law for an over-limit fee, meal and snack purchases, and

purchases made by the Sheriff's Office

We tested all 337 fuel card purchases from August 2017, totaling $13,318, and found:

* No receipts or other documentation supported any purchases tested. However, as of

December 2018, the County has established procedures requiring receipts to support fuel

purchases.

+ The County lacked sufficient documentation and did not perform a review to demonstrate

that all fuel purchases were for valid business purposes.

We tested the storage of credit cards and fuel cards and found 35 of 42 cards were not properly

stored in a secure location as required by County policy.

We recommend the County:

Strengthen its controls and follow its established policies for credit card and fuel card

purchases

Maintain adequate documentation to demonstrate purchases are for valid business purposes

and comply with County policies and state laws

Store credit and fuel cards not in use in a secure location as its policy requires

10

Exit Recommendations

Whitman County

Audit Period Ending: December 31, 2017

We are providing the following exit recommendations for management's consideration. They are

os teferenced in the audit report, We may review the status of the following exit items in our next

audit.

Accountability:

Internal Service Fund - Information Technology

The County should develop and follow a policy that governs how the County calculates and

charges Internal Service Fund - Information Technology shared costs to all funds. The policy

should specifically require the County to:

© Document the rationale for charging shared services to each fund.

‘* Retain support of the actual charges to each fund and how they were calculated.

‘+ Maintain adequate support that ending fund balance reflects a level that is anticipated to

assure continued operations of the fund.

Continue to ensure that excess or deficit fund balances are addressed timely through annual

rate adjustments

+ Review and update the policy and the cost allocation plan for charging shared services

costs at Jeast annually.

Petty Cash (District Court)

The District Court should establish appropriate procedures for the stamps petty cash fund as

prescribed by the BARS Manual section 3.8.8.20 to ensure:

+ The stamps on hand are reconciled to the authorized balance.

+ The reconciliation is periodically reviewed by someone other than the custodian.

Tracking and Safeguarding Assets (Parks & Recreation Department)

‘The Parks and Recreation Department should establish and follow policies and procedures to:

+ Monitor and track the purchase, disposal and location of assets to ensure the inventory list

is complete and accurate,

+ Ensure assets are properly tagged and identified as County property.

iL

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- 16-10 Excessive Force, Failure To Provide CareDokument4 Seiten16-10 Excessive Force, Failure To Provide CareWhitman County WatchNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- 17-17 Excessive Force Complaint (Exonerated)Dokument14 Seiten17-17 Excessive Force Complaint (Exonerated)Whitman County WatchNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- CHS Questions/concerns: Weiler, PhilDokument3 SeitenCHS Questions/concerns: Weiler, PhilWhitman County WatchNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- 17-14 Drone Complaint (Closed As Inquiry)Dokument3 Seiten17-14 Drone Complaint (Closed As Inquiry)Whitman County WatchNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 14-02 Racial Bias Complaint (Unfounded)Dokument4 Seiten14-02 Racial Bias Complaint (Unfounded)Whitman County WatchNoch keine Bewertungen

- 17-18 Inaccurate Reports (Sustained)Dokument21 Seiten17-18 Inaccurate Reports (Sustained)Whitman County WatchNoch keine Bewertungen

- 15-03 Squirrel Cage Complaint (Unfounded)Dokument2 Seiten15-03 Squirrel Cage Complaint (Unfounded)Whitman County WatchNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Vanek Draft Removal Letter - May 2018Dokument2 SeitenVanek Draft Removal Letter - May 2018Whitman County WatchNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Prosecutor Letter Declining Charges in Perez IncidentDokument2 SeitenProsecutor Letter Declining Charges in Perez IncidentWhitman County WatchNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 17-19 Use of Force, Fitness For Duty (Exonerated)Dokument14 Seiten17-19 Use of Force, Fitness For Duty (Exonerated)Whitman County WatchNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 18-05 PPD Excessive Force (Unfounded)Dokument7 Seiten18-05 PPD Excessive Force (Unfounded)Whitman County WatchNoch keine Bewertungen

- Clear Risk Initial Nov. 12 ReportDokument7 SeitenClear Risk Initial Nov. 12 ReportWhitman County WatchNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Whitman County Republican Central Committee Bylaws 2018Dokument12 SeitenWhitman County Republican Central Committee Bylaws 2018Whitman County WatchNoch keine Bewertungen

- ChaparritoReinspectionDokument2 SeitenChaparritoReinspectionWhitman County WatchNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Clear Risk Dec. 19 ReportDokument9 SeitenClear Risk Dec. 19 ReportWhitman County WatchNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- ChaparritoRoutineDokument2 SeitenChaparritoRoutineWhitman County WatchNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- NewGardenRoutineDokument2 SeitenNewGardenRoutineWhitman County WatchNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Scott Patrick Internal Affairs ReportDokument2 SeitenScott Patrick Internal Affairs ReportWhitman County WatchNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- CJTC Official Statement To CityDokument1 SeiteCJTC Official Statement To CityWhitman County WatchNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Whitman County 2019 Schedule of Board and Committee MeetingsDokument4 SeitenWhitman County 2019 Schedule of Board and Committee MeetingsWhitman County WatchNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)