Beruflich Dokumente

Kultur Dokumente

SET50 Index Options: SET50 Index Options Is A Contract Written by A Seller That Conveys To The Buyer The Right

Hochgeladen von

Adnan KamalOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SET50 Index Options: SET50 Index Options Is A Contract Written by A Seller That Conveys To The Buyer The Right

Hochgeladen von

Adnan KamalCopyright:

Verfügbare Formate

Updated 1 Feb, 2016

SET50 Index Options

SET50 Index Options is a contract written by a seller that conveys to the buyer the right —

but not the obligation — to buy (in the case of a call option) or to sell (in the case of a put option) a

particular asset, such as a piece of property, or shares of stock or some other underlying security,

such as, among others, a futures contract. In return for granting the option, the seller collects a

payment (the premium) from the buyer.

Type of SET50 Index Options

SET50 Index Options can be divided into 2 categorized, including SET50 Index Call Options and

SET50 Index Put Options

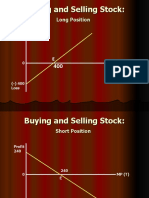

Call Options Put Options

Buyer The right to buy the underlying The right to sell the underlying

Long Position asset at the specified price and asset at the specified price and

amount. amount.

Seller The obligation to sell the The obligation to buy the

Short Position underlying asset at the exercise underlying asset from the buyer in

price. case of the right is exercised.

Symbol of SET50 Index Options conducted from:

• Underlying Asset The underlying asset is SET50 Index

• Expiration Month The delivery month

• Call or Put Type of options holding.

• Strike Price The price at which holder can exercise his/her right.

Updated 1 Feb, 2016

From the example above, S50H16C900 is equivalent to SET50 Call Option expired in March

2016 with exercise price equals to 900 points. The first 6 abbreviated characters are similar to SET50

Futures, however for SET50 Options, the type of options and the strike price are being added at the

end.

Contract Specification of SET50 Index Options

Specification Detail

Underlying Asset SET50 Index

Tick Size 0.1 index point

Multiplier 200 Baht per 1 point of index

Expiration Month Three nearest consecutive monthly contracts, and the nearest

quarterly contract

Trading Session Pre-open 9.15 – 9.45

Morning Session 9.45 – 12.30

Pre-open 13.45 – 14.15

Afternoon Session 14.15 – 16.55

Strike Price Interval 25 points at the beginning of each day

• 1 series at at-the-money

• 2 series at in-the-money

• 2 series at out-of-the-money

A new series will be added so that there are at least 2 in-the-

money series and 2 out-of-the-money series

Price Limit ±30% of the previous day’s settlement price without a 10% floor

Daily Settlement Price The last 5 minutes of a trading session (16.50 – 16.55) using the

Updated 1 Feb, 2016

average weighted price

Updated 1 Feb, 2016

Specification Detail

Final Settlement Price Weighted average price of SET50 Index during the last 15 minutes

of trading including the closing price and cut off 3 highest, lowest

price before rounding into 2 decimal

Settlement Method By cash (Cash Settlement)

The Last Trading Day The preceding working day before the last trading day for that

particular maturity contract month, ending at 4.30 P.M. on the last

trading day

Position Limit Net 100,000 delta equivalent SET50 Index Futures contracts on one

side of the market in any contract months of SET50 Index Futures

and SET50 Index Options combined

Large Position Report A report must be made when a net position held in any series or the

total holding of a call or put option exceeds 2,500 contracts

Notice: The report to TFEX is needed for every trading day after the

position possession meet the following condition by TFEX and will

continue until the position possession is lower than the figure set by

TFEX on the day after that

Margin Requirement Calculation Standard Portfolio Analysis of Risk (SPAN)

Das könnte Ihnen auch gefallen

- Derivatives - 4 PDFDokument10 SeitenDerivatives - 4 PDFKsagarika PatraNoch keine Bewertungen

- The Closing Prices Handbook: The Definitive Guide to Closing Prices DefinitionVon EverandThe Closing Prices Handbook: The Definitive Guide to Closing Prices DefinitionNoch keine Bewertungen

- Futures Contract Generic SpecificationsDokument5 SeitenFutures Contract Generic SpecificationsPuthpura PuthNoch keine Bewertungen

- SWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)Von EverandSWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)Noch keine Bewertungen

- TRSMGT Module III CH 2Dokument19 SeitenTRSMGT Module III CH 2santucan1Noch keine Bewertungen

- Margins The Margining System Is Based OnDokument36 SeitenMargins The Margining System Is Based OnPhaniraj LenkalapallyNoch keine Bewertungen

- Hand Book On Derivatives Trading: National Stock Exchange of India LimitedDokument7 SeitenHand Book On Derivatives Trading: National Stock Exchange of India LimitedKanwaljit Singh JollyNoch keine Bewertungen

- DerivativesDokument36 SeitenDerivativessajal30100% (1)

- Application of Futures: Chitra PotdarDokument31 SeitenApplication of Futures: Chitra PotdarDarshit ShahNoch keine Bewertungen

- Futures & Options SegmentDokument18 SeitenFutures & Options SegmentmeetwithsanjayNoch keine Bewertungen

- Derivatives TradingDokument26 SeitenDerivatives TradingNitu YadavNoch keine Bewertungen

- CDDokument2 SeitenCDGautam PraveenNoch keine Bewertungen

- Chapter - 7: Options and Their ValuationDokument29 SeitenChapter - 7: Options and Their ValuationAkash saxenaNoch keine Bewertungen

- Introduction To Financial DerivativesDokument80 SeitenIntroduction To Financial Derivativessnehakopade0% (1)

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDokument31 SeitenInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownyousufalkaiumNoch keine Bewertungen

- Derivatives TYFM Unit 1Dokument64 SeitenDerivatives TYFM Unit 1sacos16074Noch keine Bewertungen

- HOSE Trading Rule (En)Dokument11 SeitenHOSE Trading Rule (En)settles1187Noch keine Bewertungen

- Chapter 21 - Introduction To Derivative MarketsDokument31 SeitenChapter 21 - Introduction To Derivative MarketsSaad KhanNoch keine Bewertungen

- Contract Specifications For Stock OptionsDokument6 SeitenContract Specifications For Stock Optionssangeetha subramanianNoch keine Bewertungen

- Financial Derivatives: By: Saad HussainDokument26 SeitenFinancial Derivatives: By: Saad HussainSaad HussainNoch keine Bewertungen

- Session 5Dokument22 SeitenSession 5nikNoch keine Bewertungen

- Introduction To Financial DerivativesDokument64 SeitenIntroduction To Financial DerivativesranjitamodakNoch keine Bewertungen

- ProductSetUp OEXP v2Dokument8 SeitenProductSetUp OEXP v2Jeremy DickmanNoch keine Bewertungen

- Futures and Options:: Emerging TrendsDokument48 SeitenFutures and Options:: Emerging TrendsMihika BaxiNoch keine Bewertungen

- Definition OfUNDERLYINGDokument6 SeitenDefinition OfUNDERLYINGvjvijay88Noch keine Bewertungen

- Futers and OptionsDokument33 SeitenFuters and Optionssivannarayana katragaddaNoch keine Bewertungen

- DerivativesDokument41 SeitenDerivativesRajib MondalNoch keine Bewertungen

- Class Notes On OptionsDokument7 SeitenClass Notes On OptionsAnvesha TyagiNoch keine Bewertungen

- DMDM Corr PDFDokument2 SeitenDMDM Corr PDFNaveenNoch keine Bewertungen

- Derivatives MarketDokument62 SeitenDerivatives MarketswastikNoch keine Bewertungen

- Definition: A Derivative Is A Contract Between Two Parties Which Derives Its Value/price From An UnderlyingDokument4 SeitenDefinition: A Derivative Is A Contract Between Two Parties Which Derives Its Value/price From An UnderlyingriyakarthikaNoch keine Bewertungen

- NiftyDokument15 SeitenNiftySayali KambleNoch keine Bewertungen

- Drivers of Growth in Derivative MarketDokument13 SeitenDrivers of Growth in Derivative MarketsuhasinihoneyNoch keine Bewertungen

- An Option Is Part of A Class of Securities Called DerivativesDokument9 SeitenAn Option Is Part of A Class of Securities Called DerivativesajnabeeesNoch keine Bewertungen

- FuturesDokument105 SeitenFuturesheenamehta26100% (1)

- Risk ManagementDokument24 SeitenRisk ManagementSoujanya NagarajaNoch keine Bewertungen

- Vstoxx Jun01Dokument22 SeitenVstoxx Jun01maixoroNoch keine Bewertungen

- Options: Presented By:-Pramod Singh Baghel (30) Prince Asati (32) Rajat AgrawalDokument21 SeitenOptions: Presented By:-Pramod Singh Baghel (30) Prince Asati (32) Rajat AgrawaldomcertNoch keine Bewertungen

- 50767066Dokument27 Seiten50767066omprakashNoch keine Bewertungen

- Basics of Derivative Trading Basics of Derivative Trading: Financial MarketsDokument42 SeitenBasics of Derivative Trading Basics of Derivative Trading: Financial Marketschaitu511Noch keine Bewertungen

- Derivative 333Dokument3 SeitenDerivative 333muntaquirNoch keine Bewertungen

- 7.futures NSE GuidDokument4 Seiten7.futures NSE GuidAMAN KUMAR KHOSLANoch keine Bewertungen

- Corporate Finance: Class Notes 14Dokument24 SeitenCorporate Finance: Class Notes 14Sakshi VermaNoch keine Bewertungen

- Future ContractDokument24 SeitenFuture ContractKhyaati SharmaNoch keine Bewertungen

- Option Pricing Theory & Financial OptionsDokument70 SeitenOption Pricing Theory & Financial OptionsPiyush KhemkaNoch keine Bewertungen

- BAF 462 Investment Analysis and Portfolio Management Investments and Derivatives StrategiesDokument55 SeitenBAF 462 Investment Analysis and Portfolio Management Investments and Derivatives StrategiesLaston MilanziNoch keine Bewertungen

- Currency Derivatives SegmentDokument14 SeitenCurrency Derivatives Segmentnivedita_h42404Noch keine Bewertungen

- Introduction To Derivatives: Nse Academy CertifiedDokument55 SeitenIntroduction To Derivatives: Nse Academy CertifiedSrividhya RaghavanNoch keine Bewertungen

- Introduction To Derivatives (Part One)Dokument6 SeitenIntroduction To Derivatives (Part One)sandeep_bansal_8Noch keine Bewertungen

- Factsheet Eurex Euro-Swap FuturesDokument2 SeitenFactsheet Eurex Euro-Swap FuturesMarco PoloNoch keine Bewertungen

- Derivatives TrainingDokument83 SeitenDerivatives TrainingvaibhavgdNoch keine Bewertungen

- NISMDokument38 SeitenNISMkannan2505100% (1)

- Specification of Stock OptionDokument1 SeiteSpecification of Stock OptionPuthpura PuthNoch keine Bewertungen

- NSE DerivativesDokument7 SeitenNSE DerivativesVivek MishraNoch keine Bewertungen

- A Study For Management of Risks Through DerivativesDokument27 SeitenA Study For Management of Risks Through DerivativesAshish PoddarNoch keine Bewertungen

- 2 Forwards & Futures PricingDokument60 Seiten2 Forwards & Futures PricingparthNoch keine Bewertungen

- SAPM 12 - Options and FuturesDokument70 SeitenSAPM 12 - Options and FuturesmannanabdulahmedNoch keine Bewertungen

- Options TheoryDokument8 SeitenOptions TheoryKondalaRav MaduriNoch keine Bewertungen

- CHAPTER 3 Investment Information and Security TransactionDokument22 SeitenCHAPTER 3 Investment Information and Security TransactionTika TimilsinaNoch keine Bewertungen

- LepDokument2 SeitenLepAdnan KamalNoch keine Bewertungen

- 2013 Dec13 Real Estate InvestmentDokument1 Seite2013 Dec13 Real Estate InvestmentAdnan KamalNoch keine Bewertungen

- Copenhagen Finance NotesDokument176 SeitenCopenhagen Finance NotesElia ScagnolariNoch keine Bewertungen

- An Examination of The Maturity Effect in The Indian Commodities Futures MarketDokument8 SeitenAn Examination of The Maturity Effect in The Indian Commodities Futures MarketAdnan KamalNoch keine Bewertungen

- The Valuation of Options For Alternative StochastiDokument23 SeitenThe Valuation of Options For Alternative StochastiAdnan KamalNoch keine Bewertungen

- Implied Volatility Formula of European Power Option Pricing: ( ) RespectivelyDokument8 SeitenImplied Volatility Formula of European Power Option Pricing: ( ) RespectivelyAdnan KamalNoch keine Bewertungen

- Registration Form For Semester 1-2018Dokument1 SeiteRegistration Form For Semester 1-2018Adnan KamalNoch keine Bewertungen

- Academic Program 20802 PDFDokument98 SeitenAcademic Program 20802 PDFAdnan KamalNoch keine Bewertungen

- BS OpmDokument2 SeitenBS OpmShijo ThomasNoch keine Bewertungen

- PH.D BA - Class Schedule 1-2018Dokument1 SeitePH.D BA - Class Schedule 1-2018Adnan KamalNoch keine Bewertungen

- Petition Form PDFDokument1 SeitePetition Form PDFAdnan KamalNoch keine Bewertungen

- Meyers Risk Aversion OptimizationDokument25 SeitenMeyers Risk Aversion OptimizationAdnan KamalNoch keine Bewertungen

- Sustainable Green Banking: The Case of Greece: Angelos PapastergiouDokument12 SeitenSustainable Green Banking: The Case of Greece: Angelos PapastergiouAdnan KamalNoch keine Bewertungen

- PH.D BA - Class Schedule 1-2018Dokument1 SeitePH.D BA - Class Schedule 1-2018Adnan KamalNoch keine Bewertungen

- Price Lists Bangladesh-Car PartsDokument28 SeitenPrice Lists Bangladesh-Car PartsAdnan KamalNoch keine Bewertungen

- Soft Skills PDFDokument117 SeitenSoft Skills PDFAdnan KamalNoch keine Bewertungen

- Bank Board Structure and Performance: Evidence For Large Bank Holding CompaniesDokument22 SeitenBank Board Structure and Performance: Evidence For Large Bank Holding CompaniesAdnan KamalNoch keine Bewertungen

- DerivativesDokument16 SeitenDerivativesMustafaKamalNoch keine Bewertungen

- 10 1 1 320 1538 PDFDokument27 Seiten10 1 1 320 1538 PDFAdnan KamalNoch keine Bewertungen

- CH Pres 01Dokument58 SeitenCH Pres 01Adnan KamalNoch keine Bewertungen

- Econ11 09 Lecture2 PreferencesDokument22 SeitenEcon11 09 Lecture2 PreferencesTania SahaNoch keine Bewertungen

- City Brokerage Limited: Account Status Till TodayDokument1 SeiteCity Brokerage Limited: Account Status Till TodayAdnan KamalNoch keine Bewertungen

- Topic Interested EconometricsDokument18 SeitenTopic Interested EconometricsAdnan KamalNoch keine Bewertungen

- Research Paper Mispricing of Index OptionsDokument31 SeitenResearch Paper Mispricing of Index OptionsAdnan KamalNoch keine Bewertungen

- Lecture 1: Risk and Risk AversionDokument15 SeitenLecture 1: Risk and Risk AversionDavide Paccia BattistiniNoch keine Bewertungen

- Power PointDokument18 SeitenPower PointAdnan KamalNoch keine Bewertungen

- Leadership ModelsDokument49 SeitenLeadership ModelsAdnan KamalNoch keine Bewertungen

- Football Vs Hockey Even BetDokument16 SeitenFootball Vs Hockey Even BetAdnan KamalNoch keine Bewertungen

- Power PointDokument18 SeitenPower PointAdnan KamalNoch keine Bewertungen

- Process Costing Tutorial SheetDokument3 SeitenProcess Costing Tutorial Sheets_camika7534Noch keine Bewertungen

- Our Plan For Prosperity - Excerpts From The PPP/C Manifesto 2020-2025Dokument8 SeitenOur Plan For Prosperity - Excerpts From The PPP/C Manifesto 2020-2025People's Progressive Party86% (14)

- Chapter 5 NotesDokument3 SeitenChapter 5 NotesSarah WintersNoch keine Bewertungen

- 1 InvoiceDokument1 Seite1 InvoiceMohit GargNoch keine Bewertungen

- Your Guide To Employing A Foreign Domestic Worker in QatarDokument20 SeitenYour Guide To Employing A Foreign Domestic Worker in QatarMigrantRightsOrg100% (1)

- Case Study 3 - Heldon Tool Manufacturing CaseDokument3 SeitenCase Study 3 - Heldon Tool Manufacturing CasethetinkerxNoch keine Bewertungen

- Business English Stock MarketDokument2 SeitenBusiness English Stock MarketMara CaiboNoch keine Bewertungen

- Project Summary For Public DisclosureDokument2 SeitenProject Summary For Public DisclosureRohit BhamareNoch keine Bewertungen

- Agricultural Transformation and Rural DevelopmentDokument3 SeitenAgricultural Transformation and Rural DevelopmentKailah CalinogNoch keine Bewertungen

- Question Bank Macro EconomicsDokument4 SeitenQuestion Bank Macro EconomicsSalim SharifuNoch keine Bewertungen

- Islamic Modes of Financing: Diminishing MusharakahDokument40 SeitenIslamic Modes of Financing: Diminishing MusharakahFaizan Ch0% (1)

- Brain Drain Reading Comprehension Exercises - 72947Dokument1 SeiteBrain Drain Reading Comprehension Exercises - 72947MouradFilali100% (1)

- Retirement WorksheetDokument55 SeitenRetirement WorksheetRich AbuNoch keine Bewertungen

- BCM 2104 - Intermediate Accounting I - October 2013Dokument12 SeitenBCM 2104 - Intermediate Accounting I - October 2013Behind SeriesNoch keine Bewertungen

- Product Development Life Cycle - In-Depth DiscussionDokument2 SeitenProduct Development Life Cycle - In-Depth DiscussionFahim IftikharNoch keine Bewertungen

- DMA Case-Tean Assignment-Group4 v1Dokument8 SeitenDMA Case-Tean Assignment-Group4 v1Aissam OuazaNoch keine Bewertungen

- Working Capital Management at BEMLDokument20 SeitenWorking Capital Management at BEMLadharav malikNoch keine Bewertungen

- Module 2-APPLIED ECONDokument5 SeitenModule 2-APPLIED ECONMae EnteroNoch keine Bewertungen

- Chapter 2 Test BankDokument7 SeitenChapter 2 Test Bankrajalaxmi rajendranNoch keine Bewertungen

- The Accounting Principles Board - ASOBATDokument14 SeitenThe Accounting Principles Board - ASOBATblindleapNoch keine Bewertungen

- EY Pathway To Successful Family and Wealth ManagementDokument32 SeitenEY Pathway To Successful Family and Wealth ManagementJesse Carmichael100% (1)

- BarillaDokument22 SeitenBarillaAbhinav LuthraNoch keine Bewertungen

- Topic-3-Price Determination Under Perfect CompetitionDokument19 SeitenTopic-3-Price Determination Under Perfect Competitionreuben kawongaNoch keine Bewertungen

- FIN542 Ind. AssignmentDokument10 SeitenFIN542 Ind. AssignmentCici KakaNoch keine Bewertungen

- Revised Corporation CodeDokument5 SeitenRevised Corporation CodekeithNoch keine Bewertungen

- Blue Nile GooodDokument67 SeitenBlue Nile GooodKamil Jagieniak100% (1)

- MACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)Dokument514 SeitenMACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)the.lord.of.twitter101Noch keine Bewertungen

- Means of Avoiding or Minimizing The Burdens of TaxationDokument6 SeitenMeans of Avoiding or Minimizing The Burdens of TaxationRoschelle MiguelNoch keine Bewertungen

- Canara BankDokument18 SeitenCanara Bankmithun mohanNoch keine Bewertungen

- DCC 135Dokument193 SeitenDCC 135Shariful IslamNoch keine Bewertungen