Beruflich Dokumente

Kultur Dokumente

Taxes: Transactions in Property: Involuntary Conversions

Hochgeladen von

El Sayed AbdelgawwadOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Taxes: Transactions in Property: Involuntary Conversions

Hochgeladen von

El Sayed AbdelgawwadCopyright:

Verfügbare Formate

49 MODULE 34 TAXES: TRANSACTIONS IN PROPERTY

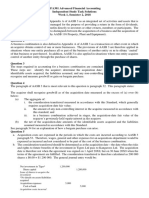

_ _B _

FMV of real estate received A_ $70,000 .

+ Liability on old real estate assumed by

$65,000

other party (boot received) 15.00 (1) 10.000

Amount realized on the exchange 0 $80,000

- Adjusted basis of old real estate transferred

- Liability assumed by taxpayer on new real $80,000 -.60,000

estate (boot given) -10.000 (2) -15.000

Gain realized $ 5.000

-50,000

$20.000 $ ".

Gain recognized (1) minus (2) $ 5.000 $60,000

Basis of old real estate transferred $50,00

+ Liability assumed by taxpayer on new real 15,000

010,000

estate (boot given) 5,000·

+ Gain recognized

- Liability on old real estate assumed by

other party (boot received) -15.000 -10.000

Basis of new real estate acquired $50 000 $65 000

(d)' Boot given in the form of an assumption of a liability does not offset boot received in the

form of cash or unlike property; however, boot given in the form of cash or unlike prop-

erty d.oes offset boot received in the form of a liability assumed by the other party.

EXAMPLE: Assume the same facts as above except that the mortgage on B's old real estate was $6,000,

and that A paid B casn of $4,000 to make up the difference. The tax effects to A remain unchanged.

. (11)However,

If withinsince

twotheyears

$4,000after

cash cannot be offset

a like-kind by the liability

exchange assumed

between by B, B

related must recognize

persons a gain of

[as defined

Sec.in

267 (b)] either person disposes of the property received

$4;000, and will have a basis of $69,000 for the ne,w real estate.

iri the exchange, any gain.

or loss that'

was not recognized on the exchange must be recognized (subject to the loss limitation rules

for related persons) as of the date that the property was disposed of. This gain recognition rule

does not apply if the subsequent disposition was the result of the death of one of the persons,

an involuntary conversion, or where neither the exchange nor the disposition had tax avoid-

ance as one of its principal purposes.

b., .Involuntary conversions

(1) Occur when money' or other property is received for property that has been destroyed, dam-

aged, stolen, or condemned (even if property is transferred only under threat or imminence of

condemnation).

(2) . If payment is received and gain is realized, taxpayer may elect not to recognize gain if con-

verted property is replaced with property of similar or related use .

(a) Gain is recognized only to the extent that the amount realized exceeds the cost of the re-

placement.

(b) The replacement must be purchased within a period beginning with the earlier of the date

of disposition or the date of threat of condemnation, and ending two years after the close

of the taxable year in which gain is first realized (three years for condemned business or

investment real property, other than inventory or property held primarily for resale) .

. (c) Basis of -replacement property is the cost of the replacement decreased by any gain not

recognized.

EXAMPLE: Taxpayer had unimproved real estate (with an adjusted basis of $20,000) which was con-

demned. by the county. The county paid him $24,000 and he reinvested $21 : 000 in unimproved real es-

tate. $1,000 of the $4,000 realized gain would not be recognized. His tax basis in the new real estate

would be $20,900 ($21,000 cost - $1,000 deferred gain).

EXAMPLE: Assume the same facts as above except the taxpayer reinvested $25,000 in unimproved real

- estate. None of the $4,000 realized gain would be recognized. His basis in the new real estate would be

$21,000 ($25,000 cost - $4,000 deferred gain).

(3) If property is converted directly into property similar or related in service or use, complete

nonrecognition of gain is mandatory. The basis of replacement property is the same as the

property converted.

(4) The meaning of property similar or related in service or use is more restrictive than "like-

kind."

Das könnte Ihnen auch gefallen

- South Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFDokument45 SeitenSouth Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFSarahSweeneyjpox100% (8)

- Debt RestructuringDokument4 SeitenDebt RestructuringAra BellaNoch keine Bewertungen

- Drill Corporate LiquidationDokument3 SeitenDrill Corporate LiquidationElizabeth DumawalNoch keine Bewertungen

- Cruz16e Chap12 IMDokument8 SeitenCruz16e Chap12 IMJosef Galileo SibalaNoch keine Bewertungen

- Chapter 9-Debt Restructure: Journal EntryDokument6 SeitenChapter 9-Debt Restructure: Journal EntrySymon AngeloNoch keine Bewertungen

- Taxes: Transactions in Property:) S - C S - S S o y S y S - S" e S A A A S G S. X S, ADokument3 SeitenTaxes: Transactions in Property:) S - C S - S S o y S y S - S" e S A A A S G S. X S, AZeyad El-sayedNoch keine Bewertungen

- Scan 0001Dokument2 SeitenScan 0001Zeyad El-sayedNoch keine Bewertungen

- Scan 0001Dokument2 SeitenScan 0001Zeyad El-sayedNoch keine Bewertungen

- Pcoa 008 - Intermediate Accounting Ii MODULE 5: Debt RestructureDokument15 SeitenPcoa 008 - Intermediate Accounting Ii MODULE 5: Debt RestructureErika EsguerraNoch keine Bewertungen

- TA Xes: Transactions in Property: (5) The Basis of Like-Kind Property Received Is The Basis of Like-Kind Property GivenDokument2 SeitenTA Xes: Transactions in Property: (5) The Basis of Like-Kind Property Received Is The Basis of Like-Kind Property GivenEl Sayed AbdelgawwadNoch keine Bewertungen

- Chapter 18Dokument3 SeitenChapter 18Yasmeen YoussefNoch keine Bewertungen

- Chapter 10 15Dokument89 SeitenChapter 10 15Aira Mae P. VispoNoch keine Bewertungen

- ACC 430 Chapter 9Dokument13 SeitenACC 430 Chapter 9vikkiNoch keine Bewertungen

- Acctg 162 Handout 03 Corporate LiquidationDokument3 SeitenAcctg 162 Handout 03 Corporate LiquidationTrisha VenegasNoch keine Bewertungen

- BFA301 Independent Study Task Solutions Week 1 PDFDokument3 SeitenBFA301 Independent Study Task Solutions Week 1 PDFerinNoch keine Bewertungen

- Wassim Zhani Income Taxation of Corporations (Chapter 2)Dokument46 SeitenWassim Zhani Income Taxation of Corporations (Chapter 2)wassim zhaniNoch keine Bewertungen

- Corporate Liquidation Answer SheetDokument4 SeitenCorporate Liquidation Answer SheetsatyaNoch keine Bewertungen

- ABC FX Summer 22 23Dokument16 SeitenABC FX Summer 22 23Patricia EsplagoNoch keine Bewertungen

- Nontaxable Exchanges Like-Kind Exchanges - 1031Dokument6 SeitenNontaxable Exchanges Like-Kind Exchanges - 1031张心怡Noch keine Bewertungen

- Far Acctg Notes - CompressDokument3 SeitenFar Acctg Notes - CompressMARK JHEN SALANGNoch keine Bewertungen

- Topic 1 Corporate Liquidation - ModuleDokument11 SeitenTopic 1 Corporate Liquidation - ModuleJenny LelisNoch keine Bewertungen

- June 9-Acquisition of PPEDokument2 SeitenJune 9-Acquisition of PPEJolo RomanNoch keine Bewertungen

- Accounting For InvestmentDokument19 SeitenAccounting For InvestmentJhon Vincent BuragaNoch keine Bewertungen

- Donors Tax Handout 3Dokument5 SeitenDonors Tax Handout 3Xerez SingsonNoch keine Bewertungen

- Ch10 ProblemDokument2 SeitenCh10 ProblempalashndcNoch keine Bewertungen

- Acc 496 Chapter 3Dokument2 SeitenAcc 496 Chapter 3Abdul HassonNoch keine Bewertungen

- Project On DissolutionDokument5 SeitenProject On DissolutionUday MathurNoch keine Bewertungen

- Chapter 15, Modern Advanced Accounting-Review Q & ExrDokument16 SeitenChapter 15, Modern Advanced Accounting-Review Q & Exrrlg4814100% (2)

- Executors AccountsDokument5 SeitenExecutors AccountskennedyNoch keine Bewertungen

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDokument3 SeitenModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNoch keine Bewertungen

- Module 8 - Derecognition of ReceivablesDokument6 SeitenModule 8 - Derecognition of Receivablesshaira doctorNoch keine Bewertungen

- Requirement: Determine The Financial Liabilities To Be Disclosed in The NotesDokument4 SeitenRequirement: Determine The Financial Liabilities To Be Disclosed in The NotesInvisible CionNoch keine Bewertungen

- Business Combination - ExercisesDokument36 SeitenBusiness Combination - ExercisesJessalyn CilotNoch keine Bewertungen

- Chapter 02 - Consolidation of Financial Information: PROBLEMS 2-20, 2-21, 2-27, 2-22Dokument33 SeitenChapter 02 - Consolidation of Financial Information: PROBLEMS 2-20, 2-21, 2-27, 2-22Su Ed100% (1)

- Applied Audit Chapter 16Dokument20 SeitenApplied Audit Chapter 16Nannette RomaNoch keine Bewertungen

- Conceptual Framework and Accounting Standards Q A 4Dokument5 SeitenConceptual Framework and Accounting Standards Q A 4James DetallaNoch keine Bewertungen

- 01 Handout FINAC2 Lease Accounting Debt Restructuring PDFDokument4 Seiten01 Handout FINAC2 Lease Accounting Debt Restructuring PDFNil Allen Dizon FajardoNoch keine Bewertungen

- M AX N N: Odule T Es: Transactio SI PropertyDokument2 SeitenM AX N N: Odule T Es: Transactio SI PropertyEl Sayed AbdelgawwadNoch keine Bewertungen

- L2 - Business Combinations II (2023)Dokument12 SeitenL2 - Business Combinations II (2023)waiwaichoi112Noch keine Bewertungen

- TB 6Dokument2 SeitenTB 6Louiza Kyla AridaNoch keine Bewertungen

- Module 40 Taxes: Gift and Estate: 11. Generation-Skipping TaxDokument2 SeitenModule 40 Taxes: Gift and Estate: 11. Generation-Skipping TaxZeyad El-sayedNoch keine Bewertungen

- Solution:: Problem 4: For Classroom DiscussionDokument2 SeitenSolution:: Problem 4: For Classroom DiscussionAnika Gaudan PonoNoch keine Bewertungen

- Intangible AssetsDokument1 SeiteIntangible AssetsGraceila P. CalopeNoch keine Bewertungen

- Lease AccountingDokument3 SeitenLease AccountingkirigofortunateNoch keine Bewertungen

- FAR.3015 Cash and Cash EquivalentsDokument3 SeitenFAR.3015 Cash and Cash EquivalentsJoana Tatac100% (1)

- Property Tax 2022Dokument35 SeitenProperty Tax 2022rav danoNoch keine Bewertungen

- Akl Ii TM 10Dokument5 SeitenAkl Ii TM 10Amalia FillahNoch keine Bewertungen

- Donor's Tax 2024Dokument6 SeitenDonor's Tax 2024Michael BongalontaNoch keine Bewertungen

- Partnership Formation 46A 46JDokument11 SeitenPartnership Formation 46A 46JRaella FernandezNoch keine Bewertungen

- Business Combi. Chapter 1 PROBLEM 3Dokument4 SeitenBusiness Combi. Chapter 1 PROBLEM 3latte aeriNoch keine Bewertungen

- L1 - Business Combinations I - Supplementary (2023)Dokument3 SeitenL1 - Business Combinations I - Supplementary (2023)waiwaichoi112Noch keine Bewertungen

- Debt Restructure - SIM - 0Dokument14 SeitenDebt Restructure - SIM - 0lilienesieraNoch keine Bewertungen

- Chapter 10Dokument26 SeitenChapter 10IstikharohNoch keine Bewertungen

- Name: Ortega, Jacqueline L. Course & Year: BS Accountancy 3 Business Combination: Specific Cases Problem 1: True or FalseDokument6 SeitenName: Ortega, Jacqueline L. Course & Year: BS Accountancy 3 Business Combination: Specific Cases Problem 1: True or FalseJacqueline OrtegaNoch keine Bewertungen

- Advanced Tax (Acct 407) Chapter 17, 2, 3, 4, and 5Dokument14 SeitenAdvanced Tax (Acct 407) Chapter 17, 2, 3, 4, and 5barlie3824Noch keine Bewertungen

- Debt Restructuring - Prof PDFDokument6 SeitenDebt Restructuring - Prof PDFDonise Ronadel Santos50% (2)

- Chapter 2 AssignmentDokument3 SeitenChapter 2 AssignmentJasmin MarreroNoch keine Bewertungen

- Chapter 9 PDFDokument17 SeitenChapter 9 PDFJay BrockNoch keine Bewertungen

- Taxes: Transactions in PropertyDokument2 SeitenTaxes: Transactions in PropertyEl Sayed AbdelgawwadNoch keine Bewertungen

- The Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeVon EverandThe Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeNoch keine Bewertungen

- Module 22 Federal Securities Acts and Antitrust LawDokument2 SeitenModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNoch keine Bewertungen

- P L N L U N N T MP: Sarbanes-Ox Eyactof2 2Dokument2 SeitenP L N L U N N T MP: Sarbanes-Ox Eyactof2 2El Sayed AbdelgawwadNoch keine Bewertungen

- Federal Securities Acts and Antitrust LawDokument3 SeitenFederal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNoch keine Bewertungen

- Module 22 Federal Securities Acts and Antitrust LawDokument2 SeitenModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNoch keine Bewertungen

- Agency: I. Formation of The Agency RelationshipDokument7 SeitenAgency: I. Formation of The Agency RelationshipEl Sayed AbdelgawwadNoch keine Bewertungen

- M Dule 22 Federal Securities Acts and Antitrust LawDokument2 SeitenM Dule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0015Dokument2 SeitenScan 0015El Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0014Dokument2 SeitenScan 0014El Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0014Dokument2 SeitenScan 0014El Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0021Dokument2 SeitenScan 0021El Sayed AbdelgawwadNoch keine Bewertungen

- Contracts: Over IDokument2 SeitenContracts: Over IEl Sayed AbdelgawwadNoch keine Bewertungen

- C Ayton Act of 1914: Module 22 Fe E A SE UDokument2 SeitenC Ayton Act of 1914: Module 22 Fe E A SE UEl Sayed AbdelgawwadNoch keine Bewertungen

- Federal Securities Acts and Antitrust Law: C o C eDokument2 SeitenFederal Securities Acts and Antitrust Law: C o C eEl Sayed AbdelgawwadNoch keine Bewertungen

- Cont A: R CTSDokument2 SeitenCont A: R CTSEl Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0020Dokument2 SeitenScan 0020El Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0003Dokument2 SeitenScan 0003El Sayed AbdelgawwadNoch keine Bewertungen

- Contracts: D Still Owes CTDokument2 SeitenContracts: D Still Owes CTEl Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0014Dokument2 SeitenScan 0014El Sayed AbdelgawwadNoch keine Bewertungen

- S S S T I E: ContractsDokument2 SeitenS S S T I E: ContractsEl Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0002Dokument2 SeitenScan 0002El Sayed AbdelgawwadNoch keine Bewertungen

- Ill LLQ J: ContractsDokument2 SeitenIll LLQ J: ContractsEl Sayed AbdelgawwadNoch keine Bewertungen

- Cont Acts: G A A yDokument1 SeiteCont Acts: G A A yEl Sayed AbdelgawwadNoch keine Bewertungen

- Secured Transactions: FreezerDokument2 SeitenSecured Transactions: FreezerEl Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0007Dokument2 SeitenScan 0007El Sayed AbdelgawwadNoch keine Bewertungen

- J .T/DTD: Tjrrji?"Dokument1 SeiteJ .T/DTD: Tjrrji?"El Sayed AbdelgawwadNoch keine Bewertungen

- Scan 0002Dokument2 SeitenScan 0002El Sayed AbdelgawwadNoch keine Bewertungen

- Priorities: Secu Ed TransactionsDokument2 SeitenPriorities: Secu Ed TransactionsEl Sayed AbdelgawwadNoch keine Bewertungen

- Module 26 Secured Transactions:: o C, G eDokument2 SeitenModule 26 Secured Transactions:: o C, G eEl Sayed AbdelgawwadNoch keine Bewertungen

- Module 26 Secured Transactions:: S G S C R eDokument2 SeitenModule 26 Secured Transactions:: S G S C R eEl Sayed AbdelgawwadNoch keine Bewertungen

- Fi V Y, A (A A y I R S (B) A R S Si: Secured TransactionsDokument2 SeitenFi V Y, A (A A y I R S (B) A R S Si: Secured TransactionsEl Sayed AbdelgawwadNoch keine Bewertungen

- Ch.6 TariffsDokument59 SeitenCh.6 TariffsDina SamirNoch keine Bewertungen

- Student Guidelines The School PoliciesDokument5 SeitenStudent Guidelines The School PoliciesMaritessNoch keine Bewertungen

- CDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)Dokument2 SeitenCDR Questionnaire Form: of The Project I.E. How The Objectives of The Project Was Accomplished in Brief.)NASEER AHMAD100% (1)

- Chapter 12Dokument72 SeitenChapter 12Samaaraa NorNoch keine Bewertungen

- DepEd Red Cross 3 4 Seater Detached PoWs BoQsDokument42 SeitenDepEd Red Cross 3 4 Seater Detached PoWs BoQsRamil S. ArtatesNoch keine Bewertungen

- How To Write A Driving School Business Plan: Executive SummaryDokument3 SeitenHow To Write A Driving School Business Plan: Executive SummaryLucas Reigner KallyNoch keine Bewertungen

- Susan Rose's Legal Threat To Myself and The Save Ardmore CoalitionDokument2 SeitenSusan Rose's Legal Threat To Myself and The Save Ardmore CoalitionDouglas MuthNoch keine Bewertungen

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDokument1 SeitePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsRISHABH YADAVNoch keine Bewertungen

- Organizational Behavior: Chapter 6: Understanding Work TeamDokument6 SeitenOrganizational Behavior: Chapter 6: Understanding Work TeamCatherineNoch keine Bewertungen

- CT 1 - QP - Icse - X - GSTDokument2 SeitenCT 1 - QP - Icse - X - GSTAnanya IyerNoch keine Bewertungen

- Weight Watchers Business Plan 2019Dokument71 SeitenWeight Watchers Business Plan 2019mhetfield100% (1)

- HelpDokument5 SeitenHelpMd Tushar Abdullah 024 ANoch keine Bewertungen

- Trade Promotion Optimization - MarketelligentDokument12 SeitenTrade Promotion Optimization - MarketelligentMarketelligentNoch keine Bewertungen

- Cuthites: Cuthites in Jewish LiteratureDokument2 SeitenCuthites: Cuthites in Jewish LiteratureErdincNoch keine Bewertungen

- Jonathan Bishop's Election Address For The Pontypridd Constituency in GE2019Dokument1 SeiteJonathan Bishop's Election Address For The Pontypridd Constituency in GE2019Councillor Jonathan BishopNoch keine Bewertungen

- AJWS Response To July 17 NoticeDokument3 SeitenAJWS Response To July 17 NoticeInterActionNoch keine Bewertungen

- Sailpoint Training Understanding ReportDokument2 SeitenSailpoint Training Understanding ReportKunalGuptaNoch keine Bewertungen

- JournalofHS Vol11Dokument136 SeitenJournalofHS Vol11AleynaNoch keine Bewertungen

- The Tragedy of Karbala by Dr. Israr AhmedDokument13 SeitenThe Tragedy of Karbala by Dr. Israr AhmedMehboob Hassan100% (2)

- How To Claim Your VAT RefundDokument5 SeitenHow To Claim Your VAT Refundariffstudio100% (1)

- Communication and Design Portafolio - Vanessa CerviniDokument34 SeitenCommunication and Design Portafolio - Vanessa CerviniVanCerRNoch keine Bewertungen

- The Engraves of Macau by A. Borget and L. Benett in Stella Blandy's Les Épreuves de Norbert en Chine' (1883)Dokument8 SeitenThe Engraves of Macau by A. Borget and L. Benett in Stella Blandy's Les Épreuves de Norbert en Chine' (1883)Ivo CarneiroNoch keine Bewertungen

- 6 Chase Nat'l Bank of New York V BattatDokument2 Seiten6 Chase Nat'l Bank of New York V BattatrNoch keine Bewertungen

- Daftar Kata Kerja Beraturan (Regular Verbs) : Kata Dasar Past Participle ArtinyaDokument6 SeitenDaftar Kata Kerja Beraturan (Regular Verbs) : Kata Dasar Past Participle ArtinyaEva Hirul MalaNoch keine Bewertungen

- Notice - Carte Pci - Msi - Pc54g-Bt - 2Dokument46 SeitenNotice - Carte Pci - Msi - Pc54g-Bt - 2Lionnel de MarquayNoch keine Bewertungen

- Rakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)Dokument2 SeitenRakesh Ali: Centre Manager (Edubridge Learning Pvt. LTD)HRD CORP CONSULTANCYNoch keine Bewertungen

- Section 7 4 Part IVDokument10 SeitenSection 7 4 Part IVapi-196193978Noch keine Bewertungen

- eLTE5.0 DBS3900 Product Description (3GPP)Dokument37 SeiteneLTE5.0 DBS3900 Product Description (3GPP)Wisut MorthaiNoch keine Bewertungen

- Consolidation Physical Fitness Test FormDokument5 SeitenConsolidation Physical Fitness Test Formvenus velonza100% (1)

- Dividend Discount ModelDokument54 SeitenDividend Discount ModelVaidyanathan Ravichandran100% (1)