Beruflich Dokumente

Kultur Dokumente

Cestam2015 ST Annx5

Hochgeladen von

Group M20 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten1 SeiteThis document is a comparative statement of items from audited annual accounts and tax returns. It includes a table with 6 columns comparing information on value of services provided, service tax paid, value of exports, and details of CENVAT credit availed and utilized as per the ST-3 tax return, income tax audit report, income tax return, and audited annual accounts. The purpose is to reconcile any differences across these financial documents.

Originalbeschreibung:

required for audit

Originaltitel

Cestam2015 St Annx5

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document is a comparative statement of items from audited annual accounts and tax returns. It includes a table with 6 columns comparing information on value of services provided, service tax paid, value of exports, and details of CENVAT credit availed and utilized as per the ST-3 tax return, income tax audit report, income tax return, and audited annual accounts. The purpose is to reconcile any differences across these financial documents.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten1 SeiteCestam2015 ST Annx5

Hochgeladen von

Group M2This document is a comparative statement of items from audited annual accounts and tax returns. It includes a table with 6 columns comparing information on value of services provided, service tax paid, value of exports, and details of CENVAT credit availed and utilized as per the ST-3 tax return, income tax audit report, income tax return, and audited annual accounts. The purpose is to reconcile any differences across these financial documents.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

ANNEXURE - ST-V

Comparative statement of items from audited annual accounts/returns via-a-

vis reflected in ST-3 returns

Sl. Item As per

No. ST-3 Income Tax Income tax AUDITED

Audit Report returns ITR ANNUAL

under Section IV/ ITRV/ ACCOUNTS

44AB of the /ITR VI as /

Income Tax Act, applicable TRIAL

1961 BALANCE

(1) (2) (3) (4) (5) (6)

1 Value of Services provided

(including TDS amount

deducted , if any)

2 Service Tax Paid

i) Credit Account

ii) Account Current

Sub-total of 2

3 Value of Exports

4 Details of CENVAT Credit

availed and utilised

a. Opening Balance

b. CENVAT Credit availed

on

i. Manufacturer invoice

ii. I & II Stage Dealer

iii. Imported Inputs

iv. Capital Goods from

Manufacturer/ Dealer

v. Imported Capital Goods

vi. Input Services

Sub-Total of (b)

C. Total Credit available

(a+b)

d. Credit utilsed

i. Payment of duty on

Services

ii Removal of Inputs &

Capital Goods as such

Sub Total of (d)

e. Closing Balance

5 Written off stock

Note:- If the information sought is not applicable in any column, Please mention

N.A. against the same.

Das könnte Ihnen auch gefallen

- Schaum's Outline of Principles of Accounting I, Fifth EditionVon EverandSchaum's Outline of Principles of Accounting I, Fifth EditionBewertung: 5 von 5 Sternen5/5 (3)

- WWW - Incometaxindia.gov - In: Instructions To Form ITR-7 (A.Y .2018-19)Dokument26 SeitenWWW - Incometaxindia.gov - In: Instructions To Form ITR-7 (A.Y .2018-19)Uttam K SharmaNoch keine Bewertungen

- Itr U EnglishDokument4 SeitenItr U EnglishSHREYASNoch keine Bewertungen

- GST Annual Return and AuditDokument34 SeitenGST Annual Return and Auditdasari satishNoch keine Bewertungen

- Revenue Memorandum Circular No.Dokument5 SeitenRevenue Memorandum Circular No.Joel SyNoch keine Bewertungen

- Office of The Commissioner of Commercial Taxes: Orissa, CuttackDokument17 SeitenOffice of The Commissioner of Commercial Taxes: Orissa, CuttackJayant JoshiNoch keine Bewertungen

- Form No. 3CD Format in ExcelDokument41 SeitenForm No. 3CD Format in ExcelranjitNoch keine Bewertungen

- Faqs Form Gstr-3B About Form Gstr-3BDokument8 SeitenFaqs Form Gstr-3B About Form Gstr-3BAsh WNoch keine Bewertungen

- Practical Aspects - GST Annual ReturnDokument26 SeitenPractical Aspects - GST Annual ReturnCA Shubhank SharmaNoch keine Bewertungen

- PPT-on-GST Annual-ReturnDokument33 SeitenPPT-on-GST Annual-Returnshrutha p jainNoch keine Bewertungen

- Tax Audit Form 3CDDokument18 SeitenTax Audit Form 3CDaishwarya raikarNoch keine Bewertungen

- Advisory On GSTR-2B Dated 02.04.2021Dokument6 SeitenAdvisory On GSTR-2B Dated 02.04.2021V RawalNoch keine Bewertungen

- Icai Tax Audit ChecklistDokument61 SeitenIcai Tax Audit ChecklistRajesh Mahesh BohraNoch keine Bewertungen

- Insertion of New Tables in GSTR-1Dokument5 SeitenInsertion of New Tables in GSTR-1rvsiddharth054Noch keine Bewertungen

- Tax Audit Plan and ProgrammeDokument39 SeitenTax Audit Plan and Programmepradhan13Noch keine Bewertungen

- GSTR 9Dokument24 SeitenGSTR 9Pushpraj SinghNoch keine Bewertungen

- Tally Prime Syllabus 2021Dokument12 SeitenTally Prime Syllabus 2021bvsaisuraj100% (1)

- Tax Audit Clauses PDFDokument13 SeitenTax Audit Clauses PDFSunil KumarNoch keine Bewertungen

- GSTR 9 9A CA Mohit SinghalDokument61 SeitenGSTR 9 9A CA Mohit SinghalRishav AnandNoch keine Bewertungen

- Instructions For Filling Out FORM ITR-4Dokument14 SeitenInstructions For Filling Out FORM ITR-4Srinivasan ParthasarathyNoch keine Bewertungen

- Chapter - Tax Audit & Ethical CompliancesDokument106 SeitenChapter - Tax Audit & Ethical CompliancessayanghoshNoch keine Bewertungen

- Training On GSTR-9 & 9CDokument2 SeitenTraining On GSTR-9 & 9CKavita RanaNoch keine Bewertungen

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Dokument7 SeitenStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNoch keine Bewertungen

- GSTR-9 AND GSTR-9C - OutwardDokument39 SeitenGSTR-9 AND GSTR-9C - OutwardRahul KLNoch keine Bewertungen

- Circular 12 2019Dokument3 SeitenCircular 12 2019gnmanoj86Noch keine Bewertungen

- Analysis-GST Annual-Return-25052019Dokument30 SeitenAnalysis-GST Annual-Return-25052019mvsarmaNoch keine Bewertungen

- Changes in ITC Reporting in GSTR - 3BDokument6 SeitenChanges in ITC Reporting in GSTR - 3BKirtan Ramesh JethvaNoch keine Bewertungen

- Form No. 3CdDokument17 SeitenForm No. 3Cdmohammad yasirNoch keine Bewertungen

- Instructions For Form GSTR-9Dokument8 SeitenInstructions For Form GSTR-9param.ginniNoch keine Bewertungen

- GSTR 01Dokument9 SeitenGSTR 01nisho tyagiNoch keine Bewertungen

- Statement Outwrad SupplyDokument4 SeitenStatement Outwrad SupplyTushar GoelNoch keine Bewertungen

- Help Kit - AoC-4 CFS NBFCDokument15 SeitenHelp Kit - AoC-4 CFS NBFCNavneetNoch keine Bewertungen

- Process Flow For Filing Audit FormsDokument2 SeitenProcess Flow For Filing Audit FormssumathiravirajNoch keine Bewertungen

- Tax Audit ReportDokument18 SeitenTax Audit ReportNeha DenglaNoch keine Bewertungen

- Major Changes in New Form 3CD (Tax Audit Report Format) #SIMPLETAXINDIADokument4 SeitenMajor Changes in New Form 3CD (Tax Audit Report Format) #SIMPLETAXINDIAశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNoch keine Bewertungen

- Instructions ITR5 AY2021 22Dokument196 SeitenInstructions ITR5 AY2021 22Partha Pratim BiswasNoch keine Bewertungen

- Form 704Dokument179 SeitenForm 704navnath13146720Noch keine Bewertungen

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDokument4 SeitenForm VAT-R2: (See Rule 16 (2) ) DdmmyyPRAHLAD_KUMAR8424Noch keine Bewertungen

- Form 16 Part A: WWW - Taxguru.inDokument5 SeitenForm 16 Part A: WWW - Taxguru.inDarshan PatelNoch keine Bewertungen

- Form 3CDDokument8 SeitenForm 3CDmahi jainNoch keine Bewertungen

- On Tax Audit 03.10.20Dokument59 SeitenOn Tax Audit 03.10.20Mahendra Kumar SoniNoch keine Bewertungen

- FORM GSTR-2B - Advisory (Available Under "Advisory" Tab of GSTR-2B) Terms UsedDokument4 SeitenFORM GSTR-2B - Advisory (Available Under "Advisory" Tab of GSTR-2B) Terms UsedSachin KNNoch keine Bewertungen

- NOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question PaperDokument8 SeitenNOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question Papersheena2saNoch keine Bewertungen

- Income-Tax Rules, 1962Dokument17 SeitenIncome-Tax Rules, 1962mohd aslamNoch keine Bewertungen

- TaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsDokument5 SeitenTaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsAmit AgrawalNoch keine Bewertungen

- Instructions GSTR-9Dokument9 SeitenInstructions GSTR-9pankajNoch keine Bewertungen

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDokument4 SeitenBureau of Internal Revenue: Republic of The Philippines Department of FinanceHanabishi RekkaNoch keine Bewertungen

- Form No. 3Cd: Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961Dokument9 SeitenForm No. 3Cd: Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961shaikhNoch keine Bewertungen

- Mushak 9.1 Dec2019Dokument28 SeitenMushak 9.1 Dec2019Iftekhar-Ul- IslamNoch keine Bewertungen

- Cajournal May2021 12Dokument7 SeitenCajournal May2021 12S M SHEKARNoch keine Bewertungen

- Annual Return - Salem BranchDokument23 SeitenAnnual Return - Salem BranchSureshkumarNoch keine Bewertungen

- Tax Audit Series 6 - S. Nos 14-15Dokument4 SeitenTax Audit Series 6 - S. Nos 14-15Hanumantha Reddy BellaryNoch keine Bewertungen

- RMC No. 49-2020Dokument4 SeitenRMC No. 49-2020Juna May YanoyanNoch keine Bewertungen

- Accounting EntriesDokument1 SeiteAccounting EntriesSushil GoelNoch keine Bewertungen

- Form Aoc-4 XBRL HelpDokument23 SeitenForm Aoc-4 XBRL HelpkruthiNoch keine Bewertungen

- Income-Tax Rules, 1962: Form No.29BDokument5 SeitenIncome-Tax Rules, 1962: Form No.29Bjack sonNoch keine Bewertungen

- Return Formats (Monthly/Quarterly (Normal) Return - FORM GST RET-1)Dokument39 SeitenReturn Formats (Monthly/Quarterly (Normal) Return - FORM GST RET-1)chaitanya chNoch keine Bewertungen

- NOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question PaperDokument8 SeitenNOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question Papersheena2saNoch keine Bewertungen

- E-Filing of TDS ReturnsDokument10 SeitenE-Filing of TDS ReturnsMayur KundarNoch keine Bewertungen

- Chapter 10 Taxation of Partnerships LlamadoDokument3 SeitenChapter 10 Taxation of Partnerships LlamadoLiana Monica LopezNoch keine Bewertungen

- 3 - 2551442 - Salary - Illustration - 7 - 19 - 2022 9 - 16 - 28 PMDokument1 Seite3 - 2551442 - Salary - Illustration - 7 - 19 - 2022 9 - 16 - 28 PMShauryaNoch keine Bewertungen

- General Principles of Taxtion Part 2Dokument19 SeitenGeneral Principles of Taxtion Part 2Claudemir AriasNoch keine Bewertungen

- 3 - Solution Guide - Short Term Budgeting AssignmentDokument3 Seiten3 - Solution Guide - Short Term Budgeting AssignmentEdward Glenn BaguiNoch keine Bewertungen

- RenderPayslip PDFDokument1 SeiteRenderPayslip PDFEzikel PerezNoch keine Bewertungen

- SahanaDokument1 SeiteSahanaShreenath AgarwalNoch keine Bewertungen

- An Appraisal of The Oversight Functions of The Legislative Arm of Government CHAPTER1-5Dokument85 SeitenAn Appraisal of The Oversight Functions of The Legislative Arm of Government CHAPTER1-5KAYODE OLADIPUPONoch keine Bewertungen

- Tax Invoice: Gstin Drug Licence NoDokument1 SeiteTax Invoice: Gstin Drug Licence NoRohit BansalNoch keine Bewertungen

- Indian Oil Corporation Limited: Ppadma@indianoil - In/dmahapatra@indianoil - inDokument3 SeitenIndian Oil Corporation Limited: Ppadma@indianoil - In/dmahapatra@indianoil - inSaileshNoch keine Bewertungen

- Facture Farftech 1Dokument1 SeiteFacture Farftech 1Adam-IsmailNoch keine Bewertungen

- Residence, Domicile and The Remittance Basis: Hmrc6Dokument81 SeitenResidence, Domicile and The Remittance Basis: Hmrc6Mahboob Ur-RahmanNoch keine Bewertungen

- Financial Planning CalculatorDokument8 SeitenFinancial Planning CalculatorJuan FrivaldoNoch keine Bewertungen

- Challan PaymentDokument1 SeiteChallan Paymentjyoti meenaNoch keine Bewertungen

- Activity 2 Problems Vat On Sale of Goods or PropertiesDokument3 SeitenActivity 2 Problems Vat On Sale of Goods or PropertiesNiña Mae NarcisoNoch keine Bewertungen

- Income Tax Rates, Rebates & DeductionsDokument35 SeitenIncome Tax Rates, Rebates & DeductionsMaryam IkhlaqeNoch keine Bewertungen

- BIR RULING NO. 154-93: King, Capuchino, Tan and AssociatesDokument2 SeitenBIR RULING NO. 154-93: King, Capuchino, Tan and Associatesrian.lee.b.tiangcoNoch keine Bewertungen

- Tax On Individuals QuizDokument6 SeitenTax On Individuals QuizJomarNoch keine Bewertungen

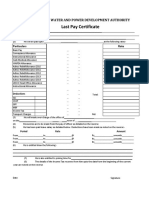

- Last Pay CertificateDokument2 SeitenLast Pay CertificateGES ISLAMIA PATTOKI100% (1)

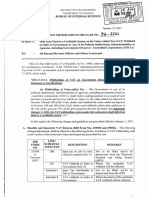

- Revei (Ue Memorai/Dum Crrcular No.: Interi (AlDokument2 SeitenRevei (Ue Memorai/Dum Crrcular No.: Interi (AlRONIN LEENoch keine Bewertungen

- Silkair V CIRDokument2 SeitenSilkair V CIRJazzelle SalesNoch keine Bewertungen

- Public Finance PDFDokument3 SeitenPublic Finance PDFMahbubur Rahman100% (1)

- CIR Vs Smart CommunicationsDokument1 SeiteCIR Vs Smart CommunicationsHoreb FelixNoch keine Bewertungen

- Singapore Airlines v. CIR CTA No. 7500Dokument15 SeitenSingapore Airlines v. CIR CTA No. 7500bianca.denise.dawisNoch keine Bewertungen

- Tax Ordinance No. 2021-22Dokument3 SeitenTax Ordinance No. 2021-22Evangeline PalitayanNoch keine Bewertungen

- CertainGovernmentPayments1099G JamesSmith-654202001310815Dokument4 SeitenCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallNoch keine Bewertungen

- Module 7Dokument10 SeitenModule 7Muyco Mario AngeloNoch keine Bewertungen

- PS 202106070069Dokument1 SeitePS 202106070069Vivek VermaNoch keine Bewertungen

- Composition SchemeDokument10 SeitenComposition SchemeAnonymous xH9VFaNUNoch keine Bewertungen

- ER E-BooksDokument100 SeitenER E-BooksNitin DalwaleNoch keine Bewertungen