Beruflich Dokumente

Kultur Dokumente

Pulses Procesing Cost PDF

Hochgeladen von

MANOJ JAINOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pulses Procesing Cost PDF

Hochgeladen von

MANOJ JAINCopyright:

Verfügbare Formate

Sl. No.

Group / Name of Village Industries Code Page

A. Agro Based Food Processing Industries ABFPI

13. Pulses Processing ABFPI-13 25

ABFPI-13

KHADI & VILLAGE INDUSTRIES COMMISSION

PROJECT PROFILE FOR GRAMODYOG ROZGAR YOJANA

PULSES PROCESSING UNIT

The pulse manufacturing is one of oldest traditional activities of the country. It has a linkage between the

agriculture and industry as employment awareness to the rural inhabitants. The industry contributes to the

people in the form of delicious and nutritious food to the people. It has got awide scope for generating more

and more employment opportunities in the industry. The raw materials can be easily procured du+B30ring-

harvesting season from the farmers and also from the wholesalers.

1. Name of the Product : Pulses Processing

2. Project Cost :

a) Capital Expenditure

Land : Own

Building Shed 1000 Sq.ft. : Rs. 200000.00

Drying Yard 600 Sq. ft. : Rs. 20000.00

Equipment : Rs. 150000.00

(1) Grader, (2) Dal Mill, (3) Sheller,

(4) Polisher, (5) Buff Polisher, (6) Roller

(7) Varam Machine, (8) Screens, etc.

Total Capital Expenditure : Rs. 370000.00

(b) Working Capital : Rs. 149000.00

TOTAL PROJECT COST : Rs. 539000.00

]3. Estimated Annual Production of Pulses : (Value in í000)

Sl.No. Particulars Capacity Rate Total Value

1. Dal/Pulses 110 Quintal 5400.00 595.80

2. Broken

3. Husk

TOTAL 110 5400.00 595.80

4. Raw Material : Rs. 200000.00

5. Labels and Packing Material : Rs. 25000.00

6. Wages (Skilled & Unskilled) : Rs. 75000.00

7. Salaries : Rs. 90000.00

8. Administrative Expenses : Rs. 20000.00

9. Overheads : Rs. 90000.00

10. Miscellaneous Expenses : Rs. 25000.00

11. Depreciation : Rs. 25000.00

12. Insurance : Rs. 3700.00

13. Interest (As per the PLR)

(a) Capital Expenditure Loan : Rs. 48100.00

(b) Working Capital Loan : Rs. 19370.00

Total Interest : Rs. 67470.00

14. Working Capital Requirement

Fixed Cost : Rs. 186800.00

Variable Cost : Rs. 409370.00

Requirement of Working Capital per Cycle : Rs. 149043.00

15. Estimated Cost Analysis

Sl.No. Particulars Capacity Utilization (Rs. in í000)

100% 60% 70% 80%

1. Fixed Cost 186.80 112.08 130.76 149.44

2. Variable Cost 410.00 246.00 287.00 328.00

3. Cost of Production 596.80 358.08 417.76 477.44

4. Projected Sales 775.84 465.50 543.09 620.67

5. Gross Surplus 179.04 107.42 125.33 143.23

6. Expected Net surplus 154.00 82.00 100.00 118.00

Note:

1. All figures mentioned above are only indicative and may vary from place to place.

2. If the investment on Building is replaced by Rental Premises-

(a) Total Cost of Project will be reduced.

(b) Profitability will be increased.

(c) Interest on Capital Expenditure will be reduced.

Das könnte Ihnen auch gefallen

- A. Agro Based Food Processing Industries ABFPIDokument2 SeitenA. Agro Based Food Processing Industries ABFPIebersworld_2011Noch keine Bewertungen

- A. Agro Based Food Processing Industries ABFPDokument2 SeitenA. Agro Based Food Processing Industries ABFPSandeep DigwaniNoch keine Bewertungen

- Noodles Manufacturing UnitDokument2 SeitenNoodles Manufacturing UnitsweeturituNoch keine Bewertungen

- C. Polymer and Chemical Based Industries PCBIDokument2 SeitenC. Polymer and Chemical Based Industries PCBIMohammed Shafi AhmedNoch keine Bewertungen

- Pulses MillDokument2 SeitenPulses Millram100% (1)

- Khadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana Tiny Unit For Plastic BottlesDokument2 SeitenKhadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana Tiny Unit For Plastic Bottlesmoon_mohiNoch keine Bewertungen

- Industry ProjectDokument2 SeitenIndustry ProjectKeerthi KumarNoch keine Bewertungen

- Sl. No.: B. Forest Based Industries FbiDokument2 SeitenSl. No.: B. Forest Based Industries FbiharyroyNoch keine Bewertungen

- Techno Economic Feasibiliy CUM Project Profile ON Red Bricks Manufacturing Manufacturing Unit Under P.M.E.G.PDokument7 SeitenTechno Economic Feasibiliy CUM Project Profile ON Red Bricks Manufacturing Manufacturing Unit Under P.M.E.G.PGlobal Law FirmNoch keine Bewertungen

- Khadi & V.I. Commission Project Profile For Gramodyog Rojgar Yojna Besan Manufacturing UnitDokument2 SeitenKhadi & V.I. Commission Project Profile For Gramodyog Rojgar Yojna Besan Manufacturing UnitAnonymous EAineTizNoch keine Bewertungen

- Techno Economic Feasibiliy CUM Project Profile ON Body Building of Vehicles (Manufacturing Unit) Under P.M.E.G.PDokument7 SeitenTechno Economic Feasibiliy CUM Project Profile ON Body Building of Vehicles (Manufacturing Unit) Under P.M.E.G.PGlobal Law FirmNoch keine Bewertungen

- Shamp PapadDokument5 SeitenShamp PapadRaj GiriNoch keine Bewertungen

- Khadi & V.I. Commission Project Profile For Gramodyog Rojgar Yojna Natural Mineral WaterDokument2 SeitenKhadi & V.I. Commission Project Profile For Gramodyog Rojgar Yojna Natural Mineral WaterMani AnanthanarayanNoch keine Bewertungen

- Feasibility Study of Best Coffee Roasting, Grinding and PackingDokument19 SeitenFeasibility Study of Best Coffee Roasting, Grinding and PackingFekaduNoch keine Bewertungen

- Ivi Farm Feasibility StudyDokument8 SeitenIvi Farm Feasibility StudyEBENEZERNoch keine Bewertungen

- Project ReportDokument9 SeitenProject ReportAsutosh Vyas VyasNoch keine Bewertungen

- Techno Economic Feasibiliy Cum Project Profile ON Cyber-Cafe (Service UNIT) Under P.M.E.G.PDokument5 SeitenTechno Economic Feasibiliy Cum Project Profile ON Cyber-Cafe (Service UNIT) Under P.M.E.G.PPawan KumarNoch keine Bewertungen

- Project Plan For Leather Goods & BagsDokument2 SeitenProject Plan For Leather Goods & Bagssekhar_jvj67% (3)

- Techno Economic Feasibiliy CUM Project Profile ON Computer Assembling Unit Manufacturing Unit Under P.M.E.G.PDokument7 SeitenTechno Economic Feasibiliy CUM Project Profile ON Computer Assembling Unit Manufacturing Unit Under P.M.E.G.PGlobal Law FirmNoch keine Bewertungen

- Deepak Ku, Mar Pandey GarageDokument13 SeitenDeepak Ku, Mar Pandey GarageGlobal Law FirmNoch keine Bewertungen

- Papad NamkeenDokument9 SeitenPapad NamkeenSneha Dudhe YadavNoch keine Bewertungen

- Nail FacDokument23 SeitenNail Facahadu abiyNoch keine Bewertungen

- Establishment of Dhaba Project ReportDokument2 SeitenEstablishment of Dhaba Project Reportjyotikokate83% (6)

- Brown Rice Report BI To BP by Naval BhushaniaDokument19 SeitenBrown Rice Report BI To BP by Naval BhushaniaNaval BhushaniaNoch keine Bewertungen

- Project Red Oxide in IndiaDokument8 SeitenProject Red Oxide in IndiaanaazizNoch keine Bewertungen

- 25-Wood and Steel AlmirahDokument7 Seiten25-Wood and Steel AlmirahGlobal Law FirmNoch keine Bewertungen

- Worksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dokument7 SeitenWorksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dinku Mamo100% (1)

- Auto Leaf SpringDokument11 SeitenAuto Leaf SpringVijayKrishnaAmaraneniNoch keine Bewertungen

- Plant Desin Report For Spice ProductionDokument7 SeitenPlant Desin Report For Spice ProductionUmar Mohammad Mir0% (1)

- Project Profile On Tyre RetreadingDokument5 SeitenProject Profile On Tyre RetreadingBinu Balakrishnan100% (2)

- Project For Cold Storage UnitsDokument26 SeitenProject For Cold Storage Unitsniteen_mulmule485Noch keine Bewertungen

- Dairy Project Input FileDokument13 SeitenDairy Project Input FileAshish Kumar RaiNoch keine Bewertungen

- Mukul Mittal Project ReportDokument13 SeitenMukul Mittal Project Reportoffice osbdsNoch keine Bewertungen

- NAAFCO Denim Ltd. PPDokument68 SeitenNAAFCO Denim Ltd. PPFahimNoch keine Bewertungen

- Design Handbook MAchine DesignDokument5 SeitenDesign Handbook MAchine DesignsouravNoch keine Bewertungen

- Project Profile On P.P ThermoformingDokument11 SeitenProject Profile On P.P ThermoformingAnonymous NUn6MESxNoch keine Bewertungen

- Project Profile On Glass MirrorDokument10 SeitenProject Profile On Glass MirrorHarsh GoyalNoch keine Bewertungen

- Project Plan For Ice Cream ParlourDokument2 SeitenProject Plan For Ice Cream Parloursekhar_jvjNoch keine Bewertungen

- Project Profile On The Production of Beverage Cap-Corwn CorkDokument5 SeitenProject Profile On The Production of Beverage Cap-Corwn CorkSuleman100% (1)

- 55786077mini Rice MillDokument2 Seiten55786077mini Rice MillSimha TestNoch keine Bewertungen

- Desk Break LiningDokument15 SeitenDesk Break Liningbig johnNoch keine Bewertungen

- Engineering EconomyDokument16 SeitenEngineering EconomyHazel Marie Ignacio PeraltaNoch keine Bewertungen

- Flour Mill UnitDokument4 SeitenFlour Mill UnitKrishnamoorthy SureshNoch keine Bewertungen

- Stainless Steel Cooking UtensilsDokument9 SeitenStainless Steel Cooking UtensilsGopal AgrawalNoch keine Bewertungen

- Project Report Cement PavverDokument6 SeitenProject Report Cement PavverSaveesh Sasidharan0% (2)

- Project Report Cement PaverDokument6 SeitenProject Report Cement PaverJayjeet BhattacharjeeNoch keine Bewertungen

- Hotel ProposalDokument14 SeitenHotel ProposalAssefa MogesNoch keine Bewertungen

- Cotton Knitted Undergarments (Briefs, Panties, Vests) : 1. Procurement of Knitted FabricDokument6 SeitenCotton Knitted Undergarments (Briefs, Panties, Vests) : 1. Procurement of Knitted FabricPaka ManojNoch keine Bewertungen

- Socks Manufacturing (Brief Project Report)Dokument2 SeitenSocks Manufacturing (Brief Project Report)arunlal100% (2)

- Namkeenfarsan Manufacturing SchemeDokument2 SeitenNamkeenfarsan Manufacturing Schemeanas malikNoch keine Bewertungen

- Medium Density Fiberboard MDF Market Survey Cum Detailed Techno Economic Feasibility Project Report PDFDokument53 SeitenMedium Density Fiberboard MDF Market Survey Cum Detailed Techno Economic Feasibility Project Report PDFGagsNoch keine Bewertungen

- MPP Servicing Repairing Two WheelerDokument6 SeitenMPP Servicing Repairing Two WheelerVignesh RavichandranNoch keine Bewertungen

- Economics of Climate Change Mitigation in Central and West AsiaVon EverandEconomics of Climate Change Mitigation in Central and West AsiaNoch keine Bewertungen

- District Cooling in the People's Republic of China: Status and Development PotentialVon EverandDistrict Cooling in the People's Republic of China: Status and Development PotentialNoch keine Bewertungen

- Waste to Energy in the Age of the Circular Economy: Compendium of Case Studies and Emerging TechnologiesVon EverandWaste to Energy in the Age of the Circular Economy: Compendium of Case Studies and Emerging TechnologiesBewertung: 5 von 5 Sternen5/5 (1)

- Improving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentVon EverandImproving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentBewertung: 5 von 5 Sternen5/5 (1)

- Carbon Capture, Utilization, and Storage Game Changers in Asia and the Pacific: 2022 Compendium of Technologies and EnablersVon EverandCarbon Capture, Utilization, and Storage Game Changers in Asia and the Pacific: 2022 Compendium of Technologies and EnablersNoch keine Bewertungen

- Guidelines for the Economic Analysis of ProjectsVon EverandGuidelines for the Economic Analysis of ProjectsNoch keine Bewertungen

- Carbon Capture, Utilization, and Storage Game Changers in Asia: 2020 Compendium of Technologies and EnablersVon EverandCarbon Capture, Utilization, and Storage Game Changers in Asia: 2020 Compendium of Technologies and EnablersBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Banking Practical 1 InformationDokument4 SeitenBanking Practical 1 InformationMadhur AbhyankarNoch keine Bewertungen

- International Trade and Capital FlowsDokument34 SeitenInternational Trade and Capital FlowsPrince AgrawalNoch keine Bewertungen

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDokument1 SeiteAhmedabad Municipal Corporation Mahanagar Sewa SadanJohn FernendiceNoch keine Bewertungen

- First, President's Salary Is Not Exempt From Income TaxDokument2 SeitenFirst, President's Salary Is Not Exempt From Income TaxRishabh ChawlaNoch keine Bewertungen

- Role of RBI Under Banking Regulation Act, 1949Dokument5 SeitenRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- Status of Balance of Payment in IndiaDokument30 SeitenStatus of Balance of Payment in IndiaSathushra EswaranNoch keine Bewertungen

- Gadget - Pers & Prof Use 2Dokument1 SeiteGadget - Pers & Prof Use 2Sagar Bhikamchand GugaliyaNoch keine Bewertungen

- Current Macroeconomic SituationDokument9 SeitenCurrent Macroeconomic SituationMonkey.D. LuffyNoch keine Bewertungen

- Evidencia 8 Actividad 15Dokument10 SeitenEvidencia 8 Actividad 15Angela Maria Galan NavasNoch keine Bewertungen

- Developing International MarketsDokument5 SeitenDeveloping International Marketsskumah48Noch keine Bewertungen

- IBM556 Reflection ReportDokument3 SeitenIBM556 Reflection ReportFaiz FahmiNoch keine Bewertungen

- United National Independence PartyDokument3 SeitenUnited National Independence PartyMarcusNoch keine Bewertungen

- Analysis of South Africa's EconomyDokument12 SeitenAnalysis of South Africa's EconomyKeven NgetiNoch keine Bewertungen

- Test Bank For Chapter 7 - Trade Policies For Developing NationsDokument4 SeitenTest Bank For Chapter 7 - Trade Policies For Developing NationsfoofanaticNoch keine Bewertungen

- Macroeconomics Tuto c2Dokument1 SeiteMacroeconomics Tuto c2Nazri AnaszNoch keine Bewertungen

- Task 13: Industry Analysis - Financial Services Sector & Case StudiesDokument5 SeitenTask 13: Industry Analysis - Financial Services Sector & Case StudiesVidhi SanchetiNoch keine Bewertungen

- Potvrda o Oporezivi Dohodak Obrazac CPT 106 - Bos I EngDokument2 SeitenPotvrda o Oporezivi Dohodak Obrazac CPT 106 - Bos I EngEldin RatkovicNoch keine Bewertungen

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokument1 SeiteBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountMythri BhatNoch keine Bewertungen

- Toyota'S European Operating Exposure: Summary of Mini-CaseDokument3 SeitenToyota'S European Operating Exposure: Summary of Mini-CaseCuongNoch keine Bewertungen

- Guided Notes #2 Great DepressionDokument1 SeiteGuided Notes #2 Great DepressionGiovanni BurkeNoch keine Bewertungen

- International Business Tutorial QuestionDokument2 SeitenInternational Business Tutorial QuestionChoo YieNoch keine Bewertungen

- Egyptian Real GDP Growth Rate Analysis 2018/2021assignment: Waleed Amin HammadDokument9 SeitenEgyptian Real GDP Growth Rate Analysis 2018/2021assignment: Waleed Amin Hammadwaleed aminNoch keine Bewertungen

- Break Even AnalysisDokument13 SeitenBreak Even Analysissuchipatel100% (2)

- Growth of Commercial Bank in IndiaDokument2 SeitenGrowth of Commercial Bank in Indiavinayak_874580% (5)

- Gapol, Rach Au C. Pantia, Patrik Oliver E. Pasaol, Devvie Mae ADokument3 SeitenGapol, Rach Au C. Pantia, Patrik Oliver E. Pasaol, Devvie Mae APatrik Oliver PantiaNoch keine Bewertungen

- International Business: An Asian PerspectiveDokument25 SeitenInternational Business: An Asian PerspectiveNur AddninNoch keine Bewertungen

- Ib06 A2Dokument4 SeitenIb06 A2ParidhiNoch keine Bewertungen

- MergedDokument299 SeitenMergedTanu GuptaNoch keine Bewertungen

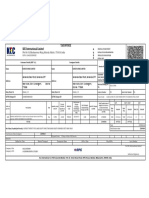

- GST InvoiceDokument1 SeiteGST Invoicemrutyunjaya1Noch keine Bewertungen

- Global Business Today Canadian 4th Edition Hill Test BankDokument31 SeitenGlobal Business Today Canadian 4th Edition Hill Test Bankcovinoustomrig23vdx100% (24)