Beruflich Dokumente

Kultur Dokumente

Inspection, SCN Do, Raid Page 2

Hochgeladen von

Neera JainOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Inspection, SCN Do, Raid Page 2

Hochgeladen von

Neera JainCopyright:

Verfügbare Formate

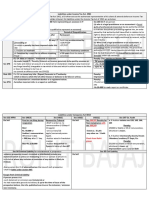

Regular Audit INSPECTION, SEARCH, SEIZURE AND ARREST

(Documents, Goods & Person)

SCN/Demand Order

COMMISSIONER I Inspection of ANY business place (Premises / warehouse /

OFFICE 0---------------0 TAX not paid / Short-Paid/Erroneous Refund N showroom etc.) of I & II Party –inspection of books of account,

ITC Wrongly Availed/Utilised S documents, computers, computer programs, computer software

(Audit / Special Audit May or May Not be) and the Person will cooperate.

Audit of books of account at any office (assessee/officer) P

(Period: 1 or more FY & Frequency TBD) E IF JC or above Rank officer has reason to believe that I/II party

OFFER : 1 OFFER : 1 involve in TAX EVASION.(by himself or through authorised

C officer: GST INS- 01 )

INFO. /Notice 15 DAYS in advance [GST ADT- 01]

(PAY TAX + INTEREST) PAY TAX + INTEREST + 15% Penalty T II Party means: Transporter, warehouse keeper etc.

Assessee Facilitate Officer - & Time of SCN 3 / 6 Months in advance I

Note: Inspection of Goods in movement / Transit-Possible - IF

provide timely & correct INFO. O Value of Goods Rs. 50,000 Plus – and the interceptor may require

IN FULL IN PART IN PART IN FULL

Time Limit of Audit: 3Months + EXT of 6 Months from:- N PIC to produce the document and will do so and allow the

inspection of goods.

For Balance For Balance

* Books of A/c made L

Available. A No SCN No SCN IF J.C. or Above Rank Officer during Inspection or OTHERWISE

OR T No Penalty SCN / Supp. SCN (i.e. Direct reason) has reason to believe -that any contraband goods or

* Actual Institution of Audit E [TAX+INT+PENALTY (10% S useful Doc. – Secreted at ANY place – then search & seize - Such

@ Assessee’s Office R or Rs. 10,000 For Bonafide] A Documents & Goods & pass an order GST INS: 02

(For Fraud 100%) Prepare Inventory (Note: Assessee may Take Xerox).

On conclusion [GST ADT- 02] officer Inform Findings R Power of Officer: Seal / break or open the door/ any Almirah

. &tell the Rights & Obligation & If Necessary-SCN shall C /Box/ electronic devices etc.

Within 30 Days Within 30 Days Note: If any goods- practically not possible to seize then pass an order

be issued. OFFER: 2 OFFER: 2 H to not to remove the goods or otherwise deal with the goods (except

with the prior permission of such officer GST INS- 03).

Note: Seized document etc. will be returned after the purpose is solved

(TAX + INTEREST) PAY: TAX + INTEREST &

OFFICE OF Demand Order and documents which are not in use shall be returned within 30 days.

ASSESSEE * No Penalty +PENALTY 25% Note: seized goods shall be released on provisional basis after taking a

* CASE Close. (Tax + Penalty + (Not exceed Amount S BOND [GST INS- 03] with security or payment of tax, interest,

Interest) Specified in SCN) CASE Close penalty etc. [if fails to return then security will be encashed]

E

Within 30 Days I Date of seizure

SPECIAL AUDIT:

OFFER:3 Z

IF NO Notice is issued within 6M+6M

Need to conduct During ANY – Scrutiny/Enquiry/ U then the goods shall be returned to the

Investigation/Other Proceedings & complexity of case PAY: TAX + INT. + 50% R person.

Value in issue, ITC not with in normal Limit. Penalty E Note: After Seizure Perishable

Time Limit of : Demand Order: (CASE Close) Goods/ hazardous goods shall be

Notice dispose off /Sold.

with in 3/5 year of DD of filing of Annual Return

AC/DC within 3/5 year of : Date of Erroneous Refund

or With Approval of Commissioner Otherwise proceedings shall be deemed to be concluded.

Above Officer

* Reason of arrest: done any criminal offence specified in

Within 2 years in referred back cases A section 132(1) (a), (b), (c), (d)

Notice to person for Special/Audit to be conducted by R

. CA/Cost Accountant as Nominated by Commissioner. R *Power to arrest: any officer with the order of

[GST ADT- 03] File an Appeal to First Appellate Commissioner

Report Time: 90 Days + 90 Days Authority E *Power to hold: - Cognizable Officer: inform grounds of

S arrest and Produce before Magistrate within 24 Hrs. - Non

Opportunity of Being heard IF Adverse Report. General Points: T Cognizable: May Release.

* Stay period to be excluded in computing the period.

SCN – May be – Issued- if needed

Fees of Auditor: to be paid by Commissioner. * Fraud Charge Impose – D/o – App. Order – Assessee found honest/Bonafide then SCN – shall be treated to issue

as in Bonafide case. Other Power:

Note: It is Irrelevant that Tax Audit/Cost Audit etc. * Opportunities of being heard. * Summons any Relevant Person to give evidence or produce doc

already conducted. *Access to registered premises for carryout

* Adjournment 3 times (Max.) to a Party.

Special Audit Report : [GST ADT- 04] any Audit Scrutiny Verification check & Assesse shall Co-

* Demand order – with Reasoning and Double penalty.

Operate.

* App. Order Modify – INTEREST / Penalty also to be modified. * Police officer/Custom Officer/Railway/officers engaged in land

* INTEREST PAYABLE even IF NOT specified in Demand order. revenue collection/ village officers/ SGST or UTGST officer etc.

* Above Provisions also applicable when only INTEREST in Dispute. shall assist such GST Officer.

* Self assessed liability as shown in return u/s 39 – direct recovery- without issuing SCN and Demand Order.

Das könnte Ihnen auch gefallen

- IPCRDokument1 SeiteIPCRTess Legaspi0% (1)

- QC Government - Transfer of OwnershipDokument24 SeitenQC Government - Transfer of OwnershipLorish ArguellesNoch keine Bewertungen

- TEP SOP-New-23 - 09. 2016 PDFDokument10 SeitenTEP SOP-New-23 - 09. 2016 PDFprakashtanwar9100% (3)

- New Business Registration Proposal - 100719Dokument3 SeitenNew Business Registration Proposal - 100719Lawrence SantellaNoch keine Bewertungen

- COA - C2017-001 - Expenses Below 300 Not Requiring ReceiptsDokument2 SeitenCOA - C2017-001 - Expenses Below 300 Not Requiring ReceiptsJuan Luis Lusong100% (3)

- Uganda Full Audit Program 2008Dokument14 SeitenUganda Full Audit Program 2008Michel Bryan SemwoNoch keine Bewertungen

- Assessment AppealDokument10 SeitenAssessment AppealGrubber grubNoch keine Bewertungen

- Liabilities of AuditorDokument3 SeitenLiabilities of AuditorVrinda KNoch keine Bewertungen

- Arnold Schwarzenegger - Form 700 2009Dokument19 SeitenArnold Schwarzenegger - Form 700 2009SpotUsNoch keine Bewertungen

- 14-A Bir Rmo No. 5-2009 (Annex A)Dokument1 Seite14-A Bir Rmo No. 5-2009 (Annex A)Clarissa SawaliNoch keine Bewertungen

- Municipal Assessor'S Office External ServicesDokument10 SeitenMunicipal Assessor'S Office External ServicesMarven JuadiongNoch keine Bewertungen

- Rpo-12 2019Dokument3 SeitenRpo-12 2019Jessa GebilaguinNoch keine Bewertungen

- Citizens Charter 2Dokument83 SeitenCitizens Charter 2KarpioNoch keine Bewertungen

- Taxation Review - Prefinals 2015Dokument37 SeitenTaxation Review - Prefinals 2015Mary Grace OrdonezNoch keine Bewertungen

- Tax 1 MamalateoDokument21 SeitenTax 1 Mamalateodonsiccuan100% (1)

- Administrative Remedies in TaxDokument11 SeitenAdministrative Remedies in TaxEFASNoch keine Bewertungen

- CITIZENS CHARTER NO. RO-F-03a. ISSUANCE OF CERTIFICATE OF VERIFICATION COV FOR THE TRANSPORT OF PLANTED TREES WITHIN PRIVATE LAND NON-TIMBER FOREST PRODUCTS EXCEPT RATTAN AND BAMBOODokument3 SeitenCITIZENS CHARTER NO. RO-F-03a. ISSUANCE OF CERTIFICATE OF VERIFICATION COV FOR THE TRANSPORT OF PLANTED TREES WITHIN PRIVATE LAND NON-TIMBER FOREST PRODUCTS EXCEPT RATTAN AND BAMBOOJimmy JoseNoch keine Bewertungen

- Roles Responsibilities 29-34-2012-LI-Vol-II Dated 24-09-15Dokument4 SeitenRoles Responsibilities 29-34-2012-LI-Vol-II Dated 24-09-15Msk Gupta67% (3)

- Admin and FinDokument148 SeitenAdmin and Fincenro staritaNoch keine Bewertungen

- Action CatalogueDokument1 SeiteAction CatalogueMarkNoch keine Bewertungen

- Citizen'S Charter No. Ro-L-01. Issuance of Certification of Land Status And/Or Certification of Survey ClaimantDokument4 SeitenCitizen'S Charter No. Ro-L-01. Issuance of Certification of Land Status And/Or Certification of Survey ClaimantcarmanvernonNoch keine Bewertungen

- 51562-2015-Submission of Inventory List and Other20210524-11-Dry51yDokument6 Seiten51562-2015-Submission of Inventory List and Other20210524-11-Dry51ycatherine joy sangilNoch keine Bewertungen

- TPG MT UT ETCH Audit Contact Letter - Docx-1Dokument2 SeitenTPG MT UT ETCH Audit Contact Letter - Docx-1BALA GANESHNoch keine Bewertungen

- 4.2 Documents Under GST, Books & RecordsDokument45 Seiten4.2 Documents Under GST, Books & Recordsvenkatesh grietNoch keine Bewertungen

- Ceibcbic GST Investigation Instruction 2 2021 22Dokument5 SeitenCeibcbic GST Investigation Instruction 2 2021 22KANCHIVIVEKGUPTANoch keine Bewertungen

- Pgso Process FlowDokument2 SeitenPgso Process FlowAlni Dorothy Alfa EmphasisNoch keine Bewertungen

- O o o O: - Sjatement of Economic Interests Cover PageDokument17 SeitenO o o O: - Sjatement of Economic Interests Cover Pagechristina_jewettNoch keine Bewertungen

- Mdad Services 2020Dokument16 SeitenMdad Services 2020Hambeca PHNoch keine Bewertungen

- Irca Audit LogDokument7 SeitenIrca Audit LogDavid100% (2)

- Arta TRDokument2 SeitenArta TRTajimi CastañoNoch keine Bewertungen

- SP Final Revised Admin Qop Monitoring - 2017Dokument28 SeitenSP Final Revised Admin Qop Monitoring - 2017Ju LanNoch keine Bewertungen

- 2023 OT Carlo TESDA REPDokument1 Seite2023 OT Carlo TESDA REPMarlene L. FaundoNoch keine Bewertungen

- Report PAO16Dokument48 SeitenReport PAO16sandeep pahalNoch keine Bewertungen

- Supplemental To The Citizen - S Charter 2021 EditionDokument4 SeitenSupplemental To The Citizen - S Charter 2021 EditionChristian Romar H. DacanayNoch keine Bewertungen

- NTOT Finance-Asset October 8 2016Dokument63 SeitenNTOT Finance-Asset October 8 2016Joji Marie PalecNoch keine Bewertungen

- AuditingDokument12 SeitenAuditingMinh NguyenNoch keine Bewertungen

- Subject - Grant of Honorarium To Inquiry Officers - Presenting OfficDepartmental Inquiries Conducted by The Ministries - Departments - RegDokument3 SeitenSubject - Grant of Honorarium To Inquiry Officers - Presenting OfficDepartmental Inquiries Conducted by The Ministries - Departments - RegNitin Kumar SoniNoch keine Bewertungen

- ASSET MANAGEMENT (Supply Officer)Dokument67 SeitenASSET MANAGEMENT (Supply Officer)Audrey Burato LopezNoch keine Bewertungen

- Citizen's Charter2023Dokument22 SeitenCitizen's Charter2023Carlo CaguimbalNoch keine Bewertungen

- Complaint: (In Cases Initiated by The Proper Disciplining Authority or An Authorized Representative)Dokument4 SeitenComplaint: (In Cases Initiated by The Proper Disciplining Authority or An Authorized Representative)Ghee MoralesNoch keine Bewertungen

- 2021-1471 (Annex K)Dokument5 Seiten2021-1471 (Annex K)Vincent MarkNoch keine Bewertungen

- Internal Control and Flow Chart AnalysisDokument5 SeitenInternal Control and Flow Chart AnalysisKaren AncisNoch keine Bewertungen

- Cortes IPCR 2ndsem v1Dokument21 SeitenCortes IPCR 2ndsem v1reylaw.aiNoch keine Bewertungen

- Chap 14 - Search Seizure Survey M23Dokument10 SeitenChap 14 - Search Seizure Survey M23Prakash PullaNoch keine Bewertungen

- Routinary Slip: List of Supporting DocumentsDokument7 SeitenRoutinary Slip: List of Supporting Documents잔돈Noch keine Bewertungen

- Council General Guidelines, 2008 & DISCIPLINARY MECHANISM NotesDokument3 SeitenCouncil General Guidelines, 2008 & DISCIPLINARY MECHANISM NotesVrinda KNoch keine Bewertungen

- Finance InductionDokument14 SeitenFinance Inductionyayang indahNoch keine Bewertungen

- Revised Citizen's Charter - With Updated Person ResponsibleDokument17 SeitenRevised Citizen's Charter - With Updated Person ResponsibleRommel GaculaNoch keine Bewertungen

- DPWH DoDokument20 SeitenDPWH DoNaye TomawisNoch keine Bewertungen

- Particulars Should Be Submitted in Only, Through Intra-Mail and Special MessengerDokument2 SeitenParticulars Should Be Submitted in Only, Through Intra-Mail and Special MessengerRahulNoch keine Bewertungen

- Payment of Salaries and Other Benefits of Newly Hired Teachers or EmployeesDokument5 SeitenPayment of Salaries and Other Benefits of Newly Hired Teachers or EmployeesDennis Vigil CaballeroNoch keine Bewertungen

- Resume of M.a.yousufDokument4 SeitenResume of M.a.yousufRobal MiahNoch keine Bewertungen

- LECTURE 2 - Overview of The Audit Process and Preliminary ActivitiesDokument4 SeitenLECTURE 2 - Overview of The Audit Process and Preliminary ActivitiesAlexandra Nicole IsaacNoch keine Bewertungen

- 13 - Audit of Different Types of EntititesDokument85 Seiten13 - Audit of Different Types of EntititessmartshivenduNoch keine Bewertungen

- Remedies Tax 4 27 - Power and Remedy of AssessmentDokument15 SeitenRemedies Tax 4 27 - Power and Remedy of AssessmentEmille LlorenteNoch keine Bewertungen

- Building Permission ProcessDokument40 SeitenBuilding Permission ProcessGuru Prasad KarriNoch keine Bewertungen

- DCC-ORG-002 Qui Trinh Ho Sơ DiDokument2 SeitenDCC-ORG-002 Qui Trinh Ho Sơ DiTân MinhNoch keine Bewertungen

- IC Citizen Charter - Rev 2022 215 220Dokument6 SeitenIC Citizen Charter - Rev 2022 215 220Michaela Christel J TorresNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- SJ Shikha Jaiswal: Shikha Jaiswal M 302 Monsoon Breeze Sector 78, Gurgaon Near Rampura Chowk Gurgaon, Haryana, 122051Dokument8 SeitenSJ Shikha Jaiswal: Shikha Jaiswal M 302 Monsoon Breeze Sector 78, Gurgaon Near Rampura Chowk Gurgaon, Haryana, 122051Saini HarikeshNoch keine Bewertungen

- GST Webinar PPT 13.04Dokument43 SeitenGST Webinar PPT 13.04Ashok PatelNoch keine Bewertungen

- Order FL0267344464: Mode of Payment: CODDokument2 SeitenOrder FL0267344464: Mode of Payment: CODNasim AkhtarNoch keine Bewertungen

- Agent/ Intermediary Name and Code:VAMAN RAO BALMURI AGD0000449Dokument5 SeitenAgent/ Intermediary Name and Code:VAMAN RAO BALMURI AGD0000449katta yadi reddyNoch keine Bewertungen

- E-Way Bill Implementation in BUSYDokument12 SeitenE-Way Bill Implementation in BUSYMohnishNoch keine Bewertungen

- Shri Mata Vaishno Devi Shrine Board KatraDokument2 SeitenShri Mata Vaishno Devi Shrine Board Katraravi panchalNoch keine Bewertungen

- Appeals and Revision: After Studying This Chapter, You Will Be Able ToDokument25 SeitenAppeals and Revision: After Studying This Chapter, You Will Be Able ToAtul PaiNoch keine Bewertungen

- GST Bill Format in ExcelDokument184 SeitenGST Bill Format in Excelkrishna chaitanyaNoch keine Bewertungen

- Nippon Audiotronix Private LimitedDokument23 SeitenNippon Audiotronix Private LimitedAtika malikNoch keine Bewertungen

- 14312/BHUJ BE EXP Sleeper Class (SL)Dokument2 Seiten14312/BHUJ BE EXP Sleeper Class (SL)AnnuNoch keine Bewertungen

- Internet Invoice 21-Converted1Dokument1 SeiteInternet Invoice 21-Converted1sagar aroraNoch keine Bewertungen

- Vehicle Service Bill Jan 2023Dokument1 SeiteVehicle Service Bill Jan 2023Suthakaran Subramanian0% (1)

- What Is HUF - How To Create HUF - How To Form HUFDokument23 SeitenWhat Is HUF - How To Create HUF - How To Form HUFLS QNoch keine Bewertungen

- One Plus EarphonesDokument8 SeitenOne Plus EarphonesRed rangerNoch keine Bewertungen

- TaxInvoice AIN2223001617279Dokument2 SeitenTaxInvoice AIN2223001617279Pradeep N KNoch keine Bewertungen

- NMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYDokument5 SeitenNMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYRushil ShahNoch keine Bewertungen

- Literature Review On Tax ComplianceDokument10 SeitenLiterature Review On Tax Complianceafdttjcns100% (1)

- Internet and Telephone BillDokument4 SeitenInternet and Telephone BillNidaNoch keine Bewertungen

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Dokument1 SeiteIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)kanagarajodishaNoch keine Bewertungen

- 026 - D - Dhairya ShahDokument15 Seiten026 - D - Dhairya ShahDHAIRYA09Noch keine Bewertungen

- ForwardInvoice ORD436802373Dokument2 SeitenForwardInvoice ORD436802373Dibyendu DasNoch keine Bewertungen

- Ilovepdf MergedDokument5 SeitenIlovepdf Mergedlkobharat 00Noch keine Bewertungen

- Invoice AJIO-62Dokument1 SeiteInvoice AJIO-62ratnesh vaviaNoch keine Bewertungen

- Palkesh Asawa - S Answer To How Is GST Beneficial For The Country - How Would It Help To Improve The Country - S Economy - QuoraDokument3 SeitenPalkesh Asawa - S Answer To How Is GST Beneficial For The Country - How Would It Help To Improve The Country - S Economy - QuoraAshit AgarwalNoch keine Bewertungen

- 76220bos61590 cp7Dokument208 Seiten76220bos61590 cp7Sunil KumarNoch keine Bewertungen

- LG Microwave BillDokument1 SeiteLG Microwave BillAman GuptaNoch keine Bewertungen

- Original For Recipient DUPDokument1 SeiteOriginal For Recipient DUPMeghanNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoiceGaurav yadavNoch keine Bewertungen

- GST ProjectDokument24 SeitenGST ProjectPratyush DeroliaNoch keine Bewertungen

- Dr. Amit KumarDokument4 SeitenDr. Amit Kumarabhijeet kumarNoch keine Bewertungen